Beruflich Dokumente

Kultur Dokumente

Development banks in India classified by sector

Hochgeladen von

Akhil AyyakuttyOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Development banks in India classified by sector

Hochgeladen von

Akhil AyyakuttyCopyright:

Verfügbare Formate

Development banks in India are classified into following four groups:

A. Industrial Development Banks : It includes, for example, Industrial Finance Corporation

of India (IFCI), Industrial Development Bank of India (IDBI), and Small

Industries Development Bank of India (SIDBI).

i.

IFCI: The IFCI was the 1st specialised financial institution setup in India to provide term

finance to large industries in India. It was established on 1st July, 1948 under The

Industrial Finance Corporation Act of 1948.

Objectives of IFCI:

The main objective of IFCI is too provide medium and long term financial assistance to

large scale industrial undertakings, particularly when ordinary bank accommodation does

not suit the undertaking or finance cannot be profitably raised by the concerned by the

issue of shares.

Functions of IFCI:

1) For setting up a new industrial undertaking.

2) For expansion and diversification of existing industrial undertaking.

3) For renovation and modernisation of existing concerns.

4) For meeting the working capital requirements of industrial concerns in some

exceptional cases.

ii.

IDBI: Industrial Development Bank of India (IDBI)

The Industrial Development Bank of India (IDBI) was established on 1 July 1964 under

an Act of Parliament as a wholly owned subsidiary of the Reserve Bank of India. The

main objective was to promote and finance the development of industries. In 16 February

1976, the ownership of IDBI was transferred to the Government of India and it was made

the principal financial institution for coordinating the activities of institutions engaged in

financing, promoting and developing industry in the country. Although Government

shareholding in the Bank came down below 100% following IDBIs public issue in July

1995, the former continues to be the major shareholder.

iii.

SIDBI: Small Industries Development Bank of India is an independent financial

institution aimed to aid the growth and development of micro, small and medium-scale

enterprises in India. Set up on April 2, 1990 through an act of parliament, it was

incorporated initially as a wholly owned subsidiary of Industrial Development Bank of

India. Current shareholding is widely spread among various state-owned banks, insurance

companies and financial institutions. It is the Principal Financial Institution for the

Promotion, Financing and Development of the Micro, Small and Medium Enterprise

(MSME) sector and for Co-ordination of the functions of the institutions engaged in

similar activities. Mr. Sushil Mahnot is the chairman of SIDBI since April 4, 2012.

B. Agricultural Development Banks: It includes, for example, National Bank for Agriculture

& Rural Development (NABARD).

Role:

National Bank for Agriculture and Rural Development (NABARD) is an apex

development bank in India having headquarters based in Mumbai (Maharashtra) and

other branches are all over the country. It was established on 12 July 1982 by a special act

by the parliament and its main focus was to uplift rural India by increasing the credit flow

for elevation of agriculture & rural non farm sector. NABARD is the apex institution in

the country which looks after the development of the cottage industry, small industry and

village industry, and other rural industries.

Undertakes monitoring and evaluation of projects refinanced by it.

NABARD refinances the financial institutions which finances the rural sector.

It regulates the institution which provides financial help to the rural economy.

It provides training facilities to the institutions working in the field of rural upliftment.

It regulates the cooperative banks and the RRBs.

C. Export-Import Development Banks: It includes, for example, Export-Import Bank of

India (EXIM Bank).

The Export-Import Bank of India (Exim Bank) is a public sector financial institution

created by an Act of Parliament, the Export-import Bank of India Act, 1981. The business

of Exim Bank is to finance Indian exports that lead to continuity of foreign exchange for

India. The Exim Bank extends term loans for foreign trade.

D. Housing Development Banks: It includes, for example, National Housing Bank (NHB).

National Housing Bank: The National Housing Bank (NHB) is a state owned bank and

regulation authority in India, created on July 8, 1988 under section 6 of the National

Housing Bank Act (1987). The headquarters is in New Delhi. The institution, owned by

the Reserve Bank of India, was established to promote private real estate acquisition. The

NHB is regulating and re-financing social housing programs and other activities like

research etc. Its vision is promoting inclusive expansion with stability in housing finance

market.

Das könnte Ihnen auch gefallen

- University of Kerala: Office of The Controller of ExaminationsDokument2 SeitenUniversity of Kerala: Office of The Controller of ExaminationsAkhil AyyakuttyNoch keine Bewertungen

- Forms and Drivers of Credit RiskDokument12 SeitenForms and Drivers of Credit RiskAkhil AyyakuttyNoch keine Bewertungen

- Risk Management Mod 1 Kerala UnivDokument30 SeitenRisk Management Mod 1 Kerala UnivAkhil AyyakuttyNoch keine Bewertungen

- New Text DocumentDokument1 SeiteNew Text DocumentAkhil AyyakuttyNoch keine Bewertungen

- Guide To Benchmarking Oct2007Dokument24 SeitenGuide To Benchmarking Oct2007Akhil Ayyakutty100% (2)

- Liquidity RiskDokument12 SeitenLiquidity RiskAkhil AyyakuttyNoch keine Bewertungen

- Mis Unit 1Dokument32 SeitenMis Unit 1Akhil AyyakuttyNoch keine Bewertungen

- How To Do FSNDokument3 SeitenHow To Do FSNjav1965Noch keine Bewertungen

- Main Project Internal Viva TT 2016Dokument2 SeitenMain Project Internal Viva TT 2016Akhil AyyakuttyNoch keine Bewertungen

- Benchmark Standards CPDDokument7 SeitenBenchmark Standards CPDAkhil AyyakuttyNoch keine Bewertungen

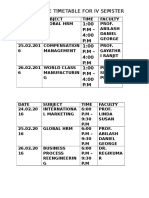

- TT Iv SemDokument1 SeiteTT Iv SemAkhil AyyakuttyNoch keine Bewertungen

- NewntDokument1 SeiteNewntAkhil AyyakuttyNoch keine Bewertungen

- WW Grainger Mcmaster Carr CaseDokument15 SeitenWW Grainger Mcmaster Carr CaseAkhil Ayyakutty100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CL 5313 17021-1 Requirements Matrix-1458-5Dokument6 SeitenCL 5313 17021-1 Requirements Matrix-1458-5Ana AnaNoch keine Bewertungen

- 27 MARCH 2020: Assignment 5 Question PaperDokument4 Seiten27 MARCH 2020: Assignment 5 Question PaperShadreck SandweNoch keine Bewertungen

- Ali ExpressDokument3 SeitenAli ExpressAnsa AhmedNoch keine Bewertungen

- FBCA Biomarkers and ConditionsDokument8 SeitenFBCA Biomarkers and Conditionsmet50% (2)

- Amar Sonar BanglaDokument4 SeitenAmar Sonar BanglaAliNoch keine Bewertungen

- Translation EquivalenceDokument6 SeitenTranslation EquivalenceJamal Anwar TahaNoch keine Bewertungen

- Lecture 1 Family PlanningDokument84 SeitenLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- Restructuring Egypt's Railways - Augst 05 PDFDokument28 SeitenRestructuring Egypt's Railways - Augst 05 PDFMahmoud Abo-hashemNoch keine Bewertungen

- Insize Catalogue 2183,2392Dokument1 SeiteInsize Catalogue 2183,2392calidadcdokepNoch keine Bewertungen

- The Sound Collector - The Prepared Piano of John CageDokument12 SeitenThe Sound Collector - The Prepared Piano of John CageLuigie VazquezNoch keine Bewertungen

- Device Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayDokument2 SeitenDevice Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayRohit Chouhan0% (1)

- Political Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyDokument6 SeitenPolitical Reporting:: Political Reporting in Journalism Is A Branch of Journalism, Which SpecificallyParth MehtaNoch keine Bewertungen

- Term Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )Dokument16 SeitenTerm Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )spachecofdz0% (1)

- Investigatory Project Pesticide From RadishDokument4 SeitenInvestigatory Project Pesticide From Radishmax314100% (1)

- Exor EPF-1032 DatasheetDokument2 SeitenExor EPF-1032 DatasheetElectromateNoch keine Bewertungen

- Vidura College Marketing AnalysisDokument24 SeitenVidura College Marketing Analysiskingcoconut kingcoconutNoch keine Bewertungen

- Kahveci: OzkanDokument2 SeitenKahveci: OzkanVictor SmithNoch keine Bewertungen

- PharmacologyAnesthesiology RevalidaDokument166 SeitenPharmacologyAnesthesiology RevalidaKENT DANIEL SEGUBIENSE100% (1)

- ĐỀ SỐ 3Dokument5 SeitenĐỀ SỐ 3Thanhh TrúcNoch keine Bewertungen

- Suband Coding in MatlabDokument5 SeitenSuband Coding in MatlabZoro Roronoa0% (1)

- Vehicle Registration Renewal Form DetailsDokument1 SeiteVehicle Registration Renewal Form Detailsabe lincolnNoch keine Bewertungen

- Machine Learning: Bilal KhanDokument26 SeitenMachine Learning: Bilal KhanBilal KhanNoch keine Bewertungen

- Overview of Quality Gurus Deming, Juran, Crosby, Imai, Feigenbaum & Their ContributionsDokument11 SeitenOverview of Quality Gurus Deming, Juran, Crosby, Imai, Feigenbaum & Their ContributionsVenkatesh RadhakrishnanNoch keine Bewertungen

- Ca. Rajani Mathur: 09718286332, EmailDokument2 SeitenCa. Rajani Mathur: 09718286332, EmailSanket KohliNoch keine Bewertungen

- Drafting TechnologyDokument80 SeitenDrafting Technologyong0625Noch keine Bewertungen

- Florence Walking Tour MapDokument14 SeitenFlorence Walking Tour MapNguyễn Tấn QuangNoch keine Bewertungen

- Living Nonliving DeadDokument11 SeitenLiving Nonliving DeadArun AcharyaNoch keine Bewertungen

- Instagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanDokument13 SeitenInstagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanXiu Jiuan SimNoch keine Bewertungen

- Quiz-Travel - Beginner (A1)Dokument4 SeitenQuiz-Travel - Beginner (A1)Carlos Alberto Rodriguez LazoNoch keine Bewertungen

- Single-Phase Induction Generators PDFDokument11 SeitenSingle-Phase Induction Generators PDFalokinxx100% (1)