Beruflich Dokumente

Kultur Dokumente

Environmental Insurance Product

Hochgeladen von

OllinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Environmental Insurance Product

Hochgeladen von

OllinCopyright:

Verfügbare Formate

5328 Environmental Insurance Product Fact Sheet.

qxp

19/04/2007

14:12

Page 1

Environmental

KKL~

Environmental Insurance

Environmental insurance is a specialist form of insurance providing cover

against losses that could be incurred as a result of third party and regulatory

action arising from pollution or contamination. It is increasingly used as an

effective mechanism to transfer environmental liabilities associated with

corporate and property transactions as well as ongoing operations.

t~===\

Environmental insurance policies cover statutory

clean-up requirements, third party claims for bodily

injury and property damage, and associated legal

expenses, resulting from pollution or contamination

events, whether such events are "sudden and

accidental" or "gradual" in nature. Related costs

such as business interruption losses (e.g. loss of

profit, loss of rental income) can also be covered.

t~=~==~==~~~\

The principal environmental insurance coverages,

which can be tailored to meet the specific risk, are:

e~=m=`W Arranged for

liabilities associated with pre-existing

contamination (e.g. due to previous industrial

operations) or for contingent liability exposures

associated with previous divestments.

l~~=m=`W Cover for

on-going pollution risks, for example from

unanticipated discharges, leakages or spillages.

`~D=m=i~W Coverage for

pollution liabilities associated with contractor's

operations, whether from the new incidents or the

mobilisation of existing contamination.

o~=`=`~W "Stop loss" programs

designed to protect against cost overruns on

contamination clean-up projects.

`=m~=~=i~=_JW

A blend of the principal coverages with a funded

element to cover known remediation costs. Such

programs can be structured to provide buyers

and/or sellers with a long-term buy-out of

environmental liabilities.

t~===~===~

~~~\

For a one-off premium payment, it is currently possible

to obtain policy periods of up to ten years for historical

contamination cover, and up to five years for "new"

pollution cover. Combined programs and liability buy-out

programs offer the potential for longer policy periods.

t~=~=~~==~~~\

Most environmental insurers are routinely able to

offer aggregate policy limits of up to US$50,000,000

(approximately 25,000,000; EUR37,000,000) per

risk, with higher limits available through the use of

excess layers.

fD=====~~~=

=\

No. Traditional insurance products provide limited, if

any, cover for pollution. At best, public liability policies

in most countries may offer cover for third party claims

(although not necessarily statutory clean-up costs)

arising from "sudden and accidental" pollution events.

Property insurance may provide limited clean-up cover,

but only if losses occur as a result of an "insured

peril". Such policies are clearly inappropriate for the

majority of environmental risks, particularly those

associated with historic contamination which is often

the key concern during transactions.

5328 Environmental Insurance Product Fact Sheet.qxp

19/04/2007

14:12

Page 2

Environmental Insurance

Consultant's professional indemnity (PI) insurance

solely provides cover for losses arising from the

consultant's negligence, and is not therefore a

substitute for environmental insurance. Environmental

insurance can also be used to underpin or replace

warranties and indemnities, or ring-fence liabilities

incurred via such agreements.

t~=~==~=~

~\

One of the key benefits of environmental insurance,

particularly long term policies, is that they are designed

to respond to changing legislation and enforcement

practice, both of which are becoming increasingly

stringent in many countries.

e===~=~=\

Premium levels will depend on factors such as the

limit of cover required, policy deductible (or 'excess'),

policy period and, of course, the nature of the risk.

The environmental insurance market is currently very

competitive, with premium levels often starting at

less than 5,000 for an annual policy. For longer

term policies, premiums can vary from less than 1%

to approximately 4% of the policy limit.

`~=~=~==

===b~=r=b~

i~=a\

Yes. Cover is available for pollution liabilities faced

under the Directive, which can be broader than those

previously imposed under legislation in many countries.

e====~==~=~

~\

If necessary, environmental insurance can be procured

within a matter of days. Even complex risks, requiring

the review of substantial quantities of technical

information, are routinely placed by Willis within

transaction timescales.

t~=~====~

~=~\

Typical requirements include desk study information

(e.g. environmental database reports, 'Phase 1' reports,

or even perhaps just property survey reports), where

necessary supplemented by Phase 2' intrusive

investigations (e.g. at industrial sites with a long

industrial history). Additional information, such as

environmental management plans, and correspondence

with environmental regulators may also be relevant.

f==~~~===

\

Yes. Business interruption (e.g. loss of rental income,

loss of profits) and restoration costs (e.g. the cost of

rebuilding a property that needs to be demolished to

allow remediation to take place), can be substantial,

and can be covered under environmental insurance

policies.

a=~=~==

==~==\

Yes. Even if a third party claim fails, the cost of

defending such a claim can be substantial. This is

covered as standard under environmental insurance

policies.

t~=~=====

~==\

Environmental insurers are typically willing to assign

policies or include additional insureds upon transfer

of the relevant assets or business to a new owner.

t===~===~=~=

=~=t\

There is simply no such thing as an "off the shelf"

environmental insurance policy as they require careful

scrutiny, evaluation and negotiation with insurers to

ensure that the policy terms and conditions meet the

client's requirements. As a market leading broker in

this specialist field, Willis is ideally placed to deliver

innovative, robust and cost effective environmental

insurance solutions, often working in conjunction with

environmental consultants and legal advisers.

We are seeing

a maturing claims

experience.

a=~=\

Yes. The environmental insurance market is relatively

young; nonetheless we are seeing a maturing claims

experience in many countries as a result of ever more

stringent environmental legislation and increasing third

party litigation.

a~=_~

Tel: +44 (0)20 7975 2310

barrd@willis.com

t=i

Ten Trinity Square

London EC3P 3AX

Tel: +44 (0)20 7488 8111

www.willis.com

Willis Limited, Registered number: 181116 England

and Wales. Registered address: Ten Trinity Square,

London EC3P 3AX. A Lloyd's Broker. Authorised and

regulated by the Financial Services Authority.

MA/5328/04/07

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Strategic Reserve Time TemplatesDokument2 SeitenStrategic Reserve Time TemplatespcmtpcmtNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

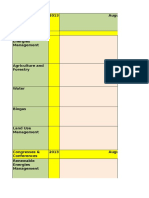

- Chapter 1 Content Overview: Unit 2 Unit 3 Unit 1Dokument1 SeiteChapter 1 Content Overview: Unit 2 Unit 3 Unit 1OllinNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Marine LitterDokument6 SeitenMarine LitterOllinNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Sample Work PlanDokument1 SeiteSample Work PlanTransi CruzNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Facts of Climate ChangeDokument3 SeitenFacts of Climate ChangeOllinNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Love Your BodyDokument4 SeitenLove Your BodyOllinNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Prelimpro Iaia11Dokument40 SeitenPrelimpro Iaia11OllinNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Ghana: SLM/PES - GEF Project (Terrafrica) : Paola Agostini E Mail: Rome, May 10, 2006Dokument23 SeitenGhana: SLM/PES - GEF Project (Terrafrica) : Paola Agostini E Mail: Rome, May 10, 2006OllinNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Fairs, Congresses & Seminars 2013-2014Dokument24 SeitenFairs, Congresses & Seminars 2013-2014OllinNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFORDokument34 Seiten5.2. Introduction To Payments For Ecosystem Services (PES) : Sheila Wertz-Kanounnikoff, CIFOROllinNoch keine Bewertungen

- WaWi Teil 01 Gesamt WebDokument144 SeitenWaWi Teil 01 Gesamt WebOllinNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Academicwriting in English: Carolyn Brimley Norris, Ph.D. Language Services University of Helsinki 2013-2014Dokument85 SeitenAcademicwriting in English: Carolyn Brimley Norris, Ph.D. Language Services University of Helsinki 2013-2014Brahim LekhtibNoch keine Bewertungen

- PAGCOR Site Regulatory ManualDokument4 SeitenPAGCOR Site Regulatory Manualstaircasewit4Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Vistara JD For Groud Staff PDFDokument6 SeitenVistara JD For Groud Staff PDFPrasad AcharyaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- United States District Court District of NebraskaDokument4 SeitenUnited States District Court District of Nebraskascion.scionNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Chapter 6-Asset ManagementDokument22 SeitenChapter 6-Asset Managementchoijin987Noch keine Bewertungen

- Logistics Distribution TescoDokument10 SeitenLogistics Distribution TescoSanchit GuptaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- AdvantageDokument10 SeitenAdvantageClifMcKinleyNoch keine Bewertungen

- M.a.part - I - Macro Economics (Eng)Dokument341 SeitenM.a.part - I - Macro Economics (Eng)Divyesh DixitNoch keine Bewertungen

- EMC Documentum Business Process Suite: Best Practices Guide P/N 300-009-005 A01Dokument118 SeitenEMC Documentum Business Process Suite: Best Practices Guide P/N 300-009-005 A01jjjjjjjhjjjhjjjjjjjjjNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Unilever: AssignmentDokument8 SeitenUnilever: AssignmentVishal RajNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- BSNL Civil Wing Org Study Synopsis1Dokument3 SeitenBSNL Civil Wing Org Study Synopsis1jayavasu89594Noch keine Bewertungen

- Pure Competition: DR Ayesha Afzal Assistant ProfessorDokument24 SeitenPure Competition: DR Ayesha Afzal Assistant ProfessorFady RahoonNoch keine Bewertungen

- BIR-1905 Updated1Dokument3 SeitenBIR-1905 Updated1Kevin CordovizNoch keine Bewertungen

- Indian Standard: Guidelines FOR Managing - The Economics of QualityDokument15 SeitenIndian Standard: Guidelines FOR Managing - The Economics of QualityproxywarNoch keine Bewertungen

- Diongzon V Mirano (Ethics)Dokument1 SeiteDiongzon V Mirano (Ethics)MMACNoch keine Bewertungen

- Rewards of EntrepreneurshipDokument18 SeitenRewards of EntrepreneurshipHemanidhi GuptaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- SME Bank, Inc. v. de GuzmanDokument16 SeitenSME Bank, Inc. v. de GuzmanKrisNoch keine Bewertungen

- Comprehensive Accounting Cycle Review ProblemDokument11 SeitenComprehensive Accounting Cycle Review Problemapi-253984155Noch keine Bewertungen

- A2 Resource Profit ModelDokument2 SeitenA2 Resource Profit ModelIvy BaayNoch keine Bewertungen

- SAP BO 4.1 ArchitectureDokument1 SeiteSAP BO 4.1 Architecturevenkat143786100% (1)

- ASIC Supervision of Markets and Participants: January To June 2013Dokument25 SeitenASIC Supervision of Markets and Participants: January To June 2013AndrewSaksNoch keine Bewertungen

- Voltas Pricelist - Ashr 2019Dokument7 SeitenVoltas Pricelist - Ashr 2019P S Raju KucherlapatiNoch keine Bewertungen

- Department of Labor: Cedfeb98Dokument24 SeitenDepartment of Labor: Cedfeb98USA_DepartmentOfLaborNoch keine Bewertungen

- Client Representation LetterDokument5 SeitenClient Representation LetterPuspita NingtyasNoch keine Bewertungen

- Packaging and Labeling DecisionsDokument11 SeitenPackaging and Labeling DecisionsAnonymous UpDFk5iANoch keine Bewertungen

- Lecture 5 - IAS 36 Impairment of AssetsDokument19 SeitenLecture 5 - IAS 36 Impairment of AssetsJeff GanyoNoch keine Bewertungen

- Mcdonald'S: Market StructureDokument5 SeitenMcdonald'S: Market Structurepalak32Noch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Location Planning and AnalysisDokument1 SeiteLocation Planning and AnalysisRoseanne Binayao LontianNoch keine Bewertungen

- Tenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100Dokument5 SeitenTenet Healthcare Corporation 401 (K) Retirement Savings Plan 25100anon-822193Noch keine Bewertungen

- Importance and Challenges of Smes: A Case of Pakistani Smes: EmailDokument8 SeitenImportance and Challenges of Smes: A Case of Pakistani Smes: EmailDr-Aamar Ilyas SahiNoch keine Bewertungen

- Project Cycle Management and Proposal WritingDokument40 SeitenProject Cycle Management and Proposal WritingZaigham KhanNoch keine Bewertungen