Beruflich Dokumente

Kultur Dokumente

UCPB Home Loan Application Form Editable

Hochgeladen von

stephanie baguyotOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

UCPB Home Loan Application Form Editable

Hochgeladen von

stephanie baguyotCopyright:

Verfügbare Formate

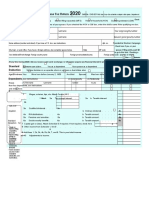

HOUSING LOAN APPLICATION

Source

Do you want a UCPB Credit Card?

Branch ______________________________

Others ______________________________

Yes

CIF Number

No

TO BE FILLED UP BY THE BORROWER

LOAN DETAILS

Date of Application

Amount Applied for

Equity Available

Mailing Instruction

Cash

Lot

Term

For delivery to the office

Purpose

Others _____________________

COLLATERAL DETAILS

Type of Property

TCT / CCT Number

Condominium Unit

House and Lot

Lot

Townhouse

Others _________________________

Address of Property

Area

TCT / CCT in the Name of

PERSONAL INFORMATION

Name of Borrower (Last Name, First Name, Middle Name)

Mothers Maiden Name

Birthplace

Birthday (mm-dd-yy)

Civil Status

Age

Nationality

Number of Dependents

Single

Present Home Address (No., Street, Village/Municipality/Barangay, City/Town/Province. If without house no., please provide sketch of residence.)

ZIP Code

Length of Stay

Permanent Home Address (No., Street, Village/Municipality/Barangay, City/Town/Province. If without house no., please provide sketch of residence.) ZIP Code

Length of Stay

Residence

TIN

SSS / GSIS Number

Mobile Phone Number

E-mail Address

Name of Present Employer / Business

Date of Employment / Incorporation

Position

Business Address

Industry

Business Telephone Number

Owned

Rented

Owned by Parents

Telephone Number

Others __________________________

Facsimile Number

SPOUSE / CO-BORROWER

Mothers Maiden Name

Name of Co-Borrower (Last Name, First Name, Middle Name)

Birthplace

Birthday (mm-dd-yy)

Civil Status

Age

Nationality

Number of Dependents

Single

Present Home Address (No., Street, Village/Municipality/Barangay, City/Town/Province. If without house no., please provide sketch of residence.)

ZIP Code

Length of Stay

Permanent Home Address (No., Street, Village/Municipality/Barangay, City/Town/Province. If without house no., please provide sketch of residence.) ZIP Code

Length of Stay

TIN

SSS / GSIS Number

Mobile Phone Number

E-mail Address

Name of Present Employer / Business

Date of Employment / Incorporation

Position

Business Address

Industry

Business Telephone Number

Residence

Rented

Owned

Owned by Parents

Telephone Number

Others __________________________

Facsimile Number

OTHER PERSONAL DETAILS

Highest Educational Attainment

Applicant

Spouse / Co-Borrower

School

Course

Year Graduated

DEPENDENTS

Name

UCPB Form No. 7-8021 Revised 9/2010

Age

Relationship

School / Employer

FINANCIAL DATA

P (In Thousands)

Applicant

Spouse / Co-Borrower

Total

Monthly Income

0.00

(A)

Monthly Expenses

0.00

(B)

Monthly Disposable Income (A-B)

P 0.00

Assets

Cash on Hand and in Bank

0.00

Real Estate

0.00

Car / Vehicles

0.00

Others (Please specify)

0.00

Total Assets

P 0.00

Liabilities

Loans

Others

0.00

0.00

Total Liabilities

Net Worth (Total Assets Less Total Liabilities)

P 0.00

P 0.00

P 0.00

0.00

DOCUMENTARY REQUIREMENTS

1.

Information on Personal Data and Income

a. Loan Application Form with ID of all Borrowers/Signatories

b. Marriage Contract

c. Bank Statements/Passbooks for the past year

d. Billing Statement

If Employed

a. Borrowers Income Tax Return (ITR) for the past year

b. Certificate of Employment and Salary

c. Payslip for 3 months

d. Photocopy of 1 government-issued ID (affix 3 specimen signatures

on the photocopy)

If Working Abroad

a. Consularized Special Power of Attorney

b. Consularized Certificate of Employment or Original COE with

employer e-mail address

c. Proof of Remittance

d. If seaman & OFW, POEA certified contract and Seamans Book

If in Business

a. ITR and Audited Financial Statement for the last 3 years

b. Certificate of Business Registration (SEC/DTI)

c.

d.

e.

f.

g.

Articles of Incorporation and By-Laws

Business background/ company profile

List of major suppliers and customers (indicate Telephone

Number and Contact Person)

Bank Statement (last 6 months)

Photocopy of 1 government-issued ID (Signatories) (affix 3 specimen

signatures on the photocopy)

2.

Information on Collateral Property

a. Photocopy of the Title (CCT / TCT)

b. Certified lot plan and location/vicinity map

c. Tax Declaration / Tax Receipts

3.

If Loan is for Construction/Renovation

a. Building Plans and Specifications

b. Bill of Materials

4.

If Loan is for Refinancing

a. Statement of Account from the Creditor/Mortgagor

A Non-Refundable Appraisal Fee shall be collected upon application

Res. Cert. ____________________________ Issued at ______________________________ Date __________________________ TIN________________________

ACR Number __________________________ Issued at ______________________________ Date __________________________ TIN________________________

Verification OR Number ___________________________ Date _____________________________

LETTER OF AUTHORIZATION AND WAIVER OF CONFIDENTIALITY

(In compliance with BSP Cir. No. 472 and Like Regulations)

To all Concerned Banks

In relation with my application with UCPB, I hereby authorize the said Bank to obtain information on my deposit accounts with you:

Bank / Branch _________________________

Deposit Type ______________________

Account Number

Bank / Branch _________________________

Deposit Type ______________________

Account Number

Bank / Branch _________________________

Deposit Type ______________________

Account Number

Bank / Branch _________________________

Deposit Type ______________________

Account Number

Bank / Branch _________________________

Deposit Type ______________________

Account Number

I hereby certify that all information contained in this Application and in all supporting documents submitted are true and correct and that the signatures

appearing thereon are genuine. In compliance with BSP Circular Nos. 472 (as amended by BSP Circular No. 549) and 589, I hereby authorize the Bank and/or

its representative, as my Attorney-in-Fact, to verify my financial capacity, creditworthiness, and all information herein, including previous credit transactions

with other institutions, to conduct random verifications with the Bureau of Internal Revenue to establish the authenticity of the Income Tax Returns and

accompanying Financial Statements/documents submitted by me in support of this Application and to report and make disclosures of any credit information

relative to me that are basically adverse in nature to credit information bureaus and organizations performing similar functions. I willingly and voluntarily, with

full knowledge of my rights under the law, waive my rights under any and all statutory and regulatory provisions governing confidentiality of information. I

hereby authorize the Bank to obtain such information as it may require concerning the statements made in this Application and that the sources to which it

may apply are authorized to provide any information relative to this Application.

I hereby hold free and harmless the Bank, its stockholders, directors, officers, employees and agents from any claims in relation to this waiver of confidentiality

and authority, herein granted.

Signed this _______ day of __________________________ 20 ____ at ________________________________.

______________________________________________

______________________________________________

Signature of Borrower

Signature of Spouse / Co-Borrower

ANNEX TO THE HOUSING LOAN APPLICATION FORM

(Applicable only to Multi-Purpose Loans)

Client Information File Number

_________________________

The undersigned BORROWER/S hereby certify that the additional information below to wit COLLATERAL:

Actual Occupants of the Property Constituting the Collateral

Collateral

(only those of legal age)

Relationship to Borrower/s

Property 1

TCT / CCT No. ___________________

1

2

3

4

5

6

7

8

9

10

Property 2

TCT / CCT No. ___________________

1

2

3

4

5

6

7

8

9

10

Property 3

TCT / CCT No. ___________________

1

2

3

4

5

6

7

8

9

10

and the documents submitted to support it, if any, are hereby true and correct and may be relied upon by the United Coconut Planters Bank (the Bank) for

the purpose of processing the undersigneds application for a Housing Loan.

Signed this _______ day of __________________________ 20 ____ at ________________________________.

______________________________________________

______________________________________________

Signature of Borrower

Signature of Spouse / Co-Borrower

Das könnte Ihnen auch gefallen

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDokument2 SeitenForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNoch keine Bewertungen

- W2 Matthew RussellDokument2 SeitenW2 Matthew Russellmatthewrussell661Noch keine Bewertungen

- 1481546265426Dokument3 Seiten1481546265426api-370784582Noch keine Bewertungen

- Cash FlowDokument1 SeiteCash Flowpawan_019Noch keine Bewertungen

- Sample Profit and Loss StatementDokument2 SeitenSample Profit and Loss StatementElisabet Halida WahyarsiNoch keine Bewertungen

- MV 441 EdlDokument4 SeitenMV 441 Edltuan nguyenNoch keine Bewertungen

- Name: in This Lesson, You Will Learn To:: Resources QuestionsDokument2 SeitenName: in This Lesson, You Will Learn To:: Resources QuestionsemscnpckNoch keine Bewertungen

- FD 941 Apr-Jun 2017 PDFDokument3 SeitenFD 941 Apr-Jun 2017 PDFScott WinklerNoch keine Bewertungen

- Schedule of Liabilities (SBA Form 2202)Dokument1 SeiteSchedule of Liabilities (SBA Form 2202)Vaé Ribera100% (1)

- 34 Wihh 504331 H 0714320240524151104202Dokument3 Seiten34 Wihh 504331 H 0714320240524151104202jamelmhunt22Noch keine Bewertungen

- Oji 2Dokument2 SeitenOji 2brent_barthanyNoch keine Bewertungen

- ResourceProxy PDFDokument3 SeitenResourceProxy PDFGuerline PhilistinNoch keine Bewertungen

- 2013 AgriSafe 990Dokument28 Seiten2013 AgriSafe 990AgriSafeNoch keine Bewertungen

- Shunzeric Farm LLCDokument2 SeitenShunzeric Farm LLCtcamon26Noch keine Bewertungen

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Dokument6 SeitenAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- P010 636211442428322820 T14385011dupD1 PDFDokument1 SeiteP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument2 SeitenU.S. Individual Income Tax Return: Filing Statusfelix angomasNoch keine Bewertungen

- Account Transcript - NICH - 103569728089Dokument2 SeitenAccount Transcript - NICH - 103569728089Ashley Marie NicholsNoch keine Bewertungen

- 1098T17Dokument2 Seiten1098T17RegrubdiupsNoch keine Bewertungen

- Form 1583Dokument2 SeitenForm 1583Eduardo LimaNoch keine Bewertungen

- 202212-Tax Return Transcript-DARA-104758594023Dokument7 Seiten202212-Tax Return Transcript-DARA-104758594023tironatirona455Noch keine Bewertungen

- Application To Rent or Lease (Fillable)Dokument2 SeitenApplication To Rent or Lease (Fillable)Victorino ValdezNoch keine Bewertungen

- 941 1st QTR 2010Dokument2 Seiten941 1st QTR 2010Larry BartonNoch keine Bewertungen

- Miami Dade County Real Estate 24 (TODOS)Dokument12 SeitenMiami Dade County Real Estate 24 (TODOS)OmarVargasNoch keine Bewertungen

- 8850 Wotc Tax FormDokument2 Seiten8850 Wotc Tax Formapi-127186411Noch keine Bewertungen

- Bill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)Dokument2 SeitenBill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)David SmithNoch keine Bewertungen

- CPR 2022 Tax ReturnDokument1 SeiteCPR 2022 Tax ReturnUmair MughalNoch keine Bewertungen

- QwertyDokument1 SeiteQwertyqwew1eNoch keine Bewertungen

- 2022 Uber 1099-NECDokument2 Seiten2022 Uber 1099-NECmwgageNoch keine Bewertungen

- Signature Card: 02/26/2017 Ross Roberts Individual Account 802 3342 Atlantic Ave BROOKLYN, NY 11208 04/15/1952Dokument1 SeiteSignature Card: 02/26/2017 Ross Roberts Individual Account 802 3342 Atlantic Ave BROOKLYN, NY 11208 04/15/1952sadik lawanNoch keine Bewertungen

- Sample InsuranceDokument4 SeitenSample InsuranceShashanth Kumar (CS - OMTP)Noch keine Bewertungen

- Tenant Ledger Beronica Leon (1085-11) Oak Glen Apartments: Date Description Charges Payments BalanceDokument2 SeitenTenant Ledger Beronica Leon (1085-11) Oak Glen Apartments: Date Description Charges Payments BalanceMark Mitch MitschNoch keine Bewertungen

- Zax11 Stockbridge Ga 9061Dokument4 SeitenZax11 Stockbridge Ga 9061Frank ValenzuelaNoch keine Bewertungen

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDokument1 SeiteMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNoch keine Bewertungen

- ShowDokument2 SeitenShowBrianna Jean-BaptisteNoch keine Bewertungen

- Annual Income Tax Return: BrianDokument4 SeitenAnnual Income Tax Return: BrianChristine ViernesNoch keine Bewertungen

- Lease: Address: 3860 Crenshaw BLVD #201 Los Angeles, CA 90008Dokument40 SeitenLease: Address: 3860 Crenshaw BLVD #201 Los Angeles, CA 90008Julian CuellarNoch keine Bewertungen

- Illinois Articles of OrganizationDokument2 SeitenIllinois Articles of OrganizationhowtoformanllcNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNoch keine Bewertungen

- Changed Circumstance Detail Form: Melissa Marie JonesDokument11 SeitenChanged Circumstance Detail Form: Melissa Marie JonesMelissa JonesNoch keine Bewertungen

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Dokument19 SeitenMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranNoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDokument6 SeitenEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterBobbyNoch keine Bewertungen

- State of Georgia G-4 PDFDokument2 SeitenState of Georgia G-4 PDFJames BoyerNoch keine Bewertungen

- Employee Paystub EditedDokument1 SeiteEmployee Paystub EditedSandra ChrisNoch keine Bewertungen

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDokument1 SeiteStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNoch keine Bewertungen

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNoch keine Bewertungen

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyDokument3 SeitenMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenNoch keine Bewertungen

- Enrollment PackageDokument11 SeitenEnrollment PackageJose EspinozaNoch keine Bewertungen

- EIN Confirmation Letter Fitzpatrick LLCDokument2 SeitenEIN Confirmation Letter Fitzpatrick LLCJhonel PauloNoch keine Bewertungen

- ResponseDokument48 SeitenResponseAlfred ReynoldsNoch keine Bewertungen

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDokument42 Seiten2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Rent Ledger PDFDokument1 SeiteRent Ledger PDFJahziel KwonNoch keine Bewertungen

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDokument11 SeitenAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidNoch keine Bewertungen

- Lay-Off Termination LetterDokument1 SeiteLay-Off Termination LetterArtee ShresthaNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return: Filing StatuspyatetskyNoch keine Bewertungen

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Dokument2 SeitenFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNoch keine Bewertungen

- 2013 - Form 990Dokument30 Seiten2013 - Form 990Fred MednickNoch keine Bewertungen

- 200mah Smart watch-TCT211224M138 - 海兰 - 401727 - MSDSDokument8 Seiten200mah Smart watch-TCT211224M138 - 海兰 - 401727 - MSDSLee PeterNoch keine Bewertungen

- REG1 RegistrationDokument7 SeitenREG1 RegistrationMohammed HussainNoch keine Bewertungen

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionVon EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNoch keine Bewertungen

- Smfi Aug 1-15, 2016Dokument152 SeitenSmfi Aug 1-15, 2016stephanie baguyotNoch keine Bewertungen

- My Grand Father Claudio QDokument1 SeiteMy Grand Father Claudio Qstephanie baguyotNoch keine Bewertungen

- My Grand Father Claudio QDokument1 SeiteMy Grand Father Claudio Qstephanie baguyotNoch keine Bewertungen

- My Grand Father Claudio QDokument1 SeiteMy Grand Father Claudio Qstephanie baguyotNoch keine Bewertungen

- Client PasswordDokument1 SeiteClient Passwordstephanie baguyotNoch keine Bewertungen

- Medical EbooksDokument60 SeitenMedical EbooksKharis Mustofa100% (2)

- Medical EbooksDokument60 SeitenMedical EbooksKharis Mustofa100% (2)

- Congestive Heart FailureDokument56 SeitenCongestive Heart Failurestephanie baguyotNoch keine Bewertungen

- Medical EbooksDokument60 SeitenMedical EbooksKharis Mustofa100% (2)

- OrigDokument1 SeiteOrigstephanie baguyotNoch keine Bewertungen

- Day 1Dokument1 SeiteDay 1stephanie baguyotNoch keine Bewertungen

- Hansa - 2015.12Dokument100 SeitenHansa - 2015.12Alessandro CastagnaNoch keine Bewertungen

- Dharavi Redevelopment ProjectDokument1 SeiteDharavi Redevelopment ProjectDanish MallickNoch keine Bewertungen

- Dela Cruz - Cloud Computing-1Dokument4 SeitenDela Cruz - Cloud Computing-1Charles TuazonNoch keine Bewertungen

- Bus - Ethics - q3 - Mod3 - Code of Ethics in Business - FinalDokument29 SeitenBus - Ethics - q3 - Mod3 - Code of Ethics in Business - FinalJessebel Dano Anthony100% (16)

- Heermm ToolDokument18 SeitenHeermm ToolJuan PabloNoch keine Bewertungen

- Material Master - ConfigurationDokument57 SeitenMaterial Master - ConfigurationRahul Aryan100% (1)

- Internal Rate of Return, DCF, NPVDokument4 SeitenInternal Rate of Return, DCF, NPVMihir AsherNoch keine Bewertungen

- SCM Group D Ca 1Dokument32 SeitenSCM Group D Ca 1shubo palitNoch keine Bewertungen

- AssignmentDokument2 SeitenAssignmentYahya TariqNoch keine Bewertungen

- Ec Bed Linen CaseDokument8 SeitenEc Bed Linen CaseAditya PandeyNoch keine Bewertungen

- LabRev Cases 1 and NCMBDokument14 SeitenLabRev Cases 1 and NCMBLila FowlerNoch keine Bewertungen

- AccoutingDokument22 SeitenAccoutingmeisi anastasiaNoch keine Bewertungen

- Oromia Regional Government - Phase II Expectations and WorkplanDokument4 SeitenOromia Regional Government - Phase II Expectations and WorkplanÁkosSzabóNoch keine Bewertungen

- Water Jet Machining and Abrasive Water Jet MachiningDokument6 SeitenWater Jet Machining and Abrasive Water Jet Machiningsree1810Noch keine Bewertungen

- P.P On Dairy (4 Lacs)Dokument6 SeitenP.P On Dairy (4 Lacs)Shyamal DuttaNoch keine Bewertungen

- Post-Covid-19 Education and Education Technology Solutionism': A Seller's MarketDokument16 SeitenPost-Covid-19 Education and Education Technology Solutionism': A Seller's MarketZeeshan KhanNoch keine Bewertungen

- China Wu Yi QuestionnaireDokument3 SeitenChina Wu Yi Questionnairerameez rajaNoch keine Bewertungen

- Matrix FAQDokument5 SeitenMatrix FAQSafix YazidNoch keine Bewertungen

- Cargo Agent Presentation For GST March 2018Dokument13 SeitenCargo Agent Presentation For GST March 2018rishi pandeyNoch keine Bewertungen

- Sticky Branding Work BookDokument38 SeitenSticky Branding Work BookChjk PinkNoch keine Bewertungen

- Pan-Os 7.1 Admin GuideDokument932 SeitenPan-Os 7.1 Admin GuideneoaltNoch keine Bewertungen

- 2016 CFA Level 1 Mock Exam Morning - Answers PDFDokument45 Seiten2016 CFA Level 1 Mock Exam Morning - Answers PDFIkimasukaNoch keine Bewertungen

- Dadra Nagar Haveli TPSDokument54 SeitenDadra Nagar Haveli TPSNiirrav MakwanaNoch keine Bewertungen

- Contract Drafting BrochureDokument10 SeitenContract Drafting BrochureUtkarshini SinhaNoch keine Bewertungen

- 2024 Appropriation Bill - UpdatedDokument15 Seiten2024 Appropriation Bill - UpdatedifaloresimeonNoch keine Bewertungen

- ABRERA Activity 2 - Transaction AnalysisDokument2 SeitenABRERA Activity 2 - Transaction AnalysisZoram AbreraNoch keine Bewertungen

- Mba08226 - Sangeethanair - Roadmap - Sangeetha NairDokument1 SeiteMba08226 - Sangeethanair - Roadmap - Sangeetha NairKAMAL NAYANNoch keine Bewertungen

- Teaching PowerPoint Slides - Chapter 1Dokument24 SeitenTeaching PowerPoint Slides - Chapter 1famin87Noch keine Bewertungen

- BusplanDokument38 SeitenBusplanCrissa MorescaNoch keine Bewertungen

- Steps in Production Planning and ControlDokument2 SeitenSteps in Production Planning and ControlImran Ali67% (3)