Beruflich Dokumente

Kultur Dokumente

Format

Hochgeladen von

Vaibhav BadgiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Format

Hochgeladen von

Vaibhav BadgiCopyright:

Verfügbare Formate

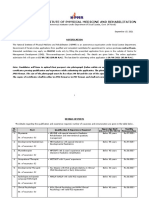

S.

No

Author and Year Bibliography

S. McKenzie, D Gerace,

Z Subedar (2007)

2 Dr. S. K. Mitra

Matloob Ullah Khan,

Ambrish Gupta, Sadaf

3 Siraj

4 Dr.Sarbapriya Ray

The Australasian Accounting

Business & Finance Journal,

December, 2007, AN EMPIRICAL

INVESTIGATION OF THE BLACKSCHOLES MODEL: EVIDENCE

FROM THE AUSTRALIAN STOCK

EXCHANGE

Global Journal of Management

and Business Research, Volume

12 Issue 3 Version 1.0 March 2012

International Journal of Economics

and Financial Issues, Vol. 3, No.

1, 2013, pp.87-98 ISSN: 21464138

Journal of Science (JOS) Vol. 2, No.

4, 2012, ISSN 2324-9854

Type of report context

Objective

To empirically examine the

accuracy and statistical

significance of the

factors within the BlackScholes model, with evidence

from the ASX.

Empirical Study

AUSTRALIAN

STOCK

EXCHANGE

Empirical Study

To empirically compare the

National Stock

Actual prices of Nifty Option

Exchange, F &

using Black's Model and B-S-M

O Market

Model.

Empirical Study

Incorporate modification in

Black-Scholes option pricing

National Stock

model formula by adding some

Exchange, F &

new variables on the basis of

O Market

given assumption related to

risk-free interest rate

Empirical Study

Place of study

Austrailian Stock Exchange ASX 200 Index

National Stock Exchange

National Stock Exchange

Population Sample Methodology

Secondary data

from for Option

contracts was

gathered from SIRCA

159

from Feb 2003- Feb

2007, Risk free rate

was - The Govt 90

Days T -Bill market,

Secondary data

from Nifty Option

from July 2008 June 2011 was

considered for the

study and the risk

29724 free rate was MIBOR

10

methodology of data collected

Tools

Econometric - time series analysis

qualitative regression;

logit and probit models;

and a maximum

likelihood approach.

Econometric - time series analysis

Black' Model and B-S-M

Model was used.

Econometric - time series analysis

5 SITUATONAL Analysis

were carried out to test

the MBSM

Findings

Your Comments

Important points

The Black Scholes model is relatively

accurate. Comparing the qualitative

regression models provides evidence

that the Black Scholes model is

significant at the 1% level in

estimating the probability of an

The use of implied

option being exercised.

volatility and a jumpThe results based on a

The paper was focused

diffusion approach,

method of maximum likelihood

on exchange traded,

improves the statistical

indicate that the factors of the

European call option

significance of the

Black-Scholes collectively are

Black-Scholes model.

statistically significant.

Black-Scholes model under the use

of implied volatility is superior to

other volatilities

total error in Black model was less

than that of B-s-M Model

In all the 5 situational analysis

carried out, the OBSM cannot be

replaced with MBSM. Also there is

strong correlation between MBSM

and OBSM

Effectiveness of the

model was tested using

Though the use of

Black-Scholes model is pared T-test

popular, the model does

not exactly fit into the

real life situations

Modification of the BSM

Interest rate (RoR)

was tested by replacing

component in case of

only I out of 5 attributes

BSM cannot be replaced of BSM

by any other format of

yield curve

key words

Das könnte Ihnen auch gefallen

- Documents Salaried Self Employed Professional Self Employed Non ProfessionalDokument5 SeitenDocuments Salaried Self Employed Professional Self Employed Non ProfessionalVaibhav BadgiNoch keine Bewertungen

- Indian Economy IntroductionDokument4 SeitenIndian Economy IntroductionVaibhav BadgiNoch keine Bewertungen

- Financial Derivaties - NotesDokument49 SeitenFinancial Derivaties - NotesVaibhav Badgi100% (2)

- Management and Entrepreneurship-Veer BhadraDokument195 SeitenManagement and Entrepreneurship-Veer BhadraPrakash Bansal100% (1)

- A Study On Receivable Management Its ImpactDokument77 SeitenA Study On Receivable Management Its ImpactVaibhav Badgi100% (3)

- ReseDokument2 SeitenResekrishnagdeshpandeNoch keine Bewertungen

- Research Methodology and Market Research: in This Chapter, The Following Questions Are DiscussedDokument14 SeitenResearch Methodology and Market Research: in This Chapter, The Following Questions Are DiscussedVaibhav BadgiNoch keine Bewertungen

- ED Poornima CharantimathDokument202 SeitenED Poornima CharantimathVaibhav Badgi64% (11)

- Afm - Mod IiiDokument21 SeitenAfm - Mod IiiVaibhav BadgiNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- MarketingDokument5 SeitenMarketingRose MarieNoch keine Bewertungen

- Mount Athos Plan - Healthy Living (PT 2)Dokument8 SeitenMount Athos Plan - Healthy Living (PT 2)Matvat0100% (2)

- Empirical Formula MgCl2Dokument3 SeitenEmpirical Formula MgCl2yihengcyh100% (1)

- Hardy-WeinbergEquilibriumSept2012 002 PDFDokument6 SeitenHardy-WeinbergEquilibriumSept2012 002 PDFGuntur FaturachmanNoch keine Bewertungen

- 2018 UPlink NMAT Review Social Science LectureDokument133 Seiten2018 UPlink NMAT Review Social Science LectureFranchesca LugoNoch keine Bewertungen

- Virtual Verde Release Plan Emails: Email 1Dokument4 SeitenVirtual Verde Release Plan Emails: Email 1Violet StarNoch keine Bewertungen

- Calcutta Bill - Abhimanyug@Dokument2 SeitenCalcutta Bill - Abhimanyug@abhimanyugirotraNoch keine Bewertungen

- Yahoo Tab NotrumpDokument139 SeitenYahoo Tab NotrumpJack Forbes100% (1)

- 2016 01 15 12 00 22 PDFDokument26 Seiten2016 01 15 12 00 22 PDFABHIJEET SHARMANoch keine Bewertungen

- HSE Matrix PlanDokument5 SeitenHSE Matrix Planवात्सल्य कृतार्थ100% (1)

- Tutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFDokument729 SeitenTutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFBadunoniNoch keine Bewertungen

- A Portrayal of Gender and A Description of Gender Roles in SelectDokument429 SeitenA Portrayal of Gender and A Description of Gender Roles in SelectPtah El100% (1)

- RH Control - SeracloneDokument2 SeitenRH Control - Seraclonewendys rodriguez, de los santosNoch keine Bewertungen

- Winifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementDokument279 SeitenWinifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementOlgaNoch keine Bewertungen

- Sample File: A of TheDokument6 SeitenSample File: A of TheMegan KennedyNoch keine Bewertungen

- National ScientistDokument2 SeitenNational ScientistHu T. BunuanNoch keine Bewertungen

- NIPMR Notification v3Dokument3 SeitenNIPMR Notification v3maneeshaNoch keine Bewertungen

- CardiologyDokument83 SeitenCardiologyAshutosh SinghNoch keine Bewertungen

- Long Range Plans ReligionDokument3 SeitenLong Range Plans Religionapi-266403303Noch keine Bewertungen

- Abstraction and Empathy - ReviewDokument7 SeitenAbstraction and Empathy - ReviewXXXXNoch keine Bewertungen

- Basic Catholic Prayer 1Dokument88 SeitenBasic Catholic Prayer 1Josephine PerezNoch keine Bewertungen

- ECON 4035 - Excel GuideDokument13 SeitenECON 4035 - Excel GuideRosario Rivera NegrónNoch keine Bewertungen

- Consolidated PCU Labor Law Review 1st Batch Atty Jeff SantosDokument36 SeitenConsolidated PCU Labor Law Review 1st Batch Atty Jeff SantosJannah Mae de OcampoNoch keine Bewertungen

- Histology Solution AvnDokument11 SeitenHistology Solution AvnDrdo rawNoch keine Bewertungen

- Clinical Handbook of Infectious Diseases in Farm AnimalsDokument146 SeitenClinical Handbook of Infectious Diseases in Farm Animalsigorgalopp100% (1)

- Domestic ViolenceDokument2 SeitenDomestic ViolenceIsrar AhmadNoch keine Bewertungen

- FORTRESS EUROPE by Ryan BartekDokument358 SeitenFORTRESS EUROPE by Ryan BartekRyan Bartek100% (1)

- World of Warcraft 5e RPG Core DocumentDokument152 SeitenWorld of Warcraft 5e RPG Core DocumentHugo Moreno100% (1)

- The Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveDokument425 SeitenThe Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveMiriaam AguirreNoch keine Bewertungen

- Department of Education Division of Cebu ProvinceDokument5 SeitenDepartment of Education Division of Cebu ProvinceNelsie FernanNoch keine Bewertungen