Beruflich Dokumente

Kultur Dokumente

Discounted Cash Flow - Wikipedia

Hochgeladen von

puput075Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Discounted Cash Flow - Wikipedia

Hochgeladen von

puput075Copyright:

Verfügbare Formate

Discounted cash flow - Wikipedia, the free encyclopedia

1 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

From Wikipedia, the free encyclopedia

In finance, the discounted cash flow (DCF) approach describes a method

of valuing a project, company, or asset using the concepts of the time value

of money. All future cash flows are estimated and discounted to give their

present values. The discount rate used is generally the appropriate

Weighted average cost of capital (WACC), that reflects the risk of the

cashflows. The discount rate reflects two things:

1. the time value of money (risk-free rate) - investors would rather have

cash immediately than having to wait and must therefore be compensated

by paying for the delay.

2. a risk premium (risk premium rate) - reflects the extra return investors

demand because they want to be compensated for the risk that the cash

flow might not materialize after all.

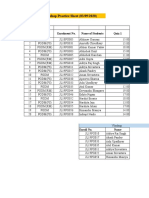

Excel spreadsheet uses Free

cash flows to estimate stock's

Fair Value and measure the

sensibility of WACC and

Perpetual growth

Discounted cash flow analysis is widely used in investment finance, real estate development, and corporate

financial management.

Very similar is the net present value.

1 History

2 Mathematics

2.1 Discrete cash flows

2.2 Continuous cash flows

3 Example DCF

4 Methods of appraisal of a company or project

5 History

6 See also

7 References

8 External links

9 Further reading

In 1938, John Burr Williams was the first to formally articulate the DCF method in a working paper released

with the title "The Theory of Investment Value".

Discrete cash flows

12/15/2009 12:12 PM

Discounted cash flow - Wikipedia, the free encyclopedia

2 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

The discounted cash flow formula is derived from the future value formula for calculating the time value of

money and compounding returns.

Thus the discounted present value (for one cash flow in one future period) is expressed as:

where

DPV is the discounted present value of the future cash flow (FV), or FV adjusted for the delay in

receipt;

FV is the nominal value of a cash flow amount in a future period;

i is the interest rate, which reflects the cost of tying up capital and may also allow for the risk that the

payment may not be received in full;

d is the discount rate, which is i/(1+i), ie the interest rate expressed as a deduction at the beginning of

the year instead of an addition at the end of the year;

n is the time in years before the future cash flow occurs.

Where multiple cash flows in multiple time periods are discounted, it is necessary to sum them as follows:

for each future cash flow (FV) at any time period (t) in years from the present time, summed over all time

periods. The sum can then be used as a net present value figure. If the amount to be paid at time 0 (now) for

all the future cash flows is known, then that amount can be substituted for DPV and the equation can be

solved for i, that is the internal rate of return.

All the above assumes that the interest rate remains constant throughout the whole period.

Continuous cash flows

For continuous cash flows, the summation in the above formula is replaced by an integration:

where FV(t) is now the rate of cash flow, and = log(1+i).

To show how discounted cash flow analysis is performed, consider the following simplified example.

John Doe buys a house for $100,000. Three years later, he expects to be able to sell this house for

$150,000.

Simple subtraction suggests that the value of his profit on such a transaction would be $150,000 $100,000

= $50,000, or 50%. If that $50,000 is amortized over the three years, his implied annual return (known as the

internal rate of return) would be about 14.5%. Looking at those figures, he might be justified in thinking that

the purchase looked like a good idea.

12/15/2009 12:12 PM

Discounted cash flow - Wikipedia, the free encyclopedia

3 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

1.1453 x 100000 = 150000 approximately.

However, since three years have passed between the purchase and the sale, any cash flow from the sale must

be discounted accordingly. At the time John Doe buys the house, the 3-year US Treasury Note rate is 5% per

annum. Treasury Notes are generally considered to be inherently less risky than real estate, since the value

of the Note is guaranteed by the US Government and there is a liquid market for the purchase and sale of

T-Notes. If he hadn't put his money into buying the house, he could have invested it in the relatively safe

T-Notes instead. This 5% per annum can therefore be regarded as the risk-free interest rate for the relevant

period (3 years).

Using the DPV formula above, that means that the value of $150,000 received in three years actually has a

present value of $129,576 (rounded off). Those future dollars aren't worth the same as the dollars we have

now.

Subtracting the purchase price of the house ($100,000) from the present value results in the net present

value of the whole transaction, which would be $29,576 or a little more than 29% of the purchase price.

Another way of looking at the deal as the excess return achieved (over the risk-free rate) is

(14.5%-5.0%)/(100%+5%) or approximately 9.0% (still very respectable). (As a check, 1.050 x 1.090 =

1.145 approximately.)

But what about risk?

We assume that the $150,000 is John's best estimate of the sale price that he will be able to achieve in 3

years time (after deducting all expenses, of course). There is of course a lot of uncertainty about house

prices, and the outturn may end up higher or lower than this estimate.

(The house John is buying is in a "good neighborhood", but market values have been rising quite a lot lately

and the real estate market analysts in the media are talking about a slow-down and higher interest rates.

There is a probability that John might not be able to get the full $150,000 he is expecting in three years due

to a slowing of price appreciation, or that loss of liquidity in the real estate market might make it very hard

for him to sell at all.)

Under normal circumstances, people entering into such transactions are risk-averse, that is to say that they

are prepared to accept a lower expected return for the sake of avoiding risk. See Capital asset pricing model

for a further discussion of this. For the sake of the example (and this is a gross simplification), let's assume

that he values this particular risk at 5% per annum (we could perform a more precise probabilistic analysis of

the risk, but that is beyond the scope of this article). Therefore, allowing for this risk, his expected return is

now 9.0% per annum (the arithmetic is the same as above).

And the excess return over the risk-free rate is now (9.0%-5.0%)/(100% + 5%) which comes to

approximately 3.8% per annum.

That return rate may seem low, but it is still positive after all of our discounting, suggesting that the

investment decision is probably a good one: it produces enough profit to compensate for tying up capital and

incurring risk with a little extra left over. When investors and managers perform DCF analysis, the important

thing is that the net present value of the decision after discounting all future cash flows at least be positive

(more than zero). If it is negative, that means that the investment decision would actually lose money even if

it appears to generate a nominal profit. For instance, if the expected sale price of John Doe's house in the

example above was not $150,000 in three years, but $130,000 in three years or $150,000 in five years, then

on the above assumptions buying the house would actually cause John to lose money in present-value terms

(about $3,000 in the first case, and about $8,000 in the second). Similarly, if the house was located in an

undesirable neighborhood and the Federal Reserve Bank was about to raise interest rates by five percentage

points, then the risk factor would be a lot higher than 5%: it might not be possible for him to make a profit in

12/15/2009 12:12 PM

Discounted cash flow - Wikipedia, the free encyclopedia

4 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

discounted terms even if he could sell the house for $200,000 in three years.

In this example, only one future cash flow was considered. For a decision which generates multiple cash

flows in multiple time periods, all the cash flows must be discounted and then summed into a single net

present value.

This is necessarily a simple treatment of a complex subject: more detail is beyond the scope of this article.

For these valuation purposes, a number of different DCF methods are distinguished today, some of which are

outlined below. The details are likely to vary depending on the capital structure of the company. However

the assumptions used in the appraisal (especially the equity discount rate and the projection of the cash flows

to be achieved) are likely to be at least as important as the precise model used.

Both the income stream selected and the associated cost of capital model determine the valuation result

obtained with each method. This is one reason these valuation methods are formally referred to as the

Discounted Future Economic Income methods.

Equity-Approach

Flows to equity approach (FTE)

Discount the cash flows available to the holders of equity capital, after allowing for cost of servicing debt

capital

Advantages: Makes explicit allowance for the cost of debt capital

Disadvantages: Requires judgement on choice of discount rate

Entity-Approach:

Adjusted present value approach (APV)

Discount the cash flows before allowing for the debt capital (but allowing for the tax relief obtained on the

debt capital)

Advantages: Simpler to apply if a specific project is being valued which does not have earmarked debt

capital finance

Disadvantages: Requires judgement on choice of discount rate; no explicit allowance for cost of debt capital,

which may be much higher than a "risk-free" rate

Weighted average cost of capital approach (WACC)

Derive a weighted cost of the capital obtained from the various sources and use that discount rate to

discount the cash flows from the project

Advantages: Overcomes the requirement for debt capital finance to be earmarked to particular projects

Disadvantages: Care must be exercised in the selection of the appropriate income stream. The net cash flow

to total invested capital is the generally accepted choice.

Total cash flow approach (TCF)

This distinction illustrates that the Discounted Cash Flow method can be used to determine the value of

various business ownership interests. These can include equity or debt holders.

12/15/2009 12:12 PM

Discounted cash flow - Wikipedia, the free encyclopedia

5 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

Alternatively, the method can be used to value the company based on the value of total invested capital. In

each case, the differences lie in the choice of the income stream and discount rate. For example, the net cash

flow to total invested capital and WACC are appropriate when valuing a company based on the market

value of all invested capital.[1]

Discounted cash flow calculations have been used in some form since money was first lent at interest in

ancient times. As a method of asset valuation it has often been opposed to accounting book value, which is

based on the amount paid for the asset. Following the stock market crash of 1929, discounted cash flow

analysis gained popularity as a valuation method for stocks. Irving Fisher in his 1930 book "The Theory of

Interest" and John Burr Williams's 1938 text 'The Theory of Investment Value' first formally expressed the

DCF method in modern economic terms.

Adjusted present value

Capital asset pricing model

Capital budgeting

Cost of capital

Economic value added

Enterprise value

Internal rate of return

Free cash flow

Financial modeling

Flows to equity

Market value added

Weighted average cost of capital

Net present value

Valuation using discounted cash flows

Time value of money

1. ^ Pratt, Shannon; Robert F. Reilly, Robert P. Schweihs (2000). Valuing a Business (http://books.google.com

/books?id=WO6wd8O8dsUC&printsec=frontcover&dq=shannon+pratt&ei=fcfUR6q-F4TCyQSrxfWABA&

sig=Fpqt8pGRjbLPZJ9e_QEQGFzQ7y0#PPA913,M1) . McGraw-Hill Professional. McGraw Hill. ISBN

0071356150. http://books.google.com/books?id=WO6wd8O8dsUC&printsec=frontcover&dq=shannon+pratt&

ei=fcfUR6q-F4TCyQSrxfWABA&sig=Fpqt8pGRjbLPZJ9e_QEQGFzQ7y0#PPA913,M1.

Continuous compounding/cash flows (http://ocw.mit.edu/NR/rdonlyres/Nuclear-Engineering

/22-812JSpring2004/67B1788B-6ADC-45A6-B85A-54D13B2F537F/0/lec03slides.pdf)

The Theory of Interest (http://www.econlib.org/library/YPDBooks/Fisher/fshToI.html) at the Library

of Economics and Liberty.

Monography about DCF (including some lectures on DCF) (http://www.wacc.biz) . Wacc.biz

Foolish Use of DCF (http://www.fool.com/news/commentary/2005/commentary05032803.htm) .

Motley Fool.

Getting Started With Discounted Cash Flows (http://www.thestreet.com/university/personalfinance

/10385275.html) . The Street.

International Good Practice: Guidance on Project Appraisal Using Discounted Cash Flow

(http://www.ifac.org/Members/DownLoads/Project_Appraisal_Using_DCF_formatted.pdf) ,

International Federation of Accountants, June 2008, ISBN 978-1-934779-39-2

Equivalence between Discounted Cash Flow (DCF) and Residual Income (RI) (http://papers.ssrn.com

/sol3/papers.cfm?abstract_id=381880) Working paper; Duke University - Center for Health Policy,

Law and Management

12/15/2009 12:12 PM

Discounted cash flow - Wikipedia, the free encyclopedia

6 dari 6

http://en.wikipedia.org/wiki/Discounted_cash_flow

International Federation of Accountants (2007). Project Appraisal Using Discounted Cash Flow.

Copeland, Thomas E.; Tim Koller, Jack Murrin (2000). Valuation: Measuring and Managing the

Value of Companies. New York: John Wiley & Sons. ISBN 0-471-36190-9.

Damodaran, Aswath (1996). Investment Valuation: Tools and Techniques for Determining the Value

of Any Asset. New York: John Wiley & Sons. ISBN 0-471-13393-0.

Rosenbaum, Joshua; Joshua Pearl (2009). Investment Banking: Valuation, Leveraged Buyouts, and

Mergers & Acquisitions. Hoboken, NJ: John Wiley & Sons. ISBN 0-470-44220-4.

James R. Hitchnera (2006). Financial Valuation: Applications and Models. USA: Wiley Finance.

ISBN 0-471-76117-6.

Retrieved from "http://en.wikipedia.org/wiki/Discounted_cash_flow"

Categories: Basic financial concepts | Real estate | Cash flow

This page was last modified on 10 December 2009 at 01:43.

Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may

apply. See Terms of Use for details.

Wikipedia is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

Contact us

12/15/2009 12:12 PM

Das könnte Ihnen auch gefallen

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!Von EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Noch keine Bewertungen

- How To Use Bollinger Bands For Profit PDFDokument6 SeitenHow To Use Bollinger Bands For Profit PDFAalon Sheikh100% (1)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Time Value of MoneyDokument5 SeitenTime Value of MoneydeepeshmahajanNoch keine Bewertungen

- GR/IR (Goods Receipt / Invoice Receipt) ProcessingDokument3 SeitenGR/IR (Goods Receipt / Invoice Receipt) ProcessingamaravatiNoch keine Bewertungen

- Mathematical Indicators of Technical AnalysisDokument10 SeitenMathematical Indicators of Technical AnalysisMuhammad AsifNoch keine Bewertungen

- How Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Dokument28 SeitenHow Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Ishtiaq Ahmed82% (11)

- Amortization Schedule - WikipediaDokument8 SeitenAmortization Schedule - Wikipediapuput075100% (2)

- Determinants of Interest Rates (Revilla & Sanchez)Dokument12 SeitenDeterminants of Interest Rates (Revilla & Sanchez)Kearn CercadoNoch keine Bewertungen

- Discounted Cash FlowDokument6 SeitenDiscounted Cash Flowtipusemua100% (1)

- Trendlines and Channels-Draw A Manual Trend LineDokument3 SeitenTrendlines and Channels-Draw A Manual Trend LineAgus Empu Ranubayan100% (1)

- R05 Time Value of Money IFT Notes PDFDokument28 SeitenR05 Time Value of Money IFT Notes PDFAbbas0% (1)

- Investment, Time & Capital MarketsDokument62 SeitenInvestment, Time & Capital MarketsAkshay ModakNoch keine Bewertungen

- Yield To CallDokument16 SeitenYield To CallSushma MallapurNoch keine Bewertungen

- High-Q Financial Basics. Skills & Knowlwdge for Today's manVon EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manNoch keine Bewertungen

- Review of Basic Bond ValuationDokument6 SeitenReview of Basic Bond ValuationLawrence Geoffrey AbrahamNoch keine Bewertungen

- DCFDokument10 SeitenDCFSunilNoch keine Bewertungen

- Online Cheap Flights TicketDokument5 SeitenOnline Cheap Flights Ticketdiana wrightNoch keine Bewertungen

- Time Value of MoneyDokument18 SeitenTime Value of MoneyJunaid SubhaniNoch keine Bewertungen

- Discounted Cash Flow PDFDokument3 SeitenDiscounted Cash Flow PDFMehul ChauhanNoch keine Bewertungen

- Discounted Cash FlowDokument7 SeitenDiscounted Cash Flowvivekananda RoyNoch keine Bewertungen

- Present Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsDokument10 SeitenPresent Value The Current Worth of A Future Sum of Money or Stream of Cash FlowsPhamela Mae RicoNoch keine Bewertungen

- Financial - Management Book of Paramasivam and SubramaniamDokument21 SeitenFinancial - Management Book of Paramasivam and SubramaniamPandy PeriasamyNoch keine Bewertungen

- Corporate Finance Fundamentals GuideDokument223 SeitenCorporate Finance Fundamentals GuideSuraj PawarNoch keine Bewertungen

- Time Value of Money-2Dokument33 SeitenTime Value of Money-2Moe HanNoch keine Bewertungen

- Unit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDokument18 SeitenUnit - Vi Energy Economic Analysis: Energy Auditing & Demand Side ManagementDIVYA PRASOONA CNoch keine Bewertungen

- Residual Cash Flow - Final OneDokument47 SeitenResidual Cash Flow - Final OneRamneek SinghNoch keine Bewertungen

- Discounted Cash Flow DCFDokument10 SeitenDiscounted Cash Flow DCFSha RonNoch keine Bewertungen

- Chapter One 1 (MJ)Dokument5 SeitenChapter One 1 (MJ)leul habtamuNoch keine Bewertungen

- Money in The Present Is Worth More Than The Same Sum of Money To Be Received in The FutureDokument7 SeitenMoney in The Present Is Worth More Than The Same Sum of Money To Be Received in The FutureJohn JamesNoch keine Bewertungen

- Present Value 1Dokument7 SeitenPresent Value 1shotejNoch keine Bewertungen

- Task 17Dokument7 SeitenTask 17Medha SinghNoch keine Bewertungen

- Net Present Value - NPV: Capital BudgetingDokument4 SeitenNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- 304A Financial Management and Decision MakingDokument67 Seiten304A Financial Management and Decision MakingSam SamNoch keine Bewertungen

- Financial DecisionsDokument45 SeitenFinancial DecisionsLumumba KuyelaNoch keine Bewertungen

- Concept of Value and Return Question and AnswerDokument4 SeitenConcept of Value and Return Question and Answervinesh1515Noch keine Bewertungen

- Unit II Eng Economics PresentDokument28 SeitenUnit II Eng Economics PresentSudeep KumarNoch keine Bewertungen

- Ques No 1.briefly Explain and Illustrate The Concept of Time Value of MoneyDokument15 SeitenQues No 1.briefly Explain and Illustrate The Concept of Time Value of MoneyIstiaque AhmedNoch keine Bewertungen

- DHA-BHI-404 - Unit4 - Time Value of MoneyDokument17 SeitenDHA-BHI-404 - Unit4 - Time Value of MoneyFë LïçïäNoch keine Bewertungen

- Time Value of MoneyDokument38 SeitenTime Value of MoneydadplatinumNoch keine Bewertungen

- Discounting Is A Financial Mechanism in Which ADokument5 SeitenDiscounting Is A Financial Mechanism in Which Ashare_feelings1445Noch keine Bewertungen

- Notes Chapter-5: Future Value It Measures The Nominal Future Sum of Money That A Given Sum of Money IsDokument10 SeitenNotes Chapter-5: Future Value It Measures The Nominal Future Sum of Money That A Given Sum of Money IsFariya HossainNoch keine Bewertungen

- Chapter 3 Time Value of MoneyDokument80 SeitenChapter 3 Time Value of MoneyMary Nica BarceloNoch keine Bewertungen

- Lec02 SwayamDokument19 SeitenLec02 Swayamkushal srivastavaNoch keine Bewertungen

- Week 3: Lecture Slides: DCF - Earnings and Terminal Value Chapter 10 and 12Dokument21 SeitenWeek 3: Lecture Slides: DCF - Earnings and Terminal Value Chapter 10 and 12joannamanngoNoch keine Bewertungen

- Research Paper Time Value of Money 2Dokument11 SeitenResearch Paper Time Value of Money 2Nhung TaNoch keine Bewertungen

- Altar, Charles Ysrael T - (Final-Financial - Management)Dokument11 SeitenAltar, Charles Ysrael T - (Final-Financial - Management)Ysrael AltarNoch keine Bewertungen

- Discounted Cash Flow (DCF) Definition - InvestopediaDokument2 SeitenDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532Noch keine Bewertungen

- Present Value Concept ExplainedDokument10 SeitenPresent Value Concept ExplainedAamir KhanNoch keine Bewertungen

- Internal Rate of Return, DCF, NPVDokument4 SeitenInternal Rate of Return, DCF, NPVMihir AsherNoch keine Bewertungen

- Time Value of Money (TVM)Dokument7 SeitenTime Value of Money (TVM)Anonymous kVrZLA1RCWNoch keine Bewertungen

- Discounted Cash FloFVDSwDokument5 SeitenDiscounted Cash FloFVDSwEKANGNoch keine Bewertungen

- Discounted Cash FlowDokument5 SeitenDiscounted Cash FlowEKANGNoch keine Bewertungen

- Finance Over All PPT at Mba FinanceDokument116 SeitenFinance Over All PPT at Mba FinanceBabasab Patil (Karrisatte)Noch keine Bewertungen

- Capital Investment Analysis and Project Assessment: PurdueDokument12 SeitenCapital Investment Analysis and Project Assessment: PurdueFAKHAN88Noch keine Bewertungen

- Chapter 3 Time Value of MoneyDokument22 SeitenChapter 3 Time Value of MoneymedrekNoch keine Bewertungen

- Financial ManagementDokument3 SeitenFinancial ManagementVjay AbendaNoch keine Bewertungen

- 03 How To Calculate Present ValuesDokument15 Seiten03 How To Calculate Present Valuesddrechsler9Noch keine Bewertungen

- PVDokument38 SeitenPVPratheep GsNoch keine Bewertungen

- Engineering Cost Analysis: Charles V. Higbee Geo-Heat Center Klamath Falls, OR 97601Dokument48 SeitenEngineering Cost Analysis: Charles V. Higbee Geo-Heat Center Klamath Falls, OR 97601Kwaku SoloNoch keine Bewertungen

- PV PrimerDokument15 SeitenPV Primerveda20Noch keine Bewertungen

- Financial Management 6Dokument26 SeitenFinancial Management 6Zero OneNoch keine Bewertungen

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisVon EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNoch keine Bewertungen

- DCF Budgeting: A Step-By-Step Guide to Financial SuccessVon EverandDCF Budgeting: A Step-By-Step Guide to Financial SuccessNoch keine Bewertungen

- Internal Rate of Return - WikipediaDokument6 SeitenInternal Rate of Return - Wikipediapuput075Noch keine Bewertungen

- Financial Analysis - WikipediaDokument3 SeitenFinancial Analysis - Wikipediapuput075Noch keine Bewertungen

- EBIT - WikipediaDokument2 SeitenEBIT - Wikipediapuput075Noch keine Bewertungen

- Depreciation - WikipediaDokument10 SeitenDepreciation - Wikipediapuput075Noch keine Bewertungen

- Competitor Analysis:: Marketing StrategyDokument1 SeiteCompetitor Analysis:: Marketing StrategyHadia RaoNoch keine Bewertungen

- Colander 11th Edition Ch01 SlidesDokument30 SeitenColander 11th Edition Ch01 SlidesSerenay AkgünNoch keine Bewertungen

- Monopoly ProjectorDokument10 SeitenMonopoly ProjectorAyesha ZainabNoch keine Bewertungen

- Materi Amb CH 8Dokument73 SeitenMateri Amb CH 8Sri HaryantiNoch keine Bewertungen

- Excel Practice Set - 03 SeptDokument13 SeitenExcel Practice Set - 03 SeptRAJAT AGARWAL Student, Jaipuria LucknowNoch keine Bewertungen

- FINA3020 Question Bank Solutions PDFDokument27 SeitenFINA3020 Question Bank Solutions PDFTrinh Phan Thị NgọcNoch keine Bewertungen

- ch09-Inventories-Additional Valuation IssuesDokument50 Seitench09-Inventories-Additional Valuation IssuesrenandanfNoch keine Bewertungen

- Share Monopoly and Oligopoly in Market StructureDokument33 SeitenShare Monopoly and Oligopoly in Market Structurekatariya vatsalNoch keine Bewertungen

- Investment Analysis & Portfolio Management: Lecture # 1 DRDokument684 SeitenInvestment Analysis & Portfolio Management: Lecture # 1 DRKhola NighatNoch keine Bewertungen

- Tulipomania: Mutemwa MwitumwaDokument13 SeitenTulipomania: Mutemwa MwitumwaRajeev ShanbhagNoch keine Bewertungen

- Meaning of Anti - Competitive AgreementsDokument14 SeitenMeaning of Anti - Competitive Agreementskhadija khanNoch keine Bewertungen

- Marketing MixDokument11 SeitenMarketing MixPauleen AbandoNoch keine Bewertungen

- Simplest Trading Strategy - BOL-STOCH-RSIDokument2 SeitenSimplest Trading Strategy - BOL-STOCH-RSIvvpvarunNoch keine Bewertungen

- Mba 518Dokument2 SeitenMba 518api-3782519Noch keine Bewertungen

- Chapter FiveDokument7 SeitenChapter FiveMoti BekeleNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentAnushkaNoch keine Bewertungen

- From The Verb ProduceDokument7 SeitenFrom The Verb ProduceStephanie Rose VirayNoch keine Bewertungen

- Deepwater Quick Reference Guide For StudentsDokument2 SeitenDeepwater Quick Reference Guide For StudentsĐăng Khoa NguyễnNoch keine Bewertungen

- Inferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsDokument5 SeitenInferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsJasmine AlucimanNoch keine Bewertungen

- Karan Desai - GB540M2 - Examine Microeconomic Tools - Competency AssessmentDokument7 SeitenKaran Desai - GB540M2 - Examine Microeconomic Tools - Competency AssessmentKaran DesaiNoch keine Bewertungen

- Three Perspectives On The Valuation of Derivative InstrumentsDokument10 SeitenThree Perspectives On The Valuation of Derivative InstrumentsNiyati ShahNoch keine Bewertungen

- Chapter 4 - Teori AkuntansiDokument30 SeitenChapter 4 - Teori AkuntansiCut Riezka SakinahNoch keine Bewertungen

- Concept of Production Productivity - Is A Measure WhichDokument59 SeitenConcept of Production Productivity - Is A Measure WhichJR DomingoNoch keine Bewertungen

- Characteristics of DerivativesDokument17 SeitenCharacteristics of DerivativesSwati SinhaNoch keine Bewertungen

- Foreword: Equity Markets and Valuation Meth-OdsDokument124 SeitenForeword: Equity Markets and Valuation Meth-OdsPaul AdamNoch keine Bewertungen