Beruflich Dokumente

Kultur Dokumente

S T e P 7

Hochgeladen von

yassercarlomanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

S T e P 7

Hochgeladen von

yassercarlomanCopyright:

Verfügbare Formate

STEP7

claiming tax benefits

To encourage corporate giving, the Philippine Government gives tax

incentives to corporations and individuals engaged in business or in

the practice of profession who donate to public or private institutions.

Corporations qualify for tax incentives when they comply with

substantive and procedural requirements imposed by the Tax Code of

1997; the Corporation Code of the Philippines; and other pertinent

laws, rules, and regulations.

Basic among the requirements are the following:

v

The corporate donor must be a BIR-registered taxpayer.

Donation must be evidenced by legal documents and

supported by duly accomplished BIR forms; specifically,

BIR Form 2322 (Certificate of Donation) and BIR Form

1800 (Donors Tax Return).

Documentation is essential both for a corporate donors record

purposes and for claiming tax benefits. The basic documents are the

following:

v

A formal donation is evidenced by a Deed of Donation and

Acceptance executed by the donor and donee

corporations, and handed over by the former to the latter.

Receipt of donation is evidenced by an Official Receipt and

a Certificate of Donation (BIR Form 2322) issued by the

donee to the donor.

In appropriate cases, the donor (with the assistance of the

donee) prepares a Notice of Donation for filing with the

BIR.

(See Appendix

requirements.)

for

more

information

on

documentary

Other requirements have to do with the nature of the donee

organizations and are explained below.

K I N D S

O F

T A X

B E N E F I T S

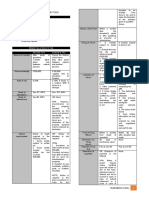

The Tax Code of 1997 provides two basic incentives for corporate

donors:

1. exemption from the donors tax, and

2. deductions from taxable income.

(Appendix B presents information on these basic tax incentives in

table form.)

E X E M P T I O N

F R O M

T A X

D O N O R S

Normally, corporate donors are required to pay a tax amounting to

30% of the value of the donation. (See Valuing Donations on page 20

for how the different forms of donation are valued.) Corporations

donating to the following beneficiaries are, however, exempted from

paying this tax:

1. Philippine government or any of its attached agencies or political

subdivisions, including fully-owned government corporations;

2. Private and public educational institutions;

3. Foreign Institutions or International Organizations;

4. PCNC-certified organizations; and

5.

Non-PCNC-certified

non-stock, non-profit

organizations

established for religious, charitable, cultural, social welfare, and

research purposes.

The process of claiming exemption from the donors tax depends

on the nature of the donation. The corporate donor must:

1. For cash and personal properties

a. Execute a Deed of Donation and Acceptance, with a

documentary stamp tax of P15.00 affixed, to be duly

accepted by the donee institution;

b. File a Donors Tax Return (BIR Form No. 1800) within 30

days from notarization of the Deed of Donation and

Acceptance at the Revenue District Office (RDO) where its

principal place of business is located; and

c. Submit to the BIR within 30 days from date of donation a

Notice of Donation stating the nature, amount, donee, and

purpose of the donation, for donations greater than One

Million Pesos (P1,000,000).

2.

For shares of stock

a. Execute a Deed of Donation and Acceptance, with a

documentary stamp tax of P15.00 affixed, to be duly

accepted by the donee institution;

b. File a Donors Tax Return (BIR Form No. 1800) within 30

days from notarization of the Deed of Donation and

Acceptance at the RDO where its principal place of

business is located;

c. Submit to the BIR within 30 days from date of donation a

Notice of Donation similar to that used for cash and

personal properties, for donations worth more than One

Million Pesos (P1,000,000); and

d. Surrender the duly endorsed stock certificate and Deed of

Donation to the Corporate Secretary of the issuing

corporation for purposes of registration of the stocks in the

name of the donee institution.

3. For real property

a.

Execute a Deed of Donation and Acceptance, with a

documentary stamp tax of P15.00 affixed, to be duly

accepted by the donee institution;

b. File a Donors Tax Return (BIR Form No. 1800) within 30

days from notarization of the Deed of Donation and

Acceptance at the RDO where its principal place of

business is located;

c. Submit to the BIR within 30 days from date of donation a

Notice of Donation similar to that used for cash and

personal properties, for donations worth more than One

Million Pesos (P1,000,000);

d. Secure a Certificate of Authority to Register (CAR) from

the BIR;

e. Update payment of real property taxes and secure a Tax

Clearance Certificate from the Office of the Assessor;

f.

Pay the transfer and registration fees;

g. Surrender the old title and apply for a new title with the

Register of Deeds, presenting the following:

notarized Deed of Donation and Acceptance

Certificate of Authority to Register (CAR)

Tax Clearance Certificate

original copy of the Transfer Certificate of Title (TCT)

tax declaration issued by the Office of the Assessor

real estate tax receipts; and

(See Appendix I for more information on the registration of real

property in the name of the donee.)

h. Apply for a new tax declaration in the name of the donee

corporation with the Assessors Office.

(For flowchart versions of these processes see Appendices F, G, and

H.)

D E D U C T I O N S

F R O M

T A X A B L E

I N C O M E

Contributions made to qualified beneficiaries can be charged as

expenses, thus lowering the donor companys taxable income for the

year. A donor company can claim either full or limited deduction,

depending on the nature of the donee institution.

1. Full deduction

Corporations may claim as deduction from taxable income (before

any other full or limited deduction is deducted from this amount)

the full amount of donations made to the following:

a.

Government of the Philippines or any of its agencies or

political subdivisions, including fully-owned government

corporations, if donation is earmarked specifically for priority

activities in education, health, youth and sports development,

science development, culture development, or economic

development in accordance with the National Priority Plan of

the National Economic Development Authority (NEDA);

b.

Foreign institutions or international organizations, if donation is

earmarked specifically for activities in pursuance of or

compliance with agreements, treaties, or commitments

between the Philippine Government and these institutions, or

for activities required to comply with special laws;

c.

PCNC-certified nongovernmental organizations (NGOs)

subject to Revenue Regulations Nos. 13 98 implementing

Section 34 (H) of the Tax Code of 1997.

2. Limited deduction

Corporations may claim up to a 5% deduction from taxable income

(before any other full or limited deduction is deducted from this

amount) for donations made to the following:

a.

Government of the Philippines or any of its agencies or

political subdivisions, if donation is earmarked or used for any

public purpose other than those in the National Priority Plan of

the NEDA;

b.

Social welfare institutions duly licensed by the Department of

Social Welfare and Development;

c.

Non-stock, non-profit corporations or associations (other than

PCNC-certified NGOs) organized and exclusively operated for

religious, charitable, scientific, cultural, educational, youth and

sports development, social welfare, or research purposes, or

for the rehabilitation of veterans.

Limited deduction means that corporations donating to the

above donees are only allowed to claim the full value of their

donation as a deduction from taxable income insofar as that

value does not exceed 5% of their taxable income. This

means that a donation with a value of, say, 7% of taxable

income entitles the donor only to a 5% deduction. The extra

2% cannot be claimed as a deduction.

A full deduction (arising from another donation) can, however,

be claimed on top of a 5% deduction. Question 6 in the

Frequently Asked Questions contains a sample computation.

Donor corporations can claim full or limited deductions or both when

they file their annual income tax returns at the Revenue District Office

(RDO) where their principal place of business is located.

Although the annual return reflects all donations given over the entire

year, donor corporations must still file quarterly returns reflecting

donations given for the quarter covered.

(See Appendix E and Question 8 in the Frequently Asked Questions for

requirements with regard to the filing of claims for deductibility.)

V A L U I N G

D O N A T I O N S

Donations are valued in the following ways:

1.

Cash the amount of the donation

2.

Real property the zonal value at the time of donation

3.

Personal property the acquisition cost; or, if used, the

depreciated or book value. Art pieces such as paintings,

sculpture, or jewelry are, however, valued at acquisition cost, as

their value usually appreciates over time.

4.

Professional and company services These should be booked

and designated as cash donations; otherwise they are not

deductible from taxable income.

A D D I T I O N A L

I N C E N T I V E S

U N D E R

S P E C I A L

L A W S

Special laws provide additional tax benefits to corporations

engaging in certain forms of corporate giving:

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- NEGO Week 12 Documents of Title, General Bonded Warehouse ActDokument9 SeitenNEGO Week 12 Documents of Title, General Bonded Warehouse ActyassercarlomanNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Week 9 NegoDokument18 SeitenWeek 9 NegoyassercarlomanNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Week 14 NegoDokument13 SeitenWeek 14 NegoyassercarlomanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Trust Receipts Law (Ampil)Dokument9 SeitenTrust Receipts Law (Ampil)yassercarlomanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- NEGO Trust Receipts Law: Emergency RecitDokument8 SeitenNEGO Trust Receipts Law: Emergency RecityassercarlomanNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Nego Case List 6 and 7 Sec 70 To 118Dokument19 SeitenNego Case List 6 and 7 Sec 70 To 118yassercarlomanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Nego Case List 4: Emergeny RecitDokument24 SeitenNego Case List 4: Emergeny RecityassercarlomanNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Pineda V.De La Rama 121 Scra 671 JedDokument31 SeitenPineda V.De La Rama 121 Scra 671 JedyassercarlomanNoch keine Bewertungen

- Nego Case List 5 - Sec 60 To 69 Liabilities of PartiesDokument22 SeitenNego Case List 5 - Sec 60 To 69 Liabilities of PartiesyassercarlomanNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 17 Nielson & Co., Inc V Lepanto Consolidated MiningDokument35 Seiten17 Nielson & Co., Inc V Lepanto Consolidated MiningyassercarlomanNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- 03 Ereña vs. Querrer-Kauffman PDFDokument25 Seiten03 Ereña vs. Querrer-Kauffman PDFyassercarlomanNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 20 Puyat & Sons, Inc. vs. Arco Amusement Co.Dokument8 Seiten20 Puyat & Sons, Inc. vs. Arco Amusement Co.yassercarlomanNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lim V CADokument13 SeitenLim V CAyassercarlomanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Ker & Co V LingadDokument10 SeitenKer & Co V LingadyassercarlomanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Negotiable Instruments Case List 1Dokument12 SeitenNegotiable Instruments Case List 1yassercarlomanNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Philpotts V Phil ManufacturingDokument5 SeitenPhilpotts V Phil ManufacturingyassercarlomanNoch keine Bewertungen

- 08 Briones-Vasquez Vs CADokument13 Seiten08 Briones-Vasquez Vs CAyassercarlomanNoch keine Bewertungen

- 10 DBP vs. Emerald Hotel PDFDokument26 Seiten10 DBP vs. Emerald Hotel PDFyassercarlomanNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 04 Sps Godofredo and Flancia vs. CADokument12 Seiten04 Sps Godofredo and Flancia vs. CAyassercarlomanNoch keine Bewertungen

- 09 First Marbella Condominium Association, Inc - vs. GatmaytanDokument11 Seiten09 First Marbella Condominium Association, Inc - vs. GatmaytanyassercarlomanNoch keine Bewertungen

- 02 Llanto vs. AlzonaDokument15 Seiten02 Llanto vs. AlzonayassercarlomanNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 09 Aguna V LarenaDokument4 Seiten09 Aguna V LarenayassercarlomanNoch keine Bewertungen

- 08 Dominion Insurance Corp V CADokument10 Seiten08 Dominion Insurance Corp V CAyassercarlomanNoch keine Bewertungen

- SalarySlipwithTaxDetails 2021 JuneDokument1 SeiteSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNoch keine Bewertungen

- Txmwi 2018 Dec Q PDFDokument15 SeitenTxmwi 2018 Dec Q PDFangaNoch keine Bewertungen

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDokument1 SeiteModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- GST PDFDokument16 SeitenGST PDFSHASHWAT MISHRANoch keine Bewertungen

- Ing N.V. Metro Manila Branch Vs Cir DigestDokument2 SeitenIng N.V. Metro Manila Branch Vs Cir Digestbrian jay hernandezNoch keine Bewertungen

- FPOE 44th CTP Result IRS - 0Dokument7 SeitenFPOE 44th CTP Result IRS - 0Muhammad AkramNoch keine Bewertungen

- Jurisdiction Details PDFDokument57 SeitenJurisdiction Details PDFjigneshNoch keine Bewertungen

- Test Bank For Corporations Partnerships Estates and Trusts 2020 43th by RaabeDokument77 SeitenTest Bank For Corporations Partnerships Estates and Trusts 2020 43th by RaabeJessica RiffleNoch keine Bewertungen

- Tax Credits and Calculation of Tax: What Is Income Tax?Dokument59 SeitenTax Credits and Calculation of Tax: What Is Income Tax?Moilah MuringisiNoch keine Bewertungen

- General Principles: Estate Tax Vs Donor's Tax Estate Tax Donor'S TaxDokument3 SeitenGeneral Principles: Estate Tax Vs Donor's Tax Estate Tax Donor'S TaxKenneth Mataban100% (1)

- Additional Income Tax QuizzerDokument3 SeitenAdditional Income Tax QuizzerJolina Mancera0% (1)

- Introduction and Basic Concept of Income Tax - Law Times JournalDokument10 SeitenIntroduction and Basic Concept of Income Tax - Law Times JournalYash RankaNoch keine Bewertungen

- CGT Tomanda AntokDokument1 SeiteCGT Tomanda AntokNvision PresentNoch keine Bewertungen

- Driver FinalDokument1 SeiteDriver Finalamit acharyaNoch keine Bewertungen

- YasabbDokument24 SeitenYasabbBisrateab GebrieNoch keine Bewertungen

- ACCOUNTING FOR LABOR AND OH LectureDokument13 SeitenACCOUNTING FOR LABOR AND OH LectureNah HamzaNoch keine Bewertungen

- VAT Consultant Exam Preparation Course - CAPEDokument5 SeitenVAT Consultant Exam Preparation Course - CAPEtasmia tasnuv33% (3)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Dokument1 SeiteStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONoch keine Bewertungen

- Week1 SolutionsDokument14 SeitenWeek1 SolutionsM Mustafa100% (1)

- Environmental EconomicsDokument8 SeitenEnvironmental EconomicsKanishk PatelNoch keine Bewertungen

- What Is A Business?: - A Habitual Engagement in A Commercial Activity Involving The Sale of Goods or Services To ClientsDokument18 SeitenWhat Is A Business?: - A Habitual Engagement in A Commercial Activity Involving The Sale of Goods or Services To ClientsClaire diane CraveNoch keine Bewertungen

- Tax 2022Dokument6 SeitenTax 2022kateNoch keine Bewertungen

- Group 23 Applied Tax AssignmentDokument8 SeitenGroup 23 Applied Tax AssignmentStephen NdambakuwaNoch keine Bewertungen

- US Internal Revenue Service: f6198 - 1999Dokument1 SeiteUS Internal Revenue Service: f6198 - 1999IRSNoch keine Bewertungen

- Tax Income in GeneralDokument38 SeitenTax Income in GeneralRIRI RUMAIZHANoch keine Bewertungen

- 2019 TaxReturn PDFDokument6 Seiten2019 TaxReturn PDFdavid barrow100% (2)

- Feb+ActFiber Invoice2022Dokument2 SeitenFeb+ActFiber Invoice2022shiva krishnaNoch keine Bewertungen

- CPAR Tax On Estates and Trusts (Batch 90) - HandoutDokument10 SeitenCPAR Tax On Estates and Trusts (Batch 90) - HandoutAljur SalamedaNoch keine Bewertungen

- Ohio House Bill To Eliminate Income TaxesDokument58 SeitenOhio House Bill To Eliminate Income TaxesWews WebStaffNoch keine Bewertungen

- Tax Tables For Charge Year 201620012016164704Dokument406 SeitenTax Tables For Charge Year 201620012016164704Chabala LwandoNoch keine Bewertungen

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)