Beruflich Dokumente

Kultur Dokumente

The Identification and Evaluation On The Risk Sources of Grid Electricity Purchasing

Hochgeladen von

SEP-PublisherOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Identification and Evaluation On The Risk Sources of Grid Electricity Purchasing

Hochgeladen von

SEP-PublisherCopyright:

Verfügbare Formate

InternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013www.ijesci.

org

TheIdentificationandEvaluationontheRisk

SourcesofGridElectricityPurchasing

Tian.Xia*1,Lingfang.Zhou2,Wei.Xiong3,Bing.Wang4,YongxiuHe4

*1,2,3,4,5

SchoolofEconomicsandManagement,NorthChinaElectricPowerUniversity,Beijing,102206,China

GansuElectricPowerCorporation,Lanzhou,730050,China

*1

850910428@qq.com;2zhou1989lingfang@163.com;3xw471559631@sina.com;4bingw1130@126.com;

52694886960@qq.com

*1

Abstract

ongridpowerpurchaseriskanalysis.However,these

studies and analyses mainly put emphasis on an

aspectorapartoftheriskanalysis,anditisdifficultto

effectivelyidentifyallkindsofcomplicatedriskinthe

processoftheGridCompanytobuyelectricity.Thus,

thispapermakesapraticalandsignificantevaluation

on classidied purchase risk source Grid Company

confronts.

This paper analyzes various types of risk sources in the

processofGridCompanytopurchaseelectricity,inreaction

to which comprehensive evaluation system has been

developedinthispaper.Basedoncombinationmethodand

fuzzycomprehensiveevaluationmethod,theGridCompany

risk empowerment evaluation indexes and the

comprehensive evaluation method have been established,

aiming at providing decisionmaking support for the risk

study on purchasing power of Grid Company and

implementationofcomprehensiveevaluation.

Risk Sources Identification Of Electricity

Purchasing

Keywords

The risk the State Grid Companyconfront when

purchasing electricity comes from different markets

participants. For the convenience of effective

managementofGridCompanysoperation,riskcanbe

classified according to the sources of risk. After the

power market of the supply side preliminarily forms,

themainrisktheStateGridCompany(SGC)facescan

usually be divided into: risk from demand side,

supplyside,orSGCandthegovernmentside.

PowerPurchasingRisk;RiskIdentification;RiskEvaluation

Introduction

With the further development of Chinas power

market reform, the traditional vertically integrated

monopoly is completely broken; and the Grid

Companybecomesaneconomicentityindependentof

thepowergenerationcompany,andconfrontsdiverse

riskderivedfromdifferentmarketparticipants.Dueto

thecomplicatedfactorsthatbringriskintheelectricity

purchasing and selling process, such as the

fluctuationsonpolicyresultingfromelectricitymarket

reform, on both the demand and supply side, as well

asonthetradingrule,andchangesonthefeedintariff,

the operation and management system, and power

technologicalinnovationandotherpolicy,therefore,it

isnecessarytoidentifyandevaluatetherisksources.

RiskfromDemandSide

The SGC buy electricity from power suppliers, and

thenselltopowerusers.Riskfromdemandsideisdue

totheuncertaintythatSGCfacesinthesellingprocess

to customers, including risk of conventional load

forecasting error, risk of direct power purchase of

heavy buyers, risk of the selfprovided power plant,

riskofalternativeenergy,etc.

1)RiskofConventionalLoadForecastingError

Most of studies on the risk management of the Grid

Company focus the risks that the Grid Corporation

may face in electricity market environment. For

example, papers[12] respectively study risk from

large consumers direct purchase of electricity and

optionstrading.Therearemanyresearchmethodsfor

risk identification. Papers [34] respectively research

theuseofportfoliotheoryandriskprofitsconstraints

The SGC usually makes electricity purchasing

strategy according to the load forecasting error in

theaspectwouldbringmarketriskforSGC.Ifthe

forecast is too low, it could lead to load shedding

or reduction of the benefits from selling electricity

totheadjacentareas;otherwise,apartofthepower

boughtbytheSGCcantsendout,ortheyhaveto

217

www.ijesci.orgInternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013

among provinces, which leads to the instability of

powerandfrequencyinthegenerationprocess.In

addition, the purchase amount of electricity is

limited , which leads to the lowquality and

uncertaintyofpower.

pay liquidated damages to the producer, which

willalsoaffectSGCsincome.

2)Risk of Direct Power Purchase Ofheavy Buyers

fromtheGenerationCompanies

The direct purchase of electricity conduct will

change the operation mode of current power

market; and the SGC will also generate electricity

purchasing cost, change the income from selling

electricityandentrusttransmissionservice,andetc.

The combined effect of the last two is the main

reason for the changes in the SGC income. If the

distribution electricity price of direct purchase is

higher than the original enterprise profit space,

then the direct purchase can increase the SGCs

overalloperatingprofit;otherwise,itwilldecrease.

2)RiskofFluctuationofElectricPriceInProvince

The electric power purchased by the grid mainly

contains thermal power, hydropower, nuclear

power and new energy power. The power

generation technology, operating cost, tax policy

and policy of the power industry may change,

resulting in the fluctuation of online price. This

may directly influence the purchase price of the

SGC, thus increasing the buying cost of electricity

andriskofthetrade.

3) Risk of Crossdistrict and Crossprovince

Supply

3)RiskoftheSelfprovidedPowerPlant

The investment of selfprovided power plant may

directly result in the decrease in power sold to

heavy buyers enterprise that has selfprovided

power plant, even as the tide of zero. Namely,

the power supply circuit construction for the

enterprise becomes sunk cost without economic

benefits,andthepowersalequantityiszerounable

togetmainbusinessincomefromtheseenterprises.

To achieve the optimize configuration of the

electric market resources, and to pursue the

maximum profit of the grid through trade and

cooperation, the crossdistrict and crossprovince

trade appear. However, the stability of power in

otherprovinces,thetransmissionofelectricpower

and the credibility of generating company from

other provinces could incur some risk. Increasing

the amount of power purchased from other

provinces means the rise of longdistance power

transmission, the increase of the transmission line

load, of network loss, which may urge the grid to

buy more power from others to fill the network

loss and the power demand, and increase the

buyingcostofpoweratthesametime.

4)RiskofAlternativeEnergy

Risk of alternative energy is the change of

electricity purchasing price caused by alternative

energypricechanges,suchasoil,coalandnatural

gas prices. On one hand, the lower or higher of

alternative energy prices will change the SGCs

powerpurchasedemandaccordingly;ontheother

hand, the rise in oil prices leads to the increasing

electric car demand that causes the rise of power

demand. These two aspects make the SGC

purchasing power fluctuated, and increase the

difficulty of load forecasting and the operational

risk.

RiskfromSGCSide

Whenthepowertradecontinues,theriskbothexiston

the supply and demand side, and the congestion risk

of transmission, the technology risk brought by the

networkstability,theriskoftrademanagementcould

alsoinfluencetheresult.

RiskfromPowerSupplySide

1)RiskoftheTransmissionLineCongestion

SGCmayfacetheriskfrompowersupplysideinthe

processofbuyingpowerfromthegenerators,suchas

thepowersupplysituationintheprovince,fluctuation

ofelectricprice,crossprovinceandcrossdistricttrade,

etc.

The transmission line congestion means that the

security and stability of the network may be

threaten by the limitation of the transmission

capacity, because the line capacity could not meet

thedemandofallthetrades,thuscausingthatthe

power trade could not develop smoothly as

planned, and may influence the SGCs profit.

Besides,thiscongestionmayinfluencethesecurity

ofthegridtoacertaindegree.

1)RiskofPowerSupplyinProvince

Sincetheconditionofpowerdiffersmuchfromone

province to another in our nation, the power

structure and the installed capacity are different

218

InternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013www.ijesci.org

2)RiskoftheNetworkStabilityTechnology

ThroughtheidentificationoftheriskSGCfaceswhen

purchasingpower,itcanbefoundthattheriskcomes

from four sides: risk from demand side, supply side,

SGC and the government. Based on the principles of

independence, feasibility and representative, this

paper establishes the evaluation index system which

contains four primary indexes and fifteen secondary

indexes,shownasfigure1.

Because of the peak shaving constraints and the

transmission technology constraints, the overload

oftheline,thedamageoftheinstrumentsandthe

fluctuationoftheamountemerge,whichmaylead

to the power failure or power rationing in some

districts, resulting in economic and credibility loss

to SGC. Inaddition, theaddition of the renewable

energy to the grid and policy of energy saving

could all affect the technological stability of peak

shavingofthegridandthusbringingthreattothe

grid.

FIGURE1COMPREHENSIVEEVALUATIONSYSTEMOFTHESGCPOWER

PURCHASINGRISK

3)RiskofTradeManagement

Riskoftrademanagementmeansthattheincrease

of SGC power purchasing risk caused by the

auction mechanism , settlement rules, generators

bidding strategies, process management of the

contract and electricity purchasing process

managementintheelectricitymarket.Thesefactors

involvingineachstepoftheelectricitytransaction,

coulddirectlyorindirectlyinfluencetheelectricity

purchasing strategy and plan of the SGC through

theaffectmadeonthebehaviorsofgenerators,grid

andcustomers.

RiskfromGovernmentSide

The SGC Electricity

Assessment

TheSGCshouldabidebytheregulationonelectricity

price while buying electricity, otherwise the stability

and security of the SGC will be threatened if the

government changes the established policy or the

electricindustrylaw.

In order to effectively avoid the risk of purchasing

electricity p, a scientific and perfect risk assessment

system should be set upto figure out the behavior of

market participants in time, and provide strong

supportfortheSGC.

InChina,theonlineandsellingpriceoftheelectricity

are influenced significantly by the policy of the

government, which leads to the unfairness between

buyers and generators from different provinces.

However, the electric market resources are allocated

according to the market signal, and the amount of

electricity will be tilted to the provinces with higher

selling price and bearing ability of the price, causing

that these provinces, even the provinces which sell

power could only buy little power or even no power

during some periods, especially the peak time, and

also leading to the risk of controlling policy from the

government. In addition, the purchasing electricity

policies such as the electric price regulation and

interconnection regulation will influence the normal

operationoftheSGCtosomeextent.

Purchasing

Risk

ASingleRiskSourceAssessment

The SGCs purchasing electricity behavior is affected

bytheuncertaintyofriskevent,sothelikelihood,time

and consequence of the risk should be taken into

consideration when evaluation is made. Through the

imitation of LEC engineering risk analysis method,

thispaperputsforwardtheLTCevaluationmethodof

a single risksource of electricity purchasing, whereL

is the likelihood of a hazardous event occurring, T

represents the continued time, and C indicates the

consequences, thus the electricity purchasing risk D

canbeexpressedasthefollowingformula(1):

D L T C (1)

ThescorevaluesofL,TandCareshownintable1:

219

www.ijesci.orgInternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013

TABLE1THESCORESTANDARDOFSGCPOWERPURCHASERISK

Ratingobjects

Scores

10

7

5

2

0.1

10

7

5

2

0.5

10

7

5

2

0.1

scoring method to the secondary index based on the

LTC risk score standards, then s the fuzzy

comprehensiveevaluationmethodisinuse.

Degreeofrisk

Completelycanbeexpected

Quiteoften

Notoften,butpossible

Completelyunexpected,lesslikely

Highlyunlikely

Existentforever

Longduration

Lastafewmonths

shorter

Lastafewdays

Hugelosses,irreversible

Largelosses,highcostofrecovery

Ordinaryconsequences,canbe

restored

Smallerlosses,lowrecoverycost

Verysmalllosses

TABLE3THERESULTSOFSGCPOWERPURCHASINGRISKEVALUATION

Elements

Riskofconventional

loadforecasting

error d11

Riskofdirectpower

purchaseoflarge

usersd12

Riskoftheself

providedpower

plantd13

Riskofalternative

energy d14

Riskofpower

supplyinprovince

d21

Riskoffluctuation

ofthermalpower

priceinprovince d22

Riskoffluctuation

ofhydropower

priceinprovince d23

Riskoffluctuation

ofnuclearpower

priceinprovince d24

Riskoffluctuation

ofnewenergy

powerpricein

province d25

Riskofcrossdistrict

andcrossprovince

supplyd26

Riskofthe

transmissionline

congestion d31

Riskofthenetwork

stabilitytechnology

d32

Riskoftrade

management d33

Riskofelectricprice

regulationchange

d41

Riskof

interconnection

regulationchange

d42

TheIndexWeightEmpowermentMethod

Through referrence to the research of scholars [5] on

weighting methods, combination with the feature of

purchasing electricity, combined empowerment

approach is employed in this paper, in which two

methods to empower different indicator levels are

utilized.

Since the participants in electricity market influence

the degree of risk the SGC confronts in the course of

purchasing,theriskavoidingpolicyputemphasison

different point, therefore, the importance of risk

sources, the avoidance possibility and cost should be

considered while the first grade indexes are

empowered usingsequence relations method, namely

if the importance of the evaluation index is set to be

xn1 and xn as ratio wn1/wn, then other indicators

weightiscalculated,andtheweightofindextcanbe

calculatedasfollows:

w

(1

n 2

s n

rs )

(2)

Otherindicatorsweightsare:

wn-1 rn-1wn (3)

iuseEigenvaluemethodisapplicabletothesecondary

index weight empowerment, namely throughindexes

pairwisecomparisontofindoutthejudgmentmatrix

E, thus the characteristics of the root of E

corresponding to the largest eigenvalue are the

weightsofindicators.

evaluationresults

Norm

Small

Large

al

Very

small

12

10

10

10

11

Firstly, establish the factors set U={u1,u2,un} and

judgesetV={v1,v2,vm},calculatetheweightsetA,

then making the evaluation according to the formula

(4)aftergettingexpertgradingevaluationmatrixR.

r11 r12

r

r

B (b1 , b2 ,bm ) A R ( a1 , a2 , an ) 21 22

rn1 rn 2

ThePowerPurchaseRiskComprehensiveEvaluation

Since the risk sources of the SGC purchasing power

are various and complex, this paper uses expert

220

Very

large

r1m

r2 m

rnm

(4)

InternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013www.ijesci.org

where bj is the membership of evaluation object

belongingtothejthcommentVj,andBisafuzzyset.

2)TheSecondaryIndexWeightEmpowerment

Through judgment, 15 secondary indicators

judgmentmatrixcanbeobtained,andtheweightis

showninTable4bytheeigenvaluemethod.

Analysis of an Example

Combined with risk evaluation system on electricity

purchasing, this paper takes M provincial SGC for

example to carry out an evaluation based on LTC

scoring method and fuzzy comprehensive evaluation

method.

TABLE4INDEXWEIGHTOFTHESGCPOWERPURCHASINGRISK

EVALUATIONSYSTEM

Serial

number

Content

Weightvector

Indexweightof

theriskfrom

demandside

A1={0.27940.2135,0.1839,0.3232}

Indexweightof

theriskfrom

supplyside

A2={0.1365,0.2203,0.1559,0.2160,0.1952,0

.0761}

Indexweightof

theriskfrom

SGCside

A3={0.3216,0.2680,0.4103}

Indexweightof

theriskfrom

governmentside

A4={0.6,0.4}

BasicData

M Province is located in Chinas western region with

abundant wind power resources and normal average

reserves of coal and natural gas, in which the

industrialdevelopmentisrapid,especiallytheenergy

intensiveindustries.

This paper uses the LTC expert scoring method, and

then classifies the resultsof20 experts scoringshown

in Table 3 according to the risk range, and the

classificationcriteriaareshowninTable2.

ComprehensiveEvaluationProcess

Through using fuzzy statistics and the dimensionless

processing to the data of SGC power purchasing risk

score, fuzzy evaluation matrix of the primary index

canbeacquired:

TABLE2THECLASSIFICATIONCRITERIAOFSGCPOWERPURCHASING

RESULT

Riskdegree

Very

large

Large

Normal

Small

Very

small

Classification

interval

[0.35,1]

[0.15,0.35)

[0.1,0.15)

[0.02,0.1)

[0,0.02)

0 0.05 0.1 0.4 0.45

0.05 0.1 0.15 0.6 0.1

R1

0 0.35 0.15 0.45 0.05

0.1

0

0.4 0.5 (6)

0

0.05 0.15 0.1 0.45 0.25

0.05 0.15 0.3 0.2 0.3

0.1 0.2 0.05 0.5 0.15

R2

0.1 0.1 0 0.35 0.45

0 0.05 0.1 0.5 0.35

0.05 0.05 0.15 0.35 0.4 (7)

Indexweightcalculation

1)ThePrimaryIndexWeightEmpowerment

Comprehensive consideration is made on the

influential degree and avoidance possibility of the

SGCpowerpurchasingrisk,itcanbeobservedthat

the relatively important relationships of indices as

Risk from the SGC side d3 Risk fromis higher

than that from the demand side d1 followed by

Risk from the supply side d2 Risk and that from

the government side d4. Then the importance

degree according to the value reference is

quantified, that is the order is from up to down

based on the importance: Risk from the SGC side,

Risk from the demand side (1.2), Risk from the

supply side (1.2), Risk from the government side

(1.2), thus the primary index weight of evaluation

indexsystemis:

0.05 0.2 0.1 0.35 0.3

0 0.05 0.55 0.4

R3 0

0.05 0.1 0.2 0.4 0.25

0.15 0.35 0.1 0.35 0.05

R4

0.15 0.3 0.2 0.25 0.1 (9)

This article selects the weighted average operator on

the demand side risk, and gets comprehensive

evaluationvectorofd1asB1:

A {d1, d2 , d3 , d4} {0.2683,0.2235,0.3219,0.1863} (5)

(8)

221

www.ijesci.orgInternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013

0.05 0.1 0.4 0.45

0

0.05 0.1 0.15 0.6 0.1

0.2135,0.1839,0.3232)

B1 A1 R1 (0.2794

0

0.35 0.15 0.45 0.05

0.1

0

0.4 0.5

0

(0.0107,0.132,0.0875,0.4519,0.3179)

(10)

1)AnalysisAccordingtothePrincipleofMaximum

MembershipDegree

Similarly, other evaluation indexes fuzzy evaluation

valuescanbecalculatedas

B2 A2 R2 , (11)

According to the principle of maximum

membershipdegree,0.4012isthemaximumamong

the five grades of membership. Therefore, the

comprehensive membership degree value of the

Grid Company power purchasing risk is 0.4012,

andtheevaluationvalueislessrisky,indicating

that the management of power purchasing risk is

well,andtheriskdegreeisverysmall.

B3 A3 R3 , (12)

B 4 A4 R 4 , (13)

So, the fuzzy comprehensive evaluation matrix R of

thefirstlayeris:

R ( B1 , B2 , B3 , B 4 )T (14)

2) Analysis with Converting the Evaluation

ResultstoScores

Thus comprehensive evaluation vector B of M

ProvincialSGCpowerpurchasingriskis:

Assume evaluation sets V= {very good, good,

normal, bad, very bad} = {100, 80, 60, 40, 0}. The

scoreofeachindexis:

B A R (0.0557,0.1576,0.1171,0.4012,0.2683) (15)

AnalysisoftheEvaluationResults

d1 0.0107 100 0.132 80 0.0875 60 0.4519 40 0.3179 0 34.9569 (16)

d2 0.0588 100 0.1199 80 0.1185 60 0.3833 40 0.3196 0 37.9113 (17)

d3 0.0366 100 0.1054 80 0.1276 60 0.4241 40 0.3063 0 36.711 (18)

d 4 0.15 100 0.33 80 0.14 60 0.31 40 0.07 0 62.2 (19)

d 0.0557 100 0.1576 80 0.1171 60 0.4012 40 0.2683 0 41.2574 (20)

Conclusions

So, the primary index can be ordered

as d 4 d 2 d 3 d 2 , in which the risk from

Based on the identification of the Grid Company

purchasing risk sources, this paper establishes

comprehensive evaluation system of electricity

purchasingrisk,takingMProvincialGridCompanyas

an example to analyze its electricity purchasing

situation and risk source sorting, and meanwhile, it

provides reference for policymakers to make

purchasing power risk identification, control and

avoidance. In view of all kinds of risk from different

marketparticipators,itisfeasibletoreducethesizeof

riskbymeansofSGCsevasiveaction,riskmitigation

action and the action of remaining risk and risk

transfer,whichhasgreatsignificanceontheeconomic

andsustainabledevelopmentofGridCompany.

government side is the largest, indicating that the

government side has themost farreaching impact on

GridCompany,followedbytheriskfromsupplyside,

theriskfromGridCorporationsideanddemandside

which are minimum. Therefore, the Grid Company

should consider the risk degree from demand side,

supply side, SGC side and government side when

makingriskaversionpolicy.

On the whole, the electricity purchasing risk score of

M Provincial Grid Company is 41.2574, very small,

revealingthattheriskfromGridCompanyislimited,

thus the Grid Company should be focused on

avoidance of the risk from the government side and

supply side, so as to further reduce the electricity

purchasingrisk.

222

ACKNOWLEDGMENTS

The work described in this paper was funded by the

National Natural Science Foundation of China (Grant

InternationalJournalofEnergyScience(IJES)Volume3Issue3,June2013www.ijesci.org

No.71273089)andBeijingNaturalScienceFoundation

ofChina(GrantNo.9122022).

Shi Quansheng. Risk Analysis of Purchasing Electricity to

Grid Company Based on Assert Combination Theory[J].

PowerSystemTechnology,2010,23(3):6871.

REFERENCES

WANG Jinfeng, LI Yuzeng, ZHANG Shaohua. Effects of

HE Yongxiu, et al. Elecric comprehensive evaluation

options trade on purchasing portfolio for load serving

method and application [M].Beijing: China Electric

entities[J]. Automation of Electric Power Systems, 2008,

PowerPress,2011:3575.

32(3):3032.

Liu Chunhui, Liu Min. Study on risk management for

Zhang Caiqing, Huang ying. Risk Assessment for Power

powergridcompanyconsideringlargeconsumersdirect

Grid Electricity Purchasing Based on PaR Constraint[J].

electricity purchasing in electricity markets[J]. Power

Central

China

Electric

Power,2008,32:137138.

SystemProtectionandControl,2011,39(12):94101.

223

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- TOR 5 MW Solar Project PDFDokument106 SeitenTOR 5 MW Solar Project PDFSufi Shah Hamid Jalali100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Methanol: The Basic Chemical and Energy Feedstock of The FutureDokument699 SeitenMethanol: The Basic Chemical and Energy Feedstock of The FutureMatías SantosNoch keine Bewertungen

- Mill's Critique of Bentham's UtilitarianismDokument9 SeitenMill's Critique of Bentham's UtilitarianismSEP-PublisherNoch keine Bewertungen

- 2021 Grade 7 NS Term 3 Exemplar TestDokument10 Seiten2021 Grade 7 NS Term 3 Exemplar TestSamuel Thembinkosi HermansNoch keine Bewertungen

- Experimental Investigation of Friction Coefficient and Wear Rate of Stainless Steel 202 Sliding Against Smooth and Rough Stainless Steel 304 Couter-FacesDokument8 SeitenExperimental Investigation of Friction Coefficient and Wear Rate of Stainless Steel 202 Sliding Against Smooth and Rough Stainless Steel 304 Couter-FacesSEP-PublisherNoch keine Bewertungen

- Influence of Aluminum Oxide Nanofibers Reinforcing Polyethylene Coating On The Abrasive WearDokument13 SeitenInfluence of Aluminum Oxide Nanofibers Reinforcing Polyethylene Coating On The Abrasive WearSEP-PublisherNoch keine Bewertungen

- Improving of Motor and Tractor's Reliability by The Use of Metalorganic Lubricant AdditivesDokument5 SeitenImproving of Motor and Tractor's Reliability by The Use of Metalorganic Lubricant AdditivesSEP-PublisherNoch keine Bewertungen

- Contact Characteristics of Metallic Materials in Conditions of Heavy Loading by Friction or by Electric CurrentDokument7 SeitenContact Characteristics of Metallic Materials in Conditions of Heavy Loading by Friction or by Electric CurrentSEP-PublisherNoch keine Bewertungen

- Effect of Slip Velocity On The Performance of A Magnetic Fluid Based Squeeze Film in Porous Rough Infinitely Long Parallel PlatesDokument11 SeitenEffect of Slip Velocity On The Performance of A Magnetic Fluid Based Squeeze Film in Porous Rough Infinitely Long Parallel PlatesSEP-PublisherNoch keine Bewertungen

- Microstructural Development in Friction Welded Aluminum Alloy With Different Alumina Specimen GeometriesDokument7 SeitenMicrostructural Development in Friction Welded Aluminum Alloy With Different Alumina Specimen GeometriesSEP-PublisherNoch keine Bewertungen

- Microstructure and Wear Properties of Laser Clad NiCrBSi-MoS2 CoatingDokument5 SeitenMicrostructure and Wear Properties of Laser Clad NiCrBSi-MoS2 CoatingSEP-PublisherNoch keine Bewertungen

- Device For Checking The Surface Finish of Substrates by Tribometry MethodDokument5 SeitenDevice For Checking The Surface Finish of Substrates by Tribometry MethodSEP-PublisherNoch keine Bewertungen

- Reaction Between Polyol-Esters and Phosphate Esters in The Presence of Metal CarbidesDokument9 SeitenReaction Between Polyol-Esters and Phosphate Esters in The Presence of Metal CarbidesSEP-PublisherNoch keine Bewertungen

- A Tentative Study On The View of Marxist Philosophy of Human NatureDokument4 SeitenA Tentative Study On The View of Marxist Philosophy of Human NatureSEP-PublisherNoch keine Bewertungen

- FWR008Dokument5 SeitenFWR008sreejith2786Noch keine Bewertungen

- Enhancing Wear Resistance of En45 Spring Steel Using Cryogenic TreatmentDokument6 SeitenEnhancing Wear Resistance of En45 Spring Steel Using Cryogenic TreatmentSEP-PublisherNoch keine Bewertungen

- Isage: A Virtual Philosopher System For Learning Traditional Chinese PhilosophyDokument8 SeitenIsage: A Virtual Philosopher System For Learning Traditional Chinese PhilosophySEP-PublisherNoch keine Bewertungen

- Delightful: The Saturation Spirit Energy DistributionDokument4 SeitenDelightful: The Saturation Spirit Energy DistributionSEP-PublisherNoch keine Bewertungen

- Quantum Meditation: The Self-Spirit ProjectionDokument8 SeitenQuantum Meditation: The Self-Spirit ProjectionSEP-PublisherNoch keine Bewertungen

- Cold Mind: The Released Suffering StabilityDokument3 SeitenCold Mind: The Released Suffering StabilitySEP-PublisherNoch keine Bewertungen

- Mindfulness and Happiness: The Empirical FoundationDokument7 SeitenMindfulness and Happiness: The Empirical FoundationSEP-PublisherNoch keine Bewertungen

- Technological Mediation of Ontologies: The Need For Tools To Help Designers in Materializing EthicsDokument9 SeitenTechnological Mediation of Ontologies: The Need For Tools To Help Designers in Materializing EthicsSEP-PublisherNoch keine Bewertungen

- Metaphysics of AdvertisingDokument10 SeitenMetaphysics of AdvertisingSEP-PublisherNoch keine Bewertungen

- Architectural Images in Buddhist Scriptures, Buddhism Truth and Oriental Spirit WorldDokument5 SeitenArchitectural Images in Buddhist Scriptures, Buddhism Truth and Oriental Spirit WorldSEP-PublisherNoch keine Bewertungen

- Enhanced Causation For DesignDokument14 SeitenEnhanced Causation For DesignSEP-PublisherNoch keine Bewertungen

- Social Conflicts in Virtual Reality of Computer GamesDokument5 SeitenSocial Conflicts in Virtual Reality of Computer GamesSEP-PublisherNoch keine Bewertungen

- Legal Distinctions Between Clinical Research and Clinical Investigation:Lessons From A Professional Misconduct TrialDokument4 SeitenLegal Distinctions Between Clinical Research and Clinical Investigation:Lessons From A Professional Misconduct TrialSEP-PublisherNoch keine Bewertungen

- Ontology-Based Testing System For Evaluation of Student's KnowledgeDokument8 SeitenOntology-Based Testing System For Evaluation of Student's KnowledgeSEP-PublisherNoch keine Bewertungen

- Damage Structures Modal Analysis Virtual Flexibility Matrix (VFM) IdentificationDokument10 SeitenDamage Structures Modal Analysis Virtual Flexibility Matrix (VFM) IdentificationSEP-PublisherNoch keine Bewertungen

- Computational Fluid Dynamics Based Design of Sump of A Hydraulic Pumping System-CFD Based Design of SumpDokument6 SeitenComputational Fluid Dynamics Based Design of Sump of A Hydraulic Pumping System-CFD Based Design of SumpSEP-PublisherNoch keine Bewertungen

- The Effect of Boundary Conditions On The Natural Vibration Characteristics of Deep-Hole Bulkhead GateDokument8 SeitenThe Effect of Boundary Conditions On The Natural Vibration Characteristics of Deep-Hole Bulkhead GateSEP-PublisherNoch keine Bewertungen

- SJVN Question Paper With Answer-2013 For EeeDokument19 SeitenSJVN Question Paper With Answer-2013 For EeeSatnam Singh100% (1)

- UFGS Solar Panel SpecificationDokument39 SeitenUFGS Solar Panel Specificationvisal097Noch keine Bewertungen

- DJJ6182 Engineering Plant TechnologyDokument4 SeitenDJJ6182 Engineering Plant TechnologyZul AimanNoch keine Bewertungen

- Manuale RDC - ENDokument45 SeitenManuale RDC - ENYiannis SteletarisNoch keine Bewertungen

- Twaron and Sulfron in Conveyor Belts - A Strong Energy Saving SolutionDokument13 SeitenTwaron and Sulfron in Conveyor Belts - A Strong Energy Saving SolutionJDNoch keine Bewertungen

- Gridtech 2013Dokument6 SeitenGridtech 2013Kornepati SureshNoch keine Bewertungen

- ABB Leaflet Comem BR-En 2018-06-07Dokument2 SeitenABB Leaflet Comem BR-En 2018-06-07Dave ChaudhuryNoch keine Bewertungen

- Ethanol As Gas Turbine FuelDokument2 SeitenEthanol As Gas Turbine FuelAnand Kumar100% (1)

- Ge Stamford Hc444c1Dokument8 SeitenGe Stamford Hc444c1Octavio EdgardoNoch keine Bewertungen

- Presentation To Sjsu Green Wave Program: California'S Green Innovations Challenge Grant and The Solartech Swic ResponseDokument52 SeitenPresentation To Sjsu Green Wave Program: California'S Green Innovations Challenge Grant and The Solartech Swic ResponsesjsusustainabilityNoch keine Bewertungen

- Sangeeta Reiki Healing 2501Dokument30 SeitenSangeeta Reiki Healing 2501snageetaorryNoch keine Bewertungen

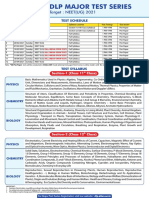

- DLP Major Test Series: Target: NEET (UG) 2021Dokument1 SeiteDLP Major Test Series: Target: NEET (UG) 2021Ankit singh TomarNoch keine Bewertungen

- IRENA Supergrids 2019Dokument20 SeitenIRENA Supergrids 2019le LENoch keine Bewertungen

- PrdsDokument0 SeitenPrdssandi1111Noch keine Bewertungen

- William KlempererDokument196 SeitenWilliam KlempererFla Cordido100% (1)

- Line Voltage Room Thermostats: FeaturesDokument4 SeitenLine Voltage Room Thermostats: FeaturesMarco ReNoch keine Bewertungen

- SBEED Validation Against ASHRAE Standard 140-2014: June 2017Dokument10 SeitenSBEED Validation Against ASHRAE Standard 140-2014: June 2017Eyris SuarioNoch keine Bewertungen

- Keph 204Dokument18 SeitenKeph 204Alex PeleNoch keine Bewertungen

- English TestDokument3 SeitenEnglish TestMaroua AissaniNoch keine Bewertungen

- ACME Details PDFDokument12 SeitenACME Details PDFBalramShuklaNoch keine Bewertungen

- Atlas Copco Compressed Air Manual: 8 EditionDokument25 SeitenAtlas Copco Compressed Air Manual: 8 EditionRajNoch keine Bewertungen

- 07a4ec05-Thermal Engineering - IDokument7 Seiten07a4ec05-Thermal Engineering - ISRINIVASA RAO GANTANoch keine Bewertungen

- Chemistry LOsDokument44 SeitenChemistry LOsYoussef samehNoch keine Bewertungen

- Fuel Injectors PDFDokument11 SeitenFuel Injectors PDFanshelNoch keine Bewertungen

- Manual-EnglishDokument29 SeitenManual-EnglishMycastNoch keine Bewertungen

- MT Steam Turbine PDFDokument2 SeitenMT Steam Turbine PDFnewuser01Noch keine Bewertungen

- 2013 Coal Combustion Product (CCP) Production & Use Survey ReportDokument1 Seite2013 Coal Combustion Product (CCP) Production & Use Survey ReportMuhammad Imam NugrahaNoch keine Bewertungen