Beruflich Dokumente

Kultur Dokumente

Ifsb

Hochgeladen von

Emzack Fahmi ZulkifliOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ifsb

Hochgeladen von

Emzack Fahmi ZulkifliCopyright:

Verfügbare Formate

3/25/2016

IFSB

AboutIFSB

StandardsDevelopment

IFSBMembership

Quicklinks

Home | ContactIFSB

Events&Activities

PressRoom

Publications

FISELearning

Data

Glossary

ContactIFSB

AboutIFSB>Establishment>Background

Background

TheIslamicFinancialServicesBoard(IFSB),whichisbasedinKualaLumpur,was

Establishment

Background

Mission

CoreValues

officially inaugurated on 3rd November 2002 and started operations on 10th March

2003. It serves as an international standardsetting body of regulatory and

supervisoryagenciesthathavevestedinterestinensuringthesoundnessandstability

oftheIslamicfinancialservicesindustry,whichisdefinedbroadlytoincludebanking,

capital market and insurance. In advancing this mission, the IFSB promotes the

developmentofaprudentandtransparentIslamicfinancialservicesindustrythrough

introducing new, or adapting existing international standards consistent with Shar'ah

Objectives

principles,andrecommendthemforadoption.

GoverningDocuments

To this end, the work of the IFSB complements that of the Basel Committee on

SecretaryGeneral

Banking Supervision, International Organisation of Securities Commissions and the

InternationalAssociationofInsuranceSupervisors.

As at December 2015, the 189 members of the IFSB comprise 65 regulatory and

supervisoryauthorities,eightinternationalintergovernmentalorganisations,and116

market players (financial institutions, professional firms and industry associations)

operatingin47jurisdictions.

Malaysia, the host country of the IFSB, has enacted a law known as the Islamic

FinancialServicesBoardAct2002,whichgivestheIFSBtheimmunitiesandprivileges

thatareusuallygrantedtointernationalorganisationsanddiplomaticmissions.

AdoptionofStandards

Sinceitsinception,theIFSBhasissuedtwentyfourStandards,GuidingPrinciples

and Technical Note for the Islamic financial services industry. The published

documentsareontheareasof:

1. RiskManagement(IFSB1)

2. CapitalAdequacy(IFSB2)

3. CorporateGovernance(IFSB3)

4. TransparencyandMarketDiscipline(IFSB4)

5. SupervisoryReviewProcess(IFSB5)

CalendarofEvents

IFSBprogrammestofacilitatethe

developmentoftheIslamicfinancial

servicesindustry

28Mar2016|Muscat,OMAN

IFSBFISWorkshopSeries(Oman)

10Apr2016|Cairo,EGYPT

IFSBAnnualMeetings2016:28th

MeetingoftheCouncil,14thGeneral

AssemblyoftheIslamicFinancial

ServicesBoard&OtherEvents

25Apr2016|KualaLumpur,

MALAYSIA

PublicHearingoftheIFSBExposure

Draft:TechnicalNoteonStress

TestingforInstitutionsOffering

IslamicFinancialServices(IIFS)

23May2016|Madrid,SPAIN

SeminaronIslamicFinanceTheReal

EconomyandtheFinancialSector

30May2016|Istanbul,TURKEY

WorldBankIFSBTurkishTreasury

Conference:RealisingtheValue

PropositionofTakfulIndustryfora

StableandInclusiveFinancialSystem

19Sep2016|Lusaka,ZAMBIA

IFSBFISWorkshopSeries(Zambia)

07Nov2016|MOROCCO

IFSBFISWorkshopSeries(Morocco)

6. GovernanceforCollectiveInvestmentSchemes(IFSB6)

7. SpecialIssuesinCapitalAdequacy(IFSB7)

8. GuidingPrinciplesonGovernanceforIslamicInsurance(Takful)Operations

(IFSB8)

9. ConductofBusinessforInstitutionsofferingIslamicFinancialServices(IIFS)

(IFSB9)

10. GuidingPrinciplesonShar`ahGoveranceSystem(IFSB10)

11. StandardonSolvencyRequirementsforTakful(IslamicInsurance)

Undertakings(IFSB11)

12. GuidingPrinciplesonLiquidityRiskManagement(IFSB12)

13. GuidingPrinciplesonStressTesting(IFSB13)

14. StandardonRiskManagementforTakful(IslamicInsurance)Undertakings

(IFSB14)

15. RevisedCapitalAdequacyStandard(IFSB15)

16. RevisedGuidanceonKeyElementsintheSupervisoryReviewProcess(IFSB

16)

17. CorePrinciplesforIslamicFinanceRegulations(IFSB17)

18. RecognitionofRatingsonShar`ahCompliantFinancialInstruments(GN1)

19. GuidanceNoteinConnectionwiththeRiskManagementandCapitalAdequacy

Standards:CommodityMurbahahTransactions(GN2)

20. GuidanceNoteonthePracticeofSmoothingtheProfitsPayouttoInvestment

AccountHolders(GN3)

21. GuidanceNoteinConnectionwiththeIFSBCapitalAdequacyStandard:The

DeterminationofAlphaintheCapitalAdequacyRatio(GN4)

22. GuidanceNoteontheRecognitionofRatingsbyExternalCreditAssessment

Institutions(ECAIS)onTakfulandReTakfulUndertakings(GN5)

23. QuantitativeMeasuresforLiquidityRiskManagement(GN6)

24. DevelopmentofIslamicMoneyMarkets(TN1)

The standards prepared by the IFSB follow a lengthy due process as outlined in its

GuidelinesandProceduresforthePreparationofStandards/Guidelineswhichinvolve,

amongothers,theissuanceofexposuredraftand,wherenecessary,theholdingofa

publichearing.

http://www.ifsb.org/background.php

1/2

3/25/2016

IFSB

AwarenessPromotion

The IFSB is actively involved in the promotion of awareness of issues that are

relevantorhaveanimpactontheregulationandsupervisionoftheIslamicfinancial

servicesindustry.Thismainlytakestheformofinternational conferences, seminars,

workshops,trainings,meetingsanddialoguesstagedinmanycountries.

SeeSpeechesdeliveredattheIFSBInaugurationCeremony(November2002)

1. WelcomingSpeechbyGovernor,BankNegaraMalaysia,Dr.ZetiAkhtarAziz

2. KeynoteAddressby(then)MalaysianPrimeMinister,Dr.MahathirMohammad

Backtotop

Copyright2010IslamicFinancialServicesBoard.Allrightsreserved.|Disclaimer|MEMA|

http://www.ifsb.org/background.php

2/2

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Islamic Financial Services Act 2013 (IFSA) - Bank Islam Malaysia BerhadDokument5 SeitenIslamic Financial Services Act 2013 (IFSA) - Bank Islam Malaysia BerhadEmzack Fahmi ZulkifliNoch keine Bewertungen

- Chapter 2 Attitude Self ConceptDokument12 SeitenChapter 2 Attitude Self ConceptEmzack Fahmi ZulkifliNoch keine Bewertungen

- BNM Administered LegislationDokument18 SeitenBNM Administered LegislationEmzack Fahmi ZulkifliNoch keine Bewertungen

- Chapter 1 Personal DevelopmentDokument21 SeitenChapter 1 Personal DevelopmentEmzack Fahmi Zulkifli100% (1)

- Perceptions of Retirement Savings Relative To PeersDokument8 SeitenPerceptions of Retirement Savings Relative To PeersNasstain Nal ArzihiNoch keine Bewertungen

- Tawhid in Al-Islam PesantrenDokument7 SeitenTawhid in Al-Islam PesantrenEmzack Fahmi ZulkifliNoch keine Bewertungen

- Fe de R at I o N o F Mal Ys I A: EDI CT OF GovernmentDokument17 SeitenFe de R at I o N o F Mal Ys I A: EDI CT OF GovernmentEmzack Fahmi ZulkifliNoch keine Bewertungen

- Ifsa 2013Dokument187 SeitenIfsa 2013Tipah HafizahNoch keine Bewertungen

- MicrosoftDokument12 SeitenMicrosoftsnowgul0% (1)

- Chapter 1 Islamic Legal FrameworkDokument28 SeitenChapter 1 Islamic Legal FrameworkEmzack Fahmi ZulkifliNoch keine Bewertungen

- Brief history of Microsoft Corporation and its productsDokument1 SeiteBrief history of Microsoft Corporation and its productsPol AnduLanNoch keine Bewertungen

- MicrosoftDokument53 SeitenMicrosoftlucky645060Noch keine Bewertungen

- 10 Jun 2016 Slide Presentation STA500Dokument11 Seiten10 Jun 2016 Slide Presentation STA500Emzack Fahmi ZulkifliNoch keine Bewertungen

- Contoh ResumeDokument2 SeitenContoh ResumeEmzack Fahmi ZulkifliNoch keine Bewertungen

- CHP 1Dokument41 SeitenCHP 1Emzack Fahmi ZulkifliNoch keine Bewertungen

- School of ThoughtDokument76 SeitenSchool of ThoughtEmzack Fahmi ZulkifliNoch keine Bewertungen

- BNM Administered LegislationDokument18 SeitenBNM Administered LegislationEmzack Fahmi ZulkifliNoch keine Bewertungen

- Clouddaydanielbuchererclean 110505222918 Phpapp01Dokument22 SeitenClouddaydanielbuchererclean 110505222918 Phpapp01Emzack Fahmi ZulkifliNoch keine Bewertungen

- Perceptions of Retirement Savings Relative To PeersDokument8 SeitenPerceptions of Retirement Savings Relative To PeersNasstain Nal ArzihiNoch keine Bewertungen

- Retirement EmployeeDokument35 SeitenRetirement EmployeeNasstain Nal ArzihiNoch keine Bewertungen

- Strategic Planning: Grow MoreDokument8 SeitenStrategic Planning: Grow MoreVFisaNoch keine Bewertungen

- Chapter 1 Islamic Legal FrameworkDokument28 SeitenChapter 1 Islamic Legal FrameworkEmzack Fahmi ZulkifliNoch keine Bewertungen

- Islamic Financial Services Act 2013 (IFSA) - Bank Islam Malaysia BerhadDokument5 SeitenIslamic Financial Services Act 2013 (IFSA) - Bank Islam Malaysia BerhadEmzack Fahmi ZulkifliNoch keine Bewertungen

- Islamic Financial Services Board (IFSB) Definition - InvestopediaDokument2 SeitenIslamic Financial Services Board (IFSB) Definition - InvestopediaEmzack Fahmi ZulkifliNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- This Study Resource Was Shared Via: TopicsDokument4 SeitenThis Study Resource Was Shared Via: TopicsNana GandaNoch keine Bewertungen

- OECD Economic Outlook - June 2023Dokument253 SeitenOECD Economic Outlook - June 2023Sanjaya AriyawansaNoch keine Bewertungen

- SiloamDokument1 SeiteSiloamJumaiyah Bin Nasir0% (1)

- Program Management Office (Pgmo) : Keane White PaperDokument19 SeitenProgram Management Office (Pgmo) : Keane White PaperOsama A. AliNoch keine Bewertungen

- Haldiram Foods International LTD 2005Dokument10 SeitenHaldiram Foods International LTD 2005Saurabh PatilNoch keine Bewertungen

- Total and Cumulative Budgeted CostDokument15 SeitenTotal and Cumulative Budgeted CostZahraJanelleNoch keine Bewertungen

- Lincoln Vs CA CIR DigestDokument1 SeiteLincoln Vs CA CIR DigestJay Ribs100% (1)

- MBA Financial Management AssignmentDokument4 SeitenMBA Financial Management AssignmentRITU NANDAL 144Noch keine Bewertungen

- Gift Case InvestigationsDokument17 SeitenGift Case InvestigationsFaheemAhmadNoch keine Bewertungen

- IFRS9Dokument218 SeitenIFRS9Hamza AmiriNoch keine Bewertungen

- Critique of PDP 2017-2022 on Monetary and Fiscal PoliciesDokument19 SeitenCritique of PDP 2017-2022 on Monetary and Fiscal PoliciesKarlRecioBaroroNoch keine Bewertungen

- Role of PAODokument29 SeitenRole of PAOAjay DhokeNoch keine Bewertungen

- Forex Trading by Money Market, BNGDokument69 SeitenForex Trading by Money Market, BNGsachinmehta1978Noch keine Bewertungen

- Chapter No.02: Costs, Concepts, Uses and ClassificationsDokument20 SeitenChapter No.02: Costs, Concepts, Uses and ClassificationsNaqibwafaNoch keine Bewertungen

- Discounted Cash Flow Valuation Concept Questions and ExercisesDokument3 SeitenDiscounted Cash Flow Valuation Concept Questions and ExercisesAnh TramNoch keine Bewertungen

- Reviewer (Cash-Accounts Receivable)Dokument5 SeitenReviewer (Cash-Accounts Receivable)Camila Mae AlduezaNoch keine Bewertungen

- 1991 Indian Economic Crisis and Reforms v4Dokument20 Seiten1991 Indian Economic Crisis and Reforms v4Hicham Azm100% (1)

- © The Institute of Chartered Accountants of IndiaDokument3 Seiten© The Institute of Chartered Accountants of IndiaDeepak KumarNoch keine Bewertungen

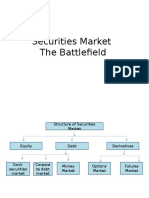

- Securities Market The BattlefieldDokument14 SeitenSecurities Market The BattlefieldJagrityTalwarNoch keine Bewertungen

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDokument28 SeitenP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahNoch keine Bewertungen

- A Study On Risk Perception of Individual InvestorsDokument7 SeitenA Study On Risk Perception of Individual InvestorsarcherselevatorsNoch keine Bewertungen

- Uts Manajemen KeuanganDokument8 SeitenUts Manajemen KeuangantntAgstNoch keine Bewertungen

- Amazon Intern Job DescriptionsDokument15 SeitenAmazon Intern Job Descriptionschirag_dceNoch keine Bewertungen

- CH 18 IFM10 CH 19 Test BankDokument12 SeitenCH 18 IFM10 CH 19 Test Bankajones1219100% (1)

- 2016pk Panels8-17Dokument18 Seiten2016pk Panels8-17pkconferenceNoch keine Bewertungen

- Journal EntryDokument15 SeitenJournal EntryNajOh Marie D ENoch keine Bewertungen

- Tom Neuenfeldt Independent For Governor: Link For The Reminder of The QuestionsDokument3 SeitenTom Neuenfeldt Independent For Governor: Link For The Reminder of The Questionsapackof2Noch keine Bewertungen

- ACCA104 - Notes ReceivableDokument7 SeitenACCA104 - Notes ReceivableAnaluz Cristine B. CeaNoch keine Bewertungen

- MMBC Faces Light Beer Market ChallengeDokument19 SeitenMMBC Faces Light Beer Market ChallengeAnshul Yadav100% (1)

- Cash Flow and Financial Planning Assignment - HM SampoernaDokument11 SeitenCash Flow and Financial Planning Assignment - HM SampoernaReynaldi DimasNoch keine Bewertungen