Beruflich Dokumente

Kultur Dokumente

Notification (Customs, Sales Tax and Income Tax)

Hochgeladen von

Farhan Jan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten1 Seitesro 499-2013

Originaltitel

20146261562730416sro499-2013

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldensro 499-2013

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

14 Ansichten1 SeiteNotification (Customs, Sales Tax and Income Tax)

Hochgeladen von

Farhan Jansro 499-2013

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

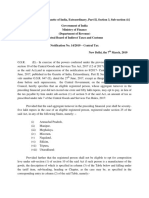

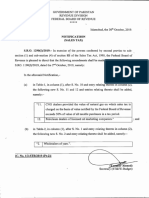

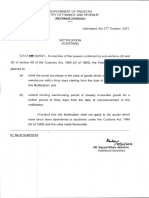

GOVERNMENT OF PAKISTAN

MINISTRY OF FINANCE, ECONOMIC AFFAIRS, STATISTICS & REVENUE

(REVENUE DIVISION)

***

Islamabad, the 12th June, 2013.

NOTIFICATION

(Customs, Sales Tax and Income Tax)

S.R.O. 499 (I)/2013.- In exercise of the powers conferred by section 19 of the

Customs Act, 1969 (IV of 1969), clause (a) of sub-section (2) of section 13 of the Sales

Tax Act, 1990 and sections 53 and 148 of the Income Tax Ordinance, 2001 (XLIX of

2001), and in supersession of Notification No. S.R.O. 607(I)/2012, dated the 2nd June,

2012, the Federal Government is pleased to exempt customs duty, sales tax and

withholding tax on import of Hybrid Electric Vehicles (HEVs) falling under PCT Code

87.03, specified in column (2) of the Table below, to the extent as specified in column

(3) thereof, namely:1[TABLE

S. No

(1)

1

2

2.

Engine Capacity

(2)

Upto 1800 CC

Exceeding 1800 cc

Extent of

exemption in

leviable duty

& taxes

(3)

50%

25%]

This notification shall take effect from the 13th day of June, 2013.

[C. No.1(3)Tar-III/2012/Pt-I]

(Mohammad Riaz)

Additional Secretary

As amended:

1.

S.R.O.567(I)/2014

dated 26.06.2014

Das könnte Ihnen auch gefallen

- 2011SRO480Dokument1 Seite2011SRO480Will Smith SmithNoch keine Bewertungen

- 2007 Sro 880Dokument3 Seiten2007 Sro 880Waqas ShaheenNoch keine Bewertungen

- SRO 490 2004-Input InadmissibleDokument1 SeiteSRO 490 2004-Input Inadmissiblemsadhanani3922Noch keine Bewertungen

- Notification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andDokument1 SeiteNotification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andayazkhan7979Noch keine Bewertungen

- Government of Pakistan Revenue Division Federal Board of RevenueDokument1 SeiteGovernment of Pakistan Revenue Division Federal Board of RevenuehardajhbfNoch keine Bewertungen

- 2016 P T D 648Dokument4 Seiten2016 P T D 648haseeb AhsanNoch keine Bewertungen

- SRO - ST - Increase in Retailer's ScopeDokument1 SeiteSRO - ST - Increase in Retailer's ScopeMuhammad Khalid Hafeez RaoNoch keine Bewertungen

- Csadd01 2023 453274Dokument1 SeiteCsadd01 2023 453274Manish DahiyaNoch keine Bewertungen

- Sro 967 (I) 2022Dokument3 SeitenSro 967 (I) 2022Hassan MujtabaNoch keine Bewertungen

- 20196291962542408694of2019dated29 06 2019Dokument1 Seite20196291962542408694of2019dated29 06 2019bilalsiddiqi1048Noch keine Bewertungen

- 202311614112317194cgo03 2023Dokument1 Seite202311614112317194cgo03 2023Farhan MalikNoch keine Bewertungen

- csnt67 2013Dokument1 Seitecsnt67 2013stephin k jNoch keine Bewertungen

- 2007 Sro 395Dokument1 Seite2007 Sro 395Muhammad AliNoch keine Bewertungen

- 202232113255192sro322 (I) 2022Dokument1 Seite202232113255192sro322 (I) 2022MuhammadIjazAslamNoch keine Bewertungen

- Sro862 (I) 2010Dokument1 SeiteSro862 (I) 2010Muhammad Ammar KhanNoch keine Bewertungen

- GST CT 37 2023 1Dokument1 SeiteGST CT 37 2023 1cadeepaksingh4Noch keine Bewertungen

- 10 2018 Notification Dated 02 Feb 2018Dokument2 Seiten10 2018 Notification Dated 02 Feb 2018vinodNoch keine Bewertungen

- Sro 69Dokument1 SeiteSro 69Babar HassanNoch keine Bewertungen

- 2022621116837291sro806 2022Dokument1 Seite2022621116837291sro806 2022MuhammadIjazAslamNoch keine Bewertungen

- Notificatiion (Sales Tax)Dokument1 SeiteNotificatiion (Sales Tax)Shoaib UsmanNoch keine Bewertungen

- Notification No. 9/2013-Customs (ADD)Dokument3 SeitenNotification No. 9/2013-Customs (ADD)stephin k jNoch keine Bewertungen

- Notification No.7/2013-Central Excise: Vide G.S.R No.471 (E), DatedDokument2 SeitenNotification No.7/2013-Central Excise: Vide G.S.R No.471 (E), Datedpatelpratik1972Noch keine Bewertungen

- Amendment 659 of 2007 SRO-677 (I) 2019-28.06.2019Dokument1 SeiteAmendment 659 of 2007 SRO-677 (I) 2019-28.06.2019Muzammil Hussain BrohiNoch keine Bewertungen

- Notfctn 14 Central Tax English 2019Dokument2 SeitenNotfctn 14 Central Tax English 2019sathishmrNoch keine Bewertungen

- GST CT 28 2023 5Dokument1 SeiteGST CT 28 2023 5cadeepaksingh4Noch keine Bewertungen

- HighLights ST FEDokument34 SeitenHighLights ST FEShakir MuhammadNoch keine Bewertungen

- Ce 0713Dokument1 SeiteCe 0713yagayNoch keine Bewertungen

- 2021326153532729circular13 2021Dokument4 Seiten2021326153532729circular13 2021Ahmad SafiNoch keine Bewertungen

- Notification No 9 CustomDokument1 SeiteNotification No 9 CustomShubham MittalNoch keine Bewertungen

- SRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionDokument93 SeitenSRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionmnasirmehmoodNoch keine Bewertungen

- Notification No. 11/2014-Customs (ADD)Dokument3 SeitenNotification No. 11/2014-Customs (ADD)stephin k jNoch keine Bewertungen

- Amendments in Notification No. GSR 381 (E) Dated 27th June 2006 - Taxguru - inDokument1 SeiteAmendments in Notification No. GSR 381 (E) Dated 27th June 2006 - Taxguru - inpramilaventNoch keine Bewertungen

- SRO693 (I) 200629oct2013Dokument42 SeitenSRO693 (I) 200629oct2013Naveed AhmedNoch keine Bewertungen

- Propertytax PDFDokument2 SeitenPropertytax PDFAamir RazzaqNoch keine Bewertungen

- The The The The Gazette Gazette Gazette of Pakistan of Pakistan of Pakistan of PakistanDokument2 SeitenThe The The The Gazette Gazette Gazette of Pakistan of Pakistan of Pakistan of PakistanHamid RehmanNoch keine Bewertungen

- Exemption Certificate No 1109040120120001Dokument1 SeiteExemption Certificate No 1109040120120001Muhammad Badar KhanNoch keine Bewertungen

- cs09 2013Dokument2 Seitencs09 2013stephin k jNoch keine Bewertungen

- 2008sro532 PDFDokument1 Seite2008sro532 PDFhardajhbfNoch keine Bewertungen

- Notfctn 74 Central Tax English 2020Dokument1 SeiteNotfctn 74 Central Tax English 2020cadeepaksingh4Noch keine Bewertungen

- To Be Published in The Gazette of Pakistan Part-IiDokument23 SeitenTo Be Published in The Gazette of Pakistan Part-IisadamNoch keine Bewertungen

- Customs Tariff Notification No.13/2014 Dated 11th July, 2014Dokument1 SeiteCustoms Tariff Notification No.13/2014 Dated 11th July, 2014stephin k jNoch keine Bewertungen

- GST Rate Fs Bricks Tiles EnglishDokument5 SeitenGST Rate Fs Bricks Tiles EnglishdhananjayNoch keine Bewertungen

- cs33 2013Dokument1 Seitecs33 2013stephin k jNoch keine Bewertungen

- 2023741475729233icto30 06 2023Dokument17 Seiten2023741475729233icto30 06 2023areebamushtaq717Noch keine Bewertungen

- Anti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014Dokument9 SeitenAnti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014stephin k jNoch keine Bewertungen

- Notificatiion (Sales Tax)Dokument1 SeiteNotificatiion (Sales Tax)inocentNoch keine Bewertungen

- Enhancement of Wage Ceilling Under Payment of Wages Act PDFDokument1 SeiteEnhancement of Wage Ceilling Under Payment of Wages Act PDFVenkataraju BadanapuriNoch keine Bewertungen

- Tax ExpenditureDokument3 SeitenTax ExpenditureMohsin ShahidNoch keine Bewertungen

- Enhancement of Wage Ceilling Under Payment of Wages Act PDFDokument1 SeiteEnhancement of Wage Ceilling Under Payment of Wages Act PDFVenkataraju BadanapuriNoch keine Bewertungen

- (I) 20123Dokument80 Seiten(I) 20123Muddassir AliNoch keine Bewertungen

- 20156302363822344492SROamendmentofSRO647 Sec8bDokument1 Seite20156302363822344492SROamendmentofSRO647 Sec8bMuhammadIjazAslamNoch keine Bewertungen

- cs24 2013Dokument3 Seitencs24 2013stephin k jNoch keine Bewertungen

- Maharashtra Package Scheme of Incentives 2013 2018Dokument36 SeitenMaharashtra Package Scheme of Incentives 2013 2018bakulhariaNoch keine Bewertungen

- GST CT 13 2023Dokument1 SeiteGST CT 13 2023Naga Obul ReddyNoch keine Bewertungen

- ICT (Tax On Services) Updated Upto 15.01.2022Dokument15 SeitenICT (Tax On Services) Updated Upto 15.01.2022Zafar IqbalNoch keine Bewertungen

- 2021102812105615917sro1399 2021Dokument1 Seite2021102812105615917sro1399 2021MuhammadIjazAslamNoch keine Bewertungen

- Notfn 12 2019Dokument2 SeitenNotfn 12 2019Sri CharanNoch keine Bewertungen

- Grounds For Return of PlaintDokument11 SeitenGrounds For Return of PlaintFarhan Jan50% (2)

- Abc Manufacturers Debit Note: Revised PriceDokument2 SeitenAbc Manufacturers Debit Note: Revised PriceFarhan JanNoch keine Bewertungen

- Examples Salary 2015Dokument44 SeitenExamples Salary 2015Farhan JanNoch keine Bewertungen

- Welcome To The Participants of The: Softax (Private) LimitedDokument84 SeitenWelcome To The Participants of The: Softax (Private) LimitedFarhan JanNoch keine Bewertungen

- Tool Kit Salary 2015Dokument11 SeitenTool Kit Salary 2015Farhan JanNoch keine Bewertungen

- EOBI FS Operational Manual For EmployersDokument128 SeitenEOBI FS Operational Manual For EmployersFarhan JanNoch keine Bewertungen

- Fate Outreach 17oct2011 (Islamabad)Dokument8 SeitenFate Outreach 17oct2011 (Islamabad)Farhan JanNoch keine Bewertungen

- 10DS LL.B PII s2014Dokument1 Seite10DS LL.B PII s2014Farhan JanNoch keine Bewertungen

- Begum Nusrat BhuttoDokument4 SeitenBegum Nusrat BhuttoFarhan JanNoch keine Bewertungen

- What Is Forgery: Foe Example: B, Picks Up A Cheque On A Banker Signed by D, Payable To Bearer, But Without Any Sum HavingDokument1 SeiteWhat Is Forgery: Foe Example: B, Picks Up A Cheque On A Banker Signed by D, Payable To Bearer, But Without Any Sum HavingFarhan JanNoch keine Bewertungen