Beruflich Dokumente

Kultur Dokumente

MRF QTR 1 14 15

Hochgeladen von

Nikhil TiwariOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MRF QTR 1 14 15

Hochgeladen von

Nikhil TiwariCopyright:

Verfügbare Formate

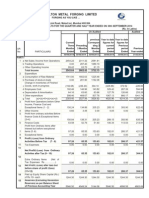

MRF LIMITED

Regd.Office: New No.114,Old No.124, Greams Road, Chennai - 600 006

CIN: L25111TN1960PLC004306; Website: www.mrftyres.com; Email: mrfshare@mrfmail.com; Ph: 044-28292777

PART I

Statement of Standalone Unaudited Results for the Quarter ended 31st DECEMBER, 2014

Rs. Lakhs

Quarter Ended

PARTICULARS

1 Income from Operations

(a) Gross Sales/Income from Operations

Less:Excise duty

Net Sales/Income from Operations

(b) Other Operating Income

Total income from operations ( net)

2 Expenses

a) Cost of materials consumed

b) Purchases of stock-in-trade

c) Changes in inventories of finished goods, work-in-progress and stock-in-trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other Expenses

Total Expenses

3 Profit from Operations before Other Income, finance costs and exceptional items (1-2)

4 Other Income

5 Profit from Ordinary activities before finance costs and exceptional items (3+/ (-) 4)

6 Finance costs

7

8

9

10

11

12

13

14

15

16

17

18

Profit from Ordinary activities after finance costs but before exceptional items (5+/(-)6)

Exceptional Items

Profit from Ordinary activities before tax ( 7 +/(-)8)

Tax Expense

Net Profit from ordinary activities after tax ( 9-10)

Extraordinary items

Net Profit for the period ( 11 +/(-) 12)

Paid-up Equity Share Capital (Face value of Rs.10/- each)

Paid-up Debt Capital of the Company *

Reserve excluding Revaluation Reserves as per balance sheet of previous accounting year

Debenture Redemption Reserve(Cumulative)

Earnings Per Share (Face value Rs.10/- each)

Basic and diluted EPS (Rs. Per Share)

See accompanying Notes to the financial results

PART II

Year Ended

31.12.2014

30.09.2014

31.12.2013

30.09.2014

Unaudited

Unaudited

Unaudited

(Audited)

372040

36872

335168

133

335301

373009

37018

335991

121

336112

354077

34365

319712

345

320057

1464094

145121

1318973

785

1319758

203140

506

(9571)

20223

11600

58370

284268

51033

2562

53595

6019

47576

47576

15225

32351

32351

424

63500

8636

205700

727

(6520)

18033

11103

57421

286464

49648

2488

52136

5645

46491

46491

14800

31691

31691

424

63500

8177

208622

4014

(4044)

17531

9934

52048

288105

31952

994

32946

5857

27089

27089

9100

17989

17989

424

70000

8093

829890

6122

1918

73269

42309

215765

1169273

150485

6562

157047

23158

133889

133889

44100

89789

89789

424

63500

451340

8177

762.78

747.24

424.17

.

Select Information for the Quarter ended 31st DECEMBER, 2014

Quarter Ended

PARTICULARS

31.12.2014 30.09.2014 31.12.2013

A PARTICULARS OF SHAREHOLDING

1 Public Shareholding - No of Shares

% of Shareholding

2 Promoters and promoter group Shareholding

a) Pledged/Encumbered

- No. of Shares

- (As a % of the total shareholding of promoter and promoter group)

- (As a % of the total share capital of the Company)

b) Non-encumbered

- No. of Shares

- (As a % of the total shareholding of promoter and promoter group)

- (As a % of the total share capital of the Company)

Particulars

B INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

2117.09

Year Ended

30.09.2014

3086556

72.78%

3083366

72.70%

3082327

72.68%

3083366

72.70%

6550

0.57%

0.15%

6550

0.57%

0.15%

6550

0.57%

0.15%

6550

0.57%

0.15%

1148037

99.43%

27.07%

1151227

99.43%

27.15%

1152266

99.43%

27.17%

1151227

99.43%

27.15%

Quarter ended

31.12.2014

Nil

5

2

3

Notes:

1) The above unaudited standalone results have been subjected to Limited Review by the Statutory Auditors, reviewed by the Audit

Committee and approved by the Board of Directors at its meeting held on 12th Feb,2015.

2) Provision for Taxation has been made in respect of Income presently determined, subject to appropriate revision/adjustment on final determination

of Income for the relevant Previous Year as per Income Tax Act, 1961.

3) The Company is dealing mainly in rubber products and has no other reportable segment.

4) In terms of the proviso to clause 3(i) of Part A of Schedule II to the Companies Act, 2013, the Company has, after technical assessment,

decided to retain the useful life hitherto adopted for certain categories of fixed assets, which are in certain cases, different from those prescribed

in Schedule II to the Act. The Company believes that based on the policy followed by it of continuous and periodic assessment, the estimated useful

life adopted is appropriate. Accordingly, Depreciation on Fixed Assets has been charged on a provisional basis subject to final adjustment,

if any, before the year end. As a result, the depreciation charge for the quarter is lower by Rs.677 Lakhs. Further, consequent to Notification

GSR 627(E) dated August 29, 2014 amending Para 7(b) under Schedule II, Company has charged off transitional depreciation amounting to Rs.699

Lakhs to Statement of Profit and Loss.

5) Figures have been regrouped wherever necessary.

* Paid up Debt Capital represents Secured Redeemable Non-Convertible Debentures.

For MRF LIMITED

Place: Chennai

Date: 12th Feb,2015

(ARUN MAMMEN)

MANAGING DIRECTOR

Das könnte Ihnen auch gefallen

- Arcadian Microarray Technologies, IncDokument27 SeitenArcadian Microarray Technologies, Incnatya lakshita100% (2)

- Practice Questions - Eqty1Dokument17 SeitenPractice Questions - Eqty1gauravroongtaNoch keine Bewertungen

- Financial Analysis of Bajaj Auto Ltd.Dokument25 SeitenFinancial Analysis of Bajaj Auto Ltd.Subhendu Ghosh100% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Sebi MillionsDokument3 SeitenSebi MillionsShubham TrivediNoch keine Bewertungen

- Dabur Balance SheetDokument30 SeitenDabur Balance SheetKrishan TiwariNoch keine Bewertungen

- Year Ended Quarter Ended: 30th June, 2014 UnauditedDokument2 SeitenYear Ended Quarter Ended: 30th June, 2014 UnauditedHitesh Pratap ChhonkerNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokument11 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDokument3 SeitenPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNoch keine Bewertungen

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Dokument6 SeitenAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument6 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument7 SeitenUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Result)Dokument5 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Avt Naturals (Qtly 2012 12 31)Dokument1 SeiteAvt Naturals (Qtly 2012 12 31)Karl_23Noch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- MRF PNL BalanaceDokument2 SeitenMRF PNL BalanaceRupesh DhindeNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument8 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Karnataka Bank Results Sep12Dokument6 SeitenKarnataka Bank Results Sep12Naveen SkNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- CFAP 6 AARS Summer 2018Dokument4 SeitenCFAP 6 AARS Summer 2018shakilNoch keine Bewertungen

- Nucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003Dokument1 SeiteNucleus Software Exports Limited: 33-35, Thyagraj Nagar Market, Near Lodhi Colony, New Delhi-110003nit111Noch keine Bewertungen

- q6 TaxDokument13 Seitenq6 Taxmajidpathan208Noch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Result Q-1-11 For PrintDokument1 SeiteResult Q-1-11 For PrintSagar KadamNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- GRP LTD (Gujarat Reclaim) Annual Report 12-13Dokument76 SeitenGRP LTD (Gujarat Reclaim) Annual Report 12-13bhavan123Noch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNoch keine Bewertungen

- LSCs List For Website 07 - 01 - 2014 PDFDokument5 SeitenLSCs List For Website 07 - 01 - 2014 PDFNikhil TiwariNoch keine Bewertungen

- Principles and Practices of Management ADLDokument165 SeitenPrinciples and Practices of Management ADLNikhil TiwariNoch keine Bewertungen

- Data Analysis and ManipulationDokument1 SeiteData Analysis and ManipulationNikhil TiwariNoch keine Bewertungen

- Principals of Management-Project: Sunil Jaiswal - 9819212154 Masters in Marketing ManagementDokument65 SeitenPrincipals of Management-Project: Sunil Jaiswal - 9819212154 Masters in Marketing ManagementNikhil TiwariNoch keine Bewertungen

- Btech II Biotechnology 2014 20aug14 PDFDokument22 SeitenBtech II Biotechnology 2014 20aug14 PDFNikhil TiwariNoch keine Bewertungen

- BA 99.1 DiagnosticDokument1 SeiteBA 99.1 Diagnostictikki0219Noch keine Bewertungen

- PT Astra International TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianDokument132 SeitenPT Astra International TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianMuhammad Ganang PramandaNoch keine Bewertungen

- Financial Info and Cashflows 1st Workbook Te CH 1Dokument40 SeitenFinancial Info and Cashflows 1st Workbook Te CH 1Ayodeji BabatundeNoch keine Bewertungen

- Chapter 3 SolutionsDokument15 SeitenChapter 3 Solutionsjohn brown100% (1)

- Assignment 1558529720 SmsDokument43 SeitenAssignment 1558529720 SmsSmit JariwalaNoch keine Bewertungen

- MIF Pre-Course Acc Exam - SolDokument6 SeitenMIF Pre-Course Acc Exam - SolpantolaNoch keine Bewertungen

- Islamic Financial Accounting Standard-2 Ijarah: Interpretation and ImplementationDokument23 SeitenIslamic Financial Accounting Standard-2 Ijarah: Interpretation and Implementationhammad067Noch keine Bewertungen

- Cfas - Module 2 SynthesisDokument4 SeitenCfas - Module 2 SynthesisjenNoch keine Bewertungen

- L3.3 - Comparative AdvantageDokument1 SeiteL3.3 - Comparative AdvantagePhung NhaNoch keine Bewertungen

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDokument12 SeitenBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNoch keine Bewertungen

- Arab Final 90% Fall2021 (YS)Dokument8 SeitenArab Final 90% Fall2021 (YS)ahmed abuzedNoch keine Bewertungen

- Pay Stock Dividends Dr. Stock Dividends 34,320.00 Cr. Common Shares 34,320.00Dokument16 SeitenPay Stock Dividends Dr. Stock Dividends 34,320.00 Cr. Common Shares 34,320.00Yevhenii VdovenkoNoch keine Bewertungen

- Intermediate Accounting: Prepared by University of California, Santa BarbaraDokument69 SeitenIntermediate Accounting: Prepared by University of California, Santa BarbaraHenry BarlowNoch keine Bewertungen

- SAPM ValuationDokument21 SeitenSAPM ValuationJayavignesh JtNoch keine Bewertungen

- Ifrs ChecklistDokument8 SeitenIfrs ChecklistMeenakshi ChumunNoch keine Bewertungen

- Responsi Akkeu 2 EquityDokument36 SeitenResponsi Akkeu 2 EquityAngel Valentine TirayoNoch keine Bewertungen

- AC5511 +1819A-Course+OutlineDokument6 SeitenAC5511 +1819A-Course+Outline靳雪娇Noch keine Bewertungen

- Project ReportDokument16 SeitenProject ReportAshok PatelNoch keine Bewertungen

- Valuation For Company AnalysisDokument11 SeitenValuation For Company AnalysisPrasoon AwasthiNoch keine Bewertungen

- Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDokument7 SeitenAbsorption, Variable, and Throughput Costing: Multiple Choice QuestionsRhea RamirezNoch keine Bewertungen

- Nike, Inc. Cost of Capital - A Case Study. IA2.Dokument6 SeitenNike, Inc. Cost of Capital - A Case Study. IA2.TineNoch keine Bewertungen

- ABC - Final Exam: RequiredDokument17 SeitenABC - Final Exam: RequiredCristel TannaganNoch keine Bewertungen

- AccountingDokument4 SeitenAccountingDWNoch keine Bewertungen

- Chun Ling Trial Exam 2022 - P2 (Answers)Dokument9 SeitenChun Ling Trial Exam 2022 - P2 (Answers)Wei WenNoch keine Bewertungen

- Liquidity Ratios: ProvisionDokument3 SeitenLiquidity Ratios: ProvisionFurious GamingNoch keine Bewertungen

- Financial Statements 2022 PDFDokument110 SeitenFinancial Statements 2022 PDFSerge Kabati100% (1)

- SFAC No 5Dokument29 SeitenSFAC No 5FridRachmanNoch keine Bewertungen