Beruflich Dokumente

Kultur Dokumente

Aftab Automobiles Limited and Its Subsidiaries

Hochgeladen von

Nur Md Al HossainOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aftab Automobiles Limited and Its Subsidiaries

Hochgeladen von

Nur Md Al HossainCopyright:

Verfügbare Formate

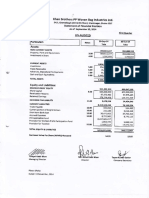

AFTAB AUTOMOBILES LIMITED

HALF-YEARLY REPORT

2012-2013

Dear Shareholders,

We are pleased to forward herewith this half yearly un-audited financial statements which consist of consolidated

statement of financial position as at 28 February 2013, consolidated statement of comprehensive income, consolidated

statement of changes in equity and consolidated statement of cash flows for the half year ended on that date.

Sd/Managing Director

Dated, Dhaka.

March 28, 2013

Aftab Automobiles Limited and its Subsidiaries

Un-Audited consolidated Statement of Comprehensive Income

For the half year ended February 28,2013

(Amount in "000" Tk. )

Half year ended

Half year ended

28/02/13

29/02/12

3-Months

ended

28/02/13

3-Months ended

1/12/11 to

29/02/12

Particulars

BD Taka

BD Taka

BD Taka

BD Taka

Revenues

1,838,702

1,691,754

Less: Cost of sales

1,445,385

1,303,210

947,150

753,002

Gross profit

393,317

388,544

1,005,623

815,149

190,474

Less: Operating expenses

188,947

159,322

74,617

42,124

76,091

70,732

35,920

58,904

64,498

89,580

24,852

30,167

34,561

204,370

229,222

100,894

119,531

49,615

42,415

27,302

22,126

253,985

271,637

141,657

67,146

63,181

128,196

41,647

186,840

208,456

86,550

104,825

880

(3,368)

78

(1,268)

187,720

205,088

86,628

1,243,825

187,701

205,080

86,617

1,243,821

Administrative expenses

Selling and distribution expenses

Financial charges

Operating profit

Add:Other income

Profit before tax

Less: Income tax expense

Net income for the Period

* Other comprehensive income for the Period

Total comprehensive income for the Period

194,148

19,361

21,401

33,855

36,832

Attributable to:

Equity holders

Non-controlling interests

Total comprehensive income for the period

Earnings per share

19

11

187,720

205,088

86,628

1,243,825

2.19

2.44

1.01

1.23

* Investment in shares were classified as held for maturity at the time of purchased of these shares because the market price

thereof was not available then. The investee company is presently listed in the market and reclassification from held for maturity

to held for trading is required as per BAS 28. We have reclassified this investment in these financial statements. Hence Other

comprehensive income for the period has arisen for considering the market price of the shares of the investee company and

comparative figures are restated accordingly.

Sd/Managing Director

Sd/Company Secretary

Aftab Automobiles Limited and its Subsidiaries

Un-Audited consolidated Statement of Financial Position

As at February 28, 2013

Amount in '000' Tk

28/02/13

31/08/12

BD Taka

BD Taka

Assets :

Non-current assets

Property, plant and equipment

Capital work in progress

Investments in share at market value

(comparative figure is restated)

Investments in association

Total non-current assets

958,264

241,265

6,684

974,465

241,265

5,805

229,359

1,435,572

229,359

1,450,894

Current assets

Stock and stores

Trade debtors

Income tax deducted at source

Advances, deposits and prepayments

Cash and bank balances

Total current assets :

1,202,563

1,126,483

339,159

1,192,639

890,676

4,751,520

1,125,949

1,463,199

282,573

1,269,903

867,445

5,009,069

Total Assets

6,187,092

6,459,963

Equity and Liabilities :

Capital & reserve

Share capital

Share premium

Reserve

Retained earnings

Equity attributable to equity holders

Non-controlling interest

Total equity

854,754

1,925,859

67,338

1,845,271

4,693,222

485

4,693,707

683,803

1,925,859

67,338

1,828,521

4,505,521

466

4,505,987

25,310

68,824

94,134

25,310

66,713

92,023

Current liabilities :

Short term loan

Accrued and other current liabilities

Total current liabilities :

689,506

709,745

1,399,251

996,661

865,292

1,861,953

Total liabilities

1,493,385

1,953,976

Total Equity and Liabilities

6,187,092

6,459,963

54.91

65.89

Non-current liabilities

Loan and deferred liabilities (unsecured)

Deferred Tax Liabilities

Total non-current liabilities

Net assets value per share (NAVPS )

Sd/Managing Director

Sd/Company Secretary

Aftab Automobiles Limited and its Subsidiaries

Un-audited consolidated Statement of Cash Flows

For the half year ended February 28, 2013

(Amount in "000" Tk. )

Particulars

Half year ended

Half year ended

28/02/13

29/02/12

BD Taka

BD Taka

A. Cash flows from operating activities

Receipts from customers

Receipts as other income

Payments to suppliers and employees

2,175,418

49,615

(1,686,759)

1,850,541

42,415

(1,492,570)

Cash generated from operations

538,274

400,386

Financial charges paid

Income tax paid

(70,732)

(56,586)

(64,498)

(55,228)

Net cash generated by operating activities

410,956

280,660

Acquisition of property, plant & equipment

Capital work in progress

(13,449)

(17,909)

(10,543)

Net cash used investing activities

(13,449)

(28,452)

Repayment of bank loan

Repayment of other Finance

Dividend paid

(307,155)

(67,121)

-

(63,135)

(84,163)

(113,967)

Net cash used in financing activities

(374,276)

(261,265)

B. Cash flows from investing activities

C. Cash flows from financing activities

D. Net changes in cash & cash equivalents for the period (A+B+C)

23,231

(9,057)

E. Cash & cash equivalents at beginning of the period

867,445

794,796

F. Cash & cash equivalents at end of the period (D+E)

890,676

785,739

4.81

Net operating cash flows per share (NOCFPS)

Sd/Managing Director

Sd/Company Secretary

Aftab Automobiles Limited and its Subsidiaries

Un-audited consolidated Statement of Changes in Equity

For the half year ended February 28,2013

Purticulars

(Amount in "000" Tk. )

Share

capital

BD Taka

Balance as on 1st September , 2011

569,836

Share

premium

Reserves

Issue of bonus share

Cash dividend

Comprehensive income for the period

Attributable

to equity

holders of the

company

Noncontrolling

interest

Total

BD Taka

BD Taka

BD Taka

BD Taka

BD Taka

BD Taka

1,925,859

67,338

1,520,386

4,083,419

424

4,083,843

4,083,419

424

4,083,843

8,122

Adj. for revaluation of Investment in share

Restated Balance as on 1st September , 2011

Retained

earnings

569,836

113,967

1,925,859

67,338

1,528,508

(113,967)

(113,967)

(113,967)

205,088

208,448

208,456

(113,967)

Balance at February 29, 2012

683,803

1,925,859

67,338

1,505,662

4,177,900

432

4,178,332

Balance as on 1st September , 2012

683,803

1,925,859

67,338

1,828,521

4,505,521

466

4,505,987

Issue of bonus share

170,951

Comprehensive income for the period

Balance at February 28, 2013

Sd/Managing Director

854,754

(170,951)

187,701

187,701

19

187,720

1,845,271

4,693,222

485

4,693,707

1,925,859

67,338

Sd/Company Secretary

Das könnte Ihnen auch gefallen

- Mastering Trading Psychology - Andrew Aziz PDFDokument345 SeitenMastering Trading Psychology - Andrew Aziz PDFchallakishore89% (18)

- DELL LBO Model Part 2 Completed (Excel)Dokument9 SeitenDELL LBO Model Part 2 Completed (Excel)Mohd IzwanNoch keine Bewertungen

- Bond & Stock ValuationDokument37 SeitenBond & Stock ValuationSara KarenNoch keine Bewertungen

- Financial StatementDokument115 SeitenFinancial Statementammar123Noch keine Bewertungen

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Dokument32 Seiten4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNoch keine Bewertungen

- Turkish Airlines Financial Statements Exel (Hamada SH)Dokument89 SeitenTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992Noch keine Bewertungen

- The Value of Common Stocks: Principles of Corporate FinanceDokument35 SeitenThe Value of Common Stocks: Principles of Corporate Financesachin199021Noch keine Bewertungen

- Matahari Department StoreDokument59 SeitenMatahari Department StoreResti0805_DyoNoch keine Bewertungen

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Dokument36 SeitenNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNoch keine Bewertungen

- Unaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009Dokument4 SeitenUnaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009James WarrenNoch keine Bewertungen

- 28 Consolidated Financial Statements 2013Dokument47 Seiten28 Consolidated Financial Statements 2013Amrit TejaniNoch keine Bewertungen

- MCB Annual Report 2008Dokument93 SeitenMCB Annual Report 2008Umair NasirNoch keine Bewertungen

- Example SDN BHDDokument9 SeitenExample SDN BHDputery_perakNoch keine Bewertungen

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDokument8 SeitenJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNoch keine Bewertungen

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDokument19 SeitenUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNoch keine Bewertungen

- Afm PDFDokument5 SeitenAfm PDFBhavani Singh RathoreNoch keine Bewertungen

- Elpl 2009 10Dokument43 SeitenElpl 2009 10kareem_nNoch keine Bewertungen

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Dokument40 SeitenHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425Noch keine Bewertungen

- ConsolidatedReport08 (BAHL)Dokument87 SeitenConsolidatedReport08 (BAHL)Muhammad UsmanNoch keine Bewertungen

- MCB Consolidated For Year Ended Dec 2011Dokument87 SeitenMCB Consolidated For Year Ended Dec 2011shoaibjeeNoch keine Bewertungen

- Auditors' Report To The MembersDokument59 SeitenAuditors' Report To The MembersAleem BayarNoch keine Bewertungen

- Consolidated Accounts June-2011Dokument17 SeitenConsolidated Accounts June-2011Syed Aoun MuhammadNoch keine Bewertungen

- Pak Elektron Limited: Condensed Interim FinancialDokument16 SeitenPak Elektron Limited: Condensed Interim FinancialImran ArshadNoch keine Bewertungen

- Standalone Accounts 2008Dokument87 SeitenStandalone Accounts 2008Noore NayabNoch keine Bewertungen

- Bestway Cement Annual 15 AccountsDokument49 SeitenBestway Cement Annual 15 AccountsM Umar FarooqNoch keine Bewertungen

- Desco Final Account AnalysisDokument26 SeitenDesco Final Account AnalysiskmsakibNoch keine Bewertungen

- Beximco Hy2014Dokument2 SeitenBeximco Hy2014Md Saiful Islam KhanNoch keine Bewertungen

- Third Quarter March 31 2014Dokument18 SeitenThird Quarter March 31 2014major144Noch keine Bewertungen

- Comptes 31dec 2007 enDokument88 SeitenComptes 31dec 2007 enthaituan2808Noch keine Bewertungen

- Letter To Shareholders and Financial Results September 2012Dokument5 SeitenLetter To Shareholders and Financial Results September 2012SwamiNoch keine Bewertungen

- Myer AR10 Financial ReportDokument50 SeitenMyer AR10 Financial ReportMitchell HughesNoch keine Bewertungen

- Auditors Report Financial StatementsDokument57 SeitenAuditors Report Financial StatementsSaif Muhammad FahadNoch keine Bewertungen

- FY 2012 Audited Financial StatementsDokument0 SeitenFY 2012 Audited Financial StatementsmontalvoartsNoch keine Bewertungen

- Financial Statements For The Year Ended 31 December 2009Dokument64 SeitenFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNoch keine Bewertungen

- 2012 Annual Financial ReportDokument76 Seiten2012 Annual Financial ReportNguyễn Tiến HưngNoch keine Bewertungen

- Nigeria German Chemicals Final Results 2012Dokument4 SeitenNigeria German Chemicals Final Results 2012vatimetro2012Noch keine Bewertungen

- 2011 Consolidated All SamsungDokument43 Seiten2011 Consolidated All SamsungGurpreet Singh SainiNoch keine Bewertungen

- Reports 6Dokument18 SeitenReports 6Asad ZamanNoch keine Bewertungen

- Dabur Balance SheetDokument30 SeitenDabur Balance SheetKrishan TiwariNoch keine Bewertungen

- 1.accounts 2012 AcnabinDokument66 Seiten1.accounts 2012 AcnabinArman Hossain WarsiNoch keine Bewertungen

- Profit & Loss Account NewDokument2 SeitenProfit & Loss Account NewPatel SagarNoch keine Bewertungen

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Dokument30 SeitenWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNoch keine Bewertungen

- Consolidated Annual Fin State31Dec14Dokument88 SeitenConsolidated Annual Fin State31Dec14aqeel shoukatNoch keine Bewertungen

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Dokument17 SeitenRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillNoch keine Bewertungen

- Cash Flow StatementDokument1 SeiteCash Flow StatementBharat AroraNoch keine Bewertungen

- Metro Holdings Limited: N.M. - Not MeaningfulDokument17 SeitenMetro Holdings Limited: N.M. - Not MeaningfulEric OngNoch keine Bewertungen

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Dokument18 SeitenDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNoch keine Bewertungen

- Balance Sheet Asat31 March 2012Dokument52 SeitenBalance Sheet Asat31 March 2012Pravin BhojwaniNoch keine Bewertungen

- S H D I: Untrust OME Evelopers, NCDokument25 SeitenS H D I: Untrust OME Evelopers, NCfjl300Noch keine Bewertungen

- Comman Size Analysis of Income StatementDokument11 SeitenComman Size Analysis of Income Statement4 7Noch keine Bewertungen

- BMW's Financial Statements For The Year 2013Dokument8 SeitenBMW's Financial Statements For The Year 2013audit202Noch keine Bewertungen

- Valuasi TLKM Aditya Anjasmara Helmi DhanuDokument64 SeitenValuasi TLKM Aditya Anjasmara Helmi DhanuSanda Patrisia KomalasariNoch keine Bewertungen

- B. LiabilitiesDokument1 SeiteB. LiabilitiesSamuel OnyumaNoch keine Bewertungen

- RMG Sales Forecast - QueenieDokument31 SeitenRMG Sales Forecast - QueenieQueenie Amor AstilloNoch keine Bewertungen

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Dokument4 SeitenNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNoch keine Bewertungen

- Dont Del My Folder Its ImportantDokument15 SeitenDont Del My Folder Its ImportantMinha irshadNoch keine Bewertungen

- Oldtown QRDokument26 SeitenOldtown QRfieya91Noch keine Bewertungen

- Vertical and Horizontal Analysis of PidiliteDokument12 SeitenVertical and Horizontal Analysis of PidiliteAnuj AgarwalNoch keine Bewertungen

- Bangladesh Commerce Bank Limited: Balance Sheet As at 31 December 2008Dokument4 SeitenBangladesh Commerce Bank Limited: Balance Sheet As at 31 December 2008nurul000Noch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- PEL 2009 FinancialsDokument7 SeitenPEL 2009 FinancialssaqibaliraoNoch keine Bewertungen

- PCC - Financial Stahtements 2013 - Final by RashidDokument56 SeitenPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- 2015 3rd Quarter Financial ReportDokument5 Seiten2015 3rd Quarter Financial ReportNur Md Al HossainNoch keine Bewertungen

- Share Holding January, 2016Dokument1 SeiteShare Holding January, 2016Nur Md Al HossainNoch keine Bewertungen

- Aftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveDokument4 SeitenAftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveNur Md Al HossainNoch keine Bewertungen

- SQUARE Pharma Equity Note PDFDokument2 SeitenSQUARE Pharma Equity Note PDFNur Md Al HossainNoch keine Bewertungen

- Generic DrugDokument8 SeitenGeneric DrugNur Md Al HossainNoch keine Bewertungen

- 15 089 Drug Testing Lab Assessment Bangladesh - FormatDokument19 Seiten15 089 Drug Testing Lab Assessment Bangladesh - FormatNur Md Al HossainNoch keine Bewertungen

- 1433435393national Budget Review FY 2015-16Dokument4 Seiten1433435393national Budget Review FY 2015-16Nur Md Al HossainNoch keine Bewertungen

- 2 Original Article On Pharmaceutical Biotechnology by Dr. Sarker-LibreDokument6 Seiten2 Original Article On Pharmaceutical Biotechnology by Dr. Sarker-LibreNur Md Al HossainNoch keine Bewertungen

- Illegal Drug Markets, Research and Policy: Crime Prevention Studies, Volume 11, Pp. 1-17Dokument17 SeitenIllegal Drug Markets, Research and Policy: Crime Prevention Studies, Volume 11, Pp. 1-17Nur Md Al HossainNoch keine Bewertungen

- A!xt, 651,22, I I I L I: Brothers Woven LndustriesDokument4 SeitenA!xt, 651,22, I I I L I: Brothers Woven LndustriesNur Md Al HossainNoch keine Bewertungen

- Beacon Pharmaceuticals LTD.: ParticularsDokument6 SeitenBeacon Pharmaceuticals LTD.: ParticularsNur Md Al HossainNoch keine Bewertungen

- Complexation of Ciprofloxacin With Paracetamol and Zinc in Aqueous MediumDokument8 SeitenComplexation of Ciprofloxacin With Paracetamol and Zinc in Aqueous MediumNur Md Al HossainNoch keine Bewertungen

- Equity Research On Square Pharmaceutical Limited PDFDokument8 SeitenEquity Research On Square Pharmaceutical Limited PDFNur Md Al Hossain100% (1)

- Bangladesh Tax Handbook 2008-2009 PDFDokument53 SeitenBangladesh Tax Handbook 2008-2009 PDFNur Md Al HossainNoch keine Bewertungen

- Color RuleDokument1 SeiteColor RuleNur Md Al HossainNoch keine Bewertungen

- Adjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedDokument9 SeitenAdjudication Order Against MR - Sagar Pravin Shah in The Matter of Amar Remedies LimitedShyam SunderNoch keine Bewertungen

- For The Large Stock Company Use Wal Mart Pick 4 Investments 1 Large Stock This Should Be An EasDokument3 SeitenFor The Large Stock Company Use Wal Mart Pick 4 Investments 1 Large Stock This Should Be An EasDoreenNoch keine Bewertungen

- Exercise 5 - Group 2Dokument1 SeiteExercise 5 - Group 2Thi Kim Ngan BuiNoch keine Bewertungen

- Management Glossary - PDF Version 1Dokument75 SeitenManagement Glossary - PDF Version 1Fàrhàt HossainNoch keine Bewertungen

- Nse Academy'S Certification in Financial Markets (NCFM) : Registration FormDokument9 SeitenNse Academy'S Certification in Financial Markets (NCFM) : Registration FormmailnowNoch keine Bewertungen

- Instructions / Checklist For Filling KYC FormDokument29 SeitenInstructions / Checklist For Filling KYC FormSuraj MehtaNoch keine Bewertungen

- I Am Sharing 'Afar Quiz' With YouDokument20 SeitenI Am Sharing 'Afar Quiz' With YouAmie Jane MirandaNoch keine Bewertungen

- ACC3706 - GRP ProjectDokument8 SeitenACC3706 - GRP ProjectkennethNoch keine Bewertungen

- Module-3 Types of Financial ServicesDokument141 SeitenModule-3 Types of Financial Serviceskarthik karthikNoch keine Bewertungen

- Business Finance (WEEK - 2-3)Dokument10 SeitenBusiness Finance (WEEK - 2-3)Mizuki YamizakiNoch keine Bewertungen

- Accounting MBA Sem I 2018Dokument4 SeitenAccounting MBA Sem I 2018yogeshgharpureNoch keine Bewertungen

- Expertravel & Tours, Inc. vs. Court of Appeals and KOREAN AIRLINES, G.R. No. 152392, May 26, 2005, Callejo, SR., JDokument17 SeitenExpertravel & Tours, Inc. vs. Court of Appeals and KOREAN AIRLINES, G.R. No. 152392, May 26, 2005, Callejo, SR., JRaymarc Elizer AsuncionNoch keine Bewertungen

- Project (Air India)Dokument81 SeitenProject (Air India)Amulay Oberoi100% (2)

- Gardner DenverDokument25 SeitenGardner DenverConstantin WellsNoch keine Bewertungen

- Prospects and Challenges For Developing Securities Markets in Ethiopia An Analytical ReviewDokument16 SeitenProspects and Challenges For Developing Securities Markets in Ethiopia An Analytical ReviewSinshaw Bekele100% (10)

- Chapter 22 - Dividend PolicyDokument88 SeitenChapter 22 - Dividend Policypraveen83362Noch keine Bewertungen

- Chapter 1 - Understanding Business FundamentalsDokument49 SeitenChapter 1 - Understanding Business Fundamentalsmohammed_ibrahim_62Noch keine Bewertungen

- Quiz Bomb FDDokument12 SeitenQuiz Bomb FDTshering Pasang SherpaNoch keine Bewertungen

- Accounting From A Global PerspectiveDokument58 SeitenAccounting From A Global PerspectivezelNoch keine Bewertungen

- Financial Management: Operating Leverage & Financial LeverageDokument70 SeitenFinancial Management: Operating Leverage & Financial LeverageHarnitNoch keine Bewertungen

- Corporation Law NotesDokument32 SeitenCorporation Law NotesGracious CondesNoch keine Bewertungen

- Gold Update: Bernie Doyle Investment AdvisorDokument12 SeitenGold Update: Bernie Doyle Investment AdvisorBernie DoyleNoch keine Bewertungen

- International University Vietnam National University - HCMC: Date: 19/8/2021Dokument17 SeitenInternational University Vietnam National University - HCMC: Date: 19/8/2021Quỳnh NhưNoch keine Bewertungen

- Accounting For Business Combination - CompressDokument17 SeitenAccounting For Business Combination - CompressRonan Ian DinagtuanNoch keine Bewertungen

- CF (Collected)Dokument76 SeitenCF (Collected)Akhi Junior JMNoch keine Bewertungen