Beruflich Dokumente

Kultur Dokumente

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Hochgeladen von

Shyam SunderCopyright:

Verfügbare Formate

RA~JSA NI(El'

UEAljrrV

t.rn,

(Ji'OI'IlHH'ly kuuw n us Su u ket l n torua tlo uul (,/(1.)

Date: 12th August, 2016

To,

The Secretary,

(Listing Department)

USE Limited

Phiroze Jeejeebhoy Towers,

Dalal Street,

Mumbai - 40000 I,

Ref: COlllpnny's Sel'ipColle No, 512409

Sub: Submissioll of Unaudil'ed Fillnllcial ResuUs fot the Qllnr/el' Ended 30 ' 11 June, 2016,

pursuant to UegulaHoll 330f SEnI (Lis/illl! Obligntiolls &, J)iscloslll'e Requirements)

Regulations, 2015

Dear Sir,

Kindly find enclosed herewith the Following:

1. A copy of Unaudited Financial Results of the Company for the Quarter Ended ao" June,

2016, along with Limited Review Report of Auditor of the Company on Unaudited

Financial Results of the Company for the Quarter Ended 30th June, 2016.

This is for your information and record.

Thanking You,

Yours faithfully,

For Rajsanket Realty Limited

Shri Haresh Sutaria

Whole Time Director

DIN: 01612392

Encl: a/a.

REGD. OFFICE: 139, SEKSARIA CHAMBERS, 2ND FLOOR, N,M. ROAD, FORT, MUMBAI- 400023

TEL: +91-22-22670717 FAX: +91-22-22672013,

Email: sanketinternationalltd@yahoo.com CIN: L70101 MH1985PLC036272

KAJSANKEI T{EALIY LIMI

Its,L'

( FORMERLY KNOWN AS SANKET TNTERNATTONAL LTMTTED)

CIN : L701

01 MH1

985PLC036272

Registered Office : 139 Seksaria Chambers, 2nd Floor, N. M. Road, Fort, Mumbai - 400023.

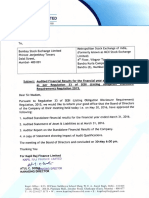

STATEMENT OF UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 3OTH JUNE,2016.

PART I

Rs. in Lakhs

o

lncome from Operations

(a) Net Sales / lncome from Operations[net of excise duty]

(b) Other Opertaing income

Total lncome from operation (Net)

Expenses

a. Cost of Material Consumed

b. Construction Expenses

c. Changes in lnventories of construction work - in progress and stock - in - trade

d. Employee benefits expenses

e. Depreciation and amortisation expense

f. Other expenses

Total Exoenses

)rofit / (Loss) from Operations before other income, finance

:ost and Exceptional items ('l-2)

Jther lncome

rrofit / (Loss) from ordinary activities before finance cost &

-xceptional items (3+4)

:inance costs

)rofit / (Loss) from ordinary activities after finance cost but

:efore Exceotional items (5-6)

5

b

7

8

o

lxceptional items

trofit / (Loss) from ordinary activities before tax (7+8)

10

Tax Expenses

\et Profit / (Loss) from ordinary activities after tax (9-10)

lxtraordinarv ltem (net of tax exoenses )

\et Profit / (Loss) for the periodl11+121

11

12

13

(.luaner Enqeq

Particulars

Sr.N

raid-up equity share capital

'Face Value of the Share is Rs. 10 each )

15 leserve excluding Revaluation Reserves as per balance

;heet of previous accoutinq vear

Earning Per Share (before Extraordinary items)

16i of Rs.10/- each [not annualised]

Year Enoeo

30/06/2016

31t03t2016

30/06/2015

31t03t2016

Unaudited

Audited

Unaudited

Audited

320.40

320.40

251.37

251.37

231.54

r,oor.oa

231.s4

1,001.04

180.65

146.55

100.75

519.24

671.54

1,049.29

(801.16)

(463.e6)

33.87

31.40

2.13

64.35

906.66

(1,380.0s)

(2,891.33

128.30

28.72

2.27

2.01

8.42

(420.09"

18.78

(243.94

98.67

(59.87

170.65

(628.01

740.50

0.54

495.31

1.09

291.41

1,629.05

1.82

741.03

496.40

715.42

525.42

291.41

435.54

1.630.88

1,904.78

25.61

(29.02

n44.13

(273.91

25.61

(29.02

(8.51

(44.13'

(273.91',

7.88

(86.061

17.73

(20.51

(46.64)

(97.49',

(187.85

17.73

(20.51

(97.49\,

(187.851

239.50

239.50

239.50

239.50

20.34

14

(a)Basic

(b)Diluted

Earning Per Share (after Extraordinary items)

16ii of Rs.10/- each [not annualised]

(a)Basic

th'lDilrrted

Notes

(338.56

0.74

0.74

(0.86)

(0.86)

(4.07)

(4.07)

(7.84)

(7.84)

0.74

0.74

(0.86)

(0.86)

(4.07)

(4.07)

(7.84)

(7.84),

1) The above results have been reviewed by the Audit Committee and were taken on recored by

the Board of Directors

in their meeting held on 12th August, 2016.

2) The above results have been reviewed by the Statutory Auditors of the Company.

3) The company operates in one business segment only i.e. Real Estate segment. Therefore, there

is no separate

reportable primary segment as per Accounting Standard '17.

4)

Figures for the previous periods have been regrouped / restated where necessary to confirm to the current period's classification.

By Order of the Board

For Rajsanket RealtY Limited

(Formerly Known as Sanket lnternational Ltd)

+w

Haresh V. Sutaria

Place: Mumbai

Date: 12th August 20l

Whole-time Director

b.

DIN - 01612392

CHANDAN PARA/IAR

CO.

Chartered Accountants

AlliChambers, Gr. Floor, HomiModi 9nd Cross Lane, Fort Mumbai - 400 093.

Iel.: 9966 4433 Fax: 2266 2255 E-mail: cmparco@yahoo.co.in

Review Report to Bombay Stock Exchange Ltd.. Mumbai.

We have reviewed the accompanying statement of unaudited financial results

of RAISANKET REALTY LIMITED for the quarter ended 30th fune, 2016. This

statement is the responsibility of the Company's Management and has been

approved by the Board of Directors. Our responsibility is to issue a report on these

financial statements based on our review.

We conducted our review in accordance with the Standard on Review

Engagement (SRE) 2400, Engagements to Reztiew Financial Statements issued by the

Institute of Chartered Accountants of India. This standard requires that we plan and

perform the review to obtain moderate assurance as to whether the financial

statements are free of material misstatement. A review is limited primarily to

inquiries of company personnel and analytical procedures applied to financial data

and thus provides less assurance than an audit. We have not performed an audit and

accordingly,we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention

that causes us to believe that the accompanying statement of unaudited financial

results prepared in accordance with applicable accounting standards and other

recognized accounting practices and policies has not disclosed the information

required to be disclosed in terms of Regulation 33 of the SEBI (Listing Obligations

and Disclosure Requirements) Regulations,2015 including the manner in which it is

to be disclosed, or that it contains any material misstatement.

For CHANDAN PARMAR

Chartered Accountants

FRN No'101'662w

ifr1tAl

l-f':,'llir \B'

.j-;,j'*

nwbe&r^L

MUMBAI

Place : Mumbai

Date :12-08-201,6

pak H.Padachh

^ Partner

Membership No.45741

&

CO.

Das könnte Ihnen auch gefallen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument3 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument15 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Revised Financial Results For June 30, 2016 (Result)Dokument4 SeitenRevised Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument12 SeitenStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- JUSTDIAL Mutual Fund HoldingsDokument2 SeitenJUSTDIAL Mutual Fund HoldingsShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of R.R. Corporate Securities LimitedDokument2 SeitenSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNoch keine Bewertungen

- Mutual Fund Holdings in DHFLDokument7 SeitenMutual Fund Holdings in DHFLShyam SunderNoch keine Bewertungen

- HINDUNILVR: Hindustan Unilever LimitedDokument1 SeiteHINDUNILVR: Hindustan Unilever LimitedShyam SunderNoch keine Bewertungen

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDokument2 SeitenSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDokument5 SeitenExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Order of Hon'ble Supreme Court in The Matter of The SaharasDokument6 SeitenOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2014 (Audited) (Result)Dokument3 SeitenFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Dokument1 SeitePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For March 31, 2016 (Result)Dokument11 SeitenStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Mar 31, 2014 (Result)Dokument2 SeitenFinancial Results For Mar 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For Dec 31, 2013 (Result)Dokument4 SeitenFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument3 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Financial Results For September 30, 2013 (Result)Dokument2 SeitenFinancial Results For September 30, 2013 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For June 30, 2013 (Audited) (Result)Dokument2 SeitenFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For June 30, 2016 (Result)Dokument2 SeitenStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Transcript of The Investors / Analysts Con Call (Company Update)Dokument15 SeitenTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Investor Presentation For December 31, 2016 (Company Update)Dokument27 SeitenInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Acc 0Dokument21 SeitenAcc 0Ashish BhallaNoch keine Bewertungen

- Jomo Kenyatta University Strategic ManagementDokument12 SeitenJomo Kenyatta University Strategic ManagementRedemptah Mutheu Mutua100% (1)

- PNB Housing Loan ProjectDokument38 SeitenPNB Housing Loan ProjectgunpriyaNoch keine Bewertungen

- SPIVA Scorecard Year End 2010Dokument31 SeitenSPIVA Scorecard Year End 2010pkfinancialNoch keine Bewertungen

- Economic Impact of Tribal GamingDokument2 SeitenEconomic Impact of Tribal GamingKJZZ PhoenixNoch keine Bewertungen

- Karachi University Business School final exam questionsDokument2 SeitenKarachi University Business School final exam questionsSaif ali KhanNoch keine Bewertungen

- Online Assessment Centre - Self-Access Corner: NSS Exploring EconomicsDokument5 SeitenOnline Assessment Centre - Self-Access Corner: NSS Exploring EconomicsPang Kwan WingNoch keine Bewertungen

- Final Practice QuestionsDokument32 SeitenFinal Practice Questions282487239Noch keine Bewertungen

- Types Of Preference Shares ExplainedDokument2 SeitenTypes Of Preference Shares ExplainedpurnendupatraNoch keine Bewertungen

- Compensation Practices at NBPDokument9 SeitenCompensation Practices at NBPBen TenisonNoch keine Bewertungen

- Cost of Capital AmeritradeDokument20 SeitenCost of Capital AmeritradeJonMartello0% (1)

- CH 20Dokument53 SeitenCH 20Sergio Hoffman100% (1)

- Latihan Time Value of MoneyDokument2 SeitenLatihan Time Value of MoneyHalida An NabilaNoch keine Bewertungen

- Cost Accounting FundamentalsDokument56 SeitenCost Accounting FundamentalsPiyu Jain100% (2)

- Practical Guide Setting Up A Business in BelgiumDokument48 SeitenPractical Guide Setting Up A Business in BelgiumMikeNoch keine Bewertungen

- Challenge Exam Study Material 2013Dokument85 SeitenChallenge Exam Study Material 2013iluvhuggies100% (1)

- Pricing Strategies and ConsiderationsDokument33 SeitenPricing Strategies and ConsiderationsNorberto CoraldeNoch keine Bewertungen

- Pre Class Notes and Assignment PDFDokument18 SeitenPre Class Notes and Assignment PDFShah SujitNoch keine Bewertungen

- Case Study - Car Care BusinessDokument2 SeitenCase Study - Car Care BusinessprosysscribdNoch keine Bewertungen

- Business Model of TATA Consultancy ServicesDokument41 SeitenBusiness Model of TATA Consultancy ServicesMathan Anto MarshineNoch keine Bewertungen

- Marketing Director in Charlotte NC Resume Karen KistenmacherDokument2 SeitenMarketing Director in Charlotte NC Resume Karen KistenmacherKarenKistenmacherNoch keine Bewertungen

- Business Economics and Financial Analysis IntroductionDokument9 SeitenBusiness Economics and Financial Analysis Introductionprasad babuNoch keine Bewertungen

- 3 Chapter 1Dokument13 Seiten3 Chapter 1nurzbiet8587Noch keine Bewertungen

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Dokument76 SeitenACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Unit 4Dokument21 SeitenUnit 4Yonas0% (1)

- PICOP v. CADokument2 SeitenPICOP v. CAVon Lee De LunaNoch keine Bewertungen

- RA Manual 2015Dokument176 SeitenRA Manual 2015anon_177396550Noch keine Bewertungen

- Anhui Expressway 2020 Interim Report HighlightsDokument102 SeitenAnhui Expressway 2020 Interim Report HighlightsWinston MahNoch keine Bewertungen

- BUSINESS STUDIES PUC 1st YEAR QUESTION BANKDokument15 SeitenBUSINESS STUDIES PUC 1st YEAR QUESTION BANKVikas R Gaddale100% (3)

- Plain Coon To A TycoonDokument58 SeitenPlain Coon To A Tycoonsbrown7554Noch keine Bewertungen