Beruflich Dokumente

Kultur Dokumente

11flexible Budget and

Hochgeladen von

Joyce Anne TilanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

11flexible Budget and

Hochgeladen von

Joyce Anne TilanCopyright:

Verfügbare Formate

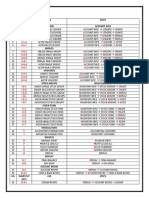

11FLEXIBLE BUDGET AND

OVERHEAD ANALYSIS

DISCUSSION QUESTIONS

1.A static budget is for a particular level of activity. A flexible budget is one that

can be established

for any level of activity.

2.For performance reporting, it is necessary to compare the actual costs for the

actual level of

activity with the budgeted costs for the actual level of activity. A flexible budget

provides the means to compute the budgeted costs for the actual level of activity, after

the fact.

3.A flexible budget is based on a simple formula: Total costs (Y) = F + VX,

where F = fixed costs

and V = variable cost per unit; this requires knowledge of both fixed and variable

components (see Cornerstone 112).

4.A before-the-fact flexible budget allows managers to engage in sensitivity

analysis by looking at

the financial outcomes possible for a number of different plausible scenarios.

5.An after-the-fact flexible budget facilitates performance evaluation by allowing

the calculation of

what spending should have been for the actual level of activity.

6.Part of a variable overhead spending variance can be caused by inefficient use

of overhead

resources.

7.Agree. This variance, assuming that variable overhead costs increase as labor

usage increases,

is caused by the efficiency or inefficiency of labor usage.

8.The variable overhead efficiency variance values the difference between the

actual hours and the

hours allowed using the standard variable overhead rate, while the labor

efficiency variance values the difference using the standard labor rate.

9.Fixed overhead costs are either committed or discretionary. The committed

costs will not differ

by their very nature. Discretionary can vary, but the level the company wants to

spend

on these items is decided at the beginning of the time period and usually will be

met

unless there is a conscious decision to change the predetermined levels.

10.The volume variance occurs when the actual volume differing from the

expected volume used to compute the predetermined standard fixed overhead rate. An

unfavorable volume variance occurs

when the actual volume is less than the expected volume. Thus, an unfavorable

volume

variance means that actual production is less than expected.

11.If the actual volume is different from the expected, then the company has

either lost or earned

contribution margin. The volume variance signals this outcome, and if the

variance is large, then the loss or gain is large since the volume variance understates

the effect.

11-1

2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or

duplicated, or posted to a publicly accessible website, in whole or in part.

Das könnte Ihnen auch gefallen

- Certificate of Recognition: Is Awarded ToDokument1 SeiteCertificate of Recognition: Is Awarded ToJoyce Anne TilanNoch keine Bewertungen

- Certificate of Recognition for Best Cheer at Survivor Blaze 2016Dokument1 SeiteCertificate of Recognition for Best Cheer at Survivor Blaze 2016Joyce Anne TilanNoch keine Bewertungen

- Case StudyDokument10 SeitenCase StudyJoyce Anne TilanNoch keine Bewertungen

- Heneral LunaDokument7 SeitenHeneral LunaJoyce Anne Tilan80% (5)

- Joyce Ann SDokument5 SeitenJoyce Ann SJoyce Anne TilanNoch keine Bewertungen

- Republic of The PhilippinesDokument55 SeitenRepublic of The PhilippinesJoyce Anne TilanNoch keine Bewertungen

- Jerrold TarogDokument35 SeitenJerrold TarogJoyce Anne TilanNoch keine Bewertungen

- FringeDokument7 SeitenFringeJoyce Anne TilanNoch keine Bewertungen

- What Is The RizalDokument5 SeitenWhat Is The RizalJoyce Anne TilanNoch keine Bewertungen

- Mglmod 9Dokument15 SeitenMglmod 9Joyce Anne TilanNoch keine Bewertungen

- Duterte SpeechDokument4 SeitenDuterte SpeechPrins Khanna DifuntorumNoch keine Bewertungen

- Philippines Gross National ProductDokument4 SeitenPhilippines Gross National ProductJoyce Anne TilanNoch keine Bewertungen

- AASC15Dokument35 SeitenAASC15Mimi KòiNoch keine Bewertungen

- GovernmentDokument19 SeitenGovernmentJoyce Anne Tilan100% (1)

- NewsDokument19 SeitenNewsJoyce Anne TilanNoch keine Bewertungen

- Banks DefinedDokument2 SeitenBanks DefinedJoyce Anne TilanNoch keine Bewertungen

- Karen's Deep and Long-Drawn Sigh Signifies A Mixture of Two Things: Excitement and Apprehension. Now That Sounds A Little Confusing, But Here's WhyDokument1 SeiteKaren's Deep and Long-Drawn Sigh Signifies A Mixture of Two Things: Excitement and Apprehension. Now That Sounds A Little Confusing, But Here's WhyJoyce Anne TilanNoch keine Bewertungen

- Karen's sigh of mixed emotionsDokument1 SeiteKaren's sigh of mixed emotionsJoyce Anne TilanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Clarkson Lumber SolutionDokument9 SeitenClarkson Lumber SolutionDiego F. Guty JadueNoch keine Bewertungen

- Penny Blossom Income Statement Problem SolutionDokument3 SeitenPenny Blossom Income Statement Problem SolutionCataPrietoNoch keine Bewertungen

- Chapter 4-Demand Supply ApplicationsDokument24 SeitenChapter 4-Demand Supply ApplicationsNuriIzzatiNoch keine Bewertungen

- Lecture - 2 (Strategic Marketing Planning)Dokument22 SeitenLecture - 2 (Strategic Marketing Planning)Ali HashimNoch keine Bewertungen

- Marketing Strategies and MorphDokument31 SeitenMarketing Strategies and MorphChris Claro MarfilNoch keine Bewertungen

- BSBSMB301 Investigate Micro Business Opportunities: Term 3, 2019 Week: 4Dokument11 SeitenBSBSMB301 Investigate Micro Business Opportunities: Term 3, 2019 Week: 4Helpin AssignmentsNoch keine Bewertungen

- Rekening Koran Desember Februari 2023Dokument3 SeitenRekening Koran Desember Februari 2023Panji PrakosoNoch keine Bewertungen

- Module - 1: What Do You Already Know?Dokument23 SeitenModule - 1: What Do You Already Know?Lene Corpuz100% (1)

- Parle-G Final Report...Dokument13 SeitenParle-G Final Report...zebaishhNoch keine Bewertungen

- Marketing Strategies of Olper's Milk and MilkpakDokument25 SeitenMarketing Strategies of Olper's Milk and MilkpakKhadija Haider71% (14)

- ERP Applications: An Overview of Enterprise Resource Planning SystemsDokument22 SeitenERP Applications: An Overview of Enterprise Resource Planning SystemsBuddhika GamageNoch keine Bewertungen

- HRD AuditDokument15 SeitenHRD AuditVilay GuptaNoch keine Bewertungen

- Distribution in Rural Market.Dokument4 SeitenDistribution in Rural Market.Mitesh Kadakia100% (1)

- 0452 s07 QP 3 PDFDokument20 Seiten0452 s07 QP 3 PDFAbirHudaNoch keine Bewertungen

- Luxury Brand Goods Repurchase Intentions Brand-Self CongruityDokument17 SeitenLuxury Brand Goods Repurchase Intentions Brand-Self CongruityMahasiswa BiasaNoch keine Bewertungen

- Labor Productivity and Comparative Advantage: The Ricardian ModelDokument26 SeitenLabor Productivity and Comparative Advantage: The Ricardian ModelJonny FalentinoNoch keine Bewertungen

- Special Journals - SsDokument2 SeitenSpecial Journals - SsEsther FanNoch keine Bewertungen

- Kaha Marketing PlanDokument23 SeitenKaha Marketing PlanMahmoud Elyamany100% (2)

- Operations and Supply Chain Management 15th Edition Jacobs Solutions ManualDokument11 SeitenOperations and Supply Chain Management 15th Edition Jacobs Solutions Manualhangnhanb7cvf100% (34)

- Group Assignment 1 - Group 5Dokument9 SeitenGroup Assignment 1 - Group 5Suhaimi SuffianNoch keine Bewertungen

- Anchor SwitchesDokument12 SeitenAnchor SwitchesAnusha PaulNoch keine Bewertungen

- Strategic AnalysisDokument6 SeitenStrategic AnalysisShrestha KishorNoch keine Bewertungen

- Topic: Accounting EnvironmentDokument24 SeitenTopic: Accounting Environmentsdae_hoNoch keine Bewertungen

- Tally Shortcut Keys GuideDokument2 SeitenTally Shortcut Keys Guideradha ramaswamyNoch keine Bewertungen

- MBA Case StudiesDokument123 SeitenMBA Case StudiesMariell Joy Cariño-TanNoch keine Bewertungen

- Chapter 2Dokument14 SeitenChapter 2Ncim PoNoch keine Bewertungen

- Managing Brand OvertimeDokument8 SeitenManaging Brand Overtimedolevikas5163Noch keine Bewertungen

- Week 13.2 - Business Unit Level StrategyDokument35 SeitenWeek 13.2 - Business Unit Level StrategyPhakpoom NajiNoch keine Bewertungen

- This Year, It Was The Seventh-Largest Commercial Vehicle Manufacturer in The World (2019)Dokument11 SeitenThis Year, It Was The Seventh-Largest Commercial Vehicle Manufacturer in The World (2019)alpha kachhapNoch keine Bewertungen

- E - CommerceDokument9 SeitenE - CommerceVishal Kumar ShawNoch keine Bewertungen