Beruflich Dokumente

Kultur Dokumente

Irs

Hochgeladen von

Lou Corina Lacambra0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteIR

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIR

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten1 SeiteIrs

Hochgeladen von

Lou Corina LacambraIR

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

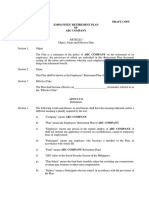

2016 Tax Season is just around the corner. It will begin on 19 January 2016.

Beginning on the said

date, the United States Internal Revenue Service (IRS) will be accepting both electronic and paper 2015

tax returns.

The last day of filing 2015 tax returns will be on 18 April 2016. It used to be 15 April 2016. Since

Washington D.C. will be celebrating its Emancipation Day on 15 April, the deadline is moved to 18

April. However, for those in Maine and Massachusetts, the deadline is on 19 April 2016 due to Patriots

Day.

Before filing the returns, taxpayers must see to it that they have the following necessary documents: a)

year-end statements, b) Form W-2 from employers, c) Form 1099 from banks and other payers, and d)

Form 1095-A from the marketplace for those claiming the premium tax credit. As per IRS, the fastest

and easiest way to file returns and receive refunds are through e-file and direct deposit.

For those who have no idea on how to file their returns, you may ask the help of trusted tax

professionals to assist you. The Volunteer for Income Tax Assistance (VITA) and Tax Counseling for

the elderly offer free tax assistance to those who are eligible.

Das könnte Ihnen auch gefallen

- Paper On PhotographyDokument1 SeitePaper On PhotographyLou Corina LacambraNoch keine Bewertungen

- After School ExtendedDokument2 SeitenAfter School ExtendedLou Corina LacambraNoch keine Bewertungen

- Demand LetterDokument1 SeiteDemand LetterCamille GrandeNoch keine Bewertungen

- You QyuDokument4 SeitenYou QyuLou Corina LacambraNoch keine Bewertungen

- Business Consulting (BCM) Application Form PDFDokument5 SeitenBusiness Consulting (BCM) Application Form PDFLou Corina LacambraNoch keine Bewertungen

- GuidelinesDokument17 SeitenGuidelinesLou Corina LacambraNoch keine Bewertungen

- TagalogDokument3 SeitenTagalogLou Corina LacambraNoch keine Bewertungen

- English 1Dokument1 SeiteEnglish 1Lou Corina LacambraNoch keine Bewertungen

- Word FileDokument1 SeiteWord FileLou Corina LacambraNoch keine Bewertungen

- Happy Birthday!Dokument1 SeiteHappy Birthday!Lou Corina LacambraNoch keine Bewertungen

- What Is FINREP?: To Whom Does It apply?COREP & FINREP Will Apply ToDokument1 SeiteWhat Is FINREP?: To Whom Does It apply?COREP & FINREP Will Apply ToLou Corina LacambraNoch keine Bewertungen

- Demand Letter 1Dokument3 SeitenDemand Letter 1Lou Corina LacambraNoch keine Bewertungen

- Coaching AgreementDokument2 SeitenCoaching AgreementLou Corina LacambraNoch keine Bewertungen

- X RayDokument1 SeiteX RayLou Corina LacambraNoch keine Bewertungen

- Amended IRR of Book V of The Labor CodeDokument8 SeitenAmended IRR of Book V of The Labor CodeLou Corina LacambraNoch keine Bewertungen

- Defined Benefit PlanDokument9 SeitenDefined Benefit PlanLou Corina LacambraNoch keine Bewertungen

- Approval and Appointment of New Compliance OfficerDokument1 SeiteApproval and Appointment of New Compliance OfficerLou Corina LacambraNoch keine Bewertungen

- ECC3Dokument2 SeitenECC3Lou Corina LacambraNoch keine Bewertungen

- Defined Benefit PlanDokument9 SeitenDefined Benefit PlanLou Corina LacambraNoch keine Bewertungen

- Of For: PilipinasDokument107 SeitenOf For: PilipinasLou Corina LacambraNoch keine Bewertungen

- Things I Like About YouDokument1 SeiteThings I Like About YouLou Corina LacambraNoch keine Bewertungen

- 2011 MornbfiDokument145 Seiten2011 MornbfiLou Corina LacambraNoch keine Bewertungen

- NapDokument3 SeitenNapLou Corina LacambraNoch keine Bewertungen

- Blue Chip TalentDokument8 SeitenBlue Chip TalentLou Corina LacambraNoch keine Bewertungen

- Funny GuyDokument1 SeiteFunny GuyLou Corina LacambraNoch keine Bewertungen

- For HiringDokument9 SeitenFor HiringLou Corina LacambraNoch keine Bewertungen

- VisaDokument1 SeiteVisaLou Corina LacambraNoch keine Bewertungen

- RemDokument55 SeitenRemLou Corina LacambraNoch keine Bewertungen

- Brief History The Institute For Labor Studies (ILS) Traces Its Roots From The Institute of Labor andDokument3 SeitenBrief History The Institute For Labor Studies (ILS) Traces Its Roots From The Institute of Labor andLou Corina LacambraNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)