Beruflich Dokumente

Kultur Dokumente

Worst of Autocall Certificate On ABB, Muenchener Rueckversicherungs-Gesellschaft and Petroplus

Hochgeladen von

api-25889552Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Worst of Autocall Certificate On ABB, Muenchener Rueckversicherungs-Gesellschaft and Petroplus

Hochgeladen von

api-25889552Copyright:

Verfügbare Formate

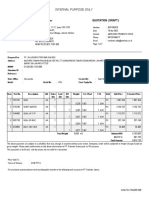

Worst Of Autocall Certificate on ABB, Muenchener Rueckversicherungs-

Gesellschaft and Petroplus

4.25% Quarterly Conditional Coupon (17% p.a.) - European Barrier at 80% - 5 Years - CHF

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International Collateral-Secured Investment On 14.05.2010 Client pays CHF 1000 (Denomination x I ssue Price)

Rating: Fitch A No Issuer Risk

Underlying ABB LTD-REG MUENCHENER PETROPLUS Each Quarter, with N being the number of Quarters since the last Coupon (since inception if no

RUECKVER AG-REG HOLDINGS AG Coupon has been paid so far)

Bbg Ticker ABBN VX Equity MUV2 GY Equity PPHN VX Equity

Spot Ref. (100%) CHF 21.19 EUR 107.6 CHF 19.93 If all the Underlyings close above their Coupon Trigger Level:

Barrier Level (80%) CHF 16.95 EUR 86.08 CHF 15.94 The Investor will receive a 4.25% Coupon

Autocall Level (100%) CHF 21.19 EUR 107.6 CHF 19.93

Coupon Trigger (80%) CHF 16.95 EUR 86.08 CHF15.94 On top of the Coupon, if all the Underlyings close above their Autocall Trigger Level:

Conversion Ratio 47.1920 9.2940 50.1760 The product is early redeemed and the Investor receives a Cash Settlement in CHF equal to:

Initial Fixing Date 30.04.10 The Denomination . The product expires

Payment Date 14.05.10

Valuation Date 30.04.15 On 30.04.2015 Client receiv es (if the product has not been early redeemed):

Maturity 07.05.15

Details Physical Settlement Quarterly Coupon Observation a. If the Worst Performing Underlying closes above the Barrier Level on the Valuation date:

Quarterly Autocall Observation The Investor will receive a Cash Settlement in CHF equal to: Denomination + 4.25% Coupon

ISIN CH0112500084

Valoren 11250008 b. If the Worst Performing Underlying closes at or below the Barrier Level on the Valuation date: The

SIX Symbol EFHIF Investor will receive a predefined round number (i.e. Conversion Ratio) of the Worst Peforming

Underlying.

Characteristics

Underlying_____________________________________________________________________________________________________________________________________________________________________________________________________

- ABB Limited provides power and automation technologies. The Company operates under segments that include power products, power systems, automation products, process automation and robotics.

- Muenchener Rueckversicherungs-Gesellschaft AG (MunichRe) provides financial services. The Company offers reinsurance, insurance, and asset management services. MunichRe has subsidiaries in most major financial

centers throughout the world.

- Petroplus Holdings AG refines and wholesales petroleum products. The Company owns and operates refineries located throughout Europe.

Opportunities___________________________________________________________________________ Risks________________________________________________________________________________________________________

1. Quarterly opportunity to receiv e a 4.25% Coupon 1. I f on the Valuation Date, at least one Underlying closes at or below its Barrier Lev el, the I nv estor will

2. Your capital is protected against a decrease of 20% on the Valuation Date suffer a loss reflecting the performance of the Underlying

3. Secondary market as liquid as equity markets

4. COSI Product: the I nv estor does not bear issuer's Credit risk

Best case scenario___________________________________________________________________ Worst case scenario_________________________________________________________________________________________

The Worst Performing Underlying closes betw een the Coupon Trigger Lev el and the The Worst Performing Underlying has nev er closed abov e the Coupon Trigger Lev el on any

Autocall Trigger Lev el on each Observ ation Date. Observ ation Date, and it closes below the Barrier Lev el on the Valuation Date.

Redemption: Denomination + 20 Coupons of 4.25% (total return: 185%) Redemption: Shares of the Worst performing Underlying

Historical Chart

150%

importer depuis la deuxieme feuille Observation date scenario

ABB

140% N Quarters since inception

Muenchener Rueckversicherungs-Gesellschaft

130% Early Redemption:

Petroplus Denomination

120%

110%

Autocall Level at 100%

100%

(N x 4.25% ) Coupon is paid

90%

Coupon Trigger and Barrier Level at 80%

80%

70% On the Maturity Date:

Shares of the Worst performing

60% Underlying

50%

Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves only for info rmatio n purposes and is not research; it constitutes neither a recommendatio n for the purchase of financial instruments nor an offer or an invitatio n for an o ffer. No respo nsibility is taken for the correctness of this info rmatio n. The financial instruments mentio ned in this do cument are derivative instruments. They do

no t qualify as units of a collective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct on Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised by the Swiss Financial M arket Supervisory Authority FINM A. Investors bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative

instruments, Investors are highly reco mmended to ask their financial adviso r for advice specifically focused o n the Investor´s financial situatio n; the information contained in this do cument do es no t substitute such advice. This publicatio n do es not co nstitute a simplified prospectus pursuant to art. 5 CISA , o r a listing prospectus pursuant to art. 652a o r

1156 of the Swiss Code of Obligatio ns. The relevant pro duct documentation can be obtained directly at EFG Financial Products A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Ko ng, Singapore, the USA , US persons, and the United Kingdom (the issuance is subject to Swiss

law). The Underlyings´ performance in the past do es not constitute a guarantee for their future perfo rmance. The financial products' value is subject to market fluctuatio n, what can lead to a partial or to tal loss o f the invested capital. The purchase o f the financial products triggers co sts and fees. EFG Financial P roducts A G and/or another related

co mpany may o perate as market maker fo r the financial products, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price movement, or the liquidity o f the financial products. © EFG Financial P ro ducts A G All rights reserved.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 52patterns - 7 Chart PatternsDokument64 Seiten52patterns - 7 Chart PatternspravinyNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Telegram Cloud Document 4 5774082087745225801 PDFDokument75 SeitenTelegram Cloud Document 4 5774082087745225801 PDFBen Willmott100% (2)

- Delayed: Intermediaries, They CollecDokument16 SeitenDelayed: Intermediaries, They CollecNadeesha UdayanganiNoch keine Bewertungen

- PDF#23 - A New Real Estate Deal Enters The MixDokument3 SeitenPDF#23 - A New Real Estate Deal Enters The MixMatthew Tyrmand100% (1)

- Audit Programme For Accounts ReceivableDokument5 SeitenAudit Programme For Accounts ReceivableDaniela BulardaNoch keine Bewertungen

- MyTW Bill 475525918821 12 12 2022Dokument1 SeiteMyTW Bill 475525918821 12 12 2022lapenbNoch keine Bewertungen

- Internship ReportDokument33 SeitenInternship ReportPriyanka A SNoch keine Bewertungen

- CG European Income Fund: StrategyDokument2 SeitenCG European Income Fund: Strategyapi-25889552Noch keine Bewertungen

- NullDokument6 SeitenNullapi-25889552Noch keine Bewertungen

- CG European Capital Growth Fund: StrategyDokument2 SeitenCG European Capital Growth Fund: Strategyapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Weekly Markets UpdateDokument39 SeitenWeekly Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- NullDokument10 SeitenNullapi-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- NullDokument15 SeitenNullapi-25889552Noch keine Bewertungen

- Global Financial Centres: March 2010Dokument41 SeitenGlobal Financial Centres: March 2010api-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument38 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- NullDokument41 SeitenNullapi-25889552Noch keine Bewertungen

- Guy Butler Limited: AUD NZD CAD Denominated BondsDokument1 SeiteGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Noch keine Bewertungen

- NullDokument6 SeitenNullapi-25889552Noch keine Bewertungen

- Morning News 28 May 2010Dokument3 SeitenMorning News 28 May 2010api-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument30 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument33 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDokument65 SeitenUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Noch keine Bewertungen

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Dokument1 Seite1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Noch keine Bewertungen

- Worldwide Real Estates: Gibraltar LettingsDokument8 SeitenWorldwide Real Estates: Gibraltar Lettingsapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument36 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Dokument1 Seite1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Noch keine Bewertungen

- NullDokument3 SeitenNullapi-25889552Noch keine Bewertungen

- NullDokument1 SeiteNullapi-25889552Noch keine Bewertungen

- NullDokument1 SeiteNullapi-25889552Noch keine Bewertungen

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Noch keine Bewertungen

- NullDokument39 SeitenNullapi-25889552Noch keine Bewertungen

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Dokument61 SeitenNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaNoch keine Bewertungen

- Startups - Financial PrudenceDokument12 SeitenStartups - Financial PrudenceNeelajit ChandraNoch keine Bewertungen

- StockRants CostBasisCalcDokument2 SeitenStockRants CostBasisCalcArvinNoch keine Bewertungen

- The Basics of Capital Budgeting: Evaluating Cash FlowsDokument3 SeitenThe Basics of Capital Budgeting: Evaluating Cash Flowstan lee huiNoch keine Bewertungen

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDokument90 Seiten35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Allux Indo 8301385679Dokument2 SeitenAllux Indo 8301385679Ardi dutaNoch keine Bewertungen

- Idbi BankDokument1 SeiteIdbi BankSakinah SNoch keine Bewertungen

- Fema Add CHDokument54 SeitenFema Add CHMukesh DholakiaNoch keine Bewertungen

- M Form 2019Dokument4 SeitenM Form 2019Kamille Ann RiveraNoch keine Bewertungen

- Invoice - Ali Abid - 000660485Dokument1 SeiteInvoice - Ali Abid - 000660485AliAbidNoch keine Bewertungen

- Paper 7 CmaDokument16 SeitenPaper 7 CmaRama KrishnaNoch keine Bewertungen

- Ac3059 ch1-3 PDFDokument60 SeitenAc3059 ch1-3 PDFTomson KosasihNoch keine Bewertungen

- NHB Vishal GoyalDokument24 SeitenNHB Vishal GoyalSky walkingNoch keine Bewertungen

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosDokument3 Seiten201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HNoch keine Bewertungen

- ReceiptDokument3 SeitenReceiptAhsan KhanNoch keine Bewertungen

- InflationDokument40 SeitenInflationmaanyaagrawal65Noch keine Bewertungen

- Payment InstructionDokument2 SeitenPayment Instructionjiachendu.caNoch keine Bewertungen

- Balance B/F 0.00 Payments/RefundsDokument2 SeitenBalance B/F 0.00 Payments/RefundssharonNoch keine Bewertungen

- Module 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGDokument12 SeitenModule 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGMae Gamit LaglivaNoch keine Bewertungen

- As Unnit 5 Class NotesDokument38 SeitenAs Unnit 5 Class NotesAlishan VertejeeNoch keine Bewertungen

- Schedule of New Fees - RetooledDokument2 SeitenSchedule of New Fees - RetooledRaymund Fernandez CamachoNoch keine Bewertungen

- Quarterly Report (Q3 2023) - 13 November 2023Dokument59 SeitenQuarterly Report (Q3 2023) - 13 November 2023judy jace thaddeus AlejoNoch keine Bewertungen

- ACEFIAR Quiz No. 1Dokument3 SeitenACEFIAR Quiz No. 1Marriel Fate CullanoNoch keine Bewertungen