Beruflich Dokumente

Kultur Dokumente

Principles of Taxation Seminar 1

Hochgeladen von

nauxnewCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Principles of Taxation Seminar 1

Hochgeladen von

nauxnewCopyright:

Verfügbare Formate

Principles of Taxation Seminar 1

Jurisdiction

Need to establish nexus between

o The state and the person whose income is to be taxed and/or

Nexus established if the person is the resident of the country based on tax laws of the

country

o The state and the income to be taxed

Nexus established if source of income is located within the geographical boundaries of the

country

Source of income The originating cause of the income receipt AKA the activity that

gives rise to the income

Source and residence are used in combination to define the income tax jurisdiction

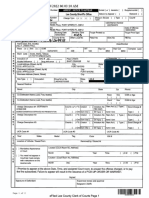

2 common jurisdictional models

o Territorial tax system Only tax income sourced within the state (narrow)

Within the state

(Domesticsourced)

Outside the state

(Foreign-sourced)

Worldwide tax system (wide)

Within the state

(Domesticsourced)

Outside the state

(Foreign-sourced)

Resident

Taxed

Non-resident

Taxed

Not taxed

Not taxed

Resident

Taxed

Non-resident

Taxed

Taxed

Not taxed

Base

Tax base = Income

*Fundamental issue Income vs capital gains

Income tax liability = Tax base x Income tax rate

Allocation

Most income tax system assess income and collect tax on an annual basis

Tax year may be defined differently in different states

Person

Individuals, partnerships, companies, trusts, etc. differ in their legal and economics

characteristics

*Fundamental issue Identity of person to be taxed and timing of tax imposition

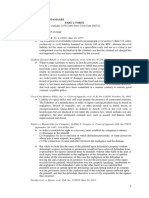

Cross-Border Linkages

Double taxation

Ta

Foreign

income

Ta

Malaysia

Singapore

Company

Double taxation is avoided when either the state of source of income or the state of residence of

the person provide relief from double taxation

If there is a tax treaty between the 2 states, tax relief will be given according to the tax treaty

Provision in tax treaty prevails over the provision in the countrys tax laws

Tax expenditures AKA tax preferences / incentives

Promote economic, social or other objectives in the following ways:

o Exclusions from income tax base

o Abatement against the income tax liability

o Postponement or deferral of income tax liability

Tax administration

How do we go about collecting tax from tax payers?

Administrative procedures required to:

o Structure the tax imposition and collection process

o Define the rights and obligations of the tax payers and the tax authority

____________________________________________________________________________________________________________

Section 10(1) Charging Section

Income tax shall, subject to the provisions of this Act, be payable at the rate or rates specified hereinafter

for each year of assessment upon the income of any person accruing in or derived from Singapore or

received in Singapore from outside Singapore in respect of

(a) gains or profits from any trade, business, profession or vocation, for whatever period of time such

trade, business, profession or vocation may have been carried on or exercised;

(b) gains or profits from any employment;

(c) [deleted]

(d) dividends, interest or discounts;

(e) any pension, charge or annuity;

(f) rents, royalties, premiums and any other profits arising from property; and

(g) any gains or profits of an income nature not falling within any of the preceding paragraphs.

Jurisdiction

Income accruing in or derived in Singapore

o Refers to Singapore-sourced income (SSI)

o Taxed on accrual basis

Income received in Singapore from outside Singapore

o Refers to foreign-sourced income received in Singapore (FSI)

o Taxed on receipt basis Taxable only upon receipt into SG

*Exemption of tax for FSI received in SG *refer to Sem3*:

For individuals S13(7A)

by a resident individual on/after 1.1.2004 (except through a partnership); or

by a non-resident individual

*partnership outside scope of AC2301

For companies S13(8) to (11)

Certain FSI received in SG are tax-exempt for resident companies, subject to certain

conditions

For non-resident company that does not carry on a business in SG Does not have a

source of trade or business in SG

Base

What is to be taxed? Income (excludes capital gains)

Capital gains are not taxed in Singapore

*Income Receipts vs Capital Receipts (PMA Test)

Income: Receipt obtained from the sale (including compensation received for the loss,

destruction or giving up) of an asset or advantage

that does not form part of the profit-making apparatus

that is in the nature of circulating capital

that, may be described as the fruit

is an income generation process income is a product of capital

Capital: Receipt obtained from the sale (including compensation received for the loss,

destruction or giving up) of an asset or advantage

that forms part of the profit-making apparatus

that is in the nature of fixed capital

that, may be described as the tree

retained and used in the income generation process to produce income

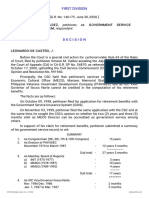

Statutory Income, Assessable Income, Chargeable Income

Income tax base = Chargeable income

2 concepts for the computation of chargeable income statutory income and assessable income

Compute SI first, derive AI from SI, then from AI arrive to get CI

Statutory income

o excludes non-taxable receipts (i.e. FSI not received in SG, capital gains) and income that are

tax exempt under ITA

o is a net concept deductions are allowed for each source of income but some deductions are

prohibited under ITA

o is also net of capital allowance

o comprises of income from the 6 categories heads of charges listed in S10(1)

Allocation

Basis of assessment (Tax Year) Year of Assessment (YA) and its related basis period

o YA 1 Jan to 31 Dec every year i.e. YA 2016: 1.1.2016 to 31.12.2016

o Basis period Period you earn the income

o 2 bases of assessment

Preceding Calendar Year (PCY) YA 2016 BP: 1.1.2015 to 31.12.2015

Preceding Accounting Year (PAY) YA 2016 BP: 1.4.2014 to 31.3.2015 (assume 31 mar acc

yr end)

o Companies adopt PAY basis for all income (trade + non-trade)

o Individuals adopt

PAY basis for trade income

PAY basis for non-trade income derived from his business

PCY basis for non-trade income derived from his personal asset

Timing of tax exposure

o SSI Taxable in the BP when it accrues to or is derived by the person

When there is legal entitlement to receive the income

When obligations to earn the income are fulfilled or performed

o FSI Taxable in the BP when it is received or deemed received in Singapore

Deemed received Deemed remittance under S10(25)

Person

Individual, company, a body of persons, but not a partnership

o Company incorporated in Singapore or elsewhere (SG-incorporated and foreign companies)

o Body of persons does not include company or partnership

o Income of partnership is allocated to the partners and are taxable at the partners level

Tax Rate

Resident individuals Progressive tax rate *non-examinable

Non-resident individuals Generally 20% with exceptions, based on type of income

Corporate (both resident and non-resident) Flat rate

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elward Evidence OutlineDokument31 SeitenElward Evidence OutlineAnonymous 13FhBKlNoch keine Bewertungen

- GOH BAK MING v. YEOH ENG KONG & OTHER APPEALSDokument17 SeitenGOH BAK MING v. YEOH ENG KONG & OTHER APPEALSJJNoch keine Bewertungen

- Judaff - Hostile Witness (NG Meng Tam vs. China Banking)Dokument2 SeitenJudaff - Hostile Witness (NG Meng Tam vs. China Banking)Victor GalangNoch keine Bewertungen

- James Lally Arrest WarrantDokument10 SeitenJames Lally Arrest WarrantKyra ShportunNoch keine Bewertungen

- 11 Heirs of Mendoza v. ES Trucking and Forwarders, G.R. No. 243237, February 17, 2020Dokument14 Seiten11 Heirs of Mendoza v. ES Trucking and Forwarders, G.R. No. 243237, February 17, 2020RozaiineNoch keine Bewertungen

- Temporary Reunion During Pendency of Divorce Proceedings Will Not Defeat The Claim For Dissolution of Marriage Kerala HCDokument20 SeitenTemporary Reunion During Pendency of Divorce Proceedings Will Not Defeat The Claim For Dissolution of Marriage Kerala HCsrivani217Noch keine Bewertungen

- Constitution of India ExcerciseDokument2 SeitenConstitution of India ExcerciseGaurav BatraNoch keine Bewertungen

- Inocencio GonzalezDokument2 SeitenInocencio GonzalezJan Brylle100% (2)

- So v. Republic DigestDokument4 SeitenSo v. Republic DigestPaoloDimNoch keine Bewertungen

- On Liability For Defective Goods and Deficient ServicesDokument4 SeitenOn Liability For Defective Goods and Deficient ServicesOleg AndreevNoch keine Bewertungen

- Exempting CircumstancesDokument1 SeiteExempting CircumstancesKarissa TolentinoNoch keine Bewertungen

- Baroy V PhilippinesDokument1 SeiteBaroy V PhilippinesinvictusincNoch keine Bewertungen

- KP Form 1Dokument1 SeiteKP Form 1Maria Maida DaniotNoch keine Bewertungen

- Interpleader Suits - CPC - ProjectDokument21 SeitenInterpleader Suits - CPC - ProjectManeesh Reddy100% (4)

- Land Transpotation CasesDokument19 SeitenLand Transpotation CasesNotaly Mae Paja Badting100% (1)

- G.R. No. 102549 Javellana vs. DILGDokument5 SeitenG.R. No. 102549 Javellana vs. DILGMARIA KATHRINA BENITEZNoch keine Bewertungen

- Alih Et. Al. vs. Castro - DigestDokument1 SeiteAlih Et. Al. vs. Castro - DigestSyd Geemson ParrenasNoch keine Bewertungen

- ST Mary Vs Prima Real Case DigestDokument27 SeitenST Mary Vs Prima Real Case DigestCorina Jane AntigaNoch keine Bewertungen

- Valdez v. GSISDokument8 SeitenValdez v. GSISlouis adriano baguioNoch keine Bewertungen

- B. Resolution No. 01-0940 Administrative Disciplinary Rules On Sexual Harassment CasesDokument26 SeitenB. Resolution No. 01-0940 Administrative Disciplinary Rules On Sexual Harassment CasesWolf DenNoch keine Bewertungen

- LAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsDokument12 SeitenLAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsanneNoch keine Bewertungen

- (See Rule - ) Registration Certificate Issued Under SectionDokument4 Seiten(See Rule - ) Registration Certificate Issued Under SectionChujja ChuNoch keine Bewertungen

- Freedom of Information RequestDokument3 SeitenFreedom of Information RequestDocumentsZANoch keine Bewertungen

- Administrative Law (Constitutionality of Delegated LegsilationDokument22 SeitenAdministrative Law (Constitutionality of Delegated LegsilationPrachi TripathiNoch keine Bewertungen

- R.A. No. 10666 (Children's - Safety - On - Motorcycles - Act - of - 2015)Dokument3 SeitenR.A. No. 10666 (Children's - Safety - On - Motorcycles - Act - of - 2015)Anonymous zDh9ksnNoch keine Bewertungen

- Estrellita Tadeo-Matias vs. Republic, GR. No. 230751 - April 25, 2018Dokument21 SeitenEstrellita Tadeo-Matias vs. Republic, GR. No. 230751 - April 25, 2018Azryel VarcaNoch keine Bewertungen

- Billanes v. Latido Full TextDokument9 SeitenBillanes v. Latido Full Textfaye wongNoch keine Bewertungen

- Aug. 26 FranchisesDokument9 SeitenAug. 26 FranchisesEdz Votefornoymar Del RosarioNoch keine Bewertungen

- Statutory Construction by Rolando SuarezDokument278 SeitenStatutory Construction by Rolando SuarezJulius David Ubalde91% (46)

- Fudot Vs Cattleya LandDokument14 SeitenFudot Vs Cattleya LandJeryl Grace FortunaNoch keine Bewertungen