Beruflich Dokumente

Kultur Dokumente

OSK 2010 Jewels Book Launch 20100506 OSK

Hochgeladen von

Fznzm AbdullahCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

OSK 2010 Jewels Book Launch 20100506 OSK

Hochgeladen von

Fznzm AbdullahCopyright:

Verfügbare Formate

PP10551/10/2010(025682)

06 May 2010

MALAYSIA EQUITY

Investment Research

Daily News

Strategy

Jeffrey Tan

+60 (3) 9207 7633

jeffrey.tan@osk.com.my Small Caps

The Research Team

+60 (3) 9207 7688

research2@osk.com.my

The 2010 Jewels Unveiled

We recently launched the latest edition of our Top Malaysian Small Cap Companies

(50 Jewels) handbook. The full day event was attended by some 70 fund managers

and investors. As with previous years, the Top 5 companies selected were invited for

a short presentation followed by a corporate luncheon. These were followed by

exclusive break-out sessions with investors. This year’s Top 5 companies are Alam

Maritim, C.I. Holdings, Leader Universal, Freight Management and Naim Holdings,

which have market capitalisation ranging from RM97m-RM905m. We believe the 2010

jewels offer fair play in terms of risk and reward given the market volatility. We

advocate trading on smaller caps in the medium term to capitalize on their still

attractive valuations, thematic opportunities and to ride on the improving earnings

momentum.

19 new companies (and more). For the 2010 edition, we raised the market capitalisation

eligibility bar to RM1.5bn from RM1bn previously so as to maintain the breadth of coverage

and to ensure that undervalued companies continue to be represented. Two new industry

classifications, namely ‘financial services’ and ‘conglomerate’, were introduced for stocks in

these categories featured for the first time. A total of 19 new companies (see Table 1)

handpicked by our research analysts for their positive share price characteristics, attractive

valuations and strong/improving fundamentals were introduced.

Naim, Freight and C.I Holdings garnered the biggest interest among the Top 5. The

presentation on Alam was delivered by Encik Azmi Bin Ahmad (Managing Director/CEO),

C.I. Holdings was represented by Encik Syed Khalil Bin Syed Ibrahim (Vice-President,

Corporate Finance & Planning), Leader by Mr. Kon Ted Liuk (Deputy Managing Director),

Freight Management by Mr. Chew Chong Keat (Group Managing Director) and Naim by

Ricky Kho (Senior Director, Corporate Services & Human Resources). We gather that most

investors were comfortable with our choice of top picks as many were familiar names with

good credentials and track records. Companies that garnered the most interest were Naim,

C.I. Holdings and Freight Management. Naim is OSK’s top construction pick for exposure to

the Sarawak theme and SCORE. We like Freight Management’s unique asset light business

model, C.I. Holdings for robust earnings growth underpinned by its bottling line expansion to

meet insatiable demand, and Leader for the twin drivers of strong cable demand and as a

emerging power play in Cambodia.

Figure 1: Snapshots of the launch

Source: OSK

OSK Research | See important disclosures at the end of this report 1

OSK Research

Insightful breakout sessions. While pre-bookings for the Top 5 breakout slots were initially

slow, registrations picked up after the individual corporate presentations. This is hardly

surprising as investors would have had more time to digest the key messages and

takeaways from the presentations before forming an opinion on the individual companies.

The break-out sessions served as a good focal point for investors to uncover new ideas and

obtain the latest updates given that meeting requests are sometimes hard to come by for

smaller cap companies. We note that the meeting slots for Naim and Freight Management

were all taken up and extended into the late afternoon, which reflected their popularity with

the investment community. Meanwhile, the meetings featuring C.I. Holdings, Leader and

Alam were no less well-attended, as 80% of their slots were taken up. The major takeaways

from the individual breakout sessions are included in the appendix to this report.

Figure 2: Snapshots taken during the launch

Source: OSK

Plant tours provided good eye candy. A sweetener for the book launch this year were the

site visits, which offered OSK clients the opportunity to get up close with the production

facilities at 4 chosen companies. We toured the bottling and F&B facility of Permanis

(subsidiary of C.I. Holdings) in Bangi which produces carbonated beverages under the

PepsiCo umbrella, as well as the popular ready-to-drink Tropicana range of fruit drinks. At

Mamee’s factory in Subang, the group witnessed the production of its yoghurt drink,

Nutrigen, and its potato crisps under the Mister Potato brand. The CEO of Notion VTec

provided an update on the latest corporate developments and played host to the tour of the

company’s plant in Klang, where our entourage witnessed first hand the fabrication of

moulds and component parts used in the manufacture of hard disk drive and camera

components. Lastly, a tour of Kossan Rubber’s rubber glove production facilities made the

visits more complete.

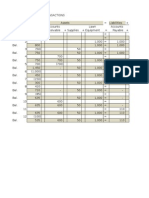

Table 1: OSK Small Cap 50 Jewels (2010 Edition)- Top 10 companies

Share Target Div

Companies Sector price^ price Yield^

(RM) (RM) (%)

Alam Maritim Oil & Gas 1.75 2.99 1.1

C.I. Holdings Consumer 2.26 3.40 2.8

Faber Group Conglomerate 2.26 2.75 3.1

Freight Logistics

Management 0.78 0.95 7.1

Glomac Property 1.35 1.83 5.2

Hai-O Enterprise Consumer 4.08 5.04 5.9

KPJ Healthcare Healthcare 2.83 3.92 3.4

Industrial

Leader Universal Products 0.94 1.13 3.9

Lion Industries Steel 1.65 2.51 0.6

Naim Holdings Construction 3.20 4.21 2.3

Source : OSK ^ as at May 5 2010

OSK Research | See important disclosures at the end of this report 2

See important disclosures at the end of this publication

OSK Research

Table 2: Number of stocks listed by sector and new additions for the 2010

edition

Sector classification No of stocks New additions

featured

Delloyd Ventures, EP

Automotive 4 Manufacturing (EPMB)

Building Materials 4 Evergreen Fibreboard

Conglomerate^ 1 Faber

Construction 4 Sunway, Protasco

C.I. Holdings, Mamee, Multi-

Sports, Signature Int.,

Consumer 11 Zhulian

Education* 1 -

Financial Services^ 1 AEON Credit

Healthcare 1 -

Industrial Products 1 -

Logistics 3 -

Oil and Gas 3 Handal

Others 1 Salcon

Property 2 Glomac

REIT 2 Axis REIT

Rubber Gloves 2 -

Steel 4 Southern Steel

Technology 4 Engtek, Notion VTec,

Toll Concession 1 -

^ new categories in 2010 edition

Source : OSK

2010 selection offers fair play in terms of risk and reward. We believe our stock

selection in the latest edition would whet the appetite of the more sophisticated investors

looking for value plays within a volatile external environment, as well as the risk seekers. For

the more risk-averse investors, we have introduced new yield plays to supplement the

conventional and already familiar names. By virtue of their business models, most of the

stocks featured in our Top 10 offer fair play on both themes - presenting growth prospects as

well as commanding defensive attributes that would mitigate earnings downside risks. Some

of the new inclusions that fulfill the dividend-defensive theme are Mamee, Zhulian and

Freight Management, which ranks alongside Hai-O, Yi-Lai and Hektar REIT, which have

appeared in our past editions. Naim and Leader are thematic names which we recommend

as proxy plays for exposure to our advocated Sarawak theme and for rising energy demand

in the region respectively. Our Top 5 is a selection of stocks that straddle both the risk-

reward thresholds and hence offers investors a more balanced investment proposition. The

valuation of these stocks are undemanding and are at attractive forward PERs of 5x-8x and

dividend yields that are not only on par with their bigger cap peers but in many instances,

even above.

Continue to trade small caps. Our investment strategy for small caps does not deviate

much from the broader house view espoused in our 3 May strategy report on the outlook for

May in which we advocated a trading stance on smaller caps in the medium-term. We

expect the key share price re-rating catalysts to come from: (i) better earnings to be reported

during the current reporting season which has just commenced; (ii) announcement of new or

additional contracts; and (iii) positive corporate developments, including value accretive

capital exercises.

OSK SMALL CAP TOP 5 PICKS

Stock Price Fair Value Mkt Cap PER (x) FY1 P/NTA Rating

(RM)^ (RM) (RMm) FY1 FY2 DY % (x)

Alam Maritim 1.78 2.99 904.8 7.2 6.8 0.6 0.5 BUY

C.I. Holdings 2.26 3.40 316.7 9.3 8.1 3.1 2.4 BUY

Freight Management 0.80 0.95 97.3 6.1 5.7 6.9 1.2 BUY

Leader Universal 0.975 1.13 425.6 6.2 5.5 3.9 0.7 BUY

Naim Holdings 3.420 4.21 855.0 9.1 7.7 2.2 1.3 BUY

^ as at 30 April 2010

OSK Research | See important disclosures at the end of this report 3

See important disclosures at the end of this publication

OSK Research

APPENDIX 1

6-month Share Price Performance ALAM MARITIM (BUY, TP: RM2.99)

2.20

2.00

Key takeaways

1.80

Its offshore support vessels are mostly on long- term charter to Petronas and PSC

1.60

contractors at attractive charter rates of USD1.70-USD2.40/bhp.

1.40 Management expects more new vessel contracts to be awarded in 2H10 to

1.20 support the installation of pipelines and facilities, revival of existing oilfields and

Oct-09 Dec-09 Jan-10 Feb-10 Mar-10 May-10

platforms, and for deepwater fields.

Alam is moving into becoming a 1-stop vessel solution provider through vertical

Jason Yap integration such as the expansion into the pipelay business via a JV with Swiber

+60 (3) 9207 7698 and the vessel repair business.

jason.yap@my.oskgroup.com Going forward, its business direction is to focus on new but related offshore

support businesses rather than vessel chartering.

Management is looking to address the issue of liquidity through a bonus issue or

placement by owners.

Maintain Buy. Our target price for Alam of RM2.99 is premised on 12x FY10 earnings.. We

like the company for its JV strategy to penetrate new businesses (pipelay barge) and new

geographical markets (Middle East and India) as well as the financing of new vessels (via a

JV with CIMB Private Equity and Tabung Haji). This will not only safeguard its gearing but

also instills greater investor confidence in the company.

6-month Share Price Performance C.I. HOLDINGS (BUY, TP: RM3.40)

2.50

2.30

2.10 Key takeaways

1.90

1.70

1.50

Sustainable long-term relationship with PepsiCo

1.30

1.10 Expect revenue growth from new capacity in the non carbonated drinks category

0.90

0.70 to drive FY2011 earnings

0.50

Sep-09 Nov-09 Dec-09 Jan-10 Mar-10 Apr-10

Extensive and growing distribution network

Management has guided for a decent double digit growth for FY11

Undemanding valuation at 12x FY11 EPS

Law Mei Chi

+60 (3) 9207 7621

meichi.law@my.oskgroup.com

Maintain Buy. We have a price target of RM3.40 based on 12x FY11 earnings. We expect

stronger contribution from its non carbonated drinks segment from mid- FY11 given that the

new hot-filled production line would be commissioned then. The target of 42,000 licensed

outlets by year-end will also continue to support topline growth. We believe the long term

relationship with PepsiCo would ensure sustainability in earnings with little business risks. C.I.

Holdings is our top buy in the consumer food sector.

OSK Research | See important disclosures at the end of this report 4

See important disclosures at the end of this publication

OSK Research

6-month Share Price Performance FREIGHT MANAGEMENT (BUY, TP: RM0.95)

0.85

0.80

Key takeaways

0.75

0.70 Management is guiding for earnings growth of 15%-20% for FY10 vs our

0.65

projection of 17.6%

Pending the outcome of due diligence, few new ventures including a

0.60

pharmaceutical distribution contract could be announced

0.55

Nov-09 Dec-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr

Freight rates have inched up and profit spreads have started to narrow. The

impact will nonetheless be compensated by a larger revenue base given the pick-

up in shipment volume

Ahmad Maghfur Usman Thailand’s railway operation has come to a standstill due to the country’s political

+60 (3) 9207 7654 unrest. However, it is business as usual for truck operations

ahmad.maghfurusman@my.oskgroup

Management is targeting Vietnam to strengthen its client base going forward

.com

Maintain BUY. Our TP of RM0.95 is premised on its 12M rolling EPS, which we have

pegged at a forward sector average of 7x. Going forward, Freight Management’s strong

network of forwarding agents worldwide, clientele base, heightening trade activities and

volume should continue to propel earnings. Despite the volatile economic conditions over

the past 5 years, Freight Management has continued to impress with double digit earnings

growth alongside superior ROEs (16%-17%), thanks to its asset light business model.

6-month Share Price Performance LEADER UNIVERSAL (BUY, TP: RM1.13)

1.10

1.05

1.00 Key takeaways

0.95

0.90

0.85 Cables and wires revenue to increase in tandem with rising copper and aluminum

0.80

prices.

0.75

0.70 Volume sales to strengthen post 2H on intensifying SCORE region developments.

0.65

Cambodian PT systems to contribute to earnings next year while its 100MW coal-

0.60

Nov-09 Dec-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 fired power plant should contribute in 2012.

17%-owned associate Sarawak Cable, which is en route to an IPO, will unlock

Vincent Lim Vi Ming further value

+60 (3) 9207 7663

viming.lim@my.oskgroup.com

Maintain BUY recommendation based on a SOP-derived target price of RM1.13. At current

levels, Leader is trading at an undemanding forward PE of 6.2x, below the building materials

sector PE of 7x-10x. Our forecast is unchanged pending the release of its upcoming 1QFY10

results and a further update from management.

OSK Research | See important disclosures at the end of this report 5

See important disclosures at the end of this publication

OSK Research

6-month Share Price Performance NAIM HOLDINGS (BUY, TP: RM4.21)

3.80

3.60 Key takeaways

3.40

3.20

3.00

Final project value for Kuching Flood mitigation could be RM1.7bn-RM1.8bn.

2.80 Management expects an award for Phase 2 in the coming months

2.60 Other potential jobs are a resettlement village (RM200m), road works (RM250m)

2.40

and affordable housing (RM150m)

2.20

Nov-09 Dec-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 Plans to JV with Bintulu Development Authority to construct housing for workers in

Similajau

Property division to remain focused on affordable housing, RM80m in unbilled

Jeremy Goh, CFA sales

+60 (3) 9207 7600

jeremy.goh@my.oskgroup.com

Maintain Buy. Our TP for Naim is based on a 2-stage SOP. We value Naim’s earnings (ex.

Dayang) at 12x FY10 earnings and its share of Dayang’s earnings at 9x. Naim remains our

preferred pick for Sarawak play. We expect to see increasing contract flows within Sarawak

moving closer to the state elections.

OSK Research | See important disclosures at the end of this report 6

See important disclosures at the end of this publication

OSK Research

Market capitalisation of the Top 50 (RMm) Return on equity (ROE) of the Top 50 (%)

KPJ Hai-O Enterprise

Lingkaran Trans Kota Pantech Group …

Lion Industries Multi Sports …

QL Resources Adventa

Kossan Signature…

Southern Steel Zhulian

Alam Maritim Kossan Rubber …

Sunway Holdings Notion Vtec

Faber Coastal Contracts

Hock Seng Lee NTPM Holdings

Coastal Contracts Handal Resources

Hai-O CBS Technology

Evergreen Fibreboard AEON Credit Service

Naim Hock Seng Lee

Zhulian Mamee-Double…

Pelikan Padini Holdings

MBM Resources C.I. Holdings

NTPM QL Resources

Axis REIT Faber Group

Adventa Lingkaran Trans …

Kian Joo Eng Teknologi…

Notion Vtec Southern Steel

Padini Alam Maritim …

AEON Credit Help International

Mamee KPJ Healthcare

Leader Freight …

Glomac Ef f icient E-Solutions

Plenitude Kawan Food

Hektar REIT Evergreen Fibreboard

Pantech Century Logistics …

Salcon Sunway Holdings

Eng Teknologi Naim Holdings

Protasco Ajiya

C.I. New Hoong Fatt …

Delloyd Ventures Delloyd Ventures

Malaysia Steel Works Protasco

Help International Leader Universal …

Multi Sports Pelikan …

New Hoong Fatt Malaysia Steel Works

Kawan Food Lion Industries …

Ajiya MBM Resources

Century Logistics Hektar REIT

Efficient E-Solutions Salcon

Yi-Lai Axis REIT

Signature Plenitude

Freight Management Trans-Asia …

Trans-Asia Shipping Glomac

CBS Technology Kian Joo Can Factory

EP Manufacturing Yi-Lai

Handal EP Manuf acturing

0 400 800 1,200 1,600 0% 10% 20% 30% 40%

OSK Research | See important disclosures at the end of this report 7

See important disclosures at the end of this publication

OSK Research

FY10 PER of the Top 50 (x) FY10 Dividend yields of the Top 50 (%)

Multi Sports… Mamee-Double Decker

Handal Resources Multi Sports Holdings Ltd

Lion Industries … Hektar REIT

Malaysia Steel Works Yi-Lai

Century Logistics… Axis REIT

Ajiya Zhulian

New Hoong Fatt … Trans-Asia Shipping …

Coastal Contracts Freight Management …

Trans-Asia Shipping… New Hoong Fatt …

Eng Teknologi … Protasco

Freight … C.I. Holdings

Southern Steel Kian Joo Can Factory

Signature International Lingkaran Trans Kota…

Leader Universal … Eng Teknologi Holdings

Protasco Aeon Credit Service

Plenitude Hai-O Enterprise

Delloyd Ventures NTPM Holdings

CBS Technology Century Logistics…

Efficient E-Solutions Glomac

Pantech Group … Southern Steel

MBM Resources Padini Holdings

EP Manufacturing Plenitude

Sunway Holdings Pelikan International …

Pelikan International … Leader Universal …

Evergreen Fibreboard Notion Vtec

Mamee-Double… Evergreen Fibreboard

Zhulian Corporation MBM Resources

Alam Maritim … KPJ Healthcare

Kian Joo Can Factory Malaysia Steel Works

Naim Holdings QL Resources

AEON Credit Service Ajiya

Adventa Handal Resources

Faber Group Faber Group

Notion Vtec Pantech Group Holdings

Kawan Food Efficient E-Solutions

Padini Holdings Hock Seng Lee

Yi-Lai Delloyd Ventures

C.I. Holdings Kawan Food

Glomac Naim Holdings

Help International Signature International

Hektar REIT Adventa

Kossan Rubber… Kossan Rubber…

Salcon Help International

Axis REIT Salcon

Hai-O Enterprise Alam Maritim Resources

Hock Seng Lee Coastal Contracts

NTPM Holdings Sunway Holdings

KPJ Healthcare Lion Industries …

QL Resources Ep Manufacturing

Lingkaran Trans … CBS Technology

0 5 10 15 20 0% 5% 10% 15%

OSK Research | See important disclosures at the end of this report 8

See important disclosures at the end of this publication

OSK Research

OSK Research Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated (NR): Stock is not within regular research coverage

All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed

will be subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or

financial instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment

decision-making based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest

and/or underwriting commitments in the securities mentioned.

Distribution in Singapore

This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to “Institutional Investors”, “Expert Investors” or

“Accredited Investors” as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an “Institutional Investor”, “Expert Investor”

or “Accredited Investor”, this research report is not intended for you and you should disregard this research report in its entirety. In respect of any

matters arising from, or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd

(“DMG”).

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research.

Published and printed by :-

OSK RESEARCH SDN. BHD. (206591-V)

(A wholly-owned subsidiary of OSK Investment Bank Berhad)

Chris Eng

Kuala Lumpur Hong Kong Singapore Jakarta Shanghai

Malaysia Research Office Hong Kong Office Singapore Office Jakarta Office Shanghai Office

OSK Research Sdn. Bhd. OSK Securities DMG & Partners PT OSK Nusadana Securities OSK (China) Investment

6th Floor, Plaza OSK Hong Kong Ltd. Securities Pte. Ltd. Indonesia Advisory Co. Ltd.

Jalan Ampang 12th Floor, 20 Raffles Place Plaza Lippo, 14th Floor, Room 6506, Plaza 66

50450 Kuala Lumpur World-Wide House #22-01 Ocean Towers Jln. Jend. Sudirman Kav 25, No.1266, West Nan Jing Road

Malaysia 19 Des Voeux Road Singapore 048620 Jakarta 12920 200040 Shanghai

Tel : +(60) 3 9207 7688 Central, Hong Kong Tel : +(65) 6533 1818 Indonesia China

Fax : +(60) 3 2175 3202 Tel : +(852) 2525 1118 Fax : +(65) 6532 6211 Tel : +(6221) 520 4599 Tel : +(8621) 6288 9611

Fax : +(852) 2810 0908 Fax : +(6221) 520 4598 Fax : +(8621) 6288 9633

OSK Research | See important disclosures at the end of this report 9

See important disclosures at the end of this publication

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CAPMDokument69 SeitenCAPMshaza443100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Finance WikibookDokument112 SeitenFinance Wikibookjurjevic100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Corpo Law ReviewerDokument24 SeitenCorpo Law ReviewerVina CeeNoch keine Bewertungen

- Financial ManagementDokument393 SeitenFinancial ManagementSM Friend100% (1)

- High Frequency Trading - Shawn DurraniDokument49 SeitenHigh Frequency Trading - Shawn DurraniShawnDurraniNoch keine Bewertungen

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Dokument16 SeitenAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiNoch keine Bewertungen

- Alpha and The Paradox of Skill (MMauboussin - July '13)Dokument12 SeitenAlpha and The Paradox of Skill (MMauboussin - July '13)Alexander LueNoch keine Bewertungen

- Project On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.Dokument15 SeitenProject On Ratio and Cash Flow Analysis For Titan Industries Pvt. Ltd.hemu1163% (16)

- Book 1Dokument14 SeitenBook 1Jap Ibe100% (2)

- Intermediate Accounting Volume 3 ValixDokument4 SeitenIntermediate Accounting Volume 3 ValixVyonne Ariane EdiongNoch keine Bewertungen

- PPTDokument60 SeitenPPTKajal Heer100% (1)

- Deloitte LuxgaapvsifrsDokument48 SeitenDeloitte LuxgaapvsifrsJustine991Noch keine Bewertungen

- Jim's LawncareDokument18 SeitenJim's LawncareJakeDickersonNoch keine Bewertungen

- BlockPark Offering PPMDokument92 SeitenBlockPark Offering PPMAnonymous 2kQo0MpACNoch keine Bewertungen

- FIN3103 ExamDokument20 SeitenFIN3103 ExamKevin YeoNoch keine Bewertungen

- DOW Theory - 6 SecretsDokument2 SeitenDOW Theory - 6 Secretssmksp1Noch keine Bewertungen

- AFAR QuestionsDokument6 SeitenAFAR QuestionsTerence Jeff TamondongNoch keine Bewertungen

- Financial Policy and StrategyDokument40 SeitenFinancial Policy and StrategyMarianna RetziNoch keine Bewertungen

- Insiders Power Oct 2016Dokument16 SeitenInsiders Power Oct 2016InterAnalyst, LLCNoch keine Bewertungen

- Icf LCF A BookletDokument20 SeitenIcf LCF A BookletDhwanik DoshiNoch keine Bewertungen

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Dokument5 SeitenComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNoch keine Bewertungen

- Assignment - 4 Jul 31Dokument5 SeitenAssignment - 4 Jul 31spectrum_48Noch keine Bewertungen

- Sample Cir BSPDokument1 SeiteSample Cir BSPAngelo SandovalNoch keine Bewertungen

- Does CAPM Hold Good For Indian Stocks A Case Study of CNX Nifty ConstituentsDokument14 SeitenDoes CAPM Hold Good For Indian Stocks A Case Study of CNX Nifty Constituentsarcherselevators100% (1)

- CFA Training BrochureDokument4 SeitenCFA Training Brochurevijay789Noch keine Bewertungen

- The National Stock ExchangeDokument4 SeitenThe National Stock ExchangeChintan VoraNoch keine Bewertungen

- Indah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014Dokument3 SeitenIndah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014btishidbNoch keine Bewertungen

- Money Market Vs Capital MarketDokument1 SeiteMoney Market Vs Capital MarketIrfaN TamimNoch keine Bewertungen

- QuestionsDokument7 SeitenQuestionsFariha NazamNoch keine Bewertungen

- Analysis of Financial Statement Bank Alfalah ReportDokument14 SeitenAnalysis of Financial Statement Bank Alfalah ReportIjaz Hussain BajwaNoch keine Bewertungen