Beruflich Dokumente

Kultur Dokumente

Earningsoption Scenario Wba Us 01072016

Hochgeladen von

julienmessias2Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Earningsoption Scenario Wba Us 01072016

Hochgeladen von

julienmessias2Copyright:

Verfügbare Formate

In Progress...

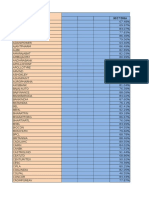

Probability

Cum. Prob

81

0

0

Maturity/Scenario

08/07/2016

15/07/2016

22/07/2016

29/07/2016

05/08/2016

12/08/2016

81.5

0

0

81

-68%

-50%

-41%

-35%

-25%

-28%

81.5

-79%

-57%

-47%

-40%

-29%

-30%

82

5%

0.05

82

-86%

-63%

-52%

-43%

-31%

-32%

82.5

10%

0.15

82.5

-91%

-68%

-55%

-46%

-33%

-33%

83

83.5

84

84.5

15%

25%

25%

10%

0.3

0.55

0.8

0.9

Strangle Put 81 Call 86

85

5%

0.95

83

-94%

-70%

-57%

-47%

-34%

-34%

85

-85%

-61%

-50%

-41%

-29%

-30%

83.5

-95%

-71%

-57%

-47%

-34%

-34%

84

-94%

-69%

-56%

-46%

-33%

-33%

84.5

-90%

-66%

-54%

-44%

-32%

-32%

85.5

5%

1

85.5

-77%

-55%

-45%

-37%

-26%

-27%

86

0

1

1

OK

86

-67%

-47%

-38%

-32%

-21%

-24%

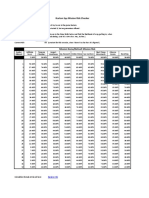

WALGREENS BOOTS ALLIANCE INC

WBA US

83.3

Spot basis (round)

Expectation

-91.8%

-67.9%

-55.2%

-45.5%

-32.8%

-33.0%

Dates

08/07/2016

15/07/2016

22/07/2016

TS bef.

40.6%

33.5%

29.9%

TS aft.

22.6%

22.5%

21.7%

Earnings Release Paris Time:

Management Call Paris Time:

81.5

82

82.5

83

83.5

06/07/2016

FOR US STOCKS

Calls

81

13:00

14:30:00

29/07/2016

28.1%

21.6%

We assume sticky moneyness.

julien.messias@uncia-am.com

05/08/2016

28.0%

23.0%

Summary as of

01/07/2016

12/08/2016

27.7%

23.6%

We price the options as if we were just before earnings release.

The earnings date must be before the first option maturity date

OK

Fill in the yellow cells

According to ATM volatilities, assuming a flat Term Structure, formula for implied earnings move is:

Minimum premium is set up at 0.02

Expected move - act

5.58%

83.5

Strike Step (+-)

0.5

Strikes Strangle

81

86

Puts

RETURN OPTIONS MATU 08-07-2016. Vol swings from 40.6 to 22.6. Spot at 83.5

Strike/Spot

06/07/2016

06/07/2016

84

84.5

85

RETURN OPTIONS MATU 08-07-2016. Vol swings from 40.6 to 22.6. Spot at 83.5

85.5

86 Expectation Strike/Spot

84

84.5

85

85.5

86

81

81

-44%

-62%

-76%

-86%

-92%

-96%

-98%

-99%

-100%

-100%

-100%

-94%

81.5

81.5

-30%

-50%

-67%

-79%

-87%

-93%

-96%

-98%

-99%

-100%

-100%

-91%

82

82

-16%

-38%

-56%

-70%

-81%

-89%

-93%

-96%

-98%

-99%

-100%

-87%

82.5

82.5

-3%

-25%

-45%

-61%

-74%

-83%

-90%

-94%

-97%

-98%

-99%

-82%

83

83

8%

-14%

-34%

-51%

-65%

-76%

-85%

-91%

-95%

-97%

-99%

-75%

17%

-4%

-23%

-41%

-56%

-69%

-79%

-86%

-92%

-95%

-97%

-68%

81

81.5

83.5

-97%

-95%

-91%

-85%

-76%

-65%

-50%

-33%

-13%

9%

32%

-57%

83.5

84

-98%

-97%

-94%

-89%

-82%

-72%

-59%

-42%

-22%

0%

25%

-64%

84

84.5

-99%

-98%

-96%

-93%

-88%

-80%

-68%

-53%

-34%

-11%

16%

-72%

84.5

85

-100%

-99%

-98%

-96%

-92%

-85%

-76%

-62%

-44%

-22%

5%

-78%

85

85.5

-100%

-99%

-99%

-97%

-95%

-90%

-83%

-72%

-57%

-37%

-11%

-84%

85.5

-100% -100%

-99%

-99%

-97%

-94%

-88%

-80%

-66%

-48%

-24%

-89%

86

86

81

81.5

82

82.5

83

83.5

RETURN OPTIONS MATU 15-07-2016. Vol swings from 33.5 to 22.5. Spot at 83.5

Strike/Spot

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

Expectation

RETURN OPTIONS MATU 15-07-2016. Vol swings from 33.5 to 22.5. Spot at 83.5

86 Expectation Strike/Spot

82

82.5

83

83.5

84

84.5

85

85.5

86

81

81

-13%

-30%

-44%

-56%

-66%

-74%

-81%

-86%

-90%

-93%

-95%

-74%

81.5

81.5

-5%

-22%

-37%

-50%

-60%

-69%

-77%

-83%

-87%

-91%

-93%

-69%

82

82

1%

-15%

-30%

-44%

-55%

-65%

-73%

-79%

-84%

-88%

-92%

-65%

82.5

82.5

6%

-10%

-25%

-38%

-50%

-60%

-68%

-75%

-81%

-86%

-90%

-60%

83

83

14%

-2%

-17%

-31%

-43%

-54%

-63%

-71%

-77%

-83%

-87%

-55%

19%

3%

-12%

-25%

-37%

-48%

-58%

-66%

-73%

-79%

-84%

-50%

81

-4%

-2%

6%

11%

15%

18%

81.5

-19%

-16%

-9%

-4%

1%

5%

RETURN OPTIONS MATU 22-07-2016. Vol swings from 29.9 to 21.7. Spot at 83.5

82

82.5

83

83.5

84

84.5

85

-32%

-44%

-54% -62% -69%

-76%

-81%

-29%

-40%

-50% -59% -67%

-73%

-78%

-22%

-34%

-44% -54% -62%

-69%

-75%

-17%

-29%

-39% -49% -57%

-65%

-71%

-12%

-24%

-35% -45% -53%

-61%

-68%

-8%

-20%

-31% -40% -49%

-57%

-64%

85.5

-85%

-83%

-80%

-77%

-74%

-70%

86

-88%

-87%

-84%

-81%

-79%

-76%

Expectation

-63%

-60%

-55%

-50%

-46%

-42%

81

2%

7%

9%

13%

15%

9%

81.5

-11%

-7%

-4%

0%

3%

-2%

RETURN OPTIONS MATU 29-07-2016. Vol swings from 28.1 to 21.6. Spot at 83.5

82

82.5

83

83.5

84

84.5

85

-23%

-34%

-44% -53% -60%

-67%

-72%

-19%

-30%

-40% -48% -56%

-63%

-69%

-16%

-27%

-36% -45% -53%

-60%

-66%

-12%

-23%

-33% -42% -50%

-57%

-63%

-9%

-19%

-29% -38% -46%

-54%

-60%

-12%

-22%

-31% -39% -47%

-54%

-60%

85.5

-77%

-74%

-72%

-69%

-66%

-66%

86

-81%

-79%

-77%

-74%

-71%

-71%

Expectation

-53%

-49%

-46%

-43%

-40%

-41%

81

9%

12%

15%

18%

19%

4%

81.5

-3%

0%

3%

6%

8%

-6%

RETURN OPTIONS MATU 05-08-2016. Vol swings from 28 to 23. Spot at 83.5

82

82.5

83

83.5

84

84.5

85

-14%

-24%

-33% -41% -48%

-55%

-61%

-11%

-21%

-30% -38% -46%

-52%

-59%

-7%

-17%

-26% -35% -42%

-49%

-56%

-4%

-14%

-23% -32% -39%

-46%

-53%

-2%

-12%

-21% -29% -37%

-44%

-51%

-14%

-22%

-30% -37% -44%

-50%

-55%

85.5

-67%

-64%

-61%

-59%

-56%

-61%

86

-71%

-69%

-67%

-64%

-62%

-65%

Expectation

-42%

-39%

-36%

-33%

-31%

-38%

81

6%

-1%

5%

3%

15%

-7%

81.5

-4%

-11%

-4%

-6%

5%

-15%

RETURN OPTIONS MATU 12-08-2016. Vol swings from 27.7 to 23.6. Spot at 83.5

82

82.5

83

83.5

84

84.5

85

-14%

-22%

-31% -38% -45%

-51%

-57%

-19%

-27%

-34% -41% -47%

-53%

-58%

-13%

-21%

-29% -36% -42%

-49%

-54%

-14%

-22%

-29% -36% -42%

-48%

-54%

-4%

-12%

-20% -28% -35%

-41%

-47%

-22%

-28%

-35% -40% -46%

-51%

-56%

85.5

-62%

-63%

-59%

-59%

-53%

-60%

86

-66%

-68%

-64%

-63%

-58%

-64%

Expectation

-39%

-42%

-37%

-37%

-29%

-42%

83.5

-84%

-78%

-71%

-63%

-54%

-43%

-30%

-17%

-1%

15%

33%

-37%

83.5

84

-86%

-81%

-75%

-67%

-58%

-48%

-35%

-21%

-6%

11%

30%

-42%

84

-88% -84% -78% -71% -63% -52% -40%

-26%

-10%

7%

-90% -87% -81% -75% -67% -57% -45%

-31%

-15%

3%

-92% -89% -84% -78% -71% -62% -50%

-37%

-21%

-2%

-94% -91% -87% -82% -75% -66% -56%

-43%

-27%

-9%

RETURN OPTIONS MATU 22-07-2016. Vol swings from 29.9 to 21.7. Spot at 83.5

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

27%

23%

18%

12%

-46%

-51%

-55%

-60%

84.5

85

85.5

86

84.5

85

85.5

86

Strike/Spot

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

Strike/Spot

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

Strike/Spot

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

Strike/Spot

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

-75% -69% -62% -54% -45% -35% -24%

-12%

1%

15%

-78% -72% -65% -57% -49% -39% -27%

-15%

-1%

13%

-81% -76% -70% -62% -54% -45% -34%

-22%

-9%

6%

-82% -77% -71% -63% -55% -45% -34%

-21%

-7%

9%

-84% -79% -74% -67% -58% -49% -37%

-25%

-10%

6%

-86% -81% -76% -69% -61% -52% -41%

-28%

-13%

3%

RETURN OPTIONS MATU 29-07-2016. Vol swings from 28.1 to 21.6. Spot at 83.5

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

-69% -63% -57% -49% -41% -32% -22%

-11%

0%

-70% -64% -58% -50% -41% -32% -22%

-10%

2%

-73% -68% -61% -54% -46% -37% -27%

-15%

-3%

-75% -69% -62% -55% -47% -37% -26%

-15%

-2%

-77% -71% -65% -58% -49% -40% -29%

-17%

-4%

-78% -73% -66% -59% -51% -41% -30%

-18%

-4%

RETURN OPTIONS MATU 05-08-2016. Vol swings from 28 to 23. Spot at 83.5

81

81.5

82

82.5

83

83.5

84

84.5

85

12%

15%

10%

12%

10%

10%

85.5

-58% -52% -45% -37% -29% -20% -11%

-1%

10%

22%

-60% -53% -46% -39% -30% -21% -11%

-1%

10%

22%

-61% -55% -48% -40% -32% -23% -13%

-2%

9%

22%

-63% -57% -50% -42% -34% -25% -14%

-3%

8%

21%

-65% -59% -52% -44% -35% -26% -15%

-4%

8%

21%

-66% -60% -53% -45% -36% -26% -15%

-4%

9%

23%

RETURN OPTIONS MATU 12-08-2016. Vol swings from 27.7 to 23.6. Spot at 83.5

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

-58%

-56%

-59%

-55%

-58%

-64%

-52%

-50%

-53%

-49%

-52%

-58%

-46%

-43%

-47%

-42%

-45%

-52%

-40%

-36%

-40%

-34%

-37%

-45%

-33%

-29%

-33%

-26%

-29%

-38%

-26%

-21%

-25%

-17%

-20%

-30%

-18%

-12%

-17%

-7%

-10%

-21%

-10%

-3%

-8%

3%

0%

-12%

-1%

7%

2%

14%

11%

-1%

8%

17%

12%

26%

23%

10%

86 Expectation Strike/Spot

30%

29%

21%

26%

23%

22%

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

-31%

-34%

-40%

-40%

-43%

-46%

86 Expectation Strike/Spot

25%

29%

24%

27%

25%

27%

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

-28%

-28%

-32%

-32%

-35%

-36%

86 Expectation Strike/Spot

33%

34%

35%

34%

35%

38%

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

-16%

-17%

-19%

-20%

-22%

-22%

86 Expectation Strike/Spot

18%

28%

22%

39%

36%

21%

81

81.5

82

82.5

83

83.5

84

84.5

85

85.5

86

-23%

-18%

-22%

-13%

-16%

-26%

ATM TS before (blue) / after (orange)

Expectation

Historical Distribution of Earnings Moves (10 yrs histo) - in red, estimate of abs value for next earnings

45%

20%

40%

15%

35%

-2%

30%

10%

25%

20%

5%

15%

10%

04/07/2016

0%

09/07/2016

14/07/2016

19/07/2016

24/07/2016

29/07/2016

03/08/2016

08/08/2016

13/08/2016

18/08/2016

-20% -18% -16% -14% -12% -10% -8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

>0.2

Das könnte Ihnen auch gefallen

- Netflix Earnings 18042016Dokument1 SeiteNetflix Earnings 18042016julienmessias2Noch keine Bewertungen

- Tabela de Conversao de DoseDokument3 SeitenTabela de Conversao de DoseJulia VogelNoch keine Bewertungen

- Introduccion Al Uso de MacrosDokument5 SeitenIntroduccion Al Uso de MacrosGabriela ANoch keine Bewertungen

- The XL Academy Excel Percentage Data AnalysisDokument7 SeitenThe XL Academy Excel Percentage Data AnalysisROHIT SAININoch keine Bewertungen

- Dec 9 MonWed GradesDokument3 SeitenDec 9 MonWed GradescsschwarNoch keine Bewertungen

- Lesson 02Dokument34 SeitenLesson 02ROHIT SAININoch keine Bewertungen

- Dec 8 MonWed GradesDokument3 SeitenDec 8 MonWed GradescsschwarNoch keine Bewertungen

- Tabelas de Coeficientes de Depreciacao Ross HeideckeDokument2 SeitenTabelas de Coeficientes de Depreciacao Ross HeideckeMauricio CastroNoch keine Bewertungen

- Dec 15 MonWed GradesDokument4 SeitenDec 15 MonWed GradescsschwarNoch keine Bewertungen

- Red Line Oil Mix ChartDokument1 SeiteRed Line Oil Mix ChartturboguzziNoch keine Bewertungen

- Dec 13 MonWed GradesDokument3 SeitenDec 13 MonWed GradescsschwarNoch keine Bewertungen

- Simulação ChancesDokument76 SeitenSimulação ChancesMarcos Vinícius BrumNoch keine Bewertungen

- 06 - Uas Pai - Ida Ayu Made Dwi PuspitaDokument7 Seiten06 - Uas Pai - Ida Ayu Made Dwi PuspitaGus TutNoch keine Bewertungen

- Ganancias y PerdidasDokument1 SeiteGanancias y PerdidasLuis Leonardo Llanos EscobarNoch keine Bewertungen

- Summary StatisticsDokument3 SeitenSummary StatisticsNguyenNoch keine Bewertungen

- Dec 10 MonWed GradesDokument3 SeitenDec 10 MonWed GradescsschwarNoch keine Bewertungen

- Copia de INFORME GENERAL VA. AGREGADO 2021 AL 07-04-2022Dokument70 SeitenCopia de INFORME GENERAL VA. AGREGADO 2021 AL 07-04-2022Kevin BohórquezNoch keine Bewertungen

- Tabela de Cálculo Ensino Fundamental I - 2022 - 3Dokument1 SeiteTabela de Cálculo Ensino Fundamental I - 2022 - 3Creche Municipal Maria Edite de Medeiros DantasNoch keine Bewertungen

- Scheda Regionali 2010 Riepilogo VecchianoDokument1 SeiteScheda Regionali 2010 Riepilogo VecchianoMovimento per la Salute, l'Ambiente e il TerritorioNoch keine Bewertungen

- Porcentaje de Ocupacion Hospitalaria 26 Junio 2023Dokument1 SeitePorcentaje de Ocupacion Hospitalaria 26 Junio 2023Ashley CastañedaNoch keine Bewertungen

- Easy Tasas OkDokument1 SeiteEasy Tasas OkclaudioNoch keine Bewertungen

- Conbloc Infratecno Proyek Jalan Tambang Pt. Borneo Indobara Tanah Bumbu - Kalimantan Selatan Data Curah Hujan Presentasi Jumlah Hari Hujan Dalam 1 BulanDokument1 SeiteConbloc Infratecno Proyek Jalan Tambang Pt. Borneo Indobara Tanah Bumbu - Kalimantan Selatan Data Curah Hujan Presentasi Jumlah Hari Hujan Dalam 1 BulanDaniel BryanNoch keine Bewertungen

- Inversion 6 EmpresasDokument12 SeitenInversion 6 EmpresasJassmin Atarama carreñoNoch keine Bewertungen

- Symbol Roll Over 10/27/2016Dokument32 SeitenSymbol Roll Over 10/27/2016Huge EarnNoch keine Bewertungen

- Pronosticos ResueltosDokument20 SeitenPronosticos ResueltosDanielMedinaMendozaNoch keine Bewertungen

- Ketepatan Pengembalian RM Rawat InapDokument4 SeitenKetepatan Pengembalian RM Rawat InapciptaningtyasNoch keine Bewertungen

- Silkolene Mix ChartDokument1 SeiteSilkolene Mix ChartOrlandoNoch keine Bewertungen

- Production Line Performance ReportDokument4 SeitenProduction Line Performance ReportDISEÑO DigitalNoch keine Bewertungen

- PercentualDokument10 SeitenPercentualGessinaldo BorbaNoch keine Bewertungen

- RP DBem RDokument112 SeitenRP DBem RGiadira Vasquez FollegatiNoch keine Bewertungen

- MSSP - Guaranteed Surrender Value Factors - tcm47-71735Dokument9 SeitenMSSP - Guaranteed Surrender Value Factors - tcm47-71735Sheetal KumariNoch keine Bewertungen

- TamizDokument3 SeitenTamizDavid VegasNoch keine Bewertungen

- Chemical AppendixDokument29 SeitenChemical AppendixArjunNoch keine Bewertungen

- Dec 15 TuesThurs GradesDokument7 SeitenDec 15 TuesThurs GradescsschwarNoch keine Bewertungen

- Analysis of December 2019 performanceDokument1 SeiteAnalysis of December 2019 performanceLuis CastilloNoch keine Bewertungen

- Simple Iterative AttacksDokument5 SeitenSimple Iterative Attackskevin_sueNoch keine Bewertungen

- Análisis Esp 2017 ZONA 04Dokument8 SeitenAnálisis Esp 2017 ZONA 04Edgar AlcántaraNoch keine Bewertungen

- Sucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronDokument9 SeitenSucursal Ruta Seguimiento Datos Iniciales Escaneo Compra Vs PronjoseNoch keine Bewertungen

- Normal ProbabilitiDokument4 SeitenNormal ProbabilitiОлег ЯрошNoch keine Bewertungen

- Test-2 Test-3 Test-4 Initiating Planning Execution M&C Closing TotalDokument2 SeitenTest-2 Test-3 Test-4 Initiating Planning Execution M&C Closing TotalPrashant TewariNoch keine Bewertungen

- IDELA assessment scores for early childhood developmentDokument3 SeitenIDELA assessment scores for early childhood developmentPreetika SainiNoch keine Bewertungen

- OMS Head Circumference Percentiles Calculator for Infant AgeDokument1 SeiteOMS Head Circumference Percentiles Calculator for Infant AgeSolhana MendietaNoch keine Bewertungen

- General: NAM AdidasDokument2 SeitenGeneral: NAM Adidasluis wilbertNoch keine Bewertungen

- Dec 10 TuesThurs GradesDokument6 SeitenDec 10 TuesThurs GradescsschwarNoch keine Bewertungen

- Cumulative Figures: Figures Are For A 60 Period DurationDokument10 SeitenCumulative Figures: Figures Are For A 60 Period Durationrajkamal eshwarNoch keine Bewertungen

- Dec 12 Tues ThursDokument5 SeitenDec 12 Tues ThurscsschwarNoch keine Bewertungen

- BANANADokument3 SeitenBANANADiego ParedesNoch keine Bewertungen

- Spy Table Calc-IkariamDokument3 SeitenSpy Table Calc-IkariamcjipescuNoch keine Bewertungen

- Sample in MPS-subjectDokument9 SeitenSample in MPS-subjectRubilen Papasin SatinitiganNoch keine Bewertungen

- Analisa Kehadiran 2018Dokument25 SeitenAnalisa Kehadiran 2018Mash NkhanNoch keine Bewertungen

- PrakashDokument9 SeitenPrakashjagadeeshdk3853Noch keine Bewertungen

- Taux D'Occupation Des Residences de Tourisme Par Zone: Nouvelles ZonesDokument5 SeitenTaux D'Occupation Des Residences de Tourisme Par Zone: Nouvelles ZonespaulieNoch keine Bewertungen

- Damage Reduction Stats by Defense LevelDokument14 SeitenDamage Reduction Stats by Defense LevelianharNoch keine Bewertungen

- GAMA2Dokument1 SeiteGAMA2rakotondrahantafiniavanaNoch keine Bewertungen

- Libro3 - ESTADISTICADokument51 SeitenLibro3 - ESTADISTICAMaira LozanoNoch keine Bewertungen

- Libro3 - ESTADISTICADokument51 SeitenLibro3 - ESTADISTICAMaira LozanoNoch keine Bewertungen

- 6974 01 Small Business Powerpoint Deck 16x9Dokument20 Seiten6974 01 Small Business Powerpoint Deck 16x9vijaya bhanuNoch keine Bewertungen

- Book 1Dokument1 SeiteBook 1AraaNoch keine Bewertungen

- Comparing power consumption of air compressor controls at varying capacitiesDokument8 SeitenComparing power consumption of air compressor controls at varying capacitiesJuan Miguel Castro VargasNoch keine Bewertungen

- US Small CapsDokument13 SeitenUS Small Capsjulienmessias2Noch keine Bewertungen

- We Have 4 Random VariablesDokument2 SeitenWe Have 4 Random Variablesjulienmessias2Noch keine Bewertungen

- UnciaSmartPremia Weekly22072016Dokument2 SeitenUnciaSmartPremia Weekly22072016julienmessias2Noch keine Bewertungen

- PEAD Momentum 29012016Dokument6 SeitenPEAD Momentum 29012016julienmessias2Noch keine Bewertungen

- RiskPremia SmartEarnings 20052016Dokument6 SeitenRiskPremia SmartEarnings 20052016julienmessias2Noch keine Bewertungen

- Smart Earnings & Equity Risk PremiaDokument3 SeitenSmart Earnings & Equity Risk Premiajulienmessias2100% (1)

- Earningsoption Scenario NFLX Us 09102015Dokument1 SeiteEarningsoption Scenario NFLX Us 09102015julienmessias2Noch keine Bewertungen

- PEAD Momentum 29012016Dokument6 SeitenPEAD Momentum 29012016julienmessias2Noch keine Bewertungen

- PEAD Momentum 22012016Dokument6 SeitenPEAD Momentum 22012016julienmessias2Noch keine Bewertungen

- SPX Skew Steepness - Follow UpDokument7 SeitenSPX Skew Steepness - Follow Upjulienmessias2Noch keine Bewertungen

- How To Properly Price Earnings Implied Moves?Dokument3 SeitenHow To Properly Price Earnings Implied Moves?julienmessias2Noch keine Bewertungen

- Dispersion Trading: Many ApplicationsDokument6 SeitenDispersion Trading: Many Applicationsjulienmessias2100% (2)

- Why We Do Need To Actively Manage An Equity Portfolio During Earning Releases PeriodDokument5 SeitenWhy We Do Need To Actively Manage An Equity Portfolio During Earning Releases Periodjulienmessias2Noch keine Bewertungen

- PEAD PPT Confidentiel-SummaryDokument3 SeitenPEAD PPT Confidentiel-Summaryjulienmessias2Noch keine Bewertungen

- Business CrosswordDokument1 SeiteBusiness CrosswordJHON PAEZNoch keine Bewertungen

- Practical Project Execution Alloy Wheels Manufacturing PlantDokument5 SeitenPractical Project Execution Alloy Wheels Manufacturing PlantSanjay KumarNoch keine Bewertungen

- 2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Dokument37 Seiten2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Chíi KiệttNoch keine Bewertungen

- DO 19-93 (Construction Industry)Dokument6 SeitenDO 19-93 (Construction Industry)Sara Dela Cruz AvillonNoch keine Bewertungen

- PARTNERSHIP ACCOUNTING EXAM REVIEWDokument26 SeitenPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- Advertising Effectiveness of Coca ColaDokument28 SeitenAdvertising Effectiveness of Coca Colar01852009paNoch keine Bewertungen

- How Competitive Forces Shape StrategyDokument11 SeitenHow Competitive Forces Shape StrategyErwinsyah RusliNoch keine Bewertungen

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Dokument10 SeitenCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNoch keine Bewertungen

- Aadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaDokument1 SeiteAadfi Rates BDC Amongst The Best Performing African Development Finance Institutions in AfricaLesego MoabiNoch keine Bewertungen

- Marketing Executive AssignmentDokument4 SeitenMarketing Executive AssignmentVinayak PandlaNoch keine Bewertungen

- Financial InstrumentsDokument3 SeitenFinancial InstrumentsGeeta LalwaniNoch keine Bewertungen

- Tally 9.ERP - The complete guide to accounting featuresDokument7 SeitenTally 9.ERP - The complete guide to accounting featuresRAKESH MESHRAMNoch keine Bewertungen

- Why Renting Is Better Than BuyingDokument4 SeitenWhy Renting Is Better Than BuyingMonali MathurNoch keine Bewertungen

- Question Bank1Dokument357 SeitenQuestion Bank1xerxesNoch keine Bewertungen

- Week 2 QuestionsDokument2 SeitenWeek 2 Questionskailu sunNoch keine Bewertungen

- Experienced Sales and Marketing Professional Seeking New OpportunitiesDokument2 SeitenExperienced Sales and Marketing Professional Seeking New OpportunitiesAshwini KumarNoch keine Bewertungen

- Tax Invoice Details for Mobile Phone PurchaseDokument1 SeiteTax Invoice Details for Mobile Phone PurchaseNiraj kumarNoch keine Bewertungen

- Interim and Continuous AuditDokument4 SeitenInterim and Continuous AuditTUSHER147Noch keine Bewertungen

- Assignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Dokument3 SeitenAssignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Giselle MartinezNoch keine Bewertungen

- Managing Organizational Change at Campbell and Bailyn's Boston OfficeDokument12 SeitenManaging Organizational Change at Campbell and Bailyn's Boston OfficeBorne KillereNoch keine Bewertungen

- Standard Notes To Form No. 3CD (Revised 2019) CleanDokument8 SeitenStandard Notes To Form No. 3CD (Revised 2019) CleanRahul LaddhaNoch keine Bewertungen

- Concentrate Business Vs Bottling BusinessDokument3 SeitenConcentrate Business Vs Bottling BusinessShivani BansalNoch keine Bewertungen

- Ind As 16Dokument41 SeitenInd As 16Vidhi AgarwalNoch keine Bewertungen

- NMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYDokument46 SeitenNMIMS TRIMESTER VI - BRAND MANAGEMENT HISTORYPayal AroraNoch keine Bewertungen

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeDokument1 SeitePrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneNoch keine Bewertungen

- Medanit Sisay Tesfaye PDF Th...Dokument71 SeitenMedanit Sisay Tesfaye PDF Th...Tesfahun GetachewNoch keine Bewertungen

- International Marketing Strategic AlliancesDokument37 SeitenInternational Marketing Strategic AlliancesMohammed Kh DerballaNoch keine Bewertungen

- Form A2: AnnexDokument8 SeitenForm A2: Annexi dint knowNoch keine Bewertungen

- Accounting Cycle Work SheetDokument32 SeitenAccounting Cycle Work SheetAbinash MishraNoch keine Bewertungen

- Group 12 - Gender and Diversity - RITTER SPORT BIODokument40 SeitenGroup 12 - Gender and Diversity - RITTER SPORT BIOIsabel HillenbrandNoch keine Bewertungen