Beruflich Dokumente

Kultur Dokumente

Fomtnp RRF 2013

Hochgeladen von

L. A. PatersonOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fomtnp RRF 2013

Hochgeladen von

L. A. PatersonCopyright:

Verfügbare Formate

(j)

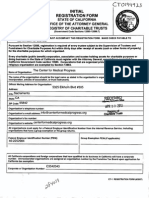

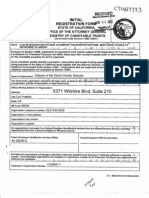

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

WEB SITE ADDRESS:

http://ag.ca.gov/charities/

t1DI00)SILO

ANNUAL

REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code

11 Cal. Code Regs. sections 301-307, 311 and 312

Failure to submit this report annually no later than four months and fifteen days after the .... ,r- ., ~ ..

end of the organization's accounting period may result in the loss of tax exemption and

the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties

as defined in Government Code section 12586.1. IRS extensions will be honored.

Alll:lmiiY

'I

3 0 lUJ3_

Check if:

0Change of address

0Amended report

Corporate or Organization No.

3.5" 2. 7 2 'Z 0

Federal Employer I. D. No. q~-

City or Town, State and ZIP Code

0 'Z ~ 7 2... Lf 3

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307,311 and 312)

Make Check Payable to Attorney General's Registry of Charitable Trusts

Gross Annual Revenue

Less than $25,000

Between $25,000 and $100,000

Gross Annual Revenue

Gross Annual Revenue

0

$25

Between 100,001 and $250,000

Between $250,001 and $1 million

$50

$75

$150

$225

$300

Between $1,000,001 and $10 million

Between $10,000,001 and $50 million

Greater than $50 million

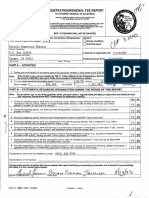

PART A -ACTIVITIES

For your most recent full accounting period (beginning _!Li...J:f_J.....L.l::::_ ending _f?__l~..)~) list:

Gross annual revenue $

Total assets$

L> r.r:r~

/lot

0 ,e::-

o<...-L:> L..r a..uoro ~.,,.

.2-o

PART B- STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

If you answer ''yes" to any of the questions below, you must attach a separate sheet providing an explanation and details for each ''yes"

response. Please review RRF-1 instructions for information required.

Yes

1.

During this reporting period, were there any contracts, loans, leases or other financial transactions between the organization and any

officer, director or trustee thereof either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable property or funds?

3.

During this reporting period, did non-program expenditures exceed 50% of gross revenues?

4.

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a Form 4720 with the

Internal Revenue Service, attach a copy.

5.

During this reporting period, were the services of a commercial fundraiser or fundraising counsel for charitable purposes used? If "yes,"

provide an attachment listing the name, address, and telephone number of the service provider.

6.

During this reporting period, did the organization receive any governmental funding? If so, provide an attachment listing the name of

the agency, mailing address, contact person, and telephone number.

7.

During this reporting period, did the organization hold a raffle for charitable purposes? If "yes, provide an attachment indicating the

number of raffles and the date(s) they occurred.

8.

Does the organization conduct a vehicle donation program? If "yes," provide an attachment indicating whether the program is operated

by the charity or whether the organization contracts with a commercial fundraiser for charitable purposes.

9.

Did your organization have prepared an audited financial statement in accordance with generally accepted accounting principles for this

reporting period?

Organization's area code and telephone number (

No

53/

Organization's e-mail address

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief,

it is

and cornpl<ete,v-

-\1-'i

RRF-1 (3-05)

--------------

-------------------------,

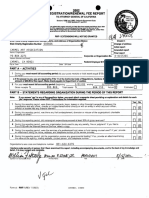

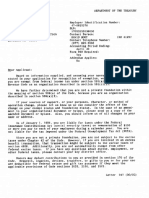

RE: Part B , item 1.

The sum of$400 was advanced by Francis P. Lloyd for the filing fee payable to the IRS

for the processing of the corporation's application for its 501 (c) ( 3) tax exempt status.

The corporation has funds to repay that advancement, but payment has been delayed until

the corporation has sufficient funds to enable it to pay that sum without causing its bank

balance to drop to the point where it has to pay monthly fees to the bank for its checking

account. Therefore the advancement is temporarily unpaid. No interest is chargeable on

the advancement. Francis P. Lloyd is a member of the board of directors of the

corporation and its President. Francis P. Lloyd is a California attorney and he prepared

the 501 (c) (3) application. He advanced the fee as a mater of convenience in order to get

the application on file with the IRS as soon as possible.

Das könnte Ihnen auch gefallen

- Dispute To Creditor For Charge OffDokument4 SeitenDispute To Creditor For Charge Offrodney76% (21)

- Virgilio S. Delima V. Susan Mercaida Gois GR NO. 178352 - June 17, 2008 FactsDokument6 SeitenVirgilio S. Delima V. Susan Mercaida Gois GR NO. 178352 - June 17, 2008 FactsNikki BarenaNoch keine Bewertungen

- Anthony Flagg's Complaint Against Eddie LongDokument23 SeitenAnthony Flagg's Complaint Against Eddie LongRod McCullom100% (1)

- Quality Risk ManagementDokument29 SeitenQuality Risk ManagementmmmmmNoch keine Bewertungen

- Fomtnp RRF 2015Dokument2 SeitenFomtnp RRF 2015L. A. PatersonNoch keine Bewertungen

- SCC RRF 2005Dokument3 SeitenSCC RRF 2005L. A. PatersonNoch keine Bewertungen

- SCC RRF 2011Dokument2 SeitenSCC RRF 2011L. A. PatersonNoch keine Bewertungen

- SCC RRF 2004Dokument3 SeitenSCC RRF 2004L. A. PatersonNoch keine Bewertungen

- FTG RRF 2012Dokument1 SeiteFTG RRF 2012L. A. PatersonNoch keine Bewertungen

- SCC RRF 2010Dokument2 SeitenSCC RRF 2010L. A. PatersonNoch keine Bewertungen

- Caa RRF 2014Dokument1 SeiteCaa RRF 2014L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2002Dokument2 SeitenPac Rep RRF 2002L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2005Dokument2 SeitenPac Rep RRF 2005L. A. PatersonNoch keine Bewertungen

- Pacrep RRF 2014Dokument1 SeitePacrep RRF 2014L. A. PatersonNoch keine Bewertungen

- Caa RRF 2001Dokument2 SeitenCaa RRF 2001L. A. PatersonNoch keine Bewertungen

- Caa RRF 2004Dokument2 SeitenCaa RRF 2004L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2003Dokument2 SeitenPac Rep RRF 2003L. A. PatersonNoch keine Bewertungen

- Caa RRF 2012Dokument1 SeiteCaa RRF 2012L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2007Dokument1 SeitePac Rep RRF 2007L. A. PatersonNoch keine Bewertungen

- FTG RRF 2001Dokument2 SeitenFTG RRF 2001L. A. PatersonNoch keine Bewertungen

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDokument1 SeiteC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonNoch keine Bewertungen

- Caa RRF 2010Dokument1 SeiteCaa RRF 2010L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2009Dokument2 SeitenPac Rep RRF 2009L. A. PatersonNoch keine Bewertungen

- FTG RRF 2002Dokument2 SeitenFTG RRF 2002L. A. PatersonNoch keine Bewertungen

- FTG RRF 2003Dokument2 SeitenFTG RRF 2003L. A. PatersonNoch keine Bewertungen

- FTG RRF 2005Dokument2 SeitenFTG RRF 2005L. A. PatersonNoch keine Bewertungen

- FTG RRF 2007Dokument1 SeiteFTG RRF 2007L. A. PatersonNoch keine Bewertungen

- Pac Rep RRF 2006Dokument1 SeitePac Rep RRF 2006L. A. PatersonNoch keine Bewertungen

- CA Charity Annual Report FormDokument1 SeiteCA Charity Annual Report FormagbufzbfNoch keine Bewertungen

- FTG RRF 2009Dokument1 SeiteFTG RRF 2009L. A. PatersonNoch keine Bewertungen

- FTG RRF 2006Dokument1 SeiteFTG RRF 2006L. A. PatersonNoch keine Bewertungen

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDokument1 SeiteCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonNoch keine Bewertungen

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDokument1 SeiteIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonNoch keine Bewertungen

- SCC RRF 2009Dokument2 SeitenSCC RRF 2009L. A. PatersonNoch keine Bewertungen

- FTG RRF 2004Dokument2 SeitenFTG RRF 2004L. A. PatersonNoch keine Bewertungen

- FTG RRF 2000Dokument1 SeiteFTG RRF 2000L. A. PatersonNoch keine Bewertungen

- 2014 2015 Annual Registration Renewal Form RRF 1Dokument2 Seiten2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetNoch keine Bewertungen

- FTG RRF 2013Dokument1 SeiteFTG RRF 2013L. A. PatersonNoch keine Bewertungen

- Center For Medical Progress California RegistrationDokument10 SeitenCenter For Medical Progress California RegistrationelicliftonNoch keine Bewertungen

- ST Ending:: CincinnatiDokument3 SeitenST Ending:: CincinnatiMassiNoch keine Bewertungen

- Clinton Foundation Revised Filing 2013Dokument108 SeitenClinton Foundation Revised Filing 2013Daily Caller News FoundationNoch keine Bewertungen

- CWCS Founding DocumentsDokument98 SeitenCWCS Founding DocumentsWilliamsburg GreenpointNoch keine Bewertungen

- FFATA Data Collection Form.EDokument2 SeitenFFATA Data Collection Form.EandresNoch keine Bewertungen

- Pac Rep RRF 2004Dokument4 SeitenPac Rep RRF 2004L. A. PatersonNoch keine Bewertungen

- Period Covered Filing DeadlineDokument10 SeitenPeriod Covered Filing DeadlineHaftari HarmiNoch keine Bewertungen

- Breast Cancer Survivors FoundationDokument48 SeitenBreast Cancer Survivors FoundationthereadingshelfNoch keine Bewertungen

- 2010 One Caribbean Exempt App RedactedDokument43 Seiten2010 One Caribbean Exempt App RedactedJimmy VielkindNoch keine Bewertungen

- IRS Complaint Against NH District Corporation 11-18-19Dokument26 SeitenIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanNoch keine Bewertungen

- Request For Copy of Personal Income or Fiduciary Tax ReturnDokument2 SeitenRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNoch keine Bewertungen

- Irs Tax ExemptDokument59 SeitenIrs Tax ExemptPopeye2112100% (1)

- Reporting Requirements For Charities and Not For Profit OrganizationsDokument15 SeitenReporting Requirements For Charities and Not For Profit OrganizationsRay Brooks100% (1)

- IRS e-file Acknowledgement for Tax Year 2016Dokument2 SeitenIRS e-file Acknowledgement for Tax Year 2016anandrapakaNoch keine Bewertungen

- 230 Short Sale Packet - BayviewDokument16 Seiten230 Short Sale Packet - BayviewrapiddocsNoch keine Bewertungen

- '!'iiltio T!LB Ard: IffundedDokument3 Seiten'!'iiltio T!LB Ard: IffundedEmily GloverNoch keine Bewertungen

- Checklist For Starting A Kentucky NonprofitDokument19 SeitenChecklist For Starting A Kentucky NonprofitNancy Slonneger HancockNoch keine Bewertungen

- rrf1 FormDokument5 Seitenrrf1 Formsalman_fbNoch keine Bewertungen

- Accounting Questionnaire for Non-ProfitsDokument15 SeitenAccounting Questionnaire for Non-ProfitsJayson Caño BualoyNoch keine Bewertungen

- 2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovDokument76 Seiten2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovJason GrohNoch keine Bewertungen

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDokument4 SeitenUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerNoch keine Bewertungen

- Form CRI 200 Short Form Registration Verification Statement PDFDokument5 SeitenForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyNoch keine Bewertungen

- ACH Payment Guide SummaryDokument12 SeitenACH Payment Guide Summarya100% (1)

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument2 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- Agenda City Council Special Meeting 12-03-18Dokument3 SeitenAgenda City Council Special Meeting 12-03-18L. A. PatersonNoch keine Bewertungen

- Councilmember Announcements 12-03-18Dokument1 SeiteCouncilmember Announcements 12-03-18L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council AgendaDokument2 SeitenCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument5 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- Holiday Closure 12-03-18Dokument3 SeitenHoliday Closure 12-03-18L. A. PatersonNoch keine Bewertungen

- Appointments Monterey-Salinas Transit Board 12-03-18Dokument2 SeitenAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonNoch keine Bewertungen

- Adopting City Council Meeting Dates For 2019 12-03-18Dokument3 SeitenAdopting City Council Meeting Dates For 2019 12-03-18L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument2 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- Mprwa Minutes October 25, 2018Dokument2 SeitenMprwa Minutes October 25, 2018L. A. PatersonNoch keine Bewertungen

- Appointments FORA 12-03-18Dokument2 SeitenAppointments FORA 12-03-18L. A. PatersonNoch keine Bewertungen

- Minutes 12-03-18Dokument7 SeitenMinutes 12-03-18L. A. PatersonNoch keine Bewertungen

- Minutes City Council Special Meeting November 5, 2018 12-03-18Dokument1 SeiteMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonNoch keine Bewertungen

- Minutes City Council Regular Meeting November 6, 2018 12-03-18Dokument5 SeitenMinutes City Council Regular Meeting November 6, 2018 12-03-18L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council AgendaDokument2 SeitenCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council AgendaDokument5 SeitenCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonNoch keine Bewertungen

- MPRWA Agenda Packet 11-08-18Dokument18 SeitenMPRWA Agenda Packet 11-08-18L. A. PatersonNoch keine Bewertungen

- Monthly Reports September 2018 11-05-18Dokument55 SeitenMonthly Reports September 2018 11-05-18L. A. PatersonNoch keine Bewertungen

- Mprwa Minutes April 26, 2016Dokument2 SeitenMprwa Minutes April 26, 2016L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDokument2 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNoch keine Bewertungen

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Dokument2 SeitenProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonNoch keine Bewertungen

- Agenda City Council 03-21-18Dokument2 SeitenAgenda City Council 03-21-18L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument4 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument3 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- Agenda City Council 03-21-18Dokument2 SeitenAgenda City Council 03-21-18L. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDokument8 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument5 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDokument4 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonNoch keine Bewertungen

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDokument4 SeitenCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonNoch keine Bewertungen

- Destruction of Certain Records 11-05-18Dokument41 SeitenDestruction of Certain Records 11-05-18L. A. PatersonNoch keine Bewertungen

- Successful Organizational Change FactorsDokument13 SeitenSuccessful Organizational Change FactorsKenneth WhitfieldNoch keine Bewertungen

- CCTV8 PDFDokument2 SeitenCCTV8 PDFFelix John NuevaNoch keine Bewertungen

- Camera MatchingDokument10 SeitenCamera MatchingcleristonmarquesNoch keine Bewertungen

- The Study of Accounting Information SystemsDokument44 SeitenThe Study of Accounting Information SystemsCelso Jr. AleyaNoch keine Bewertungen

- For-tea Tea Parlour Marketing Strategy Targets 40+ DemographicDokument7 SeitenFor-tea Tea Parlour Marketing Strategy Targets 40+ Demographicprynk_cool2702Noch keine Bewertungen

- Incident Report Form: RPSG-IMS-F-24 Accident and Investigation Form 5ADokument2 SeitenIncident Report Form: RPSG-IMS-F-24 Accident and Investigation Form 5ARocky BisNoch keine Bewertungen

- Proprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie AutovehiculDokument3 SeitenProprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie Autovehicultranspol2023Noch keine Bewertungen

- Sampling Fundamentals ModifiedDokument45 SeitenSampling Fundamentals ModifiedArjun KhoslaNoch keine Bewertungen

- 20220720-MODIG-Supply Chain Manager (ENG)Dokument2 Seiten20220720-MODIG-Supply Chain Manager (ENG)abhilNoch keine Bewertungen

- Stellar Competent CellsDokument1 SeiteStellar Competent CellsSergio LaynesNoch keine Bewertungen

- Password CrackingDokument13 SeitenPassword CrackingBlue MagicNoch keine Bewertungen

- 2014 March CaravanDokument48 Seiten2014 March CaravanbahiashrineNoch keine Bewertungen

- Shri Siddheshwar Co-Operative BankDokument11 SeitenShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- Research Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormDokument13 SeitenResearch Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormBikaZee100% (1)

- cp2021 Inf03p02Dokument242 Seitencp2021 Inf03p02bahbaguruNoch keine Bewertungen

- A Research About The Canteen SatisfactioDokument50 SeitenA Research About The Canteen SatisfactioJakeny Pearl Sibugan VaronaNoch keine Bewertungen

- Data Collection Methods and Tools For ResearchDokument29 SeitenData Collection Methods and Tools For ResearchHamed TaherdoostNoch keine Bewertungen

- Data SheetDokument14 SeitenData SheetAnonymous R8ZXABkNoch keine Bewertungen

- Congress Policy Brief - CoCoLevyFundsDokument10 SeitenCongress Policy Brief - CoCoLevyFundsKat DinglasanNoch keine Bewertungen

- DS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDokument2 SeitenDS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDragana SkipinaNoch keine Bewertungen

- Article. 415 - 422Dokument142 SeitenArticle. 415 - 422Anisah AquilaNoch keine Bewertungen

- Lab - Activity CCNA 2 Exp: 7.5.3Dokument13 SeitenLab - Activity CCNA 2 Exp: 7.5.3Rico Agung FirmansyahNoch keine Bewertungen

- Kuliah Statistik Inferensial Ke4: Simple Linear RegressionDokument74 SeitenKuliah Statistik Inferensial Ke4: Simple Linear Regressionvivian indrioktaNoch keine Bewertungen

- Presentation of The LordDokument1 SeitePresentation of The LordSarah JonesNoch keine Bewertungen

- Tita-111 2Dokument1 SeiteTita-111 2Gheorghita DuracNoch keine Bewertungen

- Marketing Management NotesDokument115 SeitenMarketing Management NotesKajwangs DanNoch keine Bewertungen

- RS-RA-N01-AL User Manual of Photoelectric Total Solar Radiation TransmitterDokument11 SeitenRS-RA-N01-AL User Manual of Photoelectric Total Solar Radiation TransmittermohamadNoch keine Bewertungen