Beruflich Dokumente

Kultur Dokumente

The Fiscal Impact of The War of The Pacific

Hochgeladen von

Mario Estay ElguetaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Fiscal Impact of The War of The Pacific

Hochgeladen von

Mario Estay ElguetaCopyright:

Verfügbare Formate

Cliometrica (2009) 3:97121

DOI 10.1007/s11698-008-0028-6

ORIGINAL PAPER

The fiscal impact of the War of the Pacific

Richard Sicotte Catalina Vizcarra

Kirsten Wandschneider

Received: 3 April 2008 / Accepted: 22 May 2008 / Published online: 21 June 2008

! Springer-Verlag 2008

Abstract In the War of the Pacific (18791883), Chile defeated Peru and Bolivia,

and acquired territories that contained vast deposits of sodium nitrate, a leading

fertilizer. Chiles export tax on nitrates later accounted for at least one half of all

government revenue. We employ a multi-country model of export taxation in order

to simulate the potential government revenues that Bolivia, Chile and Peru could

have earned under the counterfactual scenario that Chile did not conquer the nitraterich provinces of its adversaries. Our results are that Peruvian and Bolivian government revenues could have been at least double their historical levels. We

estimate that, over the remainder of the nineteenth century, Chiles earnings from

nitrates would have fallen by 80%.

Keywords

Export tax ! Nitrates ! War of the Pacific ! South America

JEL Classification

C72 ! F13 ! F14 ! F17 ! H21 ! N46 ! N76

1 Introduction

In the War of the Pacific (18791883), Chile defeated the combined armies of Peru

and Bolivia and acquired territories on the Pacific coast of South America from both

countries. Peru lost its two southernmost provinces, Tarapaca and Arica, and

R. Sicotte (&) ! C. Vizcarra

University of Vermont, Burlington, VT, USA

e-mail: rsicotte@uvm.edu

C. Vizcarra

e-mail: cvizcarr@uvm.edu

K. Wandschneider

Occidental College, Los Angeles, CA, USA

e-mail: kirsten@oxy.edu

123

98

R. Sicotte et al.

recovered the province of Tacna only after a final treaty was signed in 1929. Perhaps

the war is best remembered today because Bolivia lost its entire seacoast to Chile.

The issue continues to be a flashpoint in relations between the countries and

resonates strongly in their respective domestic politics.

But from the perspective of the time, the war was a major turning point as much

in the economic history of Chile and Peru as of Bolivia. The territories that Chile

absorbed contained vast depositsthe worlds only commercially viable deposits

of sodium nitrate, a natural source of nitrogen that was the worlds leading fertilizer

in the decades before World War I. Nitrate so dominated the economic life of Chile

during those years that the period is now referred to as el ciclo del salitrethe

nitrate cycle. The primary reason for the salience of nitrate in Chilean economic

history was the influence of the industry on the public treasury. The export tax on

nitrates routinely accounted for at least one half of all government revenue. With

those revenues, the Chilean government invested heavily in transportation,

infrastructure, and public education. For Peru, the loss of immense nitrate wealth

came at the most inauspicious time imaginable. In the 1870s Perus export boom

based on guano came to an end, and in 1876 the government defaulted on its

enormous foreign debt, leaving a number of railroads partially constructed. The

government was counting on public revenues from the nitrate industry to return to

solvency. The loss of the war was catastrophic. Economic depression, financial

chaos and civil war followed Perus defeat. Default settlement resulted in foreign

monopoly control of the countrys railroads.

Although historical work on the war is voluminous, there are no quantitative

estimates of the wars impact based on economic theory and statistical techniques.

Our goal is to fill that gap. One avenue that we considered was to construct

computable general equilibrium (CGE) models of the Bolivian, Peruvian and

Chilean economies, but the existing data are not adequate for such an exercise. The

data on the Chilean nitrate industry after 1880, however, are quite complete. Using

these data, we provide quantitative measures of the fiscal impact of the War of the

Pacific. We employ a multi-country model of export taxation in order to simulate the

potential government revenues that Bolivia, Chile and Peru could have earned under

the counterfactual scenario that Chile did not conquer the nitrate-rich provinces of its

adversaries. We estimate demand and supply elasticities from historical data with

which we are able to parameterize the model and obtain simulation results. Our

results are that Peru lost the potential to earn more than 1.5 million pounds sterling

per year in nitrate export tax revenue throughout the 1880s, a figure that exceeded its

entire government revenue at the time. We estimate that Bolivias potential revenues

from export taxes in were in the range of 200,000400,000 pounds sterling during the

1880s, much less than for Peru, but still large for a country with an annual budget

between 400,000 and 500,000 pounds sterling. Chiles actual government revenues

from nitrate export taxation averaged about 1.5 million pounds sterling annually over

the decade of the 1880s, but we estimate that without the benefit of the conquered

territories, revenue from nitrates would have been no more than 300,000 pounds.

These estimated effects are of sufficient magnitude that they imply major effects on

the governments treasuries. In particular, the options open to the countries insofar as

public investments and tax cuts were greatly affected by the war. We show that the

123

The fiscal impact of the War of the Pacific

99

pattern of government taxation and spending in the three countries in the decades

following the war reflect their different options. As a consequence, it is logical to

conclude that the war had a significant effect on the progress of infrastructure,

literacy, debt service and international trade, although quantitative estimates of these

effects are left for future work.

The paper proceeds as follows. In the next two sections we describe the

international market for nitrates before World War I, and the historical experience

of nitrate export taxation. We present our theoretical model in the Sect. 4. In

Sect. 5, we present our data and econometric estimation of nitrate demand and

supply elasticities. We next present our model simulation results and sensitivity

analyses. We discuss their implications in Sect. 7. Section 8 concludes.

2 The fertilizer market, 18701913

Sodium nitrate was the most important of several nitrogen fertilizers in the late

nineteenth and early twentieth centuries, accounting for 60% or more of commercial

nitrogen sources.1 Others included ammonium sulfate, manure, guano, cotton-seed

meal, dried blood, fish waste, and meat tankage. Synthetic ammonia and calcium

cyanamid became major sources of nitrogen fertilizer during and after World War I.

Ammonium sulfate was the major competitor of nitrates, but it required a different

application because sodium nitrate is a base and ammonium sulfate is a powerful acid.

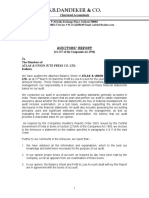

Nonetheless, their prices tracked one another fairly closely (Fig. 1). This suggests that

the two fertilizers may have been reasonable substitutes, with a concomitant

significant positive cross-price elasticity. To the extent that ammonium sulfate and

other competitors of nitrates were relatively simple and attractive alternatives to

nitrate, the own-price elasticity of demand for nitrate would have been higher as well.

Nitrogen fertilizers were used especially for sugar beets, potatoes, cereals,

onions, and vegetables. The use of nitrogen products in the manufacture of

munitions and explosives was a secondary source of demand until World War I.2

The entire worlds production of sodium nitrate took place in the Atacama Desert of

South America. Because it dissolves easily in water, large deposits could only build

up in extremely arid climates. The Atacama Desert is one of the driest places on

Earth. The nitrate deposits extended across the pre-war borders of Chile, Bolivia and

Peru. Production was concentrated in the Peruvian province of Tarapaca, and near

the Bolivian port of Antofogasta.

Nearly all nitrate exports were to Europe and North America. Miniscule amounts

of nitrates were consumed in South American markets. Figure 2 shows the

evolution of nitrate exports by region from the 1870s until World War I. In order to

aid in interpreting the counterfactual, in the graph we continue to label regions

1

See Partington and Parker (1922, p. 25). Soto Cardenas (1998, p. 75) and Yunge (1909, pp. .308324);

Chile, Memoria de la Delegacion Fiscal de Salitreras (1893, 1897, 1902). See also annual reviews of the

chemicals trade in the Economist.

See Brown (1963, p. 231); Bermudez (1984, p. 198), Greenhill (1977, p. 247), Partington and Parker

(1922), Wheeler (1918); Chile, Memoria de la Hacienda (1889); Chile, Memoria de la Delegacion Fiscal

de Salitreras (various years).

123

100

R. Sicotte et al.

Fertilizer Prices, 1873-1913

Pounds sterling per ton

25

20

Nitrate

Ammon Sulfate

15

10

1913

1911

1909

1907

1905

1903

1901

1899

1897

1895

1893

1891

1889

1887

1885

1883

1881

1879

1877

1875

1873

Year

Fig. 1 Fertilizer Prices, 18731913. Source: Nitrate: 18731879: Paish (1914). 18801913: Chile.

Ministerio de Hacienda (1925). Ammonium sulfate: Chile. Ministerio de Hacienda (1925)

Nitrate Exportsby Region

Thousands of Long Tons

2500

Chile

Bolivia

Peru

2000

1500

1000

500

1909

1908

1907

1906

1905

1904

1903

1902

1901

1900

1899

1898

1897

1896

1895

1894

1893

1892

1891

1890

1889

1888

1887

1886

1885

1884

1883

1882

1881

1880

1879

1878

1877

1876

1875

1874

1873

Year

Fig. 2 Nitrate Exports by Region. The legend shows countries, which is correct prior to 1879. From

1879 forward, Chile corresponds to exports from the port of Taltal and Caleta Colosa, Bolivia from

the ports of Antofagasta and Tocopilla, and Peru for exports from the various ports of

Tarapaca.Sources: 18731879: Bermudez (1963, p. 372374); 18801909: Chile. Ministerio de

Hacienda; Chile. Memoria de la Delegacion Fiscal de Salitreras; 19101913: Chile. Estadistica Comercial

pertaining to Peru and Bolivia, even though after 1883 these territories were

formally part of Chile. Nitrate exports expanded rapidly in the period from 1883 to

1913, averaging a 7% annual increase.

The nitrate fertilizer production process required key inputs of labor, dynamite,

water, coal and transportation. A layer of rock called caliche, usually several feet

below the surface, contained sodium nitrate. Caliche was mined by setting off

charges of dynamite below the surface and blowing apart the rock of a large area.

123

The fiscal impact of the War of the Pacific

101

Workmen would then gather the chunks of caliche and transport them to a

processing facility, called an oficina. At the oficina, the sodium nitrate was extracted

from the caliche by the Shanks process, named after its inventor. The process

amounted to grinding down the caliche, leaching it out with hot water and then

crystallizing the nitrate.3 Once the nitrate was obtained, it was bagged and

transported by rail to the coast for export.

3 Government taxation of nitrate exports

Table 1 shows the export taxes that were in force in the respective countries from

1876 to 1913. Peru charged an export tax, which was modified several times, on

exports by private producers. Beginning in 1876, the Government of Peru began to

implement a scheme to purchase nitrate companies. Because this process was

gradual, private exports accounted for about 50% of total exports during the 3 years

prior to the war. At the time of the conflict, it was uncertain what path nitrate policy

would take in the future.4

Bolivian exports were duty free. Indeed, it was Bolivias enactment of a 10-cent

per quintal export tax in 1878 that was the direct cause of the war.5 The major

nitrate producing company, which had important Chilean investors, refused to pay

the tax. Chile claimed that this contravened the border treaties between Chile and

Bolivia, which included economic considerations. When Bolivia refused to rescind

the tax, Chile occupied Antofagasta. Chile later declared war on Peru, which was a

signatory to a mutual defense treaty with Bolivia.6

Prior to the war, Chile had no export tax on nitrates. With occupation and the

extraordinary expenses of war, the Chilean government created a commission to

study how best to take advantage of the resources now under its control. The

commissions recommendations, which were by and large adopted, were to

privatize the oficinas that had been in possession of the Peruvian government, and to

enact an export tax. Beginning in 1880, Chile charged a specific export duty of 2.57

shillings per cwt, which it maintained until the 1920s.7

The Shanks system was widely employed from the 1870s until the 1920s. See Bain and Mulliken

(1923), Bermudez (1963), Crozier (1997) and Whitbeck (1931).

See Bermudez (1963, p. 343) and Cruchaga (1929, pp. 257260) and Greenhill and Miller (1973, p.

125). The model we analyze below assumes export taxation by all three countries. A possible extension of

this model is to model one or more of the countries as operating a state-owned monopoly.

In 1878 10 Bolivian cents were equal to roughly 3.7 pence, so the tax amounted to 7 shillings per ton.

As the price of nitrate was 10.6 pounds sterling per ton, the tax was equivalent to about 3% ad valorem.

For BolivianBritish exchange, see Penalozo Cordero (1984, p. 49).

See Bermudez (1963), Dennis (1967), Kiernan (1955), Mayo (1979) and Querejazu Calvo (1995).

See Bermudez (1984, pp. 148194); Billinghurst (1889, pp. 3846) and Sater (1986, pp. 135140). The

report of the commission, known as the Comision Consultiva de Salitres, is reproduced in the Memoria de

la Hacienda (1880). The tax rate was that proposed by the commission, and it was approved by the

Chilean Congress after considerable debate. Proponents argued that the rate struck a balance between the

need to raise revenue for the nation at war, and the desire not to damage the industry. They maintained

that foreign consumers would bear most of the burden of the tax.

123

102

R. Sicotte et al.

Table 1 Export duties, 18761913, pounds sterling per ton

Year

Perua

Bolivia

Chileb

1876

1.93 (JanuaryJune); 3.23

(JulyDecember)

None

None

1877

2.42

None

None

1878

3.45

0.35 (not enforced)

None

1879

None

18801913

2.57

The Peruvian export tax only applied to exports by private producers, not the government company.

Duties from 1876 until occupation were specified in Peruvian currency. The duty was initially 60

centavos of a sol per quintal (45.9 kg), but was changed to 1.25 soles per quintal. See Madueno (1919, pp.

78) and Bermudez (1963, p. 342344). PeruvianBritish exchange rates from OBrien (1982, p. 161),

were used to calculate shillings per cwt. These values fluctuated substantially during the period, so the

Peruvian duty is a rough estimate

Chile first imposed export duties on the occupied territories in 1879 (from September for Antofagasta

and from December for Tarapaca). These duties were 40 centavos of one peso per 100 kg for Antofagasta,

and 1.5 pesos per quintal for Tarapaca. Bermudez (1984, pp. 9899, 144147). Again using exchange

rates from OBrien (1982, p. 161), these correspond to 0.52 shillings per cwt, and 4.29 shillings per cwt,

respectively. In October, 1880, Chile enacted an export duty 2.57 shillings per cwt, which remained in

place until the 1920s. Exports from Taltal and Aguas Blancas paid fifty percent of the duty until 30 June

1882, and 30 June 1883, respectively (Hernandez 1930, pp. 112118)

The nitrate export tax revenues earned by Peru and Chile during the years 1876

1913 are displayed in Fig. 3.8 Before the war, Peruvian revenues approached 1

million pounds sterling. Chilean revenues increased from about 1.5 million pounds

sterling in the mid 1880s to nearly 7 million pounds sterling by 1913. Nitrate

revenues constituted at least 20% of all Peruvian government revenues before 1879,

although much of it was earmarked for payments related to the expropriation scheme

and the administration of the state nitrate operation. In Chiles case, nitrate revenues

rose steadily in importance throughout the 1880s until they reached 48% of revenues

in 1890. This percentage remained more or less constant until World War I.9

4 A multi-country model of export taxation

In this section we present a theoretical framework for analyzing the fiscal impact

of the war under the counterfactual that pre-war boundaries persisted and that the

8

The figures for revenues include nitrate of soda and iodine. Some oficinas also produced iodine from

the nitrate deposits. The vast majority of these iodine-producing oficinas were in Tarapaca. See Crozier

(1993), and Memorias de la Delegacion de Salitreras, various years, for iodine exports by port. Iodine

export tax revenues were about 15% of the total for most of the period. Government revenues include

both export tax revenues and revenues from government sales (the Peruvian Government company for

18761879 and the Chilean government during 18801882). Figures for Chile do not include proceeds

from the privatization of nitrate deposits, which could amount to 200,000 pounds sterling per year (see

Resumen de la Hacienda Publica de Chile desde 1833 hasta 1914).

9

See Tantalean Arbulu (1983), Madueno (1919), Greenhill and Miller (1973) and Mamalakis (1971, p.

184). Nitrates were about 70% of total Chilean exports.

123

The fiscal impact of the War of the Pacific

103

three national governments taxed nitrate exports. We model two alternative

objective functions for the governments. First, that they wished to maximize social

welfare by setting an optimal export tax, and second, that they wished to

maximize government revenue. The key difference between the two taxes is that

under the former, governments trade off the benefits of the tax revenue paid by

foreign consumers against the decreased producer surplus earned by domestic

suppliers (domestic consumer surplus does not exist in our case because the

product was not consumed locally). Under the latter, the focus is exclusively on

maximizing government revenue. Figure 4 shows the maximum revenue tax under

two basic assumptions. First, we assume that the nitrate industry within the

country is perfectly competitive. This allows us to draw a straightforward supply

curve for the industry, simplifying the problem facing the government. In the

multi-country model that follows, we assume that each countrys industry is

perfectly competitive, which allows us to focus on the non-cooperative game

between the three governments, rather than model imperfect competition among

the actual producers of nitrate within each country.10 The second assumption is

that the demand and supply curves are linear. The initial equilibrium is given by

equating export supply and export demand, resulting in price P1 and exports Q1.

In order to obtain the maximum revenue ad valorem tax rate t*, a government

equates marginal export revenue with the marginal cost of raising export tax

revenue. This increases the world price to P2, decreases the quantity of exports to

Q2, and raises tax revenue to tP2 Q2 P2 $ P2 1 $ tQ2 : An optimal export tax

differs in that the government does not exert monopsony power over its own

producers. Thus, the optimal tax is solved by equating export supply with

marginal revenue.

Chilean producers had a monopoly in the world nitrate market. Under the

counterfactual, producers from three countries would have shared the market, and

therefore the optimal (or maximum-revenue) taxes for each country would depend

upon the tax rates of other countries. The strategic interdependence of optimal tax

rates is conducive to game-theoretic analysis. We follow the multi-country

theoretical model of export taxation proposed by Panagariya and Schiff (1994,

10

Perfect competition requires homogeneous products, many firms and ease of entry. Although the

nitrate deposits were of distinct qualities, the processed product was homogeneous. As far as the number

of firms, there were dozens of firms in Peru, but initially fewer in Bolivia and Chile. The ease of entry

depends upon capital requirements, capital markets, and legal barriers. Barriers were not likely to be too

high. Many firms freely accessed international capital markets. Furthermore, governments could auction

lands to prospective producers if they deemed competition inadequate. To the extent that domestic

industries were imperfectly competitive, this would have reduced the revenues accruing to the

government with jurisdiction. If, for example, imperfect competition would have been more severe in

Chile and Bolivia than in Peru, then Peruvian government revenues would have been higher, and the other

governments revenues would have been lower. Finally, nitrate producers attempted to form cartels

beginning in the 1880s. Some of these cartels were more successful in their collusion than others.

Insufficient quantitative evidence remains to model and estimate the cartel subgame. As discussed below,

in our empirical estimation we account for imperfect competition by including a dummy variable in our

regression for years in which cartels operated. This approach follows that of Irwin (2003a), in his study of

U.S. steel exports, who includes a dummy variable to measure the effect of the U.S. steel merger.

123

R. Sicotte et al.

Government Revenues from Nitrate

8000

7000

6000

Peru

Chile

5000

4000

3000

2000

1913

1911

1909

1907

1905

1903

1901

1899

1897

1895

1893

1891

1889

1887

1885

1881

1883

1879

1877

1000

1875

Thousands of Pounds Sterling

104

Year

Fig. 3 Government revenues from nitrate. Sources: Chile: Resumen de la Hacienda Publica de Chile

desde 1833 hasta 1914, Mamalakis (1971, p. 184). Peru: Hunt (1985)

1995).11 Accordingly, we solve a model for linear demand and supply curves for

three countries exporting a homogeneous product. This corresponds well in the case

of nitrate, which was extracted from caliche by the universally employed Shanks

process. The optimal (maximum-revenue) tax in each country is a function of the

export demand and supply parameters, as in the single country case, but export

demand for each country is a residual demand, which depends in part on the export

taxes employed by the rival countries. Thus, each countrys optimal tax rate can be

expressed as a reaction function, depending on other countries tax rates. The Nash

equilibrium solution concept can be used to solve these functions simultaneously.

QD A $ BP

qsi

ai bi p i

QD

i A $ aj $ ak $ B bj 1 $ tj bk 1 $ tk P

ti P $ pi =P;

where Eq. (1) is the world demand fuction, Eq. (2) is the supply function for country

i, Eq. (3) is the residual demand function for country i, and Eq. (4) is the export

tariff reaction function for country i. The formal model is defined and solved in the

11

Yilmaz (1999, 2006) applies this framework in his empirical investigation of the international cocoa

market. Our approach differs from that of Irwin (2003b) in his analysis of the optimal export tax on cotton

in the antebellum U.S. The most significant difference is that our model explicitly includes the reaction

functions of all market participants while Irwin does not model the optimal reactions of other countries to

an optimal U.S. export tariff. Our methodological choice is motivated by our desire to obtain estimates for

all three countries simultaneously, and to empirically investigate the importance of the strategic

interaction.

123

The fiscal impact of the War of the Pacific

105

Price

Marginal Cost of

Raising Revenue

Export

Supply

P2

P1

P2(1 t)

Export

Demand

Marginal

Revenue

Q2

Q1

Quantity

Fig. 4 The maximum revenue export tax

Appendix. Note that the tax rate is expressed as a percentage of the world price, so

that resulting tax revenue for country i is ti*qi*P. This means that the tax rate is not

directly comparable with ad valorem tax rates, which typically are expressed as a

percentage of the pre-tax domestic price.

In order to operationalize this model, we obtain econometric estimates of the

world demand elasticity. The econometric exercise will also provide an estimate of

the historical (Chile) supply elasticity, which we use as a benchmark for the supply

elasticities of the three countries nitrate-producing provinces. Once we have

obtained these estimates, we then use them to obtain estimates of the supply and

demand parameters in our reaction functions (A, B, ai and bi). We do this by making

use of the fact that eD,S = DQ/DP*P/Q, and that DQ/DP is the inverse of the slope of

the demand (supply) curve (B and bi in the model). Using actual price and quantity

from each year, we obtain the slopes of the demand and supply curves for that year.

Knowing a point on the curve and the slope allows us to find the intercept (A and ai).

With the parameters in this model obtained in the preceding manner, we solve for

the Nash optimal and maximum revenue taxes under the counterfactual. After

calculating those taxes, we then calculate the effects on the world price, exports, and

resulting tax revenues. As a by-product, the econometric estimates of demand and

supply elasticities also enable us to obtain estimates of Chiles optimal and

maximum revenue taxes under the historical case of Chile as world monopolist.

5 Econometric estimation of nitrate demand and supply

In this section we estimate an econometric model of the nitrate market, in order to

provide benchmark estimates in the simulation of the theoretical model presented

123

106

R. Sicotte et al.

above. The data span the years 18811913, during which time Chile held control of

all provinces and there was no change in the tariff. Because price and quantity are

simultaneously determined, the regressions are estimated using three stage least

squares.

The demand for Chilean nitrate exports is specified as:

ln Qt b0 b1 ln PUK;t b2 ln PAMMON;t b3 INCt b4 ln PUK;t$1 lt ;

where Qt is the total quantity of nitrate exports, PUK is the price of nitrate in the

United Kingdom, PAMMON is the price of ammonium sulfate, which was the

principle competitor of nitrate at the time. INC is an index of the gross domestic

products of the nitrate-importing countries, weighted by their consumption.12 We

include a lagged price. Nitrate could easily be stored, so last years price strongly

affected this years nitrate demand, a high previous price indicating that consumers

held off on stock accumulation. l is a random demand shock.

The inverse supply of Chilean nitrate exports is specified as:

ln PUK;t a0 a1 ln Qt a2 ln Wt a3 ln PCoal;t a4 Intt

a5 Cartel a6 ln Qt$1 et

W is a Chilean wage index and PCOAL is the price of coal, both major input

prices. No series of Chilean coal prices is available. Between 40 and 50% of coal

consumed in Chile during this period was imported from Britain.13 We estimate the

price of coal in Chile by adding the freight rate from Britain to Chile to the British

price of coal. Int is the Chilean interest rate, which has two possible interpretations.14 First, it is the price of financing capital expenditures and can be considered

an input price. Second, consistent with Hotellings (1931) model of natural resource

extraction, producers are hypothesized to trade off the benefits of saving the income

from mineral extraction at the interest rate versus the benefits of extracting the

minerals later and selling them at the future price. Because we do not have access to

the price and interest rate expectations of producers, the inclusion of this variable is

an incomplete econometric specification of the natural resource extraction problem.

Holding price and interest rate expectations constant, however, we expect the sign

of this variable to be negative, as higher interest rates lower the opportunity cost of

production today. Nitrate producers formed cartels of varying duration over the

period of our study. We include a dichotomous cartel variable that takes the value

12

Quantity is from Chile, Ministerio de Hacienda, Memoria de la Hacienda. Nitrate and ammonium

prices are from Chile, Ministerio de Hacienda, Antecedentes. We use United Kingdom prices for both of

these products. The U.K. nitrate price was the international standard. The country was the first major

export market, and remained an important market and trans-shipment point. Chilean sources continued to

quote UK, rather than German, French or U.S. prices, into the 1920s. The countries in the foreign income

index are the United Kingdom, Germany, France, the United States, the Netherlands, Belgium and Italy.

Together they accounted for over 90% of nitrate consumption. The GDP data are from Maddison (2000).

The consumption weights are from Chile, Antecedentes.

13

We thank an anonymous referee for providing us with this figure.

14

The wage is calculated from Wagner (1992) and Braun et al. (2000). Coal prices are from Mitchell

(1988), and the freight rates are from Oribe Stemmer (1989). Interest rates are from Braun et al. (2000).

123

The fiscal impact of the War of the Pacific

107

Table 2 Three stage least squares estimates of nitrate demand and supply, 18811913

Dependent variable

Chilean export demand

(log total export volume)

Chilean export supply

(log export price)

Constant

5.69***

-0.13

Ln export price

-2.54***

Ln ammonia price

0.73***

Ln foreign income

2.39***

Ln lagged export price

0.95**

Ln export quantity

1.27***

Ln wage

0.40*

Ln coal price

0.10

Interest rate

-0.06

Cartel

0.20**

0.93

0.75

Ln lagged export quantity

Adjusted R2

-1.14***

N = 33

*** Significant at the 1% level; ** significant at the 5% level; * significant at the 10% level

one when a cartel was in operation and zero when it was not.15 Because cartels

should raise prices if they are effective, the expected sign is positive for this

variable. For the supply equation we include a lagged term of the total export

quantity to again capture the storage features of the nitrate. We expect todays price

to be lower if yesterdays exports were relatively high.

Table 2 displays the results of the estimation. The price elasticity of demand for

Chilean nitrate exports is estimated to be -2.54 indicating that demand is price

elastic. The cross price elasticity with ammonium is 0.73 and the income elasticity

with respect to the foreign income is 2.39. The lagged price coefficient behaves as

expected. For the supply equation, the reciprocal of the coefficient on export volume

indicates the elasticity of export supply, so the export supply for Chile is inelastic at

a value of 0.79. Wages are positive and significant as expected. The coefficient on

coal prices has the correct sign but is insignificant. This is perhaps due to the

unfortunate lack of a coal price series directly from the region. The interest rate is

negative and insignificant. The cartel variable suggests that producer collusion did

have some ability to raise prices. Lagged exports are associated with lower prices, as

expected.

Our econometric investigation yields elasticity estimates that are statistically

significant and highly plausible. Ours are the first econometric estimates of nitrate

demand and supply elasticity for this period so it is impossible to argue plausibility

by comparing with previous work. It is likely that nitrate demand was elastic,

because there were different substitute fertilizers available. Insofar as the supply

elasticity, the estimate is statistically significant and suggests inelastic supply. The

fact that there was virtually no domestic market for nitrate meant that all nitrate

15

Information on cartel operation is from Brown (1963) and Chile, Ministerio de Hacienda (1935).

123

108

R. Sicotte et al.

produced had to be stored or exported. The lack of substitute domestic market surely

contributed toward a lower export supply elasticity.

6 Simulation results

We now calculate maximum revenue and optimal taxes. We begin by examining

the historical case with Chile as an international monopolist on nitrate exports.

We solve our theoretical model in a single country setting (setting a2, a3, b2, b3

equal to zero), so as to make the results directly comparable to our multi-country

case. We obtain our parameters for 1883, using the method described above. The

simulation results are presented in Table 3. The baseline cases refer to

demand elasticity = -2.54 and supply elasticity = 0.79, as estimated. For those

values, an optimal tax rate of 34% would have generated revenues equal to

about 2.082 million pounds sterling at a world price of 11.6 pounds sterling per

ton. A maximum revenue tax would have been double, 68%, and earned

revenues of 3 million pounds sterling. Both were substantially in excess of

Chiles actual export tax earnings in 1883, which approached 1.5 million pounds

sterling.

Table 3 Simulations of optimal and maximum revenue tariffs: Chile as a monopolist (year: 1883)

Actual

Elasticities

World price

(pounds sterling

per ton)

Tax rate

(%)

Quantity

(thousands

of tons)

Tax revenue

(thousands of

pounds sterling)

11.2

23

576

1,479

eD = -2.54

11.6

34

522

2,082

11.9

31

485

1,800

11.2

25

568

1,564

11.2

24

560

1,524

13.0

68

336

3,000

12.6

39

390

1,915

12.3

66

342

2,777

11.9

34

419

1,722

Optimal tax

Baseline case

eS = 0.79

eD = -2.54

eS = 3

eD = -4

eS = 0.79

eD = -4

eS = 3

Max. revenue tax

Baseline case

eD = -2.54

eS = 0.79

eD = -2.54

eS = 3

eD = -4

eS = 0.79

eD = -4

eS = 3

123

The fiscal impact of the War of the Pacific

109

We check the sensitivity of these results to changes in the elasticities. More

elastic supply or demand will lead to lower optimal and maximum revenue taxes.

So we treat our initial estimates as an upward limit and explore what happens with

substantially more elastic supply and demand. In particular, first we raise the

supply elasticity to 3, holding the demand elasticity constant. Then we increase

the demand elasticity to -4, holding supply elasticity constant. The final case we

examine is with a demand elasticity of -4 and a supply elasticity of 3. Revenues

fall to 1.5 million in the optimal tax case and to 1.7 million in the maximum

revenue tax case. Taken as a whole, our simulation-based estimates of Chiles

optimal tax rate and tax revenue are reasonably close to the actual tax rate and

revenue Chile earned. A complete discussion of whether Chile was seeking to fix

an optimal or revenue-maximizing tax rate is beyond the scope of this paper. Still,

our results suggest that Chile was not maximizing revenue, but was closer to

fixing an optimal tax.

We now present simulations of nitrate tax revenue under the counterfactual that

the Peru, Bolivia and Chile held to their original pre-War of the Pacific borders. We

first solve the model using our econometric estimates of supply and demand

elastiticies, and we assume that each area had the same supply elasticity. We

provide estimates for 1883, 1893, 1903 and 1913. The estimates for later years are

more speculative, because our model is static and the pattern of entry by nitrate

firms in country would be affected by tariff policy in each country. Further,

governments might take positive steps to stimulate their nitrate industries, such as

constructing railroads or ports.

Table 4 contains the optimal tax simulations and Table 5 the maximum revenue

simulations. It is clear that for 1883, 1893 and 1903 Peru was earning most of the

revenues because Tarapaca provided most of the exports during those years (Fig. 2).

For 1883, Perus optimal tax rate of 29.2% yields revenue of about 1.5 million

pounds sterling. The optimal rates for Bolivia and Peru are less than 5% and

generate comparatively little revenue. The tax rates and relative positions of the

countries revenues remain stable in the 1893 and 1903, although revenues increase

as the market for nitrates grew substantially.

Table 4 Simulations of Nash optimal export taxes

Year World

price

(pounds

sterling

per ton)

Peru

Tax

rate

(%)

Bolivia

Quantity

(thousands

of tons)

Tax revenue Tax

(thousands

rate

of pounds

(%)

sterling)

Chile

Quantity Tax

Tax

revenue rate

(%)

Quantity Tax

revenue

1883 11.2

29.2

456

1,496

4.3

79

38

1.6

31

1893

9.4

30.3

784

2,240

3.0

94

27

2.9

90

25

1903

9.4

27.2 1,061

2,710

6.2 278

162

1913 10.7

13.9 1,093

1,628

10.6 852

968

139

39

11.2 900

1,080

eD = -2.54; eSi = 0.79

123

110

R. Sicotte et al.

Table 5 Simulations of Nash maximum revenue export taxes

Year World

price

(pounds

sterling

per ton)

Peru

1883 12.9

67.2 289

2,503

60

45

349

59

18

1893 10.8

67.2 441

3,207

59

53

340

59

51

327

1903 10.9

66.4 673

4,865

60

161

1,052

59

80

512

1913 12.6

62.9 660

5,234

62

508

3,970

62

537

4,216

Tax

rate

(%)

Bolivia

Quantity

(thousands

of tons)

Tax revenue Tax

rate

(thousands

of pounds

(%)

sterling)

Chile

Quantity Tax

Tax

revenue rate

(%)

Quantity Tax

revenue

133

eD = -2.54; eSi = 0.79

The major change comes in 1913. During this period the provinces of

Antofogasta and Taltal expanded production enormously, so the simulation results

based upon this historical fact reflect it. Perus optimal tax rate falls as its market

power diminishes (its residual demand curve becomes more elastic), while the

opposite occurs for Bolivia and Chile. The tax rates converge, as do the revenues.

Importantly, Perus simulated revenue actually declines from 1903 to 1913.

Repeating the exercise for the maximum revenue tariff, we find substantial

increases in the tax rate and revenue relative to the optimal tariff. In the case of

Peru, the maximum revenue tax rate remains quite stable at between 62.9% in

1913 and 67.2% in 1883 and 1893. Revenues increase from the already substantial

sum of 2.5 million pounds sterling in 1883 to over 5 million pounds by 1913,

although much of the increase is complete by 1903. As residual demand elasticity

rises, the burden of the tax is increasingly being borne by domestic producers. The

Bolivian and Chilean maximum revenue tax rates are much higher than their

optimal rates, and generate much more revenue, albeit still far less than Peru until

1913.

We report sensitivity analysis of the three-country maximum revenue baseline

simulations in Table 6.16 We experiment with lower and higher demand and supply

elasticities. We focus on the year 1883. Cases 1 and 2 show results at lower and

higher world demand elasticities, respectively, holding supply elasticities constant.

A substantially less elastic world demand leads to much higher revenues for each

country, but still a relatively small amount for Chile. Cases 3 and 4 reflect lower and

higher Peruvian supply elasticity, respectively, holding other parameters constant.

These cause major changes in the maximum revenue tariff and revenue. In

particular, in case 4 Peru cuts its tariff rate to 37% and its revenues fall to 1.6

million pounds, about 900.000 less than it earned at the estimated elasticities

reported in Table 5. Interestingly, as Peru cuts its tariff, revenues for Bolivia and

Chile fall somewhat. This is because the cut in the Peruvian tariff results in greater

Peruvian exports, and concomitantly a decrease in Bolivian and Chilean residual

demand. Finally, in case 5 all supply and demand elasticities are given high values,

16

We conducted similar analyses for the optimal tariff. The maximum revenue tariff is more sensitive to

changes in supply elasticity than the optimal tariff, as in Table 3. These results are available upon request.

123

-2.54

-2.54

-4.00

3.00

3.00

0.50

0.79

0.79

3.00

0.79

0.79

0.79

0.79

Peru supply Bolivia and Chile

elasticity

supply elasticities

Tax revenue in thousands of pounds sterling

-0.50

-4.00

Demand

elasticity

Case

#

32

37

91

65

80

1,403

1,617

3,248

2,327

4,292

26

60

60

60

60

Maximum

revenue tax rate

(%)

Maximum

revenue tax rate

(%)

Maximum

revenue tax

revenue

Bolivia

Peru

Table 6 Sensitivity analysis of maximum revenue tariff under the counterfactual (year: 1883)

206

329

354

321

715

Maximum

revenue tax

revenue

26

60

59

60

58

Maximum

revenue tax rate

(%)

Chile

79

126

136

123

278

Maximum

revenue tax

revenue

The fiscal impact of the War of the Pacific

111

123

112

R. Sicotte et al.

and this results in much lower maximum revenue tax rates for all three countries,

and much lower revenues.

7 The impact of the war on government revenues

The simulations provide estimates of tax revenues for Chile, Peru and Bolivia under

the counterfactual that they maintained their pre-1879 borders. If so, no country

would have had a monopoly in the nitrate market, although Perus initial position

was one of substantial market power (most nitrate exports were from Tarapaca until

after 1900). The simulation results are consistent with this observation. Perus

optimal and maximum revenue taxes (and revenue) were less than what Chiles

were as a monopolist. Yet, they still represented a considerable sum, exceeding 1.5

million pounds in 1883 every scenario that we examine. Bolivia, according to our

estimates, could have earned a maximum of about 700,000 pounds sterling in 1883,

and this only if the world elasticity of demand was markedly below our econometric

estimates. The other simulations put Bolivian revenues at between 321,000 and

354,000 pounds in 1883. Finally, Chiles prospects for substantial revenues from

nitrates in 1883 were extremely limited, according to our results.

In order to give some sense of the fiscal significance of our results, we compare

these estimates of nitrate revenues to overall pre and post-war government revenues

in the three countries. These comparisons are presented in Table 7. In the upper

panel of the table, actual government revenues for each country are provided for

1878, 1885, 1903 and 1913. All figures are converted to pounds sterling. The year

before the war was a year of low revenues. Each country had seen declines in

government revenue over the 1870s, and Bolivia was especially hard hit in 1878, a

year in which its citizens endured famine and plague.17 Before the war the Peruvian

government revenues exceeded Chilean government income, while the Bolivian

government earned much less. We chose 1885 as the next benchmark year, because

it was after Chile and Bolivias war finance regime had ended. The Peruvian

government, now engaged in civil war, was attempting to raise as much revenue as

it could. Even with that in mind, Peruvian government revenue fell dramatically

between 1878 and 1885. Chile, in contrast, saw a very large increase in government

revenue over the same period. Nitrate revenues played a significant role in that

expansion. Bolivias revenue increased substantially as well. Over the next

25 years, all countries saw revenues increase, although nearly all of the increase

for Peru and Bolivia occurred in between 1903 and 1913. In 1903 and 1913, Chile

earned more revenues from nitrates alone than the combined government revenues

of Peru and Bolivia. By 1913 the relative fiscal positions of the Chilean and

Peruvian governments had changed dramatically compared to 1878. However, the

Bolivian government continued to earn the smallest revenues of the three.

In the lower panel of Table 7, we show how the maximum revenue nitrate

revenues, as calculated in our simulations and reported in Table 5, compare to the

actual revenues that those countries earned. The simulation results in Table 5 are

17

See Bonilla (1980), Paz (1927) and Sater (1979).

123

The fiscal impact of the War of the Pacific

113

Table 7 Actual and potential roles of nitrate revenue in government finance

1878

1885

1903

1913

Actual government revenues, thousands of pounds sterling

Bolivia

137

448

492

1,070

Chile

2,317

3,824

8,096

13,958

Nitrates

Peru

Nitrates

1,079

3,716

6,801

3,595

1,160

1,607

3,549

1,093

Counterfactual maximum nitrate revenues as a percent of actual revenues

Bolivia

78% (46%)

214%

371%

Chile

3% (2%)

6%

30%

12% (7%)

14%

62%

216% (121%)

303%

147%

Perc. of actual nitrate revs

Peru

Bolivia: Paz (1927), Mitchell (2003). Exchange rates from Hillman (1984, p. 426), and McQueen (1924,

p. 6). Chile: Resumen de la Hacienda Publica de Chile. Peru: Basadre (1983), Tantalean Arbulu (1983)

The counterfactual nitrate revenues are from the baseline Nash maximum revenue export tax simulation, in which the elasticity of world demand is -2.54 and the elasticity of supply for all countries is

0.79. These are the elasticities obtained from the econometric estimates. The figures in parentheses in

column three of the lower panel are calculated using simulated export revenues from case 5 in Table 6.

Bolivian government revenues are for 1900 and 1910, not 1903 and 1913

based upon the econometric estimates of demand and supply elasticity. For 1885,

we also use the lowest estimates of maximum tariff revenues from Table 6 (case 5),

which are based upon the most elastic demand and supply. These lower estimates of

tariff revenue as a percent of actual revenues are reported in parentheses. First, for

Bolivia, the counterfactual maximum tariff revenue, although relatively small in an

absolute sense, would have been a large increase in government revenues for the

country, even in the 1880s. Using the elasticities from the econometric estimation,

Bolivian maximum revenue tariff would have generated revenues 78% of actual

Bolivian revenues in 1885. Using the lower estimate of revenues calculated from the

higher elasticities, nitrate revenues still amounted to 46% of actual revenues. The

potential revenues in 1903 and 1913 were even more significant, far outstripping

actual Bolivian government revenues at the time. In the case of Peru, the maximum

tariff revenue also was hugeat least equal to actual Peruvian government revenues

in each year examined. The interpretation of Chile is different, because its

governments actual revenues included proceeds from the nitrate export tax. So

instead, we compare counterfactual nitrate revenues to actual nitrate revenues.

Simulated nitrate revenues were between 7 and 12% of actual nitrate revenues in

1885; 14% in 1903 and 62% in 1913 after the local industry in Taltal took off.

Obtaining quantitative estimates of total government revenues under the

counterfactual is more speculative, because it also requires making assumptions

about how each government would have adjusted their tax policies, and then

estimating the economic effects of those changes. Given the fact that the existing

data are not up to the requirements of such an exercise, we restrict ourselves to

analyzing what some of the most likely changes in policy would have been.

123

114

R. Sicotte et al.

In the case of Chile, we can reach some conclusions about possible policy changes

under the counterfactual by observing Chilean government tax policy before and after

the war. Facing a severe decline in government revenues in the 1870s, Chile raised

import tariffs and enacted an income tax and an inheritance tax (Sater 1979). Between

1880 and 1900, however, the average import tariff (import tariff revenues divided by

the value of imports) fell by more than 25%.18 The income tax and inheritance taxes,

which never raised more than 200,000 pounds sterling per year, were repealed in 1890.

Cariola and Sunkel (1985) observe that other internal taxes were eliminated in the

1880s. Scholars tie the reduction and elimination of these taxes directly to the nitrate

windfall. Chiles import tariffs and the internal taxes imposed deadweight losses of an

uncertain magnitude. Conversely, according to our estimates Chiles nitrate export tax

was efficiency enhancing (the optimal export tax on nitrates that we calculate was

positive and greater than Chiles actual tax). Thus, the war permitted changes in

Chiles fiscal policy that overall were efficiency enhancing. Quantitative estimates of

these savings are beyond the scope of our analysis.

As with Chile, Bolivia did not earn revenues from nitrate export taxes prior to the

war, and was also suffering from a severe economic depression. We have estimated

that the taxation of nitrate exports could have supplied funds easily surpassing 50%

of the revenues that the Bolivian government actually raised between 1880 and

1913. Bolivia eschewed direct taxes, and relied heavily on import and export tariffs

for government revenue. We found no evidence of an increase in import tariffs in

the immediate aftermath of the war, which is probably not surprising, because the

government was not seeking to offset lost nitrate revenues (recall that the export tax

was not successfully imposed). Insofar as other taxes, export duties on silver and tin

were vital for the Bolivian government prior to World War I. It is reasonable to

assume that Bolivia possessed market power in those two industries, so that some

positive export tax was optimal (Hillman 1984). Thus, barring political considerations, those export taxes would not have been eliminated even if Bolivia had held

on to Antofogasta. Bolivia might have chosen to reduce import tariffs if it had

earned the levels in the counterfactual, but because of the very large size of potential

nitrate revenues relative to the actual Bolivian budget, it is reasonable to conclude

that the country would have seen a net increase in government revenues

approximately equal to whatever nitrate tax revenues they earned.

Peru was earning about 1 million pounds sterling from the nitrate industry prior

to the war. As Table 7 shows, government revenues plummeted by more than that

amount between 1878 and 1885. There are two reasons why. First, Peruvian

government revenues from the sale of guano, which had been in decline in the 1870s

because of the exhaustion of the best deposits, did not recover. Second, the country

suffered a severe trade depression that impacted imports, and therefore tariff

revenues. Indeed, immediately following Perus defeat, it raised import tariffs, but

this did not provide a large increase in government revenue. Later it created a

tobacco tax and established a state salt monopoly. (Basadre 1983; Coatsworth and

Williamson 2002). Taxes on agricultural exports later became additional sources of

revenue. All of these taxes implied deadweight losses (including the export taxes,

18

See Diaz and Wagner (2004). Coatsworth and Williamson (2002) obtain a similar result.

123

The fiscal impact of the War of the Pacific

115

which were on products where Peru had no ability to affect the world price).

Further, none of the new taxes came close to being able to raise revenue comparable

to what a nitrate export tax had the potential to raise.

The conclusion is inescapable that both Peru and Bolivia would have had much

larger government revenues, at least 50% more and probably more than double, if they

had not lost the war and had been able to impose a nitrate export tax. This is true even

if policy-makers lacked the ability or will to enact optimal or maximum revenue taxes.

Recall that according to our estimates, Chile achieved its massive revenues even

though it was taxing below the optimal and maximum tariff rates. There is no reason to

believe that Peru would have been less able to raise revenue than Chile. Moreover, the

Peruvian government was strapped for funds, and had the motivation to extract as

much revenue as possible. This was primarily due to the fact that it had defaulted on its

foreign debt, which required at least 2 million pounds annually to service.

8 Conclusions

As a result of the War of the Pacific, Chile was able to obtain a stream of revenues

that would have been difficult, if not impossible, to achieve otherwise. First, the

direct taxes that it had imposed just prior to the conflict generated a relatively small

amount of revenue, and the elite had only gone along with their enactment

grudgingly. Second, what market power Chile enjoyed in the international fertilizer

market was, at least initially, almost entirely due to the conquest of Peruvian

territory. Its counterfactual nitrate export tax revenues would have been paltry in the

short run.

Peru and Bolivia lost access to a resource that, under a variety of assumptions

about elasticities of supply and demand, would have had the potential at least to

double government revenue. In the counterfactual, Bolivia, like Chile, would have

had extremely limited market power. In terms of revenues, although we estimate

that Bolivia would not have earned more than a few hundred thousand pounds

annually before 1900, these funds would have been large relative to its small

government budget. Peru, in contrast, would have had substantial market power, as

its province of Tarapaca was home to most of the early nitrate industry. It likely

would have taken years for this situation to change. Historically, Tarapacas market

share did not decline significantly until the twentieth century. We estimate that the

Peruvian government lost the potential to earn at least 1.5 million pounds sterling in

government per year over the 1880s.

Our study also reaches some interesting conclusions pertinent to Chilean

economic history. Given the econometric estimates of demand and supply, we

calculate that Chile was setting an export tax slightly below the optimal rate.

Additionally, since we estimate that demand for nitrate fertilizer was more elastic

than supply, any tax revenue gains would involve a substantial burden for domestic

producers. To the extent that these producers were foreign companies, one could

argue that Chile would not have weighted the firms earnings, unless they were

concerned about the foreign policy implications. Our findings suggest that the

political economy of Chiles export tax is a promising area of future research.

123

116

R. Sicotte et al.

Table 8 Railroads (km)

1877

Bolivia

Source: Mitchell (2003)

1895

1913

209

972

1,284

Chile

1,624

3,497

8,070

Peru

2,030

1,734

3,276

Assessing quantitatively the overall economic impact of the war remains

difficult. We can conclude that, because of the significance of the war for

government revenues, government spending also would have been commensurately

affected. Inasmuch as this entailed public investments in infrastructure and

education, the effects could have been far-reaching. Table 8 shows the kilometers

of railroads in operation in the three countries in 1877, 1895 and 1913. The Chilean

system expanded very rapidly after the war, but so did Bolivias. The Chilean

government played an important role in fomenting railroad construction. Railroad

construction was financed at least in part by the accumulation of foreign debt.

Between 1885 and 1900, Chile accumulated 19 million pounds of external debt,

much of it used to finance public investments. Without the steady stream of nitrate

revenues behind it, Chile might have had a much more difficult time borrowing in

international capital markets.

In the case of Bolivia, much of the railroad expansion was financed directly by

foreign capital, mainly Chilean. Railroad development in Bolivia played a key role

in the expansion of silver and tin exports. The Peruvian case contrasts with the other

two. The countrys rail system expanded at a much more modest rate. The initial

decline is at least in part due to the loss of the southern provinces, which contained

some important rail lines serving the nitrate ports of Iquique and Pisagua.

Government spending on education is illustrated in Table 9. Chile spent more to

begin with, but greatly expanded its spending and educational system in the late

nineteenth and early twentieth centuries. The rate of expansion in Peru was much

slower, and the total spending in Bolivia was quite low as late as 1913. Literacy

rates reflected these investments, with Chiles 43% by 1900, a level not approached

by Peru until around 1930 and Bolivia until after World War II. This cursory review

of the data on railroad development and education spending suggests that the war

played an important role in Chiles ability to finance public investments.

It is more difficult to state what would have been the spending outcome in Bolivia

and Peru. With regards to Bolivia, it experienced relatively rapid railroad expansion

despite having lost the war. There is little basis for drawing conclusions with regard to

education spending in Bolivia. Insofar as Peru, its railroad development clearly

lagged, as did its investment in education. At least in theory, the large increase in

government revenues could have been used to finance expansion in either area.

Table 9 Government education

spending, thousands of pounds

sterling

Source: Mitchell (2003)

123

1877

*1900

1913

Bolivia

NA

NA

185

Chile

196

545

1,563

Peru

78

143

260

The fiscal impact of the War of the Pacific

117

However, the complicating factor for Peru is that it had a very large foreign debt in

default. Servicing that debt would have required at least 2 million pounds sterling per

year. This exceeds our lower estimates of nitrate revenues for 1883, and even would

have constituted a significant proportion of Perus potential nitrate revenues 20 years

later. Ultimately, drawing more firm conclusions about how Peru and Bolivia would

have allocated nitrate revenues under the counterfactual require a more detailed

political economic analysis, which we leave to future research.

Future work might also employ our findings to reinterpret some of the previous

historical assessments of the impact of the war on overall economic and political

development. Scholars of Chile such as Palma (2000), Cariola and Sunkel (1985)

and Mamalakis (1971), have argued that the nitrate boom was beneficial to Chiles

economic development, although their opinion is not shared by all, for example

Gunder Frank (1976). From the perspective of political economy, one can

hypothesize that in the absence of the nitrate tax, Chile would have maintained

income and inheritance taxes that would have resulted in greater income and wealth

equality. Sater (1979) defends this position. Sokoloff and Zolt (2007) persuasively

argue that Latin Americas regressive tax structure has been both a symptom and a

cause of continued inequality, and that inequality has been a major factor inhibiting

economic growth in the region. Further investigation also could draw on the work of

Acemoglu et al. (2005), Drelichman and Voth (2008), and Robinson et al. (2006),

and examine the connections between the control of nitrate resources, institutional

development and economic growth.

Acknowledgments The authors would like to thank Mauricio Drelichman, Bill Gibson, Marc Law, Art

Woolf, Kamil Yilmaz, and participants in the 2005 Canadian Network for Economic History conference,

the 2007 Economic History Association conference, and the University of Massachusetts-Amherst

economic history workshop for helpful comments on previous versions of the paper. We would also like

to thank Matthias Aschenbrenner for assistance with the simulations.

Appendix A: three-country model of export taxation

Three countries export a product to a world market. None of the countries has a

domestic market for the product. We assume linear demand and supply, and a

perfectly competitive industry. The relevant demand and supply equations are:

World demand:

Country 1 supply:

QD A $ BP

qs1 a1 b1 p1

Country 2 supply:

qs2 a2 b2 p2

Country 3 supply:

qs3 a3 b3 p3

123

118

R. Sicotte et al.

Each country sets an ad valorem tariff with respect to the world price:

P1 P1 $ t1

P2 P1 $ t2

P3 P1 $ t3

We proceed with the equations for country one, noting that the equations for the

other countries are symmetric.

Country one residual demand:

D

s

s

QD

1 Q $ q2 $ q3

A $ a2 $ a3 $ B b2 1 $ t2 b3 1 $ t3 P

The marginal revenue function for country one is:

MR1

$2QD

1 A $ a2 $ a3

B b2 1 $ t2 b3 1 $ t3

The marginal cost function for country one is:

MC1 p1

1 s

q $ a1

b1 1

We now solve for the reaction functions yielding the Nash optimum export taxes.

First, set MC1 MR1

and qs1 QD

1 q1

solve for q1

q1

q1 a1

$2q1 A $ a2 $ a3

$

b1 b1 B b2 1 $ t2 b3 1 $ t3

a1 B b2 1 $ t2 b3 1 $ t3 A $ a2 $ a3 b1

B b2 1 $ t2 b3 1 $ t3 2b1

Now, by substituting the above expression for q1 into country ones demand we

get P as a function of the parameters, A, B, ai, bi.

!

"

q1 $ A a2 a3

P$

B b2 1 $ t2 b3 1 $ t3

And by substituting the expression for q1 into country ones supply we get p1 as a

function of the parameters.

p1

1

q1 $ a1

b1

With expressions for P and p1, we can derive the reaction function for optimal

export tariff:

t1

123

P $ p1

P

The fiscal impact of the War of the Pacific

119

We now solve the reaction functions yielding the Nash maximum revenue taxes

for country one. From above, we know that:

T P $ p1 q1

where T is tax revenue.

!

P$

Solving for T:

q1 $ A a2 a3

B b2 1 $ t2 b3 1 $ t3

"

!

"

$q1 A $ a2 $ a3 q1 $ a1

$

q1

B

b1

#!

" !

" $

A $ a2 $ a3 a1

1

1

$

q1 q1

B b1

B

b1

Maximize taxing revenue, the first-order condition is:

!

"

A $ a2 $ a 3 a1

1

1

$ 2q1

0

B b1

B

b1

Solving for q1

q1

a1 B b2 1 $ t2 b3 1 $ t3 A $ a2 $ a3 b1

2B b2 1 $ t2 b3 1 $ t3 b1

Substituting, we obtain expressions for P and p1 as a function of the parameters.

!

"

q1 $ A a2 a3

P$

B b2 1 $ t2 b3 1 $ t3

p1 1=b1 ' q1 $ a1 :

And from these we get the reaction function for country one:

t1 P $ p1 =P:

This is the same form as the reaction function under the optimal tariff, but q1

under the maximum revenue tariff is less than q1 under the optimal tariff. Note

that under the maximum revenue tariff the denominator is multiplied by two. As

consequence, when substitutions are made, the reaction functions are algebraically different. We solved the simulations using the mathematical software

MAPLE.

References

Acemoglu D, Johnson S, Robinson J (2005) Institutions as the fundamental cause of long-run growth. In:

Aghion P, Durlauf S (eds) Handbook of economic growth. Elsevier, Amsterdam

Bain HF, Mulliken HS (1923) The cost of Chilean nitrate. United States Department of Commerce. Trade

Information Bulletin no. 170

Basadre J (1983) Historia del Peru. Ediciones Universitaria, Lima

Bermudez O (1963) Historia del salitre desde sus orgenes hasta la guerra. Ediciones de la Universidad de

Chile, Santiago

123

120

R. Sicotte et al.

Bermudez O (1984) Historia del salitre desde la Guerra del Pacfico hasta la Revolucion de 1891.

Ediciones Pampa Desnuda, Santiago

Billinghurst G (1889) Los capitales salitreros de Tarapaca. El Progreso, Santiago

Bonilla H (1980) Un siglo a la deriva: Ensayos sobre el Peru, Bolivia y la guerra. Instituto de Estudios

Peruanos, Lima

Braun J, Braun M, Briones I, Diaz J (2000) Economia chilena 18101995. Estadisticas historicas.

Pontificia Universidad Catolica de Chile Instituto de Economia Documento de Trabajo No. 187

Brown JR (1963) Nitrate crisis, combinations and the Chilean Government in the Nitrate Age. Hisp Am

Hist Rev 43:230246. doi:10.2307/2510493

Cariola C, Sunkel O (1985) The growth of the nitrate industry and socioeconomic change in Chile, 1880

1930. In: Cortes-Conde R, Hunt S (eds) The Latin American economies: growth and the export

sector, 18801930. Holmes and Meier, New York

Chile (1914) Direccion de Contabilidad. Resumen de la hacienda publica de Chile desde 1833 hasta 1914.

Spottiswoode, London

Chile (1925) Ministerio de Hacienda. Antecedentes sobre la industria salitrera. Imprenta Universo,

Santiago

Chile (1935) Ministerio de Hacienda. La industria del salitre de Chile. Santiago: Talleres Graficos La

Nacion

Chile (various years) Oficina Central de Estadstica. Estadstica comercial

Chile (various years) Delegacion Fiscal de Salitreras. Memoria

Chile (various years) Ministerio de Hacienda. Memoria

Coatsworth J, Williamson J (2002) The roots of Latin American protectionism: looking befote the great

depresion. NBER Working Paper No. 8999

Crozier R (1993) La industria del yodo, 18151915. Historia 27:141212

Crozier R (1997) El salitre hasta la Guerra del Pacfico: una revision. Historia 30:53126

Cruchaga M (1929) Salitre y guano. Editorial Reus, S.A, Madrid

Dennis W (1967) Tacna and arica. Archon Books, N!P

Diaz J, G Wagner (2004) Politica comercial: instrumentos y antecedentes. Chile en los siglos XIX y

XX. Pontificia Universidad Catolica de Chile Instituto de Economia Documento de Trabajo No.

223

Drelichman M, Voth H-J (2008) Institutions and the resource curse in early modern Spain. In: Helpman E

(ed) Institutions and economic performance. Harvard University Press, Cambridge

Greenhill R (1977) The nitrate and iodine trades, 18801914. In: Platt DCM (ed) Business imperialism,

18401930. Clarendon Press, Oxford, pp 231283

Greenhill R, Miller R (1973) The Peruvian Government and the nitrate trade, 18731879. J Lat Am Stud

5:107131

Gunder Frank A (1976) Capitalism and underdevelopment in Latin America: historical studies of Chile

and Brazil. Monthly Review Press, New York

Hernandez R (1930) El salitre, resumen historico desde su descubrimiento y explotacion. Fisher,

Valparaso

Hillman J (1984) The emergence of the tin industry in Bolivia. J Lat Am Stud 16:403437

Hotelling H (1931) The economics of exhaustible resources. J Polit Econ 39:137175. doi:

10.1086/254195

Hunt S (1985) Growth and Guano in nineteenth-century Peru. In: Conde C, Hunt SJ (eds) The Latin

American economies. Growth and export sector 18801930. Holmes & Meier, New York

Irwin D (2003a) Explaining Americas surge in manufactured exports, 18801913. Rev Econ Stat

85:364376. doi:10.1162/003465303765299873

Irwin D (2003b) The optimal tax on antebellum U.S. cotton exports. J Int Econ 60:275291. doi:

10.1016/S0022-1996(02)00052-1

Kiernan VG (1955) Foreign interests and the War of the Pacific. Hisp Am Hist Rev 35:1436. doi:

10.2307/2509249

Maddison A (2000) Monitoring the world economy, 18201992. OECD, Paris

Madueno R (1919) La industria salitrera del Peru antes de la guerra con Chile. Sanmart y Ca, Lima

Mamalakis M (1971) The role of government in the resource transfer and resource allocation processes:

the Chilean nitrate sector, 18801930. In: Ranis G (ed) Government and economic development.

Yale University Press, New Haven, pp 181215

Mayo J (1979) La compana de salitres de Antofagasta y la Guerra del Pacfico. Historia 14:71103

123

The fiscal impact of the War of the Pacific

121

McQueen C (1924) The Bolivian public debt with a survey of Bolivian financial history. U.S. Department

of Commerce. Bureau of Foreign and Domestic Commerce. Trade Information Bulletin No. 194.

GPO, Washington

Mitchell B (1988) British historical statistics. Cambridge University Press, New York

Mitchell B (2003) International historical statistics: the Americas, 17502000. Palgrave Macmillan, New

York

OBrien T (1982) The nitrate industry and Chiles crucial transition, 18701891. New York University

Press, New York

Paish G (1914) Prices of commodities in 1913. J R Stat Soc (Ser A) 77:556570

Palma G (2000) Trying to tax and spend oneself out of the Dutch Disease: the Chilean economy from

the War of the Pacific to the Great Depression. In: Cardenas E, Antonio Ocampo J, Thorp R (eds)

An economic history of twentieth-century Latin America, vol 1. Palgrave, New York

Panagariya A, Schiff M (1994) Can revenue-maximizing export taxes yield higher welfare than welfare

maximizing export taxes? Econ Lett 45:7984. doi:10.1016/0165-1765(94)90062-0

Panagariya A, Schiff M (1995) Optimum and revenue-maximizing trade taxes in a multicountry

framework. Revista de Analisis Economico 10:1935

Partington JR, Parker LH (1922) The nitrogen industry. Constable and Co, London

Paz J (1927) Historia economica de Bolivia. Imprenta Artistica, La Paz

Penalozo Cordero L (1984) Nueva historia economica de Bolivia, vol 5. Editorial Los Amigos del Libro,

La Paz

Querejazu Calvo R (1995) Aclaraciones historicas sobre la guerra del Pacfico. Librera Editorial

Juventud, La Paz

Robinson JA, Torvik R, Verdier T (2006) Political foundations of the resource curse. J Dev Econ 79:447

468. doi:10.1016/j.jdeveco.2006.01.008

Sater W (1979) Chile and the world depression of the 1870s. J Lat Am Stud 11:6799

Sater W (1986) Chile and the War of the Pacific. University of Nebraska Press, Lincoln

Sokoloff K, Zolt E (2007) Inequality and the evolution of institutions of taxation: evidence from the

economic history of the Americas. In: Edwards S, Esquivel G, Marquez G (eds) The decline of Latin

American economies. University of Chicago Press, Chicago

Soto Cardenas A (1998) Influencia Britanica en el salitre: orgen, naturaleza y decadencia. Editorial de la

Universidad de Santiago de Chile, Santiago

Stemmer JO (1989) Freight rates in the trade between Europe and South America, 18401914. J Lat Am

Stud 21:2359

Tantalean Arbulu J (1983) Poltica economico-financiera y la formacion del estado, siglo XIX. Centro de

Estudios para el Desarrollo y la Participacion, Lima

Wagner G (1992) Trabajo, produccion y crecimiento, la economia chilena 18601930. Pontificia

Universidad Catolica de Chile Instituto de Economia Documento de Trabajo No. 150

Wheeler HJ (1918) The fertilizer needs of the United States. Q J Econ 32:209237. doi:10.2307/1885426

Whitbeck RH (1931) Chilean nitrate and the nitrogen revolution. Econ Geogr 7:273283. doi:

10.2307/140893

Yilmaz K (1999) Optimal export taxes in a multicountry framework. J Dev Econ 60:439465. doi:

10.1016/S0304-3878(99)00048-6

Yilmaz K (2006) How much should primary commodity exports be taxed? Nash and Stackelberg

equilibria in the global cocoa market. J Int Trade Econ Dev 15:126. doi:

10.1080/09638190500523360

Yunge G (1909) Estadstica minera de Chile en 1906 i 1907. Barcelona, Santiago

123

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Nur Barizah Abu Bakar, Abdul Rahim Abdul Rahman, Hafiz Majdi Abdul RashidDokument20 SeitenNur Barizah Abu Bakar, Abdul Rahim Abdul Rahman, Hafiz Majdi Abdul RashidJa'izah JazzyNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ADR and GDRDokument22 SeitenADR and GDRsaini_randeep2Noch keine Bewertungen