Beruflich Dokumente

Kultur Dokumente

MC and Lodging

Hochgeladen von

Abhishek Bhatnagar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

7 Ansichten3 Seitenlodging

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenlodging

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

7 Ansichten3 SeitenMC and Lodging

Hochgeladen von

Abhishek Bhatnagarlodging

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

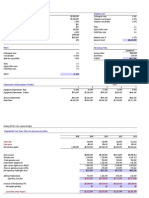

Cost of Capital for Marriott as a whole

Cost and Amount of Debt

Target capital Structure

debt rate premium above govt

30 year fixed US government rate

COST of DEBT for MARRIOTT

tax rate

After Tax cost of Debt

60%

1.30%

8.95%

10.25%

34%

6.77%

The Cost of Equity ( using CAPM)

levered equity beta

target debt ratio

actual debt ratio

asset beta

calculating levered equity beta at 60% debt

risk less rate

risk premium

expected return

0.97

60%

41%

0.57

1.43

8.95%

7.43%

19.58%

WACC

11.89%

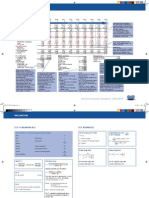

Cost of Capital for Lodging

Cost and Amount of Debt

74%

1.10%

8.95%

10.05%

34%

Target capital Structure

debt rate premium above govt

30 year fixed US government rate

COST of DEBT for MARRIOTT

tax rate

After Tax cost of Debt

6.63%

The Cost of Equity ( using CAPM)

target debt ratio

asset beta

calculating levered equity beta at 74% debt

risk less rate

risk premium

expected return

74%

0.41

1.56

8.95%

7.43%

20.56%

WACC

10.25%

Company

Revenues

Hilton

Holiday

La Quinta Motor Inns

Ramada Inns

0.77

1.66

0.17

0.75

3.35

ASSET BETAS for LODGING

Hilton Hotels

Holiday Corp.

La Quinta Motor Inns

Ramada Inns

Equity ratio

0.86

0.21

0.31

0.35

weight

0.23

0.496

0.05

0.224

Levered Equity Beta

Unlevered Asset Beta

0.88

1.46

0.38

0.95

0.76

0.31

0.12

0.33

0.38

0.41

Average unlevered Asset Beta

Weighted Average( by sales) Asset beta

Das könnte Ihnen auch gefallen

- Mariott Case SolnDokument7 SeitenMariott Case SolnSurbhi JainNoch keine Bewertungen

- Marriott Case - Dakota ChristensenDokument5 SeitenMarriott Case - Dakota Christensendchristensen5Noch keine Bewertungen

- Cost of Equity and Beta: Debt RatiosDokument11 SeitenCost of Equity and Beta: Debt Ratiosminhthuc203Noch keine Bewertungen

- Excelerite SolutionDokument4 SeitenExcelerite SolutionDaneya HemansNoch keine Bewertungen

- Mariott Corp AnalysisDokument14 SeitenMariott Corp AnalysisvarjinNoch keine Bewertungen

- Agro Chem, Inc.Dokument32 SeitenAgro Chem, Inc.Camryn Bintz50% (2)

- Online Test 3 - Cost of CapitalDokument16 SeitenOnline Test 3 - Cost of CapitalShereena FarhoudNoch keine Bewertungen

- Marriott Case FinalDokument17 SeitenMarriott Case FinalFabia BourdaNoch keine Bewertungen

- Finished Star CaseDokument15 SeitenFinished Star CaseSteven Nava100% (1)

- BUS322Tutorial8 SolutionDokument10 SeitenBUS322Tutorial8 Solutionjacklee1918100% (1)

- Synergy ValuationDokument2 SeitenSynergy ValuationThomas Kyei-BoatengNoch keine Bewertungen

- Cost of Equity and Beta: Debt RatiosDokument11 SeitenCost of Equity and Beta: Debt Ratiosminhthuc203Noch keine Bewertungen

- Optimal Financing Mix V: Alternate ApproachesDokument16 SeitenOptimal Financing Mix V: Alternate ApproachesAnshik BansalNoch keine Bewertungen

- Group2 Marriott V6Dokument54 SeitenGroup2 Marriott V6Ibraheem RabeeNoch keine Bewertungen

- Cost of Equity and Beta: Debt RatiosDokument12 SeitenCost of Equity and Beta: Debt Ratiosminhthuc203Noch keine Bewertungen

- Corporate Finance Cost of Capital: Dr. Avinash Ghalke, CFADokument20 SeitenCorporate Finance Cost of Capital: Dr. Avinash Ghalke, CFAmansi agrawalNoch keine Bewertungen

- Synergy ValuationDokument2 SeitenSynergy ValuationrobinkapoorNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementVaibhav AroraNoch keine Bewertungen

- Group 10Dokument12 SeitenGroup 10Vaibhav AroraNoch keine Bewertungen

- Financial ManagementDokument12 SeitenFinancial ManagementVaibhav AroraNoch keine Bewertungen

- Group 10 FMDokument12 SeitenGroup 10 FMVaibhav AroraNoch keine Bewertungen

- DCF Analysis Assignment 2Dokument5 SeitenDCF Analysis Assignment 2minajadritNoch keine Bewertungen

- Real Estate ModelDokument13 SeitenReal Estate Modelgiorgiogarrido667% (3)

- Assignment 5 - CH 10 - The Cost of Capital PDFDokument6 SeitenAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Marriott CaseDokument5 SeitenMarriott CaseVysh PujaraNoch keine Bewertungen

- WACC CalculatorDokument11 SeitenWACC CalculatorshountyNoch keine Bewertungen

- FINA 4383 Quiz 2Dokument9 SeitenFINA 4383 Quiz 2Samantha LunaNoch keine Bewertungen

- Marriott Corporation: The Cost of CapitalDokument3 SeitenMarriott Corporation: The Cost of CapitalabhilashdNoch keine Bewertungen

- Cost of Capital Answer KeyDokument8 SeitenCost of Capital Answer KeyLady PilaNoch keine Bewertungen

- Cost of Capital in Canadian Utility Regulation 2013Dokument1 SeiteCost of Capital in Canadian Utility Regulation 2013DrShweta BhardwajNoch keine Bewertungen

- Marriott Corporation Case SolutionDokument9 SeitenMarriott Corporation Case SolutionZaim Zain100% (2)

- Chapter 10 - McqsDokument11 SeitenChapter 10 - McqsAHKNoch keine Bewertungen

- Bav 3Dokument31 SeitenBav 3sarvesh goyalNoch keine Bewertungen

- Financial Management. Instructor; Lê Vinh TriểnDokument22 SeitenFinancial Management. Instructor; Lê Vinh TriểndoannamphuocNoch keine Bewertungen

- Level I CFA Quiz 1Dokument5 SeitenLevel I CFA Quiz 1Kumar GaurishNoch keine Bewertungen

- CFA I QBank, Cost of CapitalDokument15 SeitenCFA I QBank, Cost of CapitalGasimovskyNoch keine Bewertungen

- Pricing Week 4&5Dokument23 SeitenPricing Week 4&5Sanket Sourav BalNoch keine Bewertungen

- Assignment 3Dokument14 SeitenAssignment 3BlairChoiNoch keine Bewertungen

- Implememntation Polaroid - Corporation - TemplateDokument11 SeitenImplememntation Polaroid - Corporation - TemplateShirazeeNoch keine Bewertungen

- Financial Analysis and Planning Project 1Dokument43 SeitenFinancial Analysis and Planning Project 1api-271895984Noch keine Bewertungen

- Notes 220119 100928Dokument4 SeitenNotes 220119 100928Elgun ElgunNoch keine Bewertungen

- Value Stock Tankrich v1.23Dokument13 SeitenValue Stock Tankrich v1.23pareshpatel99Noch keine Bewertungen

- CA Ipcc AssignmentDokument17 SeitenCA Ipcc AssignmentjesurajajosephNoch keine Bewertungen

- Zycus CalculationsDokument3 SeitenZycus CalculationsDarshan ShethNoch keine Bewertungen

- WACC ExampleDokument2 SeitenWACC Exampledchristensen5Noch keine Bewertungen

- Tutorial 7 - Cost of Debt + WACCDokument2 SeitenTutorial 7 - Cost of Debt + WACCAmy LimnaNoch keine Bewertungen

- Profitability Analysis 1.0Dokument17 SeitenProfitability Analysis 1.0l7aniNoch keine Bewertungen

- 2 The Weighted Average Cost of Capital and Company ValuationDokument10 Seiten2 The Weighted Average Cost of Capital and Company ValuationManthan ShahNoch keine Bewertungen

- Practice Problems SolutionsDokument13 SeitenPractice Problems SolutionsEMILY100% (1)

- Cost of Capital Question SetDokument8 SeitenCost of Capital Question SethbyhNoch keine Bewertungen

- Manvendra Singh - Bajaj FinanceDokument3 SeitenManvendra Singh - Bajaj FinanceManvendra SinghNoch keine Bewertungen

- Cost of Capital: Chapter # 15Dokument10 SeitenCost of Capital: Chapter # 15Syed ZamanNoch keine Bewertungen

- DCF TakeawaysDokument2 SeitenDCF TakeawaysvrkasturiNoch keine Bewertungen

- FM - MarriottDokument48 SeitenFM - MarriottAnita SharmaNoch keine Bewertungen

- Valuation Model1 by Mihir KumarDokument15 SeitenValuation Model1 by Mihir KumarMannaNoch keine Bewertungen

- Problems On Cost of Equity Capital Structure Dividend Policy and Restructuring PrintDokument41 SeitenProblems On Cost of Equity Capital Structure Dividend Policy and Restructuring Printmiradvance studyNoch keine Bewertungen

- Financial Management: Friday 9 December 2011Dokument8 SeitenFinancial Management: Friday 9 December 2011Hussain MeskinzadaNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- The Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionVon EverandThe Mortgage Encyclopedia: The Authoritative Guide to Mortgage Programs, Practices, Prices and Pitfalls, Second EditionNoch keine Bewertungen

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchVon EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchBewertung: 5 von 5 Sternen5/5 (1)

- QueriesDokument1 SeiteQueriesAbhishek BhatnagarNoch keine Bewertungen

- Why CoyDokument1 SeiteWhy CoyAbhishek BhatnagarNoch keine Bewertungen

- Tax CalculationDokument2 SeitenTax CalculationAbhishek BhatnagarNoch keine Bewertungen

- Your Name 407-111 Your Street, City, ProvinceDokument1 SeiteYour Name 407-111 Your Street, City, ProvincemmottolaNoch keine Bewertungen

- MARICO Faceof Market AnalysisDokument3 SeitenMARICO Faceof Market AnalysisAbhishek BhatnagarNoch keine Bewertungen

- InfoDokument2 SeitenInfoAbhishek BhatnagarNoch keine Bewertungen

- IRR IRR: Analyzing The IRR Returned at The End of Specific Year Thereby Suggesting Appropriate Exit Year For The InvestorDokument1 SeiteIRR IRR: Analyzing The IRR Returned at The End of Specific Year Thereby Suggesting Appropriate Exit Year For The InvestorAbhishek BhatnagarNoch keine Bewertungen

- English Economic Survey 2013Dokument374 SeitenEnglish Economic Survey 2013Hilal LoneNoch keine Bewertungen

- Cost of CapitalDokument25 SeitenCost of CapitalAbhishek BhatnagarNoch keine Bewertungen

- Resume Tips From Utsav JainDokument1 SeiteResume Tips From Utsav JainAbhishek BhatnagarNoch keine Bewertungen

- CBDokument1 SeiteCBAbhishek BhatnagarNoch keine Bewertungen

- QueriesDokument1 SeiteQueriesAbhishek BhatnagarNoch keine Bewertungen

- InfoDokument2 SeitenInfoAbhishek BhatnagarNoch keine Bewertungen

- English Economic Survey 2013Dokument374 SeitenEnglish Economic Survey 2013Hilal LoneNoch keine Bewertungen

- KPMG Sop 15p003Dokument1 SeiteKPMG Sop 15p003Abhishek BhatnagarNoch keine Bewertungen

- PasfDokument14 SeitenPasfAbhishek BhatnagarNoch keine Bewertungen

- Hero MotocorpDokument3 SeitenHero MotocorpAbhishek BhatnagarNoch keine Bewertungen

- Vodafone: NCRD Sterling Institute of Management StudiesDokument30 SeitenVodafone: NCRD Sterling Institute of Management StudiesAbhishek BhatnagarNoch keine Bewertungen

- Internationalmanagement Assignment1 Emadabouelgheit2Dokument25 SeitenInternationalmanagement Assignment1 Emadabouelgheit2Abhishek BhatnagarNoch keine Bewertungen

- Summer Intern: Email: Placement@mdi - Ac.in Contact: +91-124-4560012 Roll NoDokument1 SeiteSummer Intern: Email: Placement@mdi - Ac.in Contact: +91-124-4560012 Roll NoAbhishek BhatnagarNoch keine Bewertungen

- Health Development Corporation: Ashutosh DashDokument24 SeitenHealth Development Corporation: Ashutosh DashAbhishek BhatnagarNoch keine Bewertungen

- Customer Relation Management in The Vodafone GroupDokument14 SeitenCustomer Relation Management in The Vodafone GroupAbhishek BhatnagarNoch keine Bewertungen

- SerialDokument1 SeiteSerialAbhishek BhatnagarNoch keine Bewertungen

- InfoDokument2 SeitenInfoAbhishek BhatnagarNoch keine Bewertungen

- MC and LodgingDokument3 SeitenMC and LodgingAbhishek BhatnagarNoch keine Bewertungen

- Your Result Number of Questions Attempted Score Grade Overall Percentile College PercentileDokument6 SeitenYour Result Number of Questions Attempted Score Grade Overall Percentile College PercentileAbhishek BhatnagarNoch keine Bewertungen

- FA1Dokument289 SeitenFA1Abhishek BhatnagarNoch keine Bewertungen

- Fcfe 2 STDokument14 SeitenFcfe 2 STAbhishek BhatnagarNoch keine Bewertungen

- InfoDokument2 SeitenInfoAbhishek BhatnagarNoch keine Bewertungen

- ' ) ) ) ( //) ) (Iuytrereewq1Dokument44 Seiten' ) ) ) ( //) ) (Iuytrereewq1Abhishek BhatnagarNoch keine Bewertungen