Beruflich Dokumente

Kultur Dokumente

Bond Prices and Interest Rates (METP PGDM)

Hochgeladen von

tanya17800 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten11 Seitenarticle

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenarticle

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten11 SeitenBond Prices and Interest Rates (METP PGDM)

Hochgeladen von

tanya1780article

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

18-1

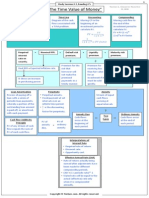

Chapter 18

Financial Markets and Asset Prices

Item

Item

Item

Etc.

McGraw-Hill/Irwin

Macroeconomics, 10e

18-2

2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

Introduction

Financial markets link the macroeconomy and

government policy directly to the lives of everyday

people

Changes in interest rates affect our ability to finance a home, car

Movements in the stock market determine the value of pensions

In this chapter we examine the behavior of three financial

markets:

Bond market

Stock market

Foreign exchange market

18-3

Interest Rates: Long and Short Term

Interest rates summarize the promised repayment terms

on bonds, loans not just one interest rate

Interest rates differ according to:

Credit worthiness of issuer

Tax treatments

Risk

Term

Other factors

The factor of greatest focus here is the term or the length

of time the interest rate covers

The relation between interest rates of different maturities is

called the term structure of interest

18-4

Interest Rates: Long and Short Term

Figure 18-1 shows interest

rates for U.S. Treasury

securities from 3 months to 30

years

[insert Figure 18-1 here]

Interest rates of different

maturities mostly go up and down

together

The gap between long term rates

and short-term rates varies

Long-term rates are usually higher

than short-term rates

18-5

Interest Rates: Long and Short Term

Consider the relation between the 1-year and 3-year rates (today is

January 1, 2020)

You have the option of:

Making a three year investment today and earning 3i2020 each year OR

Investing for one year, reinvesting for another year at the prevailing rate at

the beginning of 2021, and doing the same at the beginning of 2022

[Insert Figure 18-2 here]

18-6

Interest Rates: Long and Short Term

If all of the rates in Figure 18-2 were known in advance, the total

returns would be equal for both options

If the total returns were not equal, everyone would invest in the alternative

with the greatest return

(1 i20201 i20211 i2022)

illustrates the idea of ARBITRAGE: 3 i2020

3

The long-term interest rate equals the average of current

and future short-term interest rates.

[Insert Figure 18-2 here]

18-7

Interest Rates: Long and Short Term

The problem is, in 2020 we do not know 1i2021 or 1i2022

with certainty

Need to modify our equation in two ways:

Todays long-term rate depends on the current short-term rate and

the expected future short-term rates

Uncertainty implies risk, and long-term investments command a

term premium, PR, to compensate for this risk

The term structure equation becomes:

3 2020

e

e

(1)

i

2020 1 2021 1 2022

PR

3

18-8

Interest Rates: Long and Short Term

1 2020

3 2020

e

e

1 i2021

1 i2022

PR

3

Table 18-1 shows the average

term premiums based on the

interest rates shown in Figure

18-1

Equation (1) shows the

expectations theory of the term

structure

Term premiums vary over time,

but are generally higher for

longer-term rates

[Insert Table 18-1 here]

[Insert Figure 18-1 here, again]

18-9

The Yield Curve

Interest rates for different

maturities are illustrated by the

yield curve Figure 18-3

[Insert Figure 18-3 here]

Typically upward sloping since

long-term rates are generally

higher than short-run rates

If yield curve slopes downward,

indicates financial markets expect

interest rates to fall

Often a recessionary signal

Indicates the market

anticipates a coming drop in

interest rates

18-10

Bond Prices and Yields

Bond prices are inversely related to interest rates

If a bond is to pay $100 a year from now and has an interest rate i, then its price, P, must be such

that:

P (1 i ) 100 P

100

(1 i )

Ex. A $100 bond will have a 5% yield if its price is $95.24

Specific Example : Suppose you buy a bond with a coupon of $5 at the end of year 1 and again

at the end of year 2, plus a $100 return of principal at the end of year 2.

Price of this bond = $100 = [ 5 / (1 + 0.05) ] + [ 5 / (1 + 0.05)2 ] + [ 100 / (1 + 0.05)2 ]

When a bond price equals its face value, the bond is said to trade at par.

Suppose that an instant after you purchased the bond, i rises from 5% to 10%

In order to sell your bond, you must now compensate the buyer for the lower coupons of $5

on this bond as compared to a brand new $100 bond which will offer coupons of $10 .

Hence, your (old) bond will now sell at a lower price of :

$ 91.32 = [ 5 / (1 + 0.10) ] + [ 5 / (1 + 0.10)2 ] + [ 100 / (1 + 0.10)2 ]

The longer the term of the bond, the greater the required change in the price to

compensate for a change in the interest rate.

Long term bonds are subject to considerable price fluctuations.

18-11

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- AndreasenJ Back To The FutureDokument6 SeitenAndreasenJ Back To The FutureQilong ZhangNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- How To Pass The CFA Level 1 ExamDokument2 SeitenHow To Pass The CFA Level 1 Examtanya1780Noch keine Bewertungen

- The Carry Concept in Fixed IncomeDokument30 SeitenThe Carry Concept in Fixed IncomerpcampbellNoch keine Bewertungen

- Pricing Basket Options With SkewDokument7 SeitenPricing Basket Options With Skewstranger33350% (2)

- Fitting Nelson-Siegel Yield Curve With VBADokument21 SeitenFitting Nelson-Siegel Yield Curve With VBAsilver_rain_gr100% (3)

- Dhiraj TiwariDokument193 SeitenDhiraj TiwariDharmender KumarNoch keine Bewertungen

- Mock Exam Portfolio Theory 2020 With AnswersDokument10 SeitenMock Exam Portfolio Theory 2020 With AnswersSamir Ismail100% (1)

- FA FS Front Arena 4.2Dokument2 SeitenFA FS Front Arena 4.2Joanne ChungNoch keine Bewertungen

- Reforms: Good, Bad and UglyDokument2 SeitenReforms: Good, Bad and Uglytanya1780Noch keine Bewertungen

- Speed Math - ShortCutsDokument17 SeitenSpeed Math - ShortCutsDilipKumarNoch keine Bewertungen

- Application of Derivatives: by Alok Kumar SinghDokument14 SeitenApplication of Derivatives: by Alok Kumar Singhtanya1780Noch keine Bewertungen

- MSME Ministry, Samsung To Set Up Technical Schools Across CountryDokument2 SeitenMSME Ministry, Samsung To Set Up Technical Schools Across Countrytanya1780Noch keine Bewertungen

- Bachpan Bachao AndolanDokument3 SeitenBachpan Bachao Andolantanya1780Noch keine Bewertungen

- Agrifood Demand in India To Rise by 136 %: ABARESDokument2 SeitenAgrifood Demand in India To Rise by 136 %: ABAREStanya1780Noch keine Bewertungen

- 10 Marketing Mistakes To Avoid in Rural Markets: 1. Customization Is The Basic IngredientDokument6 Seiten10 Marketing Mistakes To Avoid in Rural Markets: 1. Customization Is The Basic Ingredienttanya1780Noch keine Bewertungen

- Differences Between Operating Lease and Finance LeaseDokument2 SeitenDifferences Between Operating Lease and Finance Leasetanya1780Noch keine Bewertungen

- Quant SummaryDokument16 SeitenQuant Summarytanya1780Noch keine Bewertungen

- Human Resources Law - US: ABA - Section of Labor and Employment LawDokument1 SeiteHuman Resources Law - US: ABA - Section of Labor and Employment Lawtanya1780Noch keine Bewertungen

- Doubt QuestionsDokument3 SeitenDoubt Questionstanya1780Noch keine Bewertungen

- Bonds - 53 SummaryDokument5 SeitenBonds - 53 Summarytanya1780Noch keine Bewertungen

- Artko Capital 2017 Q2 LetterDokument7 SeitenArtko Capital 2017 Q2 LetterSmitty WNoch keine Bewertungen

- Chap 014Dokument15 SeitenChap 014Jitendra PatelNoch keine Bewertungen

- QUIZ2BDokument12 SeitenQUIZ2BHa MinhNoch keine Bewertungen

- Bnu Mba SyllabusDokument17 SeitenBnu Mba SyllabusShiva RajNoch keine Bewertungen

- Treasury Yield Curve: FUQINTRD 683W: Global Markets and InstitutionsDokument23 SeitenTreasury Yield Curve: FUQINTRD 683W: Global Markets and InstitutionsNaresh KumarNoch keine Bewertungen

- Chapter 11 Bond ValuationDokument28 SeitenChapter 11 Bond ValuationGracia Tiffany Septiana100% (1)

- Full Download Financial Markets and Institutions 5th Edition Saunders Test BankDokument30 SeitenFull Download Financial Markets and Institutions 5th Edition Saunders Test Bankezranewood100% (36)

- 2023 Global Market Outlook Full ReportDokument16 Seiten2023 Global Market Outlook Full ReportMimi KamilNoch keine Bewertungen

- Derivatives Principle and PracticeDokument9 SeitenDerivatives Principle and PracticeDiana HerreraNoch keine Bewertungen

- Finance 3010 Test 1 Version A Spring 2006Dokument13 SeitenFinance 3010 Test 1 Version A Spring 2006HuyNguyễnQuangHuỳnhNoch keine Bewertungen

- MGT411 Online Quizzes No.2Dokument17 SeitenMGT411 Online Quizzes No.2Kanwar M. AbidNoch keine Bewertungen

- Theory of Money - Homework Assignment #1Dokument10 SeitenTheory of Money - Homework Assignment #1Edric LuNoch keine Bewertungen

- PD Portfolios-Questions 19-06-2019Dokument15 SeitenPD Portfolios-Questions 19-06-2019Cesar Eduardo Caldas CardenasNoch keine Bewertungen

- Expectations TheoryDokument10 SeitenExpectations TheorywanNoch keine Bewertungen

- Assignment Money & Banking.Dokument14 SeitenAssignment Money & Banking.Kirsty FarrugiaNoch keine Bewertungen

- Chapter Three Interest Rates in The Financial SystemDokument40 SeitenChapter Three Interest Rates in The Financial SystemKalkayeNoch keine Bewertungen

- FIN 9781 Midterm 2Dokument2 SeitenFIN 9781 Midterm 2Thabata RibeiroNoch keine Bewertungen

- MBA Review in Financial ManagementDokument30 SeitenMBA Review in Financial ManagementNnickyle LaboresNoch keine Bewertungen

- Don M. Chance - Derivatives & RiskDokument18 SeitenDon M. Chance - Derivatives & RiskOat KopkunNoch keine Bewertungen

- Final ExamDokument28 SeitenFinal Examsojol islamNoch keine Bewertungen

- Fixed Income Technical Note - Samir LakkisDokument7 SeitenFixed Income Technical Note - Samir Lakkissamir_lakkisNoch keine Bewertungen

- Fundamentals of Interest RatesDokument5 SeitenFundamentals of Interest RatesHunter FaughnanNoch keine Bewertungen