Beruflich Dokumente

Kultur Dokumente

SVat Quick Guide

Hochgeladen von

IndrajithAbeysingheOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SVat Quick Guide

Hochgeladen von

IndrajithAbeysingheCopyright:

Verfügbare Formate

Sri Lanka Inland Revenue

-How to file SVATHow to file the SVAT form and schedules

Manually

Online

SUMMARY OF CHANGES

Calendar: Monthly (No change)

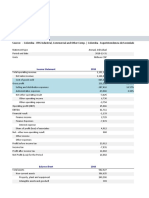

SVAT 04 form:

Cage split into Normal supplies and NFE supplies

No. of invoices cage kept only for SVAT05

Declaration by supplier and purchaser updated

Schedules:

SVAT06, 06a, 06b schedules consolidated into one SVAT06

SVAT07a, 07b, 07c,07d schedules consolidated into one SVAT07

Submission of forms and schedules:

Mandatory submission of schedules. Forms without schedules will be considered incomplete and will

not be processed, and may result in penalties

Can be submitted manually or electronically if number of entries <= 20

Must be submitted electronically if number of entries > 20

Changes effective from: Monthly: 01 Feb 2016 (for Jan 2016)

To file the SVAT form and schedule online, refer to

To request for credit vouchers, refer to

A. Form and schedule submission

B. Request for credit vouchers online NEW

To understand the structure of the SVAT schedules and how to generate them, refer to

To verify the format of your SVAT schedules with the schedule verifier too, refer to

To check the new help options, refer to

NEW

C. Schedule files NEW

D. Schedule verifier tool

NEW

E. Help options

A. Form and schedule submission

Access www.ird.gov.lk and login to e-services. Refer to the quick guide How to login for more details

Select Assessment Simplified Value Added Tax (SVAT) from the top menu

Sri Lanka Inland Revenue

-How to file SVAT3

If you are a registered supplier, follow steps 4 to 10 to submit the SVAT04 form

If you are a registered purchaser, follow steps 11 to 15 to approve the SVAT04 form submitted by the registered

supplier

Submit SVAT04 form by registered supplier

The SVAT pending for submissions is displayed. Click Pending Submission

8

5

In the event that there is no suspended supplies for the current month, tick this checkbox and proceed to step 8

Enter the goods/services declaration under SVAT scheme details and click Save

The record is added as shown. Repeat step 6 to add more records

Click Proceed

2

Sri Lanka Inland Revenue

-How to file SVAT-

Check I Agree and click Submit

10

10

You will receive a confirmation of your submission. Click on the Printer icon to print a copy of this confirmation for

your own record

Approve SVAT04 form by registered purchaser

12

11

11

In the event that there are no suspended purchases in the current month, tick this checkbox and click Submit

12

To approve suspended purchases for the current month, click SVAT04 Pending RIP Approval

Sri Lanka Inland Revenue

-How to file SVAT-

13

14

13

Verify the details entered by the supplier. If everything is ok, click Approve with the CRV number

14

To reject, enter the reason for rejection and click Reject. Both RIS and RIP will have to rework on the submission

15

15

You will have to declare that the information provided is accurate. Check I Agree and click Approve

16

For registered suppliers:

- To submit the SVAT05 (including SVAT05A and SVAT05B) schedule, refer to steps 17 to 26

- To submit the SVAT07 schedule, refer to steps 27 to 36

For registered purchasers:

- To submit the SVAT06 schedule, refer to steps 37 to 47

Sri Lanka Inland Revenue

-How to file SVATSubmit SVAT05 by Registered Supplier

17

Login as the registered supplier

18

18

Click Submit SVAT05

19

20

19

Enter the Goods/Services Declaration Supplementary Form (SVAT05) summary details

20

Select the Document Type to upload and click Select Files

21

22

21

If applicable, enter the Suspended VAT Debit Notes (SVAT05A) summary details

22

Select the Document Type to upload and click Select Files

Sri Lanka Inland Revenue

-How to file SVAT-

23

24

25

23

If applicable, enter the Suspended VAT Credit Notes (SVAT05B) summary details

24

Select the Document Type to upload and click Select Files

25

Click Submit

26

26

You will see a confirmation that the SVAT05 schedule has been submitted

Sri Lanka Inland Revenue

-How to file SVATSubmit SVAT07 by Registered Supplier

27

Login as the registered supplier

28

28

Click Submit SVAT07

29

30

29

Enter the Summary of Suspended Supplies (SVAT07) details

30

If you have 20 or less records to enter for SVAT07, you can enter these details online.

Click + Update SVAT07 Data Online. Refer to steps 31 to 34

If you have more than 20 records to enter for SVAT07, you must upload these details using the SVAT07 schedule

template. Click + Upload SVAT07 Data. Refer to steps 35 to 36

7

Sri Lanka Inland Revenue

-How to file SVATUpdate SVAT07 Data Online

33

31

32

34

31

Enter the SVAT07 record details

32

Click Save

33

The record is added as shown. Repeat steps 31 to 32 to add more records

34

Once done, click Submit

Upload SVAT07 Data

35

36

35

Select the Document Type to upload and click Select Files

36

Click Submit

8

Sri Lanka Inland Revenue

-How to file SVATSubmit SVAT06 by Registered Purchaser

37

Login as the registered purchaser

38

38

Click SVAT06 Pending Upload

39

39

Click Submit SVAT06

40

41

40

Enter the Summary of Suspended Purchases (SVAT06) details

41

If you have 20 or less records to enter for SVAT06, you can enter these details online.

Click + Update SVAT06 Online. Refer to steps 42 to 45

If you have more than 20 records to enter for SVAT06, you must upload these details using the SVAT06 schedule

template. Click + Upload SVAT06 Data. Refer to steps 46 to 47

9

Sri Lanka Inland Revenue

-How to file SVATUpdate SVAT06 Online

44

42

43

45

42

Enter the SVAT06 record details

43

Click Save

44

The record is added as shown. Repeat steps 42 to 43 to add more records

45

Once done, click Submit

Upload SVAT06 Data

46

47

46

Select the Document Type to upload and click Select Files

47

Click Submit

10

Sri Lanka Inland Revenue

-How to file SVATB. Request for credit vouchers online

This section is applicable to the Registered Identified Purchase (RIP) who will need to request for credit vouchers for

suspended purchases

48

Access www.ird.gov.lk and login to e-services. Refer to the quick guide How to login for more details

49

49

Select Assessment Simplified Value Added Tax (SVAT) from the top menu

50

50

Click SVAT06 Pending Upload

51

51

Click Request credit vouchers

52

53

52

Enter the necessary details

53

Click Submit

54

You will receive an email from the SVAT branch for you to collect the voucher at the IRD premises

11

Sri Lanka Inland Revenue

-How to file SVATC. Schedule files

55

55

Access Downloads Schedules from the top menu. Download the excel templates from the IRD portal to your

hard drive

56

To understand more about the structure of the SVAT schedule 05 file, what the individual fields mean and the

naming convention required, refer to steps 62-64

57

To understand more about the structure of the SVAT schedule 05A file, what the individual fields mean and the

naming convention required, refer to steps 65-67

58

To understand more about the structure of the SVAT schedule 05B file, what the individual fields mean and the

naming convention required, refer to steps 68-70

59

To understand more about the structure of the SVAT schedule 06 file, what the individual fields mean and the

naming convention required, refer to steps 71-73

60

To understand more about the structure of the SVAT schedule 07 file, what the individual fields mean and the

naming convention required, refer to steps 74-76

61

Once you have generated your schedule files, you may want to verify that they are free of errors and ready to be

uploaded. Refer to

D. Schedule verification tool

12

Sri Lanka Inland Revenue

-How to file SVATSVAT Schedule 05

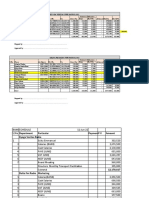

This schedule is to be filled by the supplier

62

Sample format:

Please note that the above format appears as a single line inside the schedule file. It

has been broken into 2 lines for illustration purposes

63

64

Field explanation:

File naming

convention:

Field

Explanation

Serial No.

Running unique serial number

RIP TIN No.

Purchaser TIN Number

RIP SVAT No.

Purchaser SVAT Number

Credit Voucher No.

Credit Voucher Number

Normal / NFE

If this record details Normal Supplies then indicate as Normal

If this record details NFE Supplies then indicate as NFE

Invoice Date

Invoice date in DDMMYYYY format

Suspended Tax Invoice No.

Suspended Tax Invoice number

Value of Supply

Value of Supply in Rupees

Suspended VAT Amount

Suspended VAT Amount

You will have to name the SVAT schedule 05 file according to the following format:

RISSVATNO_YYYYMM_SVAT05.CSV

Suppliers SVAT

number

Month of submission

For example, 123456_201601_SVAT05.csv

Ensure that the file is saved in .csv format

13

Sri Lanka Inland Revenue

-How to file SVATSVAT Schedule 05A

This schedule is to be filled by the supplier

65

Sample format:

Please note that the above format appears as a single line inside the schedule file. It

has been broken into 2 lines for illustration purposes

66

67

Field explanation:

File naming

convention:

Field

Explanation

Serial No.

Running unique serial number

RIP TIN No.

Purchaser TIN Number

RIP SVAT No.

Purchaser SVAT Number

Invoice Date

Invoice date in DDMMYYYY format

Invoice No.

Invoice Number

Normal / NFE

If this record details Normal Supplies then indicate as Normal

If this record details NFE Supplies then indicate as NFE

Relevant Credit Voucher No.

Relevant Credit Voucher Number

Date of Debit Note

Date of Debit Note in DDMMYYYY format

Debit Note No.

Debit Note Number

Credit Voucher No.

Credit Voucher Number issued for the current month

Value of SVAT Debit Note

Value of SVAT Debit Note

Suspended VAT Amount

Suspended VAT Amount

You will have to name the SVAT schedule 05A file according to the following format:

RISSVATNO_YYYYMM_SVAT05A.CSV

Suppliers SVAT

number

Month of submission

For example, 123456_201601_SVAT05A.csv

Ensure that the file is saved in .csv format

14

Sri Lanka Inland Revenue

-How to file SVATSVAT Schedule 05B

This schedule is to be filled by the supplier

68

Sample format:

Please note that the above format appears as a single line inside the schedule file. It

has been broken into 2 lines for illustration purposes

69

70

Field explanation:

File naming

convention:

Field

Explanation

Serial No.

Running unique serial number

RIP TIN No.

Purchaser TIN Number

RIP SVAT No.

Purchaser SVAT Number

Invoice Date

Invoice date in DDMMYYYY format

Invoice No.

Invoice Number

Normal / NFE

If this record details Normal Supplies then indicate as Normal

If this record details NFE Supplies then indicate as NFE

Relevant Credit Voucher No.

Relevant Credit Voucher Number

Date of Credit Note

Date of Credit Note in DDMMYYYY format

Credit Note No.

Credit Note Number

Credit Voucher No.

Credit Voucher Number issued for the current month

Value of SVAT Credit Note

Value of SVAT Credit Note

Suspended VAT Amount

Suspended VAT Amount

You will have to name the SVAT schedule 05B file according to the following format:

RISSVATNO_YYYYMM_SVAT05B.CSV

Suppliers SVAT

number

Month of submission

For example, 123456_201601_SVAT05B.csv

Ensure that the file is saved in .csv format

15

Sri Lanka Inland Revenue

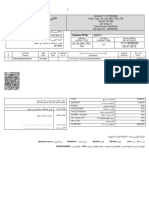

-How to file SVATSVAT Schedule 06

This schedule is to be filled by the purchaser

71

Sample format:

Please note that the above format appears as a single line inside the schedule file. It

has been broken into 2 lines for illustration purposes

72

73

Field explanation:

File naming

convention:

Field

Explanation

Serial No.

Running unique serial number

RIS TIN No.

Supplier TIN Number

RIS SVAT No.

Supplier SVAT Number

Credit Voucher No.

Credit Voucher Number

No. of Invoices

Number of Invoices

Normal / NFE

If this record details Normal Supplies then indicate as Normal

If this record details NFE Supplies then indicate as NFE

Total Purchases

Total Purchase Amount

Credit Note Value

Credit Notes Value Amount

Debit Note Value

Debit Notes Value Amount

Net Purchases

Net Purchases Amount

SVAT for Net Purchases

SVAT for Net Purchases

You will have to name the SVAT schedule 06 file according to the following format:

RIPSVATNO_YYYYMM_SVAT06.CSV

Purchasers

SVAT number

Month of submission

For example, 123456_201601_SVAT06.csv

Ensure that the file is saved in .csv format

16

Sri Lanka Inland Revenue

-How to file SVATSVAT Schedule 07

This schedule is to be filled by the supplier

74

Sample format:

Please note that the above format appears as a single line inside the schedule file. It

has been broken into 2 lines for illustration purposes

75

76

Field explanation:

File naming

convention:

Field

Explanation

Serial No.

Running unique serial number

RIP TIN No.

Purchaser TIN Number

RIP SVAT No.

Purchaser SVAT Number

Credit Voucher No.

Credit Voucher Number

No. of Invoices

Number of Invoices

Normal / NFE

If this record details Normal Supplies then indicate as Normal

If this record details NFE Supplies then indicate as NFE

Value as per Invoices

Total Supplies Amount

Value of Credit Notes

Credit Notes Value Amount

Value of Debit Notes

Debit Notes Value Amount

Net Value

Net Supplies Value Amount

SVAT for Net Supplies

SVAT for Net Supplies

You will have to name the SVAT schedule 07 file according to the following format:

RISSVATNO_YYYYMM_SVAT07.CSV

Suppliers SVAT

number

Month of submission

For example, 123456_201601_SVAT07.csv

Ensure that the file is saved in .csv format

17

Sri Lanka Inland Revenue

-How to file SVATD. Schedule verification tool

77 Ensure that all schedule files have been filled in and saved as CSV format. Refer to

C. Schedule files

78

78

Access Downloads Schedules from the top menu. Download the schedule verification tool from the IRD portal

79

79

Launch the schedule verification tool by double clicking on the ScheduleFileVerifier.exe file. Click File Type

18

Sri Lanka Inland Revenue

-How to file SVAT-

80

80

Select the appropriate schedule file type to verify

81

82

83

Note: This screen is for illustration purposes only

81

Select the schedule file to be verified

82

Click Verify

83

If the schedule file is according to the correct format required, you will see the Validation passed message.

Otherwise, the errors will be reflected here

84 If there are errors in your file, refer to

to review the schedule file structure, ensure that

C. Schedule files

you have named your file according to the required naming convention and to make sure that your file is saved in

.csv format

19

Sri Lanka Inland Revenue

-How to file SVATE. Help options

Online help prompts: The blue icons next to some fields show additional information when the mouse is

placed on them

Walk in to the Taxpayer Services Unit- Monday to Friday 8:30 am to 4:00 pm (except public holidays)

The TPS unit can help you with:

Registration as a Taxpayer and issuing of Taxpayer Identification Number (TIN)

Registration for tax types

Updating of Taxpayer profile

Taxpayer Services Unit

Issuing of Personal Identification Number (PIN) to use e-Services

INLAND REVENUE DEPARTMENT

Issuing of Clearance certificate

SIR CHITTAMPALAM A GARDINER

MAWATHA,

Advice on tax responsibilities and obligations

COLOMBO 02

Collection of returns and supporting documents

Call Center- Monday to Friday 9:00 am to 7:00 pm, Saturday 9:00 am to 1:00 pm

Call Center

1944

20

Das könnte Ihnen auch gefallen

- GST - Ready Reckoner - Woorkbook PDFDokument53 SeitenGST - Ready Reckoner - Woorkbook PDFChaitanya NarreddyNoch keine Bewertungen

- Avalara Growing Your Accounting Practice How Tax Compliance Adds To Your Bottom LineDokument22 SeitenAvalara Growing Your Accounting Practice How Tax Compliance Adds To Your Bottom LineJonathan StepanNoch keine Bewertungen

- For Amo WebinarsDokument79 SeitenFor Amo WebinarsLiezl Tizon ColumnasNoch keine Bewertungen

- Taxation Laws - Ms. de CastroDokument54 SeitenTaxation Laws - Ms. de CastroCC100% (1)

- BMBE SeminarDokument60 SeitenBMBE SeminarBabyGiant LucasNoch keine Bewertungen

- General Principles of TaxationDokument25 SeitenGeneral Principles of TaxationJephraimBaguyo100% (1)

- Sponsor LetterDokument2 SeitenSponsor LetterIndrajithAbeysingheNoch keine Bewertungen

- Annual ReportDokument37 SeitenAnnual ReportMukesh ManwaniNoch keine Bewertungen

- (Your Company Name) (Your State or Jurisdiction)Dokument7 Seiten(Your Company Name) (Your State or Jurisdiction)Perimenopause Symptoms100% (1)

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDokument66 SeitenMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Withholding Tax 101Dokument82 SeitenWithholding Tax 101Maria GinalynNoch keine Bewertungen

- Overview of General Ledger TasksDokument8 SeitenOverview of General Ledger TasksamrNoch keine Bewertungen

- UAE Comprehensive VAT GuideDokument19 SeitenUAE Comprehensive VAT GuidefasmekbakerNoch keine Bewertungen

- Advanced Taxation: The Institute of Chartered Accountants of PakistanDokument4 SeitenAdvanced Taxation: The Institute of Chartered Accountants of PakistanAhmed Raza MirNoch keine Bewertungen

- MayniladDokument1 SeiteMayniladTheo AmadeusNoch keine Bewertungen

- Notes To Financial StatementsDokument9 SeitenNotes To Financial StatementsCheryl FuentesNoch keine Bewertungen

- New VAT Audit FormatDokument12 SeitenNew VAT Audit FormatparulshinyNoch keine Bewertungen

- Accountant TestDokument3 SeitenAccountant TestMax SuperNoch keine Bewertungen

- Accounting Policies and Procedures ManualDokument62 SeitenAccounting Policies and Procedures ManualKhints EttezilNoch keine Bewertungen

- 267731702final PDFDokument5 Seiten267731702final PDFelmarcomonal100% (1)

- Ebiz Tax Test FlowDokument4 SeitenEbiz Tax Test FlowTim TomNoch keine Bewertungen

- Final AccountsDokument65 SeitenFinal AccountsAmit Mishra100% (1)

- Power Sector v. CIR GR No. 198146 Dated August 08, 2017Dokument4 SeitenPower Sector v. CIR GR No. 198146 Dated August 08, 2017Vel JuneNoch keine Bewertungen

- Harera Astaire FinalDokument52 SeitenHarera Astaire FinalAnanya PatilNoch keine Bewertungen

- VAT and SD Act 2012 EnglishDokument91 SeitenVAT and SD Act 2012 EnglishMonjurul HassanNoch keine Bewertungen

- 2019 ICREATE Audit ReportDokument3 Seiten2019 ICREATE Audit ReportJoanna GarciaNoch keine Bewertungen

- Value-Added Tax (Vat) : Bar Examination Questions and Answers in TaxationDokument31 SeitenValue-Added Tax (Vat) : Bar Examination Questions and Answers in TaxationHaRry PeregrinoNoch keine Bewertungen

- Procedure of Appeal To The Income Tax Appellate Authority in BangladeshDokument4 SeitenProcedure of Appeal To The Income Tax Appellate Authority in BangladeshMasum GaziNoch keine Bewertungen

- VAT SummaryDokument1 SeiteVAT SummarybanglauserNoch keine Bewertungen

- Sample FS PDFDokument20 SeitenSample FS PDFCjls KthyNoch keine Bewertungen

- BSB40215 Certificate IV in Business BSBFIA402 Report On Financial ActivityDokument12 SeitenBSB40215 Certificate IV in Business BSBFIA402 Report On Financial Activity______.________Noch keine Bewertungen

- Chart of Accounts For Dilley and CompanyDokument9 SeitenChart of Accounts For Dilley and CompanyCharitycharityNoch keine Bewertungen

- IT QuestionsDokument108 SeitenIT QuestionsDeepika MittalNoch keine Bewertungen

- Practical Income Tax & VAT Management: WWW - Bim.gov - BDDokument2 SeitenPractical Income Tax & VAT Management: WWW - Bim.gov - BDrumon hossain100% (2)

- DRC VAT Training CAs Day 1-2Dokument40 SeitenDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- AAT Willis CH02Dokument15 SeitenAAT Willis CH02CJ0% (1)

- Certificate of Compensation Payment/Tax WithheldDokument1 SeiteCertificate of Compensation Payment/Tax WithheldJeffreyNoch keine Bewertungen

- Audit Module 1 - Trial Balance Account MappingDokument6 SeitenAudit Module 1 - Trial Balance Account MappingGaurav KumarNoch keine Bewertungen

- Financial Reporting Act 2015 - English - Unofficial VersionDokument29 SeitenFinancial Reporting Act 2015 - English - Unofficial VersionReefat HasanNoch keine Bewertungen

- Coa Mapping Int enDokument26 SeitenCoa Mapping Int enMuhammad Javed IqbalNoch keine Bewertungen

- Taxguru - In-Guide To Approved Gratuity FundDokument12 SeitenTaxguru - In-Guide To Approved Gratuity FundnanuNoch keine Bewertungen

- Birefps User Guide UpdatedDokument20 SeitenBirefps User Guide UpdatedIreneMackay GiraoNoch keine Bewertungen

- Section 195 and Form 15CBDokument53 SeitenSection 195 and Form 15CBVALTIM09Noch keine Bewertungen

- Handbook of VATDokument66 SeitenHandbook of VATMd SelimNoch keine Bewertungen

- The The The The The: Published by AuthorityDokument92 SeitenThe The The The The: Published by Authorityrahulchow2Noch keine Bewertungen

- CAR 2D Expanded Engagement Ltr-Compilation (5-17)Dokument8 SeitenCAR 2D Expanded Engagement Ltr-Compilation (5-17)Andy RossNoch keine Bewertungen

- GMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Dokument4 SeitenGMCAC - Follow-Up Clarification On Taxability of Purchase of GCs - 11.19.15Monica SorianoNoch keine Bewertungen

- BIR Form 2316 UndertakingDokument1 SeiteBIR Form 2316 UndertakingJan Paolo CruzNoch keine Bewertungen

- Cover LetterDokument3 SeitenCover Letterapi-358201396Noch keine Bewertungen

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDokument29 SeitenWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Firm'S Profile: Grow With IntegrityDokument27 SeitenFirm'S Profile: Grow With IntegrityIrshad murtazaNoch keine Bewertungen

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDokument64 SeitenSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51Noch keine Bewertungen

- The Financial Reporting Standards CouncilDokument15 SeitenThe Financial Reporting Standards CouncilPrincess Joy VillaNoch keine Bewertungen

- Bir Ruling 044-10Dokument4 SeitenBir Ruling 044-10Jason CertezaNoch keine Bewertungen

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Dokument52 SeitenCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeanieNoch keine Bewertungen

- How To Draft Legal Opinion - by Rehan Aziz Shervani - Advocate High Court - Cell-0333-4324961Dokument1 SeiteHow To Draft Legal Opinion - by Rehan Aziz Shervani - Advocate High Court - Cell-0333-4324961rehanshervaniNoch keine Bewertungen

- Avidesa Mac Pollo S A (Colombia)Dokument18 SeitenAvidesa Mac Pollo S A (Colombia)Batfori clucksNoch keine Bewertungen

- E-Filing of Vat ReturnDokument43 SeitenE-Filing of Vat Returnanoop kumarNoch keine Bewertungen

- Vat Returns Manual 2021Dokument25 SeitenVat Returns Manual 2021mactechNoch keine Bewertungen

- ANNEX 1 - Revised People's FOI Manual of The BIRDokument34 SeitenANNEX 1 - Revised People's FOI Manual of The BIRRio SanchezNoch keine Bewertungen

- Your Checklist For VAT Return Filing - GCCDokument1 SeiteYour Checklist For VAT Return Filing - GCCAli AyubNoch keine Bewertungen

- Period Control Method - Depreciation KeyDokument5 SeitenPeriod Control Method - Depreciation KeySpandana SatyaNoch keine Bewertungen

- Updated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)Dokument13 SeitenUpdated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)samNoch keine Bewertungen

- Fixed Assets Purchse Flow ChartDokument41 SeitenFixed Assets Purchse Flow ChartAbu NaserNoch keine Bewertungen

- 1701 GuidelinesDokument4 Seiten1701 GuidelinesJazz techNoch keine Bewertungen

- Cutover Strategy Document For ARASCO V1.0Dokument12 SeitenCutover Strategy Document For ARASCO V1.0Anonymous hCDnyHWjTNoch keine Bewertungen

- ITR1 - Part 3 (How To Download 26AS)Dokument8 SeitenITR1 - Part 3 (How To Download 26AS)gaurav gargNoch keine Bewertungen

- Journal ArticleDokument9 SeitenJournal ArticleIndrajithAbeysingheNoch keine Bewertungen

- ELT UpcomingSessionsDokument1 SeiteELT UpcomingSessionsIndrajithAbeysingheNoch keine Bewertungen

- Keep Satisfied Keep Satisfied Manage Closely Manage Closely: Stakeholders - Power/Interest GridDokument3 SeitenKeep Satisfied Keep Satisfied Manage Closely Manage Closely: Stakeholders - Power/Interest GridIndrajithAbeysingheNoch keine Bewertungen

- Vatnbt29042019 eDokument1 SeiteVatnbt29042019 eIndrajithAbeysingheNoch keine Bewertungen

- F6uk 2011 Dec QDokument12 SeitenF6uk 2011 Dec Qmosherif2011Noch keine Bewertungen

- 38 Section 2 PDFDokument34 Seiten38 Section 2 PDFAlessandro MediciNoch keine Bewertungen

- NIRC Sec 141-151Dokument9 SeitenNIRC Sec 141-151Euxine AlbisNoch keine Bewertungen

- Bill AprilDokument1 SeiteBill AprilAnamul HaqueNoch keine Bewertungen

- IAS-01 Audit Application Form V40 (5 May 23)Dokument7 SeitenIAS-01 Audit Application Form V40 (5 May 23)hrdhse. WanxindaNoch keine Bewertungen

- Bank Schedle Sept 2022Dokument10 SeitenBank Schedle Sept 2022Mercy FaithNoch keine Bewertungen

- 1000&1250 11 Oltc R1Dokument3 Seiten1000&1250 11 Oltc R1Rohan KallaNoch keine Bewertungen

- Cases MSC VNDokument32 SeitenCases MSC VNNam Nguyen hoaiNoch keine Bewertungen

- M-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1Dokument47 SeitenM-FAC 4861 - 3 - IFRS 16 Leases Lecture Notes-1AceNoch keine Bewertungen

- Fac1502 Exam Pack Exam Pack With AnswersDokument175 SeitenFac1502 Exam Pack Exam Pack With AnswersPortia MokoenaNoch keine Bewertungen

- Local Taxation AND Fiscal MattersDokument68 SeitenLocal Taxation AND Fiscal MattersAnonymous EEVZMa0hnNoch keine Bewertungen

- Vat ComputationDokument18 SeitenVat ComputationWillowNoch keine Bewertungen

- IVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Dokument3 SeitenIVAS - DLV - BP User Guide For Submit Value Added Tax Return Mushak-9.1Azhar JamalNoch keine Bewertungen

- Unnati - Auto & Auto Ancillaries - 2018 PDFDokument135 SeitenUnnati - Auto & Auto Ancillaries - 2018 PDFSubhendu PradhanNoch keine Bewertungen

- Review Questions - VATDokument3 SeitenReview Questions - VATDavis Deo KagisaNoch keine Bewertungen

- Erd.2.f.006 Application For Vat Zero Rating Certification Rev.05Dokument1 SeiteErd.2.f.006 Application For Vat Zero Rating Certification Rev.05ivee.upak032023Noch keine Bewertungen

- Arrastre Tariff Rate New June 5 2018Dokument1 SeiteArrastre Tariff Rate New June 5 2018Declarant 88SunfreightNoch keine Bewertungen

- 06-Pms-Tropical Hardwood in DenmarkDokument16 Seiten06-Pms-Tropical Hardwood in Denmarknajmie99Noch keine Bewertungen

- MYOB Qualification Test: Level BasicDokument7 SeitenMYOB Qualification Test: Level BasiculfahNoch keine Bewertungen

- Contract: Organisation Details Buyer DetailsDokument3 SeitenContract: Organisation Details Buyer DetailsVikas MantriNoch keine Bewertungen

- Sales InvoiceDokument1 SeiteSales InvoiceMoussa Al BeshyNoch keine Bewertungen

- Revenue Memorandum Ruling 01-02Dokument10 SeitenRevenue Memorandum Ruling 01-02A Febb M. VillarNoch keine Bewertungen

- S3 Credit Revision Pack (Complete)Dokument48 SeitenS3 Credit Revision Pack (Complete)DavidNoch keine Bewertungen