Beruflich Dokumente

Kultur Dokumente

Renew Life Insurance Premium Receipt

Hochgeladen von

Thelu RajuOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Renew Life Insurance Premium Receipt

Hochgeladen von

Thelu RajuCopyright:

Verfügbare Formate

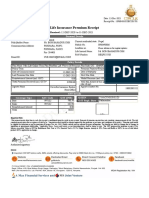

RENEWAL LIFE INSURANCE PREMIUM RECEIPT

Insured Name

: THELU MOHAN PURUSHOTTAM ADITYA

Policy No

: C320284551

Policyowner

: THELU NOOKA RAJU

Receipt Date

: 2016/02/15

Agent/Broker Code

: 001144966

Agent/Broker Name : TATA AIA Vizag UM

: VS02

Office Code

Payment Mode

Payment Method

Annual

Cash/Cheque

Modal Premium

Service Tax*

Amount Due

` 7,496.00

` 136.00

` 7,632.00

Premium due Period

Basic Plan Name

Tata AIA Life MahaLife (110N024V01)

Temporary Receipt No

Date

V0266602

2016/01/18

From 2016/02/14 to 2017/02/14

Amount Received

` 7,632.00

Amount `

`

7,632.00

Excess as on date (if any) : ` 0.00

Next Premium Due on : 2017/02/14

Upon issuance of this receipt, all previously issued temporary receipts, if any, related to this policy are considered null and void. Any excess

premium will be deposited in Future Policy Deposit Fund (FPDF). The amount lying in FPDF shall not bear any interest.

Tax benefits ** on Life Insurance Policies are available u/s 80C, on Pension u/s 80CCC & Health policies / Riders u/s 80D of Income tax Act,

1961 Tax benefit u/s 80D is not available for premium payment in cash.

Tax benefits u/s 80CCC and 80D are not available for premium payment through automatic loans from Cash Value of the policy if any, as per

the policy provisions

This is a computer-generated receipt and does not require signature.

This receipt is null and void ab initio, if the cheque / any other valid negotiable instrument as per the Negotiable Instruments Act,1881, as receipted by the

Company vide this receipt , is reported as dishonoured by the Company bank or any other Financial Institution on which the Negotiable instrument is drawn or is

not acceptable to the Company due to any reason deemed fit by the company.

* Service tax is applicable as per governing laws and the same shall be borne by the policyholder. Tata AIA Life Insurance Company Limited reserves the right to recover from the

policyholder, any levies and duties (including service tax), as imposed by the government from time to time.

Service tax Registration Number: AABCT3784CST001

Category of Service: Life Insurance Service and / or Management of investment under ULIP Services

** Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata AIA Life Insurance Company Ltd. does

not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

Consolidated Revenue stamp duty paid: Notification No. Mudrank 2015/1637/PR.KR.539/M-1-03/09/2015 vide receipt No. MH002350286201516M dated 17-Jul-15

Tata AIG Life Insurance Company Ltd. (Reg. No. 110)

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Tata AIA Life Insurance Company Ltd. (IRDA of India Regn. No. 110) (CIN U66010MH2000PLC128403)

Regd./Corporate Office : Delphi-B Wing, 2nd Floor, Orchard Avenue, Hiranandani Business Park, Powai, Mumbai - 400 076

For more

call the

AIG

Toll-free

24-hourBusiness

HelplinePark,

at 1-800-119966

or You

can

also Parel,

SMS SERVICE

to 58888.

Registered

& information,

Corporate Office:

14thTata

Floor,

Tower

A, Peninsula

Senapati Bapat

Marg,

Lower

Mumbai 400013.

For can

more

information,

contactinformation

your advisoron

ore-mail.

call on We

our urge

Helpline

1 800 267

9966

(tollidfree)

1 writing

860 266in

9966

(local charges apply)

You

now

get your policy

youNos

to register

your

e-mail

withorusatby

to customercare@tata-aig.com

or SMS Service to 58888 or e mail us at customercare@tataaia.com or visit our website: www.tataaia.com

C320284551

Version 12/15/FCI

Version 3.0/FCI

S/ROR/Other/862

Das könnte Ihnen auch gefallen

- Pawan S PDF CompletedDokument1 SeitePawan S PDF CompletedAsifshaikh7566Noch keine Bewertungen

- Prashant (1) CompletedDokument1 SeitePrashant (1) CompletedAsifshaikh7566Noch keine Bewertungen

- Renewal NoticeDokument2 SeitenRenewal NoticeJerry LamaNoch keine Bewertungen

- Donation Receipt One Foundation (Paid)Dokument1 SeiteDonation Receipt One Foundation (Paid)shiva krishnaNoch keine Bewertungen

- Consolidated Premium Paid STMT 2012-2013Dokument1 SeiteConsolidated Premium Paid STMT 2012-2013jahmeddNoch keine Bewertungen

- Fee Receipt 2nd QTRDokument1 SeiteFee Receipt 2nd QTRabhaskumar68Noch keine Bewertungen

- 80CDokument3 Seiten80CRajesh AdluriNoch keine Bewertungen

- Life insurance premium receiptDokument1 SeiteLife insurance premium receiptani dNoch keine Bewertungen

- Birla Premium Paid Certificate 2020Dokument2 SeitenBirla Premium Paid Certificate 2020SindhuNoch keine Bewertungen

- The New India Assurance Co. Ltd. (Government of India Undertaking)Dokument4 SeitenThe New India Assurance Co. Ltd. (Government of India Undertaking)Ameya SudameNoch keine Bewertungen

- Health Insurance Policy Certificate Section80DDokument1 SeiteHealth Insurance Policy Certificate Section80DDebosmita DasNoch keine Bewertungen

- Bajaj Cash Assure Renewal Receipt PDFDokument1 SeiteBajaj Cash Assure Renewal Receipt PDFPawan KumarNoch keine Bewertungen

- Renewal ReceiptDokument1 SeiteRenewal ReceiptAnkit SinghNoch keine Bewertungen

- Premium Receipt PDFDokument1 SeitePremium Receipt PDFAjit Kumar TiwariNoch keine Bewertungen

- Premium ReceiptDokument2 SeitenPremium Receiptthetrilight2023Noch keine Bewertungen

- Oriental Insurance Company Health Policy DetailsDokument3 SeitenOriental Insurance Company Health Policy Detailsraja_tanukuNoch keine Bewertungen

- Premium Paid CertificateDokument1 SeitePremium Paid CertificateSenthil balasubramanianNoch keine Bewertungen

- ICICI COI IncomeProtect 445605Dokument5 SeitenICICI COI IncomeProtect 445605sree koundinyaNoch keine Bewertungen

- Premium Paid CertificateDokument1 SeitePremium Paid CertificateSenthil balasubramanianNoch keine Bewertungen

- 13 18 0038121 00 PDFDokument7 Seiten13 18 0038121 00 PDFRaoul JhaNoch keine Bewertungen

- Premium Payment Receipt AcknowledgmentDokument1 SeitePremium Payment Receipt AcknowledgmentDhruv PrakashNoch keine Bewertungen

- JayPrakash PDFDokument7 SeitenJayPrakash PDFDigvijayNoch keine Bewertungen

- PolicyDokument3 SeitenPolicyJyoti SharmaNoch keine Bewertungen

- Tax Certificate: R MargabandhuDokument2 SeitenTax Certificate: R MargabandhuTrollstyleNoch keine Bewertungen

- Parents Insurance PremiumDokument1 SeiteParents Insurance Premiumprajeesh.vijayanNoch keine Bewertungen

- Dear Saurabh SinghDokument1 SeiteDear Saurabh SinghSaurabh SinghNoch keine Bewertungen

- Developing Web Apps Servlets JSP Niit ReceiptDokument3 SeitenDeveloping Web Apps Servlets JSP Niit ReceiptJogeshNoch keine Bewertungen

- S.Kannan: 131118 SD CODE SD131118 Intermediary Code NameDokument3 SeitenS.Kannan: 131118 SD CODE SD131118 Intermediary Code NamesuhailafrozNoch keine Bewertungen

- Received With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromDokument5 SeitenReceived With Thanks ' 40,367.12 Through Payment Gateway Over The Internet FromAkash MitraNoch keine Bewertungen

- Premium Paid AcknowledgementDokument1 SeitePremium Paid Acknowledgementharsh421Noch keine Bewertungen

- All The Children: Donation ReceiptDokument1 SeiteAll The Children: Donation ReceiptSYED AJEEZ0% (1)

- Kavita 2Dokument2 SeitenKavita 2api-3721187Noch keine Bewertungen

- Abhay KumarDokument5 SeitenAbhay KumarSunil SahNoch keine Bewertungen

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDokument17 SeitenCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNoch keine Bewertungen

- Preventive Health Check Up Receipt PDFDokument41 SeitenPreventive Health Check Up Receipt PDFsan mohNoch keine Bewertungen

- HDFC ERGO Health Insurance RenewalDokument4 SeitenHDFC ERGO Health Insurance RenewalAhesan Ali MominNoch keine Bewertungen

- Add-On Health Checkup InvoiceDokument1 SeiteAdd-On Health Checkup InvoiceRohan Desai0% (1)

- Family Health Insurance Plan DetailsDokument2 SeitenFamily Health Insurance Plan DetailsSudesh ChauhanNoch keine Bewertungen

- Individual Premium Paid STMTDokument1 SeiteIndividual Premium Paid STMTGanesh SlvNoch keine Bewertungen

- Interest Certificate: Shivam Garg and Ramkrishna GargDokument1 SeiteInterest Certificate: Shivam Garg and Ramkrishna GargShivamNoch keine Bewertungen

- All Donations To Besant Memorial Animal Dispensary Are Exempt Under Section 80GDokument1 SeiteAll Donations To Besant Memorial Animal Dispensary Are Exempt Under Section 80GRUVIKNoch keine Bewertungen

- 1865362Dokument1 Seite1865362Bhavesh ParekhNoch keine Bewertungen

- Subject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inDokument31 SeitenSubject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inUday NainNoch keine Bewertungen

- Life Insurance Premium Receipt: Personal DetailsDokument1 SeiteLife Insurance Premium Receipt: Personal DetailsRITIKANoch keine Bewertungen

- HDFC ERGO Health Insurance Policy DetailsDokument3 SeitenHDFC ERGO Health Insurance Policy DetailsAnish ShahNoch keine Bewertungen

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDokument1 SeiteBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- Policy Protection PlanDokument36 SeitenPolicy Protection Plankrishna_1238Noch keine Bewertungen

- Receipt PDFDokument1 SeiteReceipt PDFnsrivastav1Noch keine Bewertungen

- Online premium receipt confirmationDokument1 SeiteOnline premium receipt confirmationSasidharKalidindiNoch keine Bewertungen

- Tax CertificateDokument3 SeitenTax Certificateamrita50% (2)

- Receiptsreceipts 04032011 25203Dokument1 SeiteReceiptsreceipts 04032011 25203Deepak KumarNoch keine Bewertungen

- Cons-0420925660 08082020170150Dokument1 SeiteCons-0420925660 08082020170150Ananya SharmaNoch keine Bewertungen

- All The Children: Donation ReceiptDokument2 SeitenAll The Children: Donation Receiptsathish kumarNoch keine Bewertungen

- RenewalReceipt 502-7066983 PolicyRenewalDokument2 SeitenRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNoch keine Bewertungen

- Icici Lombard Mh!49966Dokument3 SeitenIcici Lombard Mh!49966suresh sivadasanNoch keine Bewertungen

- Life Insurance Premium Receipt: Personal DetailsDokument1 SeiteLife Insurance Premium Receipt: Personal Detailschanam bedantaNoch keine Bewertungen

- Tata AIA Life Insurance Company Limited: Premium Payment Failure NotificationDokument1 SeiteTata AIA Life Insurance Company Limited: Premium Payment Failure NotificationPrashant RajaNoch keine Bewertungen

- TATA Premium ReceiptDokument1 SeiteTATA Premium ReceiptkabuldasNoch keine Bewertungen

- C301149660-Renewal Premium ReceiptDokument1 SeiteC301149660-Renewal Premium ReceiptsaivenkateswarNoch keine Bewertungen

- Lim Teck Kong V DR Abdul Hamid Abdul Rashid & AnorDokument22 SeitenLim Teck Kong V DR Abdul Hamid Abdul Rashid & Anorengyi96Noch keine Bewertungen

- Rodriguez Vs RavilanDokument3 SeitenRodriguez Vs RavilanElerlenne LimNoch keine Bewertungen

- Pleadings, Functions and Fundamental Principles Which Govern All PleadingsDokument4 SeitenPleadings, Functions and Fundamental Principles Which Govern All PleadingsEmmanuel Nhachi100% (2)

- MSP-EXP430F5529LP Software ManifestDokument7 SeitenMSP-EXP430F5529LP Software ManifestsrikanthNoch keine Bewertungen

- March14.2016passage of Proposed Tricycle Driver Safety Act SoughtDokument2 SeitenMarch14.2016passage of Proposed Tricycle Driver Safety Act Soughtpribhor2100% (1)

- Assignment of Agreement of Purchase and Sale: Form 145Dokument7 SeitenAssignment of Agreement of Purchase and Sale: Form 145ReCyoNoch keine Bewertungen

- United States v. Anthony Braithwaite, 4th Cir. (2012)Dokument4 SeitenUnited States v. Anthony Braithwaite, 4th Cir. (2012)Scribd Government DocsNoch keine Bewertungen

- Corre vs. Tan CorreDokument1 SeiteCorre vs. Tan CorrePaolo Adalem100% (2)

- Analysis Us Constitution PDFDokument2.830 SeitenAnalysis Us Constitution PDFtatianabulgakovNoch keine Bewertungen

- XYZ Cement Co nuisance case analyzedDokument4 SeitenXYZ Cement Co nuisance case analyzedKershey Salac50% (2)

- Loadstar Shipping Co V CADokument2 SeitenLoadstar Shipping Co V CAAnonymous cRzv1YJWMNoch keine Bewertungen

- Kansas Tenants Handbook (2007)Dokument48 SeitenKansas Tenants Handbook (2007)shivad0g100% (1)

- John Witkowski v. Intl Brotherhood of Boilermake, 3rd Cir. (2010)Dokument9 SeitenJohn Witkowski v. Intl Brotherhood of Boilermake, 3rd Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- 10 - Hyborian Age GovernmentsDokument9 Seiten10 - Hyborian Age GovernmentspfckainNoch keine Bewertungen

- Quiz 6.13 Answer KeyDokument4 SeitenQuiz 6.13 Answer KeyAngelo LabiosNoch keine Bewertungen

- U S Bank Psa Does Not Provethey Own The Loan Chase California Case Javaheri Email From Dennis GrayDokument2 SeitenU S Bank Psa Does Not Provethey Own The Loan Chase California Case Javaheri Email From Dennis GrayJulio Cesar NavasNoch keine Bewertungen

- Template SPADokument11 SeitenTemplate SPAAnis Syahirah FauziNoch keine Bewertungen

- United States v. Jose Rafael Marte, 11th Cir. (2014)Dokument4 SeitenUnited States v. Jose Rafael Marte, 11th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- Government Gazette Republic of Namibia: General NoticeDokument38 SeitenGovernment Gazette Republic of Namibia: General NoticePaulNoch keine Bewertungen

- Melbourne Storm Deloitte InvestigationDokument6 SeitenMelbourne Storm Deloitte InvestigationABC News Online100% (1)

- DMBA 405 PPT Subject Compilation by MeritcheDokument30 SeitenDMBA 405 PPT Subject Compilation by MeritcheMeritche Rodrigo Solacito PeñarandaNoch keine Bewertungen

- Christopher Martens v. James Shannon, Attorney General, 836 F.2d 715, 1st Cir. (1988)Dokument5 SeitenChristopher Martens v. James Shannon, Attorney General, 836 F.2d 715, 1st Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- Module 1 - Law of Contract IIDokument30 SeitenModule 1 - Law of Contract IIAnkitNoch keine Bewertungen

- To 27-Oct-2022 Employee Name Designat Ion Emp IdDokument2 SeitenTo 27-Oct-2022 Employee Name Designat Ion Emp IdNagar Fact100% (1)

- Amity Law School, Noida: Weekly Progress ReportDokument3 SeitenAmity Law School, Noida: Weekly Progress ReportadeebNoch keine Bewertungen

- G.R. No. 193385 December 1, 2014 People of The Philippines, PlaintiffDokument5 SeitenG.R. No. 193385 December 1, 2014 People of The Philippines, PlaintiffrapsodyNoch keine Bewertungen

- Brokenshire Mem Hosp Vs NLRCDokument2 SeitenBrokenshire Mem Hosp Vs NLRCtengloyNoch keine Bewertungen

- Module 3Dokument8 SeitenModule 3Jim M. MagadanNoch keine Bewertungen

- Birth and Death Corrections (New) - CDMADokument2 SeitenBirth and Death Corrections (New) - CDMADevendra DevNoch keine Bewertungen

- Revocable Living TrustDokument14 SeitenRevocable Living TrustJack100% (7)