Beruflich Dokumente

Kultur Dokumente

Parsonage

Hochgeladen von

wsider0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

234 Ansichten4 SeitenA number of rabbis teach at the Frankel Jewish academy. At issue is whether the Rabbis' duties will enable them to qualify for the parsonage allowance granted under the Internal Revenue Code. Parsonage may exist in situations where clergy either rent or even own their own homes.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenA number of rabbis teach at the Frankel Jewish academy. At issue is whether the Rabbis' duties will enable them to qualify for the parsonage allowance granted under the Internal Revenue Code. Parsonage may exist in situations where clergy either rent or even own their own homes.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

234 Ansichten4 SeitenParsonage

Hochgeladen von

wsiderA number of rabbis teach at the Frankel Jewish academy. At issue is whether the Rabbis' duties will enable them to qualify for the parsonage allowance granted under the Internal Revenue Code. Parsonage may exist in situations where clergy either rent or even own their own homes.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

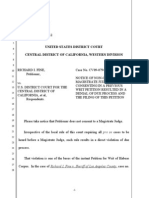

Memorandum

TO: Ken Goss, Finance

Committee Chair, FJA

FROM: William E. Sider

RE: Parsonage and Related Issues

DATE: September 21, 2008

BACKGROUND

The Frankel Jewish Academy (“FJA”) has on its staff a number of

rabbis who collectively teach a variety of courses in the Jewish studies

curriculum (the “Rabbis”). While the Rabbis’ principal duties involve

the instruction of their particular courses, their responsibilities also

include attendance at and supervision of the daily minyanim at FJA.

At issue is whether the Rabbis’ duties will enable them to qualify

for the parsonage allowance granted under the Internal Revenue Code

(the “Code”) and if so, what collateral consequences result from such a

favorable determination.

PARSONAGE ALLOWANCE UNDER THE CODE

The ability of clergy to exclude from gross income a parsonage

allowance has long been a staple of Federal tax law. Historically, the

form of such parsonage included the free use of a home owned by a

church, but the scope of parsonage is not limited to this situation.

Parsonage may exist in situations where clergy either rent or even own

their own homes. Code § 107(2) specifically provides that gross

income does not include:

[T]he rental allowance paid to [a minister of the

gospel] as part of his compensation, to the extent

used by him to rent or provide a home and to the

extent such allowance does not exceed the fair

rental value of the home, including furnishings and

Page 2

appurtenances such as a garage, plus the cost of

utilities.

Much of the litigation surrounding parsonage focuses on

the question of who qualifies as a “minister of the gospel.” Note

that these terms, despite their Christian connotations, are

intended as generic terms by the Code. While no statute or

regulation defines eligibility, a number of cases have routinely

interpreted the phrase to include ordained clergy. Rabbis clearly

fall into this category and a number of authorities also conclude

that cantors do as well (D. Silverman, 72-2 USTC ¶ 9546 (8th

Cir.)).

Beyond eligibility requirements, Treasury Regulations

under Code § 107 specify the mechanics associated with

claiming a parsonage allowance:

The designation of an amount as rental allowance

may be evidenced in an employment contract, in

minutes of or in a resolution by a church or other

qualified organization or in its budget, or in any other

appropriate instrument evidencing such official

action. The designation referred to in this paragraph

is a sufficient designation if it permits a payment or a

part thereof to be identified as a payment of rental

allowance as distinguished from salary or other

remuneration.

Treasury Regulation § 1.107-1(b).

I have personally drafted a number of rabbi contracts

and compliance with the above Regulation usually occurs

by the board of a synagogue agreeing to pay parsonage to

the rabbi in his employment contract. Such agreement,

per the Treasury Regulations, must be taken in advance of

the payment. The burden for designating the “fair rental

value” is placed upon the rabbi during each year of his

contract, but subject to consent by the synagogue. The

amount finally designated by the synagogue as parsonage

is typically recorded in a resolution and communicated to

the rabbi. Thereafter, the burden falls on the rabbi to claim

the exemption for parsonage on his Form 1040.

PARSONAGE AND FJA RABBIS

Page 3

The above rules and procedures apply easily to the situation of a

synagogue rabbi. The duties of the FJA Rabbis, however, do not fit

within this model. Rather, their responsibilities more closely resemble

other teachers.

The Treasury Regulations at § 1.107-1(a) offer the following

guidance on the scope of the parsonage exclusion:

In order to qualify for the exclusion, the home or

rental allowance must be provided as remuneration

for services which are ordinarily the duties of a

minister of the gospel. In general, the rules provided

in § 1.1402(c)-5 will be applicable to such

determination. Examples of specific services the

performance of which will be considered duties of a

minister for purposes of section 107 include the

performance of sacerdotal functions, the conduct of

religious worship, the administration and

maintenance of religious organizations and their

integral agencies, and the performance of teaching

and administrative duties at theological seminaries.

The citation above significantly narrows the scope of the

parsonage allowance. Only those ministers who perform

the “ordinary” duties of such a clergy will qualify. As noted

in the Regulation, the following “specific” services will be

treated as ordinary for ministers: (i) sacerdotal functions;

(ii) the conduct of religious worship; (iii) the administration

and maintenance of religious organizations and their

integral agencies and (iv) teaching at a theological

seminary. The reference to § 1.1402(c)-5 largely repeats

this list, but contains a further limitation. “[S]ervice

performed by a minister in the exercise of his ministry

includes the ministration of sacerdotal functions and the

conduct of religious worship, and the control, conduct, and

maintenance of religious organizations (including the

religious boards, societies, and other integral agencies of

such organizations), under the authority of a religious body

constituting a church or church denomination.” [Emphasis

added].

With respect to the above, the Rabbis clearly do not

undertake sacerdotal duties, conduct religious worship1

and FJA will not qualify as a religious seminary. Thus, the

1

Supervision of the minyanim constitutes only a small percentage of remuneration

paid the Rabbis.

Page 4

only way the Rabbis may validly claim parsonage is to

argue that their duties constitute either the “administration

and maintenance of a religious organization” or “an

integral agency.” Further, as the gloss of 1.1402(c)-5(b)

(2) adds, such organizations or agencies must be under the

authority of a church.

A number of authorities have considered the

availability of parsonage to teachers. at Often, “religious

organization” is used interchangeably with references to a

church in the Code. usually refers to an organization with

significant overlap in control or contemplates a

church.Typically, however, this reference is analogous to

church in the Code. The answer depends on the FJA,

while promoting religious values and undertaking religious

worship is a primarily a high school and at best, an

“integral agency” of a church.

Das könnte Ihnen auch gefallen

- Preparing Tax Returns for Ministers: An Easy Reference GuideVon EverandPreparing Tax Returns for Ministers: An Easy Reference GuideNoch keine Bewertungen

- Eman ManekDokument53 SeitenEman ManekyohanismariovianytualakaNoch keine Bewertungen

- The Vestry Handbook, Fourth EditionVon EverandThe Vestry Handbook, Fourth EditionBewertung: 4 von 5 Sternen4/5 (1)

- Assign Canon LawDokument5 SeitenAssign Canon LawMCoJ SMPNoch keine Bewertungen

- Preparing for a Wedding in the Episcopal ChurchVon EverandPreparing for a Wedding in the Episcopal ChurchNoch keine Bewertungen

- Message of MissionDokument2 SeitenMessage of MissionTheLivingChurchdocsNoch keine Bewertungen

- Financial Management for Episcopal Parishes: Revised EditionVon EverandFinancial Management for Episcopal Parishes: Revised EditionNoch keine Bewertungen

- Lewin, Jacob - Orthodox Jewish Women and Eligibility For The Parsonage ExemptionDokument33 SeitenLewin, Jacob - Orthodox Jewish Women and Eligibility For The Parsonage ExemptionNateFeinNoch keine Bewertungen

- Michael D. Weber Barbara L. Weber v. Commissioner of The Internal Revenue Service, 60 F.3d 1104, 4th Cir. (1995)Dokument19 SeitenMichael D. Weber Barbara L. Weber v. Commissioner of The Internal Revenue Service, 60 F.3d 1104, 4th Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Guide To CovenantingDokument1 SeiteGuide To CovenantingBrader Marcos EbanghelistaNoch keine Bewertungen

- The Church As An Organization PDFDokument3 SeitenThe Church As An Organization PDFbass manNoch keine Bewertungen

- Partners in Authorizing MinistryDokument25 SeitenPartners in Authorizing MinistryMark GoforthNoch keine Bewertungen

- CAC Constitution and Bylaws W Cover Letter - Revised - Full Page - 2Dokument16 SeitenCAC Constitution and Bylaws W Cover Letter - Revised - Full Page - 2Elugbadebo JohnNoch keine Bewertungen

- Davis v. United States, 495 U.S. 472 (1990)Dokument14 SeitenDavis v. United States, 495 U.S. 472 (1990)Scribd Government DocsNoch keine Bewertungen

- Local Church ConstitutionDokument37 SeitenLocal Church Constitutionapi-198736150Noch keine Bewertungen

- Clerical Reverence and ObedienceDokument8 SeitenClerical Reverence and ObedienceRolando Mamites OCarmNoch keine Bewertungen

- Organization and AdministrationDokument3 SeitenOrganization and AdministrationYerry RisakottaNoch keine Bewertungen

- Bylaws - Crosspointe PcaDokument23 SeitenBylaws - Crosspointe PcadpsmartsNoch keine Bewertungen

- HB 6779 BW ArticleDokument2 SeitenHB 6779 BW ArticlejennidyNoch keine Bewertungen

- Trustees and Canon Law PDFDokument8 SeitenTrustees and Canon Law PDFJosé Cabrera RodríguezNoch keine Bewertungen

- 2019 Resolutions PacketDokument2 Seiten2019 Resolutions PacketEpiscopal Diocese of West TexasNoch keine Bewertungen

- Task Force On Diocesan Structure Diocese San JoaquinDokument14 SeitenTask Force On Diocesan Structure Diocese San Joaquinapi-27269104Noch keine Bewertungen

- 02 MinGen Relnuovi-Visitatori-Generali ENG74Dokument6 Seiten02 MinGen Relnuovi-Visitatori-Generali ENG74bovanagiri balajyothiNoch keine Bewertungen

- Final As-Adopted HCC Constitution Bylaws 2014-11-10Dokument22 SeitenFinal As-Adopted HCC Constitution Bylaws 2014-11-10api-260277644Noch keine Bewertungen

- LlldgsDokument11 SeitenLlldgsnikNoch keine Bewertungen

- Ridley BurundiDokument2 SeitenRidley BurundiAndrew GoddardNoch keine Bewertungen

- The Office of The Church SecretaryDokument10 SeitenThe Office of The Church SecretaryJobNoch keine Bewertungen

- On UCCP Property Development by Dr. MendozaDokument2 SeitenOn UCCP Property Development by Dr. MendozajtjzamboNoch keine Bewertungen

- 2112 MinTaxGuideSec2Dokument4 Seiten2112 MinTaxGuideSec2BogdanBogdanNoch keine Bewertungen

- QSF: A Legal and Financial AnalysisDokument10 SeitenQSF: A Legal and Financial AnalysisForge ConsultingNoch keine Bewertungen

- Equity and TrustDokument43 SeitenEquity and TrustBoikobo Moseki0% (1)

- How To Start A ChurchDokument11 SeitenHow To Start A ChurchErnest Ross100% (1)

- Model Constitution For Congregations 08 2022Dokument36 SeitenModel Constitution For Congregations 08 2022Johannes MarimaNoch keine Bewertungen

- Employment of Church Workers June 2015Dokument28 SeitenEmployment of Church Workers June 2015Anonymous UwND8bNoch keine Bewertungen

- Cole 1995 The Master of Novices According To The Constitutions of The Dominican OrderDokument12 SeitenCole 1995 The Master of Novices According To The Constitutions of The Dominican OrderofficiumdivinumNoch keine Bewertungen

- Religious Corp Act IllinoisDokument7 SeitenReligious Corp Act IllinoisEl_NobleNoch keine Bewertungen

- CAP Regulation 265-1 - 05/09/2007Dokument11 SeitenCAP Regulation 265-1 - 05/09/2007CAP History LibraryNoch keine Bewertungen

- GBC Constitution Bylaws FinalDokument16 SeitenGBC Constitution Bylaws Finalapi-225178665Noch keine Bewertungen

- 2012 Pastoral CompensationDokument11 Seiten2012 Pastoral CompensationifyjoslynNoch keine Bewertungen

- AC Principles of Canon Law 97 126Dokument30 SeitenAC Principles of Canon Law 97 126AlexsacerdoteNoch keine Bewertungen

- Canon 213Dokument1 SeiteCanon 213Dagul JauganNoch keine Bewertungen

- MATRIMONY/ Archdiocesan Marriage Regulations 3.2Dokument9 SeitenMATRIMONY/ Archdiocesan Marriage Regulations 3.2EmmanuelNoch keine Bewertungen

- A Study of Church Governance and UnityDokument54 SeitenA Study of Church Governance and UnityJared Wright (Spectrum Magazine)100% (1)

- Circuit Stewards Handbook 2021Dokument34 SeitenCircuit Stewards Handbook 2021Qhayiya NjomeniNoch keine Bewertungen

- TCBC Marriage PolicyDokument2 SeitenTCBC Marriage PolicyAlex S. LeungNoch keine Bewertungen

- TX - scribdSECTION B Apr2010Dokument11 SeitenTX - scribdSECTION B Apr2010api-22471550Noch keine Bewertungen

- Comparison LCMC - NALCDokument4 SeitenComparison LCMC - NALCTy AndorNoch keine Bewertungen

- Constitution & Bylaws 2012Dokument15 SeitenConstitution & Bylaws 2012Virginia MCNoch keine Bewertungen

- Corporation SoleDokument13 SeitenCorporation Soledsr_prophet100% (1)

- Jurist 2007 Accountability of Diocesan BishopsDokument45 SeitenJurist 2007 Accountability of Diocesan BishopsshamboorNoch keine Bewertungen

- Adventist Today, Volume 20, Number 4 (September-October 2012)Dokument9 SeitenAdventist Today, Volume 20, Number 4 (September-October 2012)theomarioNoch keine Bewertungen

- THE SAMPLE Constitution TemplateDokument20 SeitenTHE SAMPLE Constitution TemplateJohannes MarimaNoch keine Bewertungen

- Hernandez v. Commissioner, 490 U.S. 680 (1989)Dokument27 SeitenHernandez v. Commissioner, 490 U.S. 680 (1989)Scribd Government DocsNoch keine Bewertungen

- Financial Rationale For BankruptcyDokument59 SeitenFinancial Rationale For Bankruptcyamber healyNoch keine Bewertungen

- Introduction To The RiTe of MarriageDokument3 SeitenIntroduction To The RiTe of MarriageA ANoch keine Bewertungen

- The Ordinariate - Some Questions and Answers On The Legal Position BriefingDokument7 SeitenThe Ordinariate - Some Questions and Answers On The Legal Position BriefingFuzzy_Wood_PersonNoch keine Bewertungen

- Rights and Duties of Spouses. Group BDokument14 SeitenRights and Duties of Spouses. Group BMaryam MainasaraNoch keine Bewertungen

- Ridley New ZealandDokument5 SeitenRidley New ZealandAndrew GoddardNoch keine Bewertungen

- TX - Scribdappendix 5 June 2007Dokument2 SeitenTX - Scribdappendix 5 June 2007api-22471550Noch keine Bewertungen

- Keuangan Gereja Dalam KHKDokument10 SeitenKeuangan Gereja Dalam KHKYohanes Paulus CSENoch keine Bewertungen

- 22062013hou MS11Dokument5 Seiten22062013hou MS11sherakhoNoch keine Bewertungen

- Rosales vs. vs. New a.N.J.H. EnterprisesDokument19 SeitenRosales vs. vs. New a.N.J.H. EnterprisesJerome ArañezNoch keine Bewertungen

- RizalDokument6 SeitenRizalelaineNoch keine Bewertungen

- Elisco Vs CADokument6 SeitenElisco Vs CAjessapuerinNoch keine Bewertungen

- PAG-IBIG Loan Payment-Feb 2020Dokument4 SeitenPAG-IBIG Loan Payment-Feb 2020Tonie Naelgas GutierrezNoch keine Bewertungen

- The Pre-Natal Diagnostic Techniques, (PNDT) Act: Public Interest LitigationDokument2 SeitenThe Pre-Natal Diagnostic Techniques, (PNDT) Act: Public Interest Litigationbaby_ssNoch keine Bewertungen

- Sarbananda SonowalDokument9 SeitenSarbananda SonowalHumanyu KabeerNoch keine Bewertungen

- The Wanta ChroniclesDokument17 SeitenThe Wanta ChroniclespfoxworthNoch keine Bewertungen

- Presentation On Cyber LawsDokument24 SeitenPresentation On Cyber Lawsbhoney_10Noch keine Bewertungen

- USDC Habeas II - Notice of Non-Consent To Magistrate JudgeDokument6 SeitenUSDC Habeas II - Notice of Non-Consent To Magistrate JudgeHonor in Justice100% (1)

- Law Student Resume SampleDokument2 SeitenLaw Student Resume Samplefancybae2Noch keine Bewertungen

- 20bs Javellana V LedesmaDokument2 Seiten20bs Javellana V Ledesmacrisanto m. perezNoch keine Bewertungen

- Macam Vs GatmaitanDokument4 SeitenMacam Vs GatmaitanIvan Montealegre Conchas100% (1)

- UCSP Quarter Examination (2nd Quarter)Dokument9 SeitenUCSP Quarter Examination (2nd Quarter)GIO JASMINNoch keine Bewertungen

- The Registration of Electors Rules, 1960 PDFDokument50 SeitenThe Registration of Electors Rules, 1960 PDFAnonymous H1TW3YY51KNoch keine Bewertungen

- Human Rights in Undp: Practice NoteDokument29 SeitenHuman Rights in Undp: Practice NoteVipul GautamNoch keine Bewertungen

- Salle DigestDokument2 SeitenSalle DigestCarlota Nicolas VillaromanNoch keine Bewertungen

- Geluz vs. Ca - Case DigestDokument2 SeitenGeluz vs. Ca - Case Digestchatmche-06100% (2)

- Second EDSA RevolutionDokument25 SeitenSecond EDSA RevolutionEDSEL ALAPAGNoch keine Bewertungen

- Caf 4 BL ST 2022Dokument294 SeitenCaf 4 BL ST 2022Muhammad Rajeel Gil KhanNoch keine Bewertungen

- Consular Electronic Application Center - Print Application C'rp. 1 Uz 4Dokument4 SeitenConsular Electronic Application Center - Print Application C'rp. 1 Uz 4Yerlan YeshmuhametovNoch keine Bewertungen

- 1ac v. FirewaterDokument13 Seiten1ac v. FirewateralkdjsdjaklfdkljNoch keine Bewertungen

- Bayan Muno v. Romulo PDFDokument112 SeitenBayan Muno v. Romulo PDFFatzie MendozaNoch keine Bewertungen

- G.R. No. 191787, June 22, 2015 - Macario Catipon, JR., Petitioner, V. Jerome Japson, RespondentDokument9 SeitenG.R. No. 191787, June 22, 2015 - Macario Catipon, JR., Petitioner, V. Jerome Japson, RespondentBret MonsantoNoch keine Bewertungen

- Concept of Constitution Meaning of ConstitutionDokument2 SeitenConcept of Constitution Meaning of Constitutionernesto pitogoNoch keine Bewertungen

- Family Code NotesDokument26 SeitenFamily Code Notesalyssa bianca orbisoNoch keine Bewertungen

- Criminal Law - DefinitionDokument5 SeitenCriminal Law - DefinitionYashwanth JyothiselvamNoch keine Bewertungen

- Preliminary Injunction Texas Medicaid 1115 WaiverDokument26 SeitenPreliminary Injunction Texas Medicaid 1115 WaiverThe TexanNoch keine Bewertungen

- MontesquieuDokument5 SeitenMontesquieuMaisamNoch keine Bewertungen

- Right To Information: Concept, Framework & Relevance: Shri Neeraj Kumar Gupta Central Information CommissionerDokument34 SeitenRight To Information: Concept, Framework & Relevance: Shri Neeraj Kumar Gupta Central Information CommissionerAarathi ManojNoch keine Bewertungen

- Building Construction Technology: A Useful Guide - Part 1Von EverandBuilding Construction Technology: A Useful Guide - Part 1Bewertung: 4 von 5 Sternen4/5 (3)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- A Place of My Own: The Architecture of DaydreamsVon EverandA Place of My Own: The Architecture of DaydreamsBewertung: 4 von 5 Sternen4/5 (242)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesVon EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesNoch keine Bewertungen

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialVon EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialNoch keine Bewertungen

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionVon EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Principles of Welding: Processes, Physics, Chemistry, and MetallurgyVon EverandPrinciples of Welding: Processes, Physics, Chemistry, and MetallurgyBewertung: 4 von 5 Sternen4/5 (1)

- The Everything Woodworking Book: A Beginner's Guide To Creating Great Projects From Start To FinishVon EverandThe Everything Woodworking Book: A Beginner's Guide To Creating Great Projects From Start To FinishBewertung: 4 von 5 Sternen4/5 (3)

- Civil Engineer's Handbook of Professional PracticeVon EverandCivil Engineer's Handbook of Professional PracticeBewertung: 4.5 von 5 Sternen4.5/5 (2)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseVon EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseBewertung: 5 von 5 Sternen5/5 (3)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedVon EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedBewertung: 5 von 5 Sternen5/5 (1)

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooVon EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooBewertung: 5 von 5 Sternen5/5 (2)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsVon EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsVon EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNoch keine Bewertungen

- Estimating Construction Profitably: Developing a System for Residential EstimatingVon EverandEstimating Construction Profitably: Developing a System for Residential EstimatingNoch keine Bewertungen

- Woodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsVon EverandWoodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsBewertung: 1 von 5 Sternen1/5 (4)

- THE PROPTECH GUIDE: EVERYTHING YOU NEED TO KNOW ABOUT THE FUTURE OF REAL ESTATEVon EverandTHE PROPTECH GUIDE: EVERYTHING YOU NEED TO KNOW ABOUT THE FUTURE OF REAL ESTATEBewertung: 4 von 5 Sternen4/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseVon EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNoch keine Bewertungen

- Power Electronics Diploma Interview Q&A: Career GuideVon EverandPower Electronics Diploma Interview Q&A: Career GuideNoch keine Bewertungen