Beruflich Dokumente

Kultur Dokumente

Arroyo - HW in Advacc 2 C14 Business Combinations

Hochgeladen von

Anjj ArroyoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Arroyo - HW in Advacc 2 C14 Business Combinations

Hochgeladen von

Anjj ArroyoCopyright:

Verfügbare Formate

Arroyo, Mae Anjeanette B.

BSA51KB1

Assignment in Advanced Accounting II

June 28, 2016

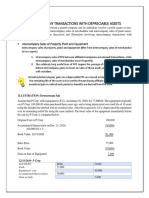

14-9

Avon Corporation issued common stock for the net assets of Bell Corporation in a business

combination.

Market value of the common stock

Par value of common stock

Fair value of Bells assets

Fair value of Bells liabilities

P 700,000

450,000

600,000

188,000

JOURNAL ENTRIES IN THE BOOKS OF AVON CORPORATION AT THE ACQUISITION DATE:

Assets

P 600,000

Goodwill

288,000

Liabilities

P 188,000

Common Stock

450,000

Additional Paid-in Capital

250,000

To record the acquisition of the net assets of Bell Corporation

SUPPORTING COMPUTATIONS:

TO COMPUTE FOR THE GOODWILL:

Consideration paid (MV of common stock)

Fair value of net assets (600,000- 188,000)

Total Goodwill to be recognized

P 700,000

(412,000)

P 288,000

TO COMPUTE FOR THE ADDITIONAL PAID-IN CAPITAL:

Market value of common stock

Par Value of Common

Total Additional Paid-in Capital

P 700,000

(450,000)

P 250,000

Arroyo, Mae Anjeanette B.

BSA51KB1

Assignment in Advanced Accounting II

June 28, 2016

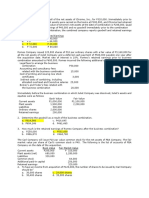

14-14

Rolex Company acquired the net assets of Seiko Company in the transaction properly accounted

for as acquisition by paying cash.

Cash paid

Fair value of Seikos assets:

Cash

Merchandise Inventory

Plant assets

Fair value of Bells liabilities

P 600,000

60,000

142,500

420,000

135,000

JOURNAL ENTRIES IN THE BOOKS OF ROLEX COMPANY AT THE ACQUISITION DATE:

Cash- Seiko Company Account

P 60,000

Merchandise Inventory

142,500

Plant Assets

420,000

Goodwill

112,500

Liabilities

P 135,000

Cash- Rolex Company Account

600,000

To record the acquisition of the net assets of Seiko Company

*Explanation about the not netting of cash account. I did not net the cash account

because the two different cash comes from two different sources. The cash paid of

600,000 is from the Rolex Company, while the cash which is included in the acquired

assets is from the Seiko Company. And to support, I assume that these cash balances are

kept in 2 different banks, thus, it shall be journalized separately. And netting the cash,

would result to credit cash of 540,000 which will not reflect the real transaction happened

which is Rolex Company paying 600,000 (not 540,000) for the acquisition of net assets of

Seiko Company which includes the cash worth 60,000.

SUPPORTING COMPUTATIONS:

TO COMPUTE FOR THE GOODWILL:

Consideration paid

Fair value of net assets (622,500- 135,000)

Total Goodwill to be recognized

P 600,000

(487,500)

P 112,500

Arroyo, Mae Anjeanette B.

BSA51KB1

Assignment in Advanced Accounting II

June 28, 2016

14-15

MM Company issued its common stock for the net assets of PP Company in a business

combination treated as acquisition.

Market value of the common stock

PP Companys net assets

P 1,000,000

800,000

JOURNAL ENTRIES IN THE BOOKS OF ROLEX COMPANY AT THE ACQUISITION DATE:

Net assets

P 800,000

Goodwill

200,000

Paid-in Capital/ Common Stock

P 1,000,000

To record the acquisition of the net assets of PP Company

SUPPORTING COMPUTATIONS:

TO COMPUTE FOR THE GOODWILL:

Consideration paid

Fair value of net assets (622,500- 135,000)

Total Goodwill to be recognized

P 1,000,000

(800,000)

P 200,000

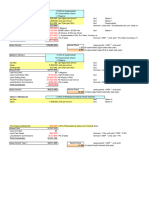

14-16

AA Company issues stock with for the net assets of BB Company in the transaction of business

combination.

Market value of the common stock

Par value of common stock

Fair value of BB Companys net assets

(which includes an equipment of 225,000)

P 600,000

250,000

420,000

JOURNAL ENTRIES IN THE BOOKS OF AVON CORPORATION AT THE ACQUISITION DATE:

Net Assets

Goodwill

Common Stock

Additional Paid-in Capital

P 420,000

180,000

250,000

350,000

Arroyo, Mae Anjeanette B.

BSA51KB1

Assignment in Advanced Accounting II

June 28, 2016

To record the acquisition of the net assets of BB Company

SUPPORTING COMPUTATIONS:

TO COMPUTE FOR THE GOODWILL:

Consideration paid (MV of common stock)

Fair value of net assets

Total Goodwill to be recognized

P 600,000

(420,000)

P 180,000

TO COMPUTE FOR THE ADDITIONAL PAID-IN CAPITAL:

Market value of common stock

Par Value of Common

Total Additional Paid-in Capital

P 600,000

(250,000)

P 350,000

Das könnte Ihnen auch gefallen

- Print ExamDokument14 SeitenPrint ExamkristinamanalangNoch keine Bewertungen

- Documento - MX Ap Receivables Quizzer QDokument10 SeitenDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNoch keine Bewertungen

- Chapter 2Dokument35 SeitenChapter 2Ellah GedalanonNoch keine Bewertungen

- ULOa Answer KeyDokument2 SeitenULOa Answer KeyAyah LaysonNoch keine Bewertungen

- Sycip Gorres Velayo & Co.: HistoryDokument5 SeitenSycip Gorres Velayo & Co.: HistoryYonko ManotaNoch keine Bewertungen

- Accounts Receivable Accounts Payable: A. P19,500 GainDokument6 SeitenAccounts Receivable Accounts Payable: A. P19,500 GainTk KimNoch keine Bewertungen

- Advac Solmal Chapter 13Dokument16 SeitenAdvac Solmal Chapter 13john paul100% (1)

- Installment Sales OldDokument3 SeitenInstallment Sales OldThea Grace Bianan0% (1)

- Midterm ExaminationDokument6 SeitenMidterm ExaminationJamie Rose Aragones100% (1)

- CMPC Quiz 2Dokument5 SeitenCMPC Quiz 2Mae-shane Sagayo50% (2)

- Auditing Appplications PrelimsDokument5 SeitenAuditing Appplications Prelimsnicole bancoroNoch keine Bewertungen

- Bustamante, Jilian Kate A. (Activity 3)Dokument4 SeitenBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNoch keine Bewertungen

- MAS 2 CAp BudgetingDokument45 SeitenMAS 2 CAp BudgetingMarian B TersonaNoch keine Bewertungen

- Practice Problems 1Dokument1 SeitePractice Problems 1Ma Angelica Balatucan0% (1)

- 09 Additional NotesDokument4 Seiten09 Additional NotesMelody GumbaNoch keine Bewertungen

- QUIZ REVIEW Homework Tutorial Chapter 5Dokument5 SeitenQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNoch keine Bewertungen

- Problem 1: 105,000 - Correct AnswerDokument1 SeiteProblem 1: 105,000 - Correct AnswerSophia MilletNoch keine Bewertungen

- Module 1 Home Office and Branch Accounting General ProceduresDokument4 SeitenModule 1 Home Office and Branch Accounting General ProceduresDaenielle EspinozaNoch keine Bewertungen

- PPE NotesDokument4 SeitenPPE Notesaldric taclanNoch keine Bewertungen

- Auditing Reviewer 3Dokument3 SeitenAuditing Reviewer 3Sheena ClataNoch keine Bewertungen

- This Study Resource Was: Available For Use 10,080,000Dokument8 SeitenThis Study Resource Was: Available For Use 10,080,000Kez MaxNoch keine Bewertungen

- CHAPTER 15 Business CombinationDokument58 SeitenCHAPTER 15 Business Combinationlo jaNoch keine Bewertungen

- SAMPLEDokument3 SeitenSAMPLEkrizzmaaaayNoch keine Bewertungen

- Chapter 4 SalosagcolDokument3 SeitenChapter 4 SalosagcolElvie Abulencia-BagsicNoch keine Bewertungen

- BusCom Prob 6 8 1Dokument6 SeitenBusCom Prob 6 8 1Jrllsy100% (1)

- Cebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSDokument9 SeitenCebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSLoren Lordwell MoyaniNoch keine Bewertungen

- History of JPIA and NFJPIADokument2 SeitenHistory of JPIA and NFJPIAJudithRavello0% (1)

- Multiple Responses - Module 2Dokument3 SeitenMultiple Responses - Module 2Jere Mae MarananNoch keine Bewertungen

- P2 06Dokument9 SeitenP2 06Darrel100% (1)

- Audit Problem Inventories AnswerDokument6 SeitenAudit Problem Inventories AnswerJames PaulNoch keine Bewertungen

- D. All of ThemDokument6 SeitenD. All of ThemRyan CapistranoNoch keine Bewertungen

- Final Examination ReviewDokument21 SeitenFinal Examination ReviewToni Marquez100% (1)

- Chapter 16Dokument27 SeitenChapter 16Red Christian Palustre100% (1)

- Consolidation worksheet eliminationsDokument2 SeitenConsolidation worksheet eliminationsCrissa Mae FalsisNoch keine Bewertungen

- Practice Problems Corporate LiquidationDokument2 SeitenPractice Problems Corporate LiquidationAllira OrcajadaNoch keine Bewertungen

- Home Office and Branch Accounting - Special ProceduresDokument17 SeitenHome Office and Branch Accounting - Special Procedureseulhiemae arongNoch keine Bewertungen

- Quiz - Act 07A: I. Theories: ProblemsDokument2 SeitenQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- Business Com Chapter 23Dokument5 SeitenBusiness Com Chapter 23Nino Joycelee TuboNoch keine Bewertungen

- AC15 Quiz 2Dokument6 SeitenAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Illustration: Formation of Partnership Valuation of Capital A BDokument2 SeitenIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNoch keine Bewertungen

- Activity - Chapter 4Dokument2 SeitenActivity - Chapter 4Greta DuqueNoch keine Bewertungen

- Solution Chapter 18 PDFDokument78 SeitenSolution Chapter 18 PDFMesbrookNoch keine Bewertungen

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDokument3 SeitenLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNoch keine Bewertungen

- Chapter 3 MultiDokument3 SeitenChapter 3 MultiJose Mari M. NavaseroNoch keine Bewertungen

- Rmbe FarDokument15 SeitenRmbe FarMiss Fermia0% (1)

- Intercompany Sale of Depreciable AssetsDokument2 SeitenIntercompany Sale of Depreciable AssetsTriechia LaudNoch keine Bewertungen

- Uloc Answer Key Let's Check: A. Contingent ConsiderationsDokument2 SeitenUloc Answer Key Let's Check: A. Contingent Considerationszee abadillaNoch keine Bewertungen

- Auditing Quiz BeeDokument9 SeitenAuditing Quiz BeeWilsonNoch keine Bewertungen

- Page Comprehensive Theories and ProblemsDokument7 SeitenPage Comprehensive Theories and Problemsharley_quinn11Noch keine Bewertungen

- Audit of SHE 1Dokument2 SeitenAudit of SHE 1Raz MahariNoch keine Bewertungen

- Partnership Profit and Loss Ratios Adjustment ProblemsDokument6 SeitenPartnership Profit and Loss Ratios Adjustment ProblemsKing MacunatNoch keine Bewertungen

- Auditing Problems Since 1977Dokument9 SeitenAuditing Problems Since 1977Alarich CatayocNoch keine Bewertungen

- Formation of Partnership 1. 1-JanDokument23 SeitenFormation of Partnership 1. 1-Janhae1234100% (1)

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Dokument5 SeitenAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Business CombinationDokument6 SeitenBusiness CombinationJalieha Mahmod0% (1)

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Dokument26 SeitenFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNoch keine Bewertungen

- AFARDokument41 SeitenAFARAlican, JerhamelNoch keine Bewertungen

- Abuscom:: Consolidated Financial Statements at The Date of AcquisitionDokument1 SeiteAbuscom:: Consolidated Financial Statements at The Date of AcquisitionMarynelle SevillaNoch keine Bewertungen

- Acquisition of Stocks Date of AcquisitionDokument9 SeitenAcquisition of Stocks Date of Acquisitiondom baldemorNoch keine Bewertungen

- Bus Combination 2Dokument8 SeitenBus Combination 2Angelica AllanicNoch keine Bewertungen

- FIATA FD2 TOPIC2 G3 rút - gọnDokument41 SeitenFIATA FD2 TOPIC2 G3 rút - gọnhuynh lanNoch keine Bewertungen

- Hello Primary Health Care Centre Iloffa/Odo-Owa: Download App - Chat With Leo - Our WebsiteDokument2 SeitenHello Primary Health Care Centre Iloffa/Odo-Owa: Download App - Chat With Leo - Our WebsiteAjiboye VictorNoch keine Bewertungen

- Hulo Integrated National High School Contact DetailsDokument36 SeitenHulo Integrated National High School Contact DetailsHellen.DeaNoch keine Bewertungen

- Bus TimetableDokument10 SeitenBus Timetableapi-233913144Noch keine Bewertungen

- Unit 1003 Payment Log DetailsDokument1.621 SeitenUnit 1003 Payment Log Detailsjejo1453Noch keine Bewertungen

- Form Ngao Limited to acquire businessDokument6 SeitenForm Ngao Limited to acquire businessJames WisleyNoch keine Bewertungen

- Test Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman DownloadDokument15 SeitenTest Bank For Introduction To Risk Management and Insurance 10th Edition by Dorfman DownloadTeresaMoorecsrby100% (41)

- Configure and Verify A Site To Site IPsec VPN Using CLIDokument4 SeitenConfigure and Verify A Site To Site IPsec VPN Using CLICristhian HadesNoch keine Bewertungen

- StatementOfAccount 3092378518 Jul17 141113.csvDokument49 SeitenStatementOfAccount 3092378518 Jul17 141113.csvOur educational ServiceNoch keine Bewertungen

- E Banking Chapter 3Dokument19 SeitenE Banking Chapter 3Philip K BugaNoch keine Bewertungen

- Natureview Farm Case Calculations Pre-Class SpreadsheetDokument12 SeitenNatureview Farm Case Calculations Pre-Class Spreadsheet1010478907Noch keine Bewertungen

- PowerCube - 24.12.2020Dokument32 SeitenPowerCube - 24.12.2020Mustaf MohamedNoch keine Bewertungen

- Pioneer Designs General JournalDokument19 SeitenPioneer Designs General JournalKim SeokjinNoch keine Bewertungen

- Record of Actual Delivery Handled: Professional Regulation Commission ManilaDokument4 SeitenRecord of Actual Delivery Handled: Professional Regulation Commission ManilaMykel Jake Vasquez100% (1)

- IBP Journal Nov 2017Dokument48 SeitenIBP Journal Nov 2017qasimNoch keine Bewertungen

- Returning Students - How To Make School Fees Payment Via InterswitchDokument9 SeitenReturning Students - How To Make School Fees Payment Via InterswitchBolaji AwokiyesiNoch keine Bewertungen

- FTPartnersResearch InsuranceTechnologyTrendsDokument248 SeitenFTPartnersResearch InsuranceTechnologyTrendsmeNoch keine Bewertungen

- SalimDokument51 SeitenSalimMuhammed Salim vNoch keine Bewertungen

- List of Relevant Master Circulars - 5Dokument4 SeitenList of Relevant Master Circulars - 5booksanand1Noch keine Bewertungen

- Supply Chain Management PepsiDokument25 SeitenSupply Chain Management PepsiNaga NagendraNoch keine Bewertungen

- MODULE 4: REPORTED SPEECH AND TRAVEL VOCABULARYDokument3 SeitenMODULE 4: REPORTED SPEECH AND TRAVEL VOCABULARYD GNoch keine Bewertungen

- Test Ii AccountsDokument17 SeitenTest Ii AccountsDhrisha GadaNoch keine Bewertungen

- Ms Mbaruku Mfaume 1252Dokument3 SeitenMs Mbaruku Mfaume 1252Mbaruku FerejiNoch keine Bewertungen

- Modems in Data CommunicationDokument38 SeitenModems in Data CommunicationsumantanwarNoch keine Bewertungen

- Cargo 82Dokument19 SeitenCargo 82api-515904890Noch keine Bewertungen

- Auditing Concepts PSA Based QuestionsDokument560 SeitenAuditing Concepts PSA Based QuestionsNir Noel Aquino100% (12)

- Service Provider Network Design and Architecture Perspective Book - 5ddf8620031b8Dokument307 SeitenService Provider Network Design and Architecture Perspective Book - 5ddf8620031b8Omar ZeyadNoch keine Bewertungen

- Short NotesDokument20 SeitenShort NotesMd AlimNoch keine Bewertungen

- DAP-2660 A1 Manual v1.03 (WW)Dokument89 SeitenDAP-2660 A1 Manual v1.03 (WW)ggcbroNoch keine Bewertungen

- Ziqitza HealthCare LTD Launches 108 ServiceDokument2 SeitenZiqitza HealthCare LTD Launches 108 ServiceZiqitza Health CareNoch keine Bewertungen