Beruflich Dokumente

Kultur Dokumente

101

Hochgeladen von

Arif Aminun RahmanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

101

Hochgeladen von

Arif Aminun RahmanCopyright:

Verfügbare Formate

101.

01

CONCEPTUAL

ACCOUNTING :

FRAMEWORKS

OF

1. Accounting is an information system Explain.

Ans. There is no doubt about the fact that accounting is an

information system. No organization can function without the use of

money and hence without accounting. Accounting is an information

system for measuring, processing and communicating information that is

useful in making economic decision. Every business is conducted to

make profit. Accounting knowledge is there to assist the business man to

assess whether the business is making profit or loss. In accounting brings

discipline on how to source money, how to spend and how much to save.

Accounting ensures consistency in the treatment of various transactions.

Accounting involves gathering of financial data, recording classifying,

summarizing and communicate the results to the owners of the business,

or to others allowed to receive this information. Accounting should not be

confused with Book keeping as Book keeping is the part of accounting

concerned with recording of financial data. Book keeping is the process

of recording data relating to accounting transactions in the books of

accounts.

2. What are the qualitative characteristics

of accounting information?

The qualitative characteristics of accounting information are given

below-

Relevance- To make a difference in the decision process, information

must possess predictive value and/or feedback value. Generally, useful

information will possess both qualities. For example, if net income and

its components confirm investor expectations about future cash-

generating ability, then net income has feedback value for investors.

This confirmation can also be useful in predicting future cashgenerating ability as expectations are revised.

Reliability- Reliability is the extent to which information is verifiable,

representationally

faithful, and neutral.

Verifiability implies

a

consensus among different measurers. For example, the historical cost

of a piece of land to be reported in the balance sheet of a company is

usually highly verifiable. The cost can be traced to an exchange

transaction, the purchase of the land.

Comparability- Accounting comparability is a quality of accounting

information that addresses the usability of financial information.

Information that is prepared using the same measurement

techniques and reported in a similar fashion is considered

comparable information because this information is similar and

can be judged side by side other similar financial information.

Consistency- The concept of accounting consistency refers to the

principle that companies should use the same accounting methods

to record similar transactions over time. In other words,

companies shouldn't bounce between accounting rules and

treatments to manipulate profits or other statement elements.

Accounting methods should be used consistently.

4. What is meant by Gaap ? Why is it important that all

companies follow GAAP in reporting to external

users?

Ans: Generally Accepted Accounting Principles (GAAP) is a

framework

of

accounting

standards,

rules

and

procedures defined by the professional accounting industry, which

has been adopted by nearly all publicly traded U.S. companies.

GAAP (generally accepted accounting principles) are a

dynamic set of both broad and specific guidelines that a

company should follow in measuring and reporting the

information in their financial statements and related notes. It

is important that all companies follow GAAP so that investors

can compare financial information across companies to make

their resource allocation decisions.

6. Define financial statement. Explain the various

elements of financial statements.

Ans:

Financial statements are a collection of reports about an

organization's financial results, financial condition, and cash

flows.

Elements of financial statementsa.

c.

5. Identify and describe the six underlying assumptions

included in accounting principles.

e.

g.

i.

Assets represent probable

future economic benefits

controlled by the enterprise.

Equity is a residual amount,

the

owners interest in assets

after subtracting liabilities.

Distributions

to

owners are decreases in

equity

resulting

from

transfers to owners.

Gains are increases in

equity from peripheral, or

incidental, transactions of

an entity.

Losses represent decreases

in equity arising from

peripheral, or incidental,

transactions of an entity.

b.

Liabilities represent obligations

to other entities.

d.

Investments by owners are

increases in equity resulting

from transfers of resources

(usually cash) to a company in

exchange for ownership interest.

f.

Revenues are gross inflows

resulting from providing goods

or services to customers.

h.

Expenses are gross outflows

incurred in generating revenues.

j.

Comprehensive income

often

does not equal net income.

7. What are the four basic assumptions underlying

GAAP? Explain why time period assumption causes

accruais and deferrals in accounting.

assumption, (3) theperiodicity assumption, and (4)

monetary unit assumption.Economic Entity Assumption.

Ans:

The four basic assumptions underlying GAAP

are (1) the economic entity assumption, (2) the going concern

the

101.02 REVIEW OF THE ACCOUNTING PROCESS:

1. Define economic events. Differentiate between external events and

Internal events. Give an example of each type of events.

Ans: ECONOMIC EVENT is the transfer of control of an economic

resource from one party to another party.

2. Explain the various steps in Accounting processing cycle.

Ans:

1. Identifying and Analyzing Business Transactions

The accounting process starts with identifying and analyzing

business transactions and events. Not all transactions and events are

entered into the accounting system. Only those that pertain to the

business entity are included in the process.

For example, a personal loan made by the owner that does not have

anything to do with the business entity is not accounted for.

2. Recording in the Journals

A journal is a book paper or electronic in which transactions are

recorded. Business transactions are recorded using the double-entry

bookkeeping system. They are recorded in journal entries

containing at least two accounts (one debited and one credited).

Transactions are recorded in chronological order and as they occur.

Journals are also known as Books of Original Entry.

3. Posting to the Ledger

7. Financial Statements

Also known as Books of Final Entry, the ledger is a collection of

accounts that shows the changes made to each account as a result of past

transactions, and their current balances.

After the posting all transactions to the ledger, the balances of each

account can now be determined.

For example, all journal entry debits and credits made to Cash would be

transferred into the Cash account in the ledger. We will be able to

calculate the increases and decreases in cash; thus, the ending balance of

Cash can be determined.

When the accounts are already up-to-date and equality between

the debits and credits have been tested, the financial statements

can now be prepared. The financial statements are the endproducts of an accounting system.

A complete set of financial statements is made up of: (1)

Statement of Comprehensive Income (Income Statement and Other

Comprehensive Income), (2) Statement of Changes in Equity, (3)

Statement of Financial Position or Balance Sheet, (4) Statement of

Cash Flows, and (5) Notes to Financial Statements.

8. Closing Entries

4. Trial balance

At the end of the accounting period (which may be a month, quarter, or

year depending on a businesss practices), you calculate a trial balance.

Temporary or nominal accounts, i.e. income statement accounts,

are closed to prepare the system for the next accounting period.

Temporary

accounts

include income,

expense,

and

withdrawal accounts. These items are measured periodically.

5. Adjusting Entries

The accounts are closed to a summary account (usually, Income

Adjusting entries are prepared as an application of the accrual

Summary) and then closed further to the appropriate capital

basis of accounting. At the end of the accounting period, some

account. Take note that closing entries are made only for

expenses may have been incurred but not yet recorded in the

temporary accounts. Real or permanent accounts, i.e. balance

journals. Some income may have been earned but not entered

in the books.

Adjusting entries are prepared to update the accounts before

they are summarized in the financial statements.

Adjusting entries are made for accrual of income, accrual of

expenses,

deferrals (income

method

or

liability

method),

prepayments (asset method or expense method), depreciation, and

9. Post-Closing Trial Balance

In the accounting cycle, the last step is to prepare a post-closing

trial balance. It is prepared to test the equality of debits and

credits after closing entries are made. Since temporary accounts

are already closed at this point, the post-closing trial balance

10. Reversing Entries: Optional step at the beginning of the new

accounting period

6. Adjusted Trial Balance

Reversing entries are optional. They are prepared at the beginning

An adjusted trial balance may be prepared after adjusting entries

of the new accounting period to facilitate a smoother and more

are made and before the financial statements are prepared.

consistent recording process.

This is to test if the debits are equal to credits after adjusting

In this step, the adjusting entries made for accrual of income,

entries are made.

accrual of expenses, deferrals under the income method, and

prepayments under the expense method are simply reversed.

3. What is work sheet? What are purposes of preparing a work

sheet?

Ans:

An accounting worksheet is a tool that businesses use to balance and

close out their books at the end of a period. An accounting

worksheet lists all the balances of each account a business has,

with adjusting and closing entries made to these balances. When

a worksheet is complete, the company prepares financial

statements

from

them.

Chart of Accounts- Every company keeps a chart of accounts

that lists every account the company has. It is divided into five

sections: assets, liabilities, equity, revenue and expenses. Each of

these accounts is in the companys general ledger, where

balances of each account are maintained. An accounting

worksheet begins by listing each account and the balance each

account has.

Adjusting Entries- One main purpose of an accounting worksheet is

to record adjusting entries. Adjusting entries are made at the end

of each period. They are not normal everyday-type entries; they

only take place at the end of a month or period. Examples of

adjusting entries are those adjusting for supplies used, insurance

used, revenue earned and interest earned. These entries are

recorded on the worksheet.

Trial Balance - After adjusting entries are made, each account is

updated on the worksheet. If an account had an adjusting entry,

the previous amount in that account needs to be adjusted. If no

adjusting entry is made to an account, the same balance transfers

over to this column. The worksheet helps to keep the companys

ledger in balance.

Closing Entries- The worksheet is a 10-column ledger and is also

used to calculate and record closing entries. Books are always

closed at the end of every fiscal year, and the worksheet aids the

closing process.

Financial Statements-One of the primary uses for a worksheet is for

the information it contains. After making adjusting entries and

finalizing closing entries, the business can generate financial

statements. The worksheet contains all the information needed to

prepare these statements. After preparing the financial statements

, the company begins a new worksheet for the following year.

4. Definition with purpose of : (a) adjusting entries; (b) closing

entries; (c) reversing entries.

Ans:

(a) Adjusting entries:

Bookkeeping entries posted at the end of an accounting

period (the balance

sheet date)

to assign expenses to

the period in which they were incurred, and revenue to the period

in which it was earned. Adjusting entries are used also to correct

entries that could not be accurately made earlier.

Also called correcting entries.

(b) Closing entries:

The closing entry is used to transfer data in the temporary accounts

to the permanent balance sheet or income statement accounts. The

purpose of the closing entry is to bring the temporary journal

account balances to zero for the next accounting period, which aids

in keeping the accounts reconciled.

(c) Reversing entries:

Revenues are reported on the income statement in the period in

which the cash is received from customers.

2.

Expenses are reported on the income statement when the cash

is paid out.

1.

Under the accrual basis of accounting...

1.

Revenues are reported on the income statement when they

are earnedwhich often occurs before the cash is received from

the customers.

2.

Expenses are reported on the income statement in the period

when they occur or when they expirewhich is often in a period

different from when the payment is made.

6. What is special journal? Name some special journals. What are

advantage of special journal?

Ans: Special Journals are designed to facilitate the process of

A journal entry made on the first day of a new accounting period to

undo the accrual type adjusting entries made prior to the

preparation of the financial statements dated one day earlier.

Reversing entries allow for an effortless way to avoid doublecounting revenues or expenses that were accrued at the end of an

accounting period.

journalizing and posting transactions. They are used for the most

frequent transactions in a business. For example, in merchandising

businesses, companies acquire merchandise from vendors, and

then in turn sell the merchandise to individuals or other

businesses. Sales and purchases are

the

most

common

transactions for the merchandising businesses.

a. Sales journal- Sales journals record transactions that involve

sales on credit.

5. Define cash basis and accrual basis of accounting. Distinguish

between them. What basis is internationally accepted?

b. Cash receipts journal- A cash receipts journal (CRJ) records

transactions that involve payments received with cash.

Cash Basis' A major accounting method that recognizes revenues

and expenses at the time physical cash is actually received or paid

out.

Under the accrual basis of accounting, expenses are matched with

the related revenues and/or are reported when the expense occurs,

not when the cash is paid. The result of accrual accounting is an

income statement that better measures the profitability of a

company during a specific time period.

Distinguish between them:

Under the cash basis of accounting...

c. Cash Payments Journal- Cash Payments Journals record

transactions that involve expenditures paid with cash

d. Expense journals

e. Purchases Journal- Purchases Journals record transactions

that involve purchases on credit.

101.03 BALANCE SHEET AND FINANCIAL DISCLOSURES (IAS-1, IAS-24,

IAS-10 & IFRS-1)

1. DEFINE BALANCE SHEET. DESCRIBE THE PURPOSES AND

LIMITATIONS OF BALANCE SHEET.

2. INCOME STATEMENT IS A CONNECTING LINK BETWEEN THE

BEGINNING AND ENDING BALANCING SHEETS.- EXPLAIN.

ANS: A balance sheet is a financial statement that summarizes a

company's assets, liabilities and shareholders' equity at a specific point

in time. The balance sheet adheres to the following formula: Assets =

Liabilities + Shareholders' Equity

A Another name for the balance sheet is the statement of financial

position. Creditors and interested stock investors use the balance

sheet to determine a company's financial standing because it lists

what a company owns and what it owes. The balance sheet

contains summarized information on a company's assets -- the

things that it owns and its liabilities -- the debts it has. When you

subtract the company's liabilities from the assets, what is left is

called stockholder's equity, the amount that is held by the

company's owners or stockholders.

LIMITATIONS-

1. It is prepared on a historical cost basis. Changes in prices are not

considered.

2. Window-dressing may be done in Balance Sheet.

3. Historical Cost of Balance Sheet does not convey fruitful

information.

4. Different assets are valued according to different rules.

5. It cannot reflect the ability or skill of staff.

6. It is measured in terms of money or moneys worth. That is, only

those assets are recorded in it which can be expressed in money.

7. In inflationary trend, if the readers are not expert may mislead.

Net Income

Comprehensive Income

Net income or net loss is equal Comprehensive income is equal to

to the sum of all revenues

net

income

plus

other

in the period minus the

comprehensive income.

sum of all expenses in the

period.

4. What is discontinued operation? How it is reported in the

income statement.

Ans: A segment of a company's business that has been sold, disposed

of or abandoned. Discontinued operations can range from a

certain product line to an entire line of business. When operations

are discontinued, this is reported on the company's income

statement as

separate from income from continued operations.

5.

What are capital transactions and why are they

reported on to retained earnings statement?

Ans: transactions affecting non-current items such as fixed assets,

long-term

debt or share

capital,

rather

than revenue

transactions.

6. Explain the factors that contribute to the reliability of

financial statements.

Ans:

3. How does comprehensive income differ from net income?

Ans:

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Classic Pen Company CaseDokument16 SeitenClassic Pen Company CaseArif Aminun RahmanNoch keine Bewertungen

- Participant Observation: Qualitative Research Methods: A Data Collector's Field GuideDokument17 SeitenParticipant Observation: Qualitative Research Methods: A Data Collector's Field GuideMarta CabreraNoch keine Bewertungen

- Corvina PRIMEDokument28 SeitenCorvina PRIMEMillerIndigoNoch keine Bewertungen

- Dialog+ SW9xx - SM - Chapter 7 - 2-2013 - EN - Rinsing Bridge Version 5Dokument1 SeiteDialog+ SW9xx - SM - Chapter 7 - 2-2013 - EN - Rinsing Bridge Version 5Al ImranNoch keine Bewertungen

- Refunding: Date Invoice No. Customer Name TK AmountDokument3 SeitenRefunding: Date Invoice No. Customer Name TK AmountArif Aminun RahmanNoch keine Bewertungen

- 9 Skills Competency Matrix PDFDokument30 Seiten9 Skills Competency Matrix PDFArif Aminun RahmanNoch keine Bewertungen

- (G Mk-7 Mycörvzš¿X Evsjv 'K MikviDokument2 Seiten(G Mk-7 Mycörvzš¿X Evsjv 'K MikviArif Aminun RahmanNoch keine Bewertungen

- E. Property Owned by Co-OwnersDokument1 SeiteE. Property Owned by Co-OwnersArif Aminun RahmanNoch keine Bewertungen

- ICT HandoutDokument42 SeitenICT HandoutArif Aminun RahmanNoch keine Bewertungen

- Résumé: Dilip Kumar RajbongshiDokument2 SeitenRésumé: Dilip Kumar RajbongshiArif Aminun RahmanNoch keine Bewertungen

- Islamic Financial System: Prepared ForDokument1 SeiteIslamic Financial System: Prepared ForArif Aminun RahmanNoch keine Bewertungen

- Resign LatterDokument8 SeitenResign LatterArif Aminun RahmanNoch keine Bewertungen

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Dokument6 SeitenRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNoch keine Bewertungen

- Functions: Var S AddDokument13 SeitenFunctions: Var S AddRevati MenghaniNoch keine Bewertungen

- Technion - Computer Science Department - Technical Report CS0055 - 1975Dokument25 SeitenTechnion - Computer Science Department - Technical Report CS0055 - 1975MoltKeeNoch keine Bewertungen

- Acampamento 2010Dokument47 SeitenAcampamento 2010Salete MendezNoch keine Bewertungen

- Bajaj CNSDokument3 SeitenBajaj CNSAbhijit PaikarayNoch keine Bewertungen

- Research Paper On Air QualityDokument4 SeitenResearch Paper On Air Qualityluwahudujos3100% (1)

- Ideal Gas Law Lesson Plan FinalDokument5 SeitenIdeal Gas Law Lesson Plan FinalLonel SisonNoch keine Bewertungen

- Optimal Dispatch of Generation: Prepared To Dr. Emaad SedeekDokument7 SeitenOptimal Dispatch of Generation: Prepared To Dr. Emaad SedeekAhmedRaafatNoch keine Bewertungen

- Powerwin EngDokument24 SeitenPowerwin Engbillwillis66Noch keine Bewertungen

- Getting Returning Vets Back On Their Feet: Ggoopp EennddggaammeeDokument28 SeitenGetting Returning Vets Back On Their Feet: Ggoopp EennddggaammeeSan Mateo Daily JournalNoch keine Bewertungen

- Intervensi Terapi Pada Sepsis PDFDokument28 SeitenIntervensi Terapi Pada Sepsis PDFifan zulfantriNoch keine Bewertungen

- Topic Group Present (Week 8) Chapter 1:sociology and Learning ManagementDokument2 SeitenTopic Group Present (Week 8) Chapter 1:sociology and Learning ManagementLEE LEE LAUNoch keine Bewertungen

- IG Deck Seal PumpDokument3 SeitenIG Deck Seal PumpSergei KurpishNoch keine Bewertungen

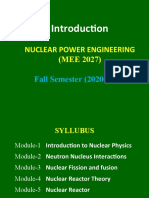

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Dokument13 SeitenNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllNoch keine Bewertungen

- BIOBASE Vortex Mixer MX-S - MX-F User ManualDokument10 SeitenBIOBASE Vortex Mixer MX-S - MX-F User Manualsoporte03Noch keine Bewertungen

- Use of Travelling Waves Principle in Protection Systems and Related AutomationsDokument52 SeitenUse of Travelling Waves Principle in Protection Systems and Related AutomationsUtopia BogdanNoch keine Bewertungen

- Liquid Chlorine SdsDokument7 SeitenLiquid Chlorine SdsIPKL RS BHAYANGKARA KEDIRINoch keine Bewertungen

- Cad Data Exchange StandardsDokument16 SeitenCad Data Exchange StandardskannanvikneshNoch keine Bewertungen

- Distribution BoardDokument7 SeitenDistribution BoardmuralichandrasekarNoch keine Bewertungen

- Lista de Precios Agosto 2022Dokument9 SeitenLista de Precios Agosto 2022RuvigleidysDeLosSantosNoch keine Bewertungen

- Bài Tập Từ Loại Ta10Dokument52 SeitenBài Tập Từ Loại Ta10Trinh TrầnNoch keine Bewertungen

- The BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptDokument19 SeitenThe BetterPhoto Guide To Creative Digital Photography by Jim Miotke and Kerry Drager - ExcerptCrown Publishing GroupNoch keine Bewertungen

- Unit 1 - Lecture 3Dokument16 SeitenUnit 1 - Lecture 3Abhay kushwahaNoch keine Bewertungen

- De DusterDokument6 SeitenDe DusterArstNoch keine Bewertungen

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Dokument9 SeitenISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602Noch keine Bewertungen

- F5 Chem Rusting ExperimentDokument9 SeitenF5 Chem Rusting ExperimentPrashanthini JanardananNoch keine Bewertungen

- Test Bank For Macroeconomics For Life Smart Choices For All2nd Edition Avi J Cohen DownloadDokument74 SeitenTest Bank For Macroeconomics For Life Smart Choices For All2nd Edition Avi J Cohen Downloadmichaelmarshallmiwqxteyjb100% (28)