Beruflich Dokumente

Kultur Dokumente

GSFC Sanman Sa June 16

Hochgeladen von

Bella BishaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GSFC Sanman Sa June 16

Hochgeladen von

Bella BishaCopyright:

Verfügbare Formate

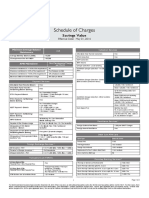

General Schedule of Features & Charges

for Sanman Savings Account

effective from 1st June, 2016

Particulars

Standard Charges (Rs.)

Sanman Savings Bank Account

NA

2000

REMITTANCE

DD at Branch Location / Pay Order

2.5 per 1000 (Min 50 Max 10000)

DD at other than Branch Location

2.5 per 1000 (Min 50 Max 10000)

DD/Pay Order by Cash Payment

(Applicable for customers not having a Savings Account)

2.5 per 1000 (Min 50 Max 10000)

NA

FCY DD ~

500

FCY TT - Corr. Bank Charges borne by beneficiary ~

250

FCY TT - Corr. Bank Charges not borne by beneficiary ~

1000

Fund Transfer

Free

Free

Upto 10000: 2.50; 10001 to 100000:5;

100001 to 200000:15;> 200000 : 25

Thru Net - Free

Thru Branch - Std charges

IMPS (Per Transaction)

Upto 10000:5; 10000 to 100000:5; 100001 to 200000:15

RTGS (Per Transaction)

200001 to 500000: 25; > 500000: 50

Average Quarterly Balance (AQB)

NEFT (Per Transaction) **

COLLECTION

Local Clearing Cheque

Free

Free

Outstation Cheque Collection Charges Branch Location (Per Instrument)

Cheques drawn on Non-Speed Clearing Locations : Instrument

value upto. 500 - Free; >500 to 5,000 20; >5,000 to10,000

35; >10,000 to 1,00,000 -85; >1,00,000 Free Cheques drawn

on Speed Clearing Branches (Irrespective of any value ) : Free

Outstation Cheque Collection Charges Other than Branch Location (Per Instrument)

Cheques drawn on Non-Speed Clearing Locations : Instrument

value upto. 500 - Free; >500 to 5,000 20; >5,000 to10,000

35; >10,000 to 1,00,000 -85; >1,00,000 Free Cheques drawn

on Speed Clearing Branches (Irrespective of any value ) : Free

0.3% of TC Amount (Min 50)

500

3.5 per 1000 (Min Rs. 100)

Free upto 5 txn per month Or Rs. 7.5 lac per month.

TC Encashment ~

FCY Cheque Collection ~

CASH TRANSACTION RELATED CHARGES

Cash Deposit at Home

Cash Withdrawal at Home Location

Cash Deposit & Withdrawal at Non Home Location

CHEQUE RELATED CHARGES

At-par Cheque Book Charges*#

Free

Free

3.5 per 1000 (Min Rs. 100)

Free upto 5 txn per month Or Rs. 3.0 lac per month

1.5 per cheque leaf

Free upto 15 leaf per quarter

350 for first return in a month thereafter

750 for each additional return in the same month

Free

*

Free

Cheque Deposited & Returned (INR) <>

100

Cheque Deposited & Returned (FCY) <>

1000

Classic Debit Card - Issuance Charge

150

Free

Gold Debit Card - Issuance Charge

500

Free

Platinum Debit Card - Issuance Charge

750

Free

DEBIT CARD ANNUAL CHARGE

Classic Debit Card - Primary

150

Free for First year, thereafter Std. charges

Classic Debit Card - Add-On

250

Gold Debit Card - Primary

500

Gold Debit Card - Add-On

500

Platinum Debit Card - Primary

750

Platinum Debit Card - Add-On

750

ECS Return / Cheque Issued & Returned

(Financial Reason) <>

Cheque Issued & Returned (Technical Reason) <>

DEBIT CARD ISSUANCE CHARGE

ATM TRANSACTION CHARGES

Cash Withdrawal at own ATM

Free

Free

Cash Withdrawal -17.80 / txn.

Balance Enquiry - 8.50 / txn.

5 txn per month Free, thereafter Std. charge

Cash Withdrawal at International ATM +

150

Balance Enquiry at International ATM +

25

Visa Global Assist Enquiry Charges

USD 5

Visa Global Assist Charges for lost Card

USD 35

25 per transaction

Cash Pick-up / Delivery

175 / txn

Instrument Pick-up / Delivery

75 / txn

Standing Instruction - Set-up

100

Standing Instruction - Amendment

25

Standing Instruction - Execution

Free

Free

Standing Instruction - Failure <>

100

Cash Withdrawal/Balance Enquiry at other Domestic ATM##

Transactions declined at other bank

ATMs due to insufficient balance <>

HOME BANKING CHARGES

STANDING INSTRUCTION

Particulars

Standard Charges (Rs.)

Sanman Savings Bank Account

Current Year Balance and Interest Statement

Free

Free

Previous Year Balance and Interest Statement

100

Signature Verification Certificate

25

Photo Attestation

50

Address Confirmation

50

Foreign Inward Remittance Certificate

100

Duplicate TDS Certificate

100

ACCOUNT STATEMENT & PASSBOOK

Physical Account Statement (Quarterly)

Free

Free

Monthly E-mail Account Statement

Free

Free

Account Statement Weekly (Physical)

100 Per Month

Account Statement Daily (Physical)

500 Per Month

Through Net Banking : Free, Through Branch : 85;

Through Phone Banking : 110.

CERTIFICATE & REPORT ISSUANCE CHARGES

Annual Combined Statement (Physical)

Duplicate /Ad-hoc Statement Branch Banking (90 days)

Through Branch: 100; Through Net/ATM: 50

Pass Book (In Lieu of Account Statement)

Free

Free

Duplicate Passbook

250

OTHER CHARGES

Non Maintenance Charge (Quarterly) <>

If AQB > 50% but less than required AQB : Rs. 300;

if AQB < 50% : Rs. 400

Charges If AQB Maintained is less than or equal to

75% of stipulated requirement # <>

Standard charge applicable (irrespective of free limit for each

product) for Cheque leaf, DD/BC, Decline in ATM/POS

transaction due to insufficient balance, and Home Banking.

Additional charges Phone Banking @ 50 per call, Classic/ Gold

Debit Card @ 25 pm, Platinum Debit Card @ RS 50 pm and

Cash Deposit@ 4 per 1000.

DD / PO / BC Revalidation / Cancellation - INR

100

DD / PO / BC Revalidation / Cancellation - FCY ~

500

Regeneration of PIN (ATM / Phone / Net)

Replacement of a damaged Debit Card (for all card types)

Replacement of a lost Debit Card (for all card types)

Stop Payment - Single / Range of Cheques

50 (sent through courier)

Free

Free

200

100; Free Over Net Banking

NA

600

Daily Balance Alert

SMS - 30 per qtr Email - Free

Weekly Balance, Transaction & Value added alerts

SMS - 15 per qtr Email - Free

Tax Collection Charge through Internet Banking

Free

Free

Tax Collection Charge at Branch

100

TOD Charges

500

Cheque Purchase Charges

0.5/1000 (Min 50 Max 10000)

Record Retrieval Charges

100 per request

Account Closure (if closed after 1 month and before

6 months of A/C opening)

Activation of Inoperative Account

Free

14 % Service tax + 0.5% Swachh Bharat Cess on Foreign Currency Conversion Charges (FCY)~

Value of purchase or sale of Foreign Currency

Up to Rs 1,00,000

Above Rs 1,00,000 to Rs 10,00,000

Above Rs 10,00,000

Service Tax + Swachh Bharat Cess Amount

0.145% of the gross value or INR 36.25/- whichever is higher

INR 145 plus 0.0725% of the amount exceeding INR 1 Lakh

INR 797.5 plus 0.0145% of the amount exceeding INR 10 Lakhs, subject to a maximum of INR 7250

*Indicates charged service. Applicable Charges will be as per Standard Charge.

## Cash withdrawal limit from other Domestic ATM is Rs. 10000 per transaction.

**Indo - Nepal Remittance Scheme (NEFT Charges):

If Beneficiary maintains an Account with Nepal SBI Bank Ltd. (NSBL): Rs. 25 per txn (incl all taxes)

If Beneficiary does not maintain an Account with Nepal SBI Bank Ltd (NSBL): Upto Rs 5000 - Rs 75 per txn & beyond Rs 5000 - Rs 100 per txn (incl all taxes)

Transaction and Value Added SMS alerts would be sent free to the customers who have subscribed for Daily / Weekly Balance Alerts facility.

Alerts that have been mandated by RBI as well as alerts which are deemed appropriate by the Bank, will be sent free of charge, even if Daily / weekly Balance SMS alerts facility has not been subscribed.

*# Rs. 3 / cheque leaf / quarter will be applicable in case the cheque book request exceeds 100 leaf / quarter

Service Charges for Senior Citizens

Following charges are waived in case of accounts where the primary account holder is a senior citizen:

Duplicate Pass book issuance, Account Closure charges, Cheque Return (Outward i.e. cheque deposited for collection and returned)

Additionally Standard Charges for DD/BC Issuance (Indian Rupees) will be Rs. 2 per 1000 (as against regular charges of Rs. 2.50 per Rs.1000).

Please Note

All Services, where a free limit is specified, usage beyond the free limit will be charged as per the standard charge of the respective service.

For all value figures k = 1000

The Bank will charge cross-currency mark-up of 3.5% on foreign currency transactions carried out on Debit Cards. The exchange rate used will be the VISA/Master Card wholesale exchange rate prevailing at the time of

transaction.

Charges are exclusive of the Service Tax, Swachh Bharat Cess (SBC)& Krishi Kalyan Cess (KKC). With effect from June 1, 2016 the effective service tax rate will be15% on taxable value ( 14 % Service tax + 0.5% SBC+0.5% KKC).

The service tax including cess is subject to change from time to time.

Monthly physical statements will be issued free to account holders on them personally visiting the home branch for the same.

Any rejections in applications made through ASBA mode due to insufficient funds will attract charges of Rs.350/- per rejection<>

As per RBI guidelines, Business / Commercial transactions are not permitted in the Savings Accounts

~ Any purchase / sale of foreign exchange will attract Service Tax on the gross amount of currency exchanged as per Service Tax on Foreign Currency Conversion Charges (FCY) table above

+ Additional charges levied by another bank on international ATM transactions will also have to be borne by the card holder

The above charges are subject to revision with a prior intimation of 30 days to all account holders. Closure of account due to revision of charges will not be subject to account closure charges.

The above charges are applicable for all states other than the State of Jammu and Kashmir. GST is applicable in the State of Jammu and Kashmir. For charges applicable to Jammu and Kashmir please contact the respective

Branch Manager

<> Penalty Charges. Not applicable once the account becomes inoperative/ dormant.

In the event of a default in maintenance of Average Quarterly Balance as agreed to between the bank and customer for the quarter (referred as Default Quarter), the bank will notify the customer clearly of the default and that

the Average Quarterly Balance for the account has to be met in the subsequent quarter (referred to as Notice Quarter) else the NMC (Non Maintenance Charges) for both the Default Quarter and Notice Quarter will be

recovered. The bank may choose to notify by SMS/ email / letter. It will be the responsibility of the customer to have a valid email id ,mobile number and address updated with the bank at all times, failing which, customer may

not receive the notification/s. The NMC charges will be based on the shortfall observed in the AQB and as specified in the slabs in GSFC.

Das könnte Ihnen auch gefallen

- Mitc For Amazon Pay Credit CardDokument7 SeitenMitc For Amazon Pay Credit Cardsomeonestupid19690% (1)

- Mitc For Amazon Pay Credit CardDokument7 SeitenMitc For Amazon Pay Credit CardBlain Santhosh FernandesNoch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- Account Tariff Structure Basic Savings AccountDokument1 SeiteAccount Tariff Structure Basic Savings Accountgaddipati_ramuNoch keine Bewertungen

- ICICI Bank Current Account ChargesDokument3 SeitenICICI Bank Current Account Chargesashishtiwari92100% (1)

- Privilege Banking AccountsDokument5 SeitenPrivilege Banking AccountsVinod MohiteNoch keine Bewertungen

- Yes Bank Smart SalaryDokument2 SeitenYes Bank Smart SalaryVicky SinghNoch keine Bewertungen

- Regular Saving AccountDokument92 SeitenRegular Saving AccountSimu MatharuNoch keine Bewertungen

- PersonalBanking SOC 26Dec13EnDokument1 SeitePersonalBanking SOC 26Dec13EnHasnain MuhammadNoch keine Bewertungen

- Schedule of Charges: Savings ValueDokument2 SeitenSchedule of Charges: Savings ValueNavjot SinghNoch keine Bewertungen

- No Frill EnglishDokument2 SeitenNo Frill EnglishRupali WaliaNoch keine Bewertungen

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Dokument2 SeitenMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNoch keine Bewertungen

- General Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Dokument2 SeitenGeneral Schedule of Features and Charges: Particulars Product Level Free Limits & Charges (In RS.)Bella BishaNoch keine Bewertungen

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Dokument5 SeitenSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNoch keine Bewertungen

- Rca SocDokument3 SeitenRca SocKrishna Kiran VyasNoch keine Bewertungen

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDokument6 SeitenTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDokument13 SeitenSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNoch keine Bewertungen

- Annex 2 Super Savings AccountDokument2 SeitenAnnex 2 Super Savings AccountPhani BhupathirajuNoch keine Bewertungen

- Tariff Guide: Account ServicesDokument3 SeitenTariff Guide: Account ServicesabidredaNoch keine Bewertungen

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Dokument2 SeitenNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741Noch keine Bewertungen

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Dokument15 SeitenSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNoch keine Bewertungen

- Sabka Basic Savings Account Complete KYC 10-10-2013Dokument2 SeitenSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNoch keine Bewertungen

- Islamic SOC Jan June 2013 FinalDokument16 SeitenIslamic SOC Jan June 2013 Finalfaisal_ahsan7919Noch keine Bewertungen

- Schedule of ChargesDokument14 SeitenSchedule of ChargeskrishmasethiNoch keine Bewertungen

- Schedule of Charges: Smart Salary ExclusiveDokument2 SeitenSchedule of Charges: Smart Salary ExclusivevedavakNoch keine Bewertungen

- Super Savings NewDokument2 SeitenSuper Savings NewwinnermeNoch keine Bewertungen

- Yes Bank - Schedule of Charges - Savings Select AccountDokument2 SeitenYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENoch keine Bewertungen

- Service Charges and FeesDokument10 SeitenService Charges and FeesBella BishaNoch keine Bewertungen

- Crown Salary Account 01042014Dokument2 SeitenCrown Salary Account 01042014Vikram IsgodNoch keine Bewertungen

- RBI SBI Demand Draft Exchange RatesDokument11 SeitenRBI SBI Demand Draft Exchange RatesJithin VijayanNoch keine Bewertungen

- NW SIBDokument5 SeitenNW SIBLoesh WaranNoch keine Bewertungen

- New Schedule of Charges For Current AccountDokument2 SeitenNew Schedule of Charges For Current AccountKishan DhootNoch keine Bewertungen

- Schedule of Charges Deutsche Bank 4Dokument3 SeitenSchedule of Charges Deutsche Bank 4Sayantika MondalNoch keine Bewertungen

- Value Based Current Accounts Schedule of ChargesDokument2 SeitenValue Based Current Accounts Schedule of ChargesDhawan SandeepNoch keine Bewertungen

- Notification FinalDokument4 SeitenNotification FinalBrahmanand DasreNoch keine Bewertungen

- Schedule of Charges Deutsche Bank 3Dokument3 SeitenSchedule of Charges Deutsche Bank 3Sayantika MondalNoch keine Bewertungen

- Schedule of Charges Deutsche BankDokument3 SeitenSchedule of Charges Deutsche BankSayantika MondalNoch keine Bewertungen

- Sme BookDokument397 SeitenSme BookVivek Godgift J0% (1)

- Multicity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesDokument6 SeitenMulticity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesEraivan EraiNoch keine Bewertungen

- Schedule of Charges Yes Bank 6Dokument2 SeitenSchedule of Charges Yes Bank 6Sayantika MondalNoch keine Bewertungen

- Savings Account DetailsDokument2 SeitenSavings Account Detailsmysto9Noch keine Bewertungen

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDokument2 SeitenTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNoch keine Bewertungen

- Schedule of Fees and Charges August 17 2012Dokument8 SeitenSchedule of Fees and Charges August 17 2012nayanghimireNoch keine Bewertungen

- HSBC Savings AccountDokument3 SeitenHSBC Savings AccountLavanya VitNoch keine Bewertungen

- SUPERCARD Most Important Terms and Conditions (MITC)Dokument14 SeitenSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNoch keine Bewertungen

- Basic Savings Bank Deposit Account SocsDokument6 SeitenBasic Savings Bank Deposit Account Socstrue chartNoch keine Bewertungen

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDokument10 SeitenImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaNoch keine Bewertungen

- Mitc 8271022000045Dokument6 SeitenMitc 8271022000045Kumar KumarNoch keine Bewertungen

- CD PremiumDokument1 SeiteCD PremiumnelzonpouloseNoch keine Bewertungen

- 2018 FRM CandidateGuideDokument14 Seiten2018 FRM CandidateGuideSagar SuriNoch keine Bewertungen

- Preferred Banking SOC FinalDokument2 SeitenPreferred Banking SOC FinalWelkin SkyNoch keine Bewertungen

- Key Fact Statement CorporateDokument7 SeitenKey Fact Statement CorporateRAM MAURYANoch keine Bewertungen

- Schedule Charges City BankDokument11 SeitenSchedule Charges City BankSumon Emam HossainNoch keine Bewertungen

- July 2013: Current, Call and Savings AccountsDokument1 SeiteJuly 2013: Current, Call and Savings AccountsBala MNoch keine Bewertungen

- Broking Idirect Linked Savings AccountDokument7 SeitenBroking Idirect Linked Savings Accounttrue chartNoch keine Bewertungen

- (1.) Service Charges To Maintain A Ledger Accounts: P A G eDokument17 Seiten(1.) Service Charges To Maintain A Ledger Accounts: P A G eshaantnuNoch keine Bewertungen

- Most Important Terms and Conditions - 2Dokument10 SeitenMost Important Terms and Conditions - 2Mohit AroraNoch keine Bewertungen

- Sosc Ver 210313Dokument3 SeitenSosc Ver 210313Shashank AgarwalNoch keine Bewertungen

- Service Charges 15-03-2011Dokument13 SeitenService Charges 15-03-2011AnandshingviNoch keine Bewertungen

- पूजा विधीDokument10 Seitenपूजा विधीBella BishaNoch keine Bewertungen

- There Is A HomeDokument5 SeitenThere Is A HomeBella BishaNoch keine Bewertungen

- MinarDokument7 SeitenMinarBella BishaNoch keine Bewertungen

- Total VidhiwuDokument2 SeitenTotal VidhiwuBella BishaNoch keine Bewertungen

- Poojasamaan QDokument4 SeitenPoojasamaan QBella BishaNoch keine Bewertungen

- First Recharge Offers: NotesDokument4 SeitenFirst Recharge Offers: NotesBella BishaNoch keine Bewertungen

- HoumkinDokument13 SeitenHoumkinBella BishaNoch keine Bewertungen

- Service Charges and FeesDokument10 SeitenService Charges and FeesBella BishaNoch keine Bewertungen

- Sheet1: Local STV Local Special Tariff Vouchers MRP (RS) (Incl. ST, SBC, KKC )Dokument4 SeitenSheet1: Local STV Local Special Tariff Vouchers MRP (RS) (Incl. ST, SBC, KKC )Bella BishaNoch keine Bewertungen

- TV Topup Vouchers MRP (RS) (Incl. ST, SBC, KKC ) Fee Talktime (RS) ValidityDokument2 SeitenTV Topup Vouchers MRP (RS) (Incl. ST, SBC, KKC ) Fee Talktime (RS) ValidityBella BishaNoch keine Bewertungen