Beruflich Dokumente

Kultur Dokumente

Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AG

Hochgeladen von

api-25889552Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AG

Hochgeladen von

api-25889552Copyright:

Verfügbare Formate

Low Strike Reverse Convertible on COMMERZBANK AG

Coupon 10.29% p.a. - 3.5 Months - EUR - Strike at 78%

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 25.05.2010 Client pays EUR 1000 (Denomination)

Rating: Fitch A

Underlying COMMERZBANK AG On 17.09.2010 Client receiv es a 3% Coupon in fine

Bbg Ticker CBK GY Equity

Payment Date 25.05.10 PLUS

Valuation Date 17.09.10

Maturity 22.09.10 Scenario 1: if the Final Fixing Lev el is above the Strike Level

Spot Reference EUR 5.66 (100%) The Investor will receive a Cash Settlement equal to the Denomination

Strike Level EUR 4.41 (78%)

EU Saving Tax Option Premium Component 9.59% p.a.

Interest Component 0.7% p.a. Scenario 2: if the Final Fixing Lev el is at or below the Strike Level

Details Physical Settlement

The Investor will receive a predefined round number (i.e. Conversion Ratio) of

Conversion Ratio 227.27

the Underlying per Denomination (with a 22% discount)

ISIN CH0113519604

Valoren 11351960

SIX Symbol not listed

Characteristics

Underlying_______________________________________________________________________________________________________________________________________________________

Commerzbank AG attracts deposits and offers retail and commercial banking services. The Bank offers mortgage loans, securities brokerage and asset

management services, private banking, foreign exchange, and treasury services worldwide.

Opportunities______________________________________________________________ Risks__________________________________________________________________________

1. A guaranteed Coupon of 3% in fine 1. Maximum yield is limited to 3% in fine

2. Contingent capital protection if the Final Fixing Lev el is at or abov e 2. Exposure to v olatility changes

the Strike Lev el.

3. I f exerciced, shares are bought at 22% low er than today's lev el

4. Low er v olatility than direct equity exposure

5. Optimization of EU Tax components

6. Secondary market as liquid as a share

Best case scenario_________________________________________________________ Worst case scenario___________________________________________________________

The Underlying closes abov e the Strike Lev el at the Final Fixing Date The Underlying closes at or below the Strike Lev el at the Final Fixing Date

Redemption: Denomination + Coupon of 3% in fine Redemption: Underlying + Coupon of 3% in fine

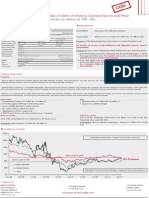

Historical Chart

importer depuis la deuxieme feuille

25

20

15

10

Spot Reference at EUR 5.66 (100%)

5 Strike at EUR 4.41 (78%) 32% Protection

0

Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10

Contacts

Filippo Colombo Christophe Spanier Nat hanael Gabay

Bruno Frat eschi +41 58 800 10 45 Sofiane Zaiem

St anislas Perromat +41 22 918 70 05

Alejandro Pou Cut uri Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves o nly fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendatio n fo r the purchase o f financial instruments no r an o ffer o r an invitatio n fo r an o ffer. No responsibility is taken fo r the correctness o f this informatio n. The financial

instruments mentio ned in this document are derivative instruments. They do no t qualify as units o f a collective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct o n Co llective Investment Schemes (CISA ) and are therefo re neither registered no r supervised

by the Swiss Financial M arket Superviso ry A utho rity FINM A . Investo rs bear the credit risk o f the issuer/guaranto r. B efo re investing in derivative instruments, Investors are highly reco mmended to ask their financial adviso r for advice specifically focused o n the Investo r´s

financial situation; the info rmation co ntained in this document does not substitute such advice. This publicatio n does not co nstitute a simplified prospectus pursuant to art. 5 CISA , o r a listing prospectus pursuant to art. 652a o r 1156 o f the Swiss Code o f Obligatio ns. The

relevant pro duct do cumentation can be obtained directly at EFG Financial P roducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, or via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Euro pe, Ho ng Kong, Singapore, the USA , US perso ns, and the United Kingdo m (the

law). The Underlyings´ perfo rmance in the past does not co nstitute a guarantee for their future performance. The financial pro ducts' value is subject to market fluctuatio n, what can lead to a partial o r to tal lo ss o f the invested capital. The purchase o f the financial products

triggers co sts and fees. EFG Financial P ro ducts A G and/o r ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may co nclude hedging transactio ns. Such activity may influence the market price, the price mo vement, o r the

liquidity o f the financial pro ducts. © EFG Financial P ro ducts A G A ll rights reserved.

Das könnte Ihnen auch gefallen

- Tarheel Consultancy Services: BangaloreDokument170 SeitenTarheel Consultancy Services: BangaloreSumit SinghNoch keine Bewertungen

- Private EquityDokument60 SeitenPrivate EquitykaikuNoch keine Bewertungen

- Treasury Manipulation ComplaintDokument61 SeitenTreasury Manipulation ComplaintZerohedgeNoch keine Bewertungen

- 9 Ways To Improve Your TradingDokument4 Seiten9 Ways To Improve Your Tradingnigo7567% (6)

- Applications For Financial FuturesDokument12 SeitenApplications For Financial FuturesNikki JainNoch keine Bewertungen

- Sebi Act 1992Dokument13 SeitenSebi Act 1992Akash saxena86% (7)

- LME Monthly Overview March 2021Dokument20 SeitenLME Monthly Overview March 2021Tram Le ThuyNoch keine Bewertungen

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDokument1 SeiteCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552Noch keine Bewertungen

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDokument1 SeiteCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552Noch keine Bewertungen

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDokument1 SeiteCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552Noch keine Bewertungen

- 7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURDokument1 Seite7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552Noch keine Bewertungen

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDokument1 SeiteCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552Noch keine Bewertungen

- 95% Capital Protected Autocallable Certificate With MemoryDokument1 Seite95% Capital Protected Autocallable Certificate With Memoryapi-25889552Noch keine Bewertungen

- Tracker Certificate On PORTUGAL TELECOM 1 YearDokument1 SeiteTracker Certificate On PORTUGAL TELECOM 1 Yearapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552Noch keine Bewertungen

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDokument1 SeiteCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856Noch keine Bewertungen

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDokument1 SeiteCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552Noch keine Bewertungen

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDokument1 SeiteCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDokument1 SeiteCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Noch keine Bewertungen

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Dokument1 Seite1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Noch keine Bewertungen

- Coupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDDokument1 SeiteCoupon 10.75% P.A. 1 Year EUR Barrier at 53.50%: Single Barrier Reverse Convertible On PORSCHE AUTOMOBIL HLDG-PFDapi-25890856Noch keine Bewertungen

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDokument1 Seite6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552Noch keine Bewertungen

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDokument1 Seite262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552Noch keine Bewertungen

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDokument1 SeiteCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552Noch keine Bewertungen

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDokument1 SeiteCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552Noch keine Bewertungen

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDokument1 SeiteCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552Noch keine Bewertungen

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDokument1 SeiteCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552Noch keine Bewertungen

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDokument1 SeiteCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552Noch keine Bewertungen

- Worst of Autocall Certificate With Memory EffectDokument1 SeiteWorst of Autocall Certificate With Memory Effectapi-25889552Noch keine Bewertungen

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Dokument1 Seite1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Noch keine Bewertungen

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDokument1 SeiteCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552Noch keine Bewertungen

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDokument1 Seite1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552Noch keine Bewertungen

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDokument1 SeiteCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552Noch keine Bewertungen

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDokument1 SeiteCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552Noch keine Bewertungen

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDokument1 SeiteExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552Noch keine Bewertungen

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDokument1 SeiteCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552Noch keine Bewertungen

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDokument1 Seite12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552Noch keine Bewertungen

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDokument1 SeiteCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552Noch keine Bewertungen

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDokument1 SeiteCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552Noch keine Bewertungen

- Coupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPDokument1 SeiteCoupon 10.8% P.A. - American Barrier at 95% - 4 Months - GBPapi-25889552Noch keine Bewertungen

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Dokument1 Seite1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552Noch keine Bewertungen

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDokument1 Seite6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552Noch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Noch keine Bewertungen

- Coupon 18% P.A. - American Barrier at 80% - 3 Months - PLNDokument1 SeiteCoupon 18% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Noch keine Bewertungen

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDokument1 SeiteCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552Noch keine Bewertungen

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDokument1 SeiteCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552Noch keine Bewertungen

- 260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onDokument1 Seite260% Participation - 105% Cap - 3 Months - EUR: Capped Outperformance Certificate On E.onapi-25889552Noch keine Bewertungen

- Coupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQDokument1 SeiteCoupon 5.40% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On POWERSHARES QQQapi-25889552Noch keine Bewertungen

- Doubled-Up Worst of Barrier Reverse ConvertibleDokument1 SeiteDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Noch keine Bewertungen

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Dokument1 Seite153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552Noch keine Bewertungen

- Coupon 17% P.A. - American Barrier at 80% - 3 Months - PLNDokument1 SeiteCoupon 17% P.A. - American Barrier at 80% - 3 Months - PLNapi-25889552Noch keine Bewertungen

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDokument1 SeiteCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552Noch keine Bewertungen

- Doubled-Up Worst of Barrier Reverse ConvertibleDokument1 SeiteDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552Noch keine Bewertungen

- Coupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDDokument1 SeiteCoupon 10.30% P.A. - 1 Year - European Barrier at 70% - USDapi-25889552Noch keine Bewertungen

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDokument1 SeiteCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552Noch keine Bewertungen

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Dokument1 SeiteCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856Noch keine Bewertungen

- Worst of Autocall Certificate With Memory EffectDokument1 SeiteWorst of Autocall Certificate With Memory Effectapi-25889552Noch keine Bewertungen

- Coupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFDokument1 SeiteCoupon 15.78% P.A. - American Barrier at 70% - 6 Months - Quanto CHFapi-25889552Noch keine Bewertungen

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDokument1 SeiteCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Noch keine Bewertungen

- Bonus Certificate On The EURO STOXX 50Dokument1 SeiteBonus Certificate On The EURO STOXX 50api-25889552Noch keine Bewertungen

- Darren FIXED INCOMEDokument31 SeitenDarren FIXED INCOMEAzadNoch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552Noch keine Bewertungen

- Delta One Tracker Certificate On Swiss EquityDokument1 SeiteDelta One Tracker Certificate On Swiss Equityapi-25889552Noch keine Bewertungen

- In Search of Returns 2e: Making Sense of Financial MarketsVon EverandIn Search of Returns 2e: Making Sense of Financial MarketsNoch keine Bewertungen

- Daily Markets UpdateDokument37 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- CG European Capital Growth Fund: StrategyDokument2 SeitenCG European Capital Growth Fund: Strategyapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- CG European Income Fund: StrategyDokument2 SeitenCG European Income Fund: Strategyapi-25889552Noch keine Bewertungen

- Weekly Markets UpdateDokument39 SeitenWeekly Markets Updateapi-25889552Noch keine Bewertungen

- NullDokument15 SeitenNullapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument35 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- NullDokument6 SeitenNullapi-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- NullDokument10 SeitenNullapi-25889552Noch keine Bewertungen

- Global Financial Centres: March 2010Dokument41 SeitenGlobal Financial Centres: March 2010api-25889552Noch keine Bewertungen

- Morning News 1 June 2010Dokument3 SeitenMorning News 1 June 2010api-25889552Noch keine Bewertungen

- NullDokument41 SeitenNullapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument33 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument30 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Morning News 28 May 2010Dokument3 SeitenMorning News 28 May 2010api-25889552Noch keine Bewertungen

- NullDokument1 SeiteNullapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument38 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- Worldwide Real Estates: Gibraltar LettingsDokument8 SeitenWorldwide Real Estates: Gibraltar Lettingsapi-25889552Noch keine Bewertungen

- Guy Butler Limited: AUD NZD CAD Denominated BondsDokument1 SeiteGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552Noch keine Bewertungen

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDokument65 SeitenUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552Noch keine Bewertungen

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Dokument1 Seite1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552Noch keine Bewertungen

- NullDokument3 SeitenNullapi-25889552Noch keine Bewertungen

- NullDokument6 SeitenNullapi-25889552Noch keine Bewertungen

- Daily Markets UpdateDokument36 SeitenDaily Markets Updateapi-25889552Noch keine Bewertungen

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Dokument1 Seite1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552Noch keine Bewertungen

- NullDokument1 SeiteNullapi-25889552Noch keine Bewertungen

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDokument1 SeiteCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552Noch keine Bewertungen

- NullDokument39 SeitenNullapi-25889552Noch keine Bewertungen

- MAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDokument5 SeitenMAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDivine VictoriaNoch keine Bewertungen

- Xumit CapitalDokument30 SeitenXumit CapitalSumit SinghNoch keine Bewertungen

- FM-Lecture4 + K-Stock Valuation ContdDokument46 SeitenFM-Lecture4 + K-Stock Valuation ContdAiman IqbalNoch keine Bewertungen

- Tata Value Fund Series 1 SidDokument44 SeitenTata Value Fund Series 1 SidAbdul Qadir SaifiNoch keine Bewertungen

- CH 17 InvestmentsDokument117 SeitenCH 17 InvestmentsSamiHadadNoch keine Bewertungen

- Stock ScreenerDokument1 SeiteStock ScreenerM WNoch keine Bewertungen

- Bond valuation and stock issuance calculationsDokument13 SeitenBond valuation and stock issuance calculationsHENDY YUDHA PRAMANANoch keine Bewertungen

- Calculate bond amortization and journal entriesDokument9 SeitenCalculate bond amortization and journal entriesClaudine LobrigasNoch keine Bewertungen

- Axis Securities Limited: Transmission-Cum-Dematerialization FormDokument1 SeiteAxis Securities Limited: Transmission-Cum-Dematerialization FormShreyans Tejpal ShahNoch keine Bewertungen

- GOU SECURITIES Auction Calendar FY 2023 24Dokument1 SeiteGOU SECURITIES Auction Calendar FY 2023 24foforoealtdNoch keine Bewertungen

- Short Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketDokument7 SeitenShort Term Trading Strategy Based On Chart Pattern Recognition and Trend Trading in Nasdaq Biotechnology Stock MarketAman KNoch keine Bewertungen

- Idea Cellular: Date Open High Low Close Rounded Low Rounded High Position BuypriceDokument6 SeitenIdea Cellular: Date Open High Low Close Rounded Low Rounded High Position BuypriceRaghu RamNoch keine Bewertungen

- SEBI Compliance for Rights Issue & Bonus SharesDokument22 SeitenSEBI Compliance for Rights Issue & Bonus SharesarjunjoshiNoch keine Bewertungen

- An LSOC Tutorial: A New Customer Protection Model For Cleared Swaps BeginsDokument3 SeitenAn LSOC Tutorial: A New Customer Protection Model For Cleared Swaps BeginsMarketsWikiNoch keine Bewertungen

- Corporation: Issuance: JPIA Mentor's CircleDokument18 SeitenCorporation: Issuance: JPIA Mentor's CircleartNoch keine Bewertungen

- The Role of Private Equity Firms - RizwanDokument17 SeitenThe Role of Private Equity Firms - RizwangizmorizNoch keine Bewertungen

- On SharesDokument26 SeitenOn SharesParth Dahuja100% (1)

- Assignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Dokument5 SeitenAssignment 3, International Banking Shafiqullah, Reg No, Su-17-01-021-001, Bba 8th.Shafiq UllahNoch keine Bewertungen

- True False True: Stockholders' EquityDokument3 SeitenTrue False True: Stockholders' EquityOMAYOMAYNoch keine Bewertungen

- Chap 21 AnswersDokument9 SeitenChap 21 AnswersJullie-Ann YbañezNoch keine Bewertungen

- Not UploadedDokument27 SeitenNot UploadedHAbbunoNoch keine Bewertungen

- Chapter - 2&3 - Practice - Problems Hull Ed 10thDokument2 SeitenChapter - 2&3 - Practice - Problems Hull Ed 10thAn KouNoch keine Bewertungen

- Islamic Preference SharesDokument3 SeitenIslamic Preference Shares0026547100% (1)

- RMS Works On The Following ConceptsDokument2 SeitenRMS Works On The Following ConceptsAbhimanyu Yashwant AltekarNoch keine Bewertungen