Beruflich Dokumente

Kultur Dokumente

Introduction To Economics & Finance: Page 1 of 8

Hochgeladen von

Ahmed Raza MirOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Economics & Finance: Page 1 of 8

Hochgeladen von

Ahmed Raza MirCopyright:

Verfügbare Formate

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

A.1

A.2

Economic wealth:

Economic wealth can be viewed as the stock of net assets owned by households,

firms and the state. It can also be defined as the total stock of goods of a society at a

given time.

The goods must possess the following attributes in order for them to be considered

as wealth.

(a) They must possess utility. In other words they must be capable of yielding

satisfaction.

(b) They must have a monetary value.

(c) They must be limited in supply. Goods are scarce in the sense that the

resources available to society are insufficient to meet all wants to the level of

complete satiety.

(d) Ownership must be possible. The ownership of such goods must be capable of

being transferred from one person to another.

Classes of ownership of wealth:

Following are the main classes of ownership of wealth.

(a) Personal wealth: It comprises personal belongings such as clothes, cars, books

and consumer durables. It also includes houses, land, paintings, jewellery and

other property owned by individuals.

(b) Business wealth: It comprises such things as factory buildings, machinery, raw

materials and stocks of finished goods.

(c) Social wealth: It consists of wealth owned collectively and includes all

property owned by the national government and local authorities. For example,

roads, schools, public libraries and museums.

(a)

Iso-cost line:

It is a line which represents alternative combinations of two factors which can be

purchased with the given amount of total money.

Iso-quant curve

An iso-quant curve is a locus of points representing the various combinations of two

inputs, capital and labour, yielding the same output.

How producers maximize level of output

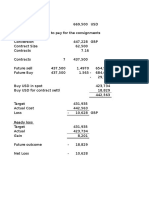

In the above diagram MN is the iso-cost line.

IQ 1, IQ 2 and IQ 3 represent various levels of production.

Page 1 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

The producer wants to produce at iso-quant IQ 3 , which shows highest level of

production at 300 units but his total cost does not allow him to reach at IQ 3 .

Although, producer can produce at iso-quant IQ 1 , which shows lowest level of

production at 100 units but he will not prefer to produce at IQ 1 because with the

given amount of total money he can produce only at IQ 2 , which shows higher level

of production at 200 units compared to IQ 1 .

Producers equilibrium occurs at point E where both the conditions of equilibrium

are satisfied. i.e.

(i) Slope of iso-cost line, MN is equal (tangent) to slope of iso-quant IQ 2 .

(ii) Iso-quant is convex to origin.

Factor combination E will cost the producer least for producing 200 units of output.

Therefore, at point E producer maximizes his level of output.

(b)

Decreasing returns to scale

When output increases less than proportionate to increase in inputs (capital and

labour) and the rate of rise in output goes on decreasing, it is called decreasing

return to scale.

Causes of decreasing returns to scale

Decreasing returns to scale arises mainly because of diseconomies of scale. Some of

the diseconomies which cause decreasing returns to scale are:

A.3

(a)

Managerial Inefficiency/Inefficient Control: Diseconomies begin to start first

at the management level. Managerial inefficiencies arise from expansion of scale

itself, which eventually decreases the level of outputs.

Exhaustibility of Natural Resources: It also leads to the decreasing returns to

scale. For example doubling the size of the coal mining plant does not double

the coal output because of limitedness of coal deposits or difficult accessibility to

coal deposits.

Price Output Determination Under Monopolistic Competition in Short-Run

(i) Super Normal Profit

(ii) Normal Profit

(iii)

Losses

AR > AC

AR < AC

In the above diagrams, AR is the average revenue curve, MR is marginal revenue

curve, SAC is the short-run average cost curve, and SMC is the short-run marginal

Page 2 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

cost curve. The marginal revenue curve (MR) and marginal cost curve (SMC)

intersect each other at the output OM at which price is OP =MP, because P is point

on AR (Average revenue), i.e. price.

In diagram (i), the firm is earning supernormal profit PT per unit of output which is

the difference between average revenue MP and average cost MT (T is on SAC) at

the equilibrium point. Total supernormal profit will be measured by the area of

rectangle PTTP, i.e. output multiplied by supernormal profit per unit of output.

In diagram (ii), the firm is earning normal profit where SAC curve is tangent to AR

curve i.e. AR=AC

In diagram (iii), the firm is incurring loss TP per unit of output which is the

difference between average cost MT (T is on SAC) and average revenue MP at the

equilibrium point. Total losses will be measured by the area of rectangle TPPT, i.e.

output multiplied by loss per unit of output.

In the short-run, therefore, the firm will be in equilibrium when it is maximising its

profits, i.e. when Marginal Revenue = Marginal Cost

(b)

Following are some factors on which the size of market depends:

Nature of supply:

For the extent of market for a product the fundamental thing that must be satisfied

is that it must be produced on a large scale. If it were to be produced on a small

scale, chances of it to expand its market are almost nil.

Durability:

Durable products have greater chances of extending their market e.g. electrical

goods, car, etc. stand a better chance of going for in the market area. This is because

durable products can last for a long period which maintain quality and usually keep

up with tastes and fashion of the consumers.

Transferability/Portability:

The movability, handiness, suitability, ease of increasing the supply, grading and

exact description of the products are some of the major attributes in determining the

size of market. The commodities which have such features are rubber, gold, silver,

etc.

Means of transport and communication:

Availability of transport and media for advertisement etc. are essential to expand

the market of a product. Without this factor, it will not be possible for the producer

to make his product available to a larger geographical segment of the economy.

Role of financial institutions:

Commercial banks and other financial institutions give loans to the producers so

that they may accumulate the capital to extend the market of their products. This

enables entrepreneurs to extend the market.

Peace and security / Political stability:

Naturally there must be peaceful environment so that transactions can take place

with ease and less obstacles. Countries at war find it difficult to extend the market of

their products.

Page 3 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

Policies of the state / Less government restrictions:

If the government were to impose high taxes on production or high tax on imported

products etc, the size of market will be retarded. Therefore, to give encouragement

for expansion of market, tax imposed should be at lower rates.

Degree of division of labour:

The greater the division of labour the cheaper would be the articles and

consequently the market would be wider.

A.4

A.5

(i)

(v)

(ix)

(xiii)

(a)

(a)

(c)

(b)

(b)

(ii)

(vi)

(x)

(xiv)

(c)

(a)

(a)

(c)

(iii)

(vii)

(xi)

(xv)

(b)

(d)

(d)

(b)

(iv) (d)

(viii) (c)

(xii) (d)

GDP :

GDP refers to Gross Domestic Product. It is the total value of goods and services

produced in a country in a year.

GNP :

GNP is the Gross National Product. GNP is the GDP plus net property income

from abroad and minus the net property income remitted abroad.

NNP :

NNP or national income is the Net National Product. NNP is the GNP minus a

fairly attributable amount of depreciation (capital consumption).

GDP at market price and GDP at factor cost:

GDP at market price is the actual amount paid for the goods by their buyers. GDP

at factor cost is the expenditure at market prices minus indirect taxes plus any

government subsidies.

(b)

Determinants of consumption function do not change in short run:

The various determinants of consumption and their behaviour in the short run, are

discussed below:

Objective factors:

Income distribution

Keynes believes that the income distribution in a country does not change in the

short run and hence does not influence the consumption function. If it is unequally

distributed it shall remain unequal and vice versa.

Consumers expectations

According to Keynes the peoples expectations remain stable i.e. they do not

forecast a fall in general price level or even speculate an increase in their income

level. As such expectations would result in the current consumption pattern to rise

and vice versa.

Stock of durable consumer goods

Stock of durable consumer goods of the people does not change in the short period.

Those who do not have the consumer goods in short run will not be able to obtain

them due to their constant level of income, whereas those who already possess these

goods do not lose those goods and thus the stock of durable consumer goods remain

constant in the short run and hence the consumption remains stable too.

Page 4 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

Liquidity preference

Keynes says that the liquidity preference of the people remains constant in short run

and as a result the consumption pattern would remain stable as well. The higher

liquidity preference results in the consumption pattern falling because with higher

liquidity preference the people have a higher tendency to save and vice versa.

Fiscal policy/Tax structure

Progressive taxes discourage saving and investment activities and raise the

consumption function whereas the regressive taxes pose the opposite problem.

Keynes assumes that the tax structure does not change in the short run and hence as

a result consumption function remains stable.

Rate of interest

Keynes believes that rate of interest remains constant in the short run and therefore

consumption function remains stable. With a change in rate of interest the

consumption function would shift e.g. if the rate of interest goes up, the income

level would fall and so would the investment level as a result consumption function

falls.

Consumer credit

Terms and conditions on which the credit is given to the consumer do not change in

the short run because with easy terms and conditions prevailing, credit facilities

would result in the encouragement of consumption and vice versa if hard terms

were imposed.

Deferred demand

Demand is not deferred and hence the consumption function remains stable. The

reason for this is that deferred demand shifts the consumption function either

upward or downward e.g. during the war, demand is deferred and the consumption

function shifts downwards and after the war consumption level shifts upwards due

to rise in demand for consumer goods.

Attitude towards thrift (saving habits)

The saving habits of people do not change in the short run and hence the

consumption function as a complementary to saving function does not shift

upwards or downwards.

Demographic factors

These are related to the size and composition of population. Such factors do not

change in the short run. A change in these factors would greatly influence the

consumption function e.g. if the size of a population increase or population of nonworking classes is large the consumption function would shift upwards or

downwards.

Subjective factors:

Psychology of human nature / social practices

Such factors are related with the psychology of people, mental trends and the social

and cultural behaviour of the society. Keynes says that psychological characteristics

of human nature and social practices of people and institutional behaviour toward

saving do not change in the short run and hence consumption function is not

affected.

Page 5 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

A.6

(a)

(b)

The Four major objectives of the governments economic policy are:

(i)

To achieve economic growth:

One of the major aims of the governments economic policy is to achieve

economic growth and increase the national income per head. This way the

GDP level will rise resulting in improvement in standards of living of the

people, higher production and more tax collection.

(ii)

To control inflation:

To have a stable price level is important so that the real income of the people

can increase with the passage of time and the standard of living can rise too.

(iii)

To achieve full employment:

This is also an important aim of the government as the government pays

unemployment benefits to the people. If there is full employment then the

government will save that money and also be able to collect more taxes. This

would help the government to increase provision of public and merit goods.

There will also be a high standard of living of the people.

(iv)

To achieve a balance between imports and exports:

Deficit in the BOT will be harmful for a countrys economy. Economic

growth would stop as more imports mean local industries are suffering from

severe competition from abroad.

Monetary policy: government increases interest rate and limits money supply to

curb inflation. However, an undue increase in interest rate and undue restriction on

money supply results in lowering growth and investment. Hence, the government

endeavours to achieve a balance by allowing a reasonable inflation to exist so that

growth and employment do not suffer.

Fiscal policy: Keynes believed that fiscal policy helps to control inflation too

(through subsidies and taxes). Through tax cuts, government can encourage

investment in industries and thereby increase production and growth. Government

spending can be increased to reduce unemployment and achieve growth. However,

tax cuts and spending may require government to borrow more which in turn would

increase inflation. Hence, here again, the government endeavours to achieve an

optimum level of taxation and spending to achieve growth and employment

without allowing inflation to rise beyond a reasonable limit.

(c)

Financial intermediary:

Financial intermediary is an institution which links lenders with borrowers by

obtaining deposits from lenders and then re-lending them to borrowers. They can

provide a link between savers and investors.

Financial intermediaries include:

(i) Banks;

(ii) Building societies, insurance companies, pension funds, unit trust companies

and investment trust companies.

Example: A person might deposit savings with a bank and the bank might use its

collective deposits of savings to provide a loan to a company.

Page 6 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

Role of financial intermediaries:

The role of financial intermediaries in an economy, such as banks and building

societies, is to provide means by which funds can be transferred from surplus units

in the economy to deficit units. The financial intermediaries develop the facilities

and financial instruments which make this lending and borrowing possible. They

obtain funds by issuing to the public their own liabilities e.g. saving deposits and

then use this money to lend or invest in entities that need the money. In this way

financial intermediaries mediate between original savers and final borrowers.

Surplus

Unit

A.7

(a)

Lends to

Financial

Intermediary

Lends to

Deficit

Unit

Following are some causes of disequilibrium in balance of payment:

Natural factors

Natural calamities like drought or flood may easily cause disequilibrium in balance

of payments. These natural calamities can adversely affect agricultural and

industrial production. Exports may decline and imports may go up, causing a

setback in the countrys balance of payment.

Trade cycles

Business fluctuations caused by the operation of trade cycles may also result in

disequilibrium in countrys balance of payments. For instance, if there occurs a

recession in foreign countries, it may induce a fall in the exports and exchange

earning of the country concerned, hence resulting in a disequilibrium in the balance

of payments.

Political instability

Political instability results in disrupting the productive potential within the country,

thereby causing a decline in exports and an increase in imports.

Relatively high rate of inflation

High rate of inflation as compared to other countries makes the goods produced by

that country relatively expensive. As a result, its exports decline and the balance of

payment runs into a deficit.

Trade restrictions by other countries

Sometimes other countries impose heavy custom duties or fix quotas or ban imports

from a country. It results in lower exports of that country.

Inelastic demand for machinery and industrial goods

The demand for these goods by less developed countries is inelastic because these

less developed countries have no choice since there is shortage of such goods in

these countries and to increase their growth rate they are going to need such goods.

Hence their imports remain high.

(b)

The following measures are usually taken to correct a disequilibrium in the Balance

of Payments:

(i)

Depreciation or devaluation of the home currency which makes the imports

costlier and uncompetitive, whereas exports become more competitive.

(ii) Protectionist measures resulting in either partial restriction or complete ban

on imports or increase in cost of imports.

(iii) Domestic deflation by reducing the supply of money and thereby aggregate

domestic demand so that the quantity of imported goods decreases.

Page 7 of 8

INTRODUCTION TO ECONOMICS & FINANCE

Suggested Answers

Foundation Examinations Autumn 2012

(iv) Increase in domestic interest rate to attract deposits from foreign countries.

(v) Import substitution to reduce the overall quantity of imports.

(vi) Exchange control regulations to restrict outflows of funds from the home

country.

(vii) Stimulating exports by providing subsidies and tax holidays to exportoriented industries.

(c)

Exchange Rate Policies of Government:

Following are the three types of policies which may be adopted by the government

for controlling exchange rate in the country:

(i)

Fixed Exchanged Rate: under Fixed Exchange Rate, either the rate is fixed at

a certain pre-determined level by the national monetary authority and can be

changed only by a government decision. or the monetary authority intervenes

by buying and selling foreign exchange to maintain the exchange rate at the

prescribed level.

(ii)

Freely Fluctuating Exchange: under Freely Fluctuating Exchange Rate, the

exchange rates are left entirely to the market forces and there is no official

intervention by the monetary authority.The price of a currency is allowed to

rise or fall according to the prevailing demand and supply conditions.

(iii) Managed Floating Exchange Rate System: In a Managed Floating Exchange

Rate system, the exchange rates are allowed to move broadly in line with the

market forces with a gradual adjustment in the exchange rate to reflect

underlying real economic factors.

The authorities intervene by buying and selling foreign exchange in the

market, but usually they are limited to managing the daily fluctuations caused

mainly by capital movements and hold the rate within certain limits. The

extent of intervention by the authorities is substantial only when speculative

forces threaten macroeconomic policies.

(THE END)

Page 8 of 8

Das könnte Ihnen auch gefallen

- Macroeconomic and Industry Analysis Chapter SummaryDokument10 SeitenMacroeconomic and Industry Analysis Chapter SummaryAuliah SuhaeriNoch keine Bewertungen

- Chapter 17: Macroeconomic and Industry AnalysisDokument10 SeitenChapter 17: Macroeconomic and Industry Analysisharjeet prasadNoch keine Bewertungen

- Chapter 17 Solutions BKM Investments 9eDokument11 SeitenChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- Macroeconomic Industry AnalysisDokument8 SeitenMacroeconomic Industry AnalysisMarwa HassanNoch keine Bewertungen

- Chapter 12 - Macroeconomic and Industry AnalysisDokument8 SeitenChapter 12 - Macroeconomic and Industry AnalysisMarwa HassanNoch keine Bewertungen

- Chapter 12 - Macroeconomic and Industry AnalysisDokument8 SeitenChapter 12 - Macroeconomic and Industry AnalysisMarwa HassanNoch keine Bewertungen

- Chapter 17: Macroeconomic and Industry AnalysisDokument9 SeitenChapter 17: Macroeconomic and Industry AnalysisMehrab Jami Aumit 1812818630Noch keine Bewertungen

- Extensions To Basic ModelDokument5 SeitenExtensions To Basic ModelhashimNoch keine Bewertungen

- Revisit - 10 Minutes ResearchDokument46 SeitenRevisit - 10 Minutes Researchavik senguptaNoch keine Bewertungen

- Understanding Aggregate Demand and SupplyDokument69 SeitenUnderstanding Aggregate Demand and SupplyShuchun YangNoch keine Bewertungen

- Answer Sheet of Business Economics For Manager by Harpreet KaurDokument5 SeitenAnswer Sheet of Business Economics For Manager by Harpreet KaurHarpreet KaurNoch keine Bewertungen

- MACROECONOMICS 2 SHORT ANSWER QUESTIONS & ANSWERS PDFDokument21 SeitenMACROECONOMICS 2 SHORT ANSWER QUESTIONS & ANSWERS PDFMon LuffyNoch keine Bewertungen

- Covid19+Submission+TemplateDokument11 SeitenCovid19+Submission+Templateanuragbose0429Noch keine Bewertungen

- Into To Economics Paper2Dokument5 SeitenInto To Economics Paper2Simbarashe MurozviNoch keine Bewertungen

- Economics PT-1 Section A AnswersDokument5 SeitenEconomics PT-1 Section A AnswersJANARTHANAN MNoch keine Bewertungen

- ECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkDokument20 SeitenECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkranashair9919Noch keine Bewertungen

- FINANCING ECONOMIC DEVELOPMENT MODELDokument15 SeitenFINANCING ECONOMIC DEVELOPMENT MODELshashankdkNoch keine Bewertungen

- EC2101 Practice Problems 8 SolutionDokument3 SeitenEC2101 Practice Problems 8 Solutiongravity_coreNoch keine Bewertungen

- ECON Macro Canadian 1st Edition McEachern Solutions Manual 1Dokument36 SeitenECON Macro Canadian 1st Edition McEachern Solutions Manual 1shawnmccartyjxqsknofywNoch keine Bewertungen

- Econ Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFDokument26 SeitenEcon Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFeric.herrara805100% (12)

- Solution Manual For Microeconomics 19th Edition by McconnellDokument14 SeitenSolution Manual For Microeconomics 19th Edition by Mcconnelllouisdienek3100% (23)

- Pallavi Covid 19 ProjectDokument10 SeitenPallavi Covid 19 ProjectPALLAVI SINGHNoch keine Bewertungen

- CB 2 - MacroDokument106 SeitenCB 2 - MacroSurbi SabharwalNoch keine Bewertungen

- B3-Spring 2010Dokument6 SeitenB3-Spring 2010munira sheraliNoch keine Bewertungen

- Practice Questions (Micoreconomics)Dokument18 SeitenPractice Questions (Micoreconomics)Jing YingNoch keine Bewertungen

- Week 5 Lecture Comparative Advantage and Market ForcesDokument5 SeitenWeek 5 Lecture Comparative Advantage and Market Forcescbenn0001Noch keine Bewertungen

- Introduction to Economics and Finance GuideDokument9 SeitenIntroduction to Economics and Finance GuideIbrahimNoch keine Bewertungen

- Macroeconomics AD-AS Model ExplainedDokument65 SeitenMacroeconomics AD-AS Model ExplainedG74GARV SETHINoch keine Bewertungen

- How OPEC, oligopolies, and pandemics impact marketsDokument8 SeitenHow OPEC, oligopolies, and pandemics impact marketssagar sundar dashNoch keine Bewertungen

- Economics Chapter QuestionsDokument36 SeitenEconomics Chapter QuestionsOlaNoch keine Bewertungen

- AC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionDokument3 SeitenAC TC/Q, AFC FC/Q, AVC VC/Q: Between Pure Monopoly & Pure CompetitionSadnima Binte Noman 2013796630Noch keine Bewertungen

- Lecture 4-EtudiantsDokument5 SeitenLecture 4-EtudiantsLucas CbrNoch keine Bewertungen

- Economics Lesson 1Dokument29 SeitenEconomics Lesson 1Yasshita GuptaaNoch keine Bewertungen

- Mcgill University: Department of EconomicsDokument8 SeitenMcgill University: Department of EconomicsAaron LuNoch keine Bewertungen

- Business economic analysis tutorial questionsDokument11 SeitenBusiness economic analysis tutorial questionsammon mabukuNoch keine Bewertungen

- Course Name: Introduction To Micro-Economics Level: Ma / MSCDokument14 SeitenCourse Name: Introduction To Micro-Economics Level: Ma / MSCMuhammad NomanNoch keine Bewertungen

- Macroeconomics Final Exam Paper SummaryDokument12 SeitenMacroeconomics Final Exam Paper SummaryAbdurehman Ullah khanNoch keine Bewertungen

- Chapter 4 Open Economic SystemDokument65 SeitenChapter 4 Open Economic Systemtigabuyeshiber034Noch keine Bewertungen

- Basic Microeconomics IIDokument5 SeitenBasic Microeconomics IIcamellNoch keine Bewertungen

- Chap 024Dokument14 SeitenChap 024KhayHninsNoch keine Bewertungen

- Lecture11 12 13Dokument91 SeitenLecture11 12 13Victor NguyenNoch keine Bewertungen

- Lecture Notes #2 - The Classical Model of The MacroeconomyDokument17 SeitenLecture Notes #2 - The Classical Model of The MacroeconomyAndre MorrisonNoch keine Bewertungen

- Part A: Here What OPEC Did Is An Example of Collusion. A Cartel of Oil Producing CountriesDokument5 SeitenPart A: Here What OPEC Did Is An Example of Collusion. A Cartel of Oil Producing CountriesSurendranath KolachalamNoch keine Bewertungen

- Macro I Chap3Dokument131 SeitenMacro I Chap3helenhabtamu18Noch keine Bewertungen

- Key Diagrams A2 Business EconomicsDokument16 SeitenKey Diagrams A2 Business EconomicsEl Niño SajidNoch keine Bewertungen

- Final Ecoomics MaterialDokument13 SeitenFinal Ecoomics MaterialNetsanet MeleseNoch keine Bewertungen

- Effects of Reduced Consumer ConfidenceDokument8 SeitenEffects of Reduced Consumer Confidencewen niNoch keine Bewertungen

- Vertical DifferentiationDokument8 SeitenVertical DifferentiationAidanNoch keine Bewertungen

- MBA (IB) Guide to Macroeconomic ConceptsDokument35 SeitenMBA (IB) Guide to Macroeconomic Conceptspulkit guptaNoch keine Bewertungen

- Business Cycle FeaturesDokument10 SeitenBusiness Cycle FeaturesLaura Kwon100% (1)

- 480505965study MaterialDokument162 Seiten480505965study Materialvishaljalan100% (1)

- Chapter 1 Introduction To MacroeconomicsDokument15 SeitenChapter 1 Introduction To MacroeconomicsyizzyNoch keine Bewertungen

- What is Aggregate Demand? Understanding the Key Components and Factors that Impact ADDokument9 SeitenWhat is Aggregate Demand? Understanding the Key Components and Factors that Impact ADShahana KhanNoch keine Bewertungen

- Perfect Competition: P SivakumarDokument33 SeitenPerfect Competition: P SivakumarAnonymous 1ClGHbiT0JNoch keine Bewertungen

- PPCDokument21 SeitenPPCJournalist ludhianaNoch keine Bewertungen

- What Is Aggregate DemandqwertDokument8 SeitenWhat Is Aggregate DemandqwertShahana KhanNoch keine Bewertungen

- As Nov Dec 2017Dokument5 SeitenAs Nov Dec 2017Ahmed Raza MirNoch keine Bewertungen

- IFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueDokument24 SeitenIFRS 10 Consolidated Financial IFRS 11 Joint Arrangements and IFRS 13 Fair ValueAhmed Raza MirNoch keine Bewertungen

- Advanced Accounting and Financial ReportingDokument6 SeitenAdvanced Accounting and Financial ReportingAhmed Raza MirNoch keine Bewertungen

- Lecture4 Inv f06 604-InventoryDokument63 SeitenLecture4 Inv f06 604-InventoryRandy CavaleraNoch keine Bewertungen

- Ifrs11 Joint Arrangements PDFDokument15 SeitenIfrs11 Joint Arrangements PDFAhmed Raza MirNoch keine Bewertungen

- Ifrs11 Joint Arrangements PDFDokument15 SeitenIfrs11 Joint Arrangements PDFAhmed Raza MirNoch keine Bewertungen

- Practical Guide Ifrs10 and 12Dokument33 SeitenPractical Guide Ifrs10 and 12Ahmed Raza MirNoch keine Bewertungen

- Ifrs11 Joint ArrangementsDokument1 SeiteIfrs11 Joint ArrangementsAhmed Raza MirNoch keine Bewertungen

- Financial AccountingDokument42 SeitenFinancial AccountingAhmed Raza MirNoch keine Bewertungen

- NPV-IRR NewDokument39 SeitenNPV-IRR NewAhmed Raza MirNoch keine Bewertungen

- p4 Summary BookDokument35 Seitenp4 Summary BookAhmed Raza MirNoch keine Bewertungen

- PracticeDokument6 SeitenPracticeAhmed Raza MirNoch keine Bewertungen

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDokument32 SeitenFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirNoch keine Bewertungen

- Grant Thornton Ifrs 10 Financial StatementsDokument104 SeitenGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirNoch keine Bewertungen

- WaccDokument44 SeitenWaccAhmed Raza MirNoch keine Bewertungen

- E Voting Guide (ICAP - Overseas Members)Dokument10 SeitenE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirNoch keine Bewertungen

- 289214169 عمرو اور سلیمانی خزانہ PDFDokument235 Seiten289214169 عمرو اور سلیمانی خزانہ PDFAhmed Raza MirNoch keine Bewertungen

- Aik Aur OptionDokument35 SeitenAik Aur OptionAhmed Raza MirNoch keine Bewertungen

- Share-Based Payment: IFRS Standard 2Dokument42 SeitenShare-Based Payment: IFRS Standard 2Teja JurakNoch keine Bewertungen

- Q6 Costing Today PaperDokument2 SeitenQ6 Costing Today PaperAhmed Raza MirNoch keine Bewertungen

- Stock ValuationDokument2 SeitenStock ValuationAhmed Raza MirNoch keine Bewertungen

- Section e - QuestionsDokument4 SeitenSection e - QuestionsAhmed Raza MirNoch keine Bewertungen

- AssertionsDokument2 SeitenAssertionsAhmed Raza MirNoch keine Bewertungen

- FR 2 QuizDokument14 SeitenFR 2 QuizAhmed Raza MirNoch keine Bewertungen

- Corporate Dividend Policy InsightsDokument7 SeitenCorporate Dividend Policy InsightsAhmed Raza MirNoch keine Bewertungen

- Section F - QuestionsDokument2 SeitenSection F - QuestionsAhmed Raza MirNoch keine Bewertungen

- Solution: Part (A)Dokument12 SeitenSolution: Part (A)Ahmed Raza MirNoch keine Bewertungen

- PC EDokument24 SeitenPC EAhmed Raza MirNoch keine Bewertungen

- Section F - AnswersDokument9 SeitenSection F - AnswersAhmed Raza MirNoch keine Bewertungen

- Solution: Part (A)Dokument12 SeitenSolution: Part (A)Ahmed Raza MirNoch keine Bewertungen

- Business Studies Class 11 Project On BankingDokument10 SeitenBusiness Studies Class 11 Project On BankingSubham Jaiswal100% (2)

- Business Cycles: Causes and CharacteristicsDokument108 SeitenBusiness Cycles: Causes and CharacteristicsBai Alleha MusaNoch keine Bewertungen

- RBI Policy Updates and Developments in April 2014Dokument4 SeitenRBI Policy Updates and Developments in April 2014Anonymous AHW3sHNoch keine Bewertungen

- TheWallStreetJournal-22 April 2019 PDFDokument40 SeitenTheWallStreetJournal-22 April 2019 PDFMauroNoch keine Bewertungen

- History of Capital Market Regulation in Nigeria - 281011Dokument8 SeitenHistory of Capital Market Regulation in Nigeria - 281011ProshareNoch keine Bewertungen

- Session 15 - Exchange Rates and Capital FlowsDokument11 SeitenSession 15 - Exchange Rates and Capital FlowsUtkarsh BhalodeNoch keine Bewertungen

- Task1 CommercialEnglishDokument2 SeitenTask1 CommercialEnglishnur khoNoch keine Bewertungen

- 73 Manila Banking Corp Vs NLRCDokument14 Seiten73 Manila Banking Corp Vs NLRCRay Carlo Ybiosa AntonioNoch keine Bewertungen

- Balance Sheet of A BankDokument2 SeitenBalance Sheet of A BankVinod GandhiNoch keine Bewertungen

- Declaration AnnexuresDokument20 SeitenDeclaration AnnexuresMaybelle VelhoNoch keine Bewertungen

- Essential Economics Concepts ExplainedDokument28 SeitenEssential Economics Concepts ExplainedJessica GonzalesNoch keine Bewertungen

- SSRN Id2405083 PDFDokument36 SeitenSSRN Id2405083 PDFMilway Tupayachi AbarcaNoch keine Bewertungen

- 2021: Issue 807, Week: 27th September - 1st October A Weekly Update From SMC (For Private Circulation Only)Dokument20 Seiten2021: Issue 807, Week: 27th September - 1st October A Weekly Update From SMC (For Private Circulation Only)ajay.r ramanathanNoch keine Bewertungen

- Dembidollo Exit ExamsDokument143 SeitenDembidollo Exit Examsbiruk habtamuNoch keine Bewertungen

- Introduction to Credit FundamentalsDokument9 SeitenIntroduction to Credit FundamentalsEve HittyNoch keine Bewertungen

- RBI Transfers Funds to Contingency FundDokument3 SeitenRBI Transfers Funds to Contingency Fundajit kumarNoch keine Bewertungen

- In Gold We Trust Report 2019 - English (Extended Version)Dokument339 SeitenIn Gold We Trust Report 2019 - English (Extended Version)Incrementum AG100% (1)

- The Role of Banks, Non-Banks and The Central Bank in The Money Creation ProcessDokument21 SeitenThe Role of Banks, Non-Banks and The Central Bank in The Money Creation Processwm100% (1)

- WSJ 25.08.2023Dokument41 SeitenWSJ 25.08.2023Edu F Llerena AmpueroNoch keine Bewertungen

- Econometric Models of The Euro Area Central BanksDokument336 SeitenEconometric Models of The Euro Area Central BanksErnest DtvNoch keine Bewertungen

- Measuring and Explaining InflationDokument23 SeitenMeasuring and Explaining Inflationfahrah daudaNoch keine Bewertungen

- Kiwibank's Strategic Management AnalysisDokument13 SeitenKiwibank's Strategic Management AnalysisAndre Fernandes100% (1)

- CurrentDokument12 SeitenCurrentAnthony CabonceNoch keine Bewertungen

- Restoring The Value of The CediDokument50 SeitenRestoring The Value of The CediMahamudu Bawumia100% (6)

- Bank jobs rise to seven-year high as deposit accounts hit 28m/TITLEDokument32 SeitenBank jobs rise to seven-year high as deposit accounts hit 28m/TITLEgangrukaNoch keine Bewertungen

- EdiiDokument22 SeitenEdiiKamlesh PandeyNoch keine Bewertungen

- We The Sheeple vs. The BankstersDokument177 SeitenWe The Sheeple vs. The BankstersLAUREN J TRATAR100% (6)

- Banking: 1. Commercial BankDokument6 SeitenBanking: 1. Commercial BankAryan RawatNoch keine Bewertungen

- MPS FY2021-22:: CPD's Reaction OnDokument49 SeitenMPS FY2021-22:: CPD's Reaction OnAdnan AsifNoch keine Bewertungen

- Market Economy: English For International EconomicsDokument13 SeitenMarket Economy: English For International Economicsfarra_lindtNoch keine Bewertungen