Beruflich Dokumente

Kultur Dokumente

Financial Inclusion

Hochgeladen von

Anish NairCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Inclusion

Hochgeladen von

Anish NairCopyright:

Verfügbare Formate

Financial inclusion or inclusive financing is the delivery of financial services at affordable costs to

sections of disadvantaged and low-income segments of society, in contrast to financial

exclusion where those services are not available or affordable. An estimated 2 billion working-age

adults globally have no access to the types of formal financial services delivered by regulated

financial institutions. For example, in Sub-Saharan Africa only 24% of adults have a bank account

even though Africa's formal financial sector has grown in recent years. [1] It is argued that as banking

services are in the nature of a public good, the availability of banking and payment services to the

entire population without discrimination is a key objective of financial inclusion.

The Alliance for Financial Inclusion (AFI) is the world's largest and most prominent network of

financial inclusion policymakers from developing and emerging economies who work together to

increase access to appropriate financial services for the poor. AFI's core mission is to adopt and

expand effective inclusive financial policies in developing nations in an effort to lift 2.5 billion

impoverished, unbanked citizens out of poverty. AFI was founded in 2008 as a Bill & Melinda Gates

Foundation-funded project, supported by AusAid, in order to advance the development of smart

financial inclusion policy in developing and emerging countries. The AFI Network [4] has grown to

more than 105 institutions from 88 member nations from 2008 to 2013. AFI hosts its landmark,

annual Global Policy Forum (GPF) as the keystone event for its membership. During the 2011 GPF,

the network adopted the Maya Declaration, a set of common principles and goals for financial

inclusion policy development. AFI uses a "polylateral development" model to contrast and compare

successful financial inclusion policies, focusing on a peer-to-peer system rather than a top-down or

North-to-South learning model.

MIX Market [1] is the premier source of public information on microfinance institutions (MFIs) and

their financial and social performance. MIX offers a suite of popular analysis reports at the global,

regional, and country levels, including global analyses of key issues for the sector. MIX has been

working over the past two years with policy makers, financial services providers, donors, and other

key stakeholders in a series of countries to gather otherwise isolated datasets that, together, can

provide them with the information they need for effective financial inclusion decision making. To date

MIX, through its FINclusionLab [2], has created 15 financial inclusion maps in 13 countries in Africa,

South Asia, and Latin America[5] and plans to add an additional 7 countries and 5 Indian states [6] to its

platform during 2014. These resources are developed in close collaboration with local stakeholders

to ensure their relevance in supporting the development and monitoring of financial inclusion

strategies both at the policy and operational levels. The MIXs move to visualize geo-spatial subnational supply-side data through publicly available geo-spatial maps will enrich the supply-side data

landscape. This will be a challenging undertaking as frequent data collection can be expensive

and/or ad hoc depending on when data may become available.

Das könnte Ihnen auch gefallen

- Deed of Extrajudicial SettlementDokument5 SeitenDeed of Extrajudicial SettlementConrad BrionesNoch keine Bewertungen

- Remedies in RightsDokument6 SeitenRemedies in RightsRebel X100% (1)

- Acknowledgement of DebtDokument2 SeitenAcknowledgement of DebttaskforcestfNoch keine Bewertungen

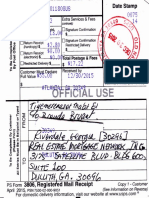

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDokument13 SeitenAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- Project On Employee RelationsDokument23 SeitenProject On Employee RelationsAnish NairNoch keine Bewertungen

- ACCO 30073 Audit of Specialized Industries 2021 2Dokument107 SeitenACCO 30073 Audit of Specialized Industries 2021 2Axl Ilao100% (2)

- Settlement LetterDokument3 SeitenSettlement LetterKritikaNoch keine Bewertungen

- 18 - Villalva vs. RCBC Savings BankDokument3 Seiten18 - Villalva vs. RCBC Savings BankJade Viguilla100% (1)

- International Finance CasesDokument20 SeitenInternational Finance CasesCaesar ZTinuNoch keine Bewertungen

- Commerce EM PDFDokument344 SeitenCommerce EM PDFkarthik_be_eeeNoch keine Bewertungen

- Financial Inclusion in AfricaDokument148 SeitenFinancial Inclusion in AfricakimringineNoch keine Bewertungen

- Microfinance and Its Impact On IndiaDokument60 SeitenMicrofinance and Its Impact On Indiabagal07100% (1)

- Strategy and Efforts of A Public Sector Bank For Financial InclusionDokument10 SeitenStrategy and Efforts of A Public Sector Bank For Financial InclusionKhushi PuriNoch keine Bewertungen

- RiddlesDokument2 SeitenRiddlesAnish NairNoch keine Bewertungen

- 4 Chapter-1Dokument11 Seiten4 Chapter-1Saransh MathurNoch keine Bewertungen

- RFP2406 Development of NFIS For HondurasDokument10 SeitenRFP2406 Development of NFIS For Honduraswownice2022Noch keine Bewertungen

- 19 Oct RFA Community of Practice - FHDokument14 Seiten19 Oct RFA Community of Practice - FHSanchita GhoshNoch keine Bewertungen

- Fic Cir 14102011Dokument12 SeitenFic Cir 14102011bindulijuNoch keine Bewertungen

- Financial InclusionDokument15 SeitenFinancial InclusionNitin SharmaNoch keine Bewertungen

- Financial InclusionDokument10 SeitenFinancial InclusionSonali SharmaNoch keine Bewertungen

- Nepal Financial InclusionDokument18 SeitenNepal Financial InclusionSanup KhanalNoch keine Bewertungen

- K C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesDokument9 SeitenK C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesAnamika Rai PandeyNoch keine Bewertungen

- 09 - Chapter 1Dokument24 Seiten09 - Chapter 1shantishree04Noch keine Bewertungen

- National Strategy For Financial Inclusion: BackgroundDokument4 SeitenNational Strategy For Financial Inclusion: BackgroundcpvinculadoNoch keine Bewertungen

- Financial Inclusion As A Tool For Sustainable Development: June 2017Dokument10 SeitenFinancial Inclusion As A Tool For Sustainable Development: June 2017ONYOIN SILVERNoch keine Bewertungen

- Project Brief - Financial IncDokument37 SeitenProject Brief - Financial IncLokesh BhoiNoch keine Bewertungen

- Financial InclusionDokument3 SeitenFinancial InclusionDhananjay ChauhanNoch keine Bewertungen

- 2994 ArticleText 9188 1 10 20210331Dokument9 Seiten2994 ArticleText 9188 1 10 20210331OlloNoch keine Bewertungen

- Financial Inclusion or Inclusive Financing Is The Delivery of Exclusion Where Those Services Are Not Available or AffordableDokument1 SeiteFinancial Inclusion or Inclusive Financing Is The Delivery of Exclusion Where Those Services Are Not Available or Affordablesrj4palsNoch keine Bewertungen

- The World Bank: International Bank For Reconstruction and DevelopmentDokument4 SeitenThe World Bank: International Bank For Reconstruction and DevelopmentAubrey Faith Palen AgbalogNoch keine Bewertungen

- Chapter One Silas Project NewDokument10 SeitenChapter One Silas Project NewSilas DanielNoch keine Bewertungen

- Bridging The Gap: Building A Financial Services System That Serves Poor People in Sri LankaDokument17 SeitenBridging The Gap: Building A Financial Services System That Serves Poor People in Sri LankaOxfamNoch keine Bewertungen

- India Learning Experience ReportDokument3 SeitenIndia Learning Experience ReportcmwainainaNoch keine Bewertungen

- A Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreDokument27 SeitenA Study On Awareness Towards Financial Inclusion Among Rural Areas With Special Reference To CoimbatoreprathikshaNoch keine Bewertungen

- Cracknell KenyaDokument75 SeitenCracknell Kenya최두영Noch keine Bewertungen

- Financial Inclusion African Finance Journal 14102010Dokument22 SeitenFinancial Inclusion African Finance Journal 14102010Mallikarjun DNoch keine Bewertungen

- I. What Is A Donor Agency?Dokument19 SeitenI. What Is A Donor Agency?Mara GeronaNoch keine Bewertungen

- Financial InclusionDokument26 SeitenFinancial InclusionErick McdonaldNoch keine Bewertungen

- South Africa Financial Inclusion PaperDokument14 SeitenSouth Africa Financial Inclusion PaperSimPhiwe Sithembisile MntamboNoch keine Bewertungen

- Market IntegrationDokument10 SeitenMarket IntegrationNeil TalamanNoch keine Bewertungen

- Financial Inclusion - RBI - S InitiativesDokument12 SeitenFinancial Inclusion - RBI - S Initiativessahil_saini298Noch keine Bewertungen

- MFG en Paper State of The Art of Microfinance A Narrative Mar 2010Dokument66 SeitenMFG en Paper State of The Art of Microfinance A Narrative Mar 2010Lyrene FelicianoNoch keine Bewertungen

- National Strategy For Financial EducationDokument4 SeitenNational Strategy For Financial EducationGaurav DevraNoch keine Bewertungen

- SJBMSDokument17 SeitenSJBMSTeresa ZaloNoch keine Bewertungen

- 1046 3980 1 PBDokument9 Seiten1046 3980 1 PBkrishnNoch keine Bewertungen

- From Billions To Trillions:: MDB Contributions To Financing For DevelopmentDokument6 SeitenFrom Billions To Trillions:: MDB Contributions To Financing For DevelopmentpavloneNoch keine Bewertungen

- Inclusive Finance: Increasing Access To Financial ServicesDokument6 SeitenInclusive Finance: Increasing Access To Financial Servicesjoe musiwaNoch keine Bewertungen

- Financial Inclusion From BIMSDokument14 SeitenFinancial Inclusion From BIMSDeepu T MathewNoch keine Bewertungen

- Financial Inclusion - A Road India Needs To TravelDokument8 SeitenFinancial Inclusion - A Road India Needs To Traveliysverya9256Noch keine Bewertungen

- Role of RBI in Financial InclusionDokument12 SeitenRole of RBI in Financial InclusionShannon Ford100% (3)

- Kushagra Amrit 1882053Dokument16 SeitenKushagra Amrit 1882053Kushagra AmritNoch keine Bewertungen

- Yaseen Anwar Speech Role of FIMs in EconomyDokument4 SeitenYaseen Anwar Speech Role of FIMs in EconomyAijaz Mustafa HashmiNoch keine Bewertungen

- Self Help GroupsDokument12 SeitenSelf Help GroupsunknownNoch keine Bewertungen

- Reserve Bank of India (RBI) Circular On Definition of InfrastructureDokument13 SeitenReserve Bank of India (RBI) Circular On Definition of InfrastructureforevermukeshNoch keine Bewertungen

- TH THDokument7 SeitenTH THapi-290145140Noch keine Bewertungen

- Financing Sustainable Development and Developing Sustainable FinanceDokument12 SeitenFinancing Sustainable Development and Developing Sustainable FinanceJosé Manuel SczNoch keine Bewertungen

- Financial Instruments For The PoorDokument15 SeitenFinancial Instruments For The PoorRajesh PaulNoch keine Bewertungen

- In-Company Training Report ON "Financial Inclusion" Completed in "Financial Inclusion Network and Operation's LTD"Dokument35 SeitenIn-Company Training Report ON "Financial Inclusion" Completed in "Financial Inclusion Network and Operation's LTD"Ashutosh TanejaNoch keine Bewertungen

- The Role of Government Microfinance Credit Scheme in Tanzania A Case of NEDF-SIDODokument15 SeitenThe Role of Government Microfinance Credit Scheme in Tanzania A Case of NEDF-SIDOIOSRjournalNoch keine Bewertungen

- Need For Financial Inclusion and Challenges Ahead - An Indian PerspectiveDokument4 SeitenNeed For Financial Inclusion and Challenges Ahead - An Indian PerspectiveInternational Organization of Scientific Research (IOSR)Noch keine Bewertungen

- Understanding The FundamentalsDokument5 SeitenUnderstanding The FundamentalsHedato M DatuNoch keine Bewertungen

- Financial Inclusion BrochureDokument24 SeitenFinancial Inclusion BrochureAngie Henderson Moncada100% (1)

- Financial Inclusion in India: Emerging Profitable ModelsDokument6 SeitenFinancial Inclusion in India: Emerging Profitable ModelsSamuel GeorgeNoch keine Bewertungen

- Financial Literacy - Reserve Bank of India's InitiativesDokument4 SeitenFinancial Literacy - Reserve Bank of India's InitiativesShankar JhaNoch keine Bewertungen

- Harvarhid TreasuryDokument4 SeitenHarvarhid TreasuryVenkat EsanNoch keine Bewertungen

- BF 434 Group1 PresentationDokument4 SeitenBF 434 Group1 Presentationgoitsemodimoj31Noch keine Bewertungen

- Finacial Inclusion and ExclusionDokument20 SeitenFinacial Inclusion and Exclusionbeena antuNoch keine Bewertungen

- Unit 3Dokument10 SeitenUnit 3Bidhan PoudyalNoch keine Bewertungen

- An Up AmDokument35 SeitenAn Up Amanupam593Noch keine Bewertungen

- ADB Annual Report 2014: Improving Lives Throughout Asia and the PacificVon EverandADB Annual Report 2014: Improving Lives Throughout Asia and the PacificNoch keine Bewertungen

- Report of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportVon EverandReport of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportNoch keine Bewertungen

- Chanakya Neeti 02Dokument2 SeitenChanakya Neeti 02Anish NairNoch keine Bewertungen

- Quotes of VivekanandaDokument1 SeiteQuotes of VivekanandaAnish NairNoch keine Bewertungen

- MBA HR Project TopicsDokument3 SeitenMBA HR Project TopicsAnish Nair0% (1)

- How To Create A Skills MatrixDokument3 SeitenHow To Create A Skills MatrixAnish NairNoch keine Bewertungen

- Importance of Kinecis and Peoxemics in Communication Are As FollowsDokument2 SeitenImportance of Kinecis and Peoxemics in Communication Are As FollowsAnish NairNoch keine Bewertungen

- MB0040 Statistics For ManagementDokument9 SeitenMB0040 Statistics For ManagementAnish NairNoch keine Bewertungen

- Importance of Kinecis and Peoxemics in Communication Are As FollowsDokument2 SeitenImportance of Kinecis and Peoxemics in Communication Are As FollowsAnish NairNoch keine Bewertungen

- It Sector in India PDFDokument77 SeitenIt Sector in India PDFAnish NairNoch keine Bewertungen

- Procedure To Export Goods Under RebateDokument2 SeitenProcedure To Export Goods Under RebateAnish NairNoch keine Bewertungen

- Table of Contents of Project ReportDokument1 SeiteTable of Contents of Project ReportAnish NairNoch keine Bewertungen

- MB0043 Human ResourceDokument7 SeitenMB0043 Human ResourceAnish NairNoch keine Bewertungen

- MB0050 - Research MethodologyDokument8 SeitenMB0050 - Research MethodologyAnish NairNoch keine Bewertungen

- Issues in Revised Schedule VI - Sushrut Chitale 15072012Dokument64 SeitenIssues in Revised Schedule VI - Sushrut Chitale 15072012Anish NairNoch keine Bewertungen

- Final PPT of Concept of RRBsDokument27 SeitenFinal PPT of Concept of RRBsManali ShahNoch keine Bewertungen

- TcodeDokument2 SeitenTcodeMere HamsafarNoch keine Bewertungen

- Pakistan 3Dokument26 SeitenPakistan 3syedqamarNoch keine Bewertungen

- Choose The Right Answer!Dokument2 SeitenChoose The Right Answer!Azmi WijaksonoNoch keine Bewertungen

- Snap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKDokument1 SeiteSnap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKners fatmaNoch keine Bewertungen

- LIC PresentationDokument28 SeitenLIC PresentationYogesh Gupta100% (2)

- IslamicDokument4 SeitenIslamicSarawathi ThulasiNoch keine Bewertungen

- Bil Tee - Harsh VirkDokument18 SeitenBil Tee - Harsh Virkharsh virkNoch keine Bewertungen

- From press-to-ATM - How Money Travels - The Indian ExpressDokument14 SeitenFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadNoch keine Bewertungen

- Bank of The Philippine Islands Vs The Intermediate Appellate Court and ZshornackDokument10 SeitenBank of The Philippine Islands Vs The Intermediate Appellate Court and ZshornackSheila RosetteNoch keine Bewertungen

- SWOT Analysis of Health Insurance SectorDokument39 SeitenSWOT Analysis of Health Insurance SectorSami Zama50% (2)

- S Fin Int PrepDokument8 SeitenS Fin Int PrepMoorthy EsakkyNoch keine Bewertungen

- Explanation T030 GGP en 2Dokument39 SeitenExplanation T030 GGP en 2scontranNoch keine Bewertungen

- PM Event Analyses Report 20110524Dokument29 SeitenPM Event Analyses Report 20110524Bob DijckNoch keine Bewertungen

- Balance of Payments: International FinanceDokument42 SeitenBalance of Payments: International FinanceSoniya Rht0% (1)

- Bank of Africa, Burkina Faso ScamsDokument2 SeitenBank of Africa, Burkina Faso ScamsVIJAY KUMAR HEERNoch keine Bewertungen

- Banzai Life ScenariosDokument13 SeitenBanzai Life Scenariosapi-385889456Noch keine Bewertungen

- Post OfficeDokument47 SeitenPost Officesatishputran100% (2)

- Module 2Dokument41 SeitenModule 2Sujata SarkarNoch keine Bewertungen

- Amcon Act 2010Dokument35 SeitenAmcon Act 2010Idemudia Bright AigbeNoch keine Bewertungen

- Unfair Trade Practices by Real Estate Firms: Consumer ProtectionDokument1 SeiteUnfair Trade Practices by Real Estate Firms: Consumer ProtectionAbhinav GuptaNoch keine Bewertungen