Beruflich Dokumente

Kultur Dokumente

2001 Excerpt Gao-02-111 ML Efforts in The Securities Industry

Hochgeladen von

tofumasterOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2001 Excerpt Gao-02-111 ML Efforts in The Securities Industry

Hochgeladen von

tofumasterCopyright:

Verfügbare Formate

Appendix IV

Identified Cases of Money Laundering

Through the U.S. Securities Industry Appendx

IV

i

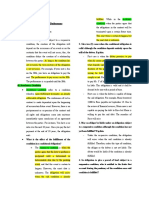

To obtain information on the extent to which the U.S. securities industry

was used to launder money as well as the vulnerability of the industry to

money laundering, we contacted various U.S. law enforcement agencies.

Within Treasury, we contacted the Customs Service, Internal Revenue

Service’s Criminal Investigation Division, Secret Service, FinCEN, Office of

Foreign Assets Control, and Office of Enforcement. At Justice, we spoke

with officials from the Drug Enforcement Administration, Federal Bureau

of Investigation, and Executive Office for U.S. Attorneys.

Statistics on the number of cases in which money was laundered through

brokerage firms and mutual funds were not readily available, but we

compiled a listing of cases in which illegal funds were laundered through

brokerage firms or mutual funds from information provided primarily by

two of the law enforcement agencies we contacted. At our request, the

Internal Revenue Service and Executive Office for U.S. Attorneys collected

information from some of its field staff that identified about 15 criminal or

civil forfeiture cases since 1997 that involved money laundering through

brokerage and mutual fund accounts. Some cases in which money

laundering is alleged involved securities fraud or crimes committed by

securities industry employees who then moved their illegally earned

proceeds to other institutions or used them to purchase other assets, thus

violating the anti-money laundering statutes. However, we only included

such cases if broker-dealer or mutual fund accounts were alleged to have

been used to launder the money.

Table 9 provides a list of criminal cases in which proceeds from illegal

activities were laundered through brokerage or mutual fund accounts.

Table 10 provides a list of forfeiture cases in which property, including

assets held in brokerage or mutual fund accounts, obtained from proceeds

that were traceable to certain criminal offenses were taken by the United

States to be distributed to the victims of such crimes as restitution. These

lists contain examples of cases that involve charges of money laundering

through brokerage or mutual fund accounts and do not represent an

exhaustive compilation of all such known cases. For example, law

enforcement officials indicated that they were unable to provide

information on many relevant pending cases in the area and further

emphasized that not all field offices and staff had been formally queried.

Specific case information presented in the tables was extracted from public

documents provided primarily by the Internal Revenue Service and

Executive Office for U.S. Attorneys.

Page 67 GAO-02-111 Efforts in the Securities Industry

Appendix IV

Identified Cases of Money Laundering

Through the U.S. Securities Industry

Table 9: Identified Criminal Cases in Which Indictments Contained Charges of Money Laundering Through Brokerage or Mutual

Fund Accounts

Date of Case

indictment or U.S. District Brief description, including Estimated amount of outcome or

disposition Case Court source of illicit funds funds laundered status

2/15/01 United States v. Southern Proceeds from narcotics (cocaine) $290,000a Convicted at

Conviction Nigel Ramsay District of trafficking activities were laundered trial

Florida through brokerage accounts.

02/12/01 United States v. Eastern District Proceeds from felony food stamp $460,000a Guilty plea

Judgment Edward Sirhan of Tennessee fraud were deposited into brokerage

accounts.

2000b United States v. Southern Proceeds from wire and mail fraud $209,700 Guilty plea

Indictment Anthony C. Wong District of New were laundered through securities

York accounts and transferred into

Cayman Island bank accounts.

11/06/00 United States v. Eastern District Indictment charged narcotics $60,000a Guilty plea

Judgment Rudolph Keszthelyi of Tennessee proceeds were laundered through

brokerage accounts.

c

05/18/00 United States v. Northern Defendant charged with extorting $114 million

Indictment Pavel Ivanovich District of stolen property in the Ukraine and

Lazarenko California transferring proceeds into U.S. bank

and brokerage accounts to disguise

the origin and owner of the money.

12/18/98 United States v. Eastern District Proceeds from food stamp fraud $55,000a Guilty plea

Indictment Wade Friday of Pennsylvania were deposited into various money

market and brokerage accounts.

10/19/98 United States v. Southern Funds embezzled from a securities $460,000 Guilty plea

Judgment David R. Hasler District of Iowa firm were wire transferred into a

personal trading account.

08/17/98 United States v. District of Proceeds from the manufacture and $526,000 Guilty plea

Plea agreement Samuel R. Snider Alaska sale of marijuana were deposited

into investment accounts.

08/18/97 United States v. Middle District Proceeds from illegal gambling were $100,000 Guilty plea

Judgment Jerry Dixon of Tennessee deposited into brokerage accounts

and other financial institutions.

a

Funds noted as laundered specifically through brokerage or mutual fund accounts.

b

Time frame was estimated on the basis of available information.

c

Information was not readily available or could not be determined from documentation at hand.

Source: Public documents provided primarily by the Internal Revenue Service and Executive Office for

U.S. Attorneys.

Page 68 GAO-02-111 Efforts in the Securities Industry

Appendix IV

Identified Cases of Money Laundering

Through the U.S. Securities Industry

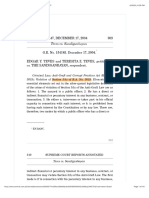

Table 10: Identified Forfeiture Cases That Involved Money Laundering Through Brokerage or Mutual Fund Accounts

Estimated

amount of

Date of Name of account under U.S. District Brief description, including source funds Status of

complaint forfeiture Court of illicit funds laundereda case

1999b Raoul M. Stetson, et al. Southern Proceeds from drug operations were $25,000 Closed

District of deposited into a brokerage account

New York and forfeited in connection with guilty

plea.

11/23/99 Proceeds of Drug Trafficking Southern Proceeds from drug trafficking were $139,000a Closed

(second Transferred to Certain Domestic District of placed into various bank and

amend.) Bank Accounts Alabama investment accounts.

12/03/98 Contents of Account Number Southern Proceeds from fraudulent purchases $750,000a Closed

5061-578941 in the Name of District of and sales of commodity futures

Andrew D. Rhee, at Refco, Inc. New York contracts were ultimately deposited

into a brokerage account.

11/15/98 Approximately $25,829,681.80 in Southern Proceeds of a wire fraud scheme $25 million Pendingc

the Court Registry Investment District of were deposited into brokerage

System New York accounts. Victims were induced to

wire transfer investment funds into

brokerage accounts to be traded.

Defendants instead withdrew the

money for their own use.

07/08/98 Contents of Account No. 594- Southern Proceeds from a “prime bank” $3.7 million Closed

07N41 in the Name of Hamilton District of schemed were placed into a brokerage

Farrar, L.L.C. at Merrill Lynch, New York account.

Pierce, Fenner & Smith, Inc.

03/18/98 All Funds Held by AMS, L.L.C., Southern Proceeds from a prime bank scheme $3.46 million Closed

as Trustee Pursuant to Court District of were wired into banks across the

Order in Dean Witter Account New York United States, then transferred into

various brokerage accounts.

08/29/97 Contents of Dean Witter Southern Proceeds from a prime bank scheme $8 million Pendingc

Brokerage Account in the Name District of were placed into a brokerage account (approx.)

of Paul W. Eggers New York and money market fund. Brokerage

account was opened with a cashier’s

check and received subsequent

deposits in wire transfers and

additional cashier’s checks.

a

Funds noted as laundered specifically through brokerage or mutual fund accounts

b

Time frame was estimated on the basis of available information.

c

Forfeiture or some aspect of the criminal case is still pending. Cases in which a defendant has been

charged but not yet convicted have not been included.

d

Prime bank schemes involve fraudulent investment recommendations in which investors are induced

to purchase and trade prime bank financial instruments on overseas markets to generate huge returns.

However, neither these instruments, nor the markets on which they allegedly trade, exist.

Source: Public documents provided primarily by the Internal Revenue Service and Executive Office for

U.S. Attorneys.

Page 69 GAO-02-111 Efforts in the Securities Industry

Das könnte Ihnen auch gefallen

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Von EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Noch keine Bewertungen

- Adeeb Salih Court DocumentsDokument6 SeitenAdeeb Salih Court DocumentsEmily NadalNoch keine Bewertungen

- Austin Davidson AffidavitDokument8 SeitenAustin Davidson AffidavitEmily BabayNoch keine Bewertungen

- Prosecutors' Sentencing Memorandum in U.S. v. SilvaDokument6 SeitenProsecutors' Sentencing Memorandum in U.S. v. SilvaDealBookNoch keine Bewertungen

- Acusación Del Departamento de Justicia de Los Estados Unidos Contra Maikel Moreno, Presidente Del Supremo VenezolanoDokument10 SeitenAcusación Del Departamento de Justicia de Los Estados Unidos Contra Maikel Moreno, Presidente Del Supremo VenezolanoPresents 360Noch keine Bewertungen

- Poliak Seizure WarrantDokument41 SeitenPoliak Seizure WarrantJ RohrlichNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument28 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Thomas S. Orr, 68 F.3d 1247, 10th Cir. (1995)Dokument9 SeitenUnited States v. Thomas S. Orr, 68 F.3d 1247, 10th Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Prenda Sealed Motion RedactedDokument197 SeitenPrenda Sealed Motion RedactedJ DoeNoch keine Bewertungen

- United States v. Voccola, 99 F.3d 37, 1st Cir. (1996)Dokument12 SeitenUnited States v. Voccola, 99 F.3d 37, 1st Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Suit Against Yellowstone PartnersDokument17 SeitenSuit Against Yellowstone PartnersJeff RobinsonNoch keine Bewertungen

- Filed U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn ClerkDokument35 SeitenFiled U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn Clerkhakan.sengezenNoch keine Bewertungen

- Fed. Sec. L. Rep. P 95,845 Securities and Exchange Commission v. Alexander Kasser, 548 F.2d 109, 3rd Cir. (1977)Dokument12 SeitenFed. Sec. L. Rep. P 95,845 Securities and Exchange Commission v. Alexander Kasser, 548 F.2d 109, 3rd Cir. (1977)Scribd Government DocsNoch keine Bewertungen

- United States v. Joseph Stefan, Irvin Freedman, United States of America v. Irvin Freedman, 784 F.2d 1093, 11th Cir. (1986)Dokument13 SeitenUnited States v. Joseph Stefan, Irvin Freedman, United States of America v. Irvin Freedman, 784 F.2d 1093, 11th Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Fifth CircuitDokument9 SeitenUnited States Court of Appeals, Fifth CircuitScribd Government DocsNoch keine Bewertungen

- Suchan Plea AgreementDokument15 SeitenSuchan Plea AgreementJustin OkunNoch keine Bewertungen

- United States v. Thomas Howerter, 248 F.3d 198, 3rd Cir. (2001)Dokument11 SeitenUnited States v. Thomas Howerter, 248 F.3d 198, 3rd Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Judge Nathan Opinion On Benjamin Wey SearchDokument92 SeitenJudge Nathan Opinion On Benjamin Wey Search92589258Noch keine Bewertungen

- United States Court of Appeals, Ninth CircuitDokument6 SeitenUnited States Court of Appeals, Ninth CircuitScribd Government DocsNoch keine Bewertungen

- 212 F.3d 180 (3rd Cir. 2000)Dokument24 Seiten212 F.3d 180 (3rd Cir. 2000)Scribd Government DocsNoch keine Bewertungen

- SovCit Pseudo-Legal Document From Heather Ann Tucci-Jarraf's TrialDokument6 SeitenSovCit Pseudo-Legal Document From Heather Ann Tucci-Jarraf's TrialJohn P CapitalistNoch keine Bewertungen

- Murray Forfeiture ComplaintDokument31 SeitenMurray Forfeiture ComplaintJ RohrlichNoch keine Bewertungen

- United States v. Blanca Acosta, 748 F.2d 577, 11th Cir. (1984)Dokument14 SeitenUnited States v. Blanca Acosta, 748 F.2d 577, 11th Cir. (1984)Scribd Government DocsNoch keine Bewertungen

- Toney Anaya and Elaine Anaya v. United States, 815 F.2d 1373, 10th Cir. (1987)Dokument11 SeitenToney Anaya and Elaine Anaya v. United States, 815 F.2d 1373, 10th Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- Page 45, Counts 15-24: Corrupt Receipt of Bribe/reward For Official Action Concerning Programs Receiving Federal Funds 18 USC 666Dokument78 SeitenPage 45, Counts 15-24: Corrupt Receipt of Bribe/reward For Official Action Concerning Programs Receiving Federal Funds 18 USC 666California Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Crypto Capital Detention MemorandumDokument7 SeitenCrypto Capital Detention MemorandumAnonymous aISWG6QrNoch keine Bewertungen

- United States v. Robert Worthington, 822 F.2d 315, 2d Cir. (1987)Dokument7 SeitenUnited States v. Robert Worthington, 822 F.2d 315, 2d Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- Diondre Winstead IndictmentDokument6 SeitenDiondre Winstead IndictmentWKRCNoch keine Bewertungen

- United States v. Christo, 129 F.3d 578, 11th Cir. (1997)Dokument5 SeitenUnited States v. Christo, 129 F.3d 578, 11th Cir. (1997)Scribd Government DocsNoch keine Bewertungen

- United States v. Ben J. Slutsky and Julius S. Slutsky D/B/A "The Nevele,", 514 F.2d 1222, 2d Cir. (1975)Dokument13 SeitenUnited States v. Ben J. Slutsky and Julius S. Slutsky D/B/A "The Nevele,", 514 F.2d 1222, 2d Cir. (1975)Scribd Government DocsNoch keine Bewertungen

- Bookkeeper TheftDokument7 SeitenBookkeeper TheftHNNNoch keine Bewertungen

- Usa V Mizuhara ComplaintDokument37 SeitenUsa V Mizuhara ComplaintcbslaNoch keine Bewertungen

- United States v. Mueller, 74 F.3d 1152, 11th Cir. (1996)Dokument13 SeitenUnited States v. Mueller, 74 F.3d 1152, 11th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- United States v. James Allen Ratchford, 942 F.2d 702, 10th Cir. (1991)Dokument8 SeitenUnited States v. James Allen Ratchford, 942 F.2d 702, 10th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Ante Litem Notice - Probate CourtDokument66 SeitenAnte Litem Notice - Probate CourtLizHowellNoch keine Bewertungen

- Konnech v. True The Vote Filed 3/14/23Dokument26 SeitenKonnech v. True The Vote Filed 3/14/23UncoverDCNoch keine Bewertungen

- United States v. Harrison P. Cronic, 900 F.2d 1511, 10th Cir. (1990)Dokument10 SeitenUnited States v. Harrison P. Cronic, 900 F.2d 1511, 10th Cir. (1990)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument15 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Shirley Lorraine Lattimore, 902 F.2d 902, 11th Cir. (1990)Dokument5 SeitenUnited States v. Shirley Lorraine Lattimore, 902 F.2d 902, 11th Cir. (1990)Scribd Government DocsNoch keine Bewertungen

- United States v. Key, 76 F.3d 350, 11th Cir. (1996)Dokument5 SeitenUnited States v. Key, 76 F.3d 350, 11th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Otuya Austin Romance Scam ComplaintDokument10 SeitenOtuya Austin Romance Scam ComplaintAnonymous Pb39klJNoch keine Bewertungen

- Nigerian Romance ScamDokument10 SeitenNigerian Romance ScamAnonymous Pb39klJNoch keine Bewertungen

- United States v. Eugene Frankel, 721 F.2d 917, 3rd Cir. (1983)Dokument9 SeitenUnited States v. Eugene Frankel, 721 F.2d 917, 3rd Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- 755 Emergency Motion To Intervene Re&f 12.18.2021Dokument5 Seiten755 Emergency Motion To Intervene Re&f 12.18.2021larry-612445Noch keine Bewertungen

- USA V Abbas ComplaintDokument28 SeitenUSA V Abbas ComplaintLaw&Crime100% (2)

- United States Court of Appeals, Second CircuitDokument8 SeitenUnited States Court of Appeals, Second CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Sandra Wert-Ruiz, A/K/A The Lady Sandra Wert-Ruiz, 228 F.3d 250, 3rd Cir. (2000)Dokument12 SeitenUnited States v. Sandra Wert-Ruiz, A/K/A The Lady Sandra Wert-Ruiz, 228 F.3d 250, 3rd Cir. (2000)Scribd Government DocsNoch keine Bewertungen

- Otaiba Leaks Filed InformationDokument5 SeitenOtaiba Leaks Filed InformationOtaiba LeaksNoch keine Bewertungen

- United States of America, Plaintiff-Respondent v. Raymond A. O'COnnOr, 237 F.2d 466, 2d Cir. (1956)Dokument14 SeitenUnited States of America, Plaintiff-Respondent v. Raymond A. O'COnnOr, 237 F.2d 466, 2d Cir. (1956)Scribd Government DocsNoch keine Bewertungen

- United States v. D'Andrea, 107 F.3d 949, 1st Cir. (1997)Dokument15 SeitenUnited States v. D'Andrea, 107 F.3d 949, 1st Cir. (1997)Scribd Government DocsNoch keine Bewertungen

- United States v. Cloyd J. Holmes and Salvatore Frasca, 44 F.3d 1150, 2d Cir. (1995)Dokument13 SeitenUnited States v. Cloyd J. Holmes and Salvatore Frasca, 44 F.3d 1150, 2d Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Mizuhara ComplaintDokument37 SeitenMizuhara ComplaintLeif SkodnickNoch keine Bewertungen

- United States v. Gerald A. Guidarelli, A/K/A Gerardo A. Quindarelli, 318 F.2d 523, 2d Cir. (1963)Dokument2 SeitenUnited States v. Gerald A. Guidarelli, A/K/A Gerardo A. Quindarelli, 318 F.2d 523, 2d Cir. (1963)Scribd Government DocsNoch keine Bewertungen

- Psychic IndictmentDokument20 SeitenPsychic IndictmentChris GothnerNoch keine Bewertungen

- Imran Awan ComplaintDokument10 SeitenImran Awan ComplaintStephen LoiaconiNoch keine Bewertungen

- United States v. Thomas G. Clines, 958 F.2d 578, 4th Cir. (1992)Dokument8 SeitenUnited States v. Thomas G. Clines, 958 F.2d 578, 4th Cir. (1992)Scribd Government DocsNoch keine Bewertungen

- Victor - Santos.et .Al .ComplaintDokument8 SeitenVictor - Santos.et .Al .Complaintdavid rockNoch keine Bewertungen

- 5 G.R. No. 162416 - de Joya v. MarquezDokument5 Seiten5 G.R. No. 162416 - de Joya v. MarquezCamille CruzNoch keine Bewertungen

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Von EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Noch keine Bewertungen

- Inter Nation Risk ManagementDokument101 SeitenInter Nation Risk ManagementtofumasterNoch keine Bewertungen

- Anti-Money Laundering Efforts in The Securities IndustryDokument92 SeitenAnti-Money Laundering Efforts in The Securities IndustrytofumasterNoch keine Bewertungen

- Summary Secure Diversified Investments and Lending Part 1Dokument66 SeitenSummary Secure Diversified Investments and Lending Part 1tofumasterNoch keine Bewertungen

- Less Than A Bubble, More Than A Burst: Randall DoddDokument36 SeitenLess Than A Bubble, More Than A Burst: Randall DoddtofumasterNoch keine Bewertungen

- Gten 01Dokument44 SeitenGten 01Flaviub23Noch keine Bewertungen

- Improved Financial and Commodities Markets Oversight and Accountablity ActDokument10 SeitenImproved Financial and Commodities Markets Oversight and Accountablity ActtofumasterNoch keine Bewertungen

- O Kelly Declaration in Support of Motion To Terminate Voting TrustDokument13 SeitenO Kelly Declaration in Support of Motion To Terminate Voting TrusttofumasterNoch keine Bewertungen

- Fraud Enforcement and Recovery Act 2009Dokument15 SeitenFraud Enforcement and Recovery Act 2009tofumasterNoch keine Bewertungen

- Mortgage, Securites and Financial Meltdown Prosecuting Those ResponsibleDokument16 SeitenMortgage, Securites and Financial Meltdown Prosecuting Those ResponsibletofumasterNoch keine Bewertungen

- Derivatives Market Manipulation Prevention Act of 2009Dokument18 SeitenDerivatives Market Manipulation Prevention Act of 2009tofumasterNoch keine Bewertungen

- Financial Markets Regulation NewsletterDokument1 SeiteFinancial Markets Regulation NewslettertofumasterNoch keine Bewertungen

- Systemic Risk Regulatory Oversight and Recent Initiatives To Address Risk Posed by Credit Default SwapsDokument32 SeitenSystemic Risk Regulatory Oversight and Recent Initiatives To Address Risk Posed by Credit Default SwapstofumasterNoch keine Bewertungen

- Senate Subcommittee Releases Gao Report On Money Laundering ActivitesDokument4 SeitenSenate Subcommittee Releases Gao Report On Money Laundering ActivitestofumasterNoch keine Bewertungen

- Transparency in Corporate Filings ActDokument6 SeitenTransparency in Corporate Filings ActtofumasterNoch keine Bewertungen

- Gao-06-320r (Qui Tam Report) False Claims Act LitigationDokument38 SeitenGao-06-320r (Qui Tam Report) False Claims Act LitigationtofumasterNoch keine Bewertungen

- Anti-Money Laundering Efforts in The Securities IndustryDokument92 SeitenAnti-Money Laundering Efforts in The Securities IndustrytofumasterNoch keine Bewertungen

- Usa Newsletter Money LaunderingDokument71 SeitenUsa Newsletter Money LaunderingtofumasterNoch keine Bewertungen

- 2009 The Civil Asset Forfeiture Reform Act of 2000Dokument65 Seiten2009 The Civil Asset Forfeiture Reform Act of 2000tofumasterNoch keine Bewertungen

- 1996 Derivatives Actions Taken or Proposed Since 1994Dokument169 Seiten1996 Derivatives Actions Taken or Proposed Since 1994tofumasterNoch keine Bewertungen

- BPI vs. CIRDokument2 SeitenBPI vs. CIRAldrin TangNoch keine Bewertungen

- 2017 MergedDokument114 Seiten2017 Mergedyaar iduNoch keine Bewertungen

- Succession AssignmentDokument7 SeitenSuccession AssignmentAlelie BatinoNoch keine Bewertungen

- US v. Esmedia G.R. No. L-5749 PDFDokument3 SeitenUS v. Esmedia G.R. No. L-5749 PDFfgNoch keine Bewertungen

- ALTAVAZ BriefDokument27 SeitenALTAVAZ BriefjustineNoch keine Bewertungen

- A.M. No. 11-1-6-SC-PHILJA (January 11, 2011)Dokument29 SeitenA.M. No. 11-1-6-SC-PHILJA (January 11, 2011)Hershey Delos Santos100% (1)

- Confiscation Order: Office of The Regional DirectorDokument5 SeitenConfiscation Order: Office of The Regional DirectorDianneBalizaBisoñaNoch keine Bewertungen

- T&E OutlineDokument99 SeitenT&E OutlineDrGacheNoch keine Bewertungen

- Buslaw Reviewer Guide QuestionsDokument9 SeitenBuslaw Reviewer Guide QuestionsFrances Alandra SorianoNoch keine Bewertungen

- Amended Complaint GSR v. Waste ManagementDokument14 SeitenAmended Complaint GSR v. Waste Managementcwhitt7890Noch keine Bewertungen

- Arnado GR 210164Dokument3 SeitenArnado GR 210164deuce scriNoch keine Bewertungen

- 01 Tayag v. Benguet Consolidated, Inc. AdriaticoDokument1 Seite01 Tayag v. Benguet Consolidated, Inc. AdriaticorbNoch keine Bewertungen

- Diño vs. Diño (Manalastas)Dokument3 SeitenDiño vs. Diño (Manalastas)Arnel ManalastasNoch keine Bewertungen

- Tala vs. Banco FilipinoDokument1 SeiteTala vs. Banco FilipinoKarissa TolentinoNoch keine Bewertungen

- Dy v. Bibat-PalamosDokument3 SeitenDy v. Bibat-PalamosTon RiveraNoch keine Bewertungen

- DENIEGADokument22 SeitenDENIEGAJaana AlbanoNoch keine Bewertungen

- People vs. MartiDokument3 SeitenPeople vs. MartiCourtney Tirol100% (2)

- G.R. No. 176102Dokument7 SeitenG.R. No. 176102ChristineNoch keine Bewertungen

- People Vs SatorreDokument1 SeitePeople Vs SatorreJorela TipanNoch keine Bewertungen

- Gonzales Vs Climax Mining GR No 161957 (2007)Dokument4 SeitenGonzales Vs Climax Mining GR No 161957 (2007)Kimberly SendinNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument12 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Index of J.D. ThesisDokument195 SeitenIndex of J.D. Thesisagnatga100% (6)

- Teves v. SandiganbayanDokument45 SeitenTeves v. SandiganbayanJess RañaNoch keine Bewertungen

- DeLoach v. Crews Et Al - Document No. 12Dokument4 SeitenDeLoach v. Crews Et Al - Document No. 12Justia.comNoch keine Bewertungen

- Rti PPTDokument28 SeitenRti PPTadv_animeshkumar100% (1)

- G.R. No. 169202 March 5, 2010 MARIA VIRGINIA V. REMO, Petitioner, The Honorable Secretary of Foreign Affairs, RespondentDokument5 SeitenG.R. No. 169202 March 5, 2010 MARIA VIRGINIA V. REMO, Petitioner, The Honorable Secretary of Foreign Affairs, RespondentDanielleNoch keine Bewertungen

- (A7) LAW 121 - JM Tuason & Co., Inc. v. Land Tenure Administration 31 SCRA 413 (1970)Dokument3 Seiten(A7) LAW 121 - JM Tuason & Co., Inc. v. Land Tenure Administration 31 SCRA 413 (1970)mNoch keine Bewertungen

- Consultants Handbook & Corporate Policy: PrefaceDokument5 SeitenConsultants Handbook & Corporate Policy: PrefaceChetanKambleNoch keine Bewertungen

- Term Paper (Power Point)Dokument27 SeitenTerm Paper (Power Point)mahar moemyintNoch keine Bewertungen

- Michael Montes JourneyDokument1 SeiteMichael Montes JourneyionaicNoch keine Bewertungen