Beruflich Dokumente

Kultur Dokumente

4 Jawapan

Hochgeladen von

Nad Adenan100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

217 Ansichten5 SeitenAuditors can be held liable for a number of types of lawsuits. A client may prefer to sue the auditor for a tort action than a breach of contract. An auditor can be liable to a client under common law for breach of contract, negligence, gross negligence or constructive fraud, and fraud.

Originalbeschreibung:

Originaltitel

4-jawapan (1).docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAuditors can be held liable for a number of types of lawsuits. A client may prefer to sue the auditor for a tort action than a breach of contract. An auditor can be liable to a client under common law for breach of contract, negligence, gross negligence or constructive fraud, and fraud.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

217 Ansichten5 Seiten4 Jawapan

Hochgeladen von

Nad AdenanAuditors can be held liable for a number of types of lawsuits. A client may prefer to sue the auditor for a tort action than a breach of contract. An auditor can be liable to a client under common law for breach of contract, negligence, gross negligence or constructive fraud, and fraud.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

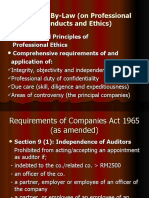

TOPIC : LEGAL LIABILITY

REVIEW QUESTION ANSWERS

1. Describe the legal environment for auditors.

Legal environment for auditors are auditors liability under common law

to clients and third parties and the auditors duties to report breaches of

laws under various statutes in Malaysia. Besides that it also explain

about the measures that auditors can undertake to minimize their

exposure to legal liability and the quality control standards that auditors

are required to comply with when providing auditing and other

assurances services. Auditors can be held liable for a number of types

of lawsuits. The types of plaintiffs that typically sue auditors, what must

be proved to sue the auditors successfully, and the defences available

to the auditor.

2. Explain what is meant by deep pocket syndrome.

Deep pocket syndrome is the tendency of the injured party to sue the

auditors regardless whether they are at fault or not. This is because

auditor is often time perceived as the only one left with financial

resources to compensate the users of financial statements (plaintiff) in

cases of business failure.

3. What is meant by proportionate liability? Contrast this legal

doctrine with the doctrine of joint and several liability.

Proportionate liability is holding each defendant liable solely for the

portion of the damages that corresponds to the percentage of

responsibilities of that dependant.

While Joint and several liability is holding defendant fully liable for all

assessed damages suffered by plaintiff regardless of the extent to which

the defendant contributed to the injury.

4. What types of actions may an auditor be liable to a client under

common law? Why would client prefer to sue the auditor for a

tort action rather than for a breach of contract?

An auditor can be liable to a client under common law for breach of

contract, negligence, gross negligence or constructive fraud, and fraud.

Any of the previously stated actions can create a situation where a

client may sue the auditor. A client may prefer to sue the auditor for a

tort action than a breach of contract because tort actions typically pay

larger sums than for a breach of contract case.

5. Liability for negligence represents a deviation from a standard

of behaviour that is consistence with that of a reasonable

person. What behaviours constitute a reasonable person in

this context?

Negligence represents a deviation from standard of behavior that is

consistence with that of a reasonable person. With respect to audit

engagements, two classic statement have often been referred to in

defining the auditors responsibility in relation to auditing of an entitys

account.

6. What elements must a plaintiff prove to be successful in an

action against an auditor for negligence?

Plaintiff should prove :

i.

The auditor owed a duty of care to the plaintiff to conform to a

required standard of care.

ii.

There is a failure to act in accordance with that duty of care that

is a breach of duty of care to the plaintiff on the part of the

auditor.

iii.

There is a causal relationship or connection between the

auditors negligence and the plaintiff damage.

iv.

The plaintiff suffered actual loss or damage.

7. How does the decision in Re Kingston Cotton Mills Case define

the standard of care in the performance of an auditors duty?

In that case, duty of an auditor to bring to bear on the work he has to

perform that skill, care and caution which a reasonable competent,

careful and cautions auditor would use depend on the particular

circumstances of each case. An auditor is not bound to be a detective or

to approach his work with suspicion or with a foregone conclusion that

there is something wrong. He is watchdog, but not a bloodhound. He is

justified in believing tried servants of the company in whom confidence

is placed by the company. He is entitled to assume that they are honest

and to rely upon their representations, provided he takes reasonable

care. If there is anything of that kind, he is only bound to be reasonably

cautious and careful.

Auditors must not be made responsible for not tracking out ingenious

and carefully laid schemes of fraud, when there is nothing to arouse

their suspicion and when those frauds are perpetrated by tried servants

of the company and are undetected for years by the directors. So to

hold would make the position of an auditor intolerable.

8. What is the famous statement made by Judge Cardozo in the

Ultramare case?

If a liability for negligence exists, a thoughtless slip or blunder, the

failure to detect a theft or forgery beneath the cover of deceptive

entries, may expose accountants to a liability in an indeterminate

amount for an indeterminate time to an indeterminate class. The

hazards of a business on these terms are so extreme as to enkindle

doubt whether a flaw may not exist in the implication of a duty that

exposes to these circumstances.

9. What is the significance of the Hedley Byrne case with relation

to auditors liability to third parties?

The significance are :

i.

The auditor must be aware that the financial statements are to

be used for a particular purpose.

ii.

A known party was intended to rely on the financial statements

for that purpose.

iii.

There must have been some conduct on the part of the auditor

linking him to that party, which indicates the auditors

understanding of that partys reliance.

10. What is the significance of the Caparo case with respect

relation to auditors liability to third parties?

In this case that the auditor should have foreseen the loss or damage

resulted from the misleading audited account. The court found that it

was was unreasonable to establish a relationship of proximity between

the auditors and the third party who was not the intended recipient of

the audit report. A most significant element in the Caparo decision is

that the auditors were found not to owe a duty of a care to potential

investors or to individual shareholders rather the duty is owed to

shareholders as a body. Lord Oliver in the Caparo case maintained that

the purpose of statutory audit and audited accounts was for the

company and the shareholders.

11. What are the statutes that impose on the auditor a duty to

report breaches of laws?

The duty primarily require the auditors to the relevant authority

violation of laws or regulations they encounter in the course of

performing their duties, for example when performing the annual

statutory audit of company accounts.

12. Identify steps that can be taken at the professional and

individual firm level to minimise legal liability against auditors.

The steps that can be taken at the professional level are :

i.

Establishing stringer auditing and assurance standards.

ii.

Continually updating the code on professional ethics and

sanctioning members who do not comply with.

iii.

Educating users.

The steps that can be taken at the firm level are :

i.

Instituting sound quality control and review procedures.

ii.

Ensuring that members of the firm are independent.

iii.

Following sound client acceptance and retention procedures.

iv.

Being alert to risk factors that may result in lawsuits.

v.

Performing and documenting work diligently.

13. What is the purpose of an audit firm establishing a system

of quality control?

The firm should establish a system of quality control designed to

provide it with reasonable assurance that the firm and its personnel

comply with professional standards and regulatory and legal

requirements, and that reports issued by the firm or engagement

partners are appropriate in the circumstances.

14. List the six elements of quality control set out in ISQC 1.

Provide one example of a policy or procedure that can be used

to fulfil each element.

Elements of quality control are :

i.

ii.

iii.

iv.

v.

vi.

Leadership responsibilities for quality on audits.

Ethical requirements

Acceptance and continuance of clients and audit engagements

Assignment of engagement team

Engagement performance

Engagement quality control review

One example of a policy or procedure that can be used to fulfil each

element is the revised ISA 220 provides guidance for quality control at the

engagement partners. The areas where quality control policies and

procedures are required for the provision of audit service.

Das könnte Ihnen auch gefallen

- Audit Chapter 3Dokument3 SeitenAudit Chapter 3Aitzaz UddinNoch keine Bewertungen

- Auditor's LiabilityDokument6 SeitenAuditor's LiabilityHilda MuchunkuNoch keine Bewertungen

- 2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingDokument56 Seiten2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingFackallofyouNoch keine Bewertungen

- Legal Concepts Related To Auditor's LiabilityDokument6 SeitenLegal Concepts Related To Auditor's LiabilityFerial FerniawanNoch keine Bewertungen

- 2 Legal LiabilityDokument68 Seiten2 Legal LiabilityEmilia Ahmad Zam ZamNoch keine Bewertungen

- 2 Legal LiabilityDokument68 Seiten2 Legal Liabilitycamillediaz100% (1)

- Ch.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryDokument6 SeitenCh.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryAndi PriatamaNoch keine Bewertungen

- Resume Buku Arens 5 & 6Dokument11 SeitenResume Buku Arens 5 & 6liamayangsNoch keine Bewertungen

- Chapter 08 Auditor's Legal LiabilityDokument20 SeitenChapter 08 Auditor's Legal LiabilityRichard de LeonNoch keine Bewertungen

- Legal LiabilityDokument33 SeitenLegal LiabilitysherlyneNoch keine Bewertungen

- Chapter 7 Audit & AssuranceDokument30 SeitenChapter 7 Audit & AssuranceKhairul Fahmi0% (2)

- Chapter 1 and 2Dokument56 SeitenChapter 1 and 2Snn News TubeNoch keine Bewertungen

- Auditor's Legal LiabilityDokument6 SeitenAuditor's Legal LiabilityMarconni B. AndresNoch keine Bewertungen

- Chapter 8Dokument16 SeitenChapter 8Genanew AbebeNoch keine Bewertungen

- AF304 - MST - Revision SolutionDokument13 SeitenAF304 - MST - Revision SolutionShivneel Naidu50% (2)

- AAA Revision Notes Dec 23-1 2Dokument29 SeitenAAA Revision Notes Dec 23-1 2ibtisaamgoolamNoch keine Bewertungen

- MCQ-for lecture-QUIZ REVISED-QUESTIONS For StudentsDokument6 SeitenMCQ-for lecture-QUIZ REVISED-QUESTIONS For Studentstinesa ambikapathyNoch keine Bewertungen

- What Is An Audit?: The Duties, Status and Liability of The AuditorDokument29 SeitenWhat Is An Audit?: The Duties, Status and Liability of The AuditorShat RongNoch keine Bewertungen

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDokument72 SeitenSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNoch keine Bewertungen

- Lesson 4 Auditors LiabilityDokument3 SeitenLesson 4 Auditors Liabilitywambualucas74Noch keine Bewertungen

- 4.1 MIA By-Law (On Professional Conducts and Ethics)Dokument84 Seiten4.1 MIA By-Law (On Professional Conducts and Ethics)Yaya-Nadia AhmadNoch keine Bewertungen

- University of Jahangir Nagar Institute of Business AdministrationDokument6 SeitenUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNoch keine Bewertungen

- AAA Auditor LiabilityDokument3 SeitenAAA Auditor LiabilityRAJKUMAREE UMMERSINGHNoch keine Bewertungen

- Chapter 08 AnsDokument7 SeitenChapter 08 AnsDave Manalo50% (2)

- Amala Kee Yaa ShureeDokument4 SeitenAmala Kee Yaa ShureeAkkamaNoch keine Bewertungen

- Legal AuditDokument4 SeitenLegal AuditchimchimcoliNoch keine Bewertungen

- Chapter 04 - Answer PDFDokument4 SeitenChapter 04 - Answer PDFjhienellNoch keine Bewertungen

- Lecture Two - Legal Liability and Ethics, Independance, Corporate GovernanceDokument42 SeitenLecture Two - Legal Liability and Ethics, Independance, Corporate GovernancePranto KarmokarNoch keine Bewertungen

- The Auditor's Legal LiabilityDokument32 SeitenThe Auditor's Legal LiabilityLaiba KanwalNoch keine Bewertungen

- MCQ-for lecture-QUIZ REVISED-QUESTIONS ANSWERS-for LecturerDokument6 SeitenMCQ-for lecture-QUIZ REVISED-QUESTIONS ANSWERS-for Lecturercynthiama7777Noch keine Bewertungen

- Acc12 - PrelimsDokument5 SeitenAcc12 - PrelimsLuise MauieNoch keine Bewertungen

- CH 1 Audit Assurance EngagmentsDokument5 SeitenCH 1 Audit Assurance EngagmentsDimpal Rabadia100% (1)

- Auditor's Responsibility (Non-Compliance)Dokument3 SeitenAuditor's Responsibility (Non-Compliance)Maria Beatriz MundaNoch keine Bewertungen

- Code of Ethics Reviewer - CompressDokument44 SeitenCode of Ethics Reviewer - CompressGlance Piscasio CruzNoch keine Bewertungen

- Legal Liability CH 5Dokument16 SeitenLegal Liability CH 5Dewi RenitasariNoch keine Bewertungen

- Auditig Chapter 6Dokument16 SeitenAuditig Chapter 6A A AYU SINTA JAYANTINoch keine Bewertungen

- Auditors LiabilityDokument2 SeitenAuditors Liabilitycessd3Noch keine Bewertungen

- Solution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionDokument15 SeitenSolution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionMeredithFleminggztay100% (86)

- Audit and AssuranceDokument53 SeitenAudit and Assuranceattaullah_niazi93Noch keine Bewertungen

- Test Bank For Auditing A Practical Approach 3rd Canadian Edition by Robyn MoroneyDokument35 SeitenTest Bank For Auditing A Practical Approach 3rd Canadian Edition by Robyn MoroneyNitin100% (1)

- AC 205 Chapter 2.2 Regulatory & Legal FrameworkDokument33 SeitenAC 205 Chapter 2.2 Regulatory & Legal FrameworkTonie NascentNoch keine Bewertungen

- UNIT 2 Professional Ethics of AuditorsDokument6 SeitenUNIT 2 Professional Ethics of Auditorsprimhaile assefaNoch keine Bewertungen

- Epa-Std-Tm 8-9Dokument16 SeitenEpa-Std-Tm 8-9fikrifaf91Noch keine Bewertungen

- AuditingDokument3 SeitenAuditingShyam BhanderiNoch keine Bewertungen

- Audit and Assurance - Past Papers Question With AnswerDokument153 SeitenAudit and Assurance - Past Papers Question With AnswerMuhammad SufyanNoch keine Bewertungen

- Auditing Fundamentals Unit 1 Meaning of Auditing: Financial StatementsDokument14 SeitenAuditing Fundamentals Unit 1 Meaning of Auditing: Financial StatementsNandhakumarNoch keine Bewertungen

- Case 14 Arguments For Restricting Non-Attest Services To Audit ClientsDokument2 SeitenCase 14 Arguments For Restricting Non-Attest Services To Audit ClientsBea Cassandra Gutierrez EdnilaoNoch keine Bewertungen

- Legal LiabilityDokument32 SeitenLegal Liabilitynurhoneyz100% (1)

- Edited Chapter IIDokument8 SeitenEdited Chapter IISeid KassawNoch keine Bewertungen

- Role of Auditors - Price Water House in Light of Satyam ScamDokument19 SeitenRole of Auditors - Price Water House in Light of Satyam ScamSneha Sachdev0% (1)

- 100 MCQ TestBankDokument18 Seiten100 MCQ TestBankMaricrisNoch keine Bewertungen

- 5th SEM AUDITING MATERIAL - pdf300Dokument33 Seiten5th SEM AUDITING MATERIAL - pdf300TayyabshabbirNoch keine Bewertungen

- AUDITINGDokument5 SeitenAUDITINGAsadul islam sajibNoch keine Bewertungen

- Corp - Gov Text Module 5Dokument6 SeitenCorp - Gov Text Module 5Rony GhoshNoch keine Bewertungen

- AU Chapter 2Dokument6 SeitenAU Chapter 2Addi Såïñt GeorgeNoch keine Bewertungen

- Audit and Review: Exam FocusDokument12 SeitenAudit and Review: Exam FocusPhebieon MukwenhaNoch keine Bewertungen

- Role of AuditorDokument5 SeitenRole of AuditorHusnainShahid100% (1)

- 24816Dokument1 Seite24816Nad AdenanNoch keine Bewertungen

- Contex DigsDokument20 SeitenContex DigsRohan PaunikarNoch keine Bewertungen

- Full Details On How To Change Your Company SecretaryDokument3 SeitenFull Details On How To Change Your Company SecretaryNad AdenanNoch keine Bewertungen

- ReferenceDokument1 SeiteReferenceNad AdenanNoch keine Bewertungen

- Factors Affecting The ImplementationDokument3 SeitenFactors Affecting The ImplementationNad AdenanNoch keine Bewertungen

- Of Accounting, Ethics and Public Policy: 1.0 The Background and Reasons For The ResearchDokument5 SeitenOf Accounting, Ethics and Public Policy: 1.0 The Background and Reasons For The ResearchNad AdenanNoch keine Bewertungen

- Chapter 2Dokument2 SeitenChapter 2Nad AdenanNoch keine Bewertungen

- Definition of TQMDokument23 SeitenDefinition of TQMnorthbride2008Noch keine Bewertungen

- Name of Team: Team Member NamesDokument6 SeitenName of Team: Team Member NamesNad AdenanNoch keine Bewertungen

- The Time Value of Money: All Rights ReservedDokument55 SeitenThe Time Value of Money: All Rights ReservedNad AdenanNoch keine Bewertungen

- 20160511140520LN10 Keown33019306 08 LN10 GEDokument68 Seiten20160511140520LN10 Keown33019306 08 LN10 GENad AdenanNoch keine Bewertungen

- 7 7Dokument11 Seiten7 7Nad AdenanNoch keine Bewertungen

- The Time Value of Money: All Rights ReservedDokument55 SeitenThe Time Value of Money: All Rights ReservedNad AdenanNoch keine Bewertungen

- EthicsDokument10 SeitenEthicsNad AdenanNoch keine Bewertungen

- Statistical Sampling QuestionDokument4 SeitenStatistical Sampling QuestionNad Adenan100% (1)

- English LicenseDokument4 SeitenEnglish LicenseasdfNoch keine Bewertungen

- NEU Law Torts Syllabus Case List 2020 PDFDokument4 SeitenNEU Law Torts Syllabus Case List 2020 PDFLadyGrace VillalbaNoch keine Bewertungen

- Far East Shipping Co V CADokument3 SeitenFar East Shipping Co V CAJet Siang100% (1)

- University of Cape Town PHD ThesisDokument8 SeitenUniversity of Cape Town PHD Thesisamandareedsalem100% (2)

- Lecture 06 Trespass To Land & Trespass To GoodsDokument8 SeitenLecture 06 Trespass To Land & Trespass To GoodsSalehNoch keine Bewertungen

- Intro To Broadcast JournDokument214 SeitenIntro To Broadcast JournVerna Astorga GastonNoch keine Bewertungen

- 4 Philtranco V ParasDokument15 Seiten4 Philtranco V ParasGenevieve Kristine ManalacNoch keine Bewertungen

- 032 - Tort Law (1041-1056)Dokument16 Seiten032 - Tort Law (1041-1056)Naveen VermaNoch keine Bewertungen

- Definition of Tort LawDokument10 SeitenDefinition of Tort LawCC OoiNoch keine Bewertungen

- Torts 2Dokument100 SeitenTorts 2mimi_012004Noch keine Bewertungen

- Effective CC PlanDokument12 SeitenEffective CC PlanFardee IsmailNoch keine Bewertungen

- LLB Syllabus FullDokument33 SeitenLLB Syllabus Fulladityasharma532Noch keine Bewertungen

- Smith and Robersons Business Law Mann Roberts 15th Edition Solutions ManualDokument27 SeitenSmith and Robersons Business Law Mann Roberts 15th Edition Solutions ManualDonaldKnoxpkqo100% (35)

- Light Rail Transit Authority v. NavidadDokument2 SeitenLight Rail Transit Authority v. NavidadAaron AristonNoch keine Bewertungen

- Chapter 4 The Law of TortsDokument28 SeitenChapter 4 The Law of TortsmaleekahNoch keine Bewertungen

- Schmitz Vs Transport VentureDokument6 SeitenSchmitz Vs Transport VentureElle Alorra RubenfieldNoch keine Bewertungen

- Lecture 2-Commercial LawDokument4 SeitenLecture 2-Commercial Law18Berna1Noch keine Bewertungen

- The Ryland's Vs Fletcher CaseDokument15 SeitenThe Ryland's Vs Fletcher CaseMario UltimateAddiction HyltonNoch keine Bewertungen

- Worklife Expectancy and Earning Capacity in Personal Injury CasesDokument26 SeitenWorklife Expectancy and Earning Capacity in Personal Injury CasesNNoch keine Bewertungen

- Doughty V Turner Manufacturing Co. LTD (1964) 1 All Er 98 - CADokument12 SeitenDoughty V Turner Manufacturing Co. LTD (1964) 1 All Er 98 - CAAzizul KirosakiNoch keine Bewertungen

- Request For Proposal (RFP) FOR: Appointment of Technical Consultant FORDokument129 SeitenRequest For Proposal (RFP) FOR: Appointment of Technical Consultant FORHarsha Vardhan ReddyNoch keine Bewertungen

- KJ Mendoza - Obligation and Contracts 2nd Year Module 2Dokument11 SeitenKJ Mendoza - Obligation and Contracts 2nd Year Module 2Kj MendozaNoch keine Bewertungen

- Corbitt V Coffee County, GA, COMPLAINT (1 Sep 2016)Dokument25 SeitenCorbitt V Coffee County, GA, COMPLAINT (1 Sep 2016)nolu chanNoch keine Bewertungen

- CIPS Limiting Liability in Contracts 0513Dokument26 SeitenCIPS Limiting Liability in Contracts 0513joao.orssattoNoch keine Bewertungen

- Chan Vs Iglesia Ni CristoDokument2 SeitenChan Vs Iglesia Ni Cristojdg jdgNoch keine Bewertungen

- 23.9.19 - Syllabus of Department of Law Old PDFDokument106 Seiten23.9.19 - Syllabus of Department of Law Old PDFanimeshNoch keine Bewertungen

- Criminal Law (Indian Penal Code) IDokument19 SeitenCriminal Law (Indian Penal Code) IShubham PandeyNoch keine Bewertungen

- Invisible ContractsDokument344 SeitenInvisible ContractsJohn Hatfield100% (8)

- Law For Business: Vicarious LiabilityDokument7 SeitenLaw For Business: Vicarious LiabilityShEny HiNeNoch keine Bewertungen

- 20 21 PDFDokument56 Seiten20 21 PDFMauricio GarciaNoch keine Bewertungen