Beruflich Dokumente

Kultur Dokumente

Intangible Assets

Hochgeladen von

brookeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intangible Assets

Hochgeladen von

brookeCopyright:

Verfügbare Formate

Since 1977

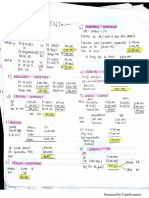

THEORY OF ACCOUNTS

ToA.1611 Intangible Assets

OCAMPO/CABARLES

MAY 2014

REVIEW QUESTIONS

1.

2.

PAS 38 applies to

a. Intangible assets that are not within the scope of

another Standard.

b. Financial assets, as defined in PAS 32 Financial

Instruments: Presentation.

c. The recognition and measurement of exploration

and evaluation assets.

d. Expenditure on the development and extraction of

minerals, oil, natural gas and similar nonregenerative resources.

Which is not within the definition of an intangible

asset?

a. Identifiable nonmonetary asset without physical

substance

b. A resource controlled by an entity as a result of

past event

c. A resource from which future economic benefits

are expected to flow to the entity

d. Held for use in the production or supply of goods

or services, for rental to others, or for

administrative purposes.

3.

Which item listed below does not qualify as an

intangible asset?

a. Computer software

b. Registered patent

c. Copyrights that are protected

d. Notebook computer

4.

Which of the following items qualify as an intangible

asset under PAS 38?

a. Advertising and promotion on the launch of a huge

product

b. College tuition fees paid to employees who decide

to enroll in an executive M.B.A. program at

Harvard University while working with the company

c. Operating losses during the initial stages of the

project

d. Legal costs paid to intellectual property lawyers to

register a patent

5.

6.

The cost of an intangible asset is composed of

a. Purchase price excluding import duties

nonrefundable taxes

b. Purchase price including import duties

nonrefundable taxes

c. Purchase

including

both

refundable

nonrefundable taxes

d. Purchase price including trade discounts

rebates

and

and

and

and

Which is incorrect concerning the recognition and

measurement of an intangible asset?

a. If an intangible asset is acquired separately, the

cost comprises its purchase price, including import

duties and taxes and any directly attributable

expenditure of preparing the asset for its intended

use.

b. If an intangible asset is acquired in a business

combination that is an acquisition, the cost is

based on its fair value at the date of acquisition.

c. If an intangible asset is acquired free of charge or

by way of government grant, the cost is equal to

its fair value.

Page 1 of 4

d.

If payment for an intangible asset is deferred

beyond normal credit terms, its cost is equal to the

total payments over the credit period.

7.

The cost of internally generated intangible asset

includes the following, except

a. Cost of materials and services used or consumed in

generating the intangible asset

b. Expenditure on training staff to operate the asset

c. Cost to register a legal right

d. Salaries, wages and other employment related

costs of personnel directly engaged in generating

the asset

8.

Legal fees incurred by a company in defending its

patent rights should be expensed when the outcome of

the litigation is

Successful

Unsuccessful

a. Yes

Yes

b. Yes

No

c. No

No

d. No

Yes

9.

When an internally generated asset meets the

recognition criteria, the appropriate treatment for costs

previously expensed is:

a. Reinstatement.

b. No adjustment as these amounts may not be

reinstated.

c. Include in the cost of the development of the

asset.

d. Capitalize into the cost of the asset and adjust

the opening balance of retained earnings.

10. According to the definition provided in PAS 38

Intangibles, activities undertaken in the research

phase of the generation of an asset may include:

a. The application of knowledge to a design for the

production of new materials;

b. The use of research findings to create a

substantially improved product;

c. Using knowledge to materially improve a

manufacturing device.

d. Original and planned investigation with the

prospect of gaining new scientific knowledge;

11. Which statement is correct regarding initial recognition

of research and development costs?

a.

All research costs should be charged to

expense.

b.

All

development

costs

should

be

capitalized.

c.

If an enterprise cannot distinguish the

research phase of an internal project to create an

intangible asset from the development phase, the

enterprise treats the expenditure for that project

as if it were incurred in the development phase

only.

d.

A research and development project

acquired in a business combination is not

recognized as an asset.

www.prtc.com.ph

ToA.1611

EXCEL PROFESSIONAL SERVICES, INC.

12. According to PAS 38 Intangibles, in order to be

able to capitalize development outlays an entity

must be able to demonstrate the following:

I.

Technical

feasibility

and

intention

of

completing the asset so it will be available

for use or sale.

II.

Its

ability

to

reliably

measure

the

expenditure on the development of the

asset.

III.

Ability to use or sell the asset.

IV.

How the asset will generate probable future

economic benefits.

a. I, II and IV only

IV only

b. II, and IV only

and IV

c.

II, III and

d.

I, II, III

13. PAS 38 Intangibles, prohibits the recognition of

the following internally generated identifiable

intangibles:

I.

Brands

II.

Mastheads

III.

Publishing titles

IV.

Customer lists

a. I, II and IV only

IV only

b. II, and IV only

and IV

c.

II, III and

d.

I, II, III

14. Which of the following would be considered

research and development?

a. Routine efforts to refine an existing product.

b. Periodic alterations to existing production

lines.

c. Marketing research to promote a new

product.

d. Construction of prototypes.

15. Which of the following costs would be

capitalized?

a. Acquisition cost of equipment to be used on

current research project only.

b. Engineering costs incurred to advance the

product to the full production stage.

c. Cost of research to determine whether a

market for the product exists.

d. Salaries of research staff.

16. If a company constructs a laboratory building to

be used as a research and development facility,

the cost of the laboratory building is matched

against earnings as

a. Research and development expense in the

period(s) of construction.

Page 2 of 4

ToA.1611

b.

c.

d.

Depreciation deducted as part of research

and development costs.

Depreciation

or

immediate

write-off

depending on company policy.

An expense at such time as productive

research

and

development

has

been

obtained from the facility.

17. Operating losses incurred during the start-up

years of a new business should be

a. Accounted for and reported like the

operating losses of any other business.

b. Written

off

directly

against

retained

earnings.

c. Capitalized as a deferred charge and

amortized over five years.

d. Capitalized as an intangible asset and

amortized over a period not to exceed 20

years.

18. Start-up costs include organizational costs, such

as legal and state fees incurred to organize a

new business entity. These costs should be

a. Capitalized and never amortized.

b. Capitalized and amortized over 40 years.

c. Capitalized and amortized over 5 years.

d. Expensed as incurred.

19. Which statement is correct concerning the

amortization of an intangible asset?

I.

The cost less residual value of an intangible

asset with a finite useful life should be

amortized over that life

II.

An intangible asset with an indefinite useful

life should not be amortized.

III.

The maximum amortization period cannot

exceed twenty years.

a.

b.

c.

d.

I only

I and II only

I and III only

Neither I, II nor III

20. A consideration not relevant in determining the

useful life of the intangible asset is the

a. The period of control over the asset and

legal or similar limits on the use of the asset

b. Technical, technological, commercial or other

types of obsolescence

c. Expected actions of competitors or potential

competitors

d. Initial cost

21. The residual value of an intangible asset

www.prtc.com.ph

EXCEL PROFESSIONAL SERVICES, INC.

a.

b.

c.

d.

Is always equal to zero

Is equal to zero unless a third party commits

to buy the asset at the end of its useful life

and there is an active market for the asset

Is equal to zero unless a third party commits

to buy the asset at the end of its useful life

or there is an active market for the asset

May be increased for the purpose of

computing amortization amount

22. The method of amortization used for an

intangible asset with a finite life

a. Should always be the straight-line method

b. Need not reflect the pattern of use of the

asset

c. Should be the straight-line method if the

pattern of use cannot be determined reliably

d. Should always be the units of production

method

23. Which of the following factors should not be

considered in determining the useful life of an

intangible asset?

a. Effects of obsolescence, changes in market

demand for the product

b. The salvage value of the asset

c. Expected

actions

of

competitors

and

potential competitors

d. The period of control over the asset and

legal or similar limits on the use of the asset,

such as expiry dates of related leases or

contractual or regulatory provisions.

24. Goodwill may be recorded when:

a. It is identified within a company.

b. One company acquires another in a business

combination.

c. The fair value of a companys assets exceeds

their cost.

d.

A company

relations.

has

exceptional

customer

25. The reason goodwill is sometimes referred to as

a master valuation account is because

a. It represents the purchase price of a

business that is about to be sold.

b. It is the difference between the fair value of

the net identifiable assets as compared with

the purchase price of the acquired business.

c. The value of a business is computed without

consideration of goodwill and then goodwill is

added to arrive at a master valuation.

d. It is the only account in the financial

statements that is based on value, all other

accounts are recorded at an amount other

than their value.

26. Which of the following intangible assets should

be shown as a separate item on the statement of

financial position?

a. Goodwill

b. Franchise

c. Patent

d. Trademark

27. Which of the following disclosures is not required

by PAS 38?

a. Useful lives of the intangible assets

b. Reconciliation of carrying amount at the

beginning and the end of the year

c. Contractual commitments for the acquisition

of intangible assets

d. Fair value of similar intangible assets used

by its competitors

- now do the DIY drill -

DO-IT-YOURSELF (DIY) DRILL

1.

A newly set up dot-com entity has engaged you

as its financial advisor. The entity has recently

completed one of its highly publicized research

and development projects and seeks your advice

on the accuracy of the following statements

made by one of its stakeholders. Which one is

true?

a. Costs incurred during the research phase

can be capitalized

b. Costs incurred during the development

phase can be capitalized if criteria such as

Page 3 of 4

ToA.1611

c.

d.

2.

technical feasibility of the project being

established are met

Training costs of technicians used in research

can be capitalized

Designing of jigs and tools qualify as

research activities

1.

When an intangible asset is acquired by an

exchange of assets, which of the following

measures will need to be considered in the

determination of that cost? The:

a. Fair value of the asset given up.

www.prtc.com.ph

EXCEL PROFESSIONAL SERVICES, INC.

3.

4.

5.

5.

6.

7.

b. Carrying amount of the asset received.

c. Initial cost of the asset given up.

d. Replacement cost of the asset received.

2.

A brand name that was acquired separately

should initially be recognized, according to PAS38

Intangible assets, at

a. Recoverable amount

b. Either cost or fair value at the choice of the

acquirer

c. Fair value

d. Cost

3.

Once recognized, intangible assets can be

carried at

a. Cost less accumulated amortization

b. Cost less accumulated amortization and less

accumulated impairment losses

c. Revalued

amount

less

accumulated

amortization

d. Cost plus a notional increase in fair value

since the intangible asset is acquired

4.

According

to

PAS38

Intangible

assets,

amortization of an intangible asset with a finite

useful life should commence when

a. It is first recognized as an asset

b. it is probable that it will generate future

economic benefits

c. It is available for use

d. The costs can be identified with reasonable

certainty

In relation to the amortization of intangible

assets, if an intangible asset has a finite useful

life:

6. a.

It must be amortized over a period

not exceeding 40 years;

7. b.

It must be amortized across a period

not exceeding 5 years;

8. c.

It is not subject to an annual

amortization charge;

9. d.

It must be amortized over that life.

10.

In relation to amortization of intangible assets,

PAS 38 Intangibles, requires that intangible

assets with indefinite useful lives:

11. a.

Are amortized by the straight-line

method across their useful lives;

12. b.

Must be amortized across a period of

no more than 20 years;

20.

13. c.

Are not subject to an amortization

charge;

14. d. Should not be amortized in a period in

which maintenance of the asset occurs.

15.

8. In relation to the amortisation of intangible

assets, the general rule in PAS 38 Intangibles, is

that unless demonstrated otherwise:

a. The residual value does not enter into the

determination of the amortisation charge.

b. The residual need no be reviewed at the end

of each annual reporting period.

c. All intangible assets have a residual value at

least equal to the amount of maintenance

costs incurred.

d. The residual value is presumed to be zero.

16.

9. Which

statement

is

incorrect

concerning

internally generated intangible asset?

a. To assess whether an internally generated

intangible asset meets the criteria for

recognition, an enterprise classifies the

generation of the asset into a research phase

and a development phase.

b. The cost of an internally generated asset

comprises all expenditure that can be

directly attributed or allocated on a

reasonable and consistent basis to creating,

producing and preparing the asset for its

intended use.

c. Internally generated brands, mastheads,

publishing titles, customer lists and items

similar in substance should not be

recognized as intangible assets.

d. Internally generated goodwill may be

recognized as an intangible asset.

17.

10. Internally generated goodwill is prohibited from

recognition in the financial statements of an

entity. The reason for this treatment is that:

a. Goodwill is not identifiable;

b. Goodwill is not measurable;

c. It is not comparable to any other intangible

assets;

d. It is not prudent to recognize intangible

assets.

18.

19. - end of ToA.1611 -

21.

22.

Page 4 of 4

ToA.1611

www.prtc.com.ph

Das könnte Ihnen auch gefallen

- Fly Ash Brick ProjectDokument4 SeitenFly Ash Brick ProjectJeremy Ruiz100% (4)

- Audit of ReceivablesDokument32 SeitenAudit of Receivablesxxxxxxxxx96% (55)

- CHAPTER 3 Financial Markets and InstitutionsDokument13 SeitenCHAPTER 3 Financial Markets and InstitutionsMichelle Rodriguez Ababa100% (4)

- 21 - Intangible AssetsDokument6 Seiten21 - Intangible AssetsralphalonzoNoch keine Bewertungen

- Quiz - Module 2Dokument5 SeitenQuiz - Module 2Alyanna Alcantara67% (3)

- Reviewer - Intangible AssetsDokument7 SeitenReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- PPE Depreciation & ImpairmentDokument25 SeitenPPE Depreciation & ImpairmentSummer Star0% (1)

- Accounting For Investments - Test BankDokument21 SeitenAccounting For Investments - Test BankIsh Selin100% (1)

- 16 - Property, Plant and EquipmentDokument2 Seiten16 - Property, Plant and EquipmentralphalonzoNoch keine Bewertungen

- Investment Property QuizDokument5 SeitenInvestment Property QuizAndrea AtendidoNoch keine Bewertungen

- INTERMEDIATE ACCTG 1B (by MILLANDokument27 SeitenINTERMEDIATE ACCTG 1B (by MILLANshelou_domantayNoch keine Bewertungen

- FAR12 Investment Property - With AnsDokument8 SeitenFAR12 Investment Property - With AnsAJ Cresmundo0% (1)

- Audit investments equity securities fishing corpDokument9 SeitenAudit investments equity securities fishing corpGirlie SisonNoch keine Bewertungen

- FarDokument14 SeitenFarKenneth Robledo100% (1)

- Accounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizDokument10 SeitenAccounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizKissy LorNoch keine Bewertungen

- Chapter 17 - Test BankDokument44 SeitenChapter 17 - Test Bankjdiaz_64624781% (16)

- AFARrDokument989 SeitenAFARrIvhy Cruz Estrella100% (1)

- 22 - Intangible Assets - TheoryDokument3 Seiten22 - Intangible Assets - TheoryralphalonzoNoch keine Bewertungen

- Ch12 Intangible AssetsDokument28 SeitenCh12 Intangible AssetsBabi Dimaano Navarez0% (1)

- Audit of Property, Plant and Equipment for Dok ManufacturingDokument13 SeitenAudit of Property, Plant and Equipment for Dok ManufacturingHijabwear BizNoch keine Bewertungen

- Intangible AssetsDokument16 SeitenIntangible Assets566973801967% (3)

- ch11 PDFDokument39 Seitench11 PDFerylpaez89% (9)

- Financial Accounting & Reporting for Biological Assets (FARDokument2 SeitenFinancial Accounting & Reporting for Biological Assets (FARMariella Catacutan67% (3)

- Audit of Property, Plant and EquipmentDokument7 SeitenAudit of Property, Plant and EquipmentclintonNoch keine Bewertungen

- FAR - RQ - Investment in AssociatesDokument2 SeitenFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Inventories - TheoriesDokument9 SeitenInventories - TheoriesIrisNoch keine Bewertungen

- K12 Philippines Whereabouts PDFDokument37 SeitenK12 Philippines Whereabouts PDFsichhahaNoch keine Bewertungen

- TOA - Theory of Accounts ReviewDokument7 SeitenTOA - Theory of Accounts ReviewAnne Lorrheine CasanosNoch keine Bewertungen

- FAR Quiz 3 Biological Assets and Investments With AnswersDokument6 SeitenFAR Quiz 3 Biological Assets and Investments With AnswersRezzan Joy Camara MejiaNoch keine Bewertungen

- National Mock Board Examination 2017 Financial Accounting and ReportingDokument9 SeitenNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- 19 - Revaluation and ImpairmentDokument3 Seiten19 - Revaluation and Impairmentjaymark canayaNoch keine Bewertungen

- Module 5 - Intangible AssetsDokument8 SeitenModule 5 - Intangible AssetsLui0% (2)

- P 1Dokument8 SeitenP 1Ken Mosende TakizawaNoch keine Bewertungen

- Property Plant and EquipmentDokument13 SeitenProperty Plant and EquipmentWilsonNoch keine Bewertungen

- Finals Answer KeyDokument11 SeitenFinals Answer Keymarx marolinaNoch keine Bewertungen

- Investments: Pas 32 Financial Instruments - PresentationDokument11 SeitenInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- DWC Legazpi Practical Accounting One LiabilitiesDokument14 SeitenDWC Legazpi Practical Accounting One Liabilitiesyukiro rineva0% (2)

- 17 - Land, Building & MachineryDokument3 Seiten17 - Land, Building & Machineryjaymark canayaNoch keine Bewertungen

- Wasting AssetsDokument2 SeitenWasting AssetsAdan NadaNoch keine Bewertungen

- CH 17Dokument37 SeitenCH 17Claire Anne Sulam0% (1)

- (Problems) - Audit of Prepayments and Intangible AssetsDokument13 Seiten(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- Intangible Assets NotesDokument6 SeitenIntangible Assets NotesRaizel RamirezNoch keine Bewertungen

- Intacc PpeDokument32 SeitenIntacc PpeIris MnemosyneNoch keine Bewertungen

- Liabilities BSA 5-2sDokument7 SeitenLiabilities BSA 5-2sJustine GuilingNoch keine Bewertungen

- p1 & AP - IntangiblesDokument13 Seitenp1 & AP - IntangiblesJolina Mancera100% (3)

- PAS 8 - Changes in Acctg Policies, Estimates and ErrorDokument12 SeitenPAS 8 - Changes in Acctg Policies, Estimates and ErrorDovelyn DorinNoch keine Bewertungen

- Iac 11 Current Liabilities PDFDokument9 SeitenIac 11 Current Liabilities PDFClarisse Pelayo0% (1)

- Mindanao State University College of Business Administration and Accountancy Marawi CityDokument7 SeitenMindanao State University College of Business Administration and Accountancy Marawi CityHasmin Saripada AmpatuaNoch keine Bewertungen

- Strategic CMDokument7 SeitenStrategic CMMjhayeNoch keine Bewertungen

- 29 - Liabilities - TheoryDokument5 Seiten29 - Liabilities - Theoryjaymark canayaNoch keine Bewertungen

- PPE Costs and DepreciationDokument6 SeitenPPE Costs and Depreciationela kikay40% (5)

- Accounting Theory and Analysis Chart 16 Test BankDokument14 SeitenAccounting Theory and Analysis Chart 16 Test BankSonny MaciasNoch keine Bewertungen

- PAS38 TheoriesDokument3 SeitenPAS38 TheoriesAngelicaNoch keine Bewertungen

- 4 InventoriesDokument5 Seiten4 InventoriesandreamrieNoch keine Bewertungen

- FAR 2&3 Test BankDokument63 SeitenFAR 2&3 Test BankRachelle Isuan TusiNoch keine Bewertungen

- FAR - Investment Property - StudentDokument3 SeitenFAR - Investment Property - StudentEdel Kristen BarcarseNoch keine Bewertungen

- Multiple Choice Theories: Polytechnic OF The Philippines (Pup)Dokument7 SeitenMultiple Choice Theories: Polytechnic OF The Philippines (Pup)Cj SernaNoch keine Bewertungen

- PAS 38 Test BankDokument9 SeitenPAS 38 Test BankJake ScotNoch keine Bewertungen

- BPS Midterm Exam KADokument5 SeitenBPS Midterm Exam KASheena CalderonNoch keine Bewertungen

- New Zealand Financial Accounting 6Th Edition Deega Test Bank Full Chapter PDFDokument67 SeitenNew Zealand Financial Accounting 6Th Edition Deega Test Bank Full Chapter PDFmichaelkrause22011998gdj100% (10)

- UntitledDokument25 SeitenUntitledKatreen SamaniegoNoch keine Bewertungen

- Australian Financial Accounting 6Th Edition Deegan Test Bank Full Chapter PDFDokument67 SeitenAustralian Financial Accounting 6Th Edition Deegan Test Bank Full Chapter PDFsarahpalmerotpdkjcwfq100% (9)

- Australian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFDokument67 SeitenAustralian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFsarahpalmerotpdkjcwfq100% (13)

- Cpa Review School of The Philippines ManilaDokument4 SeitenCpa Review School of The Philippines ManilaAljur SalamedaNoch keine Bewertungen

- New Doc 2018-01-10Dokument9 SeitenNew Doc 2018-01-10brookeNoch keine Bewertungen

- SALES Memory AidDokument39 SeitenSALES Memory AidAgniezka AgniezkaNoch keine Bewertungen

- Scanned by CamscannerDokument24 SeitenScanned by CamscannerbrookeNoch keine Bewertungen

- New Doc 2018-01-10 PDFDokument9 SeitenNew Doc 2018-01-10 PDFbrookeNoch keine Bewertungen

- Cannon Ball Review With Exercises PART 1Dokument11 SeitenCannon Ball Review With Exercises PART 1Genelyn Langote100% (1)

- Senate Bill On Tax Reform For Acceleration and Inclusion: in BriefDokument26 SeitenSenate Bill On Tax Reform For Acceleration and Inclusion: in BriefSeung-Ho YooNoch keine Bewertungen

- Partcor Reviewer PDFDokument26 SeitenPartcor Reviewer PDFKunal Sajnani100% (1)

- PWCPH Taxalert-08 PDFDokument14 SeitenPWCPH Taxalert-08 PDFKyll MarcosNoch keine Bewertungen

- Practical Accounting TwoDokument48 SeitenPractical Accounting TwoFerdinand FernandoNoch keine Bewertungen

- Ambagan Ni MayorDokument1 SeiteAmbagan Ni MayorbrookeNoch keine Bewertungen

- Quick Notes PEZADokument8 SeitenQuick Notes PEZAVic FabeNoch keine Bewertungen

- Jpia Cup p1Dokument65 SeitenJpia Cup p1RonieOlarte100% (1)

- Master To Do Lists: For Personal Use OnlyDokument1 SeiteMaster To Do Lists: For Personal Use OnlybrookeNoch keine Bewertungen

- How Was Your FaithDokument25 SeitenHow Was Your FaithbrookeNoch keine Bewertungen

- New Doc 2017-12-11 PDFDokument6 SeitenNew Doc 2017-12-11 PDFbrookeNoch keine Bewertungen

- How Was Your FaithDokument2 SeitenHow Was Your FaithbrookeNoch keine Bewertungen

- Investment PDFDokument4 SeitenInvestment PDFbrookeNoch keine Bewertungen

- Business Combi P2 PDFDokument6 SeitenBusiness Combi P2 PDFbrookeNoch keine Bewertungen

- Far Concept PDFDokument28 SeitenFar Concept PDFbrookeNoch keine Bewertungen

- New Doc 2017-11-25Dokument21 SeitenNew Doc 2017-11-25brookeNoch keine Bewertungen

- New Doc 2017-12-12 PDFDokument9 SeitenNew Doc 2017-12-12 PDFbrookeNoch keine Bewertungen

- Far Concept PDFDokument28 SeitenFar Concept PDFbrookeNoch keine Bewertungen

- Investment PDFDokument4 SeitenInvestment PDFbrookeNoch keine Bewertungen

- Business Combi P2 PDFDokument6 SeitenBusiness Combi P2 PDFbrookeNoch keine Bewertungen

- New Doc 2017-12-12Dokument9 SeitenNew Doc 2017-12-12brookeNoch keine Bewertungen

- CamScanner Scans PDF DocsDokument11 SeitenCamScanner Scans PDF DocsbrookeNoch keine Bewertungen

- Far ConceptDokument28 SeitenFar ConceptbrookeNoch keine Bewertungen

- CamScanner Scans PDF DocsDokument6 SeitenCamScanner Scans PDF DocsbrookeNoch keine Bewertungen

- Arnold Van Den Berg Power Point Jan 29 2020Dokument60 SeitenArnold Van Den Berg Power Point Jan 29 2020Gonzalo Vera MirandaNoch keine Bewertungen

- ITOP Quotation For Kebab Maker Box To Wiwih.17.9.13Dokument1 SeiteITOP Quotation For Kebab Maker Box To Wiwih.17.9.13Wiwih WahyuNoch keine Bewertungen

- Proforma Invoice and Purchase Agreement No.923788-003506Dokument2 SeitenProforma Invoice and Purchase Agreement No.923788-003506Cesar Barco OliveraNoch keine Bewertungen

- Colombia Watch Bank of America June 2023Dokument13 SeitenColombia Watch Bank of America June 2023La Silla VacíaNoch keine Bewertungen

- What's Brewing?: An Analysis of India's Coffee IndustryDokument69 SeitenWhat's Brewing?: An Analysis of India's Coffee Industrymohit sharmaNoch keine Bewertungen

- 7 External AuditDokument28 Seiten7 External Auditcuteserese roseNoch keine Bewertungen

- 7 Pager ContractDokument7 Seiten7 Pager Contractstar shiningNoch keine Bewertungen

- PaymentDokument1 SeitePaymentrobert cooperNoch keine Bewertungen

- IELTS Writing Task 1Dokument81 SeitenIELTS Writing Task 1mohamedn_15100% (2)

- Appendix 22 C: Format of Certificate of Payments Issued by The Project AuthorityDokument5 SeitenAppendix 22 C: Format of Certificate of Payments Issued by The Project Authorityavijit kundu senco onlineNoch keine Bewertungen

- Assignment 3Dokument4 SeitenAssignment 3May AlgallaiNoch keine Bewertungen

- Sales PromotionDokument22 SeitenSales PromotionHina QureshiNoch keine Bewertungen

- Summer Internship ReportDokument69 SeitenSummer Internship ReportShobhitShankhalaNoch keine Bewertungen

- Platts Pe 24 June 2015Dokument12 SeitenPlatts Pe 24 June 2015mcontrerjNoch keine Bewertungen

- Lemon Law PDFDokument26 SeitenLemon Law PDFMarc Benedict TalamayanNoch keine Bewertungen

- Segmenting The Business Market and Estimating Segment DemandDokument24 SeitenSegmenting The Business Market and Estimating Segment Demandlilian04Noch keine Bewertungen

- AIA Doc Synopses by SeriesDokument43 SeitenAIA Doc Synopses by Seriesdupree100% (1)

- Price Theory 2018-2021Dokument20 SeitenPrice Theory 2018-2021Gabriel RoblesNoch keine Bewertungen

- Beta Saham 20190316 enDokument13 SeitenBeta Saham 20190316 enLaksmana NarayanaNoch keine Bewertungen

- Kerrisdale Capital Prime Office REIT AG ReportDokument19 SeitenKerrisdale Capital Prime Office REIT AG ReportCanadianValueNoch keine Bewertungen

- Government Regulation and DeregulationDokument9 SeitenGovernment Regulation and DeregulationIan Jasper P. MongoteNoch keine Bewertungen

- Spa Lpfo AndrewDokument11 SeitenSpa Lpfo AndrewnashapI100% (1)

- Tech Analysis - Martin PringDokument149 SeitenTech Analysis - Martin Pringapi-374452792% (13)

- ACYCST2 Mock Comprehensive Examination KeyDokument9 SeitenACYCST2 Mock Comprehensive Examination KeyGian Carlo RamonesNoch keine Bewertungen

- Achievement Test 4: Chapters 7-8 Managerial AccountingDokument7 SeitenAchievement Test 4: Chapters 7-8 Managerial AccountingLey EsguerraNoch keine Bewertungen

- Distributed Generation - Definition, Benefits and IssuesDokument12 SeitenDistributed Generation - Definition, Benefits and Issuesapi-3697505100% (1)

- Chapter 6 - Simple PricingDokument30 SeitenChapter 6 - Simple PricingpropropriceNoch keine Bewertungen

- MCQS IntroDokument7 SeitenMCQS IntroABDUL RAHMANNoch keine Bewertungen