Beruflich Dokumente

Kultur Dokumente

The Monetary Transmission Mechanism - Bank of England 2012

Hochgeladen von

charlie gotaucoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Monetary Transmission Mechanism - Bank of England 2012

Hochgeladen von

charlie gotaucoCopyright:

Verfügbare Formate

The monetary transmission mechanism

Ole Rummel

CCBS, bank of England

ole.rummel@bankofengland.co.uk

18 July 2012

The monetary transmission mechanism

Outline

What is the transmission mechanism?

Different channels of transmission:

the old view - interest rate, exchange rate and asset price channels;

the new view credit market frictions and their consequences; and

new developments in the transmission mechanism for emerging

market economies

Dollarisation, banking sector consolidation and government

intervention

The risk taking channel

Summary and conclusions

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

How powerful is a central bank really?

The Feds direct power over the economy is actually more limited

than is widely appreciated. People often say that the Fed

controls interest rates, but what it actually controls is only an

interest rate, the rate in the overnight federal funds market. And

the interest rate is, in itself, of very little economic importance.

Paul Krugman, New York Times, 14 December 2001

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Definition of the monetary transmission mechanism

How changes in the monetary policy variable affect inflation and

output

We are interested in:

the channels (economic relationships) of the monetary

transmission mechanism;

how quickly they work;

how reliably they work; and

how large the effects are

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The old view: the interest rate channel

The traditional textbook (Keynesian) channel is known as the

interest rate or the intertemporal substitution channel:

(M ) i

C (I)

Yd

y

Expanding money (M) reduces interest rates (i), reduces the

cost of borrowing for firms (and consumers), leads to increased

consumption (C) as well as investment (I) and therefore higher

demand (Yd), a bigger output gap (y) and finally higher prices and

inflation ()

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The interest rate channel and policy responses

But Bernanke and Gertler (1989) pointed out that the

macroeconomic response to policy-induced interest rate changes

was considerably larger than implied by conventional estimates

of interest elasticities of consumption and investment

This suggests that mechanisms other than the interest rate

channel may also be at work in the transmission of monetary

policy

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

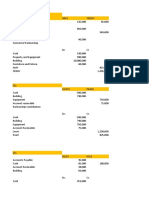

The monetary transmission mechanism

Source: Kuttner and Mosser (2002).

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The exchange rate channel: net exports

The exchange-rate channel:

i

e

NX

y

Lower interest rates (i) lead to a depreciation of the exchange

rate (e), an increase in competitiveness, an improved trade

balance (due to higher net exports, NX) and increased demand,

a larger output gap and finally higher inflation

Moreover

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The exchange rate channel: import prices

The exchange-rate channel:

i

e

Pm

An exchange rate (e) depreciation also raises import prices (Pm),

which are important determinants of firms costs and the retail

price of many goods and services: this directly affects the price

level and (temporarily) inflation

An appreciation should reduce inflation (with a longer lag if prices

are sticky on the downside)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The exchange rate channel: net wealth

The exchange-rate channel:

i

e

NW

y

An exchange rate depreciation increases the relative value of

foreign-denominated assets and liabilities and therefore net

wealth (NW), affecting demand

The sign of the effect depends on the make-up of balance sheets

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Other asset price effects

Changes in interest rates have a direct effect on the valuation of

financial assets and their expected returns

For example, lower interest rates increase the present value of

future income flows (or the cost of finance for assets) and

therefore asset prices

This may have no direct impact on inflation if asset prices are

excluded from the CPI basket...

...but it may raise (total) wealth which will affect demand

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Other asset price effects: investment (Tobins q)

The investment channel (Tobins q):

i

Pe

q

I

y

Consider two ways of increasing the size of a firm:

buy another firm (and acquire old capital); or

invest in new capital

The ratio of the market value of a firm to the replacement cost of

its assets is known as Tobins q

Tobin (1969) argued that a firm should invest in new buildings

and equipment if the stock market will value the project at more

than its cost (that is, if the project's q is greater than 1)

Increased equity prices (Pe) mean that new investment projects

have become relatively cheaper to finance and therefore more

attractive

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Other asset price effects: consumption

Other asset price effects: consumption

i

Pe

TW

C

y

The permanent income hypothesis postulates that consumers

spending is related to (total) wealth

Increased wealth (as a result of higher equity prices, Pe, say) if

it is perceived to be permanent leads to a (much smaller)

increase in (desired) consumption

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Other asset price effects: housing wealth

Other asset price effects: housing wealth

i

Ph

TW?

C

y

Increased house prices (Ph) are often associated with increased

private consumption in the UK/US

Why?

housing wealth represent greater wealth for some (but for the

economy as a whole?);

housing wealth increases available collateral and therefore reduces

credit constraints; and

people may be more likely to change house or spend on

improvements/consumer durables (in a process called mortgage

equity withdrawal)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

How do interest rates affect expectations?

An increase in short-term interest rates has an ambiguous effect

on longer-term interest rates

Expectations are all about how monetary policy changes are

interpreted as an indicator of future short rates

Interest-rate changes affect consumer confidence, cause firms to

revise spending plans and affect asset values in financial

markets (risk premia)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Credit market frictions

Financial markets do not always work perfectly

We generally assume that the effects of monetary policy work

through interest rates and that firms and individuals can borrow

freely at the quoted interest rate

In practice, most individuals and many firms can borrow only

from banks

and banks often turn down potential borrowers, despite their

willingness to pay the posted interest rate

Why does that happen and how does it affect our view of how

monetary policy works?

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

A new view: the role of banks in financial markets

Asymmetric information and costly enforcement of financial

contracts create principal-agent problems in financial markets

Banks play a special role in the financial system because they

are well suited to deal with certain types of borrowers, especially

small firms and private individuals, where the problems of

asymmetric information can be especially pronounced

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The role of banks and the credit channel

The credit channel holds that monetary policy has additional

effects because interest-rate decisions by the central bank affect

the cost and availability of credit by more than would be implied

by the associated movement in risk-free interest rates

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Two forms of the credit channel

Two basic channels of monetary transmission arise in the credit

channel as a result of principal-agent problems in credit markets:

the bank lending channel, also know as the narrow credit channel;

and

the balance sheet channel, also known as the broad credit

channel

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The balance sheet or broad credit channel (1)

Asset values play an important role in the broad credit or

balance sheet channel developed by Bernanke and Gertler

(1989)

In the broad credit channel, asset prices are especially important

in that they determine the value of the collateral that firms and

individuals will have to present when obtaining a loan

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The balance sheet or broad credit channel (2)

In frictionless credit markets, a fall in the value of borrowers

collateral will not affect investment decisions by the bank (due to

the Modigliani-Miller theorem)

but in the presence of information or agency costs, declining

collateral values will increase the premium borrowers must pay

for external finance, which in turn will reduce consumption and

investment

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The bank lending or narrow credit channel (1)

The narrow credit or bank lending channel also relies on credit

market frictions, but banks play a more central role (Bernanke

and Blinder (1988))

Banks play a special role in the economy not just by issuing

liabilities bank deposits that contribute to the broad monetary

aggregates, but also by holding assets bank loans with few

close substitutes

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The bank lending or narrow credit channel (2)

Because banks rely on reservable demand deposits as an

important source of funds, contractionary monetary policy which

reduces the aggregate volume of bank reserves will reduce the

availability of bank loans

in consequence, because a significant number of firms and

households rely heavily (or exclusively) on bank financing, a

reduction in loan supply will depress aggregate spending

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The bank lending or narrow credit channel (3)

Theory suggests that two key conditions must be satisfied for the

bank lending channel to operate:

the first essential element is that banks should not be able to fully

shield their loan portfolios from changes in monetary policy;

the presumption is that banks cannot offset completely the decline

in liquid funds due to restrictive monetary policy by resorting to

alternative sources of funding without incurring additional costs; and

as a result, banks reduce their loan supply

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The bank lending or narrow credit channel (4)

Theory suggests that two key conditions must be satisfied for the

bank lending channel to operate:

the second crucial element is that there is a substantial group of

borrowers, firms or consumers that cannot insulate their spending

from the reduction in bank credit; and

this, in turn, can depress real investment and consumption

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

New developments in emerging-market economies

The traditional intertemporal substitution channel in emerging

markets may have been modified due to recent changes in the

balance-sheet position of the private sector (Mohanty and Turner

(2008)):

changes in household balance sheets implied by the growth in

household credit;

changes in the response of investment to monetary policy changes

as a result of corporate financial disintermediation; and

the impact due to structural changes in (banks) balance sheets

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Intertemporal substitution: new developments (1)

The implications of the greatly increased proportion of bank

lending to households include:

a magnification of the intertemporal substitution effects of monetary

policy;

potential wealth effects from monetary policy, particularly through the

housing market; and

cash-flow effects of monetary policy on consumption and residential

investment, in the sense that high interest rates impose a cash-flow

constraint on prospective borrowers

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Intertemporal substitution: new developments (2)

Corporate balance sheets and the monetary transmission

mechanism:

the impact of monetary policy on non-residential investment

depends in part on the balance sheet position of corporates (through

the financial accelerator described in Bernanke et al. (1999))

Potential indicators of trends in corporate balance sheet

vulnerabilities include net worth (the ratio of net assets to

income), the ratio of debts to assets (leverage) and the ratio of

net interest payments to income

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Intertemporal substitution: new developments (3)

Implications of changes in bank balance sheets:

the relaxation of resource constraints on banks reduces non-price

related distortions on credit supply and may reduce the importance

of the bank lending channel

but changes in banks balance sheets may affect their exposure to

market risks and changes in monetary policy could thus aggravate

such exposures

another major source of exposure to monetary policy shocks could

arise from the investment portfolio of banks (which could well have

financial accelerator effects again)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The transmission mechanism and dollarisation (1)

Monetary policy needs to take into consideration banks

exposures to currency mismatches and the risk of a run on dollar

deposits in the banking system

Even with macro-prudential measures to control some of these

risks, exchange rate intervention to smooth currency fluctuations

may have unwanted effects

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The transmission mechanism and dollarisation (2)

Tighter monetary policy on its own will tend to accelerate the

short-run impact on inflation and could generate additional

adverse output effects through the exchange rate channel

But when combined with exchange market intervention, the

inflation and output effects of monetary tightening are longerlasting and more effective

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The transmission mechanism and dollarisation (3)

Yet, excessive foreign exchange intervention runs the risk that

people do not internalise the risks of denominating their debts in

foreign currencies

This is because resisting exchange-rate appreciation does not

discourage and may even encourage, by preventing the

emergence of two-way risks and leading to one-way bets in local

currency markets an upsurge in speculative net portfolio flows

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Banking sector consolidation

The balance of factors of the effect of banking sector

consolidation (mergers and acquisitions or foreign ownership) on

monetary policy transmission is uncertain:

a few large banks may dominate the banking market, which could

reduce and lower the pass-through to the policy rate to bank deposit

and lending rates; or

bank consolidation could increase the effectiveness of the interest

rate channel if it increases efficiency, reduces transaction costs and

speed up information processing

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Government intervention

In the past, government intervention in the financial system

affected the monetary transmission process in at least three

ways:

by imposing interest rate controls or other limits on financial market

prices;

by imposing direct limits on bank lending; or

by providing government-financed credit to selected areas

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The risk taking channel (1)

The most recent channel to be identified is the risk taking

channel (Bernanke and Kuttner (2005), Borio and Zhu (2008),

Adrian and Shin (2009) and Gambacorta (2009)):

an easy monetary policy (i.e., low interest rates) may give rise to

expected excess return by reducing the riskiness of stocks (for

instance, by improving the balance sheet position of firms) as well as

increasing investors willingness to bear risk (for instance, by

increasing expected future income)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

The risk taking channel (2)

In a nutshell, monetary policy may influence banks perceptions

of, and attitudes towards, risk in at least two ways:

through a search for yield process, especially in the case of nominal

return targets; and

by means of the impact of interest rates on valuations, incomes and

cash flows, which in turn can modify how banks measure risk

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Summary (1)

Developments in financial markets can affect both banks ability

and willingness to lend and companies ability to raise funds in

the capital markets

which, in turn, will affect the consumption and investment

decisions of households and businesses

Endogenous changes in creditworthiness may increase the

persistence and amplitude of business cycles (the financial

accelerator) and strengthen the influence of monetary policy (the

credit channel)

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Summary (2)

These channels complement the traditional interest rate channel

The different channels of the monetary transmission mechanism

are not mutually exclusive

and the economys overall response to monetary policy will

incorporate the impact of a variety of channels

But monetary policy appears to have less of an impact on real

activity than it once had although the causes of that change

remain an open issue

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

Conclusions

The transmission mechanism is important

We need to know the structure of the economy i.e., what is the

relevant transmission mechanism (in different countries)?

The channels of transmission continue to change as the

economy evolves central banks therefore need to be alert to

the implications of such changes and calibrate their policy

responses to macroeconomic developments

The uncertainty of the impact of any policy change increases the

importance of having a credible and transparent monetary policy

regime

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

References and further reading (1)

Adrian, T and Shin, H S (2009), Financial intermediaries and

monetary economics, Federal Reserve Bank of New York Staff

Reports No. 398.

http://www.newyorkfed.org/research/staff_reports/sr398.pdf.

Bernanke, B S and Blinder, A S (1988), Credit, money and

aggregate demand, American Economic Review, Vol. 78, No. 2,

pages 435-9.

Bernanke, B S and Gertler, M (1989), Agency costs, net worth and

business fluctuations, American Economic Review, Vol. 79, No.

1, pages 14-31.

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

References and further reading (2)

Bernanke, B S, Gertler, M and Gilchrist, S (1999), The financial

accelerator in a quantitative business cycle framework, in Taylor,

J B and Woodford, M (eds), Handbook of Macroeconomics, Vol.

1, No. 3, pages 1341-93.

Bernanke, B S and Kuttner, K N (2005), What explains the stock

markets reaction to Federal Reserve policy?, Journal of

Finance, Vol. 60, No. 3, pages 1221-57.

Borio, C and Zhu, H (2008), Capital regulation, risk-taking and

monetary policy: a missing link in the transmission mechanism?,

BIS Working Paper No. 268. http://www.bis.org/publ/work268.pdf.

Gambacorta, L (2009), Monetary policy and the risk taking

channel, BIS Quarterly Review, December, pages 43-53.

http://www.bis.org/publ/qtrpdf/r_qt0912f.pdf.

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

References and further reading (3)

Goldman Sachs (2010), A global look at the credit channel, Global

Economics Weekly 10/44, 8 December.

Ireland, P N (2008), The monetary transmission mechanism in

Blume, L E and Durlauf, S N (eds), The new Palgrave dictionary

of economics, second edition, London, Palgrave Macmillan.

Kuttner, K N and Mosser, P C (2002), The monetary transmission

mechanism: some answers and further questions, Federal

Reserve Bank of New York Economic Policy Review, Vol. 8, No.

1, pages 15-26.

http://www.newyorkfed.org/research/epr/02v08n1/0205kutt.pdf.

Mishkin, F S (1995), Symposium on the monetary transmission

mechanism, Journal of Economic Perspectives, Vol. 9, No. 4,

pages 3-10.

Monetary transmission channels, liquidity conditions and determinants of inflation

The monetary transmission mechanism

References and further reading (4)

Mohanty, M S and Turner, P (2008), Monetary policy transmissions

in emerging market economies: what is new?, in Transmission

mechanisms for monetary policy in emerging market economies,

BIS Papers No. 35, pages 1-59.

http://www.bis.org/publ/bppdf/bispap35a.pdf.

The Monetary Policy Committee (1999), The transmission

mechanism of monetary policy.

http://www.bankofengland.co.uk/publications/Documents/other/m

onetary/montrans.pdf.

Tobin, J (1969), A general equilibrium approach to monetary

theory, Journal of Money, Credit, and Banking, Vol. 1, No. 1,

pages 15-29.

Monetary transmission channels, liquidity conditions and determinants of inflation

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Deed PropertyDokument8 SeitenDeed PropertyUtkarsa GuptaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Testing Point FigureDokument4 SeitenTesting Point Figureshares_leoneNoch keine Bewertungen

- Order To Cash Automation For SAPDokument4 SeitenOrder To Cash Automation For SAPPaul McdonaldNoch keine Bewertungen

- Investments Bodie Kane Marcus 9th Edition Solutions ManualDokument6 SeitenInvestments Bodie Kane Marcus 9th Edition Solutions ManualDouglas Thompson100% (27)

- CFO Controller VP Finance in Philadelphia PA Resume Brian PickettDokument2 SeitenCFO Controller VP Finance in Philadelphia PA Resume Brian PickettBrianPickettNoch keine Bewertungen

- Balanced Scorecard-Enabled Project ManagementDokument40 SeitenBalanced Scorecard-Enabled Project ManagementEdson Andres Valencia SuazaNoch keine Bewertungen

- Investment Decision Rules: © 2019 Pearson Education LTDDokument22 SeitenInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNoch keine Bewertungen

- Korina Power Plant ProjectDokument19 SeitenKorina Power Plant ProjectNugroho CWNoch keine Bewertungen

- Case 9-30 Master Budget With Supporting SchedulesDokument2 SeitenCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Immovable Sale-Purchase (Land) ContractDokument6 SeitenImmovable Sale-Purchase (Land) ContractMeta GoNoch keine Bewertungen

- SCA Takeover Practice NoteDokument39 SeitenSCA Takeover Practice NoteWai Hoe KhooNoch keine Bewertungen

- Know Your Customer Individual)Dokument4 SeitenKnow Your Customer Individual)libelbookNoch keine Bewertungen

- YTL Corporation: Earnings Momentum To ContinueDokument17 SeitenYTL Corporation: Earnings Momentum To Continuephantom78Noch keine Bewertungen

- Project Review and Administrative AspectsDokument22 SeitenProject Review and Administrative Aspectsamit861595% (19)

- Site Visit. Promoting Frankincense Processing in Puntland State of SomaliaDokument10 SeitenSite Visit. Promoting Frankincense Processing in Puntland State of SomaliaGanacsi KaabNoch keine Bewertungen

- UnpaidDividend 2009 2010Dokument49 SeitenUnpaidDividend 2009 2010harsh bangurNoch keine Bewertungen

- Patti B Saris Financial Disclosure Report For 2010Dokument64 SeitenPatti B Saris Financial Disclosure Report For 2010Judicial Watch, Inc.Noch keine Bewertungen

- Bai Tap Chuong 7Dokument19 SeitenBai Tap Chuong 7Nguyen Quang PhuongNoch keine Bewertungen

- Bus 211 - Introduction To Accounting / Handout 2Dokument2 SeitenBus 211 - Introduction To Accounting / Handout 2ebrarrsevimmNoch keine Bewertungen

- Answers For Tutorial Chapter 4Dokument8 SeitenAnswers For Tutorial Chapter 4AdilahNoch keine Bewertungen

- Yaba, Brixzel's AssignmentDokument4 SeitenYaba, Brixzel's AssignmentYaba Brixzel F.Noch keine Bewertungen

- Where Do We Start - Renmaster Construction - PhilippinesDokument1 SeiteWhere Do We Start - Renmaster Construction - PhilippinesJonathan SanchezNoch keine Bewertungen

- USA v. MeyrowitzDokument11 SeitenUSA v. MeyrowitzBrian CubanNoch keine Bewertungen

- Final Presentationon SharekhanDokument15 SeitenFinal Presentationon SharekhanRajat SharmaNoch keine Bewertungen

- ISEM 530 ManagementDokument6 SeitenISEM 530 ManagementNaren ReddyNoch keine Bewertungen

- Doctrine of Restitution in India and EnglandDokument15 SeitenDoctrine of Restitution in India and EnglandBhart BhardwajNoch keine Bewertungen

- Notes To Financial Statements Urdaneta City Water DistrictDokument8 SeitenNotes To Financial Statements Urdaneta City Water DistrictEG ReyesNoch keine Bewertungen

- Day 12 Chap 7 Rev. FI5 Ex PRDokument11 SeitenDay 12 Chap 7 Rev. FI5 Ex PRkhollaNoch keine Bewertungen

- Chap 009Dokument20 SeitenChap 009Qasih Izyan100% (2)

- Indian Retail Lending Loans SectorDokument29 SeitenIndian Retail Lending Loans SectorBangaru BharathNoch keine Bewertungen