Beruflich Dokumente

Kultur Dokumente

Daily Equity Report-Sai Proficient

Hochgeladen von

sai proficient researchOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Equity Report-Sai Proficient

Hochgeladen von

sai proficient researchCopyright:

Verfügbare Formate

April 22, 2016

TEHNICAL & DERIVATIVE

REPORT

APRIL 22,2016

SENSEX ( 25880.38) /NIFTY (7912.05 )

Nifty may open in red tracking global cues

Indian benchmark indices are likely to open in red with the market

indicator SGX Nifty trading -30.50 points at 7,904.50 at the time of

market closed. Asian market is trading upside along with America

market but Europe market falls today.

KEY VALUE

SUPPORT 1- 7864.77

RESISTANCE1- 7942.62

SUPPORT 2- 7814.83

RESISTANCE 2- 7970.53

OBSERVATION

Nifty closed at 7912.05 with a loss of (-2.70) points. On the daily chart the

index has formed a Bullish candle indicating positive bias.The index is moving

in a Higher Top and Higher Bottom formation on the daily chart indicating

sustained up trend. The chart pattern suggests that if Nifty crosses and sustains

above 7940 level it would witness buying which would lead the index towards

7980-8040 levels.However if index breaks below 7880 level it would witness

selling which would take the index towards 7840-7820 Nifty continues to

remain in an uptrend in the short to medium term, so buying on dips continues

to be our preferred strategy. The daily strength indicator RSI is moving

downwards and above its reference line indicating pnegative bias. However

momentum oscillator Stochastic has turned negative from the overbought zone

indicating a possible consolidation or a down move in the near term The trend

deciding level for the day is 7940. If NIFTY trades above this level then we

may witness a further rally up to 7980-8040 levels. However, if NIFTY trades

below 7880 levels then we may see some loss booking initiating in the market,

which may correct up to 7 level.7840-7820.

TEHNICAL & DERIVATIVE REPORT

APRIL 22,2016

NIFTY BANK OUTLOOK- (16637.15)

On Thursday session, the index had given a flat opening followed up with positive

momentum throughout the session. The HANGING MAN pattern formed during

the previous week on weekly charts has been negated as the index has managed to

cross the high on Wednesday, thus indicating bulls taking control back in their

favor. If the index manages to continue its momentum, then it could rally up to

16500-16550 range which is 127% reciprocal retracement of the previous corrective

move from 16283 to 15440. Traders are hence advised to continue to trade in the

direction of the trend and follow strict risk management strategy on their trading

positions. Intraday support for Nifty Bank is placed around 16140 and 15975

whereas resistance are seen around 16390 and 16510.

KEY VALUE

Support 1- 16046.22

Resistance1-16364.87

Support 2- 15869.73

Resistance 2-16057.03

MARKET INDICATORS

ASIA MARKET:-

Index

Straits Times

Hang Seng

Last

Traded

2,960.78

Change

+10.83

+0.37 %

21,622.25 +385.94

+1.82 %

SSE

Composite

Index

(Shanghai)

2,952.89

Nikkei 225

17,363.62

-19.69

-0.66%

+457.08 +2.70%

AMERICA :-

Index

Last Traded

Change

Dow

JONES

18,096.27

+42.67

+0.24%

S&P500

2,102.40

+1.60

+0.08%

Nasdaq

4,948.13

+7.80

-0.16%

Europe :Index

Last Traded

Change

310,404.76

-24.44

FTSE 100

6,371.56

-38.70

-0.60%

CAC 40

4,567.48

-16.53

-0.16%

BEL-20

3,433.00

+17.50

+0.51%

DAX

-0.53%

TOP GAINERS

Amtek Auto ltd.

+8.52 %

Future Retail

+6.89 %

DCB Bank

+6.51 %

Vendata

+6.26 %

Hind.Copper

+5.10%

TOP LOSERS

Prestige Estates Pro

-4.56%

Wipro Ltd.

-7.01 %

Page Industries Ltd.

4.66 %

Network 18 Media & I

-4.49 %

Crisil

-4.38 %

TEHNICAL & DERIVATIVE REPORT

APRIL 22,2016

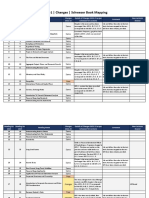

Glenmark pharma

Glenmark receives 3 observations from USFDA for Indore plant

KEY VALUE

Support 1- 783.47

Resistance1-805.72

Support 2- 774.18

Resistance 2-818.68

TEHNICAL & DERIVATIVE REPORT

APRIL 22,2016

Indusind Bank

IndusInd Bank Q4 net up 25% at Rs 620 cr; asset quality falls

KEY VALUES

SUPPORT 1- 975.28

RESISTANCE1-990.68

SUPPORT 2- 966.72

RESISTANCE 2- 997.52

TEHNICAL & DERIVATIVE REPORT

APRIL 22, 2016

DISCLAIMER

The information contained here was gathered from sources deemed reliable

however; no claim is made as to accuracy or content. This does not contain specific

recommendations to buy or sell at particular prices or time, nor should any

examples presented be deemed as such. There is a risk of loss in equity trading and

you should carefully consider your financial position before making a trade. This is

not, nor is it intended, to be a complete study of chart patterns or technical analysis

and should not be deemed as such. SAI PROFICIENT INVESTMENT

ADVISORS does not guarantee that such information is accurate or complete and

it should not be relied upon as such. Any opinions expressed reflect judgments at

this date and are subject to change without notice. For use at the sole discretion of

the investor without any liability on Sai Proficient Investment Advisors.

10

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Intermediate Accounting: IFRS Edition: Dedicated ToDokument62 SeitenIntermediate Accounting: IFRS Edition: Dedicated ToBos Kedok100% (6)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Management Accounts For The Year 2022Dokument6 SeitenManagement Accounts For The Year 2022Clyton MusipaNoch keine Bewertungen

- Derivatives FuturesDokument98 SeitenDerivatives FuturesDivyen Patel100% (2)

- Assets:: I. Introduction: Derivatives Concept andDokument58 SeitenAssets:: I. Introduction: Derivatives Concept andRanti0% (1)

- CH 10Dokument9 SeitenCH 10Paw VerdilloNoch keine Bewertungen

- DRM 01Dokument20 SeitenDRM 01Kannan MeiyurNoch keine Bewertungen

- Goldman Sachs Suggested Reading ListDokument6 SeitenGoldman Sachs Suggested Reading ListSaad Ali100% (2)

- Level III of CFA Program Mock Exam 1 - Questions (AM)Dokument26 SeitenLevel III of CFA Program Mock Exam 1 - Questions (AM)Lê Chấn PhongNoch keine Bewertungen

- Member and Authorised Person Agreement This Agreement Executed On This The - Day of - at - by and BetweenDokument5 SeitenMember and Authorised Person Agreement This Agreement Executed On This The - Day of - at - by and BetweenAshish AgarwalNoch keine Bewertungen

- Seminar Report ON Corporate Hedging Process & Techniques Submitted To: Sir. Yasin Zia Submitted By: Zahid Hussain 2009-Ag-65 MBA (R) FinanceDokument12 SeitenSeminar Report ON Corporate Hedging Process & Techniques Submitted To: Sir. Yasin Zia Submitted By: Zahid Hussain 2009-Ag-65 MBA (R) FinanceZahid HussainNoch keine Bewertungen

- A Study On Financial Derivatives (Future and Option)Dokument56 SeitenA Study On Financial Derivatives (Future and Option)Avadhut0% (2)

- CFA L-1 Schweser Mapping 2023Dokument5 SeitenCFA L-1 Schweser Mapping 2023Harsh JainNoch keine Bewertungen

- Vault Guide To Investment ManagementDokument125 SeitenVault Guide To Investment Management0123456789ra100% (2)

- Libor Market Model Specification and CalibrationDokument29 SeitenLibor Market Model Specification and CalibrationGeorge LiuNoch keine Bewertungen

- Forex Risk ManagementDokument114 SeitenForex Risk ManagementManish Mandola100% (1)

- A. Saffer: RobertDokument5 SeitenA. Saffer: Robertashish ojhaNoch keine Bewertungen

- PDF26 2Dokument182 SeitenPDF26 2Issac EbbuNoch keine Bewertungen

- Kapil SirDokument2 SeitenKapil SirmaghdheeraNoch keine Bewertungen

- FM 02 - Mfis NotesDokument7 SeitenFM 02 - Mfis NotesCorey PageNoch keine Bewertungen

- Rar HDFC Bank 2014Dokument32 SeitenRar HDFC Bank 2014Moneylife Foundation100% (1)

- PWC Mutual Fund Regulatory Services Brochure PDFDokument31 SeitenPWC Mutual Fund Regulatory Services Brochure PDFramaraajunNoch keine Bewertungen

- Credit Operations in PakistanDokument157 SeitenCredit Operations in PakistanAdnan Adil HussainNoch keine Bewertungen

- HEDGINGDokument57 SeitenHEDGINGAnthony Kwo0% (2)

- Outline 2019 JanMGFC30Dokument13 SeitenOutline 2019 JanMGFC30KevinNoch keine Bewertungen

- Kebijakan HedgingDokument10 SeitenKebijakan HedgingNida Ramona AuliaNoch keine Bewertungen

- DebtDokument106 SeitenDebthidulfiNoch keine Bewertungen

- Derivatives, Money, Finance and Imperialism: A Response To Bryan and RaffertyDokument20 SeitenDerivatives, Money, Finance and Imperialism: A Response To Bryan and RaffertyHyeonwoo KimNoch keine Bewertungen

- Parallelized Trinomial Option Pricing Model On GPU With CUDADokument7 SeitenParallelized Trinomial Option Pricing Model On GPU With CUDA최현준Noch keine Bewertungen

- Finance Interview Questions and Answers 1Dokument14 SeitenFinance Interview Questions and Answers 1Hari Priya TammineediNoch keine Bewertungen

- Excellent Present at On On Financial Management of Structured ProductsDokument18 SeitenExcellent Present at On On Financial Management of Structured ProductsForeclosure Fraud100% (1)