Beruflich Dokumente

Kultur Dokumente

PDF W2

Hochgeladen von

John LittlefairOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PDF W2

Hochgeladen von

John LittlefairCopyright:

Verfügbare Formate

*

NOTICE TO EMPLOYEE:

employer in 2015 and more than $7,347 in social

security and/or Tier 1 railroad retirement (RRTA) taxes

were withheld, you may be able to claim a credit for the

excess against your federal income tax. If you had more

than one railroad employer and more than $4,321.80

in Tier 2 RRTA tax was withheld, you also may be able

to claim a credit. See your Form 1040 or Form 1040A

instructions and Pub. 505, Tax Withholding and

Estimated Tax.

Do you have to file? Refer to the Form 1040

Instructions to determine if you are required to file a tax

return. Even if you do not have to file a tax return, you

may be eligible for a refund if box 2 shows an amount

or if you are eligible for any credit.

*

Earned income credit (EIC).

You may be able to take the EIC for 2015 if your

adjusted gross income (AGI) is less than a certain

amount. The amount of the credit is based on income

and family size. Workers without children could qualify

for a smaller credit. You and any qualifying children

must have valid social security numbers (SSNs). You

cannot take the EIC if your investment income is more

than the specified amount for 2015 or if income is

earned for services provided while you were an inmate

at a penal institution. For 2015 income limits and more

information, visit www.irs.gov/eitc. Also see Pub. 596,

Earned Income Credit. Any EIC that is more than

your tax liability is refunded to you, but only if you

file a tax return.

Instructions for Employee

*

Box 1. Enter this amount on the Wages line of your

tax return.

*

Box 2. Enter this amount on the federal income tax

withheld line of your tax return.

Box 5. You may be required to report this amount on

Form 8959, Additional Medicare Tax. See Form 1040

instructions to determine if you are required to complete

Form 8959.

Box 6. This amount includes the 1.45% Medicare Tax

withheld on all Medicare wages and tips shown in Box

5, as well as the 0.9% Additional Medicare Tax on any

of those Medicare wages and tips above $200,000.

Corrections. If your name, SSN, or address is

incorrect, correct Copies B, C, and 2 and ask your

employer to correct your employment record. Be sure

to ask the employer to file Form W-2c, Corrected Wage

and Tax Statement, with the Social Security

Administration (SSA) to correct any name, SSN, or

money amount error reported to the SSA on Form W-2.

Be sure to get your copies of Form W-2c from your

employer for all corrections made so you may file them

with your tax return. If your name and SSN are correct

but are not the same as shown on your social security

card, you should ask for a new card that displays your

correct name at any SSA office or by calling

1-800-772-1213. You also may visit the SSA at

www.socialsecurity.gov.

Box 10. This amount includes the total dependent care

benefits your employer paid to you or incurred on your

behalf (including amounts from a section 125 (cafeteria)

plan). Any amount over $5000 also is included in Box

1. Complete form 2441, Child and Dependent Care

Expenses, to compute any taxable and nontaxable

amounts.

*

Box 12. The following list explains the codes shown

in box 12. You may need this information to complete

your tax return. Elective deferrals (codes D, E) and

designated Roth contributions (codes AA, BB, and EE)

under all plans are generally limited to a total of $18,000

($12,500 if you only have SIMPLE plans; $21,000 for

section 403(b) plans if you qualify for the 15-year rule

explained in Pub. 571). Deferrals under code G are

limited to $18,000.

However, if you were at least age 50 in 2015, your

employer may have allowed an additional deferral of

up to $6,000 ($3,000 for section 401(k)(11) and 408(p)

SIMPLE plans). This additional deferral amount is not

subject to the overall limit on elective deferrals. For

code G, the limit on elective deferrals may be higher

Cost of employer-sponsored health coverage (if

such cost is provided by the employer). The

reporting in box 12, using code DD, of the cost of

employer-sponsored health coverage is for your

information only. The amount reported with code DD

is not taxable.

*

Credit for excess taxes. If you had more than one

for the last 3 years before you reach retirement age.

Contact your plan administrator for more information.

Amounts in excess of the overall elective deferral limit

must be included in income. See the "Wages, Salaries,

Tips, etc." line instructions for Form 1040.

*

Note. If a year follows code D, E, G, AA, BB or EE,

you made a make-up pension contribution for a prior

year(s) when you were in military service. To figure

whether you made excess deferrals, consider these

amounts for the year shown, not the current year. If no

year is shown, the contributions are for the current year.

*

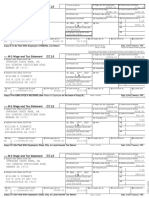

D)

A) EMPLOYEE'S SOCIAL SECURITY NO.

B) EMPLOYER IDENTIFICATION NUMBER

E)

G)

AA)

BB)

DD)

EE)

2 FEDERAL INCOME TAX WITHHELD

35,119.26

C) EMPLOYER'S NAME, ADDRESS AND ZIP CODE

3 SOCIAL SECURITY WAGES

1,924.43

4 SOCIAL SECURITY TAX WITHHELD

36,864.74

CITY OF NEW YORK

ONE CENTRE STREET-ROOM 200N

NEW YORK, N.Y. 10007

E) EMPLOYEE'S NAME, ADDRESS AND ZIP CODE

Elective deferrals and employer contributions

(including nonelective deferrals) to a section

457(b) deferred compensation plan.

Designated Roth contributions to a section

401(k) plan.

Designated Roth contributions under a section

403(b) plan.

Cost of employer-sponsored health coverage.

The amount reported with code DD is not

taxable.

Designated Roth contributions under a

governmental section 457(b) plan. The amount

does not apply to contributions under a

tax-exempt organization section 457(b) plan.

Box 13. If the "Retirement Plan" box is checked,

special limits may apply to the amount of traditional IRA

contributions you may deduct. See Pub.590, Individual

Retirement Arrangements (IRAs).

*

Note. Keep Copy C of Form W-2 for at least 3 years

after the due date for filing your income tax return.

However, to help protect your social security benefits,

keep Copy C until you begin receiving social security

benefits, just in case there is a question about your

work record and/or earnings in a particular year.

2 FEDERAL INCOME TAX WITHHELD

1,924.43

4 SOCIAL SECURITY TAX WITHHELD

36,864.74

5 MEDICARE WAGES

2,285.61

6 MEDICARE TAX WITHHELD

36,864.74

D) CONTROL NUMBER

534.54

10 DEPENDENT CARE BENEFITS

E) EMPLOYEE'S NAME, ADDRESS AND ZIP CODE

1 WAGES & OTHER COMPENSATION

13-6400434

Elective deferrals under a section 403(b) salary

reduction agreement.

3 SOCIAL SECURITY WAGES

CITY OF NEW YORK

ONE CENTRE STREET-ROOM 200N

NEW YORK, N.Y. 10007

B) EMPLOYER IDENTIFICATION NUMBER

5 MEDICARE WAGES

2,285.61

6 MEDICARE TAX WITHHELD

36,864.74

534.54

10 DEPENDENT CARE BENEFITS

11 NONQUALIFIED PLANS

35,119.26

C) EMPLOYER'S NAME, ADDRESS AND ZIP CODE

DUPLICATE*04/18/2016*827*V505

063-78-1700

1 WAGES & OTHER COMPENSATION

13-6400434

W-2 WAGE & TAX STATEMENT

A) EMPLOYEE'S SOCIAL SECURITY NO.

D) CONTROL NUMBER

DUPLICATE*04/18/2016*827*V505

063-78-1700

THIS INFORMATION IS BEING PROVIDED TO THE INTERNAL REVENUE SERVICE

DEPT. OF THE TREASURY - IRS OMB NO. 1545-0008

Elective deferrals to a Section 401(k) cash or

deferred arrangement. Also includes deferrals

under a SIMPLE retirement account that is part

of a section 401(k) arrangement.

THIS INFORMATION IS BEING PROVIDED TO THE INTERNAL REVENUE SERVICE

DEPT. OF THE TREASURY - IRS OMB NO. 1545-0008

W-2 WAGE & TAX STATEMENT

11 NONQUALIFIED PLANS

12 SEE INSTRUCTIONS FOR BOX 12

CODE

DD

12C

13

12D

RETIREMENT

PLAN

12E

2015

TAX YEAR

COPY C

EMPLOYEE'S COPY

15 NAME OF STATE

16 STATE WAGES, ETC

17 STATE INCOME TAX WITHHELD

NEW YORK

35,119.26

1,402.99

20A LOCALITY NAME

18A LOCAL WAGES, ETC

19A LOCAL INCOME TAX WITHHELD

NYC

35,119.26

903.90

20B LOCALITY NAME

18B LOCAL WAGES, ETC

19B LOCAL INCOME TAX WITHHELD

12F

14 OTHER

TAX YEAR

COPY B

6,550.83

12C

W-2 WAGE & TAX STATEMENT

A) EMPLOYEE'S SOCIAL SECURITY NO.

DUPLICATE*04/18/2016*827*V505

063-78-1700

B) EMPLOYER IDENTIFICATION NUMBER

1 WAGES & OTHER COMPENSATION

13-6400434

2 FEDERAL INCOME TAX WITHHELD

35,119.26

C) EMPLOYER'S NAME, ADDRESS AND ZIP CODE

3 SOCIAL SECURITY WAGES

CITY OF NEW YORK

ONE CENTRE STREET-ROOM 200N

NEW YORK, N.Y. 10007

1,924.43

4 SOCIAL SECURITY TAX WITHHELD

36,864.74

5 MEDICARE WAGES

2,285.61

6 MEDICARE TAX WITHHELD

36,864.74

D) CONTROL NUMBER

534.54

10 DEPENDENT CARE BENEFITS

E) EMPLOYEE'S NAME, ADDRESS AND ZIP CODE

11 NONQUALIFIED PLANS

15 NAME OF STATE

16 STATE WAGES, ETC

17 STATE INCOME TAX WITHHELD

NEW YORK

35,119.26

1,402.99

20A LOCALITY NAME

18A LOCAL WAGES, ETC

19A LOCAL INCOME TAX WITHHELD

NYC

35,119.26

903.90

20B LOCALITY NAME

18B LOCAL WAGES, ETC

19B LOCAL INCOME TAX WITHHELD

14 OTHER

IRC 414H

IRC 125

FRINGE

12 SEE INSTRUCTIONS FOR BOX 12

CODE

JOHN W LITTLEFAIR

1 ARGYLE ROAD APT 1

BROOKLYN*NY*11218

AMOUNT

DD

6,550.83

12B

12C

13

12D

TO BE FILED WITH

EMPLOYEE'S

FEDERAL TAX RETURN

1,745.48

82.95

150.00

DEPT. OF THE TREASURY - IRS OMB NO. 1545-0008

RETIREMENT

PLAN

2015

IRC 414H

IRC 125

FRINGE

12A

12B

6,550.83

12B

AMOUNT

DD

13

AMOUNT

12A

JOHN W LITTLEFAIR

1 ARGYLE ROAD APT 1

BROOKLYN*NY*11218

12A

JOHN W LITTLEFAIR

1 ARGYLE ROAD APT 1

BROOKLYN*NY*11218

12 SEE INSTRUCTIONS FOR BOX 12

CODE

12D

RETIREMENT

PLAN

12E

12F

2015

TAX YEAR

*

1,745.48

82.95

150.00

12E

TO BE FILED WITH

EMPLOYEE'S

STATE, CITY OR LOCAL TAX RETURN

COPY 2

15 NAME OF STATE

16 STATE WAGES, ETC

17 STATE INCOME TAX WITHHELD

NEW YORK

35,119.26

1,402.99

20A LOCALITY NAME

18A LOCAL WAGES, ETC

19A LOCAL INCOME TAX WITHHELD

NYC

35,119.26

903.90

20B LOCALITY NAME

18B LOCAL WAGES, ETC

19B LOCAL INCOME TAX WITHHELD

12F

14 OTHER

IRC 414H

IRC 125

FRINGE

1,745.48

82.95

150.00

Das könnte Ihnen auch gefallen

- Elina Shinkar w2 2014Dokument2 SeitenElina Shinkar w2 2014api-318948819Noch keine Bewertungen

- I Pay Statements ServncoDokument2 SeitenI Pay Statements ServncoPablito Padilla100% (2)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Dokument2 SeitenJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Form 1040A Tax Credit DetailsDokument3 SeitenForm 1040A Tax Credit DetailsYosbanyNoch keine Bewertungen

- StatementDokument2 SeitenStatementLuis HarrisonNoch keine Bewertungen

- 2019 Louisiana Resident - 2DDokument4 Seiten2019 Louisiana Resident - 2Djamo christine100% (1)

- Dan Simon 2016 W2 PDFDokument2 SeitenDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNoch keine Bewertungen

- StubsDokument2 SeitenStubsAnonymous 8C2bCutL0100% (2)

- TAXES w2 REGAL HospitalityDokument2 SeitenTAXES w2 REGAL Hospitalityoskar_herrera2012Noch keine Bewertungen

- Ioana w2 PDFDokument1 SeiteIoana w2 PDFBlueberry13KissesNoch keine Bewertungen

- AutoPay Output Documents PDFDokument2 SeitenAutoPay Output Documents PDFAnonymous QZuBG2IzsNoch keine Bewertungen

- 2019 W2 2020120235817 PDFDokument3 Seiten2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- 2018 Coleman Tax Return PDFDokument46 Seiten2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Dokument3 SeitenAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNoch keine Bewertungen

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDokument10 SeitenFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyNoch keine Bewertungen

- Filename PDFDokument3 SeitenFilename PDFIvette PizarroNoch keine Bewertungen

- 2018 TaxReturn PDFDokument6 Seiten2018 TaxReturn PDFDavid LeeNoch keine Bewertungen

- Consent To Disclose Your Information For The Credit Karma OfferDokument4 SeitenConsent To Disclose Your Information For The Credit Karma OfferDonald PetersonNoch keine Bewertungen

- Tax FormsDokument2 SeitenTax Formswilliam schwartz50% (2)

- fw4 2020Dokument4 Seitenfw4 2020Hunter TateNoch keine Bewertungen

- Marie Aladin 2019 Tax PDFDokument60 SeitenMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- Income Tax Return For Single and Joint Filers With No DependentsDokument3 SeitenIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンNoch keine Bewertungen

- Evans W-2sDokument2 SeitenEvans W-2sAlmaNoch keine Bewertungen

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIDokument3 SeitenU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduNoch keine Bewertungen

- Printw2 PDFDokument1 SeitePrintw2 PDFJhhghiNoch keine Bewertungen

- 2020 Partnership Tax ReturnDokument18 Seiten2020 Partnership Tax ReturnEdwin Altamiranda100% (2)

- FTF 2019-05-02 1556819863569 PDFDokument5 SeitenFTF 2019-05-02 1556819863569 PDFWilliam Davis0% (1)

- Income Tax Return 2019Dokument9 SeitenIncome Tax Return 2019Sh'Nanigns X3Noch keine Bewertungen

- 9YWwhh55h5384810244629010109102 PDFDokument2 Seiten9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- Unknown PDFDokument4 SeitenUnknown PDFomar hernandezNoch keine Bewertungen

- Your Benefit Statement Tax Year 2019Dokument2 SeitenYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- 120s Az FormDokument19 Seiten120s Az FormStacey CanaleNoch keine Bewertungen

- Eddie Salazar PDFDokument11 SeitenEddie Salazar PDFsloweddie salazar0% (1)

- MH0ihh081h6754910230616041100202 PDFDokument2 SeitenMH0ihh081h6754910230616041100202 PDFLogan GoadNoch keine Bewertungen

- SC Tax ReturnDokument12 SeitenSC Tax ReturnCeleste KatzNoch keine Bewertungen

- Paycheck Protection Program ApplicationDokument4 SeitenPaycheck Protection Program ApplicationJay Mike100% (1)

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFDokument6 SeitenDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- 2020 Tax Return Documents (DERICK BROOKS A)Dokument2 Seiten2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- 2014 Turbo Tax ReturnDokument85 Seiten2014 Turbo Tax ReturnBrayan Picoy ValerioNoch keine Bewertungen

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDokument6 SeitenElectronic Filing Instructions For Your 2019 Federal Tax ReturnSindy Cruz100% (1)

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDokument11 SeitenElectronic Filing Instructions For Your 2019 Federal Tax ReturnCoughman Matt67% (3)

- TaxReturn PDFDokument7 SeitenTaxReturn PDFChristine WillisNoch keine Bewertungen

- 2014 TaxReturnDokument25 Seiten2014 TaxReturnNguyen Vu CongNoch keine Bewertungen

- Rangel Taxes 2019Dokument38 SeitenRangel Taxes 2019Josue Perez VelezNoch keine Bewertungen

- Selection 26 144Dokument1 SeiteSelection 26 144Anonymous fu1jUQNoch keine Bewertungen

- Collection Information Statement For Wage Earners and Self-Employed IndividualsDokument7 SeitenCollection Information Statement For Wage Earners and Self-Employed IndividualsAnonymous dfLfinUrp60% (5)

- W-2 Form DetailsDokument6 SeitenW-2 Form Detailsjacqueline corral0% (1)

- 2020 Tax Return: Prepared ByDokument5 Seiten2020 Tax Return: Prepared ByAdam MasonNoch keine Bewertungen

- Anderson, Elle 2019 Federal Tax ReturnDokument13 SeitenAnderson, Elle 2019 Federal Tax ReturnElle Anderson100% (2)

- 2019 Tax Return Documents (VERAS MELQUISEDED)Dokument7 Seiten2019 Tax Return Documents (VERAS MELQUISEDED)Edison Estrada100% (2)

- HERBERT HERNANDEZ 2019 Tax Return PDFDokument31 SeitenHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- Fasfa DocsDokument10 SeitenFasfa DocsKira Rivera100% (1)

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDokument2 SeitenU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- Kim Gilbert 2018 PDFDokument25 SeitenKim Gilbert 2018 PDFKim Gilbert50% (2)

- File Your 2016 Taxes ElectronicallyDokument10 SeitenFile Your 2016 Taxes ElectronicallybrynsteinNoch keine Bewertungen

- W21225760934 0 PDFDokument2 SeitenW21225760934 0 PDFAnonymous czHLQeLPB4Noch keine Bewertungen

- FTF1299519215531Dokument3 SeitenFTF1299519215531Leslie Washington100% (1)

- Langford Market Corp Form W-2Dokument4 SeitenLangford Market Corp Form W-2sohcuteNoch keine Bewertungen

- 2019 W-2 Gregorio MartinezDokument2 Seiten2019 W-2 Gregorio Martinezporhj perraNoch keine Bewertungen

- TGDokument2 SeitenTGpr995Noch keine Bewertungen

- Agent Guidelines For Equator Short SaleDokument17 SeitenAgent Guidelines For Equator Short SalecpdeschenesNoch keine Bewertungen

- 2020 Health Savings Account 224911187 Form 1099 SA & InstructionsDokument2 Seiten2020 Health Savings Account 224911187 Form 1099 SA & InstructionsBlake BrewerNoch keine Bewertungen

- LIBRO 9 Derecho RomanoDokument30 SeitenLIBRO 9 Derecho RomanoDomingo VasquezNoch keine Bewertungen

- Form 1040 R.I.P.Dokument1 SeiteForm 1040 R.I.P.Landmark Tax Group™Noch keine Bewertungen

- 2020 TaxReturnDokument12 Seiten2020 TaxReturnAdam Mason67% (3)

- Schedule In-117: General InstructionsDokument2 SeitenSchedule In-117: General Instructionsjim deeznutzNoch keine Bewertungen

- Self Employment Guidance - Form 1040 Schedule C IndividualsDokument2 SeitenSelf Employment Guidance - Form 1040 Schedule C IndividualsGlenda100% (1)

- Employee's Withholding Certificate 2020Dokument4 SeitenEmployee's Withholding Certificate 2020CNBC.comNoch keine Bewertungen

- F 1040 SeDokument2 SeitenF 1040 SepdizypdizyNoch keine Bewertungen

- 2016 - Tax ReturnDokument37 Seiten2016 - Tax Returncara harrisNoch keine Bewertungen

- Webull Tax DocumentDokument10 SeitenWebull Tax DocumentHimer VerdeNoch keine Bewertungen

- Gov. Walz 2015 Tax Returns - RedactedDokument13 SeitenGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNoch keine Bewertungen

- 227 - Unrebutted Facts Regarding The IRSDokument5 Seiten227 - Unrebutted Facts Regarding The IRSDavid E Robinson100% (1)

- Form 1040-ES: Purpose of This PackageDokument12 SeitenForm 1040-ES: Purpose of This Packagetarles666Noch keine Bewertungen

- An Overview of Itemized DeductionsDokument19 SeitenAn Overview of Itemized DeductionsRock Rose100% (1)

- W-2 Tax FormDokument7 SeitenW-2 Tax FormMaria HowellNoch keine Bewertungen

- The Green Book, Written by Muammar GaddafiDokument154 SeitenThe Green Book, Written by Muammar GaddafiPape VVhoNoch keine Bewertungen

- 1.4 IRS Form 1040VDokument1 Seite1.4 IRS Form 1040VBenne James100% (1)

- Restaurant Revitalization Fund Program Guide As of 4.28.21-508 - 0Dokument22 SeitenRestaurant Revitalization Fund Program Guide As of 4.28.21-508 - 0the kingfishNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- IRS Form 1040 DisagreementDokument2 SeitenIRS Form 1040 DisagreementArielle MartinNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument9 SeitenU.S. Individual Income Tax Return: Filing Statuswalessadone50% (2)

- File Your 2020 Federal Tax Return ElectronicallyDokument21 SeitenFile Your 2020 Federal Tax Return Electronicallytraceybaker80% (5)

- Your Tax Is-: Instructions For Form 1040EZDokument9 SeitenYour Tax Is-: Instructions For Form 1040EZSamNoch keine Bewertungen

- Miscellaneous Information: Copy B For RecipientDokument4 SeitenMiscellaneous Information: Copy B For RecipientAubree Gates100% (1)

- 1099IODDokument10 Seiten1099IODpreston_402003100% (28)

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDokument7 SeitenWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNoch keine Bewertungen

- Schedule E income and expensesDokument2 SeitenSchedule E income and expensesAhmad GaberNoch keine Bewertungen

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDokument2 SeitenDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNoch keine Bewertungen

- W 2Dokument3 SeitenW 2lysprr33% (3)