Beruflich Dokumente

Kultur Dokumente

Restrictions on franking credits

Hochgeladen von

oddsey0713Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Restrictions on franking credits

Hochgeladen von

oddsey0713Copyright:

Verfügbare Formate

3.

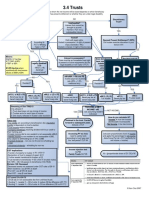

3 Franking account

Restrictions on allocation of franking credits to distributions

Maximum franking

credit rule s202-55

-Is the max amt of tax the

co has paid on profits

s202-65 acts to cap the

franking credits to the

max amt

s202-60

Franking account has a

deficit balance at year end

(ie DR)

YES

Working out FDT for franking acct purposes

Company liable to pay FDT [s20545(2)]

Amount of FDT? [s214-150]

- if co tax instalments are paid, FDT is

FDT = Franking Deficit

payable 14 days after tax refund is

Payable on 31 July

given by ATO s205-45

Working out FDT Offset for income tax purposes

FDT Offset

Company entitled to

tax offset if it incurred

FDT [s205-70(1)]

Is FDeficit > Sum of FCr x 10%?

[s205-70(2)]

REFER TO NB

YES

Reduced Tax Offset by 30%

[s205-70(2)]

FDeficit (FDeficit x 30%)

REFER TO NB

NB: When determining whether penalty is applicable, only look at

FDr from Item 1 (franked dist) , 3 (contravention of benchmark dist) ,

5 (linked dist) , 6 (tax-exempt bonus shares), 30% penalty will be

determined based on these amounts

Private Company

[s103A(1)]

- not a public company

Franking period = 1

[s203-45]

1 jul 30 jun

Franking Credit for FDT

given immediately after

liability is incurred ie

1July [s205-15 Item 5]

Credit franking account for

next year for FDT amount

bringing the balance to nil.

FDT offset included in

calculation of income tax

Commissioners discretion to

have FDT not apply s205-70(6)

Under-franking [s203-50(1)(b)]

Penalty Debit to the companies

franking account = shortfall

Debit franking account

- imputation credits wasted

(Should Attach Attached)

Benchmark Rule [s203-25]

- first frankable distribution in a

franking period sets the

benchmark franking % [s203-30]

Benchmark Franking

Percentage [s203-35(1)]

[Franking Credit Attached /

Maximum Franking Credit] x 100

*first frankable dist est benchmark

franking % s203-30

Public Company

[s103A(3)]

- <= 20 people held >= 75% of

shares, voting power, dividends

Franking Period = 2

[s203-40]

1 july 31 dec & 1 jan

30 jun

Dividend Streaming/Anti-avoidance

1) Disclosure rule s204-75

-Need to notify commissioner in writing if benchmark % differs

significantly from last franking period (#franking period x 20%)

2) Linked distributions s204-15

-when one or more entity makes dist that are linked in some way (ie

from higher/lower benchamrks)

-penalty debt arise to the higher benchmark entitys acct

3) Tax-exempt bonus shares s204-25

-penalty debit = benchmark %

4) Streaming distributions

-give imputation credits to members who benefit the most

-Comissioner may determine franking debit arises, no imputation credit

arises to favoured member

5) General Anti-avoidance s177EA(3)

-Comissioner may determine franking debit arises, no imputation credit

Captured if:

a) Scheme relating to shares, b) Frankable distribution paid, c) Franking

credit benefits, d) Purpose of obtaining imputation benefit

Unfrankable distributions s202-40, s202-45

1) Share buyback treated as dividend under s159GZZZP

2) Deemed dividends Div 7A

3) Deemed dividends s108, s109

4) Dividends debited against share capital account

Distribution Statements s202-75

-Private cos

within 4 mths

on/before dist.

-Other entities

-approved form of stat s202-80

Over-franking [s203-50(1)(a)]

Company liable for Over-Franking

Tax = excess

Pay Over-Franking Tax

- no franking credit available!

(Should Attach Attached)

Other info

-Company has a franking account s205-10

-FCr>FDr = Surplus s205-40(1)

-FDr>FCr = Deficit s205-40(2)

Tax Treatment of Dividends

-Gross up for individuals of dividends AI under s207-20(1)

-Gross up for partnerships/trusts of dividends AI under s207-35(1)

-Imputation credits available under s207-20(2)

-Dividend assessable under s44(1)

no imputation credit available, not

-Dividend paid to non-res

assessable s128D, withholding tax applies to unfranked component

s128B(ga) (30%).

-Share of franking credits for partners in partnerships s207-57(2)

non-assessable, non-exempt

-Franked dividend to non-resident

deductions disallowed s8-1(2)(c) incurred in gaining nons128D

ass/exempt income

Qualified Person

To be entitled to franking credit/rebate, need to

satisfty:

1) Minimum holding period (45-day rule)

CLP68

2) TP applied franking credit/rebate ceiling

3) Franking rebate <$5000 s160APHT

4) Dividend paid in connection with winding up

Tainting share capital account CLP69

-when you can pay frankable dividends from a

tainted share cap acct

Ken Choi 2007

Das könnte Ihnen auch gefallen

- Example 1 - Over and Under Provision of Current TaxDokument14 SeitenExample 1 - Over and Under Provision of Current TaxPui YanNoch keine Bewertungen

- Ias 12 Income TaxesDokument70 SeitenIas 12 Income Taxeszulfi100% (1)

- 3-3 Div 7A Deemed Divs - VLDokument1 Seite3-3 Div 7A Deemed Divs - VLoddsey0713Noch keine Bewertungen

- Does FBT Apply?: Div 13 ExclusionsDokument1 SeiteDoes FBT Apply?: Div 13 Exclusionsoddsey0713Noch keine Bewertungen

- 2-3 Capital AllowancesDokument1 Seite2-3 Capital Allowancesoddsey0713Noch keine Bewertungen

- 1-8 GST - GST Payable or ITC AvalDokument2 Seiten1-8 GST - GST Payable or ITC Avaloddsey0713Noch keine Bewertungen

- 4-3 Part IVA General AntiAvoidanceDokument1 Seite4-3 Part IVA General AntiAvoidanceoddsey0713Noch keine Bewertungen

- ADJUSTMENTS AT FINANCIAL PERIOD ENDDokument18 SeitenADJUSTMENTS AT FINANCIAL PERIOD ENDTevabless Suoived SpotlightbabeNoch keine Bewertungen

- Module 2Dokument12 SeitenModule 2zoyaNoch keine Bewertungen

- Capital Budgeting Decision - SBSDokument43 SeitenCapital Budgeting Decision - SBSSahil SherasiyaNoch keine Bewertungen

- TAX ADMINISTRATION GUIDEDokument4 SeitenTAX ADMINISTRATION GUIDEwumel01Noch keine Bewertungen

- Start Your BusinessDokument8 SeitenStart Your BusinessIqbal MOUSSANoch keine Bewertungen

- Smieliauskas 6e - Solutions Manual - Chapter 02Dokument14 SeitenSmieliauskas 6e - Solutions Manual - Chapter 02scribdteaNoch keine Bewertungen

- Case Notes EcoPakDokument8 SeitenCase Notes EcoPakGajan SelvaNoch keine Bewertungen

- The Future of The Accounting FirmDokument6 SeitenThe Future of The Accounting Firmomohammed20071477Noch keine Bewertungen

- Understanding Income TaxDokument43 SeitenUnderstanding Income TaxMerediths KrisKringleNoch keine Bewertungen

- Tax Book 2016-17 - Version 1.0a USB PDFDokument372 SeitenTax Book 2016-17 - Version 1.0a USB PDFemc2_mcv100% (1)

- Auditors' responsibilities and ethicsDokument12 SeitenAuditors' responsibilities and ethicsscribdtea100% (1)

- Total Tower Case 1Dokument6 SeitenTotal Tower Case 1Maya BoraNoch keine Bewertungen

- Section A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Dokument24 SeitenSection A: Multiple Choice Questions - Single Option: This Section Has 70 Questions Worth 1 Mark Each (Total of 70 Marks)Kenny HoNoch keine Bewertungen

- Book An Introduction To The Math of Financial Derivatives Neftci S.N. SOLUTIONDokument90 SeitenBook An Introduction To The Math of Financial Derivatives Neftci S.N. SOLUTIONAtiqur KhanNoch keine Bewertungen

- P4 Answer Bank PDFDokument47 SeitenP4 Answer Bank PDFyared haftuNoch keine Bewertungen

- LifeInsRetirementValuation M15 AppraisalValues 181205Dokument46 SeitenLifeInsRetirementValuation M15 AppraisalValues 181205Jeff JonesNoch keine Bewertungen

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Dokument8 SeitenAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuNoch keine Bewertungen

- CIMA Masters Gateway F2 MCQDokument27 SeitenCIMA Masters Gateway F2 MCQObaidul Hoque NomanNoch keine Bewertungen

- F6 - 2014 JunDokument11 SeitenF6 - 2014 JunphoebeNoch keine Bewertungen

- Depreciation: Depreciation Is A Term Used inDokument10 SeitenDepreciation: Depreciation Is A Term Used inalbertNoch keine Bewertungen

- Valid F2 CIMA Braindumps - F2 Dumps PDF Exam Questions CimaDumpsDokument9 SeitenValid F2 CIMA Braindumps - F2 Dumps PDF Exam Questions CimaDumpsCarly MartinNoch keine Bewertungen

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDokument2 SeitenStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyNoch keine Bewertungen

- Click The Link To Go To The Relevant Section of Your Course PageDokument2 SeitenClick The Link To Go To The Relevant Section of Your Course PageAmjad AliNoch keine Bewertungen

- Statement of Change in Financial Position-5Dokument32 SeitenStatement of Change in Financial Position-5Amit SinghNoch keine Bewertungen

- Ratio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldDokument5 SeitenRatio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldFarzan SajwaniNoch keine Bewertungen

- SBR TutorialsDokument11 SeitenSBR TutorialskityanNoch keine Bewertungen

- Additional Deferred Tax Examples.2Dokument3 SeitenAdditional Deferred Tax Examples.2milton1986100% (1)

- Chapter 01Dokument5 SeitenChapter 01Alima Toon Noor Ridita 1612638630Noch keine Bewertungen

- Corporate Finance Chapter6Dokument20 SeitenCorporate Finance Chapter6Dan688Noch keine Bewertungen

- Accrual Vs Cash Flows Lecture NotesDokument30 SeitenAccrual Vs Cash Flows Lecture NotesKericho CorryNoch keine Bewertungen

- Overview of Management Cosultancy Services by CpasDokument4 SeitenOverview of Management Cosultancy Services by Cpasnikki abalosNoch keine Bewertungen

- Cfa Level III 4 Months Study PlanDokument21 SeitenCfa Level III 4 Months Study Planzev zNoch keine Bewertungen

- SMA QuizDokument76 SeitenSMA QuizQuỳnh ChâuNoch keine Bewertungen

- ACCA F7 For 2011Dokument145 SeitenACCA F7 For 2011Hetul Sanghvi100% (1)

- Nestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)Dokument50 SeitenNestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)mohaNoch keine Bewertungen

- Solutions - Chapter 6Dokument28 SeitenSolutions - Chapter 6Dre ThathipNoch keine Bewertungen

- Chapter Two SolutionsDokument9 SeitenChapter Two Solutionsapi-3705855Noch keine Bewertungen

- Tax Function Effectiveness Best Practice ChecklistDokument2 SeitenTax Function Effectiveness Best Practice ChecklistGbengaNoch keine Bewertungen

- CMA Handbook: Your Guide To Information and Requirements For CMA CertificationDokument13 SeitenCMA Handbook: Your Guide To Information and Requirements For CMA CertificationBupe ChaliNoch keine Bewertungen

- M&a Private FirmsDokument24 SeitenM&a Private FirmsmarwanNoch keine Bewertungen

- CIMA F3 Exam Surgery: IPO Implications for Dividend, Financing, InvestmentDokument1 SeiteCIMA F3 Exam Surgery: IPO Implications for Dividend, Financing, InvestmentdakshbajajNoch keine Bewertungen

- Calculating Capital Gains TaxDokument5 SeitenCalculating Capital Gains TaxAsif A. MemonNoch keine Bewertungen

- Aud NotesDokument75 SeitenAud NotesClaire O'BrienNoch keine Bewertungen

- Corporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationDokument64 SeitenCorporate Finance: Laurence Booth - W. Sean Cleary Chapter 7 - Equity ValuationShailesh RathodNoch keine Bewertungen

- Corporate Finance Week 1 Slide SolutionsDokument4 SeitenCorporate Finance Week 1 Slide SolutionsKate BNoch keine Bewertungen

- Level I Volume 5 2019 IFT NotesDokument258 SeitenLevel I Volume 5 2019 IFT NotesNoor QamarNoch keine Bewertungen

- CH 12 NotesDokument23 SeitenCH 12 NotesBec barronNoch keine Bewertungen

- Finance Interview QuestionsDokument3 SeitenFinance Interview Questionsk gowtham kumarNoch keine Bewertungen

- Tax AdministrationDokument93 SeitenTax AdministrationRobin LiuNoch keine Bewertungen

- Accounting Dissertations - IfRSDokument30 SeitenAccounting Dissertations - IfRSgappu002Noch keine Bewertungen

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsVon EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNoch keine Bewertungen

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesVon EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNoch keine Bewertungen

- 1-4 Deductions FlowchartDokument2 Seiten1-4 Deductions Flowchartoddsey0713Noch keine Bewertungen

- 1-8 GST - GST Payable or ITC AvalDokument2 Seiten1-8 GST - GST Payable or ITC Avaloddsey0713Noch keine Bewertungen

- 1-5 Trading StockDokument1 Seite1-5 Trading Stockoddsey0713Noch keine Bewertungen

- 4-3 Part IVA General AntiAvoidanceDokument1 Seite4-3 Part IVA General AntiAvoidanceoddsey0713Noch keine Bewertungen

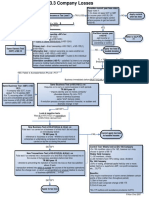

- 3-4 TrustsDokument1 Seite3-4 Trustsoddsey0713Noch keine Bewertungen

- 3-3 Company LossesDokument1 Seite3-3 Company Lossesoddsey0713Noch keine Bewertungen

- 3 5 PartnershipsDokument1 Seite3 5 Partnershipsoddsey0713Noch keine Bewertungen

- 1-3 Assessable IncomeDokument2 Seiten1-3 Assessable Incomeoddsey0713Noch keine Bewertungen

- 2-4,5 Capital WorksDokument1 Seite2-4,5 Capital Worksoddsey0713Noch keine Bewertungen

- T6 Chapter 5 Solutions To The Essential ActivitiesDokument12 SeitenT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713Noch keine Bewertungen

- Creating Effective Ads PPT 4 MGMTDokument22 SeitenCreating Effective Ads PPT 4 MGMToddsey0713Noch keine Bewertungen

- Executing-The-Creative Design Elements and Layout Styles With ADS As ExamplesDokument47 SeitenExecuting-The-Creative Design Elements and Layout Styles With ADS As Examplesoddsey0713Noch keine Bewertungen

- 2006 Planning EvalDokument33 Seiten2006 Planning EvalSanjay SahooNoch keine Bewertungen

- Case Summaries 1 193Dokument54 SeitenCase Summaries 1 193oddsey0713100% (1)

- T5 Chapters 4 and 8 Solutions To The Essential ActivitiesDokument18 SeitenT5 Chapters 4 and 8 Solutions To The Essential Activitiesoddsey0713Noch keine Bewertungen

- T8 Chapters 9 and 7 Solutions To The Essential ActivitiesDokument12 SeitenT8 Chapters 9 and 7 Solutions To The Essential Activitiesoddsey0713Noch keine Bewertungen

- T7 Chapter 6 Solutions To The Essential ActivitiesDokument26 SeitenT7 Chapter 6 Solutions To The Essential Activitiesoddsey0713Noch keine Bewertungen

- CTP-13 Exam Prep GuideDokument22 SeitenCTP-13 Exam Prep GuideJay Kab100% (1)

- Probabilistic Methods for Pricing Bonds and DerivativesDokument89 SeitenProbabilistic Methods for Pricing Bonds and DerivativesWarren CullyNoch keine Bewertungen

- Chapter 8 Capital Budgeting Models NPV IRR PIDokument18 SeitenChapter 8 Capital Budgeting Models NPV IRR PIAdmire MamvuraNoch keine Bewertungen

- Sub-Prime CrisisDokument18 SeitenSub-Prime Crisissurajvsakpal100% (2)

- Investment Strategies by George SorosDokument12 SeitenInvestment Strategies by George SorosKaishin Kaishin100% (2)

- Nfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineDokument72 SeitenNfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineAmol BhawariNoch keine Bewertungen

- Principal of AcountingDokument7 SeitenPrincipal of AcountingYusniagita EkadityaNoch keine Bewertungen

- Taxation Laws2Dokument156 SeitenTaxation Laws2KIran100% (1)

- Consumer Satisfaction in Iob BankDokument132 SeitenConsumer Satisfaction in Iob Bankvmktpt100% (2)

- Dec 2007 - AnsDokument10 SeitenDec 2007 - AnsHubbak KhanNoch keine Bewertungen

- MBA 662 Financial Institutions and Investment ManagementDokument4 SeitenMBA 662 Financial Institutions and Investment ManagementAli MohammedNoch keine Bewertungen

- Accounting Fundamentals ExplainedDokument14 SeitenAccounting Fundamentals ExplainedArjun SainiNoch keine Bewertungen

- The Economy and Securities Analysis - Business FinanceDokument45 SeitenThe Economy and Securities Analysis - Business FinanceMark Angelo R. Arceo100% (1)

- Cornerstones of Financial Accounting Canadian 1st Edition Rich Test BankDokument72 SeitenCornerstones of Financial Accounting Canadian 1st Edition Rich Test Banktaradavisszgmptyfkq100% (13)

- Valuation of AirThreadConnectionsDokument3 SeitenValuation of AirThreadConnectionsmksscribd100% (1)

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeDokument2 SeitenAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianNoch keine Bewertungen

- AccountingDokument115 SeitenAccountingDan Moloney50% (2)

- Associate Consultant - Iradar PDFDokument3 SeitenAssociate Consultant - Iradar PDFAnonymous c9VBjLIJNoch keine Bewertungen

- Technical Analysis - The Use of TrendDokument5 SeitenTechnical Analysis - The Use of TrendAnonymous H3kGwRFiENoch keine Bewertungen

- Close ChecklistDokument6 SeitenClose ChecklistShifan Ishak100% (1)

- Evaluated Receipt SettlementDokument1 SeiteEvaluated Receipt SettlementSaurav SharmaNoch keine Bewertungen

- Homework #3 - Coursera CorrectedDokument10 SeitenHomework #3 - Coursera CorrectedSaravind67% (3)

- Casey Quirk (2008) - The New GatekeepersDokument30 SeitenCasey Quirk (2008) - The New Gatekeeperssawilson1Noch keine Bewertungen

- Insurance Law-ContributionDokument5 SeitenInsurance Law-ContributionDavid FongNoch keine Bewertungen

- Brand Over ValuationDokument5 SeitenBrand Over Valuationkush_vashNoch keine Bewertungen

- BASELpap 52Dokument402 SeitenBASELpap 52sdhakal89Noch keine Bewertungen

- D PDF Sample Exam 2Dokument29 SeitenD PDF Sample Exam 2seatow6Noch keine Bewertungen

- The Mauritius Union Assurance Co LTD ProfileDokument13 SeitenThe Mauritius Union Assurance Co LTD ProfileSundeep El-NinoNoch keine Bewertungen

- Corporate Governance & Business EthicsDokument79 SeitenCorporate Governance & Business EthicsRishi Ahuja0% (1)

- Review of LiteratureDokument5 SeitenReview of LiteratureManivannanNoch keine Bewertungen