Beruflich Dokumente

Kultur Dokumente

United States v. Patricia Fountain, 3rd Cir. (2015)

Hochgeladen von

Scribd Government DocsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

United States v. Patricia Fountain, 3rd Cir. (2015)

Hochgeladen von

Scribd Government DocsCopyright:

Verfügbare Formate

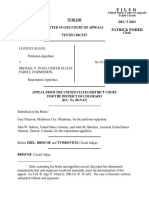

PRECEDENTIAL

UNITED STATES COURT OF APPEALS

FOR THE THIRD CIRCUIT

_____________

Nos. 13-3023, 13-3025, 13-3478

_____________

UNITED STATES OF AMERICA

v.

PATRICIA FOUNTAIN,

Appellant in 13-3023

CALVIN JOHNSON, JR.,

Appellant in 13-3025

and LARRY ISHMAEL,

Appellant in 13-3478

_______________

On Appeal from the United States District Court

for the Eastern District of Pennsylvania

(D.C. No. 2-12-cr-00155-001, 2-12-cr-00155-002 and

2-12-cr-00155-003, )

District Judge: Honorable Stewart Dalzell

_______________

Argued: December 10, 2014

Before: FUENTES, FISHER, and KRAUSE, Circuit Judges.

(Opinion Filed: July 10, 2015)

_______________

JOSEPH J. KHAN (Argued)

Office of United States Attorney

615 Chestnut Street

Suite 1250

Philadelphia, PA 19106

Counsel for Appellee United States of America

RICHARD COUGHLIN

JULIE A. MCGRAIN (Argued)

Office of Federal Public Defender

800-840 Cooper Street

Suite 350

Camden, NJ 08102

Counsel for Appellant Patricia Fountain

LAWRENCE J. BOZZELLI (Argued)

Suite 701

211 North 13th Street

Philadelphia, PA 19107

Counsel for Appellant Calvin Johnson, Jr.

DANIEL I. SIEGEL (Argued)

Office of Federal Public Defender

800 King Street

Suite 200

Wilmington, DE 19801

Counsel for Appellant Larry Ishmael

___________

OPINION OF THE COURT

KRAUSE, Circuit Judge.

This is a consolidated criminal appeal, arising out of a

large tax fraud conspiracy, that presents us with an

opportunity to clarify the mental states required of the payor

and payee to uphold a conviction for Hobbs Act extortion

under color of official right. For the reasons set forth below,

we will affirm.1

I.

Background

Between 2007 and 2012, Appellant Patricia Fountain,

an IRS employee, helped orchestrate several schemes to

fraudulently obtain cash refunds from the IRS. Those

schemes involved filing false tax returns that claimed refunds

pursuant to the Telephone Excise Tax Refund (TETR), the

First Time Home Buyer Credit (FTHBC), or the American

Opportunity Tax Credit (AOTC). Fountain employed her

knowledge of the IRSs fraud detection procedures to avoid

suspicion, including that TETR claims below $1,500 would

not be flagged for review. Over time, Fountain and her

significant other, Appellant Larry Ishmael, enlisted various

people, including Appellant Calvin Johnson, Jr., to recruit

1

The District Court had subject matter jurisdiction

under 18 U.S.C. 3231, and we have jurisdiction under 28

U.S.C. 1291 and 18 U.S.C. 3742.

claimants who would provide their personal information in

exchange for a portion of a cash refund. During the same

period, Johnson became involved in an additional conspiracy

with some of his family members and other acquaintances

that involved submitting fraudulent FTHBC and AOTC

claims.

After a two-week trial, a jury convicted Fountain,

Ishmael, and Johnson on multiple counts of conspiracy and

filing false claims to the IRS in violation of 18 U.S.C. 286

and 287. Fountain was also convicted on one count of Hobbs

Act Extortion and two counts of making or presenting false

tax returns, violations of 18 U.S.C. 1951(a) and 26 U.S.C.

7206, respectively. Additionally, Johnson was convicted of

filing false claims to the IRS while on pretrial release in

violation of 18 U.S.C. 287 and 3147(1).

Fountain moved for a judgment of acquittal after trial

on the Hobbs Act charge, which the District Court denied.

Following evidentiary hearings on the dollar amounts

involved in the Defendants schemes, the District Court

sentenced Fountain to 228 months imprisonment and a threeyear term of supervised release, and ordered her to pay

restitution of $1,740,221.40. The District Court sentenced

Ishmael to 144 months imprisonment and a three-year term

of supervised release, and ordered him to pay restitution of

$1,751,809.40. Finally, the District Court sentenced Johnson

to 216 months imprisonment and a three-year term of

supervised release, and ordered him to pay restitution of

$1,248,392.40. Each of these sentences fell within the

applicable Guidelines ranges after the District Judge imposed

various enhancements.

II.

Discussion

A.

Fountains Hobbs Act Conviction

Fountain contends that the evidence at trial was

insufficient to support a conviction for extortion under color

of official right. While sufficiency of the evidence is a

question of law subject to plenary review, [w]e review the

evidence in the light most favorable to the Government,

afford deference to a jurys findings, and draw all

reasonable inferences in favor of the jury verdict. United

States v. Moyer, 674 F.3d 192, 206 (3d Cir. 2012) (quoting

United States v. Riley, 621 F.3d 312, 329 (3d Cir. 2010)). We

will overturn the verdict only when the record contains no

evidence, regardless of how it is weighted, from which the

jury could find guilt beyond a reasonable doubt. Id. (quoting

Riley, 621 F.3d at 329) (internal quotation marks omitted).

The extortion count against Fountain alleged that she

obtained and attempted to obtain money from Deborah

Alexander under color of official right as an IRS employee.

As the Government demonstrated at trial, Alexander was a

client at Natashia Witherspoons hair salon. Witherspoon,

who was also Fountains hairstylist, recruited Alexander and

other clients to provide personal information so that Fountain

could file fraudulent tax returns in their names. Witherspoon

had Alexander fill out blank IRS forms with her personal

information and then gave those forms to Fountain for her to

file. Alexander never dealt directly with Fountain, but she

knew Fountain worked for the IRS. Sometime after her tax

return was filed, Witherspoon told her that she had to pay

Fountain a $400 fee. Alexander testified that she became

suspicious, but paid the fee anyway. Witherspoon testified

that she told some people that Fountain would red flag

them if they did not pay her fee, but did not say whether she

conveyed that information to Alexander in particular.

Likewise, Alexander did not recall Witherspoon mentioning

any consequences for failing to make the payment.

We hold that the evidence adduced at trial was

sufficient to support Fountains Hobbs Act conviction.

Because we have articulated the appropriate standard for an

official right extortion conviction in varying ways in past

cases, we take this opportunity to synthesize our case law and

explain how we come to this result.

1.

Elements of Hobbs Act Extortion

Under Color of Official Right

The federal statute penalizing extortion, 18 U.S.C.

1951, a codification of the 1946 Hobbs Act, provides that:

Whoever in any way or degree obstructs,

delays, or affects commerce or the movement of

any article or commodity in commerce, by

robbery or extortion or attempts or conspires so

to do, or commits or threatens physical violence

to any person or property in furtherance of a

plan or purpose to do anything in violation of

this section shall be fined under this title or

imprisoned not more than twenty years, or both.

18 U.S.C. 1951(a). Extortion is defined as the obtaining of

property from another, with his consent, induced by wrongful

use of actual or threatened force, violence, or fear, or under

color of official right. Id. 1951(b)(2). As we explained in

United States v. Manzo, 636 F.3d 56 (3d Cir. 2011):

Congress sought to proscribe coercive activity

through enactment of the Hobbs Act. Under the

terms of the Hobbs Act, a person can only

commit extortion in one of two ways: (1)

through threatened force, violence or fear or (2)

under color of official right. See 18 U.S.C.

1951(b)(2). Both of these types of extortion are

inherently coercive.

Id. at 65.

Whereas in a case of extortion by force, violence, or

fear, the acts or threats supply the coercion, when

proceeding under a color of official right theory, the misuse

of public office is said to supply the element of coercion.

Id. (quoting United States v. Hathaway, 534 F.2d 386, 393

(1st Cir. 1976)); see also Evans v. United States, 504 U.S.

255, 266 (1992) (adopting the majority rule that the coercive

element of Hobbs Act extortion under color of official right

is provided by the public office itself). In other words, the

importance of a defendants public office or official act to a

Hobbs Act charge is its coercive effect on the payor.

Accordingly, after reviewing the legislative history and

evaluating competing constructions of the statute, the

Supreme Court held in Evans that to prove a conviction for

extortion under color of official right, the Government need

only show that a public official has obtained a payment to

which he was not entitled, knowing that the payment was

made in return for official acts. 504 U.S. at 268.

We interpreted Evans in United States v. Antico, 275

F.3d 245 (3d Cir. 2001), and explained that no official act .

. . need be proved to convict under the Hobbs Act. Id. at

257. Rather, we focus on (1) the motivation of the payor, that

is, whether a payment was made in return for official acts,

and (2) whether the defendant knew the payors motivation.

Id. (emphasis added) (quoting Evans, 504 U.S. at 268)

(internal quotation marks omitted). As such, in Antico, we

approved a district courts instruction that the jury had to

decide whether the giver gave the payments . . . because he

believed the defendant would use his office for acts not

properly related to his official duty. Id. at 259 (underline

added). Similarly, in United States v. Urban, 404 F.3d 754

(3d Cir. 2005), we upheld a Hobbs Act conviction where the

government adduced substantial evidence that (1) the payors

made payments to the defendants knowing they were public

officials exercising governmental authority; (2) the payors

made payments in order to assure advantageous exercise of

that government authority; and (3) the defendants knew that

the [payors] payments were made for an improper purpose,

i.e., the influencing of their governmental authority. Id. at

769.

In other decisions, however, we have expressly

identified another consideration in our official right extortion

inquiry: whether the payors belief was reasonable. This line

of cases began with our en banc decision in United States v.

Mazzei, 521 F.2d 639 (3d Cir. 1975) (en banc). There, the

defendant, a state senator, received payments in exchange for

helping a corporation obtain a lease from a state executive

agency. Id. at 641. The defendant argued that he could not

have been acting under color of official right because he had

no official power in that area, and he never pretended to

have any official power. Id. at 643. We acknowledged that

the defendant had no statutory power as a state senator to

control the granting of leases by state executive agencies,

but rejected the defendants argument, because in order to

find that defendant acted under color of official right, the

jury need not have concluded that he had actual de jure power

to secure grant of the lease so long as it found that [the payor]

held, and defendant exploited, a reasonable belief that the

state system so operated that the power in fact of defendants

office included the effective authority to determine recipients

of the state leases here involved. Id.

We recently extended Mazzei in United States v.

Bencivengo, 749 F.3d 205 (3d Cir. 2014). There, we upheld a

Hobbs Act conviction of the Mayor of Hamilton Township,

New Jersey, who accepted payments in exchange for agreeing

to influence the awarding of School Board insurance

contracts. Id. at 208. We noted that the defendant had no

actual de jure or de facto power over the award of such

contracts, and that unlike in Mazzei, there was no evidence

that [the payor] believed he had such power. Id. at 212.

Nonetheless, we held that Mazzei extended to situations

where a payor reasonably believed the defendant possessed

influence, if not effective power, over an exercise of

governmental authority. Id. at 212-13. Thus, we concluded,

where a public official has, and agrees to wield, influence

over a governmental decision in exchange for financial gain,

or where the officials position could permit such influence,

and the victim of an extortion scheme reasonably believes that

the public official wields such influence, that is sufficient to

sustain a conviction under the Hobbs Act, regardless of

whether the official holds any de jure or de facto power over

the decision. Id.

Read together, our holdings in Mazzei, Antico, Urban,

and Bencivengo, while emphasizing different aspects of the

payors motivation, are consistent in accounting for the

payors reasonable belief as a reflection of the coercive effect

of the defendants official acts. The reason we included in

our inquiry the reasonableness of the payors belief that the

defendant would engage in particular official acts

whether by exercising de jure power, de facto power, or

influencein Mazzei and Bencivengo but not Antico or

Urban is simple: The defendants authority to engage in the

relevant official acts was not contested in Antico or Urban.

Both of those cases involved Philadelphia Licenses and

Inspections officers who accepted illicit payments in

exchange for favorable exercises of their authority, i.e., they

rewarded people who paid and punished people who did not.

See Urban, 404 F.3d at 760-62; Antico, 275 F.3d at 249.2

Those defendants clearly exercised de jure power over

governmental decisions.

In contrast, in Mazzei and

Bencivengo, the defendants authority was contested, as

indicated above.3 But in all of these cases, reasonableness

was inherent in our inquiry.

Thus, our case law articulates a unified standard for

official right extortion cases: We will uphold a conviction for

Hobbs Act extortion where the evidence indicates (1) that the

payor made a payment to the defendant because the payor

held a reasonable belief that the defendant would perform

official acts in return, and (2) that the defendant knew the

payor made the payment because of that belief.

2

One might refer to these as classic official right

extortion cases.

3

Fountain raises similar arguments here, as explored

below.

10

2.

Application

Upon a careful consideration of the record, we agree

with the District Court that a rational juror could conclude

that Alexander paid Fountain $400 with the understanding

that Fountain would use her position at the IRS to help her

obtain a cash refund, and that Fountain knew that Alexander

paid her for that reason. While Fountain may not have had

any power over the IRSs decision to grant any of the

fraudulent refunds she filed, we need not find that Fountain

actually used her position or performed an official act in

furtherance of the scheme to uphold her conviction; the focus

of our inquiry is on Alexanders state of mind. See Antico,

275 F.3d at 257 (In other words, no official act (i.e., no

quo) need be proved to convict under the Hobbs Act.

Nonetheless, the official must know that the paymentthe

quidwas made in return for official acts.); see also

Urban, 404 F.3d at 768 ([T]he government need not prove . .

. that the public official acted or refrained from acting as a

result of payments made.).

Fountain contends both that Alexander did not

subjectively believe and that no reasonable person in

Alexanders position could have believed that Fountain, a

customer service representative for the IRS, could influence

whether she received a refund. Viewing the evidence in the

light most favorable to the Government, however, the

evidence at trial allowed the jury to find that Alexander

reasonably believed Fountain could wield such influence. It

is not clear exactly what Alexander understood about

Fountains position, as Alexander interacted only with

Witherspoon, but as Alexander testified, once her refund

claim was submitted, she was told she had to pay $400 of the

refund to Fountain and, despite her suspicions, she acquiesced

11

because she was still hoping to get the money. Fountains

App. 327. This suggests she understood her $400 payment to

be compensation for services rendered. Indeed, when the IRS

demanded repayment of the refund, Alexander told Fountain

and Witherspoon, I want my $400 back, because if I had to

pay the $1,400 back [to the IRS], Im not going to give her

$400. Fountains App. 318. On the basis of this evidence,

the jury easily could have found that Alexander reasonably

believed Fountain would help her obtain the refund.

The jury also could have found that Alexander

reasonably feared reprisal. Alexander paid Fountain after her

claim had been submitted and despite her suspicions about

Fountains demand for payment. Even though neither

Alexander nor Witherspoon testified to any explicit

discussion with Alexander about the consequences of failing

to pay, Witherspoon did testify generally that Fountain

threatened to red flag claimants who did not pay her fee and

that she repeated Fountains warning to claimants. Fountains

App. 265-66. Thus, a reasonable inference from the

testimony, as well as the timing of the payment, is that

Alexander paid Fountain because she was concerned that

Fountain, as an IRS employee, otherwise would have

prevented the refund or flagged it to a superior for suspected

fraud.4

Finally, we reject Fountains argument that the

evidence in support of the Hobbs Act charge was insufficient

because the Government failed to prove that she used the

4

Indeed, the Government demonstrated that Fountain

did submit amended returns for claimants who ultimately

failed to pay, leading the IRS to reclaim some of the

fraudulently-obtained refunds, including from Alexander.

12

power of her employment at the IRS to induce Alexander to

pay her in exchange for filing a false claim with the IRS.

Inducement is not an element of Hobbs Act extortion under

color of official right. Evans, 504 U.S. at 256; Urban, 404

F.3d at 768; Antico, 275 F.3d at 256. Accordingly, we affirm

Fountains conviction.5

B.

The District Courts Guidelines

Determinations

Fountain, Ishmael, and Johnson each challenge the

District Courts calculation of the applicable Guidelines range

for their sentence. Where an objection is preserved at

sentencing, we exercise plenary review of a district courts

interpretation of the Guidelines but review its factual findings

for clear error. United States v. Grier, 475 F.3d 556, 570 (3d

Cir. 2007) (en banc). If the facts underlying a Guidelines

determination are not in dispute, but the issue is whether the

agreed-upon set of facts fit within the enhancement

requirements, we review the District Courts application of

the enhancement for clear error. United States v. Fish, 731

F.3d 277, 279 (3d Cir. 2013). Finally, where an objection is

not preserved at sentencing, we review that challenge for

plain error. United States v. Couch, 291 F.3d 251, 252-53 (3d

Cir. 2002); United States v. Knight, 266 F.3d 203, 206 (3d

Cir. 2001).

1.

Sophisticated Means Enhancements

Because we conclude the evidence supports

Fountains conviction for the completed offense, we need not

consider the Governments alternative contention that the

evidence supported a conviction of attempted extortion.

13

a.

Fountain and Johnson

Fountain and Johnson both argue that the District

Court erred in applying a two-level enhancement for

sophisticated means to their sentences under U.S.S.G.

2B1.1 because there was nothing particularly sophisticated

about the means employed in their schemes. Their arguments

are unpersuasive.

While the Application Notes to 2B1.1 suggest that

the use of fictitious entities, corporate shells, or offshore

financial accounts would constitute sophisticated means,6 an

offense can easily warrant the sophisticated means

enhancement absent the use of those tactics. See United

States v. Jennings, 711 F.3d 1144, 1147 (9th Cir. 2013)

6

See U.S.S.G. 2B1.1 cmt. n.9(B) ([S]ophisticated

means means especially complex or especially intricate

offense conduct pertaining to the execution or concealment of

an offense. For example, in a telemarketing scheme, locating

the main office of the scheme in one jurisdiction but locating

soliciting operations in another jurisdiction ordinarily

indicates sophisticated means. Conduct such as hiding assets

or transactions, or both, through the use of fictitious entities,

corporate shells, or offshore financial accounts also ordinarily

indicates sophisticated means.); id. 2T1.1 cmt. n.5

(explaining similar factors for applying the sophisticated

means enhancement for tax fraud offenses); see also id.

2T1.1 cmt. background (Although tax offenses always

involve some planning, unusually sophisticated efforts to

conceal the offense decrease the likelihood of detection and

therefore warrant an additional sanction for deterrence

purposes.).

14

(upholding a sophisticated means enhancement in the absence

of corporate shells or offshore accounts, and explaining that

the list contained in the application note is not exhaustive,

and that the enhancement properly applies to conduct less

sophisticated than the list articulated in the application note);

see also Fish, 731 F.3d at 280 (holding that the existence of

one of the facts listed in the application note is not necessary

to a determination that an offense employed sophisticated

means).

Determining whether a defendant employed

sophisticated means can involve considering factors like the

duration of a scheme, the number of participants, the use of

multiple accounts, and efforts to avoid detection. See Fish,

731 F.3d at 280.

Ultimately, a sophisticated means

enhancement is appropriate where a defendants conduct

shows a greater level of planning or concealment than a

typical fraud of its kind. United States v. Fumo, 655 F.3d

288, 315 (3d Cir. 2011) (quoting United States v. Landwer,

640 F.3d 769, 771 (7th Cir. 2011)) (internal quotation mark

omitted).

The enhancement was clearly appropriate here.

Fountain identified IRS programs that would pay substantial

sums and then designed a scheme to maximize her payout

while avoiding detection. In finding that she employed

sophisticated means, the District Court pointed specifically to

Fountains use of inside knowledge of the IRSs enforcement

thresholds, including that TETR claims under $1,500 would

not be flagged for review. Fountain took steps to conceal her

identity even from others involved in the scheme, employing

third parties to recruit claimants and collect their fees so she

could avoid any contact with them. Additionally, Fountain

developed an enforcement mechanism to ensure her fees were

15

paid: submitting amended returns that tipped off the IRS

when claimants were reluctant to pay her. Fountains choice

to use the IRS as her enforcer further decreased the likelihood

that claimants would report her, as they would fear

prosecution themselves. In short, Fountain endowed the

scheme with a sophisticated knowledge of IRS practices

including some not known to the publicand an elaborate

plan for manipulating hundreds of people.

For his part, Johnson engaged recruiters to collect

additional claimants and instituted additional practices to

avoid detection. He routed refunds into accounts that would

not raise alarms, like the business bank accounts of various

relatives and the estate and personal accounts of his recentlydeceased grandmother, and he used different business and

personal addresses for the delivery and cashing of checks.

Moreover, he electronically filed claims in such a manner that

they could be traced only to a third partys wireless network,

rather than his own.

Overall, the sophisticated means employed by

Fountain, Johnson, and their co-conspirators (including

Ishmael) allowed the scheme to grow to an extraordinary size

while remaining undetected for years. Their cunning and

willingness to abuse Fountains position with the IRS clearly

set this scheme apart from a typical fraud of its kind. See

Fumo, 655 F.3d at 315. Their conduct led the District Judge

to remark, at Johnsons sentencing, that this was as

sophisticated a tax fraud scheme as this Judge has seen in 22

years. Govts Supplemental App. 74. In light of these

findings, the application of sophisticated means

enhancements to Fountain and Ishmael was not clear error.

b.

Ishmael

16

In the District Court, Ishmael challenged the

sophisticated means enhancement to his sentence on the same

grounds that Fountain and Johnson did: that the scheme, as a

whole, did not involve sophisticated means. Ishmael does not

raise that argument on appeal. Instead, he argues that the

District Court committed procedural error under U.S.S.G.

1B1.3(a)(1)(B). He points to the District Courts statement

during his sentencing hearing that the fraud scheme was only

possible because of the sophisticated means that, to be sure,

were made possible by Ms. Fountain, not Mr. Ishmael.

Ishmaels App. 151. Ishmael contends that this statement

indicates that the District Court attributed Fountains

sophisticated means to Ishmael and that it erred by doing so

without finding that Fountains use of those means was

reasonably foreseeable to Ishmael. He asks us to remand for

resentencing so the District Court can make this finding.7

Ishmael argues that our decision in United States v.

Collado, 975 F.2d 985 (3d Cir. 1992), compels us to remand

for the District Court to make a finding of reasonable

Because Ishmael did not raise this objection in the

District Court, the Government argues that we should apply

plain error review. Ishmael counters that our decision in

United States v. Flores-Mejia, 759 F.3d 253 (3d Cir. 2014)

(en banc), does not apply retroactively, and, accordingly, that

we should review for an abuse of discretion. We conclude

that Ishmaels challenge fails even if we do review for an

abuse of discretion, and we thus need not decide whether his

challenge should be subject to plain error review.

17

foreseeability.8 To the contrary, Collado indicates that we

may conduct our own review of the record to see if it supports

a finding of reasonable foreseeability. See Collado, 975 F.2d

at 997. If we are convinced that the attribution of Fountains

sophisticated means is firmly supported by the record, there is

no reason to remand this case only to have the district court

reach the same sentencing decision. United States v. Duliga,

204 F.3d 97, 101 n.2 (3d Cir. 2000).

Here, it is clear that the sophisticated means Fountain

employed were reasonably foreseeable to Ishmael. Fountain

and Ishmael lived together and had children together. The

evidence established that Ishmael knew about the IRSs

$1,500 threshold for flagging TETR claims for review, and

that he knew that Fountain would reverse claimants refunds

if they did not pay her fee. Moreover, the District Court

found that Ishmael was the engine that drove [the]

conspiracy from one that might have involved a handful of

phony tax refunds to one that involved hundreds at a cost of

over $2 million to the United States treasury, and that

Ishmaels leadership succeeded in spreading [the] scheme

like wild fire. Ishmaels App. 163. Thus, we are convinced

that a finding of reasonable foreseeability is firmly supported

8

Although Collado dealt with the inclusion of drug

quantities dealt by co-conspirators in a defendants base

offense level calculation, also known as accomplice

attribution, rather than a sophisticated means enhancement,

the same reasonably foreseeable standard applies to each

inquiry, as both are guided by 1B1.3. See United States v.

Anobah, 734 F.3d 733, 739 (7th Cir. 2013); United States v.

Crosgrove, 637 F.3d 646, 666 (6th Cir. 2011).

18

by the record, and we affirm the District Courts application

of the sophisticated means enhancement to Ishmael.

2.

Fountains Enhancement for Using a

Minor

Fountain argues that the District Court erred in

applying a two-level enhancement for using a minor to

commit her offenses under U.S.S.G. 3B1.4. The evidence

established, however, that Fountain used her minor daughter

to collect payments that had been given to Witherspoon on at

least one occasion. Fountain counters that her use of her

daughter cannot support the enhancement because by the time

she had her daughter collect payments, the crime was

complete, as Fountain had already filed the false returns.9

But the focus of a courts inquiry under 3B1.4 is on the

actions and intent of the defendant. Whether the minor

himself engaged in any criminal actions, whether the minor

intended to assist in the adults criminal activity, or whether

the minor even knew that the adult was involved in criminal

activity are factors irrelevant to application of the 3B1.4

enhancement. United States v. Gaskin, 364 F.3d 438, 46465 (2d Cir. 2004) (collecting cases). Moreover, the crime

continued after the filing of returns, as collecting payment,

which occurred after filing, was the whole point of the

scheme. Further, the evidence indicates that Fountain and her

co-conspirators continued filing false returns after Fountain

9

The Government notes that Fountain did not raise

this argument in the District Court, and argues that it should

be reviewed for plain error as a result. Because we conclude

that the District Court committed no error in applying the

enhancement, we need not decide which standard applies.

19

had her daughter pick up payments from Witherspoon. Thus,

the imposition of this enhancement was not clear error.

3.

Johnsons Leadership Role

Enhancement

Johnson argues that the District Court erred in

applying a four-level enhancement under U.S.S.G. 3B1.1(a)

because the record lacks evidence that Johnson was a leader

or organizer. To support this enhancement, the evidence must

show that Johnson exercised some degree of control over at

least one other person involved in the offense. United States

v. Helbling, 209 F.3d 226, 243-44 (3d Cir. 2000). The

evidence indicated that Johnson recruited his father and a

friend named Andre Bruce to participate in the AOTC and

FTHBC schemes, and that Johnsons father eventually

became a recruiter for Johnson and would withdraw money

for him after the IRS issued refunds. Johnson also directed

Bruce to destroy evidence while Johnson was on pre-trial

release. Thus, the District Court did not clearly err in

imposing this enhancement.

4.

Johnsons Loss Calculation

Johnson also argues that in calculating the loss

attributable to him, the District Court improperly included

losses that overstate his criminal conduct and were not

reasonably foreseeable to him. It is well-settled that a

sentencing court need only make a reasonable estimate of

loss that is based on the available evidence in the record,

United States v. Tupone, 442 F.3d 145, 156 (3d Cir. 2006),

and it is clear the District Court did so here.

20

Johnsons arguments fail upon a review of the

Governments loss methodology, which the District Court

approved when it adopted the most conservative of the

Governments proposed loss calculations. Johnson argues

that the District Court erred by attributing all fraudulent tax

returns to him, but the District Court did not do so. In fact,

the Government did not ask the District Judge to do so.

Along the same lines, Johnson argues he was improperly held

responsible for returns filed from Fountains IRS computer

and for claims filed before he joined the conspiracy or after

he left. The Government, however, excluded those amounts

from its calculations. Further, Johnson argues that Bruce, not

he, was responsible for returns filed from Bruces IP address.

But the District Court and the jury already rejected this

argument based on Bruces trial testimony. Thus, attributing

those amounts to Johnson at sentencing was not clear error.

Finally, Johnson argues that the District Court

improperly attributed to Johnson losses from the TETR and

FTHBC conspiracies that were not reasonably foreseeable to

him. In light of Johnsons role in recruiting claimants and

allowing the use of his address and bank account in the TETR

scheme and his leadership in the FTHBC scheme, the District

Judges inclusion of those amounts as reasonably foreseeable

losses was not clear error.

In sum, the District Court arrived at a reasonable

estimate of the loss amount attributable to Johnson by

adopting the Governments conservative calculation. As

such, we will not disturb the District Courts findings on

appeal.

C.

Reasonableness of Fountain and Johnsons

Sentences

21

Fountain and Johnson both argue that their sentences

were procedurally and substantively unreasonable. We

review a criminal sentence for an abuse of discretion and

proceed in two stages. United States v. Wright, 642 F.3d 148,

152 (3d Cir. 2011). First, we review for procedural error,

including failure to give meaningful consideration to a

defendants arguments or the factors listed in 18 U.S.C.

3553(a). Id. Second, if there is no such error, we review for

substantive reasonableness, and we will affirm [the

sentence] unless no reasonable sentencing court would have

imposed the same sentence on that particular defendant for

the reasons the district court provided. Id. (alteration in

original) (quoting United States v. Tomko, 562 F.3d 558, 568

(3d Cir. 2009) (en banc)) (internal quotation marks omitted).

Sentences that fall within the applicable Guidelines range are

more likely to be reasonable than those that do not. United

States v. Woronowicz, 744 F.3d 848, 852 (3d Cir. 2014).

1.

Fountains Sentence

Fountain contends the District Court committed

procedural error by placing undue weight on the Guidelines

and on deterrence interests while minimizing the offenderspecific considerations in this case, including that she was a

first-time offender and the sole caregiver of four children, one

of whom received a terminal medical diagnosis during the

course of this prosecution. But the District Court gave

adequate consideration to all of these factors, finding they

were not sufficiently extraordinary to warrant a variance,

and noted that they did not deter Fountain from her

egregious and protracted criminality. Fountains App.

1008-09.

22

Fountains argument ultimately amounts to a challenge

of substantive unreasonableness, as a complaint that a district

courts choice of sentence did not afford certain factors

enough weight is a substantive complaint, not a procedural

one. United States v. Merced, 603 F.3d 203, 217 (3d Cir.

2010); see also United States v. Bungar, 478 F.3d 540, 546

(3d Cir. 2007) (Nor do we find that a district courts failure

to give mitigating factors the weight a defendant contends

they deserve renders the sentence unreasonable.). As such,

notwithstanding the tragic circumstances facing Fountains

family, Fountain cannot meet her heavy burden of showing

that a sentence within the applicable Guidelines range was

substantively unreasonable in light of the sophisticated nature

of her crimes, her lack of remorse, her abuse of her position

with the IRS, and the need to deter other public employees

from taking advantage of sensitive information.

2.

Johnsons Sentence

Johnson argues the District Court committed

procedural error by cutting off his counsels arguments at his

sentencing hearing. But the District Judge merely declined to

allow Johnsons attorney to cite an additional case in support

of his sophisticated means objection. The District Judge only

did so, moreover, after noting that all of Johnsons objections

had been briefed ad nauseam. Thus, we find no abuse of

discretion in that decision. Johnson also contends the District

Court erred in treating a sentence within the applicable

Guidelines range as presumptively correct, and by failing to

address some of Johnsons arguments at sentencing. This

contention, however, ignores the protracted exchange

between the District Judge and Johnsons counsel on the

question of whether to grant a departure or variance. The

District Court also heard allocution from Johnson himself.

23

On the whole, Johnson cannot show the District Court failed

to give meaningful consideration to any of his arguments or

any sentencing factor, nor can he show any other procedural

error.

Finally, given the District Courts findings that

Johnson grew from a relatively small player in the TETR

scheme to a major player in the conspiracy associated with

the FTHBC and the AOTC, that he continued to commit

offenses while he was on pretrial release, and that he failed to

appreciate the magnitude of his crimes, Johnson cannot show

that a sentence within the applicable Guidelines range was

substantively unreasonable.

III.

Conclusion

For the reasons stated above, we affirm the judgment

of the District Court.

24

Das könnte Ihnen auch gefallen

- Washington v. William Morris Endeavor Entertainment Et Al. - Petitioner's Motion For Leave To Proceed in Forma Pauperis (September 21, 2015)Dokument24 SeitenWashington v. William Morris Endeavor Entertainment Et Al. - Petitioner's Motion For Leave To Proceed in Forma Pauperis (September 21, 2015)Mr Alkebu-lanNoch keine Bewertungen

- Sawyer v. United States, 239 F.3d 31, 1st Cir. (2001)Dokument25 SeitenSawyer v. United States, 239 F.3d 31, 1st Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Evans v. United States, 504 U.S. 255 (1992)Dokument36 SeitenEvans v. United States, 504 U.S. 255 (1992)Scribd Government DocsNoch keine Bewertungen

- United States v. Stanley Haimowitz and Murray Lichtman, 404 F.2d 38, 2d Cir. (1968)Dokument3 SeitenUnited States v. Stanley Haimowitz and Murray Lichtman, 404 F.2d 38, 2d Cir. (1968)Scribd Government DocsNoch keine Bewertungen

- United States v. Federico Giovanelli A/K/A Fritzy, 998 F.2d 116, 2d Cir. (1993)Dokument6 SeitenUnited States v. Federico Giovanelli A/K/A Fritzy, 998 F.2d 116, 2d Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Crundwell Case: Motion To Dismiss State ChargesDokument14 SeitenCrundwell Case: Motion To Dismiss State ChargessaukvalleynewsNoch keine Bewertungen

- United States v. Ronald Robinson, 545 F.2d 301, 2d Cir. (1976)Dokument10 SeitenUnited States v. Ronald Robinson, 545 F.2d 301, 2d Cir. (1976)Scribd Government DocsNoch keine Bewertungen

- Criminal ComplaintDokument11 SeitenCriminal ComplaintCrystalhengeNoch keine Bewertungen

- United States v. Boulerice, 325 F.3d 75, 1st Cir. (2003)Dokument15 SeitenUnited States v. Boulerice, 325 F.3d 75, 1st Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- Johnson Mem Opinion and Order Denying PCC MTDDokument7 SeitenJohnson Mem Opinion and Order Denying PCC MTDjhbryanNoch keine Bewertungen

- United States v. Jackson, 4th Cir. (1998)Dokument4 SeitenUnited States v. Jackson, 4th Cir. (1998)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals: PublishedDokument14 SeitenUnited States Court of Appeals: PublishedScribd Government DocsNoch keine Bewertungen

- Sanna v. DiPaulo, 265 F.3d 1, 1st Cir. (2001)Dokument15 SeitenSanna v. DiPaulo, 265 F.3d 1, 1st Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Lionel Aubin v. Stanley Fudala, 782 F.2d 287, 1st Cir. (1986)Dokument8 SeitenLionel Aubin v. Stanley Fudala, 782 F.2d 287, 1st Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- United States v. Hankin, Perch, Perch P. Hankin, 607 F.2d 611, 3rd Cir. (1979)Dokument15 SeitenUnited States v. Hankin, Perch, Perch P. Hankin, 607 F.2d 611, 3rd Cir. (1979)Scribd Government DocsNoch keine Bewertungen

- UNITED STATES of America Ex Rel. Mackey Raymond CHOICE, Appellant, v. Joseph R. BRIERLEY, Superintendent and District Attorney of Philadelphia CountyDokument9 SeitenUNITED STATES of America Ex Rel. Mackey Raymond CHOICE, Appellant, v. Joseph R. BRIERLEY, Superintendent and District Attorney of Philadelphia CountyScribd Government DocsNoch keine Bewertungen

- United States v. Johnson, 10th Cir. (2006)Dokument12 SeitenUnited States v. Johnson, 10th Cir. (2006)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Third CircuitDokument9 SeitenUnited States Court of Appeals Third CircuitScribd Government DocsNoch keine Bewertungen

- United States of America and James Oys, an Officer of the Internal Revenue Service v. Brigham Young University and Dallin H. Oaks, President of Brigham Young University, 679 F.2d 1345, 10th Cir. (1982)Dokument8 SeitenUnited States of America and James Oys, an Officer of the Internal Revenue Service v. Brigham Young University and Dallin H. Oaks, President of Brigham Young University, 679 F.2d 1345, 10th Cir. (1982)Scribd Government DocsNoch keine Bewertungen

- UnpublishedDokument10 SeitenUnpublishedScribd Government DocsNoch keine Bewertungen

- Filed: Patrick FisherDokument22 SeitenFiled: Patrick FisherScribd Government DocsNoch keine Bewertungen

- United States v. Alfred Smith, 373 F.3d 561, 4th Cir. (2004)Dokument12 SeitenUnited States v. Alfred Smith, 373 F.3d 561, 4th Cir. (2004)Scribd Government DocsNoch keine Bewertungen

- In Re Grand Jury Investigation, Philip Charles Testa, Witness. Appeal of Philip Charles Testa, 486 F.2d 1013, 3rd Cir. (1973)Dokument7 SeitenIn Re Grand Jury Investigation, Philip Charles Testa, Witness. Appeal of Philip Charles Testa, 486 F.2d 1013, 3rd Cir. (1973)Scribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument10 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Carl E. Enlow v. United States, 239 F.2d 887, 10th Cir. (1957)Dokument5 SeitenCarl E. Enlow v. United States, 239 F.2d 887, 10th Cir. (1957)Scribd Government DocsNoch keine Bewertungen

- Benson V United States Writ of Cert - DraftDokument31 SeitenBenson V United States Writ of Cert - DraftJohn SutherlandNoch keine Bewertungen

- United States v. Harold Gross, Also Known As Harry Gross, 286 F.2d 59, 2d Cir. (1961)Dokument3 SeitenUnited States v. Harold Gross, Also Known As Harry Gross, 286 F.2d 59, 2d Cir. (1961)Scribd Government DocsNoch keine Bewertungen

- Davidson v. United States, 149 F.3d 1190, 10th Cir. (1998)Dokument7 SeitenDavidson v. United States, 149 F.3d 1190, 10th Cir. (1998)Scribd Government DocsNoch keine Bewertungen

- United States v. Ellis, 4th Cir. (1996)Dokument18 SeitenUnited States v. Ellis, 4th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Burton v. United States, 196 U.S. 283 (1905)Dokument15 SeitenBurton v. United States, 196 U.S. 283 (1905)Scribd Government DocsNoch keine Bewertungen

- Calvin Thompson v. Union Cty Social Ser, 3rd Cir. (2010)Dokument3 SeitenCalvin Thompson v. Union Cty Social Ser, 3rd Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- James P. Kyricopoulos v. Town of Orleans, 967 F.2d 14, 1st Cir. (1992)Dokument4 SeitenJames P. Kyricopoulos v. Town of Orleans, 967 F.2d 14, 1st Cir. (1992)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Tenth CircuitDokument33 SeitenUnited States Court of Appeals Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Thomas F. Johnson, 419 F.2d 56, 4th Cir. (1970)Dokument6 SeitenUnited States v. Thomas F. Johnson, 419 F.2d 56, 4th Cir. (1970)Scribd Government DocsNoch keine Bewertungen

- Bernie B. Johnson v. Marvin Runyon, Postmaster General, United States Postal Service Carl Miles Pushp Kohli, 91 F.3d 131, 4th Cir. (1996)Dokument4 SeitenBernie B. Johnson v. Marvin Runyon, Postmaster General, United States Postal Service Carl Miles Pushp Kohli, 91 F.3d 131, 4th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument9 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument11 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument11 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Eighth CircuitDokument6 SeitenUnited States Court of Appeals Eighth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. William C. Sorren, 605 F.2d 1211, 1st Cir. (1979)Dokument8 SeitenUnited States v. William C. Sorren, 605 F.2d 1211, 1st Cir. (1979)Scribd Government DocsNoch keine Bewertungen

- United States v. John Stubin, 446 F.2d 457, 3rd Cir. (1971)Dokument12 SeitenUnited States v. John Stubin, 446 F.2d 457, 3rd Cir. (1971)Scribd Government DocsNoch keine Bewertungen

- United States v. Dolores Stephens, (D.c. Criminal No. 98-Cr-00662), 198 F.3d 389, 3rd Cir. (1999)Dokument3 SeitenUnited States v. Dolores Stephens, (D.c. Criminal No. 98-Cr-00662), 198 F.3d 389, 3rd Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- AMERICAN CIVIL LIBERTIES UNION, NM v. Santillanes, 546 F.3d 1313, 10th Cir. (2008)Dokument25 SeitenAMERICAN CIVIL LIBERTIES UNION, NM v. Santillanes, 546 F.3d 1313, 10th Cir. (2008)Scribd Government DocsNoch keine Bewertungen

- United States v. David Lopez, 420 F.2d 313, 2d Cir. (1969)Dokument8 SeitenUnited States v. David Lopez, 420 F.2d 313, 2d Cir. (1969)Scribd Government DocsNoch keine Bewertungen

- White v. New Hampshire Depart, 221 F.3d 254, 1st Cir. (2000)Dokument12 SeitenWhite v. New Hampshire Depart, 221 F.3d 254, 1st Cir. (2000)Scribd Government DocsNoch keine Bewertungen

- United States v. Beach (Galen), 10th Cir. (2007)Dokument13 SeitenUnited States v. Beach (Galen), 10th Cir. (2007)Scribd Government DocsNoch keine Bewertungen

- United States v. William Calvin Johnson, 71 F.3d 139, 4th Cir. (1995)Dokument13 SeitenUnited States v. William Calvin Johnson, 71 F.3d 139, 4th Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- United States v. Richard M. Penta, 475 F.2d 92, 1st Cir. (1973)Dokument7 SeitenUnited States v. Richard M. Penta, 475 F.2d 92, 1st Cir. (1973)Scribd Government DocsNoch keine Bewertungen

- United States v. Patrice Daliberti Hurn, 368 F.3d 1359, 11th Cir. (2004)Dokument12 SeitenUnited States v. Patrice Daliberti Hurn, 368 F.3d 1359, 11th Cir. (2004)Scribd Government DocsNoch keine Bewertungen

- United States v. Loren Robbie Wilson, 719 F.2d 1491, 10th Cir. (1983)Dokument7 SeitenUnited States v. Loren Robbie Wilson, 719 F.2d 1491, 10th Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- Filed United States Court of Appeals Tenth CircuitDokument5 SeitenFiled United States Court of Appeals Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Allen v. Beck, 10th Cir. (2006)Dokument6 SeitenAllen v. Beck, 10th Cir. (2006)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, First CircuitDokument7 SeitenUnited States Court of Appeals, First CircuitScribd Government DocsNoch keine Bewertungen

- Julio Solis v. United States, 252 F.3d 289, 3rd Cir. (2001)Dokument8 SeitenJulio Solis v. United States, 252 F.3d 289, 3rd Cir. (2001)Scribd Government DocsNoch keine Bewertungen

- Karl Friedrich Haller v. P. A. Esperdy, As District Director of The Immigration and Naturalization Service, 397 F.2d 211, 2d Cir. (1968)Dokument7 SeitenKarl Friedrich Haller v. P. A. Esperdy, As District Director of The Immigration and Naturalization Service, 397 F.2d 211, 2d Cir. (1968)Scribd Government DocsNoch keine Bewertungen

- Not PrecedentialDokument5 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Sloan v. Pugh, 351 F.3d 1319, 10th Cir. (2003)Dokument8 SeitenSloan v. Pugh, 351 F.3d 1319, 10th Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- Houston v. Henderson, 10th Cir. (1999)Dokument5 SeitenHouston v. Henderson, 10th Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- United States v. O'Donnell, 1st Cir. (2016)Dokument14 SeitenUnited States v. O'Donnell, 1st Cir. (2016)Scribd Government DocsNoch keine Bewertungen

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Von EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Noch keine Bewertungen

- Coyle v. Jackson, 10th Cir. (2017)Dokument7 SeitenCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Dokument4 SeitenUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Garcia-Damian, 10th Cir. (2017)Dokument9 SeitenUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Dokument25 SeitenPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Apodaca v. Raemisch, 10th Cir. (2017)Dokument15 SeitenApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Kieffer, 10th Cir. (2017)Dokument20 SeitenUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Dokument21 SeitenCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument14 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Dokument22 SeitenConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument24 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Voog, 10th Cir. (2017)Dokument5 SeitenUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Roberson, 10th Cir. (2017)Dokument50 SeitenUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Dokument100 SeitenHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument10 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Magnan, 10th Cir. (2017)Dokument27 SeitenUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Dokument9 SeitenNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Henderson, 10th Cir. (2017)Dokument2 SeitenUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Kearn, 10th Cir. (2017)Dokument25 SeitenUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Kundo, 10th Cir. (2017)Dokument7 SeitenUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Muhtorov, 10th Cir. (2017)Dokument15 SeitenUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Northern New Mexicans v. United States, 10th Cir. (2017)Dokument10 SeitenNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Windom, 10th Cir. (2017)Dokument25 SeitenUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Chevron Mining v. United States, 10th Cir. (2017)Dokument42 SeitenChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Pledger v. Russell, 10th Cir. (2017)Dokument5 SeitenPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Robles v. United States, 10th Cir. (2017)Dokument5 SeitenRobles v. United States, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Jimenez v. Allbaugh, 10th Cir. (2017)Dokument5 SeitenJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- United States v. Magnan, 10th Cir. (2017)Dokument4 SeitenUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Publish United States Court of Appeals For The Tenth CircuitDokument17 SeitenPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Coburn v. Wilkinson, 10th Cir. (2017)Dokument9 SeitenCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Parker Excavating v. LaFarge West, 10th Cir. (2017)Dokument24 SeitenParker Excavating v. LaFarge West, 10th Cir. (2017)Scribd Government DocsNoch keine Bewertungen

- Padua V RobleDokument9 SeitenPadua V RobleJan-Lawrence OlacoNoch keine Bewertungen

- Involuntary Servitude To Citizenship - Consti - FinalsDokument44 SeitenInvoluntary Servitude To Citizenship - Consti - FinalsAdri MillerNoch keine Bewertungen

- Delhi HC Judgment in Case of Juvenile Rapist in Nirbhaya CaseDokument7 SeitenDelhi HC Judgment in Case of Juvenile Rapist in Nirbhaya CasePGurus100% (1)

- United States v. Amanda Deese, 4th Cir. (2014)Dokument2 SeitenUnited States v. Amanda Deese, 4th Cir. (2014)Scribd Government DocsNoch keine Bewertungen

- Order The Questions Are Posed. Write Your Answers Only On The Front, Not The Back, Page of Every Sheet in YourDokument6 SeitenOrder The Questions Are Posed. Write Your Answers Only On The Front, Not The Back, Page of Every Sheet in YourIan GanasNoch keine Bewertungen

- UntitledDokument17 SeitenUntitledanatheacadagatNoch keine Bewertungen

- The Search Warrant Affidavit For Officer Aaron HensonDokument4 SeitenThe Search Warrant Affidavit For Officer Aaron HensonRegionalRobNoch keine Bewertungen

- Political Turmoil Eats Up 1% of GDP: New Guidelines To End Two-Fi Nger Rape TestDokument21 SeitenPolitical Turmoil Eats Up 1% of GDP: New Guidelines To End Two-Fi Nger Rape TestDhaka TribuneNoch keine Bewertungen

- Raymond Dakura, A087 673 826 (BIA Sept. 13, 2013)Dokument9 SeitenRaymond Dakura, A087 673 826 (BIA Sept. 13, 2013)Immigrant & Refugee Appellate Center, LLCNoch keine Bewertungen

- Manuel vs. PanoDokument2 SeitenManuel vs. PanoKevin BonaobraNoch keine Bewertungen

- CSC V ColanggoDokument2 SeitenCSC V ColanggoMark Leo BejeminoNoch keine Bewertungen

- Anderson Report To The BOSDokument5 SeitenAnderson Report To The BOSLakeCoNewsNoch keine Bewertungen

- Santosh - Moot - 3 Final - RespondentDokument22 SeitenSantosh - Moot - 3 Final - RespondentSantosh Chavan Bhosari100% (1)

- MadRiverUnion 9 30 15editionDokument14 SeitenMadRiverUnion 9 30 15editionMad River UnionNoch keine Bewertungen

- UsufructDokument101 SeitenUsufructReuben EscarlanNoch keine Bewertungen

- Judicial AffidavitDokument4 SeitenJudicial Affidavitscribe03Noch keine Bewertungen

- Crim Law DigestDokument48 SeitenCrim Law DigestSarah Kate BatilongNoch keine Bewertungen

- Affidavit of FactDokument6 SeitenAffidavit of FactLeisha TringaliNoch keine Bewertungen

- Cases For Separation of PowerDokument72 SeitenCases For Separation of PowerMichael LagundiNoch keine Bewertungen

- Re Request For Live Radio TV Coverage 2Dokument2 SeitenRe Request For Live Radio TV Coverage 2Mark Joseph DelimaNoch keine Bewertungen

- Recalling The GomburzaDokument3 SeitenRecalling The GomburzaIssaRoxasNoch keine Bewertungen

- Victim or Survivor TerminologyDokument2 SeitenVictim or Survivor TerminologyRohit James JosephNoch keine Bewertungen

- Prima FacieDokument4 SeitenPrima FacieXymon BassigNoch keine Bewertungen

- Complaint - Strict Liability, NegligenceDokument4 SeitenComplaint - Strict Liability, NegligenceYuri75% (4)

- Case Studies: Admissibility of Digital Records As Legal Evidence in MalaysiaDokument12 SeitenCase Studies: Admissibility of Digital Records As Legal Evidence in MalaysiaAtizaNoch keine Bewertungen

- Case 19 Query of Atty Silverio-BuffeDokument2 SeitenCase 19 Query of Atty Silverio-BuffeTababoyNoch keine Bewertungen

- Djs 2019 Mains Paper 367Dokument16 SeitenDjs 2019 Mains Paper 367JenniferNoch keine Bewertungen

- Canon CodalDokument1 SeiteCanon CodalZyreen Kate BCNoch keine Bewertungen

- Industrial Insurance Company v. BondadDokument1 SeiteIndustrial Insurance Company v. Bondadd2015memberNoch keine Bewertungen