Beruflich Dokumente

Kultur Dokumente

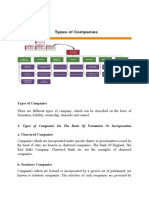

6 Types of Companies

Hochgeladen von

Pankaj TaleleCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6 Types of Companies

Hochgeladen von

Pankaj TaleleCopyright:

Verfügbare Formate

What's the difference of Co, Pty, Ltd, Inc, and so on?

Best Answer: Ltd is a company limited by shares, but older companies used this abbreviation for

all limited companies, such as Limited Liability Partnerships(LLP), Limited Liability

Companies(LLC), Limited Partnerships (LP).

Co. is simply a company which can be any business , in fact, all of the things you are asking

about can be called companies.

Corp. is a company owned by many people or groups.

Pty. means indicates that a party, or proprietor, exercises private ownership, control or use over

an item of property, usually to the exclusion of other parties.

Inc. is quite complex and can be quite similar to a corporation or can be a non-profit

There are also NL means not limited and some common foreign abbreviations are AG

(Aktiengesellschaft - German: "stock corporation"), GmbH (Gesellschaft mit beschrnkter

Haftung - German: "Company with limited liability"), S.A. ("Sociedade Annima", Portuguese:

"anonymous society" = Stock Corporation), S.r.l ("societ a responsabilit limitata") - Italian:

"limited liability Company", S.p. A. ("Societ per Azioni") - Italian: "Shares-based Company", and

PLC after a UK or Irish company name indicate that it is a public limited company, a type of

limited company whose shares may be offered for sale to the public. (The equivalent term in the

United States is Public company)

Six different types of public and proprietary companies

James

Following on from my blog on company characteristics, I thought I would write a quick

blog on the different types of companies that are common today.

Companies are classified according to liability, size and where they are listed. We will discuss the

first two and the resulting 6 common types of companies we arrive at.

Classification according to member liability

1 Companies limited by shares (known as limited liability companies)

Typically, members are usually shareholders and their liability is limited to the nominal (nominal

capital is defined as the capital with which the company was incorporated) value of their shares

plus any unpaid amount on their shares.

As an example, say you buy BHP shares at $10 for 100 shares, then your liability is limited so

that if BHP were to be sued, it is limited to the $10 paid. This is sometimes conducted differently

when you dont fully pay for shares when the company floats. If $5 was paid and $5 was then

owed on the shares, then the remaining amount must be contributed should it be called upon.

As we probably know by now, the significance is that shareholders are not liable for the full

amount. This is known as the share capital method of corporate finance. Another method is by

debt going to a bank and asking for money to be lent. This is a different contractual agreement.

2 Companies limited by guarantee (small and charitable organisations)

The difference with these companies is that members can place a guarantee on the company

which may only be enforced on the winding up of the company and is not an asset of the

company which may be charged during its life. These companies have no share capital unlike

companies limited by shares.

Often non-profit companies and charities use this method.

3 Unlimited liability companies (partnerships)

The unlimited liability company was the original form of registered company under the 1844 UK

Act. It is defined in Australia in the corporations act as a company whose members have no limit

placed on their individual liability to contribute to the debts of the company.

The Sole advantage is that this company is exempt from the prohibition on reduction of capital

(s258A) which means money can be more freely taken out of the companys capital base. The

clear disadvantage is that members might not be aware of their unlimited personal liability when

joining.

Today the unlimited liability company is used mainly by professional organisations carried on in a

partnership like many Legal and Accounting firms.

4 No liability companies (Exclusively mining and resource companies)

In Australia, companies may only be registered as no liability where

a) the company has share capital,

b) the companys constitution states that its sole objects are mining purposes and,

c) the company has no contractual right under its constitution to recover calls made on its shares

from a shareholder who fails to pay them s112(2).

s112(2) of Corporations Act says constitution must state that the sole object is mining

purposes. Originally because mining is seen as particularly risky business and people were

reluctant to invest. Shares are part paid with the option of paying the remainder later.

Classification according to size

The other key way to classify companies is by their size and the corporations act in Australia and

its equivalents abroad have provisions relating to a companys classification via its size.

Corporations Law has been structured for large companies with a division between ownership

and control with significant capital from the investing public. While this is the classic model of the

corporation, most Australian companies are small, family companies. This model is therefore

appropriate for only a tiny proportion of the market companies with the larger number of small

private companies out there. Small companies are still covered under the corporations act but

typically more regulatory burdens on are placed on larger companies.

Both proprietary and private companies exist:

1 Proprietary Companies

A proprietary company must:

a) be limited by shares (#1 above) or be an unlimited company (#3 above) with a share capital

b) have no more than 50 non-employee members

c) not do anything that would require the issue of a prospectus (prohibition on seeking

investment from the public).

If a company doesnt qualify as a proprietary company, then its a public company and must

comply with all the regulatory requirements associated with that. The minimum number of

persons is one (shareholder and director).

2 Public Companies

As above, if a company doesnt qualify as a proprietary company, then its a public company. A

public company must have a minimum of 3 directors, 2 of whom must ordinarily reside in

Australia.

However, many enterprises structured themselves so that they just met the definition of a

proprietary company to avoid regulatory provisions. The Government then redefined the

proprietary company definition in s45A(2) of Corporations Act. The act now identifies smaller

companies on the basis of value and size of the business.

A proprietary company is small if it satisfies 2 of the following criteria:

a) the consolidated gross operating revenue of the financial year of the company and any entities

it controls is less than $10m

b) the value of the consolidated gross assets at the end of the financial year of the company and

the entities it controls (if any) is less than $5m

c) the company and any entities it controls have fewer than 50 employees.

6 classifications of companies

After all this, we arrive at the following possible combinations of different companies with the

proprietary limited (pty ltd) company being the most prevalent.

Proprietary companies

1 Limited by shares 98.2%

(no more than 50 non-employee

shareholders)

3 Unlimited with share capital

Public companies

1 Limited by shares 0.7%

(all non-proprietary companies: s9

definition of public company)

2 Limited by guarantee

3 Unlimited with share capital

4 No liability company (mining

only) 0.09%

Das könnte Ihnen auch gefallen

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Von EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Noch keine Bewertungen

- CompanyDokument15 SeitenCompanykgatoNoch keine Bewertungen

- Companies Law 2013 SummaryDokument129 SeitenCompanies Law 2013 SummarychangumanguNoch keine Bewertungen

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCVon EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNoch keine Bewertungen

- Befa 1Dokument23 SeitenBefa 121WH1A6634 NALLAMOTHU HIMA SRINoch keine Bewertungen

- Company Types ExplainedDokument8 SeitenCompany Types ExplainedRizwan AhmedNoch keine Bewertungen

- ASSIGNMENT AnidaDokument14 SeitenASSIGNMENT AnidaAnida BgdNoch keine Bewertungen

- Company Formation and ManagementDokument7 SeitenCompany Formation and ManagementAnonymous TjWIMGeNoch keine Bewertungen

- Company vs PartnershipDokument20 SeitenCompany vs PartnershipSheiryNoch keine Bewertungen

- Financial Accounting - Quick Revision Notes Introduction To Business Organisation Legal Structures of A BusinessDokument26 SeitenFinancial Accounting - Quick Revision Notes Introduction To Business Organisation Legal Structures of A Businessjohn_841Noch keine Bewertungen

- Lý Thuyết Corporation Law FullDokument33 SeitenLý Thuyết Corporation Law FullÁnh Minh NguyễnNoch keine Bewertungen

- Difference Between A Private LTD and Public LTDDokument4 SeitenDifference Between A Private LTD and Public LTDShoaib Shaik0% (1)

- Limited Company: TypesDokument5 SeitenLimited Company: TypesAndrew CharlesNoch keine Bewertungen

- Key Features of A Company 1. Artificial PersonDokument19 SeitenKey Features of A Company 1. Artificial PersonVijayaragavan MNoch keine Bewertungen

- LO3 Business Law (Organisations)Dokument7 SeitenLO3 Business Law (Organisations)Pham Huyen MyNoch keine Bewertungen

- What Is Joint Stock Company Script2k22Dokument6 SeitenWhat Is Joint Stock Company Script2k22Xyra Gabayeron CayaoNoch keine Bewertungen

- All Activities: AnswerDokument6 SeitenAll Activities: AnswersyopiNoch keine Bewertungen

- 6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsDokument14 Seiten6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsTamene Tekile86% (7)

- Business DfccilDokument12 SeitenBusiness Dfccilpunhana.gitiNoch keine Bewertungen

- Business Page Issues SolvedDokument66 SeitenBusiness Page Issues SolvedAlwin MathaiNoch keine Bewertungen

- CODE:BBA 1004: November Semester 2011Dokument36 SeitenCODE:BBA 1004: November Semester 2011Happii MikoNoch keine Bewertungen

- Tata Group's Holding and Subsidiary StructureDokument41 SeitenTata Group's Holding and Subsidiary StructureVanshdeep Singh SamraNoch keine Bewertungen

- Types of Companies ExplainedDokument2 SeitenTypes of Companies ExplainedRashid AliNoch keine Bewertungen

- The Difference Between IncDokument2 SeitenThe Difference Between IncFrancisco TaquioNoch keine Bewertungen

- Corporations SummaryDokument75 SeitenCorporations SummaryVanessa ChenNoch keine Bewertungen

- INTRODUCTION TO BUSINESS AssignmentDokument10 SeitenINTRODUCTION TO BUSINESS AssignmentUrooj KhanNoch keine Bewertungen

- Company Law Unit - 1Dokument22 SeitenCompany Law Unit - 1Anjali ShuklaNoch keine Bewertungen

- Classification of CompaniesDokument39 SeitenClassification of CompaniesFatima MufNoch keine Bewertungen

- Analysis of Financial Statements: Jian XiaoDokument41 SeitenAnalysis of Financial Statements: Jian XiaoLim Mei SuokNoch keine Bewertungen

- Budgeting-QUIZ MaterialsDokument15 SeitenBudgeting-QUIZ MaterialsNazrin GuliyevaNoch keine Bewertungen

- Company Law - Assignment by Simon (BUBT)Dokument22 SeitenCompany Law - Assignment by Simon (BUBT)Simon Haque67% (3)

- Business Structure Types and Registration ProcessDokument22 SeitenBusiness Structure Types and Registration ProcessDerrick Maatla MoadiNoch keine Bewertungen

- Company LawDokument69 SeitenCompany LawAli Sibtain NaqviNoch keine Bewertungen

- Types of Companies and OPC - NotesDokument8 SeitenTypes of Companies and OPC - Notes23Mansi JainINoch keine Bewertungen

- BusinessDokument17 SeitenBusinessRobin TimkangNoch keine Bewertungen

- Company Limited by Shares Company Limited by GuaranteeDokument2 SeitenCompany Limited by Shares Company Limited by GuaranteeFaizan ChNoch keine Bewertungen

- Company Law Notes - Unit-IvDokument58 SeitenCompany Law Notes - Unit-IvTanya MalviyaNoch keine Bewertungen

- Types of Registered CompaniesDokument8 SeitenTypes of Registered Companiesvidrascu0% (2)

- Company LawDokument12 SeitenCompany LawShellian CunninghamNoch keine Bewertungen

- Companies Act 2013 Individual AssignmentDokument18 SeitenCompanies Act 2013 Individual Assignmentshaleen bansalNoch keine Bewertungen

- Limited V Unlimited CompanyDokument16 SeitenLimited V Unlimited CompanyAbhinavNoch keine Bewertungen

- Group 3Dokument25 SeitenGroup 3Md Byzed AhmedNoch keine Bewertungen

- Different Ownership Structures: OCR National Business Studies Level 2 /VGCSE Business StudiesDokument26 SeitenDifferent Ownership Structures: OCR National Business Studies Level 2 /VGCSE Business StudiesSuman PoudelNoch keine Bewertungen

- Company: DefinitionDokument6 SeitenCompany: DefinitionAnthony BlackNoch keine Bewertungen

- Lecture Notes - Company AccountsDokument5 SeitenLecture Notes - Company AccountsFredhope Mtonga100% (1)

- Choose A Legal Structure For Your Business 6Dokument11 SeitenChoose A Legal Structure For Your Business 6vidrascuNoch keine Bewertungen

- Legal structures for operating a business in KenyaDokument8 SeitenLegal structures for operating a business in KenyaMemory ApiyoNoch keine Bewertungen

- Assignment On CompanyDokument11 SeitenAssignment On CompanyHossainmoajjemNoch keine Bewertungen

- Introduction To Company Law FinalDokument42 SeitenIntroduction To Company Law FinalAyush ShakyaNoch keine Bewertungen

- Companies ActDokument9 SeitenCompanies ActSnigdhangshu BanerjeeNoch keine Bewertungen

- Company Law: Syllabus-Entire NotesDokument22 SeitenCompany Law: Syllabus-Entire NotesDiptesh MitkarNoch keine Bewertungen

- Companies ActDokument8 SeitenCompanies Actraja chatrasaalNoch keine Bewertungen

- Company Law Asynch 1Dokument5 SeitenCompany Law Asynch 1Kalyani reddyNoch keine Bewertungen

- Business Organization & Financial Institutions PDFDokument8 SeitenBusiness Organization & Financial Institutions PDFTAYYABA RAMZANNoch keine Bewertungen

- Key Features and Advantages of Incorporation Under Indian Companies ActDokument43 SeitenKey Features and Advantages of Incorporation Under Indian Companies ActSudhanshu GargNoch keine Bewertungen

- 1.definition of A Company and Its CharecteriosticsDokument11 Seiten1.definition of A Company and Its Charecteriosticssunitmishra2007Noch keine Bewertungen

- Accountant in Business: Types of OrganizationDokument24 SeitenAccountant in Business: Types of OrganizationqmlcNoch keine Bewertungen

- Organizing & Financing A New Venture: Book: Leach, J. C., & Melicher, R. W. (2011) - Entrepreneurial FinanceDokument38 SeitenOrganizing & Financing A New Venture: Book: Leach, J. C., & Melicher, R. W. (2011) - Entrepreneurial FinanceShafqat RabbaniNoch keine Bewertungen

- Company Law Exam ReviewDokument82 SeitenCompany Law Exam ReviewThomas Ranco Su100% (1)

- Assessment CriteriaDokument1 SeiteAssessment CriteriaPankaj TaleleNoch keine Bewertungen

- Jyotiba PhuleDokument57 SeitenJyotiba PhulePankaj TaleleNoch keine Bewertungen

- Likert ScaleDokument2 SeitenLikert ScaleiamELHIZANoch keine Bewertungen

- Marks DistributionDokument3 SeitenMarks DistributionPankaj TaleleNoch keine Bewertungen

- AssignmentsDokument1 SeiteAssignmentsPankaj TaleleNoch keine Bewertungen

- Responsibility Centers Board Directors Profit Centers Performance MeasurementDokument2 SeitenResponsibility Centers Board Directors Profit Centers Performance MeasurementPankaj TaleleNoch keine Bewertungen

- III SEM - Financial ServiceDokument10 SeitenIII SEM - Financial ServicenehaNoch keine Bewertungen

- May-16 RPDokument6 SeitenMay-16 RPPankaj TaleleNoch keine Bewertungen

- JSPM's Rajarshi Shahu College of Engineering, Tathwade, Pune-411033 MBA-3 Semester Sub: INCOME TAX (307 Fin) Subject-Elective-1 AssignmentDokument1 SeiteJSPM's Rajarshi Shahu College of Engineering, Tathwade, Pune-411033 MBA-3 Semester Sub: INCOME TAX (307 Fin) Subject-Elective-1 AssignmentPankaj TaleleNoch keine Bewertungen

- Business Research Objectives and MethodsDokument7 SeitenBusiness Research Objectives and MethodsPankaj TaleleNoch keine Bewertungen

- 303 McqsDokument5 Seiten303 McqsPankaj TaleleNoch keine Bewertungen

- Responsibility Centers Board Directors Profit Centers Performance MeasurementDokument2 SeitenResponsibility Centers Board Directors Profit Centers Performance MeasurementPankaj TaleleNoch keine Bewertungen

- MBA Syllabus 2013 CBCGS Pattern AssortedDokument27 SeitenMBA Syllabus 2013 CBCGS Pattern AssortedPankaj TaleleNoch keine Bewertungen

- PamDokument3 SeitenPamPankaj TaleleNoch keine Bewertungen

- Legal Aspects of BusinessDokument33 SeitenLegal Aspects of BusinessRaja Gopal100% (1)

- Certificate To Be Printed On Original Letter Head SampleDokument1 SeiteCertificate To Be Printed On Original Letter Head SamplePankaj TaleleNoch keine Bewertungen

- DS 1Dokument2 SeitenDS 1Pankaj TaleleNoch keine Bewertungen

- Marks DistributionDokument3 SeitenMarks DistributionPankaj TaleleNoch keine Bewertungen

- Exam DatesDokument2 SeitenExam DatesPankaj TaleleNoch keine Bewertungen

- Exam DatesDokument2 SeitenExam DatesPankaj TaleleNoch keine Bewertungen

- BBA Core Business Research MethodsDokument97 SeitenBBA Core Business Research MethodsAnonymous GrmNzm3gNoch keine Bewertungen

- Notes On Research Methods: These Notes Are at Http://userweb - Port.ac - Uk/ Woodm/rm/normDokument25 SeitenNotes On Research Methods: These Notes Are at Http://userweb - Port.ac - Uk/ Woodm/rm/normRia TandonNoch keine Bewertungen

- Indian Polity by M. LakshmikanthDokument3 SeitenIndian Polity by M. LakshmikanthPankaj TaleleNoch keine Bewertungen

- FREE RBI Assistant 2014 Current Affairs1 Magazine ExamPunditDokument53 SeitenFREE RBI Assistant 2014 Current Affairs1 Magazine ExamPunditNaveenNoch keine Bewertungen

- Polity Imp PointsDokument1 SeitePolity Imp PointsPankaj TaleleNoch keine Bewertungen

- NAB Handbook-Fiber Optic Transmission SystemsDokument22 SeitenNAB Handbook-Fiber Optic Transmission Systemssinghjaggisingh7674Noch keine Bewertungen

- Chapter 10 Self Test Quiz GuidanceDokument5 SeitenChapter 10 Self Test Quiz GuidanceusmanvirkmultanNoch keine Bewertungen

- KPIT Cummins Infosystems Limited: Company List Sample Placement PaperDokument23 SeitenKPIT Cummins Infosystems Limited: Company List Sample Placement PaperPankaj TaleleNoch keine Bewertungen

- MBA-012 Managerial Economics PDFDokument7 SeitenMBA-012 Managerial Economics PDFSameer AhmedNoch keine Bewertungen

- LLP Act Guide Explains Limited Liability Partnership RulesDokument7 SeitenLLP Act Guide Explains Limited Liability Partnership RulesMaygie KeiNoch keine Bewertungen

- Types of Partnerships ExplainedDokument13 SeitenTypes of Partnerships ExplainedJannefah Irish SaglayanNoch keine Bewertungen

- Swiss Corporate Governance OverviewDokument36 SeitenSwiss Corporate Governance OverviewMaka HutsonNoch keine Bewertungen

- Tutorial On Corporate ConstitutionDokument3 SeitenTutorial On Corporate ConstitutionIZZAH ZAHINNoch keine Bewertungen

- Title Xii Close Corporation: Salazar, Sopoco, Sta Ana, Suyosa, Tan, Umali, Uy, VelascoDokument9 SeitenTitle Xii Close Corporation: Salazar, Sopoco, Sta Ana, Suyosa, Tan, Umali, Uy, VelascoArvin CruzNoch keine Bewertungen

- Limited Companies and MultinationalsDokument3 SeitenLimited Companies and MultinationalsKazi Rafsan NoorNoch keine Bewertungen

- Companies (Significant Beneficial Owners) Rules, 2018Dokument14 SeitenCompanies (Significant Beneficial Owners) Rules, 2018Ram Kumar Chowdary VinjamNoch keine Bewertungen

- Memorandum of Associations Article of Associations The Differences AbcdDokument17 SeitenMemorandum of Associations Article of Associations The Differences AbcdDilwar HussainNoch keine Bewertungen

- Teck Seing - Co., Ltd. v. Pacific Commercial Co.Dokument10 SeitenTeck Seing - Co., Ltd. v. Pacific Commercial Co.Joseph Raymund BautistaNoch keine Bewertungen

- Credit Card GeneratorDokument2 SeitenCredit Card GeneratorStefan Radu100% (10)

- First Quarter Week 2 ABM FABM11 IIIb 11 14Dokument12 SeitenFirst Quarter Week 2 ABM FABM11 IIIb 11 14Mary De Jesus100% (1)

- GJ Allied Services Fee Deposit SlipDokument1 SeiteGJ Allied Services Fee Deposit SlipGTA V GameNoch keine Bewertungen

- Seca Model ShaDokument55 SeitenSeca Model ShaJanet NyxNoch keine Bewertungen

- PWC Re Lux Special PartnershipDokument7 SeitenPWC Re Lux Special PartnershipmanicpaniNoch keine Bewertungen

- CS Executive Company Law New Syllabus PDFDokument355 SeitenCS Executive Company Law New Syllabus PDFRashi ViRdi100% (1)

- Strange Bedfellows - EBay, Craiglist and Profit Versus Public ServiceDokument23 SeitenStrange Bedfellows - EBay, Craiglist and Profit Versus Public ServiceaxlNoch keine Bewertungen

- Other Kinds of CorporationsDokument1 SeiteOther Kinds of Corporationserikha_aranetaNoch keine Bewertungen

- (Elspeth Deards) Practice Notes On Partnership Law PDFDokument153 Seiten(Elspeth Deards) Practice Notes On Partnership Law PDFBee RahmingNoch keine Bewertungen

- Association of MemorandumDokument10 SeitenAssociation of MemorandumAfraNoch keine Bewertungen

- Corporation Code de LeonDokument3 SeitenCorporation Code de LeonShiela Marie VicsNoch keine Bewertungen

- Borres Realty & Development Corporation Borres Realty & Development CorporationDokument12 SeitenBorres Realty & Development Corporation Borres Realty & Development Corporation09303313316Noch keine Bewertungen

- Advantages and Disadvantages of IncorporationDokument2 SeitenAdvantages and Disadvantages of IncorporationSenelwa Anaya100% (1)

- Corporation Definition The Most Common Form ofDokument20 SeitenCorporation Definition The Most Common Form ofmtayyab_786100% (2)

- Corporation Code - General Provision - Activity 1Dokument9 SeitenCorporation Code - General Provision - Activity 1Julian Adam Pagal80% (5)

- Samplex Corpo FinalsDokument21 SeitenSamplex Corpo FinalsBert SangalangNoch keine Bewertungen

- LegisWatch - SGX Introduces Primary Listing Framework For Dual Class Share StructuresDokument7 SeitenLegisWatch - SGX Introduces Primary Listing Framework For Dual Class Share StructuresSean Ng Jun JieNoch keine Bewertungen

- Corporations PDFDokument16 SeitenCorporations PDFkylee MaranteeNoch keine Bewertungen

- TAR UC Academic Exam Corporate Law GovernanceDokument4 SeitenTAR UC Academic Exam Corporate Law GovernanceBeeJu LyeNoch keine Bewertungen

- Restatement of The Doctrine of PiercingDokument39 SeitenRestatement of The Doctrine of PiercingSGTNoch keine Bewertungen

- Annual Report 2014-2015 of Jamuna Oil Company Limited PDFDokument100 SeitenAnnual Report 2014-2015 of Jamuna Oil Company Limited PDFfahimNoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpVon EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpBewertung: 4 von 5 Sternen4/5 (214)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Project Control Methods and Best Practices: Achieving Project SuccessVon EverandProject Control Methods and Best Practices: Achieving Project SuccessNoch keine Bewertungen

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Basic Accounting: Service Business Study GuideVon EverandBasic Accounting: Service Business Study GuideBewertung: 5 von 5 Sternen5/5 (2)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen