Beruflich Dokumente

Kultur Dokumente

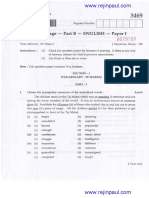

CA Ipcc Costing QP Nov 2015 Exam 06.11.2015

Hochgeladen von

Sushant SaxenaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CA Ipcc Costing QP Nov 2015 Exam 06.11.2015

Hochgeladen von

Sushant SaxenaCopyright:

Verfügbare Formate

Roll No.

Total No. of Questions

Total No. of Printed Pages -

-7

TimeAllowed-3 Hours

Maximum Marks

12

- 100

RWA

Answers are to be given in English except in the case of candidates who have opted for

Hindi Mediurn. If a candidate has not opted for Hindi Mediurn, his/her answers in Hindi

will not be valued.

Question No. 1 is compulsory.

Answer any five questions from the remaining six questions.

Working notes should fonn part of the answers.

Marks

l.

Answer the following

a:

(a)

4x5

:20

Human Resources Department of

A Ltd. computed labour turnover by

replacement method at 3oh for the quarter ended June 2015. During the

quafter, fresh recruitment of 40 workers was made. The number of

workers at the beginning and end of the quarter was 990 and

101 0

respectively.

You are required to calculate the labour turnover rate by Separation

Method and Flux Method.

RWA

P.T.O.

(2)

RWA

(b)

Marks

A cornpany gives the following infonnation

Margin of Safety

3,75,000

Total Cost

3,87,500

15000 units

5000 units

Margin of Safety

(QtV.)

Break Even Sales in

Units

You are required to calculate

(i)

Selling price per unit

(ii)

Profit

(iii) Profit/VolumeRatio

(c)

(iv)

Break Even Sales (in Rupees)

(v)

Fixed Cost

From the following details of X Ltd., prepare the Income Statement for

the year ended

I't December 2014 :

Financial Leverage

Interest

{ 2,000

Operating Leverage

Variable cost as a percentage of

sales 7 5%

lncome tax rate

30%

RWA

(3)

RWA

(d)

A company issues 25,000, t4oh debentures of

Marks

1,000 each. The debentures

are redeemable after the expiry period of 5 years. Tax rate applicable to the

company is 35o/o (including surcharge and education cess).

calculate the cost of debt after tax

if clebentures are issued at 5%

discount with 2o/o flotation cost.

2' (a)

M.L. Auto Ltd. is a manufacturer of auto components and the details

its expenses for the year z0l4 are given below

of

(i)

Opening Stock of Material

1,50,000

(ii)

Closing Stock of Material

2,00,000

(iii)

Purchase of

(iv)

Direct

(v)

Factory

(vi)

Administrative

Material

Labour

g.50"000

9.50.000

Overhead

3.g0.000

Overhead

2,50,400

During 2015, the company has received an order from

manufacturer where it estimates that the cost of rnaterial and labour

'

be

8,00,000 and

4,,50,000 respectively.

factory overhead as a percentage

M.L. Auto Ltd.

car

will

charges

of direct labour and administrative

overhead as a percentage of factory cost based on previous year's cost.

Cost of delivery of the components at customer's premises is estimated

at

( 45,000.

RWA

P.T.O.

(4)

Marks

RWA

You are required to

(i)

Calculate the overhead recovery rates based on actual costs for

20t4.

(ii)

Prepare a detailed cost statement for the order received

and the price to be quoted

in

2015

if the conrpany wants to earn a profit of

l0% on sales.

(b) VRA Limited has provided the following

infomration for the

year

endin-e 3 [" March. 201 5.

Debt Equity

Ratio

2:

14% long term debt

{ 50,,00,000

Gross Profit Ratio

30%

Return on equity

s0%

Income Tax Rate

3s%

Capital Turnover Ratio

1.2 times

Opening Stock

Closing Stock

89'o

4,50,000

of

sales

You are required to prepare Trading and Profit and Loss Account for

th: year ending

3l

" March,

201 5.

RWA

(s)

RWA

3.

Marks

(a) XY Co. Ltd manufactures two products viz., X and Y and sells them

through two divisions, East and West. For the purpose of Sales Budget

to the Budget

Courmittee, following information has been made

available for the year 2014-15

Actual Sales

Budgeted Sales

Product

East Division West Division East Division West Division

400 units at

600 units at

500 units at

700 units at

t9

{9

{9

(9

300 units at

500 units at

200 units at

400 units at

<21

<2r

<21

<21

Adequate market studies reveal that product

priced.

X is popular but under

It is expected that if the price of X is increased by t

find a ready rnarket. On the other

of Y is reduced by t

hand,,

1,,

it will

Y is overpriced and if the price

l, it will have lnore demand in the market. The

company management has agreed for the aforesaid price changes. On

the basis of these price changes and the reports of saleslnen, following

estimates have been prepared by the Divisional Managers

Percentage increase in sales over budgeted sales

Product

East

Division

West Division

100

+200

5o/o

l0o/o

RWA

P.T.0.

(6)

Marks

RWA

With the help of intensive adveltisement campaign,

following

sales

additional sales (over and above the above mentioned estimated

by Divisional Mangers) are possible

ProductEastDivisionWestDivision

60

units

70 units

40

units

50 units

You are required to prepare Sales Budget for

20 l5-

l6

after

and

incorporating above estimates and also show the Budgeted Sales

Actual Sales of 2014- I 5.

(b)

31"

Balance Sheets of KAS Limited bs on 31" March,2014 and

201 5 are furnished

below

March,

Amount in Rupees

As at 31't

As at 31"

Liabilities

March, 2014 March, 2015

Equity Share Capital

75,00,000

1,02,50,000

General Reserve

42,50,000

50,00,000

Profit & Loss Account

15,00,000

18,75,000

58,00,000

43,50,000

30,00',000

32,50,000

7,50,000

9,10,000

13% Debentures of face value

100 each

Current Liabilities

Proposed Dividend

22,50,000

Provision for Income tax

2,50r50r000

Total

RWA

24,7

5,000

2,81r101000

(7)

Marks

RWA

Amount in Ru

As at 31"

Assets

As at 31"

March, 2014 March,20l5

5,000

Goodwill

10,,00,000

Land & Building

68'00,000

6l ,,20,000

Plant & Machinery

5,12,000

1,07,95,000

Investment

25,00,000

2l ,25,000

Stock

33,00,000

27,50,000

Debtors

24,45,000

36,20,000

Cash and Bank

14,93,000

19,25,000

2r50r50,000

2,81r101000

Total

Following additional information is available

(i)

7 ,7

During the financial year 2014-15 the company issued equity

shares at par.

(ii)

Debentures were redeemed

on I't April, 2014 at a premium of

r0%.

(iii)

Sorne investments were sold at a profit of

75,000 and the profit

was credited to General Reserve Account.

(iv)

During the year an old machine costing < 23,50,000 was sold for

(v)

Depreciation is to be provided on plant and machinery at

2Ao/o on

the opening balance.

RWA

P.T.O.

(8)

RWA

(vi)

Marks

There was no purchase or sale of land and building.

(vii) Provision for tax made during the year was {

4,,50,000.

You are required to prepare a Cash Flow Statement for the year ended

3I" March,20I5.

4. (a) The following infonnation is

Process

- II of its manufacturing

furnished

Opening

(ii)

Units transferred from Process I

(iii)

Expenditure debited to Process

Work-in-Progress

- II

Consurnables

Labour

Overhead

(iv) Units transferred to Process III

Closing WIP

for

Nil

55,000 units at (

.27

.800

1,57,200

T 1.04.000

t 52.000

51.000 units

- 2000 units (Degree of cornpletion)

Consumables

Labour

80%

Overhead

60%

(vi) Units scrapped

60%

2000 units, scrapped units

were sold at

(vii) Normal

Company

activity for the month of April 2015 :

(i)

(v)

by ABC

loss

5 per unit.

4% of units introduced

RWA

(e)

RWA

You are required to

(i)

(ii)

(iii)

(b)

Marks

Prepare a Staternent of

Equivarent production.

Deterrnine the cost per

unit

Deterllrine the value of

work-i'-process and

Process _ III.

u'its

transferred to

RST Ltd' is expecting an

EBIT of T 4lakhs for F.y.

20r5-r6. presently

the company is financed

entirely by equity share capitar

of { 20 rakhs

with equity capitalization rate

of 16%. The company is conte'rprating

to redeem part of the capital

by introducing debt financing.

The

company has two options

to raise debt to the extent

the total fund.

of

30% or 5ayo

of

It is expected that for debt

financing upto 3[yo,the rate

of interest will

be 10% and equity capitalization

rate wiil

increase to r7%.If the

company opts for 50o/o

debt, then the interest rate

wilr be 12% and

equity capitalization rate

will be

20%.

You are required to compute

value of the company; its

overa, cost of

capital under different

options and also state which

is the best option.

5.

(a)

State the method

industries

of costing

ancr arso

(i)

(ii)

(iii)

Steel

(iv)

Ship Builcting

the unit of cost for the following

4x4

=16

Hotel

Toy-making

RWA

P.T.o.

( 10)

RWA

Marks

(b)

How would you account for idle capacity cost in Cost Accounting

(c)

of

Distinguish between Net Present Value (NPV) and Internal Rate

Return (IRR) methods for evaluating projects.

(d)

methods.

What is meant by venture capital financing ? State its various

6. (a) pVK Constructions commenced a contract on l" April, 2014- Total

be

contract value was t 100 lakhs. The contract is expected to

completed

by 31" December, 2016. Actual

expenditure during the

period I't April ,2014 to 3l't Maich, 2015 and estimated expenditure for

the period

l" April, 2015 to 31" December,20l6 are as follows

Actual

(O

1" Aprilr 2014

I nstimated

I't April,

(?)

2015

to

to

31 March,

3ltt Dec.,

201 5

2016

Material issued

15,30,000

2l ,00'000

Direct Wages Paid

10,12,500

12,25,000

80,000

Direct Wages outstanding

Plant purchased

7,50,000

Expenses paid

3,25,000

,l 5,000

5,40,000

68,000

Prepaid Expenses

3,00,000

Site office expenses

RWA

il

I

(11)

RWA

Marks

Part of the material procured for the contract was unsuitable and was

sold for

2,40,000 (cost being

scrapped and disposed

of for

2,55,000) and a part of plant was

80,000. The value of plant at site on

" March, 2015 was < 2,50,000 and the value of material at site was

t 73,000. Cash received on account to date was ( 36,00,000,

3l

representing 80% of the work certified. The cost of work uncertified

was valued at

{ 5,40,000.

Estimated further expenditure for completion of contract is as follows

An additional amount of

4,62,500 would have to be spent on the

plant and the residual value of the plant on the completion of the

contract would be { 67.500.

Site office expenses would be the same amount per month

as

charged in the previous year.

An amount of

1,57,500 would have

to be incurred

towards

consultancy charges.

Required

Prepare Contract Account and calculate estimated total profit on this

contract.

(b) A firm has a total sales of { 200 lakhs of which 80% is on credit. It is

offering credit terms of 2140, net 120. Of the total, 50% of customers

avail of discount and the balance pay

in 120 days. Past experience

indicates that bad debt losses are around lo/o of credit sales. The firm

spends about < 2,40,000 per annum to administer its credit sales. These

are avoidable as a factor is prepared to buy the firm's receivables. He

will

charge 2o/o commission. He

will pay advance

against receivables to

the firm at an interest rate of l8%o after withholding l0% as reserye.

RWA

P.T.O.

--<.ri.<sG

l2)

Marks

RWA

(i)

consider year as 360

what is the effective cost of factoring ?

daYs.

14%

(ii) If bank finance for working capitar is available at

service

should the firm avail of factoring

Answer any four of the following

(a)

interest,

4x4

'

:16

absorption of overheads in cost

Explain the treatment of over and under

accounting'

(b)

in adopting standard costing systern

Describe the various steps involved

in an organization'

(c)

effective cash management systetn'

Evaruate the rore of cash budget in

(d)Discusstherisk.returnconsiderationsinfinancingcunentassets.

(e)

Distinguish between the following

(i).Scraps'and.Defectives'incosting

(ii)

Preference Shares and Debentures

RWA

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Check List For Service Tax Units 2017: Cenvat IssuesDokument5 SeitenCheck List For Service Tax Units 2017: Cenvat IssuesSushant SaxenaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Communication Ethics: Ethical Communication and Organization ValuesDokument3 SeitenCommunication Ethics: Ethical Communication and Organization ValuesSushant SaxenaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Recon Il CationDokument56 SeitenRecon Il CationSushant SaxenaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Sample SCN For Club House ChargesDokument7 SeitenSample SCN For Club House ChargesSushant SaxenaNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Group Dynamics: Characteristics of GroupsDokument7 SeitenGroup Dynamics: Characteristics of GroupsSushant SaxenaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Ethics in Marketing and Consumer ProtectionDokument8 SeitenEthics in Marketing and Consumer ProtectionSushant SaxenaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Companies Act, 2013: Unit 1: PreliminaryDokument152 SeitenThe Companies Act, 2013: Unit 1: PreliminarySushant SaxenaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Basic Understanding of Legal Deeds and Documents: Partnership DeedDokument13 SeitenBasic Understanding of Legal Deeds and Documents: Partnership DeedSushant SaxenaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Ethics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaDokument8 SeitenEthics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaSushant SaxenaNoch keine Bewertungen

- Ethics in Marketing and Consumer ProtectionDokument8 SeitenEthics in Marketing and Consumer ProtectionSushant SaxenaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Part Ii: Ethics: © The Institute of Chartered Accountants of IndiaDokument9 SeitenPart Ii: Ethics: © The Institute of Chartered Accountants of IndiaRohit SinghNoch keine Bewertungen

- Interpersonal Communication SkillsDokument8 SeitenInterpersonal Communication SkillsSushant SaxenaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Corporate Governance and Corporate Social Responsibility: © The Institute of Chartered Accountants of IndiaDokument10 SeitenCorporate Governance and Corporate Social Responsibility: © The Institute of Chartered Accountants of IndiaRohit SinghNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Bos 28165 CP 9Dokument7 SeitenBos 28165 CP 9Sushant SaxenaNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Bos 28165 CP 13Dokument18 SeitenBos 28165 CP 13Sushant SaxenaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Communication in Business Environment: Notice For Annual General MeetingDokument11 SeitenCommunication in Business Environment: Notice For Annual General MeetingSushant SaxenaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Ethics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaDokument8 SeitenEthics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaSushant SaxenaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Communication Corporate Culture, Change and Innovative SpiritsDokument5 SeitenCommunication Corporate Culture, Change and Innovative SpiritsSushant SaxenaNoch keine Bewertungen

- ST Circ 206 4 2017 FNLDokument3 SeitenST Circ 206 4 2017 FNLSushant SaxenaNoch keine Bewertungen

- Communication Ethics: Ethical Communication and Organization ValuesDokument3 SeitenCommunication Ethics: Ethical Communication and Organization ValuesSushant SaxenaNoch keine Bewertungen

- The Companies Act, 2013: Unit 1: PreliminaryDokument152 SeitenThe Companies Act, 2013: Unit 1: PreliminarySushant SaxenaNoch keine Bewertungen

- Corporate Governance and Corporate Social Responsibility: © The Institute of Chartered Accountants of IndiaDokument10 SeitenCorporate Governance and Corporate Social Responsibility: © The Institute of Chartered Accountants of IndiaRohit SinghNoch keine Bewertungen

- Environment and Ethics: Sustainable DevelopmentDokument6 SeitenEnvironment and Ethics: Sustainable DevelopmentSushant SaxenaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Service Tax On Works ContractDokument37 SeitenService Tax On Works ContractSushant SaxenaNoch keine Bewertungen

- Microchip Technology (India) Pvt. LTDDokument69 SeitenMicrochip Technology (India) Pvt. LTDSushant SaxenaNoch keine Bewertungen

- ST Circ 206 4 2017 FNLDokument3 SeitenST Circ 206 4 2017 FNLSushant SaxenaNoch keine Bewertungen

- English1 June 2013Dokument12 SeitenEnglish1 June 2013Sushant SaxenaNoch keine Bewertungen

- Application Form For Computer AdvanceDokument5 SeitenApplication Form For Computer AdvanceSushant SaxenaNoch keine Bewertungen

- RTI FormatDokument2 SeitenRTI FormatSushant SaxenaNoch keine Bewertungen

- Auditannexure CDokument4 SeitenAuditannexure CSushant SaxenaNoch keine Bewertungen

- Cheque Introduction: A Cheque Is A Document of Very Great Importance in TheDokument13 SeitenCheque Introduction: A Cheque Is A Document of Very Great Importance in The777priyankaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Y9 Commercials Notes and Worksheet PDFDokument12 SeitenY9 Commercials Notes and Worksheet PDFBlack MusicNoch keine Bewertungen

- FinancialInclusion RecentInitiativesandAssessmentDokument39 SeitenFinancialInclusion RecentInitiativesandAssessmentShaneel AnijwalNoch keine Bewertungen

- Card Monthly Summary 10072022023013Dokument5 SeitenCard Monthly Summary 10072022023013Marsha BaconNoch keine Bewertungen

- Residential Status and Income Tax ImplicationsDokument6 SeitenResidential Status and Income Tax ImplicationsmamtakariraNoch keine Bewertungen

- IELTS speaking exam money and finance sample answersDokument22 SeitenIELTS speaking exam money and finance sample answersbhawnaNoch keine Bewertungen

- Free Cash FlowDokument6 SeitenFree Cash FlowAnh KietNoch keine Bewertungen

- Wells Fargo Clear Access BankingDokument5 SeitenWells Fargo Clear Access BankingМоника ПетровичNoch keine Bewertungen

- SHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCDokument7 SeitenSHORT WRITE ABOUT STOCK SHARE AND RISK Electiva CPCyarima paterninaNoch keine Bewertungen

- Union Bank 1Dokument12 SeitenUnion Bank 1bindu mathaiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Derivatives: Forward ContractsDokument4 SeitenDerivatives: Forward ContractsSAITEJA DASARINoch keine Bewertungen

- MoD Constructive Delivery-vl&c-PCSDokument6 SeitenMoD Constructive Delivery-vl&c-PCSVishal BhardwajNoch keine Bewertungen

- EVA and NPV valuation methods comparisonDokument16 SeitenEVA and NPV valuation methods comparisonJosh SmithNoch keine Bewertungen

- Manajemen Keuangan Chapter 17Dokument27 SeitenManajemen Keuangan Chapter 17zahrinaNoch keine Bewertungen

- CH 11Dokument51 SeitenCH 11Bayley_NavarroNoch keine Bewertungen

- STD X CH 3 Money and Credit Notes (21-22)Dokument6 SeitenSTD X CH 3 Money and Credit Notes (21-22)Dhwani ShahNoch keine Bewertungen

- New NabilDokument30 SeitenNew NabilMadhurendra SinghNoch keine Bewertungen

- ThesisDokument17 SeitenThesisKritiNoch keine Bewertungen

- NI Act 1881Dokument11 SeitenNI Act 1881AngelinaGuptaNoch keine Bewertungen

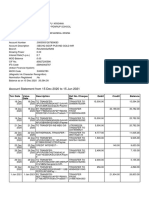

- Account statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021Dokument9 SeitenAccount statement for Mr. SAVARAPU KRISHNA from Dec 2020 to Jun 2021SRINIVASARAO JONNALANoch keine Bewertungen

- Kotak FinalDokument46 SeitenKotak FinalRahul FaliyaNoch keine Bewertungen

- MODULE 1 Understanding Personal FinanceDokument43 SeitenMODULE 1 Understanding Personal FinanceAnore, Anton NikolaiNoch keine Bewertungen

- M.ed Challan FormDokument1 SeiteM.ed Challan Formshakeel manshaNoch keine Bewertungen

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDokument14 SeitenGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlNoch keine Bewertungen

- FASB ASC Research on Classifying InvestmentsDokument2 SeitenFASB ASC Research on Classifying InvestmentsNot Tiffany HwangNoch keine Bewertungen

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDokument4 SeitenASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNoch keine Bewertungen

- Simple Interest Formula and ProblemsDokument4 SeitenSimple Interest Formula and ProblemsTAภaу ЎALLaмᎥlliNoch keine Bewertungen

- Coffee Table Booklet 19012024Dokument244 SeitenCoffee Table Booklet 19012024Antony ANoch keine Bewertungen

- Accounting IQ TestDokument12 SeitenAccounting IQ TestHarichandra Patil100% (3)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)