Beruflich Dokumente

Kultur Dokumente

2316 139520 PDF

Hochgeladen von

Anonymous EVdPq3NlOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2316 139520 PDF

Hochgeladen von

Anonymous EVdPq3NlCopyright:

Verfügbare Formate

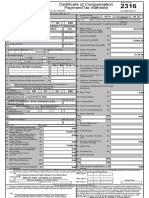

DLN:

Certificate of Compensation

Payment/Tax Withheld

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

For the Year

2015

( YYYY )

Part I

Employee Information

3 Taxpayer

305

459

499

Identification No.

4 Employee's Name (Last Name, First Name, Middle Name)

1

000

6A Zip Code

207 A F BLUMENTRITT STREET SAN JUAN CITY

1500

32 Basic Salary/

Statutory Minimum Wage

32

Minimum Wage Earner (MWE)

33 Holiday Pay (MWE)

33

34 Overtime Pay (MWE)

34

35 Night Shift Differential (MWE)

35

36 Hazard Pay (MWE)

36

37 13th Month Pay

and Other Benefits

37

38 De Minimis Benefits

38

6C Zip Code

6D Foreign Address

6E Zip Code

7 Date of Birth (MM/DD/YYYY)

8 Telephone Number

3/29/1985

9 Exemption Status

For the Period

01/01

From (MM/DD)

To (MM/DD)

12/31

Details of Compensation Income and Tax Withheld from Present Employer

Part IV-B

Amount

A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

5 RDO Code

0 4 3

6B Local Home Address

2316

July 2008 (ENCS)

TABAGO, JOHN OLIVER CENIR

6 Registered Address

BIR Form No.

Single

18,905.00

Married

9A Is the wife claiming the additional exemption for qualified dependent children?

Yes

10 Name of Qualified Dependent Children

No

11 Date of Birth (MM/DD/YYYY)

39 SSS, GSIS, PHIC & Pag-ibig 39

Contributions, & Union Dues

30,606.36

10,425.60

(Employee share only)

12 Statutory Minimum Wage rate per day

12

13 Statutory Minimum Wage rate per month

13

Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax

Part II

Employer Information (Present)

15 Taxpayer

211

015

873

000

Identification No.

16 Employer's Name

40 Salaries & Other Forms of

Compensation

40

41 Total Non-Taxable/Exempt

Compensation Income

41

59,936.96

14

TELUS INTERNATIONAL PHILIPPINES, INC

17 Registered Address

1605

Secondary Employer

x Main Employer

Part III

Employer Information (Previous)

18 Taxpayer

Identification No.

19 Employer's Name

20 Registered Address

20A Zip Code

Part IV-A

21 Gross Compensation Income from

Summary

21

22

59,936.96

Exempt (Item 41)

23 Taxable Compensation Income

23

199,455.92

from Present Employer (Item 55)

24 Add: Taxable Compensation

Income from Previous Employer

25 Gross Taxable

Compensation Income

26 Less: Total Exemptions

24

27 Less: Premium Paid on Health

27

42

180,434.40

43

44 Transportation

44

45 Cost of Living Allowance

45

46 Fixed Housing Allowance

46

47 Others (Specify)

47A

47A

47B

47B

SUPPLEMENTARY

48 Commission

48

49 Profit Sharing

49

50 Fees Including Director's

Fees

50

51 Taxable 13th Month Pay

and Other Benefits

51

52 Hazard Pay

52

53 Overtime Pay

53

259,392.88

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable/

42 Basic Salary

43 Representation

17A Zip Code

31ST FLOOR DISCOVERY CENTER, 25 ADB AVE., ORTIGAS

CENTRE, PASIG CITY

B. TAXABLE COMPENSATION INCOME

REGULAR

25

199,455.92

26

50,000.00

and/or Hospital Insurance (If applicable)

28

28 Net Taxable

Compensation Income

29 Tax Due

29

30 Amount of Taxes Withheld

30A Present Employer

30B Previous Employer

149,455.92

24,863.98

30A

54 Others (Specify)

24,863.98

54A Salaries & Other Forms of

Compensation

54B

24,863.98

55 Total Taxable Compensation

Income

54A

19,021.52

54B

30B

31 Total Amount of Taxes Withheld 31

As adjusted

55

199,455.92

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended,

and the regulations issued under authority thereof.

56

Date Signed

NONETTE NGAYAN

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57

CTC No.

of Employee

TABAGO, JOHN OLIVER CENIR

Date Signed

Employee Signature Over Printed Name

Place of Issue

Date of Issue

Amount Paid

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported I declare,under the penalties of perjury that I am qualified under substituted filing of Income Tax

Returns(BIR Form No. 1700), since I received purely compensation income from only one employer

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue.

58

NONETTE NGAYAN

Present Employer/ Authorized Agent Signature Over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

in the Phils. for the calendar year; that taxes have been correctly withheld by my employer (tax due

equals tax withheld); that the BIR Form No. 1604CF filed by my employer to the BIR shall constitute

as my income tax return;and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No.

1700 had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59

TABAGO, JOHN OLIVER CENIR

Employee Signature Over Printed Name

Das könnte Ihnen auch gefallen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- 2316 (1) 1Dokument2 Seiten2316 (1) 1dolores100% (1)

- DocumentDokument2 SeitenDocumentZandie Garcia0% (1)

- Sample PDFDokument2 SeitenSample PDFkorean languageNoch keine Bewertungen

- Date: - : District SupervisorDokument2 SeitenDate: - : District SupervisorAiza Conchada100% (1)

- Ojt CertificateDokument1 SeiteOjt CertificatePros Mktg Nueva EcijaNoch keine Bewertungen

- Affidavit of Lost CorDokument1 SeiteAffidavit of Lost CorLouie Jean Ramos100% (1)

- Certificate of Employment: 20,000.00 20,000.00 Per Month 240,000.00Dokument3 SeitenCertificate of Employment: 20,000.00 20,000.00 Per Month 240,000.00Cath Tizon-TuqueroNoch keine Bewertungen

- Sworn Application For Tax Clearance: Annex CDokument1 SeiteSworn Application For Tax Clearance: Annex CJose Edmundo DayotNoch keine Bewertungen

- COE With Compensation ASP 20KDokument2 SeitenCOE With Compensation ASP 20KRonie Brylle Ercilla IIINoch keine Bewertungen

- Letter of EFPS For BIRDokument2 SeitenLetter of EFPS For BIRLetty Tamayo100% (1)

- Philippine Health Insurance Corporation: Data Amendment Request Form General InformationDokument1 SeitePhilippine Health Insurance Corporation: Data Amendment Request Form General InformationiKON IC100% (1)

- Sales and Tax Declaration Form 2020Dokument1 SeiteSales and Tax Declaration Form 2020k act100% (1)

- Sample COEDokument1 SeiteSample COEErnz ShangNoch keine Bewertungen

- eSRS Reg Form PDFDokument1 SeiteeSRS Reg Form PDFDarlyn Etang100% (1)

- DOLE - Application For Certificate of No Pending CaseDokument1 SeiteDOLE - Application For Certificate of No Pending CaseCristian Pabon83% (6)

- Sworn Declaration BirDokument1 SeiteSworn Declaration Birynid wageNoch keine Bewertungen

- Employee 1 PayslipDokument6 SeitenEmployee 1 PayslipJeric Lagyaban AstrologioNoch keine Bewertungen

- Bir 2Q 2020Dokument4 SeitenBir 2Q 2020Leo Archival ImperialNoch keine Bewertungen

- COE For Resigned EmployeeDokument1 SeiteCOE For Resigned Employeelove pazarcoNoch keine Bewertungen

- Certificate of Employment and Clearance: July 25, 2020 To October 24, 2020Dokument1 SeiteCertificate of Employment and Clearance: July 25, 2020 To October 24, 2020Precious Anne San Jose - BeatoNoch keine Bewertungen

- CertificationDokument1 SeiteCertificationJeffrey100% (1)

- Social Security System: Collection List Thru UsbDokument8 SeitenSocial Security System: Collection List Thru UsbLala MagayanesNoch keine Bewertungen

- Pasig BPLO Charter. Udate 12-6-2018Dokument7 SeitenPasig BPLO Charter. Udate 12-6-2018Roy LataquinNoch keine Bewertungen

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDokument2 SeitenRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake MitsukiNoch keine Bewertungen

- eSRS Reg Form PDFDokument1 SeiteeSRS Reg Form PDFDarlyn Etang100% (1)

- PayslipDokument1 SeitePayslipKathy DagunoNoch keine Bewertungen

- Residencia Regina Phase 1 Homeowners Association, Inc.: Hoa Business PermitDokument1 SeiteResidencia Regina Phase 1 Homeowners Association, Inc.: Hoa Business PermitSherwin VillarinNoch keine Bewertungen

- Bir Form 2307Dokument2 SeitenBir Form 2307Geraldine BacoNoch keine Bewertungen

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDokument1 SeiteIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Eaínings Amount Deductions Amount: PayslipDokument1 SeiteEaínings Amount Deductions Amount: PayslipKuhramaNoch keine Bewertungen

- Earnings Taxable Non Taxable Hours Total: OvertimeDokument1 SeiteEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNoch keine Bewertungen

- SSS Change RequestDokument3 SeitenSSS Change RequestAngelica SarzonaNoch keine Bewertungen

- Disbursement VoucherDokument3 SeitenDisbursement VoucherRejane VidadNoch keine Bewertungen

- Letter of Request For Data FixDokument1 SeiteLetter of Request For Data FixTANCITY INC100% (1)

- Agency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemDokument3 SeitenAgency Authorized Officer (AAO) Commitment Form: Government Service Insurance SystemAnonymous pHooz5aH6VNoch keine Bewertungen

- PhilHealth Letter of RequestDokument1 SeitePhilHealth Letter of RequestMark Kevin IIINoch keine Bewertungen

- Certificate of EmploymentDokument1 SeiteCertificate of EmploymentAldo A. Lumapay Jr.Noch keine Bewertungen

- BIR Form 1905Dokument2 SeitenBIR Form 1905ejay niel100% (2)

- Fund Coordinator HDMFDokument2 SeitenFund Coordinator HDMFRalph Esteban33% (3)

- Employer'S Change of Information Form (Ecif) : Instructions RequirementsDokument2 SeitenEmployer'S Change of Information Form (Ecif) : Instructions RequirementsGen EcargNoch keine Bewertungen

- Section 2Dokument2 SeitenSection 2Robert FergustoNoch keine Bewertungen

- Pay Is inDokument2 SeitenPay Is inJo YelleNoch keine Bewertungen

- Payslip 1Dokument1 SeitePayslip 1bktsuna0201100% (2)

- Sales Declaration and Evaluation FormDokument1 SeiteSales Declaration and Evaluation FormMcAsia Foodtrade Corp100% (1)

- AwolDokument5 SeitenAwolcatherine alegriaNoch keine Bewertungen

- Kia Motors PhilippinesDokument1 SeiteKia Motors PhilippinesCrisant Dema-alaNoch keine Bewertungen

- RHED Financing Application Form 1Dokument2 SeitenRHED Financing Application Form 1Kenneth InuiNoch keine Bewertungen

- Endorsement of Task: No. Tasks StatusDokument1 SeiteEndorsement of Task: No. Tasks StatusChristian RiveraNoch keine Bewertungen

- Certificate of Contribution PhilhealthDokument2 SeitenCertificate of Contribution PhilhealthMmcmmc FcicNoch keine Bewertungen

- CONVERGE Proof of Internet SubscriptionDokument1 SeiteCONVERGE Proof of Internet SubscriptionJayrald Delos SantosNoch keine Bewertungen

- OJT Certificate of Completion TemplateDokument1 SeiteOJT Certificate of Completion TemplateJuliet ChuaNoch keine Bewertungen

- DBP Letter of Introduction 1Dokument1 SeiteDBP Letter of Introduction 1Jerry G. GabacNoch keine Bewertungen

- Birth CertificateDokument1 SeiteBirth CertificateSensei VNOJNoch keine Bewertungen

- Published WO No. RB XII 22Dokument4 SeitenPublished WO No. RB XII 22Altair0% (1)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDokument1 SeiteKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldRoger BernasorNoch keine Bewertungen

- 2316Dokument1 Seite2316EmmanuelClementCastilloTalimoroNoch keine Bewertungen

- Itr 2316Dokument1 SeiteItr 2316joshua158150% (2)

- Gadiano 2316Dokument2 SeitenGadiano 2316Jypy Torrejos100% (1)

- 2316Dokument13 Seiten2316Ariel BarkerNoch keine Bewertungen

- Electrometals AuditDokument62 SeitenElectrometals AuditMuhammad Ramiz AminNoch keine Bewertungen

- The Teaching Profession PresentationDokument26 SeitenThe Teaching Profession PresentationDarlyn BangsoyNoch keine Bewertungen

- Short Notes On Important Central Labour Legislations: Juneja & AssociatesDokument36 SeitenShort Notes On Important Central Labour Legislations: Juneja & AssociatesNaveen ChaudharyNoch keine Bewertungen

- Pigcaulan Vs Security and Credit - G.R. No. 173648. January 16, 2012Dokument7 SeitenPigcaulan Vs Security and Credit - G.R. No. 173648. January 16, 2012Ebbe DyNoch keine Bewertungen

- History and Components of CompensationDokument42 SeitenHistory and Components of CompensationNekoh Dela Cerna75% (4)

- BusPart B2 ExClassPracWS U1Dokument6 SeitenBusPart B2 ExClassPracWS U1MARYLAND Pedagogical CoordinationNoch keine Bewertungen

- Policies On Leave-1Dokument55 SeitenPolicies On Leave-10506shelton100% (3)

- Digital Services Salary Guide - 2022Dokument33 SeitenDigital Services Salary Guide - 2022erikNoch keine Bewertungen

- TCS Annual Report 2012-2013Dokument186 SeitenTCS Annual Report 2012-2013Apurva NadkarniNoch keine Bewertungen

- 261986Dokument4 Seiten261986Jaimin Mungalpara100% (1)

- Unit 10 Wages and SalaryDokument20 SeitenUnit 10 Wages and Salarysaravanan subbiahNoch keine Bewertungen

- RA 7641 - Retirement LawDokument2 SeitenRA 7641 - Retirement LawMuli MJNoch keine Bewertungen

- Institutional Contacts:: School InfoDokument79 SeitenInstitutional Contacts:: School InfoMatt BrownNoch keine Bewertungen

- ACCA TX Tutor Notes Applicable To 2022 Exams - 184Dokument184 SeitenACCA TX Tutor Notes Applicable To 2022 Exams - 184Ivan KolevNoch keine Bewertungen

- Cima Salary For YouDokument6 SeitenCima Salary For YoufdgfhhNoch keine Bewertungen

- Administrative Law CasesDokument80 SeitenAdministrative Law CasesKareen BaucanNoch keine Bewertungen

- International Human Resource ManagementDokument42 SeitenInternational Human Resource Managementnazmulsiad200767% (3)

- Obstructed Views: Illinois' 102 County Online Transparency AuditDokument21 SeitenObstructed Views: Illinois' 102 County Online Transparency AuditIllinois Policy100% (1)

- Labor Standards: Employment of Non-Resident AliensDokument10 SeitenLabor Standards: Employment of Non-Resident AliensLaydee GiaAmNoch keine Bewertungen

- Bus Math-Module 5.4 Gross and Net EarningDokument51 SeitenBus Math-Module 5.4 Gross and Net Earningaibee patatagNoch keine Bewertungen

- Project Sample - Welfare Measure in KRIBHCODokument106 SeitenProject Sample - Welfare Measure in KRIBHCORahulNoch keine Bewertungen

- Business Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPDokument8 SeitenBusiness Math - Q2 - W1 - M1 - LDS - Commissions Down Payments Gross Balance and Current Increased BalanceCommissions - JRA RTPABMachineryNoch keine Bewertungen

- AWHO RWA Draft Bye-LawsDokument39 SeitenAWHO RWA Draft Bye-Lawschandrapcnath100% (1)

- KPIS LaundryDokument10 SeitenKPIS LaundryvvvasimmmNoch keine Bewertungen

- Strategy To Reduce Inoperative AccountsDokument34 SeitenStrategy To Reduce Inoperative AccountsshannabyNoch keine Bewertungen

- OCR - MC No. 14, S. 2018Dokument122 SeitenOCR - MC No. 14, S. 2018mabzicleNoch keine Bewertungen

- Maynilad Assoc V MayniladDokument13 SeitenMaynilad Assoc V MayniladEmaleth LasherNoch keine Bewertungen

- Market Factors Affecting The Operations of Lechon Manok Enterprise in Selected Towns in Northern Samar, PhilippinesDokument5 SeitenMarket Factors Affecting The Operations of Lechon Manok Enterprise in Selected Towns in Northern Samar, PhilippinesEditor IJTSRDNoch keine Bewertungen

- Bharat Forge FinalDokument5 SeitenBharat Forge FinalVibha BhanNoch keine Bewertungen

- Human Resource Management Practices of Pawili Dressing PlantDokument17 SeitenHuman Resource Management Practices of Pawili Dressing PlantTopher PanteNoch keine Bewertungen