Beruflich Dokumente

Kultur Dokumente

Ar 2005 Financial Statements p55 e

Hochgeladen von

salehin1969Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ar 2005 Financial Statements p55 e

Hochgeladen von

salehin1969Copyright:

Verfügbare Formate

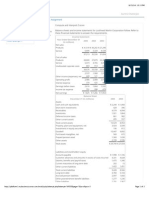

Financial statements

Consolidated statements of earnings

Years ended September 30 (in thousands of Canadian dollars, except share data)

2005

2004

2003

restated

restated

3,685,986

3,150,070

2,589,905

3,151,558

199,283

24,014

(7,156)

(11,000)

(4,216)

(321)

3,352,162

2,677,396

162,591

20,672

(8,728)

(488)

2,851,443

2,182,447

119,097

12,578

(3,094)

(295)

2,310,733

Earnings from continuing operations before income taxes

Income taxes (note 14)

Net earnings from continuing operations

333,824

114,126

219,698

298,627

113,241

185,386

279,172

113,057

166,115

Net (loss) gain from discontinued operations (note 17)

net earnings

(3,210)

216,488

8,655

194,041

3,083

169,198

419,510,503

395,191,927

0.44

0.02

0.46

0.42

0.01

0.43

2005

2004

2003

$

377,944

revenue

Operating expenses

Costs of services, selling and administrative (note 15)

Amortization (note 12)

Interest on long-term debt

Other income, net

Sale of right (note 13)

Gain on sale of investment in an entity subject to signicant inuence (note 16)

Entity subject to significant influence

Weighted-average number of outstanding Class A

subordinate and Class B shares

439,349,210

basic and diluted earnings (loss) per share (note 11)

Continuing operations

Discontinued operations

0.50

(0.01)

0.49

See Notes to the consolidated nancial statements.

Consolidated statements of retained earnings

Years ended September 30 (in thousands of Canadian dollars)

balance, beginning of year, as previously reported

769,421

$

555,310

Change in accounting policies (note 2)

Balance, beginning of year, restated

(38,664)

730,757

(13,105)

542,205

(4,937)

373,007

Net earnings

216,488

194,041

169,198

Share issue costs, net of income taxes (note 9)

Excess of purchase price over carrying value of Class A subordinate shares acquired (note 9)

balance, end of year

(51,978)

895,267

(5,489)

730,757

542,205

See Notes to the consolidated nancial statements.

cgi group inc. 2005 annual report

55

Financial statements

Consolidated balance sheets

2005

As at September 30 (in thousands of Canadian dollars)

assets

Current assets

Cash and cash equivalents

Accounts receivable (note 3)

Work in progress

Prepaid expenses and other current assets

Future income taxes (note 14)

Capital assets (note 4)

Contract costs (note 5)

Finite-life intangibles and other long-term assets (note 6)

Future income taxes (note 14)

Goodwill (note 7)

Total assets before funds held for clients

Funds held for clients (note 2)

liabilities

Current liabilities

Accounts payable and accrued liabilities

Accrued compensation

Deferred revenue

Income taxes

Future income taxes (note 14)

Current portion of long-term debt (note 8)

Future income taxes (note 14)

Long-term debt (note 8)

Accrued integration charges (note 16) and other long-term liabilities

Total liabilities before clients funds obligations

Clients funds obligations (note 2)

2004

restated

240,459

487,731

214,470

75,531

22,118

1,040,309

116,388

228,646

580,642

46,601

1,773,370

3,785,956

200,703

3,986,659

200,623

546,286

222,278

89,658

79,584

1,138,429

143,641

278,240

630,080

101,899

1,827,604

4,119,893

196,622

4,316,515

378,691

107,014

127,950

31,955

47,163

14,899

707,672

238,983

234,801

109,810

1,291,266

200,703

1,491,969

427,635

110,700

123,213

31,369

68,603

14,529

776,049

287,433

475,291

119,258

1,658,031

196,622

1,854,653

1,762,973

67,578

19,655

895,267

(250,783)

2,494,690

3,986,659

1,820,230

49,879

19,655

730,757

(158,659)

2,461,862

4,316,515

Commitments and contingencies (note 23)

shareholders equity

Capital stock (note 9)

Contributed surplus (note 10c)

Warrants (note 10b)

Retained earnings

Foreign currency translation adjustment

See Notes to the consolidated nancial statements.

Approved by the Board

(signed)

(signed)

Serge Godin

Andr Imbeau

director

56

cgi group inc. 2005 annual report

director

Financial statements

Consolidated statements of cash flows

Years ended September 30 (in thousands of Canadian dollars)

2005

2004

2003

restated

restated

219,698

185,386

166,115

230,933

(3,038)

35,650

1,993

20,554

(11,000)

(4,216)

(321)

(10,576)

479,677

192,325

(16,439)

55,626

(789)

25,559

(488)

(211,376)

229,804

146,886

(30,174)

46,249

1,914

8,168

(295)

(108,789)

230,074

investing activities

Business acquisitions (net of cash acquired) (note 16)

Proceeds from sale of assets and businesses (net of cash disposed) (note 16)

Proceeds from sale of investment in an entity subject to signicant inuence (note 16)

Proceeds from sale of right (note 13)

Purchase of capital assets

Proceeds from disposal of capital assets

Contract costs

Reimbursement of contract costs upon termination of a contract

Additions to nite-life intangibles and other long-term assets

Proceeds from disposal of nite-life intangibles

Decrease in other long-term assets

Cash used in continuing investing activities

(66,229)

29,521

20,849

11,000

(25,314)

6,663

(27,304)

15,300

(88,000)

5,251

13,018

(105,245)

(589,678)

87,503

(59,829)

4,738

(76,260)

(84,696)

17,595

(700,627)

(233,512)

(61,226)

(29,211)

(149,951)

10,321

(463,579)

financing activities

Increase in credit facilities (note 8)

Repayment of credit facilities

Increase in other long-term debt

Repayment of other long-term debt

Repurchase of Class A subordinate shares

Issuance of shares (net of share issue costs) (note 9)

Cash (used in) provided by continuing financing activities

190,000

(397,578)

(16,705)

(109,456)

4,551

(329,188)

240,534

(219,000)

257,604

(26,451)

330,996

583,683

219,000

2,471

(22,220)

6,451

205,702

operating activities

Net earnings from continuing operations

Adjustments for:

Amortization (note 12)

Deferred credits

Future income taxes (note 14)

Foreign exchange loss (gain)

Stock-based compensation expense

Sale of right (note 13)

Gain on sale of investment in an entity subject to signicant inuence (note 16)

Entity subject to signicant inuence

Net change in non-cash working capital items (note 19)

Cash provided by continuing operating activities

Effect of foreign exchange rate changes on cash and cash equivalents

of continuing operations

Net increase (decrease) in cash and cash equivalents of continuing operations

Net cash and cash equivalents provided by discontinued operations (note 17)

Cash and cash equivalents, beginning of year

cash and cash equivalents, end of year

(6,167)

39,077

759

200,623

240,459

186

113,046

4,068

83,509

200,623

917

(26,886)

6,174

104,221

83,509

Supplementary cash ow information (note 19)

See Notes to the consolidated nancial statements.

cgi group inc. 2005 annual report

57

Das könnte Ihnen auch gefallen

- 2014 IFRS Financial Statements Def CarrefourDokument80 Seiten2014 IFRS Financial Statements Def CarrefourawangNoch keine Bewertungen

- 2009 Quart01 BsDokument2 Seiten2009 Quart01 Bsyogi2416Noch keine Bewertungen

- Financial Reporting: Consolidated Statements and NotesDokument66 SeitenFinancial Reporting: Consolidated Statements and NotesJorge LazaroNoch keine Bewertungen

- DemonstraDokument75 SeitenDemonstraFibriaRINoch keine Bewertungen

- Myer AR10 Financial ReportDokument50 SeitenMyer AR10 Financial ReportMitchell HughesNoch keine Bewertungen

- Consolidated Statements of Cash Flows: Years Ended March 31Dokument8 SeitenConsolidated Statements of Cash Flows: Years Ended March 31Edielson SantanaNoch keine Bewertungen

- 2006 To 2008 Blance SheetDokument4 Seiten2006 To 2008 Blance SheetSidra IrshadNoch keine Bewertungen

- INDIGO Cash FlowsDokument9 SeitenINDIGO Cash FlowsAyush SarawagiNoch keine Bewertungen

- Wipro Financial StatementsDokument37 SeitenWipro Financial StatementssumitpankajNoch keine Bewertungen

- Standalone Accounts 2008Dokument87 SeitenStandalone Accounts 2008Noore NayabNoch keine Bewertungen

- Samsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Dokument3 SeitenSamsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Nitin SharmaNoch keine Bewertungen

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Dokument3 SeitenActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1Noch keine Bewertungen

- Macy's 10-K AnalysisDokument39 SeitenMacy's 10-K Analysisapb5223Noch keine Bewertungen

- Consolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedDokument6 SeitenConsolidated Income Statement: All Amounts in US Dollars Thousands Unless Otherwises StatedMbanga PennNoch keine Bewertungen

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDokument33 SeitenLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100Noch keine Bewertungen

- Votorantim Financial ReportDokument0 SeitenVotorantim Financial ReporthyjulioNoch keine Bewertungen

- Summary - Comparative (2020 vs. 2019)Dokument5 SeitenSummary - Comparative (2020 vs. 2019)Neil David ForbesNoch keine Bewertungen

- Fianancial StatementsDokument84 SeitenFianancial StatementsMuhammad SaeedNoch keine Bewertungen

- Tiso Blackstar Annoucement (CL)Dokument2 SeitenTiso Blackstar Annoucement (CL)Anonymous J5yEGEOcVrNoch keine Bewertungen

- TableDokument1 SeiteTableparasshah90Noch keine Bewertungen

- Q6Dokument3 SeitenQ6kheriaankit0% (3)

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- JOLLIBEE FOODS CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AND COMPREHENSIVE INCOMEDokument86 SeitenJOLLIBEE FOODS CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AND COMPREHENSIVE INCOMERose Jean Raniel Oropa63% (16)

- Dell IncDokument6 SeitenDell IncMohit ChaturvediNoch keine Bewertungen

- MCB Bank Limited 2007 Financial Statements ReviewDokument83 SeitenMCB Bank Limited 2007 Financial Statements Reviewusmankhan9Noch keine Bewertungen

- 2010 Ibm StatementsDokument6 Seiten2010 Ibm StatementsElsa MersiniNoch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- First Resources Q1 2013 Financial Statements SummaryDokument17 SeitenFirst Resources Q1 2013 Financial Statements SummaryphuawlNoch keine Bewertungen

- Nigeria German Chemicals Final Results 2012Dokument4 SeitenNigeria German Chemicals Final Results 2012vatimetro2012Noch keine Bewertungen

- Gtbank q1 2014 Unaudited Results - Draft.1Dokument5 SeitenGtbank q1 2014 Unaudited Results - Draft.1Oladipupo Mayowa PaulNoch keine Bewertungen

- Annual Report OfRPG Life ScienceDokument8 SeitenAnnual Report OfRPG Life ScienceRajesh KumarNoch keine Bewertungen

- Camposol Consolidated Financial StatementsDokument12 SeitenCamposol Consolidated Financial StatementsIvan Aguilar CabreraNoch keine Bewertungen

- Consolidated Financial Statements of The Juroku BankDokument1 SeiteConsolidated Financial Statements of The Juroku BankidhamsyaamNoch keine Bewertungen

- 3Q14 Financial StatementsDokument58 Seiten3Q14 Financial StatementsFibriaRINoch keine Bewertungen

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Dokument18 SeitenSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNoch keine Bewertungen

- Quarterly Update: First Half 2014 ResultsDokument4 SeitenQuarterly Update: First Half 2014 ResultssapigagahNoch keine Bewertungen

- Financial Statements Year Ended Dec 2010Dokument24 SeitenFinancial Statements Year Ended Dec 2010Eric FongNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Dokument16 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- DCF Valuation of Mercury Athletic FootwearDokument16 SeitenDCF Valuation of Mercury Athletic FootwearSupreetSrinivasNoch keine Bewertungen

- 61 JPM Financial StatementsDokument4 Seiten61 JPM Financial StatementsOladipupo Mayowa PaulNoch keine Bewertungen

- Consolidated Accounts June-2011Dokument17 SeitenConsolidated Accounts June-2011Syed Aoun MuhammadNoch keine Bewertungen

- (A) Nature of Business of Cepatwawasan Group BerhadDokument16 Seiten(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNoch keine Bewertungen

- Puma Energy Results Report q4 2016Dokument8 SeitenPuma Energy Results Report q4 2016KA-11 Єфіменко ІванNoch keine Bewertungen

- OfficeMax 2010 Annual Report Financial Statements and Key MetricsDokument21 SeitenOfficeMax 2010 Annual Report Financial Statements and Key MetricsBlerta GjergjiNoch keine Bewertungen

- Consolidated Financial Results and Segment DataDokument88 SeitenConsolidated Financial Results and Segment Datathaituan2808Noch keine Bewertungen

- Balance Sheet: Titan Industries LimitedDokument4 SeitenBalance Sheet: Titan Industries LimitedShalini ShreyaNoch keine Bewertungen

- Cash Flow of PureshitDokument2 SeitenCash Flow of PureshitJhess BayaNoch keine Bewertungen

- MCB Bank Limited Consolidated Financial Statements SummaryDokument93 SeitenMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNoch keine Bewertungen

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountDokument7 SeitenChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVNoch keine Bewertungen

- Afm PDFDokument5 SeitenAfm PDFBhavani Singh RathoreNoch keine Bewertungen

- Cebu AirDokument22 SeitenCebu AirCamille BagadiongNoch keine Bewertungen

- Consolidated Cashflow StatementDokument1 SeiteConsolidated Cashflow StatementKrishna KumarNoch keine Bewertungen

- Apple Inc. 2017 Annual Report Financial HighlightsDokument8 SeitenApple Inc. 2017 Annual Report Financial HighlightsJuan LaverdeNoch keine Bewertungen

- TCS Balance SheetDokument3 SeitenTCS Balance SheetdushyantkrNoch keine Bewertungen

- Peoples Bank FS June 2023 WEB FormatDokument13 SeitenPeoples Bank FS June 2023 WEB FormatroomyfarizNoch keine Bewertungen

- In Thousands of Euros: Balance SheetDokument5 SeitenIn Thousands of Euros: Balance SheetNguyễn Hải YếnNoch keine Bewertungen

- Samsung Electronics Co., LTD.: Index December 31, 2009 and 2008Dokument74 SeitenSamsung Electronics Co., LTD.: Index December 31, 2009 and 2008Akshay JainNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- VAT Act Expands Tax Areas & Consolidates CollectionDokument76 SeitenVAT Act Expands Tax Areas & Consolidates CollectionMohammad SaifNoch keine Bewertungen

- Ifrs Updates and Advanced Applications Seminar DecemberDokument1 SeiteIfrs Updates and Advanced Applications Seminar Decembersalehin1969Noch keine Bewertungen

- SolutionsDokument55 SeitenSolutionssalehin1969Noch keine Bewertungen

- Equity Method of AccountingDokument4 SeitenEquity Method of Accountingsalehin1969Noch keine Bewertungen

- Cid TG Group Accounting For Joint Ventures Apr08 PDFDokument13 SeitenCid TG Group Accounting For Joint Ventures Apr08 PDFsalehin1969Noch keine Bewertungen

- 6847merger Acquisition DivisionDokument10 Seiten6847merger Acquisition Divisionsalehin1969Noch keine Bewertungen

- How Does The Elimination of PC Method (2014 JFRP)Dokument18 SeitenHow Does The Elimination of PC Method (2014 JFRP)So LokNoch keine Bewertungen

- Equity Method in Separate Financial StatementsDokument4 SeitenEquity Method in Separate Financial Statementssalehin1969Noch keine Bewertungen

- Holding CompDokument3 SeitenHolding Compmahabalu123456789Noch keine Bewertungen

- Deferred Tax ExpenseDokument1 SeiteDeferred Tax Expensesalehin1969Noch keine Bewertungen

- Module19 - Version 2013 (Final)Dokument76 SeitenModule19 - Version 2013 (Final)salehin1969Noch keine Bewertungen

- Equity Method in Separate Financial StatementsDokument4 SeitenEquity Method in Separate Financial Statementssalehin1969Noch keine Bewertungen

- Group Accounting Consolidation F3Dokument5 SeitenGroup Accounting Consolidation F3salehin1969Noch keine Bewertungen

- 37 Sample Resolutions Very Useful, Indian Companies Act, 1956Dokument38 Seiten37 Sample Resolutions Very Useful, Indian Companies Act, 1956CA Vaibhav Maheshwari70% (23)

- EPS and Retained Earnings GuideDokument31 SeitenEPS and Retained Earnings Guidesalehin1969Noch keine Bewertungen

- Q1 2000 Results and Acquisition of Safety 1stDokument1 SeiteQ1 2000 Results and Acquisition of Safety 1stsalehin1969Noch keine Bewertungen

- Consolidation PDFDokument5 SeitenConsolidation PDFsalehin1969Noch keine Bewertungen

- Sa Aug09 Baker ClendonDokument9 SeitenSa Aug09 Baker Clendonsalehin1969Noch keine Bewertungen

- Ex Right Issue PriceDokument6 SeitenEx Right Issue Pricesalehin1969Noch keine Bewertungen

- DTL ClaculationDokument4 SeitenDTL Claculationsalehin1969Noch keine Bewertungen

- Adv Fin AccDokument568 SeitenAdv Fin Accsalehin1969100% (1)

- Group Accounting Consolidation F3Dokument5 SeitenGroup Accounting Consolidation F3salehin1969Noch keine Bewertungen

- TA ALERT 2010-44 - Non-controlling interests and OCIDokument8 SeitenTA ALERT 2010-44 - Non-controlling interests and OCIsalehin1969Noch keine Bewertungen

- ACC NotesDokument2 SeitenACC Notessalehin1969Noch keine Bewertungen

- Amendments To Ias 27 Aug 2014 WebsiteDokument15 SeitenAmendments To Ias 27 Aug 2014 Websitesalehin1969Noch keine Bewertungen

- Acca Student Accountant Convergence Article Nov 09Dokument6 SeitenAcca Student Accountant Convergence Article Nov 09salehin1969Noch keine Bewertungen

- Understanding Chapter 14 Multiple Choice and ProblemsDokument15 SeitenUnderstanding Chapter 14 Multiple Choice and Problemsmarycayton77% (13)

- Multi-Year Consolidation: Non-Controlling Interests Recognised at Fair ValueDokument37 SeitenMulti-Year Consolidation: Non-Controlling Interests Recognised at Fair ValuewarsidiNoch keine Bewertungen

- Advance Accounting 2 by GuerreroDokument13 SeitenAdvance Accounting 2 by Guerreromarycayton100% (7)

- TCS Case StudyDokument21 SeitenTCS Case StudyJahnvi Manek0% (1)

- ML QB Unit WiseDokument11 SeitenML QB Unit WiseyogeshNoch keine Bewertungen

- EXCEL Intermediate Practice ActivitiesDokument4 SeitenEXCEL Intermediate Practice ActivitiesLeosel AmorNoch keine Bewertungen

- B1 exam preparation tipsDokument4 SeitenB1 exam preparation tipsAnanth Divakaruni67% (6)

- Pagent Callgen Instructions For CLPsDokument2 SeitenPagent Callgen Instructions For CLPscalitzin1Noch keine Bewertungen

- Caterpillar: Undercarriage Repair ManualDokument24 SeitenCaterpillar: Undercarriage Repair ManualfrenkiNoch keine Bewertungen

- Mineline MSP Sell SheetDokument2 SeitenMineline MSP Sell SheetMary Huaylla ANoch keine Bewertungen

- 12 TalensDokument12 Seiten12 TalensConsignmenttoduatNoch keine Bewertungen

- Students Perceptions of Their Engagement Using GIS Story MapsDokument16 SeitenStudents Perceptions of Their Engagement Using GIS Story Mapsjj romeroNoch keine Bewertungen

- Prosedur Penggajian: Payroll ProcedureDokument5 SeitenProsedur Penggajian: Payroll ProcedureVira TrianaNoch keine Bewertungen

- NCP For PneumoniaDokument3 SeitenNCP For PneumoniaKahMallari100% (10)

- Tariffs Part IDokument26 SeitenTariffs Part IGudz NavoraNoch keine Bewertungen

- School Leaver Cover LetterDokument8 SeitenSchool Leaver Cover Letterfsv12dgd100% (1)

- 8508A Reference Multimeter PDFDokument7 Seiten8508A Reference Multimeter PDFNicole FloydNoch keine Bewertungen

- Hashing Concepts in DBMS PDFDokument7 SeitenHashing Concepts in DBMS PDFkaramthota bhaskar naikNoch keine Bewertungen

- Chicken Run: Activity Overview Suggested Teaching and Learning SequenceDokument1 SeiteChicken Run: Activity Overview Suggested Teaching and Learning SequencePaulieNoch keine Bewertungen

- Quiz Bowl, Rubiks, Sudoku Mechanics For Math - Sci FestivalDokument3 SeitenQuiz Bowl, Rubiks, Sudoku Mechanics For Math - Sci FestivalJonnah Mariz Galinea NacarNoch keine Bewertungen

- Accounting TransactionsDokument6 SeitenAccounting TransactionsCelyn DeañoNoch keine Bewertungen

- 6420B: Fundamentals of Windows Server® 2008 Microsoft® Hyper-V™ Classroom Setup GuideDokument17 Seiten6420B: Fundamentals of Windows Server® 2008 Microsoft® Hyper-V™ Classroom Setup GuideVladko NikolovNoch keine Bewertungen

- Wands and StavesDokument4 SeitenWands and StavesSarah Jean HEADNoch keine Bewertungen

- s7 1500 Compare Table en MnemoDokument88 Seitens7 1500 Compare Table en MnemoPeli JorroNoch keine Bewertungen

- Academic Reference Form - RCSI PDFDokument2 SeitenAcademic Reference Form - RCSI PDFibexamsNoch keine Bewertungen

- Basic Writing Skills ModuleDokument77 SeitenBasic Writing Skills ModuleDaniel HailuNoch keine Bewertungen

- MT8226 Block Diagram & TV Schematic DiagramsDokument12 SeitenMT8226 Block Diagram & TV Schematic DiagramsVijay DanielNoch keine Bewertungen

- Thursday: Dhaka Electric Supply Company Limited (DESCO) Load Shedding Schedule On 11 KV FeedersDokument16 SeitenThursday: Dhaka Electric Supply Company Limited (DESCO) Load Shedding Schedule On 11 KV FeedersaajahidNoch keine Bewertungen

- CDP Bettiah PDFDokument23 SeitenCDP Bettiah PDFSanatNoch keine Bewertungen

- The Impact of Air Cooled Condensers On Plant Design and OperationsDokument12 SeitenThe Impact of Air Cooled Condensers On Plant Design and Operationsandi_babyNoch keine Bewertungen

- Charlie Mouse OutdoorsDokument48 SeitenCharlie Mouse OutdoorsMarwa AhmedNoch keine Bewertungen

- El Nido Resorts Official WebsiteDokument5 SeitenEl Nido Resorts Official WebsiteCarla Naural-citebNoch keine Bewertungen

- Manual For Renewal of Dog LicenseDokument12 SeitenManual For Renewal of Dog Licensescibs123456Noch keine Bewertungen