Beruflich Dokumente

Kultur Dokumente

Iul Ira

Hochgeladen von

Wadnerson BoileauOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Iul Ira

Hochgeladen von

Wadnerson BoileauCopyright:

Verfügbare Formate

Using life insurance to fund retirement

has many benefits

While tax-qualified retirement plans

allow an individual to avoid taxes

through retirement, heavy taxes are

taken out after. A tax free

insurance based plan can maximize

your investment over time by

allowing taxes to be taken on the

seed instead of the crop.

Editors note: The tax free life insurance

savings plan discussed here requires the

investor to put a small seed investment into a

large life insurance policy and then take out

loans against the policy during retirement to

pay for basic needs. The investor can use the

interest on loans such as these as a tax

deduction, making the loans essentially taxfree.

Due to the differing opinions of investment

professionals on this subject, Citizens

recommends that you investigate carefully

before choosing any retirement plan.

by Bart S. Croxford CPA Sandy, UT

I would like to respond to the

article published in the Aug. 28

edition of the Citizens section by

Thomas McCarthy.

I do not know what financial

expertise he possesses but I strongly

disagree with his views on retirement.

Chances are that he has not run the

numbers to prove his point. He made

assertions but did not back them up

with facts and figures. I would like to

show with my graphs backed up by a

spreadsheet that he is wrong to say

that retirement should not be funded

with life insurance.

I used to share McCarthys views,

but I was convinced that I was wrong

when I saw the numbers. In fact, he

would be right if it werent for income, estate and social security taxes.

He wrote about inflation and

future tax rates. He is right that

inflation will eat into a retirement

plan, but it eats into a tax-qualified

plan just as much, or more than it

does a tax-free plan. He assumes that

a retirees tax rates will decrease, but

if they dont, he will really be in

trouble, and I dont think anyone is

going to believe that tax rates will

truly decrease in our lifetime.

Even President Reagans supposed

tax cut in the early 80s didnt last long.

In fact, according to recent newspaper

articles, he is now accused of authoring

a bigger tax increase than President

Clinton did a few years ago. McCarthy

wrote that the top tax bracket in 1960

encompassed more people than it does

today, but I fail to see what the top tax

bracket in 1960 has to do with anything.

Most retirees wont be in the top tax

bracket anyway and we all know how

hard the middle class has been hit with

taxes for many years.

I have never seen anyone who

promotes tax-qualified plans run the

figures through retirement. They run the

figures to age 65 or beyond and show

how much more you can accumulate if

you use a tax-qualified plan, such as an

IRA or 401(k) and defer your taxes until

retirement. But in savings as in sports,

its the final score that counts, not the

score at half time or even after three

quarters.

The real clincher in the whole plan is

the fact that with tax-qualified plans,

one must pay taxes on the entire amount

taken at retirement, including the

growth, which accounts for the largest

portion by far, whereas on tax-free

plans, one pays no taxes on the growth

at all. In other words, one can be taxed

either on the seed or the crop. With taxqualified plans, one pays on the crop

and on tax-free plans, one pays on the

seed. One does not receive the tax

deduction now, but instead receives a far

greater benefit by not having to pay

taxes on the amount received at

retirement.

The benefits are enhanced when one

considers that an individual using a taxfree plan will receive more social

security benefits because reportable

taxable income will be much lower.

Also, the user can choose a higher

payment pension plan, which ceases at

his death (if his employer provides one)

because he has life insurance if he dies.

Most retirees choose a lower option to

allow their spouses to continue receiving

pension proceeds after they die. It is

also a much more advantageous

option for estate planning, because

the insurance death benefits pass to

heirs tax-free (if properly planned), But

the qualified plan will lose 70-90 %

due to income and estate taxes.

Even if an employer matches its

employees contributions dollar for

dollar, it still doesnt come close to

touching a tax-free plans payout

based on investment. In fact, in the

graph, I assumed the employer

matched the employees

contributions 100%. Besides this,

the qualified plan has many

restrictions and penalties: if you take

money out too soon, you are

penalized: if you leave it in too long,

you are penalized: if you accumulate

too much, you are penalized.

Basically, the IRS is a terrible

partner to have for retirement.

The spreadsheet and graphs I have

developed prove my point. They

compare a qualified plan, such as a

401(k), with a tax-free plan, such as

an indexed universal life policy. I

have assumed that on the qualified

plan, one can earn a 12-percent

return annually and a 10-percent

return on the tax free plan because

about two percent would go to

insurance cost and loads.

Notice that the accumulation isnt

nearly as great on the tax-free plans,

but it lasts much longer because one

can take loans against the policy taxfree. In fact, one is almost 4 million

dollars better off if he or she lives to

age 95 because instead of depleting

the account, it keeps growing, even

though the net amount enjoyed by

the retiree is exactly the same

($108,560) in both cases.

I used to feel the same way Mr.

McCarthy does, but when I looked at

the whole picture, including initial

taxes and taxes through the

withdrawal period, it made much

more sense to use life insurance to

fund retirement.

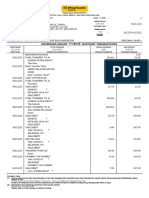

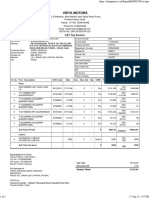

IUL -vs- Tax Deferred IRA (401k) -vs- Roth IRA

$3,600 per year or $300/month ($345/ month if Tax Deferred)

7.9% Annual Interest Rate for 35 Years (Until Age 65)

Gross

Annual

CASH

FLOW

Total

NET

Annual

Cash

Flow (age

65)

Total NET

Cash

Flow by

age 80

Total NET

Cash Flow

by age 90

Total NET

Cash Flow

by age 100

DEATH

BENEFIT

TOTAL

POTENTIAL

BENEFITS

by age 80

TOTAL

POTENTIAL

BENEFITS

by age 110

Total

Investment

(35 years)

Gross

Cash

Value @

age 65

$144,900

$697,703

$55,119

$16,536

$38,583

$578,745

$964,574

$1,350,404

$0

$578,745

$1,736,234

IRA

$126,000

$606,698

$47,929

$0

$47,929

$718,937

$1,198,229

$1,677,520

$0

$718,937

$2,156,811

IUL

$126,000

$512,307

$65,363

$0

$65,363

$980,445

$1,634,075

$2,287,705

$400,000

$1,380,445

$11,457,510

(Living off

just Interest)

Tax

Deferred

IRA401k

ROTH

Taxes

@ 30%

(*2)

*1. Roth IRA limited to $3,000 Annual Investment (Increasing to $4,000 & $5,000 in years to come, making this annual amount impossible to do with a Roth IRA, unless done through a series of rollovers)

*2. 10% Early withdrawal Penalty applies to withdrawals made prior to age 591/2, potentially increasing to age 62, 65, etc. Principal

invested may be withdrawn from Roth without Penalties or taxes.

*The values on this sheet reflect all fees, sales charges, costs, etc. of the IUL. No fees, sales charges, costs, etc. were deducted from either standard or Roth IRA.

*The tax advantages of the IUL are similar to a Roth, in that they are not tax deductible up front, but the interest earned and the cash flow taken out are not taxable as ordinary income.

Das könnte Ihnen auch gefallen

- Ninja-Wake Up MoneyDokument16 SeitenNinja-Wake Up MoneyImani BalivajaNoch keine Bewertungen

- Maybank Statement BankDokument4 SeitenMaybank Statement BankFakruul HaZmin0% (1)

- Chris-Prefontaine-Instant-Real-Estate-Investor-Blueprint-A4-Portrait-20180410v4-96dpiDokument38 SeitenChris-Prefontaine-Instant-Real-Estate-Investor-Blueprint-A4-Portrait-20180410v4-96dpiRUDINoch keine Bewertungen

- The Six Basic Rules For Investing-Robert KiyosakiDokument1 SeiteThe Six Basic Rules For Investing-Robert Kiyosakidchandra15Noch keine Bewertungen

- Quick Analysis Worksheet v5.1 - Rental Property - CharaDokument6 SeitenQuick Analysis Worksheet v5.1 - Rental Property - CharaCCerberus24Noch keine Bewertungen

- Filthy Riches Manual 2016Dokument472 SeitenFilthy Riches Manual 2016LexMercatoriaNoch keine Bewertungen

- 2013 Recruiting Tax Pros MaterialDokument13 Seiten2013 Recruiting Tax Pros MaterialmeNoch keine Bewertungen

- Why Primerica LifeDokument1 SeiteWhy Primerica LifeAnonymous oTtlhPNoch keine Bewertungen

- New Associate Checklist: Complete at OrientationDokument20 SeitenNew Associate Checklist: Complete at OrientationJeremyNoch keine Bewertungen

- Pop - A Aj GowerDokument2 SeitenPop - A Aj GowerScavat NgwaneNoch keine Bewertungen

- Retire Like a Rock Star: The Kick Butt Savings Solution That Eliminates The 7 Deadly Sins of Your IRA or 401(k)Von EverandRetire Like a Rock Star: The Kick Butt Savings Solution That Eliminates The 7 Deadly Sins of Your IRA or 401(k)Noch keine Bewertungen

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformVon EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNoch keine Bewertungen

- Seven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Von EverandSeven Crucial Components of a Well Designed I.U.L. (Indexed Universal Life)Noch keine Bewertungen

- Selling Iul Virtually PaisDokument18 SeitenSelling Iul Virtually PaisJoseAliceaNoch keine Bewertungen

- Understanding IUL's: Financial Tips From The ExpertsDokument2 SeitenUnderstanding IUL's: Financial Tips From The Expertsjhuaman74897667% (3)

- 2019 WSB AGENDA May To December 04-24-2019 FinalDokument174 Seiten2019 WSB AGENDA May To December 04-24-2019 FinalKawin ThoncompeeravasNoch keine Bewertungen

- Is An Annuity Right For YouDokument46 SeitenIs An Annuity Right For YouSavitsky AgencyNoch keine Bewertungen

- Fast StartDokument13 SeitenFast Startapi-243169874100% (1)

- Financial Literacy For Women-The Money Matter FAQs-For WomenDokument13 SeitenFinancial Literacy For Women-The Money Matter FAQs-For WomenUtkarshNoch keine Bewertungen

- Game Plan For SuccessDokument13 SeitenGame Plan For SuccessDavid Urpí Pedrajas100% (2)

- Tax Deduction ChecklistDokument2 SeitenTax Deduction ChecklistlunwenNoch keine Bewertungen

- Ultimate 2014 GameplanDokument66 SeitenUltimate 2014 GameplanoculosoakleyNoch keine Bewertungen

- Surplus Funds - How Government Pulled It OffDokument75 SeitenSurplus Funds - How Government Pulled It OffSarvesh AhluwaliaNoch keine Bewertungen

- Build Issue 1 v2Dokument22 SeitenBuild Issue 1 v2Rich DiazNoch keine Bewertungen

- The New Rules To Getting AheadDokument8 SeitenThe New Rules To Getting AheadWes LangloisNoch keine Bewertungen

- Saving: Year After Year Since 1997?Dokument8 SeitenSaving: Year After Year Since 1997?Shin ChanNoch keine Bewertungen

- The Fastest Way To Build A Large Network Marketing Downline: by Tracy BillerDokument14 SeitenThe Fastest Way To Build A Large Network Marketing Downline: by Tracy BillermiszfiezaNoch keine Bewertungen

- Chapter Nineteen: Mcgraw-Hill/IrwinDokument14 SeitenChapter Nineteen: Mcgraw-Hill/IrwinJohn ReyNoch keine Bewertungen

- WFG ToolkitDokument16 SeitenWFG ToolkitErichNoch keine Bewertungen

- Primerica Secure MapDokument2 SeitenPrimerica Secure Mapapi-306698090Noch keine Bewertungen

- 1double Your Way To MillionsDokument10 Seiten1double Your Way To MillionsAbujaNoch keine Bewertungen

- How A Newbie Can Start Building Wealth Through Real Estate WorksheetDokument1 SeiteHow A Newbie Can Start Building Wealth Through Real Estate WorksheetMoose112Noch keine Bewertungen

- Faith Based Millionaire Mindset SlidesDokument44 SeitenFaith Based Millionaire Mindset SlidesShakes SMNoch keine Bewertungen

- Multiple Streams of IncomeDokument9 SeitenMultiple Streams of IncomeWarren BuffetNoch keine Bewertungen

- Yfb Tax Free BookDokument40 SeitenYfb Tax Free BookblcksourceNoch keine Bewertungen

- Primerica DebtwatchersDokument0 SeitenPrimerica DebtwatchersDesmon FlonnoryNoch keine Bewertungen

- Todd Falcone 25 BIGGEST Mistakes Cheat SheetDokument12 SeitenTodd Falcone 25 BIGGEST Mistakes Cheat Sheeta_rogall7926100% (1)

- Retail Banking SlidesDokument22 SeitenRetail Banking SlidesArafatAdilNoch keine Bewertungen

- Build Issue 3Dokument19 SeitenBuild Issue 3Rich DiazNoch keine Bewertungen

- Dr. Ace's Guide to Personal and Financial FreedomVon EverandDr. Ace's Guide to Personal and Financial FreedomNoch keine Bewertungen

- Starting A Small Scale BusinessDokument26 SeitenStarting A Small Scale BusinessMariam Oluwatoyin CampbellNoch keine Bewertungen

- Jay Abraham - How To Unleash The Creative Power Within YouDokument198 SeitenJay Abraham - How To Unleash The Creative Power Within YoujanglepussNoch keine Bewertungen

- Secrets To Foreclosure Investing E-BookDokument93 SeitenSecrets To Foreclosure Investing E-BookCharles GalanNoch keine Bewertungen

- The Network Marketing Rat Race Exposed: Stop Listening to Your Upline ASAP!Von EverandThe Network Marketing Rat Race Exposed: Stop Listening to Your Upline ASAP!Noch keine Bewertungen

- 1843 Owner Financing Mortgage ContractDokument3 Seiten1843 Owner Financing Mortgage ContractRichie Battiest-CollinsNoch keine Bewertungen

- 8 Tips To Running A Successful Cashflow GameDokument5 Seiten8 Tips To Running A Successful Cashflow Gamedchandra15Noch keine Bewertungen

- Life InsuranceDokument17 SeitenLife InsurancegdobrinichNoch keine Bewertungen

- Ultimate Guide To Personal Finance PDFDokument65 SeitenUltimate Guide To Personal Finance PDFjuan100% (1)

- Fund Your Life OverseasDokument31 SeitenFund Your Life OverseastotalpecsNoch keine Bewertungen

- Paul Zane Pilzer-Profile (PDF Library)Dokument5 SeitenPaul Zane Pilzer-Profile (PDF Library)Vladimir VasiljevicNoch keine Bewertungen

- Game PlanDokument7 SeitenGame PlanEric Christian Monterico100% (1)

- Goal SettingDokument16 SeitenGoal Settingcartmannecron100% (1)

- Writing a Business Plan for a Successful Home-Based BusinessVon EverandWriting a Business Plan for a Successful Home-Based BusinessNoch keine Bewertungen

- 1 Intro To Financial Literacy PDFDokument48 Seiten1 Intro To Financial Literacy PDFLawrence CezarNoch keine Bewertungen

- Financial Literacy GuideDokument14 SeitenFinancial Literacy GuideEllahnae VelasquezNoch keine Bewertungen

- GMAT QuestionsDokument4 SeitenGMAT QuestionsWadnerson BoileauNoch keine Bewertungen

- WS 16Dokument36 SeitenWS 16Wadnerson BoileauNoch keine Bewertungen

- Requiter Question Answer Part5Dokument1 SeiteRequiter Question Answer Part5Wadnerson BoileauNoch keine Bewertungen

- Notes ProbabilityDokument15 SeitenNotes ProbabilityWadnerson BoileauNoch keine Bewertungen

- RoutingNo Bank USADokument224 SeitenRoutingNo Bank USAWadnerson Boileau100% (1)

- GST Question Bank Nov 22Dokument750 SeitenGST Question Bank Nov 22mercydavizNoch keine Bewertungen

- BIR-How To Compute Fringe Benefit Tax, REL PARTYDokument69 SeitenBIR-How To Compute Fringe Benefit Tax, REL PARTYLeandrix Billena Remorin Jr75% (4)

- 2011 Pub 4491WDokument208 Seiten2011 Pub 4491WRefundOhioNoch keine Bewertungen

- Reservation Information Itinerary ID: Total You Will Receive: IDR 1346400Dokument2 SeitenReservation Information Itinerary ID: Total You Will Receive: IDR 1346400Achmad Furqon SyaifullahNoch keine Bewertungen

- MR Mahmudul Hasan SabbirDokument1 SeiteMR Mahmudul Hasan Sabbirprojapoti storeNoch keine Bewertungen

- Tyscn 10 AugDokument83 SeitenTyscn 10 AugVivek PatilNoch keine Bewertungen

- Invoice FromDokument1 SeiteInvoice FromVladislavs RužanskisNoch keine Bewertungen

- CF02 TaskDokument7 SeitenCF02 TaskScribdTranslationsNoch keine Bewertungen

- CIR Vs Mirant PagbilaoDokument2 SeitenCIR Vs Mirant PagbilaoTonifranz Sareno50% (2)

- Definition of An Imprest System of Petty CashDokument2 SeitenDefinition of An Imprest System of Petty CashMark LeeNoch keine Bewertungen

- Bill - 6095Dokument2 SeitenBill - 6095vidyamotors27Noch keine Bewertungen

- 3 Key Features of The GICC Protocol - American ExpressDokument232 Seiten3 Key Features of The GICC Protocol - American Expressvanitha gunasekaranNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed Depositssaurav katarukaNoch keine Bewertungen

- December 2022 Bill: 510 BT Batok ST 52 #07-15 Singapore 650510Dokument2 SeitenDecember 2022 Bill: 510 BT Batok ST 52 #07-15 Singapore 650510Jahid IslamNoch keine Bewertungen

- Overview of TDS: by C.A. Manish JathliyaDokument21 SeitenOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNoch keine Bewertungen

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDokument1 SeiteAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioNoch keine Bewertungen

- XDokument2 SeitenXSophiaFrancescaEspinosaNoch keine Bewertungen

- Installment On CGT Subject To Mortgage2Dokument5 SeitenInstallment On CGT Subject To Mortgage2Joneric RamosNoch keine Bewertungen

- E-Ticket For Agra Fort: Important InformationDokument3 SeitenE-Ticket For Agra Fort: Important InformationAshish RaiNoch keine Bewertungen

- PDFDokument33 SeitenPDFSriram KrishnanNoch keine Bewertungen

- PreviewDokument5 SeitenPreviewFaz AliNoch keine Bewertungen

- Cheque Collection Policy 2020 21Dokument27 SeitenCheque Collection Policy 2020 21Hareesh LNoch keine Bewertungen

- General QuestionsDokument26 SeitenGeneral Questionskumarbcomca0% (1)

- Navigating TAX Regulations in Bangladesh - A 2023 GuideDokument60 SeitenNavigating TAX Regulations in Bangladesh - A 2023 Guidereazvat786Noch keine Bewertungen

- M LhuillierDokument28 SeitenM LhuillierAyidar Luratsi Nassah100% (1)

- GST Tally Invoice Format Final PDFDokument1 SeiteGST Tally Invoice Format Final PDFSyed Danish FayazNoch keine Bewertungen

- Ridf XX LDTW M 376 DTD 18 03 2020Dokument1 SeiteRidf XX LDTW M 376 DTD 18 03 2020KiranNoch keine Bewertungen

- CO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519Dokument1 SeiteCO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519ashishvaidNoch keine Bewertungen