Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

PRIMA AGRO LIMITED

CORPORATE & REGD, OFF CE

lnd ustr al Developrnent Area

lr,luppathadam P O, Edayar, Co.hin - 683 110

Kerala Slate ndra

Te 91-484-2551533. (5 L nes)

3oth July, 2016

The Manager,

Fax 91484-2556060

CIN: 115331 K11987P1C0044833

E-mail prima@vsn. n

Listing Depart ment

s/Wprimaagro.in

1.

Bombay Stock Exchange Ltd, Mumbai

Dear Sir,

Sub: Outcome of Board Meeting dated

3 ottt

fuly, 2016

Ref: Scrip Code No.519262

It is hereby informed to the Bombay Stock Exchange , that the Board of Directors

of the Company at its meeting held on 3Oth llly 2076 at the registered olfice of

the Company has inter-alia transacted the following:The Board of Directors approved the Unaudited Financial Results of the

Company for the quarter ended 3otr, Iune, 2016.

[b] The Board considered, discussed and reviewed the other reports and

ongoing business propositions.

(aJ

The copy of Unaudited Results is enclosed along with this letter fbr your

reference and records.

Kindly do the needful and oblige.

Thanking you,

Yours faithfully

For P

a Agro Ltd

S.K.Gupla

ffi{)

pkt

Chairman & Managing Direct

DIN:01575160

PRIMAAGRO tTD

Resistered Office

Door No, v-679lC, lndustrialDevetopmnt Area, Muppathadam,Edayar, cochin-5831 0

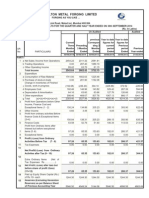

ANNEXURE-1TO CTAUSE 41

STATEMENT OF UNAUDITED TINANCIAL RESULTS FOB THE QUARTER EN DED 3OT

June,2016

PART-1

standalone/consolidated Unaudited Financial Results for the Quarter ended 30-5-2015

Standalone

Qtr endd

Qtr ended

Quarter Ended

30-5-2016

31-3-2016

30-6-2015

3t-3-2016

Unaudited

1. lncome from Operations

(b) Other ODeratine Income

295.10

290.13

2A?.24

1146.94

Total lncome from ooerations

295.1

290.73

283.28

1t46.94

0

18.25

10.5

45.15

0

{0-63}

0

0.51

I0.401

724.69

71_22

301.55

48.59

s7.24

44,98

205.95

2s.00

8.00

51.43

767.73

67.77

45.24

402.38

274.03

4L5.47

203.08

1039.88

107.06

17.21

0.00

a. Consumption of raw materials /Purchase

b. Purchase of stock in Trade

c. lncrease/decrease in stock in trade and work in prosres\

I0.261

59.94

50.71

f. Depreciation and Amortisation ExDenses

TotalErpenses

(Any item exceeding 10% of the totalexpenditure to be shown

3. Pr6fit/(Loss) fro m operations before other

and Exceptional ltems (1-2)

0.00

lncome,finance cost

41.07

llzs.74)

80.20

3.7 3

0.00

2.66

5. Profit/lLoss)from ordinary activities before finance cost and

Exceptional ltems (3+4)

84.80

112s.74)

42.46

110.33

5. Finance Cost

0.00

(3.68)

(0.12)

(4.131

7. Profit /(loss)from ordinary activities afterfinance cost but before

exceptional items (5-5)

84.80

1129.42)

42.74

106,20

8. Exceptionalitems

0.00

84.80

llze.42l

82.74

103.06

127.sll

(20.32)

(26.84)

(39.38)

55.90

63.6A

9. Profit (+)/ toss (-)from

rdina ry Activities before tax (7+8)

10. Tax expense

11. Net Profit (+)/ toss (-)from

rdina ry

ctivites after tax (9-10)

12. Extraordinary ltem (netof taxexpense Rs.

57.29

_)

1149.7

-3.14

4)

0.00

57.29

1149.74\

14, Share of Profit /Loss ofAssociates

0.00

15. Minority lnterest

0.00

16.Net Profit/Loss for the period{13+r4+1s)

57.29

13, Net Profit(+)/ Loss(-l aftr taxes but before share of profit/loss of

0.00

55.90

53.68

l!4s.74l,

55.90

63.64

519.49

519.49

519.49

519.49

10,00

10.00

10.00

10.00

(6os.3o)

(509.30)

(558.05I

(50e.3o)

1.63

lz.4e)

1_59

2.O4

associates and minority interes(11+121

17. Paid'up equity share capital

(tace Value of the share shall be indicated)

18, Reserue excluding Revaluation Reserves as per balance sheet of

previous accountjng year

19,i. Earnings Per Share (EPS)

a) Basic EPs before Extraordinary items for the period,

to date and for the previous year [hot to be

forthe year

annualizelEs

i7

r/or r

{)

er\:

txltrJoo/I

bV,

iit mU,r.rCnO Urntd

.<==>".-\+,

ffiffiffi-

o',trt"a rps u"ror" extraordinarY items for the period, for the

1.59

2.O4

1.10

-2.88

1.59

1-23

1.10

-2.88

1.59

1.23

1.53

12.4el

yeartodate and forthe previousYear (notto be annualized)

0

19.ii Earninss Per share (EPS)

,) e".i" ips utte. rrtruordinary itemsfor the period, for thevear to

date and forth previousyear (not to be annualized)

-t)

l)-6ilituu eps ufto o,traordinarv itemsforthe period, for the vear

to date and for the previousYear {not to b annualized)

pn*-r-rr'.

ser-rcr nronrrllrloN FoRTHE QUARTER & YEAR ENDED30_5_2

16

A Particulars of Shareholdinss

1. Public shareholding

D.'.""ri'c.l

3451700

3451700

3451700

3451700

66.44

66.M

66.44

1743200

!743200

t743200

66.44

1741200

ch:reholdins

2. Promoters and promoter Broup Shrleholdings

I Dla.lccdlFn.,rmhFred

0

' p"r*"t"g"

ofthe totalshareholding of

ofthe totalshare capitalofthe

a %

t"s

"tttt"*t

promoter and promoter group)

- percentage ofshares (as a%

h\ N.n-6h.xmbered

1743200

1743200

1743200

100.00

100.00

100.00

100.00

33.s6

33.56

33.56

33.55

17

P"r*.trC"

"f.1"*t

("t

"r'-f

lhe totalshareholding of

43200

promoter and Promoter SrouP)

-

P"r.""tr8".f d."t"t ("t;

% of the

totalshar capitalofthe

B. lnvestor ComPlaints

3 months ended 30.06.2015

Pending at the beginning

Nit

ofthe quarter

Ntl

Received duringthe quarter

Nil

Disposed duringthe quarter

Ntl

Remaining unresolved at ihe end ofthe quarter

Note

30 07.2016

(i) The above results were taken on record by the Board at their mee ting held on

lii) Provision for taxes includes provision for deferred Tax'

(iii) During the Period companv has not received anv complaintsfror

.e are no unresolved complaints at the

opening or closing of the Period

For PRIMA AGRO LIMITED

(iv) Previous yeafs figures have been regrouped/rearransed where

_=-=a-a>Y

{adoo

Nr{,g

5.K.Gupti

chakman & Managint Director

Date:30-7-2016

olz

Das könnte Ihnen auch gefallen

- Worksheet Pirates of The Caribbean Curse of TheDokument3 SeitenWorksheet Pirates of The Caribbean Curse of TheAylin Acar0% (1)

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- M iYN: Standalone Limited BoDokument5 SeitenM iYN: Standalone Limited BoHimanshuNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- TTR RRL: LimitedDokument5 SeitenTTR RRL: LimitedShyam SunderNoch keine Bewertungen

- Ger S G, Eejeeb Y We S,: Crjsi"Dokument5 SeitenGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaNoch keine Bewertungen

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument8 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument9 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- V-Guard Industries LTD 150513 RSTDokument4 SeitenV-Guard Industries LTD 150513 RSTSwamiNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Dokument7 SeitenStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument3 SeitenFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument15 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 2008 2009 - 31 Mar 2009Dokument3 Seiten2008 2009 - 31 Mar 2009Nishit PatelNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument8 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDokument3 SeitenPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Dabur Balance SheetDokument30 SeitenDabur Balance SheetKrishan TiwariNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument8 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Pdfnews PDFDokument5 SeitenPdfnews PDFMurthy KarumuriNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Assessing Learning Methods and TestsDokument2 SeitenAssessing Learning Methods and TestsZarah Joyce SegoviaNoch keine Bewertungen

- The Transformation of PhysicsDokument10 SeitenThe Transformation of PhysicsVíctor Manuel Hernández MárquezNoch keine Bewertungen

- Vegetation of PakistanDokument10 SeitenVegetation of PakistanAhmad sadiqNoch keine Bewertungen

- Chapter04 PDFDokument36 SeitenChapter04 PDFBabuM ACC FIN ECONoch keine Bewertungen

- Reflection Paper - InternshipDokument7 SeitenReflection Paper - Internshipapi-549362324Noch keine Bewertungen

- Impact On Modern TechnologyDokument2 SeitenImpact On Modern TechnologyNasrullah Khan AbidNoch keine Bewertungen

- Sample Thesis Title in Business ManagementDokument6 SeitenSample Thesis Title in Business Managementlisabrownomaha100% (2)

- Diaphragmatic Breathing - The Foundation of Core Stability PDFDokument7 SeitenDiaphragmatic Breathing - The Foundation of Core Stability PDFElaine CspNoch keine Bewertungen

- Grade 12 - MIL - Q1 - Week1 FinalDokument19 SeitenGrade 12 - MIL - Q1 - Week1 FinalMa'am Regie Ricafort100% (2)

- Phronesis Volume 7 Issue 1 1962 (Doi 10.2307/4181698) John Malcolm - The Line and The CaveDokument9 SeitenPhronesis Volume 7 Issue 1 1962 (Doi 10.2307/4181698) John Malcolm - The Line and The CaveNițceValiNoch keine Bewertungen

- 99 Apache Spark Interview Questions For Professionals PDF - Google SearchDokument2 Seiten99 Apache Spark Interview Questions For Professionals PDF - Google SearchCsvv VardhanNoch keine Bewertungen

- 1201 CCP Literature ReviewDokument5 Seiten1201 CCP Literature Reviewapi-548148057Noch keine Bewertungen

- Belief MatrixDokument1 SeiteBelief Matrixapi-384108912Noch keine Bewertungen

- DocxDokument2 SeitenDocxNashNoch keine Bewertungen

- Swatch Case AnalysisDokument3 SeitenSwatch Case Analysisgunjanbihani100% (1)

- Project 4: Creative Illustration: Theme: Nouns and AdjectivesDokument2 SeitenProject 4: Creative Illustration: Theme: Nouns and Adjectivesapi-278922030Noch keine Bewertungen

- Peta I Think Fizik t4Dokument18 SeitenPeta I Think Fizik t4Yk TayNoch keine Bewertungen

- Climate and Urban FormDokument10 SeitenClimate and Urban FormYunita RatihNoch keine Bewertungen

- WS 1.6 IvtDokument2 SeitenWS 1.6 IvtAN NGUYENNoch keine Bewertungen

- A Project Report On Market Research & Brand Activation: Submitted in Partial Fulfillment of The RequirementsDokument55 SeitenA Project Report On Market Research & Brand Activation: Submitted in Partial Fulfillment of The Requirementskartik chauhan100% (1)

- Optimizing RMAN RecoveryDokument61 SeitenOptimizing RMAN RecoveryVijay ParuchuriNoch keine Bewertungen

- Khulafa-al-Rashidun, UmarDokument9 SeitenKhulafa-al-Rashidun, UmarDuha QureshiNoch keine Bewertungen

- Analysis and Design of Circular Beams-2017Dokument49 SeitenAnalysis and Design of Circular Beams-2017Ragheb Ibrahim0% (1)

- Richard Payne v. Scottie Burns, Sheriff Escambia County, J.B. Redman, LT., and Cecil White, Officer, 707 F.2d 1302, 11th Cir. (1983)Dokument2 SeitenRichard Payne v. Scottie Burns, Sheriff Escambia County, J.B. Redman, LT., and Cecil White, Officer, 707 F.2d 1302, 11th Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- People v. Sandiganbayan (Evidence)Dokument2 SeitenPeople v. Sandiganbayan (Evidence)donnamariebollosNoch keine Bewertungen

- Book Review: Alain de Botton's The Art of TravelDokument8 SeitenBook Review: Alain de Botton's The Art of TravelharroweenNoch keine Bewertungen

- ĐỀ CHUẨN MINH HỌA SỐ 03Dokument17 SeitenĐỀ CHUẨN MINH HỌA SỐ 03Lê Thị Ngọc ÁnhNoch keine Bewertungen

- Critical AnalysisDokument4 SeitenCritical AnalysisAyet PNoch keine Bewertungen

- Internship Report On Nundhyar Engineering & Construction BattagramDokument65 SeitenInternship Report On Nundhyar Engineering & Construction BattagramFaisal AwanNoch keine Bewertungen