Beruflich Dokumente

Kultur Dokumente

Taxation Trends in The European Union - 2012 33

Hochgeladen von

Dimitris Argyriou0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 Seitep33

Originaltitel

Taxation Trends in the European Union - 2012 33

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenp33

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten1 SeiteTaxation Trends in The European Union - 2012 33

Hochgeladen von

Dimitris Argyrioup33

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Part I

Overall tax revenue

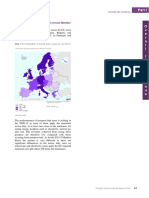

Graph 1.12: Development of top personal income tax

rate

O

v

e

r

a

l

l

1995-2012, in %

52%

50%

48%

46%

44%

42%

Between 2000 and 2010 the components of the ITR on

labour changed markedly in several Member States

(see Graph 1.14). Personal income taxation of labour as

well as employers' SSC and payroll taxes went down

markedly, while employees' SSC only slightly

decreased (all as a percentage of total labour costs). For

the euro area the declines were considerably smaller on

average, and mainly consisted of a reduction in

personal income taxation.

40%

38%

36%

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

t

a

x

EU-27

EA-17

Source: Commission services

PIT accounts for only one third of labour taxes

Of course, the picture given by the PIT rates is

incomplete. Not only the level and change of the top

r

e

v

e

n

u

e

PIT rate is relevant, but also the income level at which

they are applied. Moreover, the progression of PIT

rates applied, the structure of allowances and tax

credits, and the definition of the tax base play a key

role in defining the effective tax burden. This is very

aptly illustrated by the fact that the ITR on labour

declined only marginally in the 19952009 period,

despite the strong reduction in the top PIT rates.

Looking at changes in single Member States, most of

the countries reduced their ITR; the change was to a

large extent driven by reductions in PIT or employers'

SSC. In many countries one notices a shift in the

different components of the tax burden.

Graph 1.14: Evolution of the composition of the implicit

tax rate on labour

2000-2010, differences in percentage points

10%

5%

0%

-5%

-10%

-15%

Graph 1.13: Composition of the implicit tax rate on

labour

CY ES LU NL PT IT AT MT UK EE FR BE DE HU CZ IE

Personal income tax

2010, in %

Note:

Employees' SSC

SI EL PL LV SK FI DK RO SE LT BG

Employers' SSC and payroll taxes

EU- EA27 17

ITR on labour

Countries are ordered by the change in the ITR on labour

Source: Commission services

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

IT

BE

FR

AT

HU

FI

CZ

SE

DE

EE

NL

Personal income tax

SI

DK

ES

LV

SK

Employees' SSC

LU

LT

EL

PL

RO CY

IE

UK

BG

PT

MT

EU- EA27 17

Employers' SSC and payroll taxes

Source: Commission services

In most Member States, social security contributions

account for a much greater share of labour taxes than

the personal income tax. On average, about two thirds

of the overall ITR on labour consists of non-wage

labour costs paid by both employees and employers

(see Graph 1.13). Only in Denmark, Ireland and the

United Kingdom do personal income taxes form a

relatively large part of the total charges paid on labour

income, while in countries like Poland, Greece or

Slovakia less than 20 % of the ITR on labour consists

of the personal income tax.

32

Taxation trends in the European Union

This increase can be plausibly attributed to the effect of

the economic and financial crisis as until 2009, there

had been a clear, steady and widespread downward

trend in the top rate. Indeed, from 1995 to 2009, almost

all EU Member States cut their top rate, with only three

keeping it unchanged (Malta, Austria and the United

Kingdom) and one (Portugal) increasing it slightly.

Even taking into account the subsequent rate increase

in 2010, all in all, the EU-27 average has gone down by

9.3 percentage points since 1995, accelerating after

2000 (see Table 1.3). The fall was most noticeable in

the Central and Eastern European countries, with the

biggest cuts taking place in four countries that adopted

flat rate systems, Bulgaria ( 30.0 percentage points),

the Czech Republic ( 17.0), Romania ( 24.0) and

Slovakia ( 23.0); the acceleration after 2000 was,

however, visible also in the EU-15 Member States.

Das könnte Ihnen auch gefallen

- Inflation and UnemploymentDokument29 SeitenInflation and UnemploymentJorge CárcamoNoch keine Bewertungen

- ECON 203 Midterm 2012W AncaAlecsandru SolutionDokument8 SeitenECON 203 Midterm 2012W AncaAlecsandru SolutionexamkillerNoch keine Bewertungen

- Taxation Trends in The EU - 2016 PDFDokument340 SeitenTaxation Trends in The EU - 2016 PDFDiana IrimescuNoch keine Bewertungen

- European UnionDokument15 SeitenEuropean UnionKeahlyn Boticario CapinaNoch keine Bewertungen

- Go Book of Peach Blossom Spring 桃花泉奕譜Dokument225 SeitenGo Book of Peach Blossom Spring 桃花泉奕譜Ng Boon LeongNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 21Dokument1 SeiteTaxation Trends in The European Union - 2012 21d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 31Dokument1 SeiteTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 28Dokument1 SeiteTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in EU in 2010Dokument42 SeitenTaxation Trends in EU in 2010Tatiana TurcanNoch keine Bewertungen

- Taxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsDokument44 SeitenTaxation Trends in The European Union: Focus On The Crisis: The Main Impacts On EU Tax SystemsAnonymousNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 39Dokument1 SeiteTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 20Dokument1 SeiteTaxation Trends in The European Union - 2012 20d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 70Dokument1 SeiteTaxation Trends in The European Union - 2012 70d05registerNoch keine Bewertungen

- Ireland: Developments in The Member StatesDokument4 SeitenIreland: Developments in The Member StatesBogdan PetreNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 74Dokument1 SeiteTaxation Trends in The European Union - 2012 74d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 29Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 29Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 82Dokument1 SeiteTaxation Trends in The European Union - 2012 82d05registerNoch keine Bewertungen

- Ireland's Tax System and Recent DevelopmentsDokument1 SeiteIreland's Tax System and Recent Developmentsd05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 86Dokument1 SeiteTaxation Trends in The European Union - 2012 86d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 38Dokument1 SeiteTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 41Dokument1 SeiteTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 52Dokument1 SeiteTaxation Trends in The European Union - 2012 52d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 151Dokument1 SeiteTaxation Trends in The European Union - 2012 151d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 59Dokument1 SeiteTaxation Trends in The European Union - 2012 59d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 35Dokument1 SeiteTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNoch keine Bewertungen

- 2012-03-19 Greece Is Changing Updated Mar 2012Dokument64 Seiten2012-03-19 Greece Is Changing Updated Mar 2012guiguichardNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 25Dokument1 SeiteTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNoch keine Bewertungen

- Alia, Tax Rates. Because They Are Determined Directly Through A Political Process, Rates Provide ADokument14 SeitenAlia, Tax Rates. Because They Are Determined Directly Through A Political Process, Rates Provide AGandhi Jenny Rakeshkumar BD20029Noch keine Bewertungen

- Taxation Trends in The European Union - 2012 90Dokument1 SeiteTaxation Trends in The European Union - 2012 90d05registerNoch keine Bewertungen

- Ecfin Country Focus: Decomposing Total Tax Revenues in GermanyDokument8 SeitenEcfin Country Focus: Decomposing Total Tax Revenues in GermanyJhony SebanNoch keine Bewertungen

- Developments in Spain's Tax SystemDokument1 SeiteDevelopments in Spain's Tax Systemd05registerNoch keine Bewertungen

- Developments in Sweden's Tax SystemDokument1 SeiteDevelopments in Sweden's Tax Systemd05registerNoch keine Bewertungen

- The EU's Fiscal Crisis and Policy Response: Reforming Economic Governance in The EUDokument39 SeitenThe EU's Fiscal Crisis and Policy Response: Reforming Economic Governance in The EUAlexandra Maria CiorsacNoch keine Bewertungen

- Italy's Corporate Tax Burden Over TimeDokument23 SeitenItaly's Corporate Tax Burden Over TimeMeadsieNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 30Dokument1 SeiteTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNoch keine Bewertungen

- EF1168ENDokument13 SeitenEF1168ENJesse WellsNoch keine Bewertungen

- 01 S&D - Closing The European Tax Gap 2Dokument1 Seite01 S&D - Closing The European Tax Gap 2Dimitris ArgyriouNoch keine Bewertungen

- Faculty - Economic and ManagementDokument5 SeitenFaculty - Economic and ManagementBaraawo BaraawoNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 102Dokument1 SeiteTaxation Trends in The European Union - 2012 102d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 66Dokument1 SeiteTaxation Trends in The European Union - 2012 66d05registerNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 162Dokument1 SeiteTaxation Trends in The European Union - 2012 162d05registerNoch keine Bewertungen

- Developments in Member States: Lithuania's Taxation TrendsDokument1 SeiteDevelopments in Member States: Lithuania's Taxation Trendsd05registerNoch keine Bewertungen

- Tax competition within the EU and its impact on the EU-10 countriesDokument18 SeitenTax competition within the EU and its impact on the EU-10 countriesYudha Alief AprilianNoch keine Bewertungen

- Consumption Taxes The Way of The FutureDokument8 SeitenConsumption Taxes The Way of The FutureStacey JohnsonNoch keine Bewertungen

- Hourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Dokument4 SeitenHourly Labour Costs Ranged From 3.8 To 40.3 Across The EU Member States in 2014Turcan Ciprian SebastianNoch keine Bewertungen

- Intra-Euro Rebalancing Is Inevitable, But Insufficient: PolicyDokument12 SeitenIntra-Euro Rebalancing Is Inevitable, But Insufficient: PolicyBruegelNoch keine Bewertungen

- Bulgaria's Tax System Features Flat Personal Income Tax and High Environmental TaxesDokument1 SeiteBulgaria's Tax System Features Flat Personal Income Tax and High Environmental Taxesd05registerNoch keine Bewertungen

- Personal Tax in The European UnionDokument27 SeitenPersonal Tax in The European Unionmunchlax27Noch keine Bewertungen

- Taxation Trends in The European Union - 2011 - Booklet 13Dokument1 SeiteTaxation Trends in The European Union - 2011 - Booklet 13Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 174Dokument1 SeiteTaxation Trends in The European Union - 2012 174d05registerNoch keine Bewertungen

- What Changes Are Needed To Have A Serious Political Union in EuropeDokument6 SeitenWhat Changes Are Needed To Have A Serious Political Union in EuropeFranco PerottoNoch keine Bewertungen

- Eu 2015 Tax ReformsDokument132 SeitenEu 2015 Tax ReformsE. S.Noch keine Bewertungen

- Taxation Trends in The European Union - 2012 122Dokument1 SeiteTaxation Trends in The European Union - 2012 122d05registerNoch keine Bewertungen

- OECD Report on Growth-enhancing Tax Reform in FranceDokument14 SeitenOECD Report on Growth-enhancing Tax Reform in FranceSyed Muhammad Ali SadiqNoch keine Bewertungen

- Goverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαDokument4 SeitenGoverment at a glance OECD 2011 Κυβέρνηση με μια ματιά ΟΟΣΑ 2011 ΕλλάδαconstantinosNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 44Dokument1 SeiteTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNoch keine Bewertungen

- 1.1tax Burden Eu 2016Dokument12 Seiten1.1tax Burden Eu 2016vapevyNoch keine Bewertungen

- An Phríomh-Oifig StaidrimhDokument98 SeitenAn Phríomh-Oifig StaidrimhPolitico_ieNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 16Dokument1 SeiteTaxation Trends in The European Union - 2012 16d05registerNoch keine Bewertungen

- Taxation Trends Report 2017Dokument286 SeitenTaxation Trends Report 2017Piyush ChaturvediNoch keine Bewertungen

- VAT Romania 1aprilDokument2 SeitenVAT Romania 1aprilMaria Gabriela PopaNoch keine Bewertungen

- What Is The Economic Outlook For OECD Countries?: Angel GurríaDokument22 SeitenWhat Is The Economic Outlook For OECD Countries?: Angel GurríaJohn RotheNoch keine Bewertungen

- Arithmetic Is Absolute: Euro-Area Adjustment: PolicyDokument7 SeitenArithmetic Is Absolute: Euro-Area Adjustment: PolicyBruegelNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 42Dokument1 SeiteTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 30Dokument1 SeiteTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 45Dokument1 SeiteTaxation Trends in The European Union - 2012 45Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 44Dokument1 SeiteTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 37Dokument1 SeiteTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 40Dokument1 SeiteTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 41Dokument1 SeiteTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 40Dokument1 SeiteTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 35Dokument1 SeiteTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 38Dokument1 SeiteTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 27Dokument1 SeiteTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 39Dokument1 SeiteTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 37Dokument1 SeiteTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNoch keine Bewertungen

- Top Personal Income Tax Rates 1995-2012Dokument1 SeiteTop Personal Income Tax Rates 1995-2012Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 23Dokument1 SeiteTaxation Trends in The European Union - 2012 23Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 26Dokument1 SeiteTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNoch keine Bewertungen

- Revenue Structure by Level of GovernmentDokument1 SeiteRevenue Structure by Level of GovernmentDimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 10Dokument1 SeiteTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 29Dokument1 SeiteTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 25Dokument1 SeiteTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 8Dokument1 SeiteTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 7Dokument1 SeiteTaxation Trends in The European Union - 2012 7Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 6Dokument1 SeiteTaxation Trends in The European Union - 2012 6Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 5Dokument1 SeiteTaxation Trends in The European Union - 2012 5Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 3Dokument1 SeiteTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNoch keine Bewertungen

- Taxation Trends in The European Union - 2012 4Dokument1 SeiteTaxation Trends in The European Union - 2012 4Dimitris ArgyriouNoch keine Bewertungen

- Chapter 2 International Monetary System Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDokument5 SeitenChapter 2 International Monetary System Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsZainul Fikri ZulfikarNoch keine Bewertungen

- The Causes of Pak Rupee DevaluationDokument3 SeitenThe Causes of Pak Rupee DevaluationAsad Mehmood100% (3)

- FINS3616 Tutorials - Week 4, QuestionsDokument2 SeitenFINS3616 Tutorials - Week 4, QuestionsLena ZhengNoch keine Bewertungen

- Bicolandia Drug Corporation vs. Commissioner of Internal RevenueDokument2 SeitenBicolandia Drug Corporation vs. Commissioner of Internal RevenueWhere Did Macky GallegoNoch keine Bewertungen

- GE - McKinsey MatrixDokument27 SeitenGE - McKinsey Matrixvishal sharmaNoch keine Bewertungen

- Paper ID (B0205) : MBA/PGDBM (105) (S05) (O) (Sem. - 1) Managerial EconomicsDokument2 SeitenPaper ID (B0205) : MBA/PGDBM (105) (S05) (O) (Sem. - 1) Managerial EconomicsDeep NarayanNoch keine Bewertungen

- A Seminar Report On InflationDokument34 SeitenA Seminar Report On InflationKritika SharmaNoch keine Bewertungen

- Chapter 17 Solutions BKM Investments 9eDokument11 SeitenChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- VAT rules for hotels and restaurants under 36 charactersDokument2 SeitenVAT rules for hotels and restaurants under 36 charactersrnrbac67% (3)

- Chapter1 2Dokument39 SeitenChapter1 2Ahmed NegmNoch keine Bewertungen

- Inter Nation La FinanceDokument243 SeitenInter Nation La FinanceMpho Peloewtse Tau100% (1)

- Europa April2009europaDokument19 SeitenEuropa April2009europanishadjp9Noch keine Bewertungen

- Starbucks Exposed For Avoiding Millions in TaxDokument2 SeitenStarbucks Exposed For Avoiding Millions in Taxapi-302252730Noch keine Bewertungen

- DH 0227Dokument14 SeitenDH 0227The Delphos HeraldNoch keine Bewertungen

- Korean Labor LawDokument13 SeitenKorean Labor LawAnnabaNadyaNoch keine Bewertungen

- Rogoff (1985) ConservativeDokument5 SeitenRogoff (1985) Conservative92_883755689Noch keine Bewertungen

- ECO411Dokument6 SeitenECO411waheedahmedarainNoch keine Bewertungen

- Current Recession How Far, How DeepDokument3 SeitenCurrent Recession How Far, How DeepAMIT RADHA KRISHNA NIGAM100% (2)

- Brazil Fights A Real BattleDokument6 SeitenBrazil Fights A Real Battlehongyen10% (1)

- Monetary & Fiscal Policy in GeneralDokument129 SeitenMonetary & Fiscal Policy in GeneralNishant Neogy100% (1)

- Intro To Macroeconomics NotesDokument4 SeitenIntro To Macroeconomics NotesCristen AlvarezNoch keine Bewertungen

- Huaqiao 2010-03Dokument36 SeitenHuaqiao 2010-03will4workNoch keine Bewertungen

- The Estimation of The Public Investment Multiplier in RomaniaDokument5 SeitenThe Estimation of The Public Investment Multiplier in RomaniaBogduNoch keine Bewertungen

- Essay Outlines For CssDokument2 SeitenEssay Outlines For CssfaryalNoch keine Bewertungen

- Sample Computaion of Estate TaxDokument6 SeitenSample Computaion of Estate TaxlheyniiNoch keine Bewertungen

- Monetary Policy and Money SupplyDokument68 SeitenMonetary Policy and Money SupplypearlksrNoch keine Bewertungen