Beruflich Dokumente

Kultur Dokumente

Howard 1966 Information Value Theory

Hochgeladen von

Anonymous L4bqaG2cCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Howard 1966 Information Value Theory

Hochgeladen von

Anonymous L4bqaG2cCopyright:

Verfügbare Formate

IEEE TRANSACTIONS ON SYSTEMS SCIENCE AND CYBERNETICS

VOL.

be associated with particular obstacle categories. Subgoals

are concerned with the amount of resources to be applied

to achieve the primary goals. Boundary conditions are

given by the states themselves in combination with obstacle categories, so that each problem has two centers of

interest, the associated system state and the cause of that

particular state.

SSC-2,

NO. 1

AUGUST, 1 966

notion of a statement or sentence as a proposition, the

requirements of a statement which defines a system, and

the idea of the states of a system. As a final comment, it

should be noted that Exploration of Obstacles requires

methods for determining and scaling need for various

operational features in the system, and suitable theoretical

techniques cannot at this time be named. The methodology

of Exploration of Obstacles depends, then, on informal

CONCLUSION

reasonirng.

In conclusion of this discussion of Problem Formulation

the Exploration of Obstacles forms the last half of the step,

REFERENCES

being preceded by Statement Clarification. While Explora- [1] A. D. Hall, A Methodology for Systems Engineering. Priniceton,

tion of Obstacles alone contains the generation and ranking

N. J.: Van Nostrand, 1962.

von Bertalanffy, "An outline of general system theory,"

of problems which are the objects of the Problem Formula- [2] L.

British J. for the Philosophy of Science, vol. I, no. 2, August

tion step of a system study, it relies basically upon a clear

1950.

D. 0. Ellis and F. J. Ludwig, Systems Philosophy. New York:

interpretation of the Problem Statement as a system. It is [3] Prentice-Hall,

1962.

during Statement Clarification that the Problem Statement [4] "Systems, organizations, and interdisciplinary research,"

in Systems: Research and Design, D. P. Eckman, Ed. New York:

is reworked from an imprecise but intuitive and idealized

Wiley 1961, Ch. 2.

description of a goal into a formal but still rather abstract [5] F. B. Fitch, Symbolic Logic-An Introduction. New York:

Ronald Press, 1952.

definition of a system. In this process, some concepts of [6] L.

A. Zadeh and C. A. Desoer, Linear System Theory-The

system theory and symbolic logic are useful tools: the

State Space Approach. New York: McGraw-Hill, 1963.

Information Value Theory

RONALD A. HOWARD, SENIOR

MEMBER, IEEE

NOTATION

A SPECIAL NOTATION will be used to make as

explicit as possible the conditions underlying the

assignment of any probability. Thus,

Abstract-The information theory developed by Shannon was

designed to place a quantitative measure on the amount of information involved in any communication. The early developers

stressed that the information measure was dependent only on the

probabilistic structure of the communication process. For example, if

losing all your assets in the stock market and having whale steak

for supper have the same probability, then the information associated with the occurrence of either event is the same. Attempts to

apply Shannon's information theory to problems beyond communications have, in the large, come to grief. The failure of these

attempts could have been predicted because no theory that involves

just the probabilities of outcomes without considering their consequences could possibly be adequate in describing the importance

of uncertainty to a decision maker. It is necessary to be concerned

not only with the probabilistic nature of the uncertainties that surround us, but also with the economic impact that these uncertainties

will have on us.

In this paper the theory of the value of information that arises

from considering jointly the probabilistic and economic factors that

affect decisions is discussed and illustrated. It is found that numerical values can be assigned to the elimination or reduction of any

uncertainty. Furthermore, it is seen that the joint elimination of the

uncertainty about a number of even independent factors in a problem can have a value that differs from the sum of the values of eliminating the uncertainty in each factor separately.

- a random variable

-an event

-the state of information on which probability

assignments will be made

-the density function of the random variable x

given the state of information

{A| } the probability of the event A given the state of

information

(xj) - the expectation of the random variable x, which

x

A

$

{xIS}

equalsf, x{xjs}

= the experience brought to the problem, the

special state of information represented by total

a priori knowledge

x|} = the density function of a random variable x

assigned on the basis of only a priori knowledge

8; designated the prior on x.

Our notation does not emphasize the difference in

probability assignment to a random variable and to an

event because the context always makes clear the appro-

Manuscript received March 1, 1965.

The author is Professor of Engineering-Economic Systems,

Stanford University, Stanford, Calif.

22

1966

23

HOWARD: INFORMATION VALUE THEORY

priate interpretation. We should interpret the generalized equal to the diffcrencee between our bi(d b and our cost p.

summation symbol f used in the definition of (x 8) as an Thus, profit v to our company is defined by

integral if the random variable is continuous and as a

_ b- p if b < t

summation if it is discrete.

(3)

(3

0 if b >

=

AN INFERENTIAL CONCEPT

A most important infererntial concept is expansion; it

allows us to encode our knowledge in a problem in the

most conveniient form. The concept of expansion permits

us to introduce a new consideration into the problem.

Suppose, for example, that we must assign a probability

distribution to a random variable u. We may find it much

easier to assign a probability distribution to u if we had

previously specified the value of another random variable v

and we may also find it easy to assign a probability distribution directly to v. In this case the expansion equation,

{uIS}

fu{v I8}{vls}

(1)

uJS}

This equation indicates that the probability distribution of

profit given our bid { v|bg} would be trivial to determine

if we only knew our company's cost p and the lowest bid

of our competitors f, since by the expansion concept

v1,lb&}

fp,t{ vbpft

p ,fb&.

(4)

In this equation { p,f|b&4 rep)resents the joint distribution

of our cost and our competitor's lowest bid given our bid

and the state of knowledge & that we brought to the

problem. However, since we are interested only in the

expected profit by assumption we can write (4) in the

expectation form,

=

(v|b&) =fv,t(vfbpf&){ p,fjb&}.

(5)

is multiply

shows that all we have to do to find {

At this point we shall makc two assumptions. The first

by {v s} and sum over all possible values of the is that our cost p and the lowest competitor's bid t do not

random variable v. Alathematically this equation is no depenid upon our bid b; that is,

more than a consequence of the definition of conditional

probability, but in the operational solution of inference

(6)

{p,pjbj} =

problems it is extremely valuable. If we want to find only

the expectation of u, (u S), rather than the entire density The second assumption is that our cost p is inidependent

of the lowest competitive bid e, or,

function {

we apply expansion in the form,

=

(7)

=

=.rJ,rU

(ulS) =

fV(UIV8){VIS}. (2) With these assumptions (5r) becomes

Ju|vO}

{p,tl&)

ulS}

f,u{uls}

U{VI{vJS

{lp,tl} {PI}{&0}.

bpe&){

This equation shows that in this case we must only pro(8)

pl }I { &}.

(vIb8) fv,f(V

vide the expectation of u conditional on v and the probaIn view of (3) we have immediately that the expectationi

bility distribution of v in order to find the expectation of u.

The inferential concept of expansion allows us to go of profit conditional on our bid, our cost, and the lowest

directly from the statemenit of an inference problem to its competitive bid is simply

solutioin in simple logical steps. It provides a link between

the formalism of probability theory and the p)ath of human

(9)

(vIbpfI) = b-0 p ifif bb <> t

reasoning; it is a tool of thought.

'1'he next stel) is to assign prior probability distributions

{pg}, {4181 to our cost and to the lowest competitive bid.

A BIDIING PROBLEM

would be

The probability distribution oIn our cost {

To illustrate our a)proach we shall consider a specific based upon the information that our company had gathered

problem. Suppose that our company is bidding on a con- in performing similar contracts as amenided by the techtract againist a niumber of competitors. We shall let p be nical conisiderationis involved in the new contract. The

our company's cost of performing oin the contract; un- prior distribution on] the lowest (competitive bid {

fortunately, we are unicertain of this cost. We let t be the would be based on our experiences in bidding against our

lowest bid of our competitors, anid as you mnight expect, competitors oni previous occasioIns arid on other informathis too is uncertain. Our problenm is to determinie b, our tion such as reports in the trade press. Although we shall

company's bid oni the contract. Our objective in this not have the opportunity to digress on the subject of how

determinationi is to maximize the expected value of v, our these assignments are made, suffice it to say that effective

procedures for this purpose are available.

company's profit or value from the contract.

To gain ease of computation we shall state simply that

Naturally, our company will not wini the contract if its

bid b is higher than the lowest bid of our competitors f, in this problem the prior distribution on our company's

thus, in this case our companly's profit is zero. However, cost p is a uniform distribution betweeni zero arid one and

if our bid b is less than the lowest competitive bid t our that our prior distributioni oii our competitor's lowest bid is

company will obtaini the contract and will make a profit a uniform distribution betweein zero and two. These )rior

=

pJ8}

tl}

24

IEEE TRANSACTIONS ON SYSTEMS SCIENCE AND CYBERNETICS

and negative for bids between 0 and 1/2. Formally,

{Ii8}

{pIa}

(v| b&)

vj &) = lMax

b

{P

l}

1 {

P0 I ~

1 p0PoE

06

o

{~AI}-

_ a PI~~-p

I$0~Po~ 1

AUGUST

2Q

v| b =

9

= 27

(12)

9t

32 96'

4'

=

We have, therefore, found that the best bidding strategy is

to bid 5/4 and that this strategy will have an expected

profit of 9/32.

CLAIRVOYANCE

Even though we have devised a bidding strategy that is

1

2 10

I Po

optimum in the face of the uncertainties involved we could

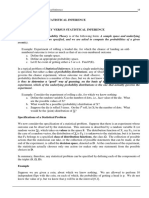

Fig. 1. Priors on cost of performance and lowest

still face a bad outcome. We may not get the contract, and

comnpetitive bid.

if we do get it, we may lose money. It is reasonable, therefore, that if a perfect clairvoyant appeared and offered to

(v |bE)= 2 (2-b) (b- 2)= + 5 b 2b2 b<,2

eliminate one or both of the uncertainties in the problem,

we would be willing to offer him a financial consideration.

The question is how large should this financial consideration be.

We shall let C represeint clairvoyance and C, represent

clairvoyance about a random variable x. Thus any probability assignment conditional on Cx is conditional on the

fact that the value of x will be revealed to us. We define

Fig. 2. Expected profit as fuLnction of our bid.

vcx as the increase in profit that arises from obtaining

clairvoyance about x. It is clear that the expected increase

distributions are shown in Fig. 1 along with the cumulative in profit owing to clairvoyance about

is just the

and complementary cumulative distributions that they difference between the expected profit that we shall

imply. From the symmetry of the density functions we see obtain as a result of the clairvoyarnce

and the

= p, is just 1/2 expected profit that we would obtain without clairvoyance

immediately that our expected cost

and that the expected lowest bid of our competitors (t 8) (v 8); thus,

is 1. However, it would be folly to assume that these ex(13)

(vcxlI) =

pected values will occur.

We can now return to (8) and substitute these results,

We compute the expected profit given clairvoyance about

x,(v0Cx4), by evaluating the expected profit given that

=

{p1;}

f5f(|vbpfE){pI8}

we know x,(v|x8), for each possible value of x that the

= f-ffb(b - p) { pl}{(18

clairvoyant might reveal and then summing this expectation with respect to the probability assignment on x,

2~~~~

Ip

,1

x,(vcJ|8)

(vlCx8)

(p&8)

(vJCX8) (vI8).

(vlb&)

=fp(b P){PJ8}&Jf>b{Jf8}

- {t>b|8}fp(b

p){pl}

-

(VICx,) = fX(v x&){x 8}.

xI81,

(14)

We use the prior probability distribution { x| 81 for x in this

calculation because up to the moment that the clairvoyant

that we

- {t>b8}(b-jP).

(10) actually reveals the value of x thex probability

must assign to his statement about is based only on our

Our expected profit, given that we bid b, is therefore the prior knowledge 8.

product of the probability that our competitor's lowest bid

By using (13) and(14) we can assign the expected value

will exceed ours and the difference between our bid and our in monetary units of eliminating any uncertainty in the

expected cost. From Fig. 1 we have that our expected problem. We shall now apply these results to computing

profit, given that we bid b, is simply

the value of eliminating the uncertainty in our cost and in

the lowest competitive bid in the problem.

(11)

(vlb)W (2 -b)b-2) < b < 2.

ANALYSIS OF CLAIRVOYANCE ABOUT OUR COST

the expected value to us of

We now determine

Figure 2 shows this expected profit as a function of our

bid. Note that a maximum profit of 9/32 is achieved by eliminating uncertainty about our cost p. From (13) and

making the bid equal to 5/4. Of course, the same result is (14) we write

obtained by setting the derivative of (11), with respect to

(15)

(vcpl&) = (vIC(8)- (vI&)

b, equal to zero and solving for b. Note that the expected

profit is positive for bids in the range between 1/2 and 2,

(16)

(vIC")

=

{t>b|8}(b- (pl8))

Kvc,18),

=f5(vIp8){pI8}

1966

25

HOWARD: INFORMATION VALUE THEORY

(vlpg)

The expected profit

that we would make if we knew

our cost is just the expected profit that we would make if

we bid b and if our cost was p maximized with respect to

our bid b; that is,

should not hire any cost accounting or production experts

to aid in eliminating uncertainty about p unless the cost

of these services is considerably below (vc,j,8). The concept

of clairvoyance plays the same role in analyzinig decision

problems that the concept of a Carnot engine plays in

(17)

(v|bp&).

(vl p) = Max

analyzing thermodynamic problems. These theoretical

b

constructs provide bench marks against which practical

Using the assumptions of (6) and (7) we invoke the realizations can be tested.

expansion concept to write

ANALYSIS OF CLAIRVOYANCE ABOUT THE LOWEST

(vl bp8) =f(vl bpf&) }

COMPETITIVE BID

f{= b(b - p){f} = (b Now we determine what it is worth to know the lowest

bid. We write immediately,

competitive

1

(18)

(b - p) 2--(2 - b)

(23)

(VctlF) = (vCQ8) - (v 8)

Note that if we take the expectation of this equation with

=

(24)

(v

respect to the prior on p we immediately obtain (11).

We determine our bid by maximizing (v bp&) with

respect to b. By setting its derivative with respect to b = 0 and

we find immediately that

(25)

(vlf&) = Mlax (v bf8).

dbKv|bp&) = 0--2 - b - (b - p) = 0, 2b = 2 + p.

We can perform expansion in terms of our cost p just as

we did in (18) in terms of L. We write,

b = 1+ 2

(19)

{I

p){C>bI&}

ICQ,) ftIe(vt8ie II8}

(v bt)

f-(vlbpe8){pl8}.

(26)

The bid should be equal to 1 plus 1/2 the value of our cost. From (9) we have immediately that

When we insert this result in (17) we find that the expected profit given that our cost is p is

- p){pl8} = b - p if b < t

v|b&)

(vbf8 ==

if b > f.

0

(27)

Kv b = (1 + ) p) = (

)

(20)

Therefore if t < p do not bid; if t > p bid t-, just below t'.

It is easy to see why this is the best bid. Since we know

Now we compute the expected profit given clairvoyance

the

lowest competitive bid t we can get the contract by

about p from (16),

bidding

just under t. However, if t is already less than our

~'/g\JO =Vd~91

P' 2 7 _28 expected cost then we would expect to lose money by such

(v|Cp8) = JIp\V|/4Jj

PlE} - "old -2\ - 2/

24 96' a strategy for it would be better nolt to get the contract

(21) at all. Consequently, if t is less thani our expected cost p

we should not bid; while if t is greater than p we should

This expected profit is 28/96, 1/96 more than we obtained bid just below f. Therefore we have

in (12) in the case of no clairvoyance. Therefore, following

(15) we have found

P f if <> p

(28)

|vtg) = Alax (vlbt8) =

fv(b

(VIp8)=

-=96

(KVCP8) = (VICP8) - (vl8)=96

(22) The expected profit given the lowest competitive bid (,

(vjt8), is plotted as a function of t in Fig. 3. To find the

The expected increase in our profit that will result from expected profit given clairvoyance about X, (vjCt8), we

having our cost revealed to us by a clairvoyant is conse- integrate this function with respect to the t density function of Fig. 1 and obtain

quently 1/96.

on

of

the

actual

If the value

this analysis depended

~~~~54

~~V I Ct8)-f1%2dl

existence of clairvoyance then it would have only theo- (v|Q8) = ff4(v|t8){C|8}

= f (t 2).2 = 16 = 96

retical interest. However, since clairvoyance represents

complete elimination of the uncertainty about a random

(29)

variable it follows that what we would pay for clairvoyance

should be an upper bound on any experimental program The expected profit given clairvoyance about t is 54/96,

that purports to aid us in eliminating uncertainty about twice as large as the expected profit of 27/96 obtained in

that variable. Thus, in the present problem the company (12) where no clairvoyance was available. The expected

= 96-

26

IEEE TRANSACTIONS ON SYSTEMS SCIENCE AND CYBERNETICS

(xt

KI )

AUGUST

Now we substitute the results of (34) and (7) to obtain

X p

(V CpA) = fP5f(VIPr8f){ Pg} { tg}

8

-fodp

I=-pdl{

I(t-p)

A~~~~

Fig. 3. Our expected profit as function of

lowest competitive bid.

1fodpfpdf(t - p) = 127 = 9656

(35)

increase in profit with clairvoyance about t is, therefore,

54 27 27

= 96 - 96 = 9

(30)

(vcft8E = (v Cf) -

The expected profit given clairvoyance about both p and t

is therefore 56/96, the highest expected profit we have

seen thus far. The expected increase in profit resulting

By comparing (30) and (22) we see that the expected from clairvoyance about p and 4 is, therefore

increase in profit because of clairvoyance about the lowest

competitive bid t is 27 times as great as the expected in=

KvCP,4~~~)

= 56

- 27 =96~

- 29

(36)

(Vcpfl-)

-96

96

crease in profit because of clairvoyance about our cost p.

Yet the density functions for p and t shown in Fig. 1 The expected value 29/96 of knowing p and t jointly is,

reveal that the range of uncertainty in t is only twice the therefore, greater than the sum of the 1/96 value of knowrange of uncertainty in p. Why, therefore, is information ing p alone and the 27/96 value of knowing t alone. The

about the lowest competitive bid so much more valuable further advantage provided by the joint knowledge of p

than information about our cost? The explanation is that and f is illustrated by the fact that now the company can

we can use information about t far more effectively in never lose money whereas in each of the two earlier cases

controlling the profitability of the situation than we can it could.

use information about our costs. If we know t then we

However, the most striking result of our analysis is the

can control immediately whether or not we get the con- way in which the uncertainty about the lowest competitive

tract, although we may still lose money even if we get it. bid towers over the uncertainty in our company's cost as a

Knowing p prevents us from bidding on any contract that concerni of management. In this problem it is worth far

would be unprofitable for us if we got it but is no help in more to know what the competition is doing than it is the

determining whether or not we will get it.

internal performance of our own company. You might say

ANALYSIS OF CLAIRVOYANCE ABOUT OUR COSTS AND THE facetiously that we have demonstrated the dollars and

cents payoff in industrial espionage.

LOWEST COMPETITIVE BID

Suppose that we are now offered clairvoyance about our

CONCLUSION

cost p and the lowest competitive bid f. What would this

The observations made in this paper have wide apjoint information be worth? We let vcpf represent the plication. We can treat the case where our clairvoyance

increase in profit because of clairvoyance about both p and is imperfect rather than perfect. The imperfection can be

4. Then in direct analogy with our earlier results for clair- because of a statistical effect arising in nature or the result

voyance about a single random variable we can write

of incompetence or mendacity or both in the source of

the information.

=

(31)

(vcpflj) (vi Cv8)

Placing a value on the reduction of uncertainty is the

= fp,K(V Pf8) {P,CJg}

(32) first step in experimental design, for only

when we know

what it is worth to reduce uncertainty do we have a basis

and

for allocating our resources in experimentation designed to

(v

bpte)

(v|pf&) = Max

the uncertainty. These remarks are as applicable to

reduce

b

the

of a research laboratory as they are to

establishment

(vJpf,) {b - p if b < t

of light bulbs.

if b > f.

(v|bpfE) = {O

(33) theIftesting

information value theory and associated decision

Therefore, if t < p, do not bid; if t > p, bid f-. Since theoretic structures do not in the future occupy a large

we know both our cost p and the lowest competitive part of the education of engineers, then the engineering

bid f we can get the contract by bidding slightly less profession will find that its traditional role of managing

than t and we want it if this bid exceeds our cost p. scientific andi economic resources for the benefit of man

Consequently, our expected profit givein p and t will be has been forfeited to another profession.

t- p if t exceeds p because we shall bid just less than ton

REFERENCES

the contract and get it. The expected profit will be zero

[1] R. A. Howard, "Bayesian decision models for system engineerif t is less than p because we shall not bid, e.g.,

(v1)

(Vjcpte) (v18)

(vIGAe)

(V18)

C> p

P iifIf (<

)

\VIP/(0

P.

(34)

ing," IEEE Trans. on Systems Science and Cybernetics, vol. SSC-1,

pp. 36-40, November 1965.

[2] --, "Dynamic inference," J. Operations Research, vol. 13, pp.

712-733, September-October 1965.

Das könnte Ihnen auch gefallen

- Management Information SystemDokument100 SeitenManagement Information Systemnehaiimt100% (1)

- Revised Assessment Tool SBMDokument12 SeitenRevised Assessment Tool SBMRoel Tanola83% (6)

- Preliminary Hazard Analysis (PHA)Dokument8 SeitenPreliminary Hazard Analysis (PHA)dNoch keine Bewertungen

- Programmer Competency MatrixDokument23 SeitenProgrammer Competency Matrixapi-25916350Noch keine Bewertungen

- Answers Review Questions EconometricsDokument59 SeitenAnswers Review Questions EconometricsZX Lee84% (25)

- SAP BPA Sizing Guide V9Dokument11 SeitenSAP BPA Sizing Guide V9RaviNoch keine Bewertungen

- 95-0120 Cometence Assurance For HSE Critical ActivitiesDokument48 Seiten95-0120 Cometence Assurance For HSE Critical ActivitiesClive Nicli100% (2)

- Introductory Workshop The Cdio Approach To Engineering EducationDokument53 SeitenIntroductory Workshop The Cdio Approach To Engineering EducationsoryesNoch keine Bewertungen

- Talent ForecastingDokument9 SeitenTalent Forecastingabhi_003Noch keine Bewertungen

- Cost Management ConceptsDokument24 SeitenCost Management ConceptsRaisa GeleraNoch keine Bewertungen

- Perpetual American Put OptionsDokument36 SeitenPerpetual American Put OptionsurkerNoch keine Bewertungen

- Theories and Models of ManagementDokument61 SeitenTheories and Models of ManagementharpreetNoch keine Bewertungen

- CSG TotalServiceMediation BrochureDokument9 SeitenCSG TotalServiceMediation Brochurefouad boutatNoch keine Bewertungen

- (Andrew Shepherd) Hierarchial Task AnalysisDokument288 Seiten(Andrew Shepherd) Hierarchial Task Analysisrolando macias100% (2)

- Game Theory An Introduction With Step-By-Step ExamplesDokument471 SeitenGame Theory An Introduction With Step-By-Step ExamplesVladimir KobelevNoch keine Bewertungen

- Value and Momentum During RecessionsDokument3 SeitenValue and Momentum During RecessionsZerohedgeNoch keine Bewertungen

- p35 Atkinson&Bench Capon&Mcburney 05Dokument10 Seitenp35 Atkinson&Bench Capon&Mcburney 05Jaime Roldán CorralesNoch keine Bewertungen

- OptPortSel 051206 2Dokument13 SeitenOptPortSel 051206 2zhaozilongNoch keine Bewertungen

- Utility in Case-Based Decision Theory: Sion Problems P, A Set of Acts A, and A Set of Outcomes R. The DecisionDokument20 SeitenUtility in Case-Based Decision Theory: Sion Problems P, A Set of Acts A, and A Set of Outcomes R. The DecisionmcznkenzieNoch keine Bewertungen

- The Introduction of Risk Into A Programming ModelDokument12 SeitenThe Introduction of Risk Into A Programming ModelSusanaNoch keine Bewertungen

- KTLTC - Phạm Thịnh Phát -31211021082Dokument14 SeitenKTLTC - Phạm Thịnh Phát -31211021082phatpham.31211021082Noch keine Bewertungen

- Stochastic Excess of Loss Pricing - Extreme ValuesDokument56 SeitenStochastic Excess of Loss Pricing - Extreme Valuesgonzalo diazNoch keine Bewertungen

- Reasoning About Trust and Belief in PASPDokument6 SeitenReasoning About Trust and Belief in PASPGabriel MaiaNoch keine Bewertungen

- An Extended Relational Database Model For Uncertain and Imprecise InformationDokument10 SeitenAn Extended Relational Database Model For Uncertain and Imprecise InformationdequanzhouNoch keine Bewertungen

- RL QB Ise-1Dokument10 SeitenRL QB Ise-1Lavkush yadavNoch keine Bewertungen

- Research What Is Research?Dokument72 SeitenResearch What Is Research?arbab buttNoch keine Bewertungen

- The Recent Development of Risk Theory: J. Kupper ZiirichDokument14 SeitenThe Recent Development of Risk Theory: J. Kupper Ziirichntt_15Noch keine Bewertungen

- Computational Methods For Compound SumsDokument29 SeitenComputational Methods For Compound Sumsraghavo100% (1)

- Assignment On Probit ModelDokument17 SeitenAssignment On Probit ModelNidhi KaushikNoch keine Bewertungen

- Nash 1950 CBXDokument9 SeitenNash 1950 CBXNicolas Diaz-CruzNoch keine Bewertungen

- Efficient Protocols For Set Membership and Range ProofsDokument19 SeitenEfficient Protocols For Set Membership and Range ProofsCong minh TongNoch keine Bewertungen

- On Lower Bounds For Statistical Learning TheoryDokument17 SeitenOn Lower Bounds For Statistical Learning TheoryBill PetrieNoch keine Bewertungen

- Probability Concepts ExplainedDokument10 SeitenProbability Concepts ExplainedPetros PianoNoch keine Bewertungen

- Backward Feature SelectionDokument7 SeitenBackward Feature SelectionPhu Pham QuocNoch keine Bewertungen

- FsadfaDokument10 SeitenFsadfaLethal11Noch keine Bewertungen

- What Is Logic?: PropositionDokument11 SeitenWhat Is Logic?: PropositionPrakshep GoswamiNoch keine Bewertungen

- Entropy: Deconstructing Cross-Entropy For Probabilistic Binary ClassifiersDokument20 SeitenEntropy: Deconstructing Cross-Entropy For Probabilistic Binary ClassifiersJazz Alberick RymnikskiNoch keine Bewertungen

- Fontana 2023 Conformal ReviewDokument23 SeitenFontana 2023 Conformal ReviewSwapnaneel BhattacharyyaNoch keine Bewertungen

- A Simplified Model For Portfolio Analysis - William SharpeDokument18 SeitenA Simplified Model For Portfolio Analysis - William SharpeRafael Solano MartinezNoch keine Bewertungen

- Information Theory and Security Quantitative Information FlowDokument48 SeitenInformation Theory and Security Quantitative Information FlowFanfan16Noch keine Bewertungen

- Week 4 - Knowledge Representation 1Dokument42 SeitenWeek 4 - Knowledge Representation 1Ayman AdilNoch keine Bewertungen

- Fuzzy Real OptionsDokument14 SeitenFuzzy Real Optionscrinaus2003Noch keine Bewertungen

- Hilpisch 2020 Artificial Intelligence in Finance 1 477 PagesDokument7 SeitenHilpisch 2020 Artificial Intelligence in Finance 1 477 Pagesthuyph671Noch keine Bewertungen

- Info-Gap Value of Information in Model Updating: Mechanical Systems and Signal Processing (2001) 15 (3), 457) 474Dokument18 SeitenInfo-Gap Value of Information in Model Updating: Mechanical Systems and Signal Processing (2001) 15 (3), 457) 474irawantaniNoch keine Bewertungen

- 10) OR Techniques Help in Training/grooming of Future ManagersDokument12 Seiten10) OR Techniques Help in Training/grooming of Future ManagersZiya KhanNoch keine Bewertungen

- Chapter 1 To Chapter 2 Stat 222Dokument21 SeitenChapter 1 To Chapter 2 Stat 222Edgar MagturoNoch keine Bewertungen

- Topic 8Dokument4 SeitenTopic 8mmmd.krmv.00Noch keine Bewertungen

- 08 Data Mining-Other ClassificationsDokument4 Seiten08 Data Mining-Other ClassificationsRaj EndranNoch keine Bewertungen

- An Agent-Based Architecture For The Decision Support ProcessDokument11 SeitenAn Agent-Based Architecture For The Decision Support ProcessLourdes B.D.Noch keine Bewertungen

- Karl BorchDokument13 SeitenKarl BorchKiran A SNoch keine Bewertungen

- Modigliani IS-LMDokument45 SeitenModigliani IS-LMeddieNoch keine Bewertungen

- University of San CarlosDokument2 SeitenUniversity of San CarlosMarivic CorveraNoch keine Bewertungen

- Bayesian Network RepresentationDokument6 SeitenBayesian Network RepresentationWaterloo Ferreira da SilvaNoch keine Bewertungen

- PP 2006 11.text PDFDokument27 SeitenPP 2006 11.text PDFGiordan BrunoNoch keine Bewertungen

- Destercke 22 ADokument11 SeitenDestercke 22 AleftyjoyNoch keine Bewertungen

- Ross-1973 - Agency Theory, Principal's ProblemDokument7 SeitenRoss-1973 - Agency Theory, Principal's ProblemMohsinNoch keine Bewertungen

- Mahfoud & Mani 1996Dokument24 SeitenMahfoud & Mani 1996Verónica Febre GuerraNoch keine Bewertungen

- Bawa & Lindenberg, 1977, Capital Market Equilibrium in A Mean-Lower Partial Moment FrameworkDokument12 SeitenBawa & Lindenberg, 1977, Capital Market Equilibrium in A Mean-Lower Partial Moment FrameworkYuchen LiNoch keine Bewertungen

- Advice: sciences/business/economics/kit-baum-workshops/Bham13P4slides PDFDokument11 SeitenAdvice: sciences/business/economics/kit-baum-workshops/Bham13P4slides PDFAhmad Bello DogarawaNoch keine Bewertungen

- Cproba PPLDokument16 SeitenCproba PPLPrathyusha MNoch keine Bewertungen

- Lars Stole Contract TheoryDokument85 SeitenLars Stole Contract TheoryJay KathavateNoch keine Bewertungen

- Bayesian Regression and BitcoinDokument6 SeitenBayesian Regression and BitcoinJowPersonaVieceliNoch keine Bewertungen

- Donald L Smith Nuclear Data Guidelines PDFDokument8 SeitenDonald L Smith Nuclear Data Guidelines PDFjradNoch keine Bewertungen

- Amd 03Dokument20 SeitenAmd 03MRINAL GAUTAMNoch keine Bewertungen

- Stat I Chapter 4Dokument29 SeitenStat I Chapter 4kitababekele26Noch keine Bewertungen

- 2002 Hakidi Cluster Validity Methods Part IIDokument9 Seiten2002 Hakidi Cluster Validity Methods Part IIGülhanEkindereNoch keine Bewertungen

- Bayesian Nonparametrics and The Probabilistic Approach To ModellingDokument27 SeitenBayesian Nonparametrics and The Probabilistic Approach To ModellingTalha YousufNoch keine Bewertungen

- WHY Decision Support Paradigm For Power System Planning: Risk Analysis Outperforms Probabilistic Choice As The EffectiveDokument6 SeitenWHY Decision Support Paradigm For Power System Planning: Risk Analysis Outperforms Probabilistic Choice As The Effectiveveljss007Noch keine Bewertungen

- Ranking of Information Systems in Agency Models: An Integral ConditionDokument8 SeitenRanking of Information Systems in Agency Models: An Integral ConditionManuel CheezlNoch keine Bewertungen

- Reference Vectors in Economic ChoiceDokument10 SeitenReference Vectors in Economic ChoiceTeycir Abdelghani GouchaNoch keine Bewertungen

- EricB Cms ConvexityDokument18 SeitenEricB Cms ConvexitycountingNoch keine Bewertungen

- WEEK 2 Objectives:: Audit in An Cbis Environment Part 1: General ControlsDokument3 SeitenWEEK 2 Objectives:: Audit in An Cbis Environment Part 1: General ControlsAboc May AnNoch keine Bewertungen

- Testing Ingine KaliDokument30 SeitenTesting Ingine KaliIngiaNoch keine Bewertungen

- Brief Introduction To Soft Systems Thinking and Adaptive Systems - ST4S39Dokument4 SeitenBrief Introduction To Soft Systems Thinking and Adaptive Systems - ST4S39Abel Jnr Ofoe-OsabuteyNoch keine Bewertungen

- Lecture 1 Software TestingDokument84 SeitenLecture 1 Software TestingSasmita PadhyNoch keine Bewertungen

- Fornel - Research Proposal 2Dokument10 SeitenFornel - Research Proposal 2Maria Theresa AlcantaraNoch keine Bewertungen

- Dimensions of Curriculum DevelopmentDokument26 SeitenDimensions of Curriculum DevelopmentshumaiylNoch keine Bewertungen

- MRP SimulationDokument4 SeitenMRP Simulationramesh_amritaNoch keine Bewertungen

- 1.1 Chapter 1 Public Policy Analysis by Peter KnoepfelDokument25 Seiten1.1 Chapter 1 Public Policy Analysis by Peter Knoepfelsikandar aNoch keine Bewertungen

- Systems Design EngineeringDokument10 SeitenSystems Design EngineeringricardoNoch keine Bewertungen

- Cognitive AnthropologyDokument22 SeitenCognitive AnthropologyAnirban GoswamiNoch keine Bewertungen

- Various Failures in Distributed SystemDokument2 SeitenVarious Failures in Distributed SystemstartronNoch keine Bewertungen

- Monograph Parametric Modeling - OS KroolDokument113 SeitenMonograph Parametric Modeling - OS KroolTAUFIQ ARIEF NUGRAHANoch keine Bewertungen

- Software Requirements ClassificationsDokument7 SeitenSoftware Requirements ClassificationsHasi RajpootNoch keine Bewertungen

- Context LinguisticsDokument16 SeitenContext LinguisticsNata KNoch keine Bewertungen

- MGMT3065 Unit 2-CorrectedDokument20 SeitenMGMT3065 Unit 2-CorrectedstacyannNoch keine Bewertungen

- Data Base Lab AssignmentDokument20 SeitenData Base Lab AssignmentSYED MUHAMMAD USAMA MASOODNoch keine Bewertungen

- 2019 Article TheWorldNeedsMetallurgicalProcDokument6 Seiten2019 Article TheWorldNeedsMetallurgicalProcernandesrizzo100% (1)

- Chapter 5Dokument4 SeitenChapter 5Risalyn BiongNoch keine Bewertungen