Beruflich Dokumente

Kultur Dokumente

Air Asia Case Study

Hochgeladen von

sanyam0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

355 Ansichten4 SeitenAirasia primarily adopted a cost-leadership strategy to gain a competitive advantage. AirAsia's intense focus on providing air travel with no frills leads to substantial costs saving. The company's ability to acquire low rates for long-term maintenance contracts and aircraft leases led to substantial cost savings.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAirasia primarily adopted a cost-leadership strategy to gain a competitive advantage. AirAsia's intense focus on providing air travel with no frills leads to substantial costs saving. The company's ability to acquire low rates for long-term maintenance contracts and aircraft leases led to substantial cost savings.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

355 Ansichten4 SeitenAir Asia Case Study

Hochgeladen von

sanyamAirasia primarily adopted a cost-leadership strategy to gain a competitive advantage. AirAsia's intense focus on providing air travel with no frills leads to substantial costs saving. The company's ability to acquire low rates for long-term maintenance contracts and aircraft leases led to substantial cost savings.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

SANYAM PUNJANI

ROLL NO. 59

GBO IV SEM

Air Asia Case Study

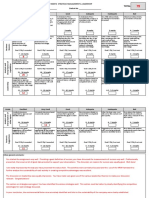

Q1 What are the strategies that have led to the success of Air Asia?

Air Asia primarily adopted a cost-leadership strategy to gain a competitive advantage

primarily by reducing its economic costs below its competitors. To achieve this, the strategic

actions were focussed on reducing costs and improving productivity. Some strategic actions

adopted by AirAsia to support its cost leadership strategy are :

a) Low Fare, No Frills

AirAsias intense focus on providing air travel with no frills leads to substantial costs saving.

The absence of in-flight services reduced pre-flight preparations such as the loading of food

and drinks, cleaning time and the cost of meals and administration. Investment in kitchens

and equipment for storing, heating and serving of meals can be avoided all together.

b) Investment in Latest Technologies & Efficient Operations

AirAsia has heavily invested in purchasing the most modern aircraft A-320s. The new aircraft

allow AirAsia to enjoy substantial lower fuel cost as these modern airplanes had lower fuel

usage by as much as 12%. Fuel accounted for almost 50% of the total operating costs and

thus it is an important component of cost saving for AirAsia. By operating a single aircraft

type allows AirAsia to achieve efficiency in executing its primary and secondary activities.

Consequently, this leads to higher productivity which in turn allows the company the option

to expand their operations with the same number of employees and right size its manpower

requirement. Improved productivity means more revenue for AirAsia. The extreme drive to

achieve high efficiency in operations allows AirAsia to clock the fastest turnaround time of

25 minutes. This invariably leads to comparatively better productivity as the company was

able to utilise its aircraft for an average of 13 hours per day as opposed to 10.5 hours by other

airlines. Again, improved productivity means more revenue for AirAsia.

c) Low Fixed Costs

AirAsias ability to acquire low rates for long-term maintenance contracts and aircraft leases

led to substantial cost savings. It was reported that AirAsias average contractual lease charge

per aircraft decreased by more than 60% from 2001 to 2004. Similarly, its aircraft

maintenance contract costs were also reported to be substantially lower than any other

airlines. In view of the airlines high safety and maintenance standards, AirAsia was also able

to procure favourable rates on its insurance policies. All these help lower fixed costs.

d) Lean Distribution System

The use of e-ticketing helps to save the cost of issuing hardcopy tickets, which were

estimated at US$10 per ticket. The company also saved on agents commissions and avoided

the need for large and expensive booking and reservation systems. This too helps lower the

overall costs.

e) Minimise Personnel Expenses

AirAsia implemented flexible work rules and streamlined administrative functions which

allowed employees to perform multiple roles. This human resource policy facilitated AirAsia

in lowering its personnel costs. In 2004, it was reported that AirAsia had the lowest staff-toper aircraft ratio (106 staff per aircraft as compared to 110 employees per aircraft registered

by other low cost carriers) and this helps lower staff cost.

f) Use of Secondary Airports

Typically, AirAsia operates out of secondary airports, which involve lower landing, parking

and ground handling fees. These airports were also less busy and had shorter runways, thus

helped reduce fuel consumption while aircraft queue for takeoff or taxy on the ground. As

many secondary airports were older, they were often close to urban areas and were thus more

attractive to some travellers. In short, the use of secondary airports can increase sales and

help to keep operating costs low.

Q2 Are the strategies replicable by other airlines?

The strategies although efficient and cost effective can be replicated. However Air Asia has

certain enjoys certain advantages that make the replication difficult for other airlines.

1. First Mover Advantage :

AirAsia has the advantage of being the first low cost airline in Asia. This allows it to

establish itself before competition increases in this low cost segment, apart from competition

that already exists across segments (low cost vs full service carriers). This is a major strength

as AirAsia will be laying down the rules and frameworks for the industry in a manner that

suits its business and operational model.

2. Brand Equity :

AirAsia will most certainly have a sustained mind share in the Asia Region consumers

psyche. They will always be remembered as the airline that took the initiative (and the risk)

to reshape an industry inside out. AirAsia was the first airline that made air travel affordable

to all Asians. This brand equity is a major strength that AirAsia must successfully capitalize.

In the long run low cost Carriers will compete by building routes, innovative pricing and

creating reputations for safety and on-time performance. Maintaining strategic Cost

differentiation is critical to long term success.

Q3 What should Air Asia do to retain its position?

A. To maintain the high level of profitability it should :

Act on the prices :

- Expensive tickets to be distributed when the demand is high (week-end).

- Prices increasing according to the demand.

- Cheap tickets available during the middle of the week.

Act on the cost :

- Offer more on board services to the passengers like internet WIFI and newspapers.

- Place advertisings on the plane's cabin.

B. Fund-raising

Fresh money could be used to finance strategic projects.

C. Invest in joint ventures.

Maintain international development across Asia in association with local budget airlines.

D. Diversification

Acquire new know-how in a view to offer more service to the consumer.

E.g. To take over an online travel agency.

E. Pursue regional expansion & expand business on existing platform (ancillary)

- Expand network to new countries

- Develop strategic partnership for mutual benefits

- Use strong brand to drive new business

F. Pursue regional market domination. Optimise routes and development of new

secondary hubs

- Further enhance route network, venture destinations previously uncovered

- Yield enhancement due to benefits of maturity

Q4 What it should do to succeed in India?

India is currently the 9th largest aviation market in the world. Indigo has the largest market

share of about 30% followed Jet airways and Air India with 19.7% and 19.2% respectively.

Following measures along with its its usual strategy should be adopted to capture a larger

share of the Indian market :

1. Promotions:

Major challenge here is spreading awareness in the untapped Indian market and reaching first

time fliers and educating them. To achieve this initially Air Asia has to go for costly

advertising like in movies, sports and tourism.

Also it should have tie ups with hotels and banks, social networking etc

2. Marketing

Targeting untapped market would require educating the customer and hence cost escalating.

Market should be segmented on geographic and demographic basis. It should target people in

income group of 3-10 lacs, small & medium businessmen, migratory workforce, tourists, and

price sensitive customers.

3. Sales

Higher sales means higher occupancy rates. Air Asia will have to gain more first time fliers

per year and develop cost effective yet profitable channels to sell. It should have tie ups with

travel agents, travel agencies and business organisations.

Das könnte Ihnen auch gefallen

- Air Asia Case StudyDokument14 SeitenAir Asia Case StudySofi JailaniNoch keine Bewertungen

- Air Asia Case StudyDokument8 SeitenAir Asia Case StudyLaila Al-Alawi80% (5)

- Air Asia Case StudyDokument8 SeitenAir Asia Case StudyGeorgeNoch keine Bewertungen

- Air Asia StrategiesDokument6 SeitenAir Asia StrategiesDenisJose2014Noch keine Bewertungen

- Strategic Analysis On AirAsiaDokument31 SeitenStrategic Analysis On AirAsiaWooGimChuan83% (12)

- AirAsia Business StrategyDokument5 SeitenAirAsia Business StrategySYAFINAS SALAM67% (9)

- Competitive Analysis For Air AsiaDokument3 SeitenCompetitive Analysis For Air AsiaEmon Bhuyan0% (1)

- AIRASIA - The Low Cost CarrierDokument8 SeitenAIRASIA - The Low Cost CarriersyfaisalNoch keine Bewertungen

- The AirAsia Company Strategic ManagementDokument13 SeitenThe AirAsia Company Strategic ManagementNur Zara100% (1)

- Air Asia - Case StudyDokument4 SeitenAir Asia - Case StudyMohsin WaheedNoch keine Bewertungen

- Strategic Management Airasia Strategic MDokument26 SeitenStrategic Management Airasia Strategic MShariful islamNoch keine Bewertungen

- Case Study Air AsiaDokument11 SeitenCase Study Air Asiajennifersmithsah100% (3)

- Air AsiaDokument14 SeitenAir AsiaFaiz AlwiNoch keine Bewertungen

- Air Asia - Brand PersonalityDokument10 SeitenAir Asia - Brand PersonalityNovena Christie HNoch keine Bewertungen

- Air Asia Case StudyDokument6 SeitenAir Asia Case StudyUyen HuynhNoch keine Bewertungen

- Air AsiaDokument45 SeitenAir Asiasummer100% (6)

- AirAsia SlidesDokument9 SeitenAirAsia SlidesjaysonchammbaNoch keine Bewertungen

- Swot AnalysisDokument5 SeitenSwot AnalysisShafieka MdSaniNoch keine Bewertungen

- Air Asia - Flying High With Low Cost HopesDokument3 SeitenAir Asia - Flying High With Low Cost HopesSheng Wei Yeo0% (1)

- AirAsia Case Study-By NadeemDokument55 SeitenAirAsia Case Study-By NadeemM Faizal100% (1)

- ReferencesDokument9 SeitenReferencesFarah WahidaNoch keine Bewertungen

- The Strategic Position of AirAsia X CanDokument10 SeitenThe Strategic Position of AirAsia X CanNur Aini RachmawatiNoch keine Bewertungen

- AirAsia CaseDokument22 SeitenAirAsia CaseAdarsh Chhajed100% (1)

- Air Asia CS#1Dokument6 SeitenAir Asia CS#1MaryamKhalilahNoch keine Bewertungen

- AIR ASIA Case StudyDokument12 SeitenAIR ASIA Case StudyMarco Rafael PefiancoNoch keine Bewertungen

- Service Marketing - Singapore Airline - Group 6Dokument7 SeitenService Marketing - Singapore Airline - Group 6Chiku JainNoch keine Bewertungen

- Southwest Airline Case StudyDokument5 SeitenSouthwest Airline Case Study1Noch keine Bewertungen

- 04 Activity 3Dokument1 Seite04 Activity 3Ronalyka Rivera BinasNoch keine Bewertungen

- Southwest Airlines: in A Different World Case SummaryDokument2 SeitenSouthwest Airlines: in A Different World Case SummaryMuhammad Humayun KhanNoch keine Bewertungen

- SM - AirAsiaDokument22 SeitenSM - AirAsiaPavithra RatenomNoch keine Bewertungen

- Analysis SWOT of AirAsiaDokument3 SeitenAnalysis SWOT of AirAsiaemmedh100% (1)

- Competitive Advantage of Air AsiaDokument4 SeitenCompetitive Advantage of Air Asiaroslinawati_ismail75% (4)

- Space Matrix MalindoDokument7 SeitenSpace Matrix MalindomaliklduNoch keine Bewertungen

- Now Everyone Can Fly Air Asia CASE DiscussionDokument27 SeitenNow Everyone Can Fly Air Asia CASE DiscussionWendy OngNoch keine Bewertungen

- Quiz 1 Air DeccanDokument4 SeitenQuiz 1 Air DeccanAbdul Rehman RashidNoch keine Bewertungen

- Air Asia Marketing PlanDokument18 SeitenAir Asia Marketing PlanDharshviny Sasidharan100% (1)

- PEST and SWOT Analysis of AirAsias International Business OperationsDokument21 SeitenPEST and SWOT Analysis of AirAsias International Business OperationsDoremon G Fly100% (1)

- Case 1 and 2Dokument2 SeitenCase 1 and 2Corgan ColendrezNoch keine Bewertungen

- Case Study Air Asia PDFDokument11 SeitenCase Study Air Asia PDFMin LwinNoch keine Bewertungen

- A Case Study of Southwest AirlinesDokument4 SeitenA Case Study of Southwest AirlinesishmaelNoch keine Bewertungen

- Southwest Airlines in 2014Dokument6 SeitenSouthwest Airlines in 2014Muhammad Faisal KhanNoch keine Bewertungen

- Perceived Value Pricing Is That ValueDokument19 SeitenPerceived Value Pricing Is That ValueAlexandria DiegoNoch keine Bewertungen

- TQM PracticesDokument11 SeitenTQM PracticesMelvin Dxb MyDubaiNoch keine Bewertungen

- Imr451 - AirasiaDokument58 SeitenImr451 - AirasiaAzz Izumi100% (1)

- Air Asia Strategic AnalysisDokument28 SeitenAir Asia Strategic AnalysisR. Iwan Budhiarta80% (20)

- The Strategic Management of Airasia Tune GroupDokument6 SeitenThe Strategic Management of Airasia Tune GroupJuni LinNoch keine Bewertungen

- The Air ArabiaDokument9 SeitenThe Air ArabiaAlaa Eldin Farhan Nabwi100% (1)

- Alternative Strategies Selection Process: A) Build Strengths-Weaknesses-Opportunities Threats (SWOT) Matrix Swot Analysis Matrix - Air Asia AirlinesDokument7 SeitenAlternative Strategies Selection Process: A) Build Strengths-Weaknesses-Opportunities Threats (SWOT) Matrix Swot Analysis Matrix - Air Asia Airlinesmalikldu50% (2)

- Air Asia-Diversification & Growth PlanDokument10 SeitenAir Asia-Diversification & Growth PlanSagarica BrahmaNoch keine Bewertungen

- Airasia InfoDokument17 SeitenAirasia InfoMay Zaw100% (2)

- Briefly Describe The Trends in The Global Airline IndustryDokument10 SeitenBriefly Describe The Trends in The Global Airline IndustryAffizul AzuwarNoch keine Bewertungen

- Air DeccanDokument8 SeitenAir Deccanprateekbapna90Noch keine Bewertungen

- Project On AIRBLUE PakistanDokument34 SeitenProject On AIRBLUE PakistanAli Rai67% (6)

- Strategic Management Airasia Strategic MDokument25 SeitenStrategic Management Airasia Strategic MnelNoch keine Bewertungen

- Air Asia Strategic ManagementDokument2 SeitenAir Asia Strategic ManagementAffizul AzuwarNoch keine Bewertungen

- SCMPE 1 New Question PaperDokument10 SeitenSCMPE 1 New Question PaperMustafa KhanbhaiNoch keine Bewertungen

- La Matrix WorkDokument3 SeitenLa Matrix WorkcristinaNoch keine Bewertungen

- StrategicMKT RevisionDokument15 SeitenStrategicMKT Revisionjennifer2707883134Noch keine Bewertungen

- Air Asia MejikDokument13 SeitenAir Asia MejikNunik Fajrinaa PutriNoch keine Bewertungen

- Porter's Five Force Model MASDokument6 SeitenPorter's Five Force Model MASDaeng BireleyNoch keine Bewertungen

- Key Points From Mind of The StrategistDokument8 SeitenKey Points From Mind of The Strategistsanyam100% (2)

- Censorship On Networking WebsitesDokument2 SeitenCensorship On Networking WebsitessanyamNoch keine Bewertungen

- March 2016 Tonic 1st 16th MarchDokument11 SeitenMarch 2016 Tonic 1st 16th MarchKapil MittalNoch keine Bewertungen

- S.E.C. Case Against Rajat GuptaDokument10 SeitenS.E.C. Case Against Rajat GuptaDealBookNoch keine Bewertungen

- Panama PapersDokument2 SeitenPanama PaperssanyamNoch keine Bewertungen

- AA Exam Tech Day 1Dokument46 SeitenAA Exam Tech Day 1shahabNoch keine Bewertungen

- Applied Corporate Finance: Class #1Dokument32 SeitenApplied Corporate Finance: Class #1Nuno LouriselaNoch keine Bewertungen

- Kode BankDokument3 SeitenKode BankYulisa Nur FilianiNoch keine Bewertungen

- An Empirical Examination of The Amortized Spread: John M.R. Chalmers !, Gregory B. Kadlec"Dokument30 SeitenAn Empirical Examination of The Amortized Spread: John M.R. Chalmers !, Gregory B. Kadlec"tsas9508Noch keine Bewertungen

- Long-Term Challenges To Food Security and Rural Livelihoods in Sub-Saharan AfricaDokument8 SeitenLong-Term Challenges To Food Security and Rural Livelihoods in Sub-Saharan AfricaAgripolicyoutreachNoch keine Bewertungen

- Quiz # 6Dokument2 SeitenQuiz # 6arslan mumtazNoch keine Bewertungen

- CSR EssayDokument5 SeitenCSR EssaySamrat ChowdhuryNoch keine Bewertungen

- Act de INFIINTARE (ESTABLISH) Banca Centrala in UGANDA - ROMANIA NU A INFIINTAT BNR (NOT ESTABLISHED)Dokument26 SeitenAct de INFIINTARE (ESTABLISH) Banca Centrala in UGANDA - ROMANIA NU A INFIINTAT BNR (NOT ESTABLISHED)Nicusor TeodorescuNoch keine Bewertungen

- Week 6 Revision QuestionsDokument3 SeitenWeek 6 Revision QuestionsDavid Tayla McCarthyNoch keine Bewertungen

- Principles of AccountingDokument28 SeitenPrinciples of Accountingعادل اعظمNoch keine Bewertungen

- Task 4 Sales Pitch Citi BankDokument1 SeiteTask 4 Sales Pitch Citi BankNishaal GoundarNoch keine Bewertungen

- BOI-business Guide 2017-20170222 - 44021Dokument146 SeitenBOI-business Guide 2017-20170222 - 44021Kamon Eak AungkhasirikunNoch keine Bewertungen

- Representative Assessee - An Overview and Future OutlookDokument63 SeitenRepresentative Assessee - An Overview and Future Outlookjoseph davidNoch keine Bewertungen

- Jaibb AccountingDokument13 SeitenJaibb AccountingAriful Haque SajibNoch keine Bewertungen

- VOL. 122, MAY 30, 1983 489: Gonzales vs. Philippine National BankDokument10 SeitenVOL. 122, MAY 30, 1983 489: Gonzales vs. Philippine National BankcyhaaangelaaaNoch keine Bewertungen

- Compound Interest FormulaDokument2 SeitenCompound Interest FormulaЕлизавета ЛебедеваNoch keine Bewertungen

- Annual Report 2013-14newDokument118 SeitenAnnual Report 2013-14newHenizionNoch keine Bewertungen

- India Equity Strategy - Mar19 - HSBC PDFDokument67 SeitenIndia Equity Strategy - Mar19 - HSBC PDFmijjNoch keine Bewertungen

- Establishing The Effectiveness of Market Ratios in Predicting Financial Distress of Listed Firms in Nairobi Security Exchange MarketDokument13 SeitenEstablishing The Effectiveness of Market Ratios in Predicting Financial Distress of Listed Firms in Nairobi Security Exchange MarketOIRCNoch keine Bewertungen

- Start Over, Finish Rich by David Bach - ExcerptDokument20 SeitenStart Over, Finish Rich by David Bach - ExcerptCrown Publishing Group40% (15)

- Introduction To Project ManagementDokument41 SeitenIntroduction To Project ManagementSheikh Muneeb Ul HaqNoch keine Bewertungen

- The Effect of External Environment On The Profitability of The Banking Industry 2 1Dokument8 SeitenThe Effect of External Environment On The Profitability of The Banking Industry 2 1Parvinder McCartneyNoch keine Bewertungen

- VARC Test 1Dokument13 SeitenVARC Test 1Shine AliNoch keine Bewertungen

- Fitch Monthly July 2014Dokument1 SeiteFitch Monthly July 2014jaycamerNoch keine Bewertungen

- AttachmentDokument8 SeitenAttachmentRessa LiniNoch keine Bewertungen

- Rangkuman Bab 2 Akuntansi KeuanganDokument11 SeitenRangkuman Bab 2 Akuntansi KeuanganMuhammad Rusydi AzizNoch keine Bewertungen

- Fed. Sec. L. Rep. P 95,804 Securities and Exchange Commission v. Universal Major Industries Corp., Arthur J. Homans, 546 F.2d 1044, 2d Cir. (1976)Dokument7 SeitenFed. Sec. L. Rep. P 95,804 Securities and Exchange Commission v. Universal Major Industries Corp., Arthur J. Homans, 546 F.2d 1044, 2d Cir. (1976)Scribd Government DocsNoch keine Bewertungen

- EY Business Plan Guide PDFDokument24 SeitenEY Business Plan Guide PDFVineethMenonNoch keine Bewertungen

- Imt Ocean Activity This Is A Document That Is A Part of Mid Sem Assignment Under The Cateogry ofDokument6 SeitenImt Ocean Activity This Is A Document That Is A Part of Mid Sem Assignment Under The Cateogry ofShradha PuroNoch keine Bewertungen

- Group 7 - Organization and Management of Insurance CompanyDokument108 SeitenGroup 7 - Organization and Management of Insurance CompanyAnn Tierra100% (1)