Beruflich Dokumente

Kultur Dokumente

Hand-Out Property Dividend

Hochgeladen von

Ashley Ibe Guevarra0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten1 SeiteOriginaltitel

Hand-out Property Dividend

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

43 Ansichten1 SeiteHand-Out Property Dividend

Hochgeladen von

Ashley Ibe GuevarraCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

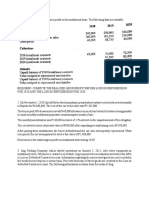

HAND-OUT ON PROPERTY DIVIDENDS

Sample Company, a real estate developer, is owned by five founding shareholders.

On December 1, 2012, the company declared a property dividend of a onebedroom flat for each shareholder. The property dividend is payable on January

31, 2013.

On December 1, 2012, the carrying amount of a one-bedroom flat is P1,000,000 and

the fair value is P1,500,000. However, the fair value is P1,800,000 on December

31, 2012 and P1,900,000 on January 31, 2013.

Related journal entries:

12/01/2012 Retained Earnings (5 X 1,500,000)

Dividend Payable

7,500,000

7,500,000

12/31/2012 Retained Earnings [(5 X 1,800,000)-7,500,000]1,500,000

Dividend Payable

1,500,000

1/31/2013

Retained Earnings [(5 X 1,900,000) 9,000,000]500,000

Dividend Payable

500,000

Dividend Payable

9,500,000

Inventory (5 x 1,000,000)

5,000,000

Gain on Distribution of Property Dividend

4,500,000

On November 1, 2012, Sample Company declared a property dividend of equipment

payable on March 1, 2013. The carrying amount of the equipment is P3,000,000

and the fair value is P2,500,000 on November , 2012. However, the fair value less

cost to distribute the equipment is P2,200,000 on December 31, 2012 and

P2,000,000 on March 1, 2013.

Related journal entries:

11/01/2012 Retained Earnings

Dividend Payable

12/31/2012 Dividend payable

Retained Earnings

Impairment loss

Equipment

03/01/2013 Dividend Payable

Retained Earnings

Dividend Payable

Loss on Distribution of Property Dividend

Equipment

2,500,000

2,500,000

300,000

300,000

800,000

800,000

200,000

200,000

2,000,000

200,000

2,200,000

Das könnte Ihnen auch gefallen

- ACCT551 - Week 7 HomeworkDokument10 SeitenACCT551 - Week 7 HomeworkDominickdadNoch keine Bewertungen

- April Joy CompanyDokument1 SeiteApril Joy CompanyQueen ValleNoch keine Bewertungen

- Adjusting Entries QuizzerDokument6 SeitenAdjusting Entries QuizzerErvin GonzalesNoch keine Bewertungen

- F2 - Financial ManagementDokument20 SeitenF2 - Financial ManagementRobert MunyaradziNoch keine Bewertungen

- At January 1 2012 Bohemia Nursery LTD S Balance Sheet ReportedDokument1 SeiteAt January 1 2012 Bohemia Nursery LTD S Balance Sheet ReportedMiroslav GegoskiNoch keine Bewertungen

- Chapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8Dokument2 SeitenChapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8aaronNoch keine Bewertungen

- For 2012, What Is The Consolidated Comprehensive Income Attributable To ControllingDokument2 SeitenFor 2012, What Is The Consolidated Comprehensive Income Attributable To ControllingWawex DavisNoch keine Bewertungen

- Week 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesDokument9 SeitenWeek 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesKumar AbhishekNoch keine Bewertungen

- Accounting Adjusting Entries SummaryDokument6 SeitenAccounting Adjusting Entries Summarysweetyraj100% (1)

- Lecture 2-2Dokument2 SeitenLecture 2-2Nouman ShamasNoch keine Bewertungen

- Answer: D. P16, 000Dokument13 SeitenAnswer: D. P16, 000JESSA ANN A. TALABOC100% (2)

- ACCOUNTING 7 & 8 Midterm Quiz1Dokument3 SeitenACCOUNTING 7 & 8 Midterm Quiz1John Mark PalapuzNoch keine Bewertungen

- AP1 Receivables 2Dokument17 SeitenAP1 Receivables 2Crazy Solo100% (1)

- Pertemuan 12 - Investasi Obligasi PDFDokument21 SeitenPertemuan 12 - Investasi Obligasi PDFayu utamiNoch keine Bewertungen

- Depreciation Methods Depreciation MethodsDokument31 SeitenDepreciation Methods Depreciation MethodsAddo Mawulolo100% (1)

- Latihan 1Dokument25 SeitenLatihan 1Sanda Patrisia KomalasariNoch keine Bewertungen

- A A P F S: Djusting Ccounts AND Reparing Inancial TatementsDokument39 SeitenA A P F S: Djusting Ccounts AND Reparing Inancial TatementsBoo LeNoch keine Bewertungen

- Acct557 w1 HomeworkDokument5 SeitenAcct557 w1 HomeworkDaMaterial Gyrl MbaNoch keine Bewertungen

- Ap SheDokument8 SeitenAp SheMary Dale Joie BocalaNoch keine Bewertungen

- MODAUD1 UNIT 6 - Audit of InvestmentsDokument7 SeitenMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNoch keine Bewertungen

- Cel 1 Prac 1 Answer KeyDokument12 SeitenCel 1 Prac 1 Answer KeyLauren ObrienNoch keine Bewertungen

- Audit of Liabiities and She-1Dokument9 SeitenAudit of Liabiities and She-1Yaj CruzadaNoch keine Bewertungen

- F2 - Financial ManagementDokument20 SeitenF2 - Financial ManagementRobert MunyaradziNoch keine Bewertungen

- T.y.baf F.A - VLDokument5 SeitenT.y.baf F.A - VLStar NxtNoch keine Bewertungen

- The Partnership of Angel Investor Associates Began Operations On January 115725Dokument1 SeiteThe Partnership of Angel Investor Associates Began Operations On January 115725M Bilal SaleemNoch keine Bewertungen

- Error Correction Sample ProblemsDokument42 SeitenError Correction Sample ProblemsKatie BarnesNoch keine Bewertungen

- Global CompanyDokument1 SeiteGlobal Companydagohoy kennethNoch keine Bewertungen

- 3620 QuizDokument4 Seiten3620 Quizbiomed12Noch keine Bewertungen

- Orca Share Media1583315619577Dokument13 SeitenOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaNoch keine Bewertungen

- Audit of InvestmentDokument5 SeitenAudit of InvestmentRodwin DeunaNoch keine Bewertungen

- Class Exercise - Defined Benfit Scheme With Asset CeilingDokument1 SeiteClass Exercise - Defined Benfit Scheme With Asset CeilingBennie KingNoch keine Bewertungen

- LIABDokument5 SeitenLIABLorie Jae DomalaonNoch keine Bewertungen

- Qa - Installment SalesDokument3 SeitenQa - Installment SalesSittie Ainna Acmed UnteNoch keine Bewertungen

- CHP 23Dokument19 SeitenCHP 23lena cpaNoch keine Bewertungen

- 01 - Preweek Lecture and ProblemsDokument15 Seiten01 - Preweek Lecture and ProblemsMelody GumbaNoch keine Bewertungen

- ReceivablesDokument9 SeitenReceivablesJerric CristobalNoch keine Bewertungen

- CH 12Dokument71 SeitenCH 12Sahar YehiaNoch keine Bewertungen

- Solved Kouchibouguac Inc Reports The Following Costs and Fair Values ForDokument1 SeiteSolved Kouchibouguac Inc Reports The Following Costs and Fair Values ForAnbu jaromiaNoch keine Bewertungen

- Financial Accounting M2Dokument4 SeitenFinancial Accounting M2Ann CalabdanNoch keine Bewertungen

- 313738Dokument90 Seiten313738louis04Noch keine Bewertungen

- FAR ModuleDokument6 SeitenFAR ModuleFannilyn Florentino GonzalesNoch keine Bewertungen

- Notes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasDokument5 SeitenNotes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasGeorge YoungNoch keine Bewertungen

- Dcomprehensiveexam DDokument12 SeitenDcomprehensiveexam DDominic SociaNoch keine Bewertungen

- Intermediate Accounting I - Investment Part 1Dokument3 SeitenIntermediate Accounting I - Investment Part 1Joovs Joovho0% (3)

- Dcomprehensiveexam DDokument12 SeitenDcomprehensiveexam DDominic SociaNoch keine Bewertungen

- PA1 Mock ExamDokument18 SeitenPA1 Mock Examyciamyr67% (3)

- Business Management Ex 30.1 30.2Dokument3 SeitenBusiness Management Ex 30.1 30.2Reyhan HuseynovaNoch keine Bewertungen

- AP.m 1401 Correction of ErrorsDokument12 SeitenAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- AP - Liabilities - Without AnswersDokument2 SeitenAP - Liabilities - Without AnswersstillwinmsNoch keine Bewertungen

- ACC For Stock IssuesDokument9 SeitenACC For Stock IssuesJasonSpringNoch keine Bewertungen

- ACCTBA1 Adjusting EntriesDokument47 SeitenACCTBA1 Adjusting Entriesqqdelossantos100% (1)

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Dokument5 SeitenTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraNoch keine Bewertungen

- Practical Accounting 1 2011Dokument17 SeitenPractical Accounting 1 2011abbey89100% (2)

- Job Application LetterDokument1 SeiteJob Application LetterAshley Ibe GuevarraNoch keine Bewertungen

- Agriculture Leaders' MeetingDokument12 SeitenAgriculture Leaders' MeetingAshley Ibe GuevarraNoch keine Bewertungen

- Commonwealth Bank of Australia Is A Provider of Financial ServicesDokument6 SeitenCommonwealth Bank of Australia Is A Provider of Financial ServicesAshley Ibe Guevarra75% (4)

- Child AssessDokument21 SeitenChild AssessAshley Ibe GuevarraNoch keine Bewertungen

- Leadership TrainingDokument18 SeitenLeadership TrainingAshley Ibe GuevarraNoch keine Bewertungen

- 3962852Dokument60 Seiten3962852Ashley Ibe GuevarraNoch keine Bewertungen

- MIS Chapter 5Dokument48 SeitenMIS Chapter 5Ashley Ibe GuevarraNoch keine Bewertungen

- Process Costing QuestionsDokument4 SeitenProcess Costing QuestionsAshley Ibe GuevarraNoch keine Bewertungen

- CH 14 SMDokument21 SeitenCH 14 SMRyan James B. Aban100% (1)

- Partcor Reviewer PDFDokument26 SeitenPartcor Reviewer PDFKunal Sajnani100% (1)

- Apex Mining Co Inc - Conso AFS As of 12.13.14Dokument100 SeitenApex Mining Co Inc - Conso AFS As of 12.13.14Ashley Ibe GuevarraNoch keine Bewertungen