Beruflich Dokumente

Kultur Dokumente

MUN 2400 Practice Final

Hochgeladen von

Mallory EnnisOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MUN 2400 Practice Final

Hochgeladen von

Mallory EnnisCopyright:

Verfügbare Formate

Business 2400, Winter 2013, Section

, Student Number

BUSINESS 2400

Sections 2, 4, and 56

Three-Hour Final Examination

Saturday, 13 April 2013, 7 to 10 pm

Please print your name (given name and surname) and tick your current programme and section

number. Other includes Diploma, B.Comm general, Business minors, other faculties, and undeclared majors. Your student number should appear at the top of this and every page.

Deacon 5:306:45

Tulett

12:301:45

Tulett

2:003:15

Given Name

Section 56

Section 2

Section 4

Surname

B.Comm co-op BBA

iBBA Other

1. The time allowed for completion is three hours.

2. The invigilator will provide every student with a copy of the two-page Course Summary Sheet.

Also, printed English/other language dictionaries are allowed. Other than these things, the exam

is closed-book.

3. All communicating electronic devices are prohibited.

4. Calculators may be used to assist with the calculations, however they cannot replace the requirement that you must explain how the solution was obtained.

5. Please show all work in order to receive full credit.

6. Be neat and legible. The marker will not search for the answers.

7. Marks for each question have been indicated. The exam is out of 100.

8. University Regulations against academic dishonesty apply to this examination.

9. This exam contains 15 pages.

Please do not write in the space below.

Problem 1 2 3 4 5 6 7 8 Total

Mark

Out of

12 13 12 14 10 19 13 7 100

Business 2400, Winter 2013, Section

, Student Number

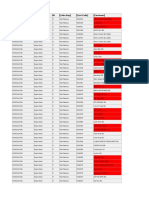

1. (12 marks) A linear optimization model has been made for a metal fabricating shop where the

variables are the number of screws, nuts, and bolts made per minute. The objective function is in

dollars; for example each screw gives a profit of $0.17 (or 17 cents) each. There are four operations:

milling; cutting; lathework; and packaging. The spreadsheet formulation (with final values) is:

A

1

2

3

4

5

6

7

8

9

10

OFV

Maximize

Constraints

Milling

Cutting

Lathe

Packaging

B

C

D

E

21.16 Screws

Nuts

Bolts

0.17

0.09

0.13

100

0

32

RHS

2

3

6

1

3

4

11

1

5

7

0

2

360

524

600

164

<=

<=

<=

<=

360

540

600

330

Using the Sensitivity Report (given at the end), answer the following questions:

(a) (1 mark) State the solution in words.

Checking the allowable ranges, determine what would happen to the objective function value in

each of the following situations (considered independently). (Assume that all proposed changes are

feasible.)

(b) (2 marks) The price of each nut rises by $0.15.

(c) (2 marks) An extra 100 units of milling becomes available.

Business 2400, Winter 2013, Section

, Student Number

(d) (5 marks) The number of units of lathework increases by 288, but the number of units of

milling falls by 40.

(e) (2 marks) The price per bolt falls by $0.05.

VariableCells

Cell

Name

$B$4 Screws

$C$4 Nuts

$D$4 Bolts

Final

Reduced

Objective

Allowable

Allowable

Value

Cost

Coefficient

Increase

Decrease

100

0

0.17

1E+30 0.111454545

0 0.204333333

0.09 0.204333333

1E+30

32

0

0.13

0.295

0.13

Constraints

Cell

$E$7

$E$8

$E$9

$E$10

Name

Milling

Cutting

Lathe

Packaging

Final

Value

360

524

600

164

Shadow

Constraint

Allowable

Price

R.H.Side

Increase

0.026

360 11.42857143

0

540

1E+30

0.019666667

600

480

0

330

1E+30

Allowable

Decrease

160

16

600

166

Business 2400, Winter 2013, Section

, Student Number

2. (13 marks) An electronics shop is about to buy some high-definition televisions (HDTVs) with

720p resolution. They can be ordered from the manufacturer at a cost of $230 each. The selling price

will be set at $330 each. Demand is estimated as being between 12 and 15 inclusive with probabilities

0.1 for 12, 0.4 for 13, 0.3 for 14, and 0.2 for 15. After this purchase, they will only order 1080p

resolution HDTVs; any leftover of these 720p TVs will be marked down to $190 each (all leftover

stock will sell with no problem at this price).

(a) (8 marks) We wish to determine how many 720p HDTVs should be ordered, according to the

following decision criteria: (i) Expected Value, (ii) pessimism (the textbook calls this maximin),

(iii) optimism (maximax), and (iv) Hurwicz (realism) with a coefficient of optimism (realism) of

0.6. Do this by using a calculator to fill in all the numbers in the range B4:I7, and state the four

recommendations clearly.

A

1 Buy

2

$230.00

3

4

12

5

13

6

14

7

15

8 Prob.

Sell

$330.00

12

13

E

F

Salvage

$190.00 (i)

14

15 EV

0.1

0.3

0.4

0.2

G

(ii)

Pess.

H

(iii)

Opt.

I

(iv)

Hurwicz

Business 2400, Winter 2013, Section

, Student Number

(b) (2 marks) Determine the EVPI.

(c) (3 marks) Verify the solution found in (a) (i) by using the marginal analysis formula.

Business 2400, Winter 2013, Section

, Student Number

3. (12 marks) Formulate (but do not solve) an algebraic model for the following situation.

(a) (7 marks) A company makes regular and premium coffee, each being made and sold by the

Tonne (1000 kg). A Tonne of regular coffee gives a profit of $150 each, while each Tonne of premium

coffee gives a profit of $260. They can sell at most 900 Tonnes of the regular coffee and at most 300

Tonnes of the premium coffee. Each product spends time on three operations as follows:

Minutes per Tonne Minutes

Operation Regular Premium Available

Packaging

4

6

7100

Roasting

2

4

4200

Grinding

5

8

8700

For every Tonne of premium coffee made, there must be at least two Tonnes of regular coffee made.

For every two Tonnes of premium coffee made, there can be at most seven Tonnes of regular coffee

made.

Business 2400, Winter 2013, Section

, Student Number

(b) (5 marks) Suppose that things are the same as before but now they can purchase up to 500

minutes (all, none, or any fraction of this amount) of additional roasting time at a cost of $2 per

minute, and can purchase an unlimited amount of extra grinding time at a cost of $3 per minute. State

what changes need to be made to the model given in part (a) (you may write the entire new model

out in full if you wish, but all thats needed is to state whats different). (Hint: you need two more

variables.)

Business 2400, Winter 2013, Section

, Student Number

4. (14 marks) A company owns production facilities in Berlin, Savannah, and Tokyo which can

ship 400, 300, and 500 units per month respectively. They have four distribution centres in Darwin, New York, Paris, and Vancouver which need 150, 250, 290, 210 units per month respectively.

Shipping costs per unit are:

Darwin

Berlin

78

Savannah

64

21

Tokyo

New York

34

15

71

Paris

12

40

63

Vancouver

65

45

39

(a) (9 marks) Formulate an algebraic model for this transportation problem. (Use numbers rather

than parameters.)

Business 2400, Winter 2013, Section

, Student Number

(b) (5 marks) If Berlin and Tokyo could use Savannah as a transshipment point, what new cost

data do we need, and how would the model given in (a) need to be modified? [Dont repeat part (a);

just show what is new.]

Business 2400, Winter 2013, Section

, Student Number

5. (10 marks) The Avalon Regional Government has six sectors which need fire protection. Adequate fire protection can be provided in each sector either by building a fire station in that sector, or

by building a fire station in another sector which is no more than a 12 minute drive away. The time to

drive between the centres of each pair of sectors is given in the following table. (Because of one-way

streets and left-turns the times are not symmetric.) The cost to build a fire station is the same in each

sector. We wish to formulate a model whose purpose is to choose which sectors should have their

own fire station.

To

From 1 2 3 4 5 6

1

0 7 15 21 23 18

2

9 0 17 20 18 11

3

13 18 0 12 8 19

4

18 14 20 0 28 10

5

13 10 12 14 0 23

6

19 13 7 16 8 0

10

Business 2400, Winter 2013, Section

, Student Number

6. (19 marks) Theres a 10% chance that pirates in the 17th century buried their treasure (bars of

silver and gold) about 35 to 40 metres beneath the surface at a particular location. If so, it would be

worth about $8,000,000 at todays prices. Otherwise, theres a 90% chance that theres no treasure.

To dig to a depth of 40 metres (which would be enough to either find the treasure, or conclude that

theres no treasure at this location) would cost $750,000.

A test based on magnetism is available at a cost of $25,000; the result will be either positive,

inconclusive, or negative. If the treasure is present then theres a 70% chance of a positive result;

a 16% chance of an inconclusive result, and a 14% chance of a negative result. If the treasure is not

present these percentages become 10%, 26%, and 64% respectively. The company has decided that if

they do a magnetism test and if it turns out to be negative, then they will not dig for treasure.

Theres also a second test available. This could only be used after doing a magnetism test and

obtaining an inconclusive result, and if used would cost $15,000. If theres treasure present the

second test will report favourable with probability 0.8; if theres no treasure the second test will

report unfavourable with probability 0.85. If an unfavourable result is obtained then they will not

dig for treasure.

Draw a decision tree and solve it using the rollback procedure to determine a recommendation

for this situation. Please use up to five decimal place accuracy for the Bayesian revisions (use either

tables or probability trees; you do not need to calculate any probabilities which are not needed for the

decision tree). [There is more space on the next page.]

11

Business 2400, Winter 2013, Section

Continuation of problem 6.

, Student Number

12

Business 2400, Winter 2013, Section

, Student Number

7. (13 marks)

(a) (10 marks) Mary has $8000 to invest in a portfolio. Her investment alternatives and their

expected returns are:

Investment

Description Expected Return

1

RRSP (retirement)

5.2%

2

Employers retirement plan

7.6%

3

Mutual Fund

6.3%

She will put at least $2000 into each investment, and cannot invest more than $8000 in total. In

addition, she has three goals which may be violated if need be. Goal 1 is for the expected annual return

to be at least $800. Goal 2 is to invest no more than $5000 in the two retirement plans combined.

Goal 3 is to invest at least twice as much in investment 2 as in investment 1.

Goal 1 is twice as important as Goal 2, and Goal 2 is three times as important as Goal 3.

Formulate but do not solve a goal optimization model for this situation.

13

Business 2400, Winter 2013, Section

, Student Number

(b) (3 marks) When using Excel to solve a goal programming problem, briefly explain how preemptive (ranked) and non-preemptive (weighted) problems are treated differently.

14

Business 2400, Winter 2013, Section

, Student Number

8. (7 marks) A wealthy couple have three children named Xena, Yuri, and Zoe. To give their

children a lesson in entrepreneurship, the parents have decided to invest a total of $35,000. They

asked their children what they could accomplish if they were given some of the money. Xena said,

Whatever you give me, I will return not only the principal but the square

root of the principal as

well. (For example, if she were given $1600, she would return 1600 + 1600 = 1640 dollars, for

a net return of $40.) Yuri thought that he could do better than his younger sister: Ill return the

principal plus twice the square root of the principal, he boasted. Their older sister Zoe felt that she

had to do even better: Ill return the principal plus three times the square root of the principal. The

parents wonder how the $35,000 should be distributed to their children, so as to maximize the total

net return.

(a) (5 marks) Formulate an algebraic model for this problem.

(b) (2 marks) In terms of whatever cells you choose to represent the variables, give the expression

in Excel format for the objective cell.

15

Das könnte Ihnen auch gefallen

- 2400 Final 2014 Winter PDFDokument16 Seiten2400 Final 2014 Winter PDFMallory EnnisNoch keine Bewertungen

- Edexcel S1 Mixed Question PDFDokument78 SeitenEdexcel S1 Mixed Question PDFDanNoch keine Bewertungen

- Management Science FinalDokument8 SeitenManagement Science FinalAAUMCLNoch keine Bewertungen

- Edexcel s1 Mixed QuestionDokument78 SeitenEdexcel s1 Mixed QuestionStylianos_C100% (1)

- MA3 Sample Exams Plus SolutionsDokument89 SeitenMA3 Sample Exams Plus Solutionsbooks_sumiNoch keine Bewertungen

- Tme 601Dokument14 SeitenTme 601dearsaswatNoch keine Bewertungen

- Introduction To Quantitative Methods: The Association of Business Executives QCFDokument12 SeitenIntroduction To Quantitative Methods: The Association of Business Executives QCFVelda Mc DonaldNoch keine Bewertungen

- Management Science 1107 - Midterms AnswersDokument4 SeitenManagement Science 1107 - Midterms AnswersHans DelimaNoch keine Bewertungen

- ISOM2700 FA21 - Quiz - 1 - Sol - Ch1 - Ch7Dokument9 SeitenISOM2700 FA21 - Quiz - 1 - Sol - Ch1 - Ch7yantelau.Noch keine Bewertungen

- SimplexDokument12 SeitenSimplexnisarg_0% (1)

- DSCI 3870 Fall 2014 Exam 1 KeyDokument9 SeitenDSCI 3870 Fall 2014 Exam 1 KeyGary ChenNoch keine Bewertungen

- Statistiek 1920 HER ENG CovDokument8 SeitenStatistiek 1920 HER ENG CovThe PrankfellasNoch keine Bewertungen

- American College of Dubai QUANTITATIVE METHODS (MAT 225) Test 1Dokument4 SeitenAmerican College of Dubai QUANTITATIVE METHODS (MAT 225) Test 1Tamil SelvanNoch keine Bewertungen

- Farmville 2 Item Lexicon (4!21!13)Dokument142 SeitenFarmville 2 Item Lexicon (4!21!13)Steven HertzNoch keine Bewertungen

- DA 2016 Problem Set 2Dokument4 SeitenDA 2016 Problem Set 2Vinit PatelNoch keine Bewertungen

- Final Exam April 2011Dokument5 SeitenFinal Exam April 2011dluvjkpopNoch keine Bewertungen

- Quantitative Methods LPDokument41 SeitenQuantitative Methods LPRyan BekinfieldNoch keine Bewertungen

- IE 423 - HMW 1Dokument6 SeitenIE 423 - HMW 1Yasemin YücebilgenNoch keine Bewertungen

- MGT 2070 - Sample MidtermDokument8 SeitenMGT 2070 - Sample MidtermChanchaipulyNoch keine Bewertungen

- Farmville2 Item LexiconDokument411 SeitenFarmville2 Item LexiconTotolici Raluca Daniela100% (1)

- Practice Problems Upto Forecasting - Dec 2010Dokument6 SeitenPractice Problems Upto Forecasting - Dec 2010Suhas ThekkedathNoch keine Bewertungen

- Question PaperDokument21 SeitenQuestion PaperKrishnaa MathiNoch keine Bewertungen

- D10 Question PaperDokument4 SeitenD10 Question Papersearchingubaby100% (1)

- Discussion 2: Standard DeluxeDokument6 SeitenDiscussion 2: Standard DeluxeJhianne Mae AlbagNoch keine Bewertungen

- AY 2021 - E210 - Practice QuestionsDokument21 SeitenAY 2021 - E210 - Practice QuestionsMj SNoch keine Bewertungen

- MAT1200 Operations Research 1, S2-2016 Assignment 3: Due Date: Friday 9 September 2016 Weight 12% Total Marks: 100Dokument8 SeitenMAT1200 Operations Research 1, S2-2016 Assignment 3: Due Date: Friday 9 September 2016 Weight 12% Total Marks: 100prmahajan18Noch keine Bewertungen

- QA 2 New Paper Style - 001Dokument3 SeitenQA 2 New Paper Style - 001kartikbhaiNoch keine Bewertungen

- 6102-Data Analysis and Decision ToolsDokument8 Seiten6102-Data Analysis and Decision ToolsTanni VermaNoch keine Bewertungen

- Patricia Abbott Irina Merkurieva Nelson Ramirez RondanDokument16 SeitenPatricia Abbott Irina Merkurieva Nelson Ramirez RondanSamuel TanuwijajaNoch keine Bewertungen

- Eco100y1 Wolfson Tt2 2012fDokument12 SeitenEco100y1 Wolfson Tt2 2012fexamkillerNoch keine Bewertungen

- Management Acocuntant BPP Workbook QDokument14 SeitenManagement Acocuntant BPP Workbook QFarahAin FainNoch keine Bewertungen

- Analytical Tools - End Term - Tri 3 Set 1Dokument9 SeitenAnalytical Tools - End Term - Tri 3 Set 1wikiSoln blogNoch keine Bewertungen

- EndSemester Exam PDFDokument4 SeitenEndSemester Exam PDFTabish HaqNoch keine Bewertungen

- EndSemester Exam PDFDokument4 SeitenEndSemester Exam PDFlapunta2201Noch keine Bewertungen

- ps1 - MicroeconomicsDokument10 Seitenps1 - MicroeconomicsLEENNoch keine Bewertungen

- QTM Test 1 2021Dokument2 SeitenQTM Test 1 2021hadhi ahamedNoch keine Bewertungen

- Mgea02 Final 2010fDokument13 SeitenMgea02 Final 2010fexamkillerNoch keine Bewertungen

- Visvesvaraya National Institute of Technology, Nagpur, M.SDokument3 SeitenVisvesvaraya National Institute of Technology, Nagpur, M.SArchit DasNoch keine Bewertungen

- Advanced Management Accounting For CA Final-Parag GuptaDokument236 SeitenAdvanced Management Accounting For CA Final-Parag GuptaPrasenjit Dey100% (1)

- BA3352: Midterm On 29 October 2002 - VERSION BDokument10 SeitenBA3352: Midterm On 29 October 2002 - VERSION BlightknowNoch keine Bewertungen

- Econ 200A Midterm 1ADokument14 SeitenEcon 200A Midterm 1Aronaldo8Noch keine Bewertungen

- Gujarat Technological UniversityDokument4 SeitenGujarat Technological UniversityBandhu SakhaNoch keine Bewertungen

- Ise216 Mid-Term 2011 Answer2Dokument4 SeitenIse216 Mid-Term 2011 Answer2David García Barrios100% (1)

- Midterm Codes A - B 28.10.21Dokument1 SeiteMidterm Codes A - B 28.10.21Thảo VũNoch keine Bewertungen

- Tugas 2Dokument7 SeitenTugas 2Henny Zahrany100% (1)

- Indr 371 Lab 2 Fall 2015, Nov. 2, 2018Dokument4 SeitenIndr 371 Lab 2 Fall 2015, Nov. 2, 2018deepakNoch keine Bewertungen

- Ryan Christopher N. David - HRENG 313 - FINAL EXAM PART 2Dokument2 SeitenRyan Christopher N. David - HRENG 313 - FINAL EXAM PART 2Arjay Lingad BaluyutNoch keine Bewertungen

- Questions Sem 2Dokument6 SeitenQuestions Sem 2YuenNoch keine Bewertungen

- 8102 Mbaex 2021Dokument6 Seiten8102 Mbaex 2021gaurav jainNoch keine Bewertungen

- Business Mathematics & Statistics PDFDokument5 SeitenBusiness Mathematics & Statistics PDFnyejosephNoch keine Bewertungen

- Tutorials BAMS1424 BASIC STATISTICAL METHODS FOR SCIENTIFIC ANALYSISDokument25 SeitenTutorials BAMS1424 BASIC STATISTICAL METHODS FOR SCIENTIFIC ANALYSISsithaarthun-wp21Noch keine Bewertungen

- The University of The West IndiesDokument10 SeitenThe University of The West IndiesDom PowellNoch keine Bewertungen

- MBA Economics For Managers Sample FinalDokument12 SeitenMBA Economics For Managers Sample FinalD RNoch keine Bewertungen

- Ip-Opgaver 10.8Dokument13 SeitenIp-Opgaver 10.8Tarique Hasan KhanNoch keine Bewertungen

- PGDM (2017-19) Term-II: End Term Examination - Operations Management - IDokument6 SeitenPGDM (2017-19) Term-II: End Term Examination - Operations Management - IAanchal MahajanNoch keine Bewertungen

- BA 502 (QMETH) Professor Hillier Sample Final ExamDokument8 SeitenBA 502 (QMETH) Professor Hillier Sample Final ExamverarenNoch keine Bewertungen

- Let's Practise: Maths Workbook Coursebook 6Von EverandLet's Practise: Maths Workbook Coursebook 6Noch keine Bewertungen

- Olympiad Sample Paper 2: Useful for Olympiad conducted at School, National & International levelsVon EverandOlympiad Sample Paper 2: Useful for Olympiad conducted at School, National & International levelsBewertung: 5 von 5 Sternen5/5 (4)

- Test 2 PDFDokument8 SeitenTest 2 PDFMallory EnnisNoch keine Bewertungen

- Test 1 PDFDokument7 SeitenTest 1 PDFMallory Ennis0% (1)

- Test 2 PDFDokument10 SeitenTest 2 PDFMallory EnnisNoch keine Bewertungen

- Test 2 PDFDokument7 SeitenTest 2 PDFMallory EnnisNoch keine Bewertungen

- Gaap-Uccino 1.5 - Part I of III - FinalDokument39 SeitenGaap-Uccino 1.5 - Part I of III - FinalmistervigilanteNoch keine Bewertungen

- Starbucks Purchasing ManagementDokument6 SeitenStarbucks Purchasing ManagementnajihahNoch keine Bewertungen

- Instrukcja Obslugi pl91tDokument29 SeitenInstrukcja Obslugi pl91tJuisNoch keine Bewertungen

- Final Exam, Berana Mclean JoshuaDokument7 SeitenFinal Exam, Berana Mclean JoshuaMCLEAN JOSHUA BERANANoch keine Bewertungen

- Kikko Max enDokument2 SeitenKikko Max enwhaleNoch keine Bewertungen

- CCD Case StudyDokument3 SeitenCCD Case StudyAbhijeet Bishayee100% (1)

- Orientations of Vietnam Coffee IndustryDokument5 SeitenOrientations of Vietnam Coffee IndustryDung NguyenNoch keine Bewertungen

- Final InvoiceDokument4 SeitenFinal InvoicePremNoch keine Bewertungen

- Restaurant GuideDokument5 SeitenRestaurant GuideAnonymous g25d5UetNoch keine Bewertungen

- Datasheet AP6060 000COSDokument1 SeiteDatasheet AP6060 000COSFernando ZunigaNoch keine Bewertungen

- Instant: Further ReadingDokument6 SeitenInstant: Further ReadingbobakerNoch keine Bewertungen

- Annotated BibliographyDokument3 SeitenAnnotated Bibliographyapi-406951522Noch keine Bewertungen

- Irish CoffeeDokument15 SeitenIrish CoffeeEvangeline ParasNoch keine Bewertungen

- 0308 Ea - Bihis, Cezar, Dedicatoria, Ong, RabajanteDokument4 Seiten0308 Ea - Bihis, Cezar, Dedicatoria, Ong, RabajanteLawrence CezarNoch keine Bewertungen

- Chapter 3 PDFDokument112 SeitenChapter 3 PDFAnonymous BJMMLHLKNoch keine Bewertungen

- New Suis JK Coffee Bar Marketing PlanDokument12 SeitenNew Suis JK Coffee Bar Marketing Planapi-719198358Noch keine Bewertungen

- Team Work Group 2 Publix Cofee Bar Deliverable 5 1Dokument63 SeitenTeam Work Group 2 Publix Cofee Bar Deliverable 5 1api-251823562Noch keine Bewertungen

- InnsDokument48 SeitenInnsCriselda CarinoNoch keine Bewertungen

- Oilahuasca - PastebinDokument4 SeitenOilahuasca - PastebinthedrdrownNoch keine Bewertungen

- Divin r17Dokument12 SeitenDivin r17Ana MuducNoch keine Bewertungen

- 369 Liver Cleanse Checklist by Shari ZiskDokument3 Seiten369 Liver Cleanse Checklist by Shari ZiskOlivia Suciu100% (1)

- Chapter 3: Effect of Roasting Temperaturetime Conditions On CO Formation and Physico-Chemical Properties of Roasted Coffee Beans-A Kinetics StudyDokument5 SeitenChapter 3: Effect of Roasting Temperaturetime Conditions On CO Formation and Physico-Chemical Properties of Roasted Coffee Beans-A Kinetics StudyPrincess Cherry KimNoch keine Bewertungen

- Newlightmyanmar 20-01-2024Dokument15 SeitenNewlightmyanmar 20-01-2024Aung MyintNoch keine Bewertungen

- The Art of Aeropress:: Standard MethodDokument19 SeitenThe Art of Aeropress:: Standard MethodTadas JasinavičiusNoch keine Bewertungen

- Ansoff MatrixDokument4 SeitenAnsoff MatrixThrowsdloh83% (6)

- But FIRST COFFEE PH Franchise Promo PackagesDokument18 SeitenBut FIRST COFFEE PH Franchise Promo PackagesNicole Gonzalez100% (2)

- Proposal Coffee GGDokument5 SeitenProposal Coffee GGWendy May Villapa100% (1)

- Socialist Republic of VietnamDokument8 SeitenSocialist Republic of VietnamDoan Pham ManhNoch keine Bewertungen

- Starbucks Purchasing Story ExplanationDokument2 SeitenStarbucks Purchasing Story ExplanationKween PhoebeNoch keine Bewertungen

- Land Resources and AgricultureDokument32 SeitenLand Resources and AgricultureAdarsh TomarNoch keine Bewertungen